Professional Documents

Culture Documents

AUD2 PROJECT - Google Sheets PRELIMS SW

Uploaded by

Julia Mari Quiñones Aguado0 ratings0% found this document useful (0 votes)

2 views10 pagesThis document contains a series of true/false questions about auditing procedures for property, plant, and equipment. For each question, respondents provided their answers and explanations for any incorrect responses. The questions cover topics like the auditors' approach, internal controls, verification procedures, reliance on specialists, identifying adjustments, and information a plant manager would be likely to provide. The explanations indicate some respondents misinterpreted question details or made incorrect assumptions, highlighting the importance of carefully reading questions in this subject area.

Original Description:

seatwork auditing 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a series of true/false questions about auditing procedures for property, plant, and equipment. For each question, respondents provided their answers and explanations for any incorrect responses. The questions cover topics like the auditors' approach, internal controls, verification procedures, reliance on specialists, identifying adjustments, and information a plant manager would be likely to provide. The explanations indicate some respondents misinterpreted question details or made incorrect assumptions, highlighting the importance of carefully reading questions in this subject area.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views10 pagesAUD2 PROJECT - Google Sheets PRELIMS SW

Uploaded by

Julia Mari Quiñones AguadoThis document contains a series of true/false questions about auditing procedures for property, plant, and equipment. For each question, respondents provided their answers and explanations for any incorrect responses. The questions cover topics like the auditors' approach, internal controls, verification procedures, reliance on specialists, identifying adjustments, and information a plant manager would be likely to provide. The explanations indicate some respondents misinterpreted question details or made incorrect assumptions, highlighting the importance of carefully reading questions in this subject area.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

SEATWORK NO.

Question Answer NARRATIVE (Bakit ka nagkamali?) RECOMMENDATION

1.) The auditors' approach to TRUE I was wrong because I thought it Read the statement carefully

the audit of property, plant and was not a result of just a few and consider the words "few"

equipment largely results from transactions. (Aguado) because most statements

the fact that relatively few mislead the reader but above

transactions occur. My understanding to the approach all, don't overthink.

of an auditor in auditing PPE is

not just largely in few transactions

but "all." (Alcantara)

I thought that the approach on the

audit of PPE results on not just a

few transaction. (Cajanding)

2.) A major control procedure FALSE When auditing PPE, the one that Analyze the statement if the

related to plant and equipment we really check is if the message makes sense or the

is a budget for depreciation. depreciation is properly allocated procedure really exists like

that's why I thought this should be budget for depreciation.

the one that needs the major

control procedure (Alcantara)

Since depreciation is always

associated to PPE, I thought there

is certain control procedure

related to that such as budget

(Vargas) (Aguado)

4.) The auditors typically FALSE I thought they should observe all In an audit of PPE, be in a POV

observe all major items of property, plant and equipment of an auditor and consider the

property, plant and equipment and not just the major ones. words like "all" or "every year"

every year. (Cajanding) (Aguado) that will make the statement

wrong.

I didn't notice the term "every

year" (Vargas)

7.) The primary purpose of FALSE Since plant and equipment is Analyze the statement if the

internal control over plant and prone to theft, I thought the message makes sense or the

equipment is to safeguard the internal control on it would be a procedure really exists like

assets from primary purpose where in fact, it safeguarding the assets from

theft. is not. (Alcantara) theft where it will also be

misleading but since it stated

I thought safeguarding of assets is that "primary", then this is not

one of the primary purpose of the the major control.

internal controls. (Cajanding)

8.) A typical procedure in the FALSE I actually answered correctly but I Analyze the statement carefully

audit of property is examination overthink it so I changed my and consider the subject of the

of public records to verify the answer. Anyways, I became sentence that gives emphasis

ownership of the property. confused when examining of like "public records" and if this

public records in verification of corresponds to the supporting

ownership. It is false because we information.

don't examine public records, just

the title or the deeds. (Alcantara)

I got confused on how the

ownership is going to be verified

and believed that examination of

public records is one of the

procedures. (Cajanding) (Aguado)

I misinterpreted the statement, I

thought examination of public

records was synonymous to deeds

and title. (Vargas)

9.) Even when internal control is TRUE The audit work on PPE I thought Mostly, the statements that is in

weak, a significant portion of is not performed at an interim good construction when you

the audit work on property, date but at the end of the period. read is correct, but still, you

plant and equipment may be (Alcantara) need to consider other facts

performed at an interim date. I thought it couldn't be done if the and your knowledge about

internal control is weak. (Aguado) audit work on property, plant,

and equipment.

I got confused with the term

"significant portion", I thought the

statement was wrong since there

is no specific quantification for

that term. (Vargas)

10.) In the audit of depletion TRUE I was thinking that they should do Consider the facts and the

the auditors must often rely on it independently and not rely on concepts in auditing of PPE like

the work of specialists. specialists. (Cajanding) this, depletion where it should

rely on specialists since this is

about mineral resources,

exploration, wasting asset, etc.

11.) An auditor has identified B. Plant assets were I thought that if there are Read the question carefully

numerous debits to retired during the year. numerous debits to accumulated because there is a question

accumulated depreciation of depreciation of equipment is that about "least likely" , "most

equipment. Which of the the prior year's depreciation likely." Then, eliminate other

following is most likely? expense was erroneously choices that is irrelevant and

understated. (Aguado) make some real-life situations

that will help you to get a

I misread the statement, I thought correct answer.

it was overstated so in order to

correct that accumulated

depreciation must be debited.

(Vargas)

12.) In testing for unrecorded A. Select items of I answered it wrong because I Understand the concept more

retirements of equipment, an equipment from the understood it in opposite to the and know the difference

auditor might. accounting records and right answer where tracing of between selecting and tracing.

then attempt to locate equipment during the plant tour

them during the plant to its subsidiary ledger.

tour. (Alcantara) (Aguado)

13.) A plant manager would be C. Existence of obsolete I thought a plant manager would The question is about "most

most likely to provide inventory. provide information about the likely" so the other options can

information on which of the physical inventory valuation also provide information but

following? techniques. (Alcantara) choose the one that really has

the best above all, the priority

than others.

14.) Which of the following D. Procedures exist to In addressing the control, I The rest of the options are very

would be least likely to address restrict access to thought it is least likely to likely to address control over

control over the initiation and equipment requests for consideration of the initiation and execution of

execution of equipment soliciting competitive bids than equipment transactions unlike

transactions? the restrict access to equipment option D which only shows who

because this control is more likely has access to equipment.

to be priority in authorization.

(Alcantara)

I thought that it would be least

likely to be address through

prenumbering purchase orders

that were used for equipment and

periodically accounting it.

(Aguado)

Since the question is about least

likely, I thought major repairs

don't need approval of highr level.

(Vargas)

15.) When there are numerous C. Tests of controls and I compared here the extensive test An auditor who plans to assess

property and equipment limited tests of current and limited test and since it is a control risk at low level

transactions during the year, an year property and low level control risk, extensive performs a combination of tests

auditor who plans to assess equipment transactions. test is not being performed. of controls and limited tests of

control risk at a low level (Alcantara) (Aguado) current year PPE transactions

usually performs: which involve evaluating

I thought assessing at low level effectiveness of client’s internal

don't need tests just analytical controls.

procedures. (Vargas)

16.) Which of the following best B. Agreement of the I also thought that only those With option B, auditors usually

describes the auditors' beginning balance to changes in the accounts will be start by comparing the

approach to the audit of the prior year's working relevant in auditing the ending beginning balances of PPE and

ending balance of property, papers and audit of balance of PPE. (Alcantara) the prior year’s which help

plant and equipment for a significant changes in them validate the accuracy of

continuing non-public client? the accounts. The question is about continuing the amount for the next year.

client, I thought direct audit of

balances is the proper approach

because you also audited them

last period. (Vargas)

17.) Which of the following is B. Requiring that the I incorrectly answered this Since we are looking for the

not a control that should be department in need of because I chose the one that is option which is not a control,

established for purchases of the equipment order the requiring the accounting policy we should check that the other

equipment? equipment. regarding the minimum dollar options mentioned in the

amount of purchase for problem are all controls that

capitalization as not a control should be established in

where this is still a control for the purchasing equipment.

equipment. (Alcantara) (Aguado)

I didn't consider the fact that

purchase of equipment can have

foreign transactions so I thought

dollar considerations ain't needed.

(Vargas)

19.) Which of the following is B. Examination of rent I thought the title policy would All of the choices mentioned

the best evidence of continuous receipts from lessees of provide an evidence for can be an evidence for the

ownership of property? the property. continuous ownership of property continuous ownership of

but I also thought that the rent property but as auditor’s we

receipts since this is to be received would know that there would

monthly, this is to be considered be a best choice and that would

as the best evidence than the be the rent receipts from the

former. (Alcantara) lessees.

I thought that examining the

deeds would be the besst evidence

of continous ownership of

property. (Aguado)

Since the question was about

property, I thought it can be best

traced through title policy.

(Vargas)

I thought the deed is the one

useful as evidence for ownership.

(Cajanding)

20.) Which of the following best D. The auditors observe I overthink it to the choice (b) as I The one that describes an

describes the auditors' typical major additions to plant thought if only those major auditor’s observation best on

observation of plant and and equipment made additions or all additions shoud PPE is the last option wherein

equipment? during the year. be observed in plant and we need to see the significant

equipment during the year or material additions through

(Alcantara) the year.

I thought that since we're talking

about PPE, auditor's typical

observation would be on its

physical inventory. (Aguado)

Since PPE is always associated

with hight cost, I thought I

thought all major items should be

observed. (Vargas)

I thought that everything should

be observed and not just the

major additions. (Cajanding)

21.) Which of the following is A. Analyzing repairs and Since the depreciation By analyzing the repairs and

used to obtain evidence that the maintenance expense expense/accumulated maintenance expense accounts

client's equipment accounts are depreciation is a contra-account we are most likely to see if

not understated? of an equipment, their there are changes through the

relationship would be of year that were expensed

understatement that's why instead of capitalizing which

recomputing it would be of good causes understatement.

evidence but it's wrong.

(Alcantara) (Cajanding)

I thought that it could be obtain if

you start with the financial

statements and trace the

transaction details to the source

document. (Aguado) (Vargas)

22.) Which of the following is D. Vouching retirements The review of property tax bills By reading the choices, you

not a test primarily used to test of plant and equipment. misled me as not a test for would know that the first three

property, plant and equipment overstatement. (Alcantara) are tests primarily used for

accounts for overstatement? overstated balances on PPE and

I thought Investigation of that vouching retirements

reductions in insurance coverage would not be one of them.

wouldn't detect overstatement but

understatement because of the

word reduction. (Aguado)

I thought insurance coverage wass

irrelevant in tests for

overstatement because some PPE

have different date of acquisition

and date of insurance. (Vargas)

I thought that investigation

regarding the insurance coverage

would not be significant on testing

accounts for overstatement.

(Cajanding)

23.) A continuing audit client's A. More audit time. I thought auditing AR is requiring Given same year-end balance

property, plant and equipment similar procedure to PPE. would give confusion to the

and accounts receivable (Alcantara) auditor wherein they would

accounts have approximately have todo confirmation on the

the same year-end balance. In I think I comprehended the accounts receivable which leads

this circumstance, when question wrong and thought that to requiring more audit time.

compared to property, plant and since they have the same balance

equipment one would normally it would consume less audit time.

expect the audit of accounts (Cajanding)

receivable to require:

I thought AR would require less

audit time and PPE more audit

time. (Aguado)

I thought similar confirmation

procedures should be done

regardless of whether the client is

a continuing client or not.

(Vargas)

24.) When comparing an initial D. Property, plant and I answered here accounts The PPE are most likely to

audit with a subsequent year equipment. receivable since it is also high in decrease because they

audit for a particular client, the risk that is to decrease but since depreciate while the rest

scope of audit procedures for our audit topic is ppe, then I think depends on the transactions

which of the following accounts the focus is PPE not AR. that happen through the year.

would be expected to decrease (Alcantara)

the most?

25.) When performing an audit A. Repairs have been An audit of PPE I thought should On generally accepted

of the property, plant and capitalized to repair also be concerned in capitalization accounting principles, it is

equipment accounts, an auditor equipment that had of its cost like freight in but the stated that we treat repairs and

should expect which of the broken down. correct one it is also should focus maintenance as an expense and

following to be most likely to in repairs and maintenance. not capitalized on the asset.

indicate a departure from (Alcantara)

generally accepted accounting

principles? I thought that the assets have

been acquired from affiliated

corporations with the related

transactions recorded and

described in the financial

statements would most likely

indicate a departure from

generally accepted accounting

principles. (Aguado)

I thought different accounting

principle was more appropriate

for affliated corporations. Like

there is a different accounting

standard that negates from the

standard in PPE. (Vargas)

You might also like

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- "Ludwig Report" On Allied Irish Bank Currency Trading ScandalDocument62 pages"Ludwig Report" On Allied Irish Bank Currency Trading ScandalMCW0No ratings yet

- Running Head: Incident Response Plan Responsibility Chart1Document7 pagesRunning Head: Incident Response Plan Responsibility Chart1api-540237180No ratings yet

- 10 Coolest Jobs in CybersecurityDocument1 page10 Coolest Jobs in CybersecurityHajaNo ratings yet

- Zitra Personal Account FormDocument2 pagesZitra Personal Account FormUgo BenNo ratings yet

- Case Study Vifel CoopDocument12 pagesCase Study Vifel CoopEvita Faith Leong78% (9)

- Assignment 001: Fundamentals of Accounting/Answer KeyDocument65 pagesAssignment 001: Fundamentals of Accounting/Answer Keymoncarla lagon83% (6)

- Technology Startup GuideDocument86 pagesTechnology Startup GuidecrinkletizzNo ratings yet

- What To Include in Financial AnalysisDocument12 pagesWhat To Include in Financial Analysisayushi kapoorNo ratings yet

- Capa EffectivenessDocument4 pagesCapa EffectivenessVinoth KumarNo ratings yet

- Auditing ExamDocument5 pagesAuditing ExamMoniqueNo ratings yet

- C12 Intangible Assets PDFDocument32 pagesC12 Intangible Assets PDFSteeeeeeeephNo ratings yet

- Human Factors, Safety Culture, Management Influences, Pressures, and MoreDocument2 pagesHuman Factors, Safety Culture, Management Influences, Pressures, and MoreJavier BaNo ratings yet

- The Death of Tick Mark - Internal AuditorDocument1 pageThe Death of Tick Mark - Internal AuditorMarthin SiagianNo ratings yet

- Completing The Accounting CycleDocument64 pagesCompleting The Accounting CyclewarsimaNo ratings yet

- CH 04Document64 pagesCH 04om feyNo ratings yet

- Are You Doing The Right MaintenanceDocument5 pagesAre You Doing The Right Maintenancelrolindo100% (1)

- Hydroseeding WorkDocument26 pagesHydroseeding WorkSamsiah TolaNo ratings yet

- Job Safety Analysis - RIG-UP OF GDS, CASCADE & SAFETY EQUIPMENTDocument3 pagesJob Safety Analysis - RIG-UP OF GDS, CASCADE & SAFETY EQUIPMENTJun DandoNo ratings yet

- Managing DistractionsDocument2 pagesManaging DistractionselaboratesolverNo ratings yet

- Case 10-35 Matrices in WordDocument4 pagesCase 10-35 Matrices in WordJhorghe GonzalezNo ratings yet

- Forensics For The Internal Auditor - Harish DuaDocument8 pagesForensics For The Internal Auditor - Harish DuaOmanjob JobNo ratings yet

- HomeworkDocument8 pagesHomeworkDarwin Quinteros100% (1)

- Five Steps To Risk ReductionDocument5 pagesFive Steps To Risk ReductionJordan PopovskiNo ratings yet

- Cost Management For Just-in-Time EnvironmentsDocument57 pagesCost Management For Just-in-Time EnvironmentsSunny NayakNo ratings yet

- Inventory Management of Big Bazaarthane PDFDocument59 pagesInventory Management of Big Bazaarthane PDFadithisarmaNo ratings yet

- The Imperfections of Accident AnalysisDocument5 pagesThe Imperfections of Accident Analysisikhan1234No ratings yet

- ProcurementDocument2 pagesProcurementBryanNo ratings yet

- AM Case StudyDocument14 pagesAM Case StudytanviNo ratings yet

- Risks Column FinalDocument7 pagesRisks Column FinalKiran BalasubramanianNo ratings yet

- Plant MaterialDocument143 pagesPlant MaterialFarook Mohideen100% (1)

- Warehouse Capacity ExplainedDocument8 pagesWarehouse Capacity ExplainedGabriel Richeley MagalhaesNo ratings yet

- 1960 3 EngDocument15 pages1960 3 EngTateNo ratings yet

- 2007 RW Reed LessonsDocument5 pages2007 RW Reed LessonsVictor ZhicayNo ratings yet

- Strict Control Kept Out Semiconductor Flaws: Electronic Design 17Document1 pageStrict Control Kept Out Semiconductor Flaws: Electronic Design 17Kirti DoshiNo ratings yet

- QM Guidelines Use of Seal 2017-12-04 WebDocument1 pageQM Guidelines Use of Seal 2017-12-04 WebSteve LéonardNo ratings yet

- CISO Instruction No.2 (2023) For PR - CCIT (CCA) Regions and DirectoratesDocument77 pagesCISO Instruction No.2 (2023) For PR - CCIT (CCA) Regions and DirectoratesSai NarayananNo ratings yet

- Understanding QRQCDocument17 pagesUnderstanding QRQCJohn OoNo ratings yet

- AI Sem V Solution Nov 2O18 Pallavi Tawde PDFDocument22 pagesAI Sem V Solution Nov 2O18 Pallavi Tawde PDFMG GalactusNo ratings yet

- 8D Reports Pdca: Summary of Training Concerning Main Tool To Treaty The Customer ClaimsDocument1 page8D Reports Pdca: Summary of Training Concerning Main Tool To Treaty The Customer ClaimsCristi BragaNo ratings yet

- Completing The Accounting CycleDocument64 pagesCompleting The Accounting CycleJoan MarieNo ratings yet

- Case 12-37 Matrices in WordDocument4 pagesCase 12-37 Matrices in WordAngelica OctaviaNo ratings yet

- 54-57 - Tony McGrailDocument4 pages54-57 - Tony McGrailbenlahnecheNo ratings yet

- Murray Content ServerDocument5 pagesMurray Content ServerLUIS FERNANDO DÁVALOS CASTRONo ratings yet

- Supplement Process MapDocument1 pageSupplement Process MapRaffi DelicNo ratings yet

- Bs 5839 1 Guide Issue Fire Alarm - PDF - Cable - Fire SafetyDocument53 pagesBs 5839 1 Guide Issue Fire Alarm - PDF - Cable - Fire SafetySHANDEEPNo ratings yet

- AcuSense Product BrochureDocument8 pagesAcuSense Product BrochureguttsaNo ratings yet

- How To Design Smart Business ExperimentsDocument10 pagesHow To Design Smart Business ExperimentsJockim Raj..DNo ratings yet

- The Dirty DozensDocument16 pagesThe Dirty DozensjouadiNo ratings yet

- 3.gypsum CeilingDocument5 pages3.gypsum Ceilingmohammed sohailNo ratings yet

- ISA 610 Using The Work of Int PDFDocument1 pageISA 610 Using The Work of Int PDFAli HaiderNo ratings yet

- Recovery EquipmentDocument4 pagesRecovery EquipmentGeslin BrunnoNo ratings yet

- 4 - JSA Manual ExcavationDocument4 pages4 - JSA Manual ExcavationAijaz AhmedNo ratings yet

- Audit Exam Course HeroDocument5 pagesAudit Exam Course HeroMd Shamimul HasanNo ratings yet

- Incident Response Play BookDocument21 pagesIncident Response Play BookUmoora MinhajiNo ratings yet

- Chap 9Document4 pagesChap 9yes it's kaiNo ratings yet

- Flowchart - Personal JurisdictionDocument1 pageFlowchart - Personal JurisdictionJNo ratings yet

- Sos Major Assignment: Gaurav Kumar GuptaDocument7 pagesSos Major Assignment: Gaurav Kumar Guptarathoreshivi04_31491No ratings yet

- 3-Katherine 2004 - Tips For Creating A Safety Culture in OrganisationsDocument6 pages3-Katherine 2004 - Tips For Creating A Safety Culture in Organisationsanon_817646886No ratings yet

- 7 16 2013 Eddie SchwartzDocument36 pages7 16 2013 Eddie SchwartztestNo ratings yet

- 2 - How To Do A Patent Search in 6 Steps (The Definite Guide)Document26 pages2 - How To Do A Patent Search in 6 Steps (The Definite Guide)Citaresik ProjectNo ratings yet

- Ebook On Call Guide PagerdutyDocument11 pagesEbook On Call Guide PagerdutyShiva KumarNo ratings yet

- The Five Orders of IgnoranceDocument4 pagesThe Five Orders of IgnoranceJeff PrattNo ratings yet

- Baby Breath Counter: ProposalDocument1 pageBaby Breath Counter: ProposalGunreet MarwahNo ratings yet

- Harel 10Document9 pagesHarel 10Nilesh GopnarayanNo ratings yet

- 1969 5 EngDocument15 pages1969 5 EngTateNo ratings yet

- Hackable: How to Do Application Security RightFrom EverandHackable: How to Do Application Security RightRating: 5 out of 5 stars5/5 (1)

- Banruptcy Notes IntroductionDocument3 pagesBanruptcy Notes IntroductionkennedyNo ratings yet

- Chapter 01Document10 pagesChapter 01ShantamNo ratings yet

- G.O.MS - No. 218Document5 pagesG.O.MS - No. 218younusbasha143No ratings yet

- Exchange-Traded Funds: An Introduction: and Further Likely EvolutionDocument9 pagesExchange-Traded Funds: An Introduction: and Further Likely EvolutionNathália Alves de JesusNo ratings yet

- Inventory Turnover Optimization Criteria of Efficiency (With Special Reference To FMCG Sector in India)Document5 pagesInventory Turnover Optimization Criteria of Efficiency (With Special Reference To FMCG Sector in India)Ayesha AtherNo ratings yet

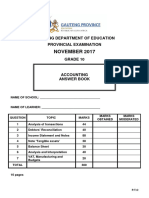

- Grade 10 Provincial Exam Accounting (English) Answer Book - 050312Document10 pagesGrade 10 Provincial Exam Accounting (English) Answer Book - 050312hobyanevisionNo ratings yet

- India Real Estate Residential Office h1 2020 Indian Real Estate Residential Office 7302Document145 pagesIndia Real Estate Residential Office h1 2020 Indian Real Estate Residential Office 7302Venkatesh SankarNo ratings yet

- Public-Private Partnership: South Lake Union Streetcar, Seattle, WADocument13 pagesPublic-Private Partnership: South Lake Union Streetcar, Seattle, WAMatthew SteenhoekNo ratings yet

- CSIT Problem QuestionsDocument3 pagesCSIT Problem QuestionsQweku TeyeNo ratings yet

- ACT 501 AssignmentDocument6 pagesACT 501 AssignmentEasin Mohammad RomanNo ratings yet

- Ias 21Document18 pagesIas 21Ogundiminegha 'Pretty' OludamilolaNo ratings yet

- Foreign Currency Term LoanDocument11 pagesForeign Currency Term LoanGunner WengerNo ratings yet

- SFM MTP 1 Nov 18 ADocument12 pagesSFM MTP 1 Nov 18 ASampath KumarNo ratings yet

- Practice Problems Far Chap 1-5Document13 pagesPractice Problems Far Chap 1-5Micah Danielle S. TORMONNo ratings yet

- Sources and Allocation of Funds of Charitable Institutions in The First District of Rizal - Chapter 1-4Document98 pagesSources and Allocation of Funds of Charitable Institutions in The First District of Rizal - Chapter 1-4Dan Joseph Sta AnaNo ratings yet

- Enhanced Consumer Credit Report: Enquiry DetailsDocument9 pagesEnhanced Consumer Credit Report: Enquiry Detailsarcman17100% (1)

- Tax 1 Comprehensive Problem For Bir FormsDocument7 pagesTax 1 Comprehensive Problem For Bir FormsMelissa BaileyNo ratings yet

- Tax InvoiceDocument1 pageTax InvoicePintu ShahNo ratings yet

- Problem Set 3 SolutionDocument12 pagesProblem Set 3 SolutionMaxNo ratings yet

- Purchase Order Policies and Procedures: Herscher Community Unit School District #2Document13 pagesPurchase Order Policies and Procedures: Herscher Community Unit School District #2Bon.AlastoyNo ratings yet

- Real-World Economics ReviewDocument182 pagesReal-World Economics Reviewadvanced91No ratings yet

- Unofficial: Institute of Business Management (Iobm) Fall 2012 ScheduleDocument52 pagesUnofficial: Institute of Business Management (Iobm) Fall 2012 ScheduleAryan SmartyNo ratings yet