Professional Documents

Culture Documents

Personal Loan Calculator Malaysia Calculator - Com.my PDF

Uploaded by

harithh.rahsiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Personal Loan Calculator Malaysia Calculator - Com.my PDF

Uploaded by

harithh.rahsiaCopyright:

Available Formats

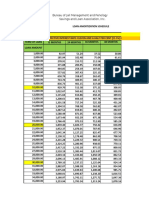

PERSONAL LOAN CALCULATOR

Loan Amount (RM):

260,000

Months:

120

Annual Interest Rate (%):

9.7

CALCULATE

Result:

Monthly Repayment

RM 3,392.87

REPORT AN ISSUE

PAYMENT SCHEDULE

RM 260,000

RM 195,000

RM 130,000

RM 65,000

RM 0

1mth 12mth 23mth 34mth 45mth 56mth 67mth 78mth

Principal

Interest

Balance

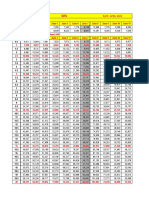

MONTHS PRINCIPAL INTEREST BALANCE

1st 1,291.21 2,101.67 258,708.79

2nd 2,592.85 4,192.90 257,407.15

3rd 3,905.01 6,273.60 256,094.99

4th 5,227.78 8,343.71 254,772.22

5th 6,561.25 10,403.11 253,438.75

6th 7,905.49 12,451.74 252,094.51

7th 9,260.60 14,489.51 250,739.40

8th 10,626.66 16,516.32 249,373.34

9th 12,003.76 18,532.09 247,996.24

10th 13,392.00 20,536.72 246,608.00

11th 14,791.46 22,530.14 245,208.54

12th 16,202.23 24,512.24 243,797.77

13th 17,624.40 26,482.94 242,375.60

14th 19,058.07 28,442.14 240,941.93

15th 20,503.33 30,389.75 239,496.67

16th 21,960.27 32,325.69 238,039.73

17th 23,428.98 34,249.84 236,571.02

18th 24,909.57 36,162.12 235,090.43

19th 26,402.13 38,062.44 233,597.87

20th 27,906.75 39,950.69 232,093.25

21st 29,423.54 41,826.77 230,576.46

22nd 30,952.59 43,690.60 229,047.41

23rd 32,493.99 45,542.07 227,506.01

24th 34,047.86 47,381.07 225,952.14

25th 35,614.28 49,207.52 224,385.72

26th 37,193.37 51,021.30 222,806.63

27th 38,785.22 52,822.32 221,214.78

28th 40,389.94 54,610.48 219,610.06

29th 42,007.63 56,385.66 217,992.37

30th 43,638.40 58,147.76 216,361.60

31st 45,282.35 59,896.69 214,717.65

32th 46,939.58 61,632.32 213,060.42

33th 48,610.22 63,354.56 211,389.78

34th 50,294.36 65,063.29 209,705.64

35th 51,992.11 66,758.41 208,007.89

36th 53,703.58 68,439.81 206,296.42

37th 55,428.89 70,107.37 204,571.11

38th 57,168.15 71,760.99 202,831.85

39th 58,921.46 73,400.55 201,078.54

40th 60,688.95 75,025.93 199,311.05

41th 62,470.72 76,637.03 197,529.28

42th 64,266.90 78,233.73 195,733.10

43th 66,077.60 79,815.90 193,922.40

44th 67,902.93 81,383.44 192,097.07

45th 69,743.02 82,936.23 190,256.98

46th 71,597.98 84,474.14 188,402.02

47th 73,467.93 85,997.05 186,532.07

48th 75,353.01 87,504.85 184,646.99

49th 77,253.31 88,997.42 182,746.69

50th 79,168.98 90,474.62 180,831.02

51th 81,100.14 91,936.34 178,899.86

52th 83,046.90 93,382.44 176,953.10

53th 85,009.40 94,812.81 174,990.60

54th 86,987.77 96,227.32 173,012.23

55th 88,982.13 97,625.84 171,017.87

56th 90,992.60 99,008.23 169,007.40

57th 93,019.33 100,374.37 166,980.67

58th 95,062.44 101,724.14 164,937.56

59th 97,122.07 103,057.38 162,877.93

60th 99,198.35 104,373.98 160,801.65

61th 101,291.41 105,673.79 158,708.59

62th 103,401.38 106,956.68 156,598.62

63th 105,528.42 108,222.52 154,471.58

64th 107,672.64 109,471.17 152,327.36

65th 109,834.20 110,702.48 150,165.80

66th 112,013.23 111,916.32 147,986.77

67th 114,209.88 113,112.55 145,790.12

68th 116,424.28 114,291.02 143,575.72

69th 118,656.58 115,451.59 141,343.42

70th 120,906.93 116,594.11 139,093.07

71th 123,175.47 117,718.45 136,824.53

72th 125,462.34 118,824.45 134,537.66

73th 127,767.70 119,911.96 132,232.30

74th 130,091.69 120,980.84 129,908.31

75th 132,434.47 122,030.93 127,565.53

76th 134,796.19 123,062.09 125,203.81

77th 137,177.00 124,074.15 122,823.00

78th 139,577.05 125,066.97 120,422.95

79th 141,996.50 126,040.39 118,003.50

80th 144,435.51 126,994.25 115,564.49

81th 146,894.24 127,928.40 113,105.76

82th 149,372.84 128,842.67 110,627.16

83th 151,871.48 129,736.90 108,128.52

84th 154,390.31 130,610.94 105,609.69

85th 156,929.50 131,464.62 103,070.50

86th 159,489.22 132,297.77 100,510.78

87th 162,069.63 133,110.24 97,930.37

88th 164,670.90 133,901.84 95,329.10

89th 167,293.20 134,672.42 92,706.80

90th 169,936.69 135,421.80 90,063.31

91th 172,601.55 136,149.81 87,398.45

92th 175,287.95 136,856.28 84,712.05

93th 177,996.07 137,541.04 82,003.93

94th 180,726.07 138,203.90 79,273.93

95th 183,478.15 138,844.70 76,521.85

96th 186,252.47 139,463.25 73,747.53

97th 189,049.21 140,059.38 70,950.79

98th 191,868.57 140,632.89 68,131.43

99th 194,710.71 141,183.62 65,289.29

100th 197,575.83 141,711.38 62,424.17

101th 200,464.10 142,215.97 59,535.90

102th 203,375.73 142,697.22 56,624.27

103th 206,310.89 143,154.94 53,689.11

104th 209,269.77 143,588.92 50,730.23

105th 212,252.57 143,998.99 47,747.43

106th 215,259.49 144,384.95 44,740.51

107th 218,290.71 144,746.60 41,709.29

108th 221,346.43 145,083.75 38,653.57

109th 224,426.85 145,396.20 35,573.15

110th 227,532.17 145,683.75 32,467.83

111th 230,662.60 145,946.20 29,337.40

112th 233,818.33 146,183.34 26,181.67

113th 236,999.56 146,394.98 23,000.44

114th 240,206.52 146,580.90 19,793.48

115th 243,439.39 146,740.90 16,560.61

116th 246,698.40 146,874.76 13,301.60

117th 249,983.75 146,982.28 10,016.25

118th 253,295.66 147,063.25 6,704.34

119th 256,634.33 147,117.44 3,365.67

120th 260,000.00 147,144.65 0.00

MALAYSIA PERSONAL LOAN CALCULATOR

Features:

Estimate monthly personal loan repayment

amount.

Generate principal, interest and balance

loan repayment chart, over loan period.

Generate principal, interest and balance

loan repayment table, by year.

How to Use:

1. Enter personal loan amount in Malaysian

Ringgit.

2. Enter loan period in Months.

3. Enter loan interest rate in Percentage.

Bank Personal Loan Interest Rates:

INTEREST

BANK NAME

RATE

Alliance Bank CashFirst Personal 8.38%

Loan

CIMB Cash Plus 10.88%

Citibank Personal Loan 7.9%

Hong Leong Personal Loan 12%

HSBC Amanah Personal Financ- 6.99%

ing-i

Maybank Personal Loan 7.0%

RHB Personal Financing-i for Pri- 12.22%

vate

Standard Chartered Quick Cash 10.56%

EDGE

UOB Personal Loan 10.99%

(Updated May 2017)

Personal Loan Rates for Government

and Public Sector Workers:

INTEREST

BANK NAME

RATE

Bank Rakyat Personal Financing-i 4.54%

Public Sector

BSN SKAP 4.75%

MBSB Mumtaz-i 3.4%

Public Bank BAE Personal Financ- 4.99%

ing-i

(Updated May 2017)

Recommended Reading

What You Need to

Know About the Differ-

ent Types of Personal

Loans

READ MORE

5 Ways Personal Loans

Can Backfire on You

READ MORE

About Us

Terms & Privacy

AdWords Disclosure

Calculator Malaysia (C) 2024 Calculator.com.my

You might also like

- Personal Loan Calculator Malaysia - Calculator - Com.my PDFDocument7 pagesPersonal Loan Calculator Malaysia - Calculator - Com.my PDFsrividhyagovindasamyNo ratings yet

- Payment Table 12455Document8 pagesPayment Table 12455syamNo ratings yet

- Attachment 3 - JADUAL BAYARAN KONTRAK BAI INAH BERPENJAMIN - May2022 1Document4 pagesAttachment 3 - JADUAL BAYARAN KONTRAK BAI INAH BERPENJAMIN - May2022 1Addasaadiah HalimatusNo ratings yet

- Trading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Document3 pagesTrading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Dani SetiawanNo ratings yet

- Payment Table PF Non Promo Without InsuranceDocument4 pagesPayment Table PF Non Promo Without Insurancejoseph bandangNo ratings yet

- Personal Financing Monthly Installment TableDocument15 pagesPersonal Financing Monthly Installment TablenormahifzanNo ratings yet

- M2, IHK, Kurs and GDP over timeDocument3 pagesM2, IHK, Kurs and GDP over timeIsnaini MozikaNo ratings yet

- AccountsDocument13 pagesAccountsVenushNo ratings yet

- Data Ekonomi 1Document3 pagesData Ekonomi 1Kristina ManaluNo ratings yet

- A-LIFE KASIH FAMILI + RIDER A-PLUS CRITICALCARE-iDocument2 pagesA-LIFE KASIH FAMILI + RIDER A-PLUS CRITICALCARE-iShaharizal HassanNo ratings yet

- Loan Amort CalculatorDocument11 pagesLoan Amort CalculatorGeromil HernandezNo ratings yet

- Payment Table - Promo Rate 3.59 IPI1Document7 pagesPayment Table - Promo Rate 3.59 IPI1crewz_19No ratings yet

- Repayment Period (Months) Principal Loan Amount (N)Document1 pageRepayment Period (Months) Principal Loan Amount (N)adebo_yemiNo ratings yet

- Memoria Anual 2018 - FcceDocument7 pagesMemoria Anual 2018 - FcceRolf Harry Crespo RuedaNo ratings yet

- PF MPS2015 BM PDFDocument1 pagePF MPS2015 BM PDFaaarieff90No ratings yet

- Tier EIR Remarks Financing Amount: RHB PERSONAL FINANCING (Promo Payment Table) 2021 Raya CampaignDocument4 pagesTier EIR Remarks Financing Amount: RHB PERSONAL FINANCING (Promo Payment Table) 2021 Raya CampaignNazrul ShahrudinNo ratings yet

- Historical PricesDocument3 pagesHistorical Pricescourier12No ratings yet

- Cuadre 5% Retenido: No. Factura Subtotal Itbis Total 5% Retenido NCFDocument11 pagesCuadre 5% Retenido: No. Factura Subtotal Itbis Total 5% Retenido NCFLisset CáceresNo ratings yet

- Testing Blind Plate TableDocument5 pagesTesting Blind Plate TableJossel Panopio JoseNo ratings yet

- Attribution DataDocument24 pagesAttribution DataShaikh Saifullah KhalidNo ratings yet

- Payment Table for Personal Financing-i Civil Sector (promo) FY2022Document4 pagesPayment Table for Personal Financing-i Civil Sector (promo) FY2022ADn DyaNo ratings yet

- Tabla de MortalidadDocument13 pagesTabla de MortalidadDavid MatuteNo ratings yet

- BPM To Milliseconds ChartDocument3 pagesBPM To Milliseconds ChartAntoinette PrescottNo ratings yet

- Payment Table PF I For Civil Sector PromoDocument8 pagesPayment Table PF I For Civil Sector PromohikmahNo ratings yet

- Revenues Expenditures Capex CurexDocument3 pagesRevenues Expenditures Capex CurexOsvaldo Kiteque AlfredoNo ratings yet

- Loan Amort Schedule Up To 750K @11.5%Document34 pagesLoan Amort Schedule Up To 750K @11.5%Molzeemolzee MolzeeNo ratings yet

- payment-table-pf-i-civil-sector-monthly-payment-promo-rates-with-takaful (6)Document6 pagespayment-table-pf-i-civil-sector-monthly-payment-promo-rates-with-takaful (6)bitshitassNo ratings yet

- Daily Rates PreviewDocument66 pagesDaily Rates Previewfadell alrekabiNo ratings yet

- EcontrdsxxiiDocument2 pagesEcontrdsxxiiRafiqul Islam RimonNo ratings yet

- Oct ClearedDocument12 pagesOct ClearedAra FeiNo ratings yet

- Pruvalue Med CoiDocument18 pagesPruvalue Med CoiAi suuNo ratings yet

- Cement Grade Wise Report-2021-2022Document28 pagesCement Grade Wise Report-2021-2022fjohnmajorNo ratings yet

- General Government Revenues and Expenditures OverviewDocument12 pagesGeneral Government Revenues and Expenditures OverviewBilge SavaşNo ratings yet

- Converison TorquesDocument2 pagesConverison TorquesSalvador Manuel Rocha CastilloNo ratings yet

- MS Excell AverageDocument13 pagesMS Excell AverageAbdullah Mamun Al SaudNo ratings yet

- File GoSDocument13 pagesFile GoSLifeof DessertNo ratings yet

- Month Deposit (USD) Profit WD USD Realisasi MAXDocument23 pagesMonth Deposit (USD) Profit WD USD Realisasi MAXditaNo ratings yet

- FIN 4 Data File - Loan Amortization TableDocument5 pagesFIN 4 Data File - Loan Amortization TableAndyTomasNo ratings yet

- Apr 2022 - ClearedDocument21 pagesApr 2022 - ClearedAra FeiNo ratings yet

- Financial Statements of Tata Steel - 2018Document69 pagesFinancial Statements of Tata Steel - 2018Samaksh VermaNo ratings yet

- Hanger Inventory Report from 18/09/2021 to 18/09/2021Document14 pagesHanger Inventory Report from 18/09/2021 to 18/09/2021sayem00001No ratings yet

- DHL Khi Rate April 2023Document2 pagesDHL Khi Rate April 2023Reema UsmaniNo ratings yet

- Production (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Document5 pagesProduction (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Merwin Jansen LadringanNo ratings yet

- Taylor Swift DiscographyDocument75 pagesTaylor Swift DiscographyZai MNo ratings yet

- Perhitungan Bunga Anuitas: Angsuran Angsuran Besar Sisa Ke Pokok Bunga Angsuran Pinjaman PokokDocument3 pagesPerhitungan Bunga Anuitas: Angsuran Angsuran Besar Sisa Ke Pokok Bunga Angsuran Pinjaman PokokIm Choirul anamNo ratings yet

- Book 1Document1 pageBook 1Nebiyu AssefaNo ratings yet

- VAT CALCULATOR-SAMPLEDocument3 pagesVAT CALCULATOR-SAMPLETesston BullionNo ratings yet

- Montante por MesesDocument46 pagesMontante por MesesJúlio Manuel JúlioNo ratings yet

- Aug 2022 - ClearedDocument11 pagesAug 2022 - ClearedAra FeiNo ratings yet

- Mar 2022 - ClearedDocument11 pagesMar 2022 - ClearedAra FeiNo ratings yet

- RunaroundDocument4 pagesRunaroundSimon VervilleNo ratings yet

- Condensate HydrostaticDocument6 pagesCondensate HydrostaticTeddyNo ratings yet

- Hnib Final Verified Presidential Poll ResultsDocument4 pagesHnib Final Verified Presidential Poll ResultsTrends KenyaNo ratings yet

- Curve element table with PI station coordinatesDocument8 pagesCurve element table with PI station coordinatesLider David Collazos PalominoNo ratings yet

- Jan 2023 - ClearedDocument9 pagesJan 2023 - ClearedNics ValdrezNo ratings yet

- Stock market indicators dashboardDocument25 pagesStock market indicators dashboardIsatoNo ratings yet

- Feb 2023 - ClearedDocument8 pagesFeb 2023 - ClearedNics ValdrezNo ratings yet

- Feb 2023 - ClearedDocument8 pagesFeb 2023 - ClearedNics ValdrezNo ratings yet

- Dabur India LTD.: Standalone Balance SheetDocument21 pagesDabur India LTD.: Standalone Balance SheetAniketNo ratings yet

- Subtracting Multi Digit Numbers Requires Thought | Children's Arithmetic BooksFrom EverandSubtracting Multi Digit Numbers Requires Thought | Children's Arithmetic BooksNo ratings yet

- Screenshot 2023-01-19 at 11.26.53 AMDocument1 pageScreenshot 2023-01-19 at 11.26.53 AMharithh.rahsiaNo ratings yet

- Partnership AgreementDocument33 pagesPartnership Agreementharithh.rahsiaNo ratings yet

- Screenshot 2021-11-03 at 5.46.52 PMDocument46 pagesScreenshot 2021-11-03 at 5.46.52 PMharithh.rahsiaNo ratings yet

- Citaglobal Acquisitions Internal - Sbh Kibing - Expedition Report CopyDocument5 pagesCitaglobal Acquisitions Internal - Sbh Kibing - Expedition Report Copyharithh.rahsiaNo ratings yet

- SEB23_Web_310523_flipDocument251 pagesSEB23_Web_310523_flipharithh.rahsiaNo ratings yet

- Citaglobal Annual Report 2022 2Document185 pagesCitaglobal Annual Report 2022 2harithh.rahsiaNo ratings yet

- 628646145-downloadfile-1Document1 page628646145-downloadfile-1harithh.rahsiaNo ratings yet

- Cagamas Bhd Information Memorandum 2019-New_1Document353 pagesCagamas Bhd Information Memorandum 2019-New_1harithh.rahsiaNo ratings yet

- 202312_PaySlip (2)Document1 page202312_PaySlip (2)harithh.rahsiaNo ratings yet

- Delivering Deals in Disruption Value Creation in Asia PacificDocument31 pagesDelivering Deals in Disruption Value Creation in Asia Pacificharithh.rahsiaNo ratings yet

- Read MeDocument1 pageRead Meharithh.rahsiaNo ratings yet

- (Mufti Menk) Embodying Prophetic Leadership Seminar Lessons For WomenDocument1 page(Mufti Menk) Embodying Prophetic Leadership Seminar Lessons For Womenharithh.rahsiaNo ratings yet

- HARITHHASHIM_693QO3_KUL-BKI copyDocument2 pagesHARITHHASHIM_693QO3_KUL-BKI copyharithh.rahsiaNo ratings yet

- Guidelines On Merger and Acquisitions 1Document69 pagesGuidelines On Merger and Acquisitions 1remihelmayNo ratings yet

- Masjid Al-Furqan - Phase 2 - Cost Estimate No.1aDocument4 pagesMasjid Al-Furqan - Phase 2 - Cost Estimate No.1aharithh.rahsiaNo ratings yet

- HTTPSWWW - Health.solutionswp-Contentuploads202012120320 - Recruitment - Booklet - UPDATED - PDF 2Document36 pagesHTTPSWWW - Health.solutionswp-Contentuploads202012120320 - Recruitment - Booklet - UPDATED - PDF 2harithh.rahsiaNo ratings yet

- My Documents - EFormsDocument1 pageMy Documents - EFormsharithh.rahsiaNo ratings yet

- EMRIBDocument1 pageEMRIBharithh.rahsiaNo ratings yet

- Data Protection and Research Briefing Note TemplateDocument3 pagesData Protection and Research Briefing Note Templateharithh.rahsiaNo ratings yet

- Your Progress in Foundations of Project ManagementDocument2 pagesYour Progress in Foundations of Project Managementharithh.rahsiaNo ratings yet

- RHB Personal Financing Application Form (V20) Borang Permohonan Pembiayaan Peribadi RHB (V20)Document6 pagesRHB Personal Financing Application Form (V20) Borang Permohonan Pembiayaan Peribadi RHB (V20)AZEANA BINTI MD IBRAHIM MoeNo ratings yet

- RHB Personal Financing Application Form (V20) Borang Permohonan Pembiayaan Peribadi RHB (V20)Document6 pagesRHB Personal Financing Application Form (V20) Borang Permohonan Pembiayaan Peribadi RHB (V20)AZEANA BINTI MD IBRAHIM MoeNo ratings yet

- Consulting Agreement AddendumDocument2 pagesConsulting Agreement Addendumharithh.rahsiaNo ratings yet

- Costing Set Nasi KerabuDocument6 pagesCosting Set Nasi Kerabuharithh.rahsiaNo ratings yet

- Land SurveyDocument2 pagesLand Surveyharithh.rahsiaNo ratings yet

- Passive Voice Exercises and AnswersDocument6 pagesPassive Voice Exercises and AnswersAlicia Villén ArandaNo ratings yet

- CS Form No. 6 Revised 2020 Application For Leave FillableDocument2 pagesCS Form No. 6 Revised 2020 Application For Leave FillableIrish SagunNo ratings yet

- Hosea Cheat Sheet Part 1Document1 pageHosea Cheat Sheet Part 1Steve DangNo ratings yet

- E-Mail: E-Mail: Direct Dial: 480-719-8501 6991 East Camelback Road, Suite D-102 Scottsdale, Arizona 85251 Fax: (480) 245-6231Document24 pagesE-Mail: E-Mail: Direct Dial: 480-719-8501 6991 East Camelback Road, Suite D-102 Scottsdale, Arizona 85251 Fax: (480) 245-6231eric misterovichNo ratings yet

- The Beginnings of Filipino NationalismDocument17 pagesThe Beginnings of Filipino NationalismTrishia Silvestre75% (4)

- Briefing by Chief of Nuclear, Biological and Chemical Protection Troops of The Armed Forces of The Russian FederationDocument2 pagesBriefing by Chief of Nuclear, Biological and Chemical Protection Troops of The Armed Forces of The Russian FederationKelen David McBreen100% (3)

- People Vs Yorac PDFDocument9 pagesPeople Vs Yorac PDFKim Muzika PerezNo ratings yet

- Bao Feng Yu LyricsDocument1 pageBao Feng Yu LyricsLisa Afriani SiregarNo ratings yet

- Vocabulary About CrimeDocument2 pagesVocabulary About CrimeDayana CamargoNo ratings yet

- Revisiting The Bank of Uganda Onecoin Public Notice.Document5 pagesRevisiting The Bank of Uganda Onecoin Public Notice.Idoot Augustine ObililNo ratings yet

- 42 Rallos vs. YangoDocument2 pages42 Rallos vs. YangoMichelle Montenegro - AraujoNo ratings yet

- The Rise of Dalit EnterpriseDocument11 pagesThe Rise of Dalit EnterpriseAbhishek SinghNo ratings yet

- Ideological Foundation and PrinciplesDocument10 pagesIdeological Foundation and PrinciplesMuhammad Tazeem MunawarNo ratings yet

- Critical Thinking ObstaclesDocument66 pagesCritical Thinking ObstaclesSwapnilNo ratings yet

- Prosecutors and RaceDocument4 pagesProsecutors and Raceapi-690916425No ratings yet

- Allison Bergman: Disciplinary BriefDocument98 pagesAllison Bergman: Disciplinary BriefStaci ZaretskyNo ratings yet

- Steag State PowerDocument7 pagesSteag State PowerDNAANo ratings yet

- Valeriano Injuries Not Work-ConnectedDocument8 pagesValeriano Injuries Not Work-Connectedangelli45No ratings yet

- Couple Assessment FormDocument5 pagesCouple Assessment FormDennis Nutter100% (1)

- Heirs of Pasag v. Parocha: Formal Offer of One's Evidence Is Deemed Waived AfterDocument1 pageHeirs of Pasag v. Parocha: Formal Offer of One's Evidence Is Deemed Waived AfterJoshua AbadNo ratings yet

- Juan Crisostomo Ibarra's Return to the PhilippinesDocument5 pagesJuan Crisostomo Ibarra's Return to the PhilippinesCodeSeekerNo ratings yet

- CV Rio Andy PrasetyoDocument1 pageCV Rio Andy Prasetyoriyo romansyahNo ratings yet

- Chapter 22 Prevention of Oppression and MismanagementDocument14 pagesChapter 22 Prevention of Oppression and MismanagementZia AhmadNo ratings yet

- Daftar Nama Anak Pemberian Sweeping Vitamin A Pekon Tanjung Anom Uptd. Puskesmas Pasar Simpang Ke - Kota Agung TimurDocument6 pagesDaftar Nama Anak Pemberian Sweeping Vitamin A Pekon Tanjung Anom Uptd. Puskesmas Pasar Simpang Ke - Kota Agung TimuridafaridaNo ratings yet

- Autoritatea Natională Sanitară Veterinară Şi Pentru Siguranţa AlimentelorDocument12 pagesAutoritatea Natională Sanitară Veterinară Şi Pentru Siguranţa AlimentelorValeria DumitrescuNo ratings yet

- De Guia Vs Manila Electric CoDocument2 pagesDe Guia Vs Manila Electric CoCarl AngeloNo ratings yet

- Devotional Final Distorted Images of GodDocument20 pagesDevotional Final Distorted Images of Godapi-201429941No ratings yet

- Mussolini and CatholicismDocument13 pagesMussolini and Catholicismapi-235221639No ratings yet

- Advanced Fellatio Techniques and SecretsDocument5 pagesAdvanced Fellatio Techniques and Secretstofty21100% (2)

- Joint and Solidary Obligations ExplainedDocument47 pagesJoint and Solidary Obligations ExplainedBernadette Ruiz AlbinoNo ratings yet