Professional Documents

Culture Documents

Pension Letter 2

Uploaded by

nahidahcomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Letter 2

Uploaded by

nahidahcomCopyright:

Available Formats

Dutypoint Ltd

Shepherds Road

Gloucester

GL2 5EL

31 May 2022

Miss N. Rana

23 Stanley Road

Gloucester

GL1 5DQ

Dear Nahidah

Dutypoint Ltd Pension Scheme – A change in the law that affects you

To help people save more for their retirement, all employers are now required by law to provide a

workplace pension for certain staff and pay money into it.

We therefore have enrolled you on 01/05/2022 into our pension scheme because you either opted to join

the pension scheme or you met all of the following criteria:

You earn over £10,000 per year (£833 per month).

You are aged 22 or over and

You are under state pension age

You can opt out of the pension scheme if you want to, but if you stay in you will have your own personal

pension when you retire. Your pension will belong to you, even if you leave us in the future.

Both Dutypoint Ltd and you will pay into the pension scheme every month, and the government will

contribute through tax relief.

The information below will tell you everything you need to know about automatic enrolment. You will also

receive a starter pack of information from the pension scheme. The scheme is provided by Nest Pension.

Yours sincerely

Annika Harris

Joiners Version 1.0

Your workplace questions answered

Why have I been automatically enrolled?

All employers now have to put their workers into a pension scheme if they earn over £10,000 per year, are

aged 22 or over and are under state pension age. This is the law, because the government wants to get

more people to have another income in addition to the state pension when they retire.

What if I don’t want to join the scheme?

What if I opt out of the scheme but then change my mind in the future?

You can ask to rejoin the scheme by contacting, Annika Harris in writing by sending a letter, which has to

be signed by you. Or if sending it electronically, it has to contain the phrase "I confirm I personally

submitted this notice to join a workplace pension scheme". Please send to:

Annika Harris

annika.harris@dutypoint.com

If you earn more than £6,240 per year (£520 per month) Dutypoint Ltd will pay contributions into the

pension scheme as well.

You can re-join only once in any 12 month period.

If I opt out what happens after that?

Anyone who opts out or stops making payments will be automatically enrolled back into a pension scheme

at a later date (usually every three years, if they meet certain criteria). This is because your circumstances

may have changed and it may be the right time for you to start saving. We will contact you when this

happens, and you can opt out again if it's still not right for you.

If I stay in the scheme do I have to pay in?

You will pay in 5.00 % of Pensionable Pay each period. This will be taken directly from your pay and will

include tax relief from the government.

We will also pay in 3.00 % of Pensionable Pay each period.

Will this amount change?

As your contribution is a percentage of your pay, the amounts will automatically go up or down if your

earnings do.

Joiners Version 1.0

Joiners Version 1.0

You might also like

- Offer Letter GurgoanDocument15 pagesOffer Letter GurgoandimpyNo ratings yet

- JayPrakash PDFDocument7 pagesJayPrakash PDFDigvijayNo ratings yet

- Donors TaxDocument39 pagesDonors TaxRowenaBuan-YostNo ratings yet

- Budget Insurance POLICY NUMBER 778754485Document13 pagesBudget Insurance POLICY NUMBER 778754485suzan moeketsiNo ratings yet

- 80D Tax CertificateDocument2 pages80D Tax CertificateShop On the spotNo ratings yet

- Policy 417815024Document5 pagesPolicy 417815024MuraliMohanNo ratings yet

- Sapient Offer Letter Gurgoan PDFDocument15 pagesSapient Offer Letter Gurgoan PDFdimpy50% (2)

- Bill165914290 1Document5 pagesBill165914290 1ali hassanNo ratings yet

- Click Here To Log in Randstad Portal: Registered OfficeDocument15 pagesClick Here To Log in Randstad Portal: Registered OfficePramod Kumar Singh100% (1)

- Statement 2024 1Document5 pagesStatement 2024 1nahidahcomNo ratings yet

- Executive Summary For HealthSouthDocument3 pagesExecutive Summary For HealthSouthtaxidriver320% (1)

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- 2 Keynote John Moavenzadeh World Economic ForumDocument57 pages2 Keynote John Moavenzadeh World Economic ForumNé MrgsfNo ratings yet

- The Modern World-System As Capitalist World-EconomyDocument14 pagesThe Modern World-System As Capitalist World-EconomyRonella DozaNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- This Study Resource WasDocument6 pagesThis Study Resource WasPandu Zea ArdiansyahNo ratings yet

- Pension LetterDocument3 pagesPension LetternahidahcomNo ratings yet

- Kensington Practice Pension Letter Joiner Mrs K. Paraiso Da Rocha 01-07-2023Document2 pagesKensington Practice Pension Letter Joiner Mrs K. Paraiso Da Rocha 01-07-2023Mia ZhandNo ratings yet

- RussDocument3 pagesRussrussell.mcghieNo ratings yet

- Statement of Benefits 30 04 2020Document10 pagesStatement of Benefits 30 04 2020Chris MillsNo ratings yet

- Here's Your Annual Statement.: NEST, Nene Hall, Lynch Wood Business Park, Peterborough, PE2 6FY T: 0300 020 0090Document9 pagesHere's Your Annual Statement.: NEST, Nene Hall, Lynch Wood Business Park, Peterborough, PE2 6FY T: 0300 020 0090Jose RayoNo ratings yet

- Covernote SA716455 1638260687459Document2 pagesCovernote SA716455 1638260687459Prashant PrinceNo ratings yet

- Transfer Quote 4 PDFDocument11 pagesTransfer Quote 4 PDFjarraspeedyNo ratings yet

- Auto Enrolment EleanorShawDocument1 pageAuto Enrolment EleanorShawEllie JeanNo ratings yet

- We've Completed Your Payment Request: NEST, Nene Hall, Lynch Wood Business Park, Peterborough, PE2 6FY T: 0300 020 0090Document2 pagesWe've Completed Your Payment Request: NEST, Nene Hall, Lynch Wood Business Park, Peterborough, PE2 6FY T: 0300 020 0090Saymon Pita ReinaNo ratings yet

- DocumentDocument1 pageDocumentPingala SoftNo ratings yet

- Caprice Postponement NoticeDocument1 pageCaprice Postponement NoticeBabacar KebeNo ratings yet

- Your Guide To Auto-EnrolmentDocument5 pagesYour Guide To Auto-EnrolmentnikNo ratings yet

- 20 August 2020 PDT18: You Qualify For A Rebate - No Action RequiredDocument1 page20 August 2020 PDT18: You Qualify For A Rebate - No Action Requiredjaale jamaalNo ratings yet

- Abdiqani Ahmed HusseinDocument1 pageAbdiqani Ahmed Husseinjaale jamaalNo ratings yet

- ASK Italian NEST FW Letter 1 NewDocument2 pagesASK Italian NEST FW Letter 1 NewGiovanni CanisiNo ratings yet

- SD502 (V22) 05.2021Document4 pagesSD502 (V22) 05.2021Beaulah HunidzariraNo ratings yet

- SD502 (V15) 12.2015Document4 pagesSD502 (V15) 12.2015Anonymous gw6lCkTiMWNo ratings yet

- Payroll: NewsletterDocument2 pagesPayroll: Newsletterapi-286748329No ratings yet

- eRRS 01962015 22092022162212 1Document2 pageseRRS 01962015 22092022162212 1Prakash GadadNo ratings yet

- Guled 2Document1 pageGuled 2jaale jamaalNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeSurya PrakashNo ratings yet

- 80D PDFDocument2 pages80D PDFPandu SathishNo ratings yet

- Jobseekers Notification - 20 - 07 - 23Document4 pagesJobseekers Notification - 20 - 07 - 23Callum MaxwellNo ratings yet

- Renewal Notice: Policy No.P/141126/01/2019/003982Document1 pageRenewal Notice: Policy No.P/141126/01/2019/003982manoharNo ratings yet

- Epolicy BondDocument25 pagesEpolicy BondViji M JNo ratings yet

- NSW CTP Insurance From Budget DirectDocument1 pageNSW CTP Insurance From Budget Directjlcastles06No ratings yet

- Receipt OT010072550Document2 pagesReceipt OT010072550thetrilight2023No ratings yet

- You're Nearing Your Nest Retirement DateDocument4 pagesYou're Nearing Your Nest Retirement Datesuegun56No ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrusharShahNo ratings yet

- De Ned Bene T Account Guide: Issued 28 February 2022Document24 pagesDe Ned Bene T Account Guide: Issued 28 February 2022Joyce SohNo ratings yet

- Click Here To Log in Randstad Portal: Registered OfficeDocument15 pagesClick Here To Log in Randstad Portal: Registered OfficePramod Kumar SinghNo ratings yet

- Star Health Offer LetterDocument1 pageStar Health Offer LetterPARVEEN CHAHAR0% (2)

- Policy Schedule - Certificate of Insurance: Cover DetailsDocument10 pagesPolicy Schedule - Certificate of Insurance: Cover DetailsburgoyneNo ratings yet

- Renewal Notice: Policy No.P/151115/01/2018/008058Document1 pageRenewal Notice: Policy No.P/151115/01/2018/008058Khel Manoranjan Mitra MandalNo ratings yet

- Click Here To Log in Randstad Portal: Registered OfficeDocument15 pagesClick Here To Log in Randstad Portal: Registered OfficePramod Kumar SinghNo ratings yet

- Ew T Lift 79876618031689223664021Document1 pageEw T Lift 79876618031689223664021Ritesh SinghNo ratings yet

- Policy DocDocument4 pagesPolicy DocsrisaravananNo ratings yet

- Benefits Handbook - October 2022Document48 pagesBenefits Handbook - October 2022Leroy HallNo ratings yet

- Renewal Notice: Policy No.P/131112/01/2019/007048Document1 pageRenewal Notice: Policy No.P/131112/01/2019/007048mkm969No ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticerajaNo ratings yet

- Policy Document 70871957Document18 pagesPolicy Document 70871957Sajid NavyNo ratings yet

- Screenshot 2023-05-12 at 2.28.08 PMDocument2 pagesScreenshot 2023-05-12 at 2.28.08 PMbhaktiNo ratings yet

- Saurabh Kumar Singh House No 505, Post Officebasantpur, Near Hanuman Mandir, Basantpur, Ballia, UTTAR PRADESH-277301 MOBILE NUMBER: 8354953469Document33 pagesSaurabh Kumar Singh House No 505, Post Officebasantpur, Near Hanuman Mandir, Basantpur, Ballia, UTTAR PRADESH-277301 MOBILE NUMBER: 8354953469Saurabh Kumar SinghNo ratings yet

- Policy DocDocument7 pagesPolicy DocYogy YNo ratings yet

- Confirming Your Eligibility For Tax ReliefDocument4 pagesConfirming Your Eligibility For Tax ReliefnahidahcomNo ratings yet

- Salary Exchange... A Tax Efficient Way To Boost Your Plans For The FutureDocument4 pagesSalary Exchange... A Tax Efficient Way To Boost Your Plans For The FutureStandard Life UKNo ratings yet

- PremiumReceipt 03128410 1638813565Document1 pagePremiumReceipt 03128410 1638813565Arpit GulhaneNo ratings yet

- Policy DocDocument6 pagesPolicy DocOmer Adelalamin AliNo ratings yet

- Rbs Switch Offer Terms 2024Document1 pageRbs Switch Offer Terms 202417624No ratings yet

- Compatibility Report Leo 2Document42 pagesCompatibility Report Leo 2nahidahcomNo ratings yet

- Nahidah RanaDocument5 pagesNahidah RananahidahcomNo ratings yet

- PDF DocumentDocument9 pagesPDF DocumentnahidahcomNo ratings yet

- L&C Mortgages ApplicationDocument11 pagesL&C Mortgages ApplicationnahidahcomNo ratings yet

- Confirming Your Eligibility For Tax ReliefDocument4 pagesConfirming Your Eligibility For Tax ReliefnahidahcomNo ratings yet

- Employment Application FormDocument6 pagesEmployment Application FormAbdilahi abdiNo ratings yet

- The Strategic Role of The HR FunctionsDocument43 pagesThe Strategic Role of The HR Functionshadi fASIALNo ratings yet

- Mansek Investor Digest 13 Mar 2024 Mandiri Investment Forum 2024Document28 pagesMansek Investor Digest 13 Mar 2024 Mandiri Investment Forum 2024Candra AdyastaNo ratings yet

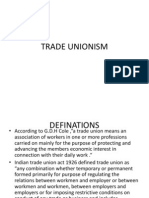

- Trade UnionismDocument16 pagesTrade UnionismBhavika BaliNo ratings yet

- Test BankDocument269 pagesTest BankmerveNo ratings yet

- Full NameDocument6 pagesFull NameMuh Nurfaiz FahmiNo ratings yet

- Financial Restructuring in CorporationsDocument48 pagesFinancial Restructuring in Corporationscalling_nNo ratings yet

- ODC AcmeOmega Group1Document3 pagesODC AcmeOmega Group1kandarp_suchakNo ratings yet

- Francis Marion University: BUSI - 458: Strategic Management Dr. Fred R. DavidDocument40 pagesFrancis Marion University: BUSI - 458: Strategic Management Dr. Fred R. DavidAlejandro Avila RestrepoNo ratings yet

- IELTS Academic Reading Exercise 4 - A Workaholic Economy A Workaholic EconomyDocument2 pagesIELTS Academic Reading Exercise 4 - A Workaholic Economy A Workaholic EconomyStrides for EnglishNo ratings yet

- Mutual Fund Management. Sybim-Sem-3 Faculty - Khyati Ma'am Co-Ordinator - Sheetal Ma'am Hinduja College of CommerceDocument24 pagesMutual Fund Management. Sybim-Sem-3 Faculty - Khyati Ma'am Co-Ordinator - Sheetal Ma'am Hinduja College of CommerceMonish jainNo ratings yet

- State Sovereignty Is Constantly Under Threat From MncsDocument8 pagesState Sovereignty Is Constantly Under Threat From MncsGary FlemmingNo ratings yet

- Aia Annual Report 2017 EngDocument281 pagesAia Annual Report 2017 EngAlezNgNo ratings yet

- Narendra MurkumbiDocument2 pagesNarendra MurkumbivikramvsuNo ratings yet

- Employment ContractDocument10 pagesEmployment ContractsusanaNo ratings yet

- Impact Report 2022 FINALDocument35 pagesImpact Report 2022 FINALclive.action01No ratings yet

- MSC Accounting and FinanceDocument2 pagesMSC Accounting and FinanceDwomoh Sarpong100% (1)

- Win22 Pill3 BoP Intl Trade HDT MrunalDocument25 pagesWin22 Pill3 BoP Intl Trade HDT MrunalAkhilesh YadavNo ratings yet

- Labour-Based Works Methodology Experiences From ILO: Module 2: Planning, Design, Appraisal and ImplementationDocument46 pagesLabour-Based Works Methodology Experiences From ILO: Module 2: Planning, Design, Appraisal and ImplementationMarvin MessiNo ratings yet

- Operations Management Iii: Miguel Ángel Heras Forcada Miguelangel - Heras@esade - EduDocument19 pagesOperations Management Iii: Miguel Ángel Heras Forcada Miguelangel - Heras@esade - Edulluisitu96No ratings yet

- Annual Report 2015Document242 pagesAnnual Report 2015Tawsif HasanNo ratings yet

- FM - 30 MCQDocument8 pagesFM - 30 MCQsiva sankarNo ratings yet

- Chapter 5 - Human Resource Planning in HrisDocument24 pagesChapter 5 - Human Resource Planning in HrisAfni SelamatNo ratings yet

- Case StudyDocument22 pagesCase StudySo BiaNo ratings yet