Professional Documents

Culture Documents

2017 Dec Q-6

Uploaded by

何健珩Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2017 Dec Q-6

Uploaded by

何健珩Copyright:

Available Formats

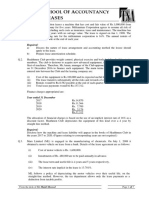

4 During the year ended 31 March 2017, Mr Mo leased out his office in Hong Kong under the following

ng terms:

(1) Term of lease: two years from 1 September 2016.

(2) Rental: $48,000 per month (inclusive of a management fee of $2,000 per month), payable in advance.

(3) Rent-free period: one month from 1 September 2016.

(4) Initial premium: $30,000, payable on signing the lease agreement.

(5) Rental deposit: $96,000, payable on signing the lease agreement. As per the lease agreement, the rental deposit

is used to compensate any loss of revenue when the tenant defaults in payment.

(6) Rates: $3,000 per quarter, payable by Mr Mo to the government.

(7) Management fee: $2,000 per month, payable by Mr Mo to the management company.

(8) Property agency fee: $24,000 payable by Mr Mo for sourcing the tenant.

(9) Mortgage interest: $16,000 per month, incurred by Mr Mo on a bank loan used to acquire the property.

(10) Renovation: $130,000, paid by Mr Mo for office renovation before the start of the lease.

(11) Repair to keylock: $500 incurred by the tenant on 1 February 2017. The tenant did not deduct the repair cost

from the rental payment.

On 1 March 2017, the tenant advised Mr Mo that they had moved out of the office due to a water dripping problem,

and refused to pay the rental for the month of March. Mr Mo immediately paid $40,000 to repair the property and

fixed the water dripping problem in a week. The tenant moved back into the property on 1 April 2017 and continued

to pay rental from that date. Mr Mo hired a lawyer to recover the March rental from the tenant and incurred a legal fee

of $5,000.

On 30 June 2017, the tenant terminated the lease and moved out of the office. Mr Mo deducted one month’s rental

from the rental deposit and refunded $48,000 to the tenant upon termination of the lease. Since then, the property

has been left vacant.

Required:

Prepare Mr Mo’s property tax computations for the years of assessment 2016/17 and 2017/18, showing the net

assessable values and the property tax payable (or repayable if appropriate) for each year.

Note: You should assume the tax rates for 2016/17 continue to apply for 2017/18.

(10 marks)

11 [P.T.O.

You might also like

- DocxDocument119 pagesDocxRene Lopez100% (1)

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- Econ Project FinalDocument9 pagesEcon Project FinalMharco Colipapa0% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Estmt - 2021 12 31Document8 pagesEstmt - 2021 12 31Jonathan Seagull LivingstonNo ratings yet

- Fake Paystub 2Document1 pageFake Paystub 2Brandon CarpenterNo ratings yet

- Johnson & JohnsonDocument5 pagesJohnson & JohnsonAngela100% (1)

- TIA 2/FM Seminar A.1 ProblemsDocument23 pagesTIA 2/FM Seminar A.1 ProblemsPrisco SayNo ratings yet

- 2018 Dec Q-11Document1 page2018 Dec Q-11何健珩No ratings yet

- 2015 Dec Q-9Document1 page2015 Dec Q-9何健珩No ratings yet

- 2016 Jun Q-4Document1 page2016 Jun Q-4何健珩No ratings yet

- 2019 Dec Q-9Document1 page2019 Dec Q-9何健珩No ratings yet

- 2015 Jun Q-9Document1 page2015 Jun Q-9何健珩No ratings yet

- Mayfair Apartments: 1. Amount Receivable From TenantsDocument4 pagesMayfair Apartments: 1. Amount Receivable From TenantsSaurabh MahajanNo ratings yet

- FAR Assignment 5 Adjusting EntriesDocument2 pagesFAR Assignment 5 Adjusting EntriesPaula BautistaNo ratings yet

- Operating Lease Vs Finance LeaseDocument5 pagesOperating Lease Vs Finance LeasexjammerNo ratings yet

- Investment GuidelinesDocument11 pagesInvestment GuidelinestelugukhanNo ratings yet

- Test Paper 1 SalaryDocument4 pagesTest Paper 1 SalaryjesurajajosephNo ratings yet

- Test Paper 1 Salary PDFDocument4 pagesTest Paper 1 Salary PDFShrikant MahajanNo ratings yet

- Financial Accounting Part 2Document5 pagesFinancial Accounting Part 2Christopher Price0% (1)

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- TQ U2 Property0 PDFDocument3 pagesTQ U2 Property0 PDFRafaelKwongNo ratings yet

- A City Engages in The Transactions That Follow For Each: Unlock Answers Here Solutiondone - OnlineDocument1 pageA City Engages in The Transactions That Follow For Each: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Problems - Adjusting EntriesDocument3 pagesProblems - Adjusting EntriesaNo ratings yet

- Assignment Cel 779Document8 pagesAssignment Cel 779Arneet SarnaNo ratings yet

- Lease Accounting QuizDocument1 pageLease Accounting QuizLanie Lamazon0% (1)

- 2016 Dec Q-4Document1 page2016 Dec Q-4何健珩No ratings yet

- Soal Matematika KeuanganDocument7 pagesSoal Matematika KeuanganchoirunnisaNo ratings yet

- Accounting ExercisesDocument1 pageAccounting Exerciseswindell arth MercadoNo ratings yet

- Balance Sheet NumericalsDocument4 pagesBalance Sheet Numericalsnandini singhNo ratings yet

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- Exercises (Adjusting)Document7 pagesExercises (Adjusting)Joey G. SantosNo ratings yet

- Adjusting Entries 11-23Document2 pagesAdjusting Entries 11-23Allen CarlNo ratings yet

- P5Document7 pagesP5Chris PecasalesNo ratings yet

- AC3202 - 20202021B - Exam PaperDocument9 pagesAC3202 - 20202021B - Exam PaperlawlokyiNo ratings yet

- Operating Lease - Lessee: Problem 1Document2 pagesOperating Lease - Lessee: Problem 1Xander MerzaNo ratings yet

- ProbsetDocument1 pageProbsetJeff tvNo ratings yet

- 1 - Notes Payable and Bonds Payable - Part 1Document1 page1 - Notes Payable and Bonds Payable - Part 1John Wendell EscosesNo ratings yet

- FE QuestionsDocument2 pagesFE Questionsviedereen12No ratings yet

- T-MEET310 PS SurnameDocument6 pagesT-MEET310 PS SurnameRochiiNo ratings yet

- Probset EeconDocument3 pagesProbset Eecongail0% (1)

- Leases PS GoodsDocument4 pagesLeases PS GoodsDissentNo ratings yet

- ECONDocument11 pagesECON22-00248No ratings yet

- Chapter 2 ANNUITIESDocument21 pagesChapter 2 ANNUITIESCarl Omar GobangcoNo ratings yet

- Lessee Company On January 1 2010 Enters Into A 5 YearDocument1 pageLessee Company On January 1 2010 Enters Into A 5 YearM Bilal SaleemNo ratings yet

- Wk7-9 Leases AssignmentsDocument2 pagesWk7-9 Leases AssignmentsScarlett ManNo ratings yet

- Comprehensive ProblemDocument3 pagesComprehensive ProblemRahul100% (1)

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Universiti Teknologi Mara Common Test 2: Instructions To CandidatesDocument5 pagesUniversiti Teknologi Mara Common Test 2: Instructions To CandidatesanisNo ratings yet

- Fundamentals of Engineering EconomyDocument3 pagesFundamentals of Engineering EconomySean Matthew L. OcampoNo ratings yet

- Task # 3 - Practice Problems. AnnuitiesDocument1 pageTask # 3 - Practice Problems. AnnuitiesEricka Mae FedereNo ratings yet

- PROBLEM SET 1 (Part 1 & 2)Document3 pagesPROBLEM SET 1 (Part 1 & 2)selmareynaldo29No ratings yet

- Ilovepdf Merged 3Document77 pagesIlovepdf Merged 3Dani ShaNo ratings yet

- Institute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalDocument5 pagesInstitute and Faculty of Actuaries: Subject CT1 - Financial Mathematics Core TechnicalfeererereNo ratings yet

- 01 Time Value of Money-ModifiedDocument62 pages01 Time Value of Money-ModifiedSatyam PandeyNo ratings yet

- Ifrs 15 QuestionsDocument2 pagesIfrs 15 QuestionsTata MgpNo ratings yet

- INTAC3 McsDocument10 pagesINTAC3 Mcsrachel banana hammockNo ratings yet

- Soal Ujian Tengah Semester - 2BD3 - 2020Document3 pagesSoal Ujian Tengah Semester - 2BD3 - 2020Fatwa XI-Adam SmithNo ratings yet

- EconDocument1 pageEconTerrellUtanesLasamNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- Equations of ValueDocument1 pageEquations of ValueAnonymous jZc1vv2100% (1)

- Winning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertFrom EverandWinning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertNo ratings yet

- 2017 Dec Q-7-8Document2 pages2017 Dec Q-7-8何健珩No ratings yet

- 2018 Jun Q-7-8Document2 pages2018 Jun Q-7-8何健珩No ratings yet

- Acct4410 2022 Spring - Profit TaxDocument2 pagesAcct4410 2022 Spring - Profit Tax何健珩No ratings yet

- 2016 Dec Q-7-8Document2 pages2016 Dec Q-7-8何健珩No ratings yet

- 2018 Dec Q-14-15Document2 pages2018 Dec Q-14-15何健珩No ratings yet

- Take Home Exercise No 4 - Salaries Tax Computation (2023S)Document3 pagesTake Home Exercise No 4 - Salaries Tax Computation (2023S)何健珩No ratings yet

- 2015 Dec Ans-5Document1 page2015 Dec Ans-5何健珩No ratings yet

- 2016 Jun Ans-3Document1 page2016 Jun Ans-3何健珩No ratings yet

- Take Home Exercise No 2 - Property Tax (2023S)Document2 pagesTake Home Exercise No 2 - Property Tax (2023S)何健珩No ratings yet

- Lecture Note 4aDocument5 pagesLecture Note 4a何健珩No ratings yet

- Lecture 9 - Digital Platform (Basics)Document30 pagesLecture 9 - Digital Platform (Basics)何健珩No ratings yet

- Business Plan: Social Impact Project - ShinyhkDocument24 pagesBusiness Plan: Social Impact Project - Shinyhk何健珩No ratings yet

- Free The FoodDocument18 pagesFree The Food何健珩No ratings yet

- 2018 Jun Ans-4Document1 page2018 Jun Ans-4何健珩No ratings yet

- Lecture 7 - E-Commerce (FinTech)Document30 pagesLecture 7 - E-Commerce (FinTech)何健珩No ratings yet

- Lecture 13 - Big Data (Analytics For Text and Network)Document31 pagesLecture 13 - Big Data (Analytics For Text and Network)何健珩No ratings yet

- Lecture 10. The Goods (And Services) Market in An Open EconomyDocument35 pagesLecture 10. The Goods (And Services) Market in An Open Economy何健珩No ratings yet

- LABU2040 Business Case Analysis: Wk. 8-9 Writing SkillsDocument21 pagesLABU2040 Business Case Analysis: Wk. 8-9 Writing Skills何健珩No ratings yet

- Interactive Form W-9 Form From EchoSign - Com Electronic SignatureDocument1 pageInteractive Form W-9 Form From EchoSign - Com Electronic SignatureEchoSign95% (19)

- Aiatsl: (Wholly Owned Subsidiary of Air India Limited)Document1 pageAiatsl: (Wholly Owned Subsidiary of Air India Limited)Ashna anilkumar pNo ratings yet

- Affin Bank PermanentIncreaseCreditLimitApplicationFormDocument3 pagesAffin Bank PermanentIncreaseCreditLimitApplicationFormTan Kae JiunnNo ratings yet

- Big GroupDocument31 pagesBig Groupvanita kunnoNo ratings yet

- Financial Peace University - Member WorkbookDocument153 pagesFinancial Peace University - Member Workbookkate1mayfield-1100% (1)

- Laporan Laba Rugi: Single Step VDocument1 pageLaporan Laba Rugi: Single Step VGazalirahman FarisiNo ratings yet

- App To Borrow On in Italy - Google SearchDocument1 pageApp To Borrow On in Italy - Google SearchCaleb OgunkoruNo ratings yet

- 2019 TSP Catch-Up Contributions and Effective Date ChartDocument1 page2019 TSP Catch-Up Contributions and Effective Date ChartRayNo ratings yet

- Blackbook Project On InsuranceDocument78 pagesBlackbook Project On Insurancesai saiNo ratings yet

- Income From Bussiness and ProfessionDocument2 pagesIncome From Bussiness and ProfessionKr KvNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- WellsFargo-2Document4 pagesWellsFargo-2itsoueNo ratings yet

- Cancellation BG-to MBBDocument6 pagesCancellation BG-to MBBfarisya amylinNo ratings yet

- Kajal Questionnaire For Customers-1Document4 pagesKajal Questionnaire For Customers-1Mukesh GiriNo ratings yet

- Lecture 6 Loan (Auto-Saved)Document48 pagesLecture 6 Loan (Auto-Saved)Felicia PriskillaNo ratings yet

- Statement 517057 86377450 17 04 2021 17 06 2021Document6 pagesStatement 517057 86377450 17 04 2021 17 06 2021Yeaze100% (1)

- Earnings Statementimportant - Keep For Your Records: E-MailDocument1 pageEarnings Statementimportant - Keep For Your Records: E-MailJuanNo ratings yet

- Ultimate Guide To Life Insurance by Bryan VillarosaDocument28 pagesUltimate Guide To Life Insurance by Bryan VillarosaBryan VillarosaNo ratings yet

- Tools Nbot 18102023Document644 pagesTools Nbot 18102023kiosbuaranNo ratings yet

- SEND Q2 GM Week 1Document37 pagesSEND Q2 GM Week 1wilzl sarrealNo ratings yet

- Gen Math Problems For Math MazeDocument1 pageGen Math Problems For Math MazeErika Roxanne ColeNo ratings yet

- Law Journal Vol. 2, No. 1 Spring 2010Document248 pagesLaw Journal Vol. 2, No. 1 Spring 2010Foreclosure FraudNo ratings yet

- 2023 08 29 Statement HSBCDocument5 pages2023 08 29 Statement HSBCTomasz WinterNo ratings yet

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudence Contact UsDocument6 pagesPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudence Contact Usinternation businesstradeNo ratings yet

- Computation of Total Income Income From Salary (Chapter IV A) 260000Document1 pageComputation of Total Income Income From Salary (Chapter IV A) 260000jassi7nishadNo ratings yet

- IGL, General Banking Law (Riguera Lec)Document12 pagesIGL, General Banking Law (Riguera Lec)Ivan LeeNo ratings yet