Professional Documents

Culture Documents

Assignment 2

Uploaded by

bchege552000 ratings0% found this document useful (0 votes)

1 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesAssignment 2

Uploaded by

bchege55200Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

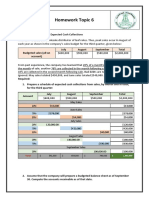

a) The following presents forecasted cash flow for Upendo Company Ltd for the period

April 2018 to December 2018

Month Sales Purchases

Shs Shs Shs

April 150,000 100,000

May 160,000 110,000

June 160,000 90,000

July 170,000 90,000

August 200,000 80,000

September 200,000 130,000

October 180,000 140,000

November 180,000 60,000

December 200,000 60,000

The following additional information is available

a) Cash in hand at the end of May 2018 will be Sh. 180,000

b) 50% of the sales proceeds are received in the current month, 30% in the following

month and the balance is received two months after sale

c) Supplies are paid one month after delivery of goods.

d) Corporation tax for 2017 amounting to Sh. 30,000 will be paid on 30th September

2018

e) Contractor’s retention monies amounting to Sh. 50,000 will be paid on 30th June,

2018

f) The shareholders at their general meeting increased the share capital by Sh. 90,000

and the first call of Sh. 50,000 will be received in October 2018

g) In October 2016, the company is due to receive Sh. 20,000 as compensation for a

civil suit

h) The monthly administration expenses amounting to Sh. 33,000 include factory

depreciation charge of Sh. 4000 and preliminary expenses of Sh. 3000

i) Office equipment worth Sh. 15,000 will be paid for in November 2018

Required;

Prepare a cash budget for the period 1st June 2018 to 31st December 2018 (7marks)

b) Highlight the advantages and disadvantages of debentures (6 mks)

c) Distinguish between financial gearing and operational gearing (4 mks)

d) Distinguish between Equity shares and preference shares (3 mks)

You might also like

- Budgeting - ExamplesDocument2 pagesBudgeting - Examplessunil.ctNo ratings yet

- Cash Budget Problem 2Document1 pageCash Budget Problem 2Akhil NarangNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- Cash Budget FIN242 PYQDocument7 pagesCash Budget FIN242 PYQNurafiqah Muddin100% (1)

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- Master BudgetDocument36 pagesMaster BudgetRafols AnnabelleNo ratings yet

- Corminal TPDocument7 pagesCorminal TPBetchang AquinoNo ratings yet

- Maria Irias Tarea Practica Capitulo7Document5 pagesMaria Irias Tarea Practica Capitulo7ScribdTranslationsNo ratings yet

- Finman Groupwork PDF FreeDocument4 pagesFinman Groupwork PDF FreeAbegiel MendozaNo ratings yet

- 08 TP - Evangelista Angela - 501PDocument9 pages08 TP - Evangelista Angela - 501PBetchang AquinoNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetAbdulkarim Hamisi KufakunogaNo ratings yet

- Final ExamDocument3 pagesFinal ExamLopez, Azzia M.No ratings yet

- Total Factory Overheads For Each Type of Product (Variable)Document2 pagesTotal Factory Overheads For Each Type of Product (Variable)Mayank JainNo ratings yet

- ACTDocument2 pagesACTjonalyn arellanoNo ratings yet

- Example Question Financial ManagementDocument3 pagesExample Question Financial ManagementNadhirah NadriNo ratings yet

- BudgetingDocument23 pagesBudgetingмарал курмановаNo ratings yet

- BudgetingDocument130 pagesBudgetingRevathi AnandNo ratings yet

- Topic 6 - Cash BudgetDocument3 pagesTopic 6 - Cash Budgetmichelle beyonceNo ratings yet

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDocument3 pagesHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamNo ratings yet

- Case Analysis (1 30)Document3 pagesCase Analysis (1 30)manishadaaNo ratings yet

- VM Salgaocar Institute of International Hospitality EducationDocument1 pageVM Salgaocar Institute of International Hospitality Educationbimbee 13No ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Tutorial Question On Cash BudgetDocument1 pageTutorial Question On Cash Budgetzulkafli muhammad zulhilmiNo ratings yet

- Question On Budget A LevelDocument3 pagesQuestion On Budget A LevelMUSTHARI KHANNo ratings yet

- Cherein Pael - Midterm Project Sept 30 - PROBLEM1Document1 pageCherein Pael - Midterm Project Sept 30 - PROBLEM1cherein6soriano6paelNo ratings yet

- Master Budgeting (Sample Problems With Answers)Document11 pagesMaster Budgeting (Sample Problems With Answers)Jonalyn TaboNo ratings yet

- Arias, Kyla Kim B. - Midterm Project Sept 30Document9 pagesArias, Kyla Kim B. - Midterm Project Sept 30Kyla Kim AriasNo ratings yet

- BudgetingDocument74 pagesBudgetingRevathi AnandNo ratings yet

- Unit - V Budget and Budgetary Control ProblemsDocument2 pagesUnit - V Budget and Budgetary Control ProblemsalexanderNo ratings yet

- Chapter 7 - Cash BudgetDocument23 pagesChapter 7 - Cash BudgetMostafa KaghaNo ratings yet

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- Budget Problems-Homework Help1Document1 pageBudget Problems-Homework Help1Ryoma EchizenNo ratings yet

- Assignment3 20110173Document5 pagesAssignment3 20110173Daud Nofel DaudNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Exercise 2.1Document9 pagesExercise 2.1Nurul ShazalinaNo ratings yet

- BudgetingDocument5 pagesBudgetingKevin James Sedurifa Oledan100% (1)

- Cash Inflows: Cash Surplus/loan RequirementDocument7 pagesCash Inflows: Cash Surplus/loan RequirementMIRZA WAQAR BAIGNo ratings yet

- Profit Planning and BudgetingDocument3 pagesProfit Planning and BudgetingRoyce Maenard EstanislaoNo ratings yet

- Final ExaminationDocument1 pageFinal ExaminationRegielyn RabocarsalNo ratings yet

- Op Budget SampleDocument2 pagesOp Budget SampleAngelica MalpayaNo ratings yet

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesNo ratings yet

- Cost Accounting 1Document2 pagesCost Accounting 1Anntoinette BendalNo ratings yet

- Cash Budget (Problem-1)Document1 pageCash Budget (Problem-1)Hakimzada Sharafat Ali HakimNo ratings yet

- TUTORIAL TOPIC 5 - Cash BudgetDocument4 pagesTUTORIAL TOPIC 5 - Cash BudgetQudwah HasanahNo ratings yet

- Assignment 3 MA 09062021 063143pmDocument1 pageAssignment 3 MA 09062021 063143pmAli AhmadNo ratings yet

- Problem On Cash BudgetDocument1 pageProblem On Cash BudgetRusheel ChavaNo ratings yet

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- Cash Budget Questions (Revised)Document6 pagesCash Budget Questions (Revised)James WisleyNo ratings yet

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- This Study Resource Was: Strategic Cost Management Master BudgetDocument5 pagesThis Study Resource Was: Strategic Cost Management Master BudgetNCTNo ratings yet

- Months: Sales Purchases Wages ExpensesDocument2 pagesMonths: Sales Purchases Wages Expensespranay639No ratings yet

- Master Budget QuizDocument1 pageMaster Budget QuizAbegail RafolsNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- Worksheet Master BudgetDocument6 pagesWorksheet Master BudgetRUPIKA R GNo ratings yet

- Tutorial 6Document5 pagesTutorial 6Steven CHONGNo ratings yet