Professional Documents

Culture Documents

Final Examination

Uploaded by

Regielyn RabocarsalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Examination

Uploaded by

Regielyn RabocarsalCopyright:

Available Formats

Final Examination

Business & Transfer Taxes

Answer the following, show your solution:

1. In April 20, 2018, Mr. Antonio Diaz, a resident citizen died leaving behind the

following properties to his only son, Thony, who is still a bachelor:

Land with a fair market value of P 4, 500, 000

House and lot with fair market value of P 8, 200, 000

Jewelries with fair market value of P 3, 800, 000

Mango farm with fair market value of P 4, 600, 000

Van with fair market value of P 900, 000.

Pertinent taxes were paid for these properties. The House and Lot has an

unpaid mortgage of P 850, 000 at the time of death of Mr. Antonio Diaz when Thony

died in October 10, 2020 the total mortgage paid on these properties is P 600, 000. His

gross estate including the properties inherited from his father were declared at

P 30 Million while deductions (for claims against the estate, claims against insolvent

person, unpaid mortgages, and transfers for public purpose) amounted to P 6.2 Million.

Other information are as follows:

Fair market value at the

Property time of death of Thony

Land P 5, 900, 000

House and lot 9, 300, 000

Jewelries 5, 100, 000

Mango farm 5, 700, 000

Van 550, 000

Required: 1. Compute for vanishing deductions.

2. Compute the estate tax payable of Thony.

2. The following are the quarterly sales and purchases of Arlyn Supermarket, a VAT-

registered entity for 2020:

Month Purchases Sales

April P 40, 850, 000 P 32, 700, 000

May 30, 400, 000 45, 600, 000

June 42, 500, 000 63, 500, 000

July 75, 200, 000 95, 300,000

August 61, 300, 000 82, 400, 000

September 70, 300, 000 65, 800, 000

October 80, 250, 000 74, 500, 000

November 40, 600, 000 76, 300, 000

December 50, 700, 000 90, 500, 000

Determine:

a Monthly VAT payable (Excess VAT)

b. Quarterly VAT payable (Excess VAT)

3. DGG General Services, a non-VAT entity has the following data for tax purposes for

the first quarter of 2021:

Month Receipts Expenses

January P 1, 260, 000 P 1, 050, 000

February 1, 300, 000 800, 000

March 700, 000 800, 800

Determine the percentage tax payable.

You might also like

- Inventories - ProblemDocument17 pagesInventories - ProblemIris Mnemosyne100% (4)

- VAT Tutorial Questions PDFDocument10 pagesVAT Tutorial Questions PDFPeter100% (1)

- c5 Solutions BudgetingDocument13 pagesc5 Solutions BudgetingChinnam Lalitha100% (1)

- Inventory Valuation and Gross Profit MethodDocument3 pagesInventory Valuation and Gross Profit MethodLuiNo ratings yet

- The Monster Guide to Candlestick PatternsDocument29 pagesThe Monster Guide to Candlestick PatternsVatsal ParikhNo ratings yet

- Ingo Corporation's cash budget and financial statementsDocument5 pagesIngo Corporation's cash budget and financial statementsLysss EpssssNo ratings yet

- BARACARBDocument2 pagesBARACARBYudha Satria50% (2)

- Synopsis On Customer Satisfaction On Internet BankingDocument5 pagesSynopsis On Customer Satisfaction On Internet BankingHitesh Chune100% (1)

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesNo ratings yet

- Act1104midterm Exam Wit AnsDocument9 pagesAct1104midterm Exam Wit AnsDyen100% (1)

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1lc100% (1)

- Illustration Deduction and Taxable EstateDocument8 pagesIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNo ratings yet

- Citibank'S Epay: Online Credit Card Payment. From Any BankDocument2 pagesCitibank'S Epay: Online Credit Card Payment. From Any BankHamsa KiranNo ratings yet

- Decoled FR Sas: Account MovementsDocument1 pageDecoled FR Sas: Account Movementsnatali vasylNo ratings yet

- Exercise 3 BudgetingDocument4 pagesExercise 3 BudgetingGabrielleNo ratings yet

- Business TaxationDocument5 pagesBusiness TaxationMajoy BantocNo ratings yet

- Profit Planning and BudgetingDocument3 pagesProfit Planning and BudgetingRoyce Maenard EstanislaoNo ratings yet

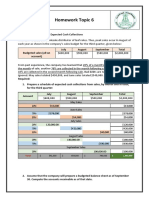

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDocument3 pagesHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamNo ratings yet

- Maria Irias Tarea Practica Capitulo7Document5 pagesMaria Irias Tarea Practica Capitulo7ScribdTranslationsNo ratings yet

- Assessment 2 2024 FAR - 1Document6 pagesAssessment 2 2024 FAR - 1ARBYLESA JUNIONo ratings yet

- Single Entry and Cash and AccrualDocument7 pagesSingle Entry and Cash and AccrualRinna LegaspiNo ratings yet

- Sales, Expenses and Cash Flow AnalysisDocument6 pagesSales, Expenses and Cash Flow AnalysisRUPIKA R GNo ratings yet

- Applied Taxation AssignmentDocument5 pagesApplied Taxation AssignmentDaud Nofel DaudNo ratings yet

- College of Business & Accountancy Manila City 1 Sem SY 2021-22Document2 pagesCollege of Business & Accountancy Manila City 1 Sem SY 2021-22Shiela Mae Pon AnNo ratings yet

- BSA 2105 Atty. F. R. Soriano Vat - Exercises 7: First QuarterDocument2 pagesBSA 2105 Atty. F. R. Soriano Vat - Exercises 7: First Quarterela kikayNo ratings yet

- MASTER-BUDGETDocument36 pagesMASTER-BUDGETRafols AnnabelleNo ratings yet

- Basic Finance Module 4Document6 pagesBasic Finance Module 4shaina bongongolNo ratings yet

- FAR Handout Borrowing CostsDocument4 pagesFAR Handout Borrowing CostsBAROTEA Cressia Mhay G.No ratings yet

- Activity 2 Problems Vat On Sale of Goods or PropertiesDocument3 pagesActivity 2 Problems Vat On Sale of Goods or PropertiesNiña Mae NarcisoNo ratings yet

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Budgeting - ExamplesDocument2 pagesBudgeting - Examplessunil.ctNo ratings yet

- AMC Company Cash Budget & Sales AnalysisDocument7 pagesAMC Company Cash Budget & Sales AnalysisBetchang AquinoNo ratings yet

- Accounting Test Bank 6Document32 pagesAccounting Test Bank 6likesNo ratings yet

- Proj 2Document15 pagesProj 2Shahan AsifNo ratings yet

- EXAMINATION ON INVENTORY MaDocument5 pagesEXAMINATION ON INVENTORY Macriszel4sobejanaNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- Solution On Taxation Module 1 and 2 PDF FreeDocument9 pagesSolution On Taxation Module 1 and 2 PDF FreePauline EchanoNo ratings yet

- 2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsDocument4 pages2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsKrisha TevesNo ratings yet

- 08 TP - Evangelista Angela - 501PDocument9 pages08 TP - Evangelista Angela - 501PBetchang AquinoNo ratings yet

- Production and Financial Projections for 2020Document2 pagesProduction and Financial Projections for 2020Jasmine UndecimoNo ratings yet

- Final ExamDocument3 pagesFinal ExamLopez, Azzia M.No ratings yet

- Example Question Financial ManagementDocument3 pagesExample Question Financial ManagementNadhirah NadriNo ratings yet

- Rañeses, Raizen Kyle - Activity For BudgetDocument4 pagesRañeses, Raizen Kyle - Activity For BudgetRK RanesesNo ratings yet

- CAS 11 Midterm QuizDocument7 pagesCAS 11 Midterm QuizShariine BestreNo ratings yet

- Bsa 2105 Atty. F. R. Soriano Value-Added TaxDocument2 pagesBsa 2105 Atty. F. R. Soriano Value-Added Taxela kikayNo ratings yet

- M4.1-M4.5 Exercise ProblemsDocument5 pagesM4.1-M4.5 Exercise ProblemsMerecci Angela De ChavezNo ratings yet

- Chapter 4 Part 2Document13 pagesChapter 4 Part 2rylNo ratings yet

- Budget Problems-Homework Help1Document1 pageBudget Problems-Homework Help1Ryoma EchizenNo ratings yet

- Assignment On TaxationDocument2 pagesAssignment On TaxationKal KalNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- Ass6 7Document1 pageAss6 7Kath LeynesNo ratings yet

- Answers ACT 209 MayugaDocument17 pagesAnswers ACT 209 MayugaAga Mathew MayugaNo ratings yet

- Illustration InventoriesDocument5 pagesIllustration InventoriesRiyhu DelamercedNo ratings yet

- Group Managerial AccountingDocument9 pagesGroup Managerial AccountingSlamet SalimNo ratings yet

- Ala in Finacct 3Document4 pagesAla in Finacct 3VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Example Cash BudgetDocument1 pageExample Cash BudgetPamela GalangNo ratings yet

- ADV Corp's 1-year sales, expenses, and 3-year projectionsDocument3 pagesADV Corp's 1-year sales, expenses, and 3-year projectionsJersey Ann AlcazarNo ratings yet

- BudgetingDocument74 pagesBudgetingRevathi AnandNo ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Wesleyan University-Philippines (WU-P) Maria, Aurora Aurora CampusDocument5 pagesWesleyan University-Philippines (WU-P) Maria, Aurora Aurora CampusYamyam ZehcnasNo ratings yet

- Albert Financial Plan FinalDocument16 pagesAlbert Financial Plan FinalJason TehNo ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- Inventory Valuation C10Document5 pagesInventory Valuation C10music niNo ratings yet

- Informações de Distribuição de CargaDocument15 pagesInformações de Distribuição de CargaSergio StoffelshausNo ratings yet

- What is Bluetooth? The complete guide to the wireless technology standardDocument4 pagesWhat is Bluetooth? The complete guide to the wireless technology standardArpit SrivastavaNo ratings yet

- PGDBF Project GuidelinesDocument9 pagesPGDBF Project Guidelineskaw_anchalNo ratings yet

- Computer Organization and ArchitectureDocument173 pagesComputer Organization and ArchitecturesalithakkNo ratings yet

- Arid Agriculture University, Rawalpindi: MultimediaDocument22 pagesArid Agriculture University, Rawalpindi: MultimediaAshh Ishh100% (1)

- EVIDENCE DIGESTS RULE 129 sEC. 4 TO Rule 130 Section 41Document48 pagesEVIDENCE DIGESTS RULE 129 sEC. 4 TO Rule 130 Section 41Pat RañolaNo ratings yet

- Assignment 2Document30 pagesAssignment 2Bikila Debela100% (1)

- PreviewpdfDocument32 pagesPreviewpdfAleena HarisNo ratings yet

- Codeigniter Library: 77 Free Scripts, Addons, Tutorials and VideosDocument6 pagesCodeigniter Library: 77 Free Scripts, Addons, Tutorials and VideosmbahsomoNo ratings yet

- Production Manager-43-4Document4 pagesProduction Manager-43-4Mohanram PandiNo ratings yet

- Sante Worklist Server QSG 1Document25 pagesSante Worklist Server QSG 1adamas77No ratings yet

- Appropriation For Annual Budget Year 2022Document5 pagesAppropriation For Annual Budget Year 2022Rafael FerolinoNo ratings yet

- Data CommunicationDocument2 pagesData CommunicationYzza Veah Esquivel100% (8)

- May 1217Document48 pagesMay 1217Matt EbrahimiNo ratings yet

- Sustainability at United Parcel ServiceDocument11 pagesSustainability at United Parcel ServiceBabak EbrahimiNo ratings yet

- MCS 150 Page 1Document2 pagesMCS 150 Page 1Galina NovahovaNo ratings yet

- 1 Network Layer Firewalls: Figure 1: Screened Host FirewallDocument3 pages1 Network Layer Firewalls: Figure 1: Screened Host FirewallAnonymous xN0cuz68ywNo ratings yet

- 0060200.installation Manual 546560Document36 pages0060200.installation Manual 546560Tríade MusicNo ratings yet

- S Com ManualDocument64 pagesS Com ManualL. J.No ratings yet

- Jnu Answer KeyDocument15 pagesJnu Answer Keykshitij singh rathore0% (1)

- Chapter 5 Study QuestionsDocument17 pagesChapter 5 Study QuestionsJohn HeilNo ratings yet

- DSP1800 Temperature and Humidity ProbeDocument2 pagesDSP1800 Temperature and Humidity ProbeGerardo SanchezNo ratings yet

- Design and Analysis of 4-2 Compressor For Arithmetic ApplicationDocument4 pagesDesign and Analysis of 4-2 Compressor For Arithmetic ApplicationGaurav PatilNo ratings yet

- Paired and Independent Samples T TestDocument34 pagesPaired and Independent Samples T TestMcjohnden LorenNo ratings yet

- The Amazing VFP2C32 LibraryDocument28 pagesThe Amazing VFP2C32 Libraryluis eduardo ostos febresNo ratings yet