Professional Documents

Culture Documents

FAR Handout Borrowing Costs

Uploaded by

BAROTEA Cressia Mhay G.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR Handout Borrowing Costs

Uploaded by

BAROTEA Cressia Mhay G.Copyright:

Available Formats

BORROWING COSTS – OTHER ISSUES

Naipaliwanag ko na nag borrowing costs sa handout sa CFAS under PAS 23. May computation din doon kaya mas magandang basahin

muna iyon bago mag-proceed sa handout na ito.

Ang issue lang na tatalakayin ko dito ay kapag ang qualifying asset ay gagawin nang mas maikli o mas mahaba sa isang tao. “yong

example ko na ibinigay sa CFAS ay exactly one year kaya mas madali ang treatment, though madali rin naman ang treatment kapag

below or more than a year.

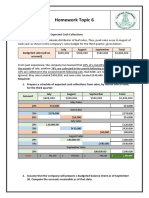

COMPUTATION OF BORROWING COST FOR CONSTRUCTION BELOW ONE YEAR

Ang pinakamababgo dito ay ang pagcocompute ng average expenditure. Ang kailangan lang i-consider sa computation ay kung ilang

month sang tagal ng construction. Therefore, hindi automatic na 12 months ang divisor.\

Example

Entity A constructed a building, which qualifies as a qualifying asset, on January 1, 2020. Construction of the building was finished on

August 31,2020. The entity borrows 2,000,000 to specifically finance the construction. It has an interest rate of 10% per annum. Other

borrowings include 3,000,000, 8% note, and 1,000,000 10% loans from bank. The following are the expenditures per month:

Month Amount of Expenditure Month Amount of Expenditure

January 300,000 May 700,000

February 500,000 June 800,000

March 400,000 July 700,000

April 800,000 August 900,000

Required: Compute the capitalizable borrowing costs assuming expenditures are made every beginning of the month.

Computation of Capitalization Rate for General Borrowing

Principal Interest rate Interest per annum

Note 3,000,000 8% 240,000

Loan 1,000,000 10% 100,000

Total 4,000,000 340,000

Capitalization rate = 340,000/4,000,000 = 8.5%

Computation of Weighted Average Expenditure

Month Expenditure Month Outstanding Total

January 300,000 8 2,400,000

February 500,000 7 3,500,000

March 400,000 6 2,400,000

April 800,000 5 4,000,000

May 700,000 4 2,800,000

June 800,000 3 2,400,000

July 700,000 2 1,400,000

August 900,000 1 900,000

Total 19,800,000

Divided by No. of Months 8 months

Average Expenditure 2,475,000

Average expenditure 2,475,000

Sourced from Specific Borrowings 2,000,000

Sourced from General Borrowing 475,000

Capitalizable Interest from Specific Borrowing (2,000,000*10*%*8/12) 133,333.33

Capitalizable Interest from General Borrowing (475,000*8.5%*8/12) 26,916.67

Total 160,250

Compare the computed amount with actual interest incurred and choose the lower amount

Actual Interest on Specific Borrowing (2,000,000*10%*8/12) 133,333.33

Actual Interest on Notes (3,000,000*8%*8/12) 160,000

Actual Interest on Loans (1,000,000*10%*8/12) 66,666.67

Total Actual Interest 360,000

Therefore, the lower amount is the computed capitalizable interest of P160,250.

Journal entry:

Construction in Progress 300,000

Cash 300,000

To record expenditure for the construction.

January.

*This entry will be made everytime na may expenditure. So, kayo na ang ma-entry para sa ibang month

Construction in Progress 160,250

Interest Expense (360,000 – 160,250) 199,750

Cash 360,000

To record capitalization of borrowing cost

and recognition of interest expense.

*Yong part ng intrest paid na hindi capitalizable at sa interest expense ichacharge.

Asset 19,960,250

Construction in Progress 19,960,250

To record constructed asset.

*Ililipat na natin sa asset account ang Construction in Progress kapag tapos na ito. Kung itutuloy nyo ang unang entry para sa lahat ng

expenditures, aabot ito ng 19,800,000 tapos may nakadebit pang 160,250 representing capitalizable borrowing costs kaya ang balance ng

Construction in Progress account ay 19,960,250

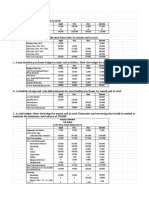

COMPUTATION OF BORROWING COST FOR CONSTRUCTION MORE ONE YEAR\

Ang issue naman dito ay kung kailan natin kukwentahin ang average expenditure at an borrowing cost. Per year ang

pagkukwentanito, at medyo kakaiba kapag na ang pagkukwenta ng average expenditure kapag sa period after the first eyar dahil

make-carry over na ung expenditure sa first year papunta sa second year

Example

Entity A constructed a building, which qualifies as a qualifying asset, on January 1, 2020. Construction of the building was finished on

August 31,2021. The entity borrows 2,000,000 to specifically finance the construction. It has an interest rate of 10% per annum. Other

borrowings include 3,000,000, 8% note, and 1,000,000 10% loans from bank. The following are the expenditures per month:

Month Amount of Expenditure Month Amount of Expenditure

January 1, 2020 600,000 February 28, 2021 400,000

May 1, 2020 900,000 March 31, 2021 300,000

October 31, 2020 800,000 June 30, 2021 400,000

December 1, 2020 800,000 August 1, 2021 500,000

Required: Compute the capitalizable borrowing costs for 2020 and 2021.

Computation of Capitalization Rate for General Borrowing

Principal Interest rate Interest per annum

Note 3,000,000 8% 240,000

Loan 1,000,000 10% 100,000

Total 4,000,000 340,000

Capitalization rate = 340,000/4,000,000 = 8.5%

FIRST YEAR (2020)

Computation of Weighted Average Expenditure

Date Expenditure Month Outstanding Total

January1 600,000 12 7,200,000

May 1 900,000 8 7,200,000

October 31 800,000 2 1,600,000

December1 800,000 1 800,000

Total 16,800,000

Divided by No. of Months 12 months

Average Expenditure 1,400,000

Average expenditure 1,400,000

Sourced from Specific Borrowings 1,400,000

Sourced from General Borrowing 0

*Since kasya naman ang specific borrowing, wala munang manggagaling sa general borrowing.

Capitalizable Interest from Specific Borrowing (1,400,000*10*%) 140,000

VS.

Actual Interest Incurred

Actual Interest on Specific Borrowing (2,000,000*10%) 200,000

Actual Interest on Notes (3,000,000*8%) 240,000

Actual Interest on Loans (1,000,000*10%) 100,000

Total Actual Interest 540,000

Therefore, the lower amount is the computed capitalizable interest of P140,000

Journal entry:

Construction in Progress 600,000

Cash 600,000

To record expenditure for the construction

on January 1.

*This entry will be made everytime na may expenditure. So, kayo na ang ma-entry para sa ibang month

Construction in Progress 140,000

Interest Expense (540,000 – 140,000) 400,000

Cash 540,000

To record capitalization of borrowing cost

and recognition of interest expense.

Observe the T-account of Construction in Progress on December 31,2020

Construction in Progress

Expenditure in January 1 600,000

Expenditure on May 1 900,000

Expenditure on October 31 800,000

Expenditure on December 1 800,000

Capitalized Borrowing Cost 140,000

Balance 3,240,000

*Sa 2021, ang 3,240,000 na construction in progress balance ay magiging part ng expenditure

SECOND YEAR (2021)

Computation of Weighted Average Expenditure

Date Expenditure Month Outstanding Total

January 1 3,240,000 8 25,920,000

February 28 400,000 6 2,400,000

March 31 300,000 5 1,500,000

June 30 400,000 2 800,000

August 1 500,000 1 500,000

Total 31,120,000

Divided by No. of Months 8 months

Average Expenditure 3,890,000

*8 months lang ang sakop ng 2021 dahil natapos na nag construction ng August 31,2021

Average expenditure 3,890,000

Sourced from Specific Borrowings 2,000,000

Sourced from General Borrowing 1,890,00

Capitalizable Interest from Specific Borrowing (2,000,000*10*%*8/12)) 133,333.33

Capitalizable Interest from General Borrowing (1,890,000*8.5%*8/12) 107,100

Total Capitalizabe Interest 240,433.33

VS.

Actual Interest on Specific Borrowing (2,000,000*10%*8/12) 133,333.33

Actual Interest on Notes (3,000,000*8%*8/12) 160,000

Actual Interest on Loans (1,000,000*10%*8/12) 66,666.67

Total Actual Interest 360,000

Therefore, the lower amount is the computed capitalizable interest of P240,433.33

Journal Entry for Capitalization of Interest

Construction in Progress 240,433.33

Interest Expense (360,000 – 240,433.33) 119,566.67

Cash 360,000

To record capitalization of borrowing cost

and recognition of interest expense.

Kapag nakumpleto na ang journal entries, ganito na nag manyayari sa T-account ng Construction in progress:

Construction in Progress

Expenditure in January 1 600,000

Expenditure on May 1 900,000

Expenditure on October 31 800,000

Expenditure on December 1 800,000

Capitalized Borrowing Cost 140,000

Balance, 12/31/20 3,240,000

Expenditure on February 28 400,000

Expenditure on March 31 300,000

Expenditure on June 30 400,000

Expenditure on August 1 500,000

Capitalized Borrowing Cost 240,433.33

Balance 08/31/21 5,080,433.33

To transfer to asset account, ito ang journal entry:

Asset 5,080,433.33

Construction in Progress 5,080,433.33

You might also like

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Borrowing CostsDocument34 pagesBorrowing CostsJeremae AbellanidaNo ratings yet

- PAS 23 borrowing costsDocument7 pagesPAS 23 borrowing costsJustine Reine CornicoNo ratings yet

- Financial Plan TPH Sharing (27-Nov-2020)Document30 pagesFinancial Plan TPH Sharing (27-Nov-2020)Htaik Ay Mi LinNo ratings yet

- Borrowing Cost (PAS 23)Document6 pagesBorrowing Cost (PAS 23)CharléNo ratings yet

- Chapter 25 - Borrowing CostsDocument35 pagesChapter 25 - Borrowing Costsmhel moyetNo ratings yet

- Exercises 7A1 and 7B1: Book: Administrative AccountingDocument9 pagesExercises 7A1 and 7B1: Book: Administrative AccountingScribdTranslationsNo ratings yet

- Additional Note Cash BudgetDocument6 pagesAdditional Note Cash BudgetRaudhatun Nisa'No ratings yet

- Final Exam - Sent StudentsDocument5 pagesFinal Exam - Sent StudentsTrần Nguyễn Tuệ MinhNo ratings yet

- Kuis AkuntansiDocument3 pagesKuis AkuntansiNurul Khalishah AzzahraNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDocument3 pagesHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamNo ratings yet

- Cash budget for manufacturing company May-JulyDocument5 pagesCash budget for manufacturing company May-JulyNidheena K SNo ratings yet

- Problem On Cash Budget: 8 (The End of The Prior Quarter), The Company's Balance Were As FollowsDocument4 pagesProblem On Cash Budget: 8 (The End of The Prior Quarter), The Company's Balance Were As Followsshreya chapagainNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Final Exam - Sent StudentsDocument6 pagesFinal Exam - Sent StudentsYến Hoàng HảiNo ratings yet

- Tutorial 6Document5 pagesTutorial 6Steven CHONGNo ratings yet

- ParCor OperationsDocument6 pagesParCor OperationsKathrynDenieceNo ratings yet

- Quiz No 3Document5 pagesQuiz No 3KristiNo ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument9 pagesFoundations of Financial Management: Spreadsheet Templatesalaa_h1100% (1)

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- Borrowing Cost ExampleDocument6 pagesBorrowing Cost ExampleShann -No ratings yet

- Proj 2Document15 pagesProj 2Shahan AsifNo ratings yet

- Final ExaminationDocument1 pageFinal ExaminationRegielyn RabocarsalNo ratings yet

- Cash Budget FIN242 PYQDocument7 pagesCash Budget FIN242 PYQNurafiqah Muddin100% (1)

- Core Investment in Website Development and Revenue Growth Over 3 YearsDocument15 pagesCore Investment in Website Development and Revenue Growth Over 3 YearsvaibhavmahajanNo ratings yet

- Chapter 10 in Class Problems DAY 3 SolutionsDocument3 pagesChapter 10 in Class Problems DAY 3 SolutionsAbdullah alhamaadNo ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Chapter # 7 Exercise & ProblemsDocument4 pagesChapter # 7 Exercise & ProblemsZia Uddin0% (1)

- MB2001 FA 2025 Week5B Liabilities Practice ExercisesDocument31 pagesMB2001 FA 2025 Week5B Liabilities Practice ExerciseschloeileenspearsNo ratings yet

- PT ANEKA KARYA Revenue Recognition Construction ContractDocument7 pagesPT ANEKA KARYA Revenue Recognition Construction Contract30 Novita Kusuma WardhaniNo ratings yet

- Act1104midterm Exam Wit AnsDocument9 pagesAct1104midterm Exam Wit AnsDyen100% (1)

- PAS 23 Borrowing Costs CapitalizationDocument34 pagesPAS 23 Borrowing Costs CapitalizationRigine Pobe Morgadez100% (1)

- W. Ave Expenditures 2016: General BorrowingsDocument3 pagesW. Ave Expenditures 2016: General BorrowingsJohn Mac MillanNo ratings yet

- Manufacturing overhead cost estimationDocument2 pagesManufacturing overhead cost estimationJames Ezra EvangelioNo ratings yet

- ACC 211 Week 10-12Document24 pagesACC 211 Week 10-12idontcaree123312No ratings yet

- Borrowing Cost Problems IIDocument15 pagesBorrowing Cost Problems IICHRISTIAN DAVE SAYSONNo ratings yet

- ACCB2003 Midterm ExamDocument2 pagesACCB2003 Midterm Exammuhammad muzzammilNo ratings yet

- Mini-Case 1 Ppe AnswerDocument11 pagesMini-Case 1 Ppe Answeryu choong100% (2)

- Chapter 08-Borrowing Costs-Tutorial AnswersDocument4 pagesChapter 08-Borrowing Costs-Tutorial AnswersMayomi JayasooriyaNo ratings yet

- Fly Ash Brick ProjectDocument14 pagesFly Ash Brick ProjectHimana Abdul MalikNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument36 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manualandrewnealobrayfksqe100% (23)

- Geme CostDocument6 pagesGeme CostBiruk Chuchu NigusuNo ratings yet

- Ia1 BC 2020Document33 pagesIa1 BC 2020Jm Sevalla100% (6)

- FAR Quiz 1 SolutionDocument16 pagesFAR Quiz 1 SolutiontruthNo ratings yet

- Principal Borrowing CostDocument3 pagesPrincipal Borrowing Costjustine reine cornicoNo ratings yet

- Dpsaf 1 NotesDocument7 pagesDpsaf 1 NotesshadrackteklaNo ratings yet

- BudgetingDocument51 pagesBudgetingVignesh KivickyNo ratings yet

- Kieso Chapter 10Document6 pagesKieso Chapter 10Dian Permata SariNo ratings yet

- Maria Irias Tarea Practica Capitulo7Document5 pagesMaria Irias Tarea Practica Capitulo7ScribdTranslationsNo ratings yet

- Chapter 7 - Cash BudgetDocument23 pagesChapter 7 - Cash BudgetMostafa KaghaNo ratings yet

- Asignación 4 LSFPDocument6 pagesAsignación 4 LSFPElia SantanaNo ratings yet

- Cash Management QuestionsDocument5 pagesCash Management QuestionsManasi Jamsandekar100% (1)

- Receivable FinancingDocument8 pagesReceivable FinancingHannah Pearl Flores VillarNo ratings yet

- PAS 23 Borrowing Costs CapitalizationDocument9 pagesPAS 23 Borrowing Costs Capitalizationphoebelyn acdogNo ratings yet

- Financial Management AssignmentDocument4 pagesFinancial Management AssignmentMoe ChannelNo ratings yet

- Automobile Spare PartsDocument5 pagesAutomobile Spare PartsSathenapalle Kiran Babu75% (4)

- Assignment 22 23 26 39Document4 pagesAssignment 22 23 26 39Georgina Francheska RamirezNo ratings yet

- Code of Corporate GovernanceDocument5 pagesCode of Corporate GovernanceBAROTEA Cressia Mhay G.No ratings yet

- Gec05 Lecture MidtermDocument82 pagesGec05 Lecture MidtermBAROTEA Cressia Mhay G.No ratings yet

- Module 02 - Four Basic ConceptsDocument30 pagesModule 02 - Four Basic ConceptsBAROTEA Cressia Mhay G.No ratings yet

- Module 02 - Mathematical LanguageDocument19 pagesModule 02 - Mathematical LanguageBAROTEA Cressia Mhay G.No ratings yet

- Module 01 - Patterns and NumbersDocument28 pagesModule 01 - Patterns and NumbersBAROTEA Cressia Mhay G.No ratings yet

- Manual Cpet3lDocument71 pagesManual Cpet3lBAROTEA Cressia Mhay G.No ratings yet

- Jargons in LawDocument1 pageJargons in LawBAROTEA Cressia Mhay G.No ratings yet

- Modern Jeepney FareDocument2 pagesModern Jeepney FareBAROTEA Cressia Mhay G.No ratings yet

- Medrano Jim Aldrin Cpe13 Activity 7Document3 pagesMedrano Jim Aldrin Cpe13 Activity 7BAROTEA Cressia Mhay G.No ratings yet

- Rights and remedies for obligations to give or do somethingDocument5 pagesRights and remedies for obligations to give or do somethingBAROTEA Cressia Mhay G.No ratings yet

- Obligations and Contracts Law Review SummaryDocument1 pageObligations and Contracts Law Review SummaryBAROTEA Cressia Mhay G.No ratings yet

- G.R. No. 126013 February 12, 1997 - HEINZRICH THEIS, ET AL. v. COURT OF APPEALS, ET AL. - February 1997 - Philipppine Supreme Court DecisionsDocument32 pagesG.R. No. 126013 February 12, 1997 - HEINZRICH THEIS, ET AL. v. COURT OF APPEALS, ET AL. - February 1997 - Philipppine Supreme Court DecisionsBAROTEA Cressia Mhay G.No ratings yet

- Conditions in 19th century PhilippinesDocument18 pagesConditions in 19th century PhilippinesBAROTEA Cressia Mhay G.No ratings yet

- Chapter 1-2Document2 pagesChapter 1-2Cressia Mhay BaroteaNo ratings yet

- Article 1156-1162Document4 pagesArticle 1156-1162BAROTEA Cressia Mhay G.No ratings yet

- Historical Context of The Rizal LawDocument14 pagesHistorical Context of The Rizal LawBAROTEA Cressia Mhay G.No ratings yet

- Acronyms by The Philippine GovernmentDocument7 pagesAcronyms by The Philippine GovernmentBAROTEA Cressia Mhay G.No ratings yet

- (PDF) Spouses Paray Vs Rodriguez Case DigestDocument3 pages(PDF) Spouses Paray Vs Rodriguez Case DigestDinarSantosNo ratings yet

- Financial Statement Analysis NestleDocument16 pagesFinancial Statement Analysis NestleRialeeNo ratings yet

- Annual Report 2022 2023 258 264 1 2Document2 pagesAnnual Report 2022 2023 258 264 1 2jagu6143No ratings yet

- FR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Document10 pagesFR M4 - Module Quiz 2: Total Marks: 1 Marks Obtained 1Nah HamzaNo ratings yet

- Composition DeedDocument3 pagesComposition DeedAnkur SharmaNo ratings yet

- Balancesheet TCSDocument7 pagesBalancesheet TCSPKNo ratings yet

- RAK N' KOLL General JournalDocument32 pagesRAK N' KOLL General JournalAlyssah Grace EllosoNo ratings yet

- Intermediate Accounting 1 Trial Balance ErrorsDocument14 pagesIntermediate Accounting 1 Trial Balance Errorscpacpacpa100% (1)

- Risk Management For Changing Interest Rates: Asset-Liability Management and Duration TechniquesDocument32 pagesRisk Management For Changing Interest Rates: Asset-Liability Management and Duration TechniquesSadia R ChowdhuryNo ratings yet

- 11 Accountancy Practice PaperDocument9 pages11 Accountancy Practice PaperPlayer dude65No ratings yet

- "In The Name of The Most Beneficient, The Most Merciful": AllahDocument74 pages"In The Name of The Most Beneficient, The Most Merciful": AllahMirwais Rahimi50% (4)

- Twelve Cases of AccountingDocument152 pagesTwelve Cases of AccountingregiscardosoNo ratings yet

- ACCT3103 Assignment 6 - SolutionsDocument4 pagesACCT3103 Assignment 6 - SolutionsEsther LiuNo ratings yet

- Module 03 - Financial ForecastingDocument59 pagesModule 03 - Financial ForecastingEUNICE LAYNE AGCONo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneyShiv Deep Sharma 20mmb087No ratings yet

- Problem 3Document4 pagesProblem 3Rio De LeonNo ratings yet

- 5 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages5 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman MasturaNo ratings yet

- (Scan QR Code To Answer Pre-Assessment) : 1 of 22 (For Dfcamclp Used Only)Document22 pages(Scan QR Code To Answer Pre-Assessment) : 1 of 22 (For Dfcamclp Used Only)maelyn calindong100% (1)

- Quiz 4 - Problem 1Document2 pagesQuiz 4 - Problem 1KyleRhayneDiazCaliwagNo ratings yet

- Activity Sheet 3 Ordinary AnnuityDocument4 pagesActivity Sheet 3 Ordinary AnnuityFaith CalingoNo ratings yet

- Qa Si Ci AdwbDocument5 pagesQa Si Ci AdwbMohit Sharma0% (1)

- 66 Lopez vs. AlvendiaDocument2 pages66 Lopez vs. AlvendiaClaudine Allyson DungoNo ratings yet

- PARTNERSHIP FORMATION Exercises AnswersDocument15 pagesPARTNERSHIP FORMATION Exercises AnswersMarjorie NepomucenoNo ratings yet

- Stephenson Real Estate Recapitalization: Market Value Balance SheetDocument4 pagesStephenson Real Estate Recapitalization: Market Value Balance SheetRizky Khairunnisa0% (1)

- Memorandum of Agreement With Acknowledgement of ObligationDocument3 pagesMemorandum of Agreement With Acknowledgement of ObligationJosemarie AntonioNo ratings yet

- Achieve Financial GoalsDocument3 pagesAchieve Financial GoalsManu ThakurNo ratings yet

- L4 - ABFA1173 POA (Lecturer)Document10 pagesL4 - ABFA1173 POA (Lecturer)Tan SiewsiewNo ratings yet

- Need For Insolvency and Bankruptcy Code: Exploring The Rationale and ObjectivesDocument26 pagesNeed For Insolvency and Bankruptcy Code: Exploring The Rationale and ObjectivesAlishaNo ratings yet

- Small Business Loan ApplicationDocument4 pagesSmall Business Loan ApplicationPetarB43No ratings yet

- Daily Compounding Loan Calculator: (Lending Company Name)Document28 pagesDaily Compounding Loan Calculator: (Lending Company Name)nevily wilbardNo ratings yet