Professional Documents

Culture Documents

Balance Sheet

Uploaded by

vinus.dhanankarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet

Uploaded by

vinus.dhanankarCopyright:

Available Formats

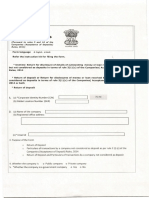

Name: SUNIL KUMAR PAN: CPQPK6581K

Code: SUNI1 Status: Individual Ass. Year: 2023-2024

BALANCE SHEET AS ON 31ST DAY OF MARCH ,2023 OF THE PROPRIETORY BUSINESS OR PROFESSION (fill items below in

Part A-BS

a case where regular books of accounts are maintained, otherwise fill item 6)

1 Proprietor's fund

a Proprietor's capital a Nil

b Reserve and surplus

i Revaluation Reserve bi Nil

ii Capital Reserve bii Nil

iii Statutory Reserve biii Nil

iv Any other Reserve biv Nil

v Total(bi+bii+biii+biv) bv Nil

C Total proprietor's fund (a+bv) 1c Nil

2 Loan funds

a Secured Loans

SOURCE OF FUNDS

i Foreign Currency Loans ai Nil

ii Rupee Loans

A From Banks iiA Nil

B From Others iiB Nil

C Total (iiA + iiB) iiC Nil

iii Total (ai + iiC) aiii Nil

b Unsecured Loans (including deposits)

i From Banks bi Nil

ii From Others bii Nil

iii Total(bi + bii) biii Nil

c Total Loan Funds(aiii+biii) 2c Nil

3 Deferred tax liability 3 Nil

4 Advances

i From persons specified in section 40A(2)(b) of the I. T.Act i Nil

ii From others i Nil

iii Total Advances (i + ii) 4iii Nil

5 Sources of funds(1c+2c+3+4iii) 5 Nil

1 Fixed assets

a Gross: Block 1a Nil

b Depreciation 1b Nil

c Net Block(a-b) 1c Nil

d Capital work-in-Progress 1d Nil

e Total (1c+1d) 1e Nil

2 Investments

a Long-term investment

APPLICATION OF FUNDS

i Government and other Securities-Quoted ai Nil

ii Government and other Securities-Unquoted aii Nil

iii Total(ai+aii) aiii Nil

b Short-Term investments

i Equity Shares,including share application money bi Nil

ii Preference Shares bii Nil

iii Debenture biii Nil

iv Total (bi + bii + biii) biv Nil

c Total investments (aiii+biv) 2c Nil

3 Current assets ,loans and advances

a Current assets

i Inventories

A Stores / consumables including packing Materials iA Nil

B Raw Materials iB Nil

C Stock-in-process iC Nil

Name: SUNIL KUMAR PAN: CPQPK6581K

Code: SUNI1 Status: Individual Ass. Year: 2023-2024

D Finished Goods/Traded Goods iD Nil

E Total(iA+iB+iC+iD) iE Nil

ii Sundry Debtors aii Nil

iii Cash and Bank Balance

A cash-in-Hand iiiA Nil

B Balance with Banks iiiB Nil

C Total(iiiA+iiiB) iiiC Nil

iv Other Current Assets aiv Nil

v Total current assets (iE+aii+iiiC+aiv) av Nil

b Loans and advances

Advances recoverable in cash or in kind or for value

i bi Nil

to be received

Deposits, loans and advances to corporates and

ii bii Nil

others

iii Balance with Revenue Authorities : etc. biii Nil

iv Total(bi+bii+biii) biv Nil

c Total (av + bv) 3c Nil

d Current liablities and provisions

i Current Liabilities

A Sundry Creditors iA Nil

B Liability for Leased Assets iB Nil

C Interest Accured on above iC Nil

D Interest accured but not due on loans iD Nil

E Total(iA+iB+iC+iD) iE Nil

ii Provisions

A Provision for Income Tax iiA Nil

Provision for Leave

C iiC Nil

encashment/Superannuation/Gratuity

D Other Provision iiD Nil

E Total(iiA+iiB+iiC+iiD) iiE Nil

iii Total(iE+iiD) diii Nil

e Net Current assets(3c-diii) 3e Nil

4 a Miscellaneous expenditure and written off or adjusted 4a Nil

b Deferred Tax Asset 4b Nil

c Profit and loss account/ Accumulated balance 4c Nil

d Total(4a+4b+4c) 4d Nil

5 Total , application of funds(1e+2c+3e+4d) 5 Nil

6 In a case where regular books of account of business or profession are not maintained:-

NO ACCOUNT

(furnish the following information as on 31st day of March, 2023, in respect of business or profession)

a Amount of total sundry debtors 6a 75000

b Amount of total sundry creditors 6b 85830

CASE

c Amount of total stock-in-trade 6c 464630

d Amount of the cash balance 6d 68000

You might also like

- Part A-Bs: Zenit - A KDK Software Software ProductDocument2 pagesPart A-Bs: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Bar Graph of Assets in 2017 and 2018Document5 pagesBar Graph of Assets in 2017 and 2018mauNo ratings yet

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- Balance Sheet TemplateDocument4 pagesBalance Sheet TemplatesenthilNo ratings yet

- Dignity LTDDocument2 pagesDignity LTDManish SinhaNo ratings yet

- Financial Statements - TemplateDocument11 pagesFinancial Statements - TemplateBakir PeljtoNo ratings yet

- Balance Sheet: As at 31st December, 2018Document22 pagesBalance Sheet: As at 31st December, 2018Ashutosh BiswalNo ratings yet

- Comparative Schedule VIDocument23 pagesComparative Schedule VIRajkumar MathurNo ratings yet

- BoP FormatDocument4 pagesBoP Formatdibyaprakash1No ratings yet

- LLP BSPLDocument17 pagesLLP BSPLKiran KumarNo ratings yet

- Form PDFDocument24 pagesForm PDFJagruk SinghNo ratings yet

- Krishna AccountssDocument12 pagesKrishna Accountsskrishnamakwana9605No ratings yet

- Stayway Homes Private Limited: Balance Sheet As at 31St March 2021Document4 pagesStayway Homes Private Limited: Balance Sheet As at 31St March 2021Nikhil TripathiNo ratings yet

- Jasch Industires LTDDocument6 pagesJasch Industires LTDAnugya GuptaNo ratings yet

- Balance of Payments (BoP)Document41 pagesBalance of Payments (BoP)anindya_kundu100% (1)

- Division II - Schedule 3Document17 pagesDivision II - Schedule 3Raj KumarNo ratings yet

- Balance Sheet ProformaDocument2 pagesBalance Sheet ProformakeziafernandesNo ratings yet

- UntitledDocument9 pagesUntitledLincoln SoetzenbergNo ratings yet

- 004 - Final SCH III - Indicative Template FinalDocument54 pages004 - Final SCH III - Indicative Template FinalAbhishek YadavNo ratings yet

- Balance SheetDocument45 pagesBalance SheetGautam MNo ratings yet

- Tata Steel Technical Services Limited Financials - March 31, 2021Document27 pagesTata Steel Technical Services Limited Financials - March 31, 2021Sibaram PattanaikNo ratings yet

- NHTM 1 ĐÃ DÒ NHƯNGNG VẪN CÒN ROA BQ 2021 1Document14 pagesNHTM 1 ĐÃ DÒ NHƯNGNG VẪN CÒN ROA BQ 2021 1ngochanhime0906No ratings yet

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniNo ratings yet

- 004 - Final SCH III - Indicative Template FinalDocument54 pages004 - Final SCH III - Indicative Template FinalmadhanNo ratings yet

- LLP Balance Sheet Format in WordDocument4 pagesLLP Balance Sheet Format in WordKiran KumarNo ratings yet

- Etoile SVTDocument8 pagesEtoile SVTkalil 555No ratings yet

- MS Eco Set 3Document4 pagesMS Eco Set 3Vaidehi BagraNo ratings yet

- BAFMP Series C Plan1 Portfolio 30nov10Document2 pagesBAFMP Series C Plan1 Portfolio 30nov10amalroy1986No ratings yet

- Adobe Scan 10 Nov 2021Document12 pagesAdobe Scan 10 Nov 2021Sanchit GargNo ratings yet

- Test Govt BudgetDocument3 pagesTest Govt BudgetshobitgupNo ratings yet

- Full A4Document1 pageFull A4Nitya SharmaNo ratings yet

- RKG Institute: B - 193, Sector - 52, NoidaDocument3 pagesRKG Institute: B - 193, Sector - 52, NoidaBHS PRAYAGRAJNo ratings yet

- Vol - III Chapter 1 (II)Document15 pagesVol - III Chapter 1 (II)Pranadhika KNo ratings yet

- Reachmee P&L and BL-Financial 21-22 UpdateDocument7 pagesReachmee P&L and BL-Financial 21-22 UpdateGST BACANo ratings yet

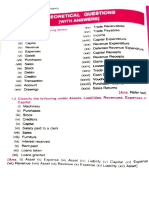

- (Ri) Trade Payables: 1.1 Explain The Tollowing TermsDocument7 pages(Ri) Trade Payables: 1.1 Explain The Tollowing TermsMurali KrishnaNo ratings yet

- Balance Sheet Midterm PracticeDocument2 pagesBalance Sheet Midterm PracticesenthilNo ratings yet

- Vedantu 2012 BS PDF 1 206701232Document27 pagesVedantu 2012 BS PDF 1 206701232smile7milesNo ratings yet

- Book 3 CH 1Document5 pagesBook 3 CH 1TanayNo ratings yet

- Financial Statement TaMoDocument8 pagesFinancial Statement TaMoJatin MittalNo ratings yet

- Balance Sheet Format 01Document6 pagesBalance Sheet Format 01Vivek SinglaNo ratings yet

- Excel 01Document8 pagesExcel 01Gadadhar Parhi100% (1)

- RCF FAWCMDocument18 pagesRCF FAWCMritikNo ratings yet

- Adobe Scan 19 Feb 2023Document7 pagesAdobe Scan 19 Feb 2023Aman JainNo ratings yet

- Worksheet 03Document4 pagesWorksheet 03LuckyNo ratings yet

- Amount (RS) Amount (RS) : As Per Our Report On Even Date For & On Behalf of The BoardDocument8 pagesAmount (RS) Amount (RS) : As Per Our Report On Even Date For & On Behalf of The BoardmuditNo ratings yet

- Annexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsDocument7 pagesAnnexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsNarendra Ku MalikNo ratings yet

- Form-14 Ngo Annual Returns - Form 14Document8 pagesForm-14 Ngo Annual Returns - Form 14LANDMARK CYBERNETNo ratings yet

- Adobe Scan 5 May 2023Document5 pagesAdobe Scan 5 May 2023NarayanNo ratings yet

- Form 060503Document5 pagesForm 060503deepakgupta.arNo ratings yet

- StandaloneDocument1 pageStandaloneArkin DixitNo ratings yet

- 780.0 Per The: Interest WhihDocument2 pages780.0 Per The: Interest WhihDope 90No ratings yet

- P&L and Balance SheetDocument3 pagesP&L and Balance Sheetamitabh kumarNo ratings yet

- Balance Sheet Format 01Document6 pagesBalance Sheet Format 01RHS Production100% (1)

- Form-14 Ngo Annual Returns - Form 14Document16 pagesForm-14 Ngo Annual Returns - Form 14LANDMARK CYBERNETNo ratings yet

- CAF 1 FAR1 Spring 2022.PDF Google DriveDocument1 pageCAF 1 FAR1 Spring 2022.PDF Google Driveusaid shaikzNo ratings yet

- Illustrative Ind As Standalone Financial Statements: XYZ Limited Standalone Balance Sheet As at 31 March 2020Document1 pageIllustrative Ind As Standalone Financial Statements: XYZ Limited Standalone Balance Sheet As at 31 March 2020Nanda KumarNo ratings yet

- JSW Steel 2019-20Document2 pagesJSW Steel 2019-20Aditya Jaiswal (AJ)No ratings yet

- Preboard 3 EcoDocument8 pagesPreboard 3 EcoSuganthi VNo ratings yet

- Company Name: Financial Follow Up Report (FFR - I)Document4 pagesCompany Name: Financial Follow Up Report (FFR - I)Ravikanth MehtaNo ratings yet

- Omni-Channel Banking: The Digital Transformation RoadmapDocument52 pagesOmni-Channel Banking: The Digital Transformation RoadmapJuan Carlos Flores100% (1)

- Gross-Estate-Lecture-January-7-2020 2Document12 pagesGross-Estate-Lecture-January-7-2020 2jonahNo ratings yet

- Screenshot 2023-06-27 at 20.18.42Document6 pagesScreenshot 2023-06-27 at 20.18.42Farshid Ahoora100% (1)

- Chapter 4 Financial Statement AnalysisDocument44 pagesChapter 4 Financial Statement AnalysisChala EnkossaNo ratings yet

- RBC GoldDocument8 pagesRBC GoldOnePunchManNo ratings yet

- UntitledDocument14 pagesUntitledKimNo ratings yet

- Flex Packaging Film - 2 Pager Teaser (Wout Watermark)Document3 pagesFlex Packaging Film - 2 Pager Teaser (Wout Watermark)izzatesaNo ratings yet

- Non Conformity Format 01-10-2022Document1 pageNon Conformity Format 01-10-2022qc vahinipipesNo ratings yet

- Contemporary Financial Management 10th Edition Moyer Solutions Manual 1Document15 pagesContemporary Financial Management 10th Edition Moyer Solutions Manual 1carlo100% (40)

- Residential Property Transactions Data H1 2020Document4 pagesResidential Property Transactions Data H1 2020zulkis73No ratings yet

- Credit Card Application FormDocument4 pagesCredit Card Application FormPSC.CLAIMS1No ratings yet

- PRABHAVATHI Form26QBDocument2 pagesPRABHAVATHI Form26QBPrakash BattalaNo ratings yet

- Financial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFDocument67 pagesFinancial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFphongtuanfhep4u100% (10)

- Particulars Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesParticulars Unadjusted Trial Balance Adjustments Debit Credit Debit Creditglaide lojeroNo ratings yet

- T R S A: HE Eview Chool of CcountancyDocument12 pagesT R S A: HE Eview Chool of CcountancyNamnam KimNo ratings yet

- JMRA - Vol 2 (1) - 1-23Document23 pagesJMRA - Vol 2 (1) - 1-23Yashika TpNo ratings yet

- Bonds PayableDocument7 pagesBonds PayableCarl Yry BitengNo ratings yet

- Accounting What The Numbers Mean Marshall 10th Edition Test BankDocument27 pagesAccounting What The Numbers Mean Marshall 10th Edition Test BankEricaPhillipsaszpc100% (37)

- Quality Management System Procedure: (Laboratory Name)Document3 pagesQuality Management System Procedure: (Laboratory Name)jeric bañaderaNo ratings yet

- Ayesha SiddiqaDocument10 pagesAyesha SiddiqaayeshaNo ratings yet

- Elasticity and Its Applications - 5 - 6 - 920220823223838Document26 pagesElasticity and Its Applications - 5 - 6 - 920220823223838Aditi SinhaNo ratings yet

- PhucLong SWOTDocument11 pagesPhucLong SWOTHieu LeNo ratings yet

- Chapter 19 20Document11 pagesChapter 19 20Kyle Francine BoloNo ratings yet

- Perkembangan Sistem Pembayaran Non Tunai Pada Era Revolusi Industri 4Document6 pagesPerkembangan Sistem Pembayaran Non Tunai Pada Era Revolusi Industri 4fadhila faquanikaNo ratings yet

- Stamp Duty Charge ListDocument10 pagesStamp Duty Charge ListPrem MahalaNo ratings yet

- Power of Attorney & Instructions: BackgroundDocument4 pagesPower of Attorney & Instructions: BackgroundSwapnil MoreNo ratings yet

- Data Analytics StrategyDocument6 pagesData Analytics StrategylemarqueNo ratings yet

- Question and Answer - 1Document31 pagesQuestion and Answer - 1acc-expertNo ratings yet

- The We Company StrategyDocument2 pagesThe We Company Strategytran quoc vietNo ratings yet

- Asia Pacific Hydrogen 2023 BrochureDocument17 pagesAsia Pacific Hydrogen 2023 BrochureDanihNo ratings yet