Professional Documents

Culture Documents

Exercise 3 JOB ORDER COSTING

Exercise 3 JOB ORDER COSTING

Uploaded by

gloryfeilagoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 3 JOB ORDER COSTING

Exercise 3 JOB ORDER COSTING

Uploaded by

gloryfeilagoCopyright:

Available Formats

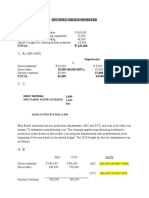

Exercise 3: Job Order Costing - Different Bases in Charging Factory Overhead

Based on production volume:

Work in Process

Direct materials 75,000 Finished Goods 0

Direct labor 25,000

Factory overhead* 28,000

128,000

128,000

No. of units

*Factory overhead = 3,000 x ₱ 9.60 = ₱ 28,000

Based on materials cost:

Work in Process

Direct materials 75,000 Finished Goods 0

Direct labor 25,000

Factory overhead* 120,000

220,000

220,000

Direct materials cost

*Factory overhead = ₱ 75,000 x 160% = ₱ 120,000

Based on labor cost:

Work in Process

Direct materials 75,000 Finished Goods 0

Direct labor 25,000

Factory overhead* 10,000

110,000

110,000

Direct labor

*Factory overhead = ₱ 25,000 x 40% = ₱ 10,000

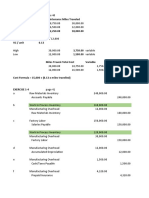

Based on labor hours:

Work in Process

Direct materials 75,000 Finished Goods 0

Direct labor 25,000

Factory overhead* 8,000

108,000

108,000

Labor hours

*Factory overhead = 1,000 x ₱ 8.00 = ₱ 8,000

Based on machine hours:

Work in Process

Direct materials 75,000 Finished Goods 0

Direct labor 25,000

Factory overhead* 9,600

108,000

109,600

Machine hours

*Factory overhead = 600 x ₱ 16.00 = ₱ 9,600

You might also like

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Chapter 3 Job Order CostingDocument20 pagesChapter 3 Job Order Costingazam_rasheedNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Gapas, Daniel John L. (Etivity 10)Document4 pagesGapas, Daniel John L. (Etivity 10)Daniel John GapasNo ratings yet

- Particulars Rs. Particulars RS.: Semester Spring 2020 Financial Accounting (Mgt101) Assignment # 01Document3 pagesParticulars Rs. Particulars RS.: Semester Spring 2020 Financial Accounting (Mgt101) Assignment # 01gulzar ahmadNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 23Document8 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 23Mr. JalilNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Cost Sheet ProblemsDocument18 pagesCost Sheet ProblemsZahid RahmanNo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- HW AcctDocument4 pagesHW AcctTrung TranNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Chapter 3 Cost AccountingDocument2 pagesChapter 3 Cost AccountingJacob DiazNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Cost Accounting Quiz 2Document13 pagesCost Accounting Quiz 2Camille G.No ratings yet

- Cost Sheet ProblemsDocument29 pagesCost Sheet Problemsishikaparate2004No ratings yet

- JOC (Discussion)Document10 pagesJOC (Discussion)Luisa ColumbinoNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- BBA II - Google DriveDocument1 pageBBA II - Google Drivechowdharyeeshika11No ratings yet

- cost ch 5 مساله-1Document2 pagescost ch 5 مساله-1joseph nabilNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- Activity 1 AnswersDocument5 pagesActivity 1 AnswersClyn CFNo ratings yet

- Chapter 1-Test Material 3Document9 pagesChapter 1-Test Material 3Marcus MonocayNo ratings yet

- COSACC Assignment 2Document3 pagesCOSACC Assignment 2Kenneth Jim HipolitoNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingGayzelle MirandaNo ratings yet

- Chapter 6 ComputationalDocument3 pagesChapter 6 ComputationalPamela GalangNo ratings yet

- Homework Chapter 3Document5 pagesHomework Chapter 3Lê Vũ Phương DungNo ratings yet

- Chapter 3 Job Order CostingDocument31 pagesChapter 3 Job Order CostingzamanNo ratings yet

- One Department: No Beginning Inventory.: (Work in Process)Document6 pagesOne Department: No Beginning Inventory.: (Work in Process)Ahmad GilaniNo ratings yet

- Chapter 1 Question Review - 102Document5 pagesChapter 1 Question Review - 102Mark Joseph CanoNo ratings yet

- ABC Costing Autumn 19Document15 pagesABC Costing Autumn 19Tory IslamNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Job, Batch and Service CostingDocument4 pagesJob, Batch and Service CostingAnimashaun Hassan OlamideNo ratings yet

- Acc 202 Exercise MyselfDocument5 pagesAcc 202 Exercise Myselfnhidiepnguyet08112004No ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Controller The Foundational 15Document9 pagesController The Foundational 15Putri Aprilia ManembuNo ratings yet

- Chapter 3-Test Material 1Document6 pagesChapter 3-Test Material 1Marcus MonocayNo ratings yet

- Cost Accounting & Control 1Document8 pagesCost Accounting & Control 1Mary Lace VidalNo ratings yet

- L3-L4 CostsheetDocument30 pagesL3-L4 CostsheetDhawal RajNo ratings yet

- Managerial Accounting and Cost ConceptDocument20 pagesManagerial Accounting and Cost ConceptNavidEhsanNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingjungoosNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingKrizia Mae FloresNo ratings yet

- Cost Acc CHP1 COCDocument8 pagesCost Acc CHP1 COCpurvi doshiNo ratings yet

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- MA007 AC&VC - Inventory Management-1Document50 pagesMA007 AC&VC - Inventory Management-1Ray LowNo ratings yet

- Week 4 Managerial AccountingDocument7 pagesWeek 4 Managerial AccountingMari SylvesterNo ratings yet

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Solutions-Chapter 2Document5 pagesSolutions-Chapter 2Saurabh SinghNo ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (26)

- Day 2 Cost Template (My)Document36 pagesDay 2 Cost Template (My)Jhilmil JeswaniNo ratings yet

- This Study Resource Was: ScoreDocument9 pagesThis Study Resource Was: ScoreReal Estate Golden TownNo ratings yet