Professional Documents

Culture Documents

Page 008

Uploaded by

francis earlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Page 008

Uploaded by

francis earlCopyright:

Available Formats

International Journal of Business Management and Commerce Vol. 1 No.

2; September 2016

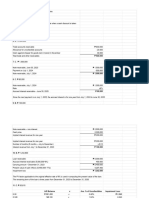

Figure 3: Bitcoin ‘Deadpool’ Grows to 26 Startups

Source: Hileman, G. (2016)

There are also competitors to cryptocurrency that are attempting to provide an alternative to digital currency.

Apple is one of the main competitors with their product ApplePay. They are levering their infrastructure and

hardware to give users the ability to charge their debit or credit cards associated to their iTunes account with their

phones. Traditional credit card companies like Visa and MasterCard are happily joining ApplePay‟s infrastructure

as are allowed to keep their fees (Gerber, 2015). Bitcoin will always have a difficult time competing with these

household names. PayPal has been very successful as the eBay exchanging system, and could potentially be

moved into mobile payment. Companies like Apple, Google, and Amazon have entire marketing budgets with a

foothold in the mobile application market, giving them a huge advantage over Bitcoin‟s comparatively small time

players. Mobile consumers want to be able to buy things with phones directly, and bitcoin would have a hard time

rallying together as a community to beat out competitors.

Another serious threat to cryptocurrency is the maze of US regulations that would need to be traversed before

mainstream user acceptance. The US government has yet to even classify what type of asset bitcoin is, which will

prevent most market participants from adopting cryptocurrency-based business models (PwC, 2015).

Cryptocurrency could be labeled as either a security, capital asset, commodity, or a currency, and each would

have a different effect on how bitcoin is adopted. International views of bitcoin vary by country, but seems to be

viewed positively based on Bitpay‟s assessment of transactions. In Europe, transactions have reached an all-time

high at 102,221 per quarter (Patterson, 2015), which may be the cause regulations being passed regarding bitcoin

and cryptocurrency. Bitcoin transaction have become exempt from value added tax by the European Court of

Justice, effectively recognizing it as a legitimate means of payment in Europe (Perez, 2015). This simply means

that bitcoin transaction will not be taxed in Europe. While great news for European bitcoin users, other major

markets are still missing crucial legislation regarding bitcoin taxation. Legislation in the United States could

negatively affect how bitcoin transactions are processed, delivering a severe blow to legitimacy as a currency.

6. Conclusions

Cryptocurrency seems to have move past the early adoption phase that new technologies experience. Even motor

vehicles experienced this phenomenon. Bitcoin has begun to carve itself a niche market, which could help

advance cryptocurrencies further into becoming mainstream; or be the main cause of it failing. Cryptocurrencies

are still in their infancy, and it is difficult to see if they will ever find true mainstream presence in world markets.

7

You might also like

- Page 006Document1 pagePage 006francis earlNo ratings yet

- Bitcoin and Cryptocurrency As A New Innovation in Economical FieldDocument5 pagesBitcoin and Cryptocurrency As A New Innovation in Economical FieldJinyoung KimNo ratings yet

- Relevance and Prospects of Investment in Cryptocurrency For Existing or New FirmsDocument10 pagesRelevance and Prospects of Investment in Cryptocurrency For Existing or New FirmsSudipto RoyNo ratings yet

- Bitcoin PDFDocument9 pagesBitcoin PDFravitejaNo ratings yet

- Bitcoin From Three PerspectivesDocument10 pagesBitcoin From Three PerspectivescreminssNo ratings yet

- Business Research Assignment Literature ReviewDocument7 pagesBusiness Research Assignment Literature ReviewSunny KumarNo ratings yet

- Does Bitcoin Follow The Hypothesis of Efficient Market?: Jakub BartosDocument14 pagesDoes Bitcoin Follow The Hypothesis of Efficient Market?: Jakub BartosNgurahNo ratings yet

- Page 009Document1 pagePage 009francis earlNo ratings yet

- Cryptocurrencies: From The Trinidad and Tobago Securities and Exchange CommissionDocument3 pagesCryptocurrencies: From The Trinidad and Tobago Securities and Exchange CommissionTNo ratings yet

- Crypto CurrencyDocument3 pagesCrypto CurrencyBD04No ratings yet

- Economia BitDocument5 pagesEconomia Bitjeffe2013No ratings yet

- BAFI3182-FINANCIAL MARKETS Assignment 3 Research PaperDocument16 pagesBAFI3182-FINANCIAL MARKETS Assignment 3 Research PaperChu Ngoc AnhNo ratings yet

- The Bitcoin BibleDocument25 pagesThe Bitcoin Biblejuan100% (14)

- Bitcoin: 9 Shocking Facts About Bitcoin Money You Need to KnowFrom EverandBitcoin: 9 Shocking Facts About Bitcoin Money You Need to KnowNo ratings yet

- Finance Crypto AssignmentDocument8 pagesFinance Crypto AssignmentPromise GapareNo ratings yet

- Is Bitcoin A Blessing or A Curse?: Kenneth FanDocument4 pagesIs Bitcoin A Blessing or A Curse?: Kenneth FanIjahss JournalNo ratings yet

- BTC FinalDocument5 pagesBTC Finalapi-302932395No ratings yet

- A Fistful of Bitcoins: The Risks and Opportunities of Virtual CurrenciesFrom EverandA Fistful of Bitcoins: The Risks and Opportunities of Virtual CurrenciesNo ratings yet

- Beginner's Guide To Buying, Selling, And Investing In BitcoinsFrom EverandBeginner's Guide To Buying, Selling, And Investing In BitcoinsNo ratings yet

- To Bitcoin or Not To Bitcoin Exploring Consumer PerceptionsDocument8 pagesTo Bitcoin or Not To Bitcoin Exploring Consumer PerceptionsThe IjbmtNo ratings yet

- Teymur Jafarli - Digital Gold (Book Reflection)Document3 pagesTeymur Jafarli - Digital Gold (Book Reflection)Teymur CəfərliNo ratings yet

- The Rise of Cryptocurrency - Benefits, Challenges, and AdoptionDocument8 pagesThe Rise of Cryptocurrency - Benefits, Challenges, and AdoptionMarcos LalorNo ratings yet

- Why I Invested in BitcoinDocument3 pagesWhy I Invested in BitcoinJuan Manuel Lopez Leon50% (2)

- In The Not-So-Distant Future, There's A Big Chance That Money Will Lose Its Power and Currency Transactions Will Be Done Using BitcoinDocument11 pagesIn The Not-So-Distant Future, There's A Big Chance That Money Will Lose Its Power and Currency Transactions Will Be Done Using BitcoinCharshiiNo ratings yet

- Korshunova GEE Individual EssayDocument9 pagesKorshunova GEE Individual EssayAnastasiia KorshunovaNo ratings yet

- Fintech Tsunami: Blockchain As The Driver of The Fourth Industrial RevolutionDocument11 pagesFintech Tsunami: Blockchain As The Driver of The Fourth Industrial RevolutionLeonardo AmancioNo ratings yet

- Bitcoin: The Ultimate Bitcoin Guidebook For BeginnersFrom EverandBitcoin: The Ultimate Bitcoin Guidebook For BeginnersRating: 4 out of 5 stars4/5 (8)

- Digital Assets Does The Perception Match RealityDocument1 pageDigital Assets Does The Perception Match Realitysensharma.rahulNo ratings yet

- Study of Consumer Awareness On CryptocuDocument7 pagesStudy of Consumer Awareness On CryptocuLoudMouth &CoNo ratings yet

- Deloitte UK Blockchain (Full Report)Document25 pagesDeloitte UK Blockchain (Full Report)Syndicated News100% (3)

- Cryptocurrency FutureDocument12 pagesCryptocurrency FutureTom K (Afro Inu)No ratings yet

- Bitcoin in The Philippines: A Perfect Cryptocurrency StormDocument5 pagesBitcoin in The Philippines: A Perfect Cryptocurrency StormPilosopo LiveNo ratings yet

- Issues Facing Cryptocurrency TodayDocument3 pagesIssues Facing Cryptocurrency TodayJoyce MontemayorNo ratings yet

- Bit Coins Future CurrencyDocument8 pagesBit Coins Future Currencysourav_padhi5150No ratings yet

- 2016 Crip To Currency I JB MCDocument10 pages2016 Crip To Currency I JB MCAnonymous 5dzNTLcergNo ratings yet

- Learn How to Earn with Cryptocurrency TradingFrom EverandLearn How to Earn with Cryptocurrency TradingRating: 3.5 out of 5 stars3.5/5 (3)

- USCC Economic Issue Brief - Bitcoin - 05 12 14Document21 pagesUSCC Economic Issue Brief - Bitcoin - 05 12 14newsbtcNo ratings yet

- Why 2020 Is The Year of StablecoinDocument2 pagesWhy 2020 Is The Year of StablecoinHola HfsaNo ratings yet

- Bitcoin and Money LaunderingDocument16 pagesBitcoin and Money LaunderingVértesy LászlóNo ratings yet

- The Crypto Crusher - The Safest Way To Get 1,000+% From Bitcoin True Market Insider 1Document15 pagesThe Crypto Crusher - The Safest Way To Get 1,000+% From Bitcoin True Market Insider 1Bill100% (1)

- National Law Institute University, Bhopal: Rise of Bitcoin As Macroeconomics PhenomenonDocument11 pagesNational Law Institute University, Bhopal: Rise of Bitcoin As Macroeconomics PhenomenonDeepanshu MandliNo ratings yet

- Industry Analysis: Sip Project Title: Digital Currencies and Blockchain Technology: A Revolution For Financial SectorDocument6 pagesIndustry Analysis: Sip Project Title: Digital Currencies and Blockchain Technology: A Revolution For Financial SectorYukta SalviNo ratings yet

- Role of Islamic Finance in The Face of The Digital Currency RevolutionDocument11 pagesRole of Islamic Finance in The Face of The Digital Currency RevolutionMuhammad RizwanNo ratings yet

- Understanding Platform-Based Digital Currencies: Ben Fung and Hanna Halaburda, Currency DepartmentDocument9 pagesUnderstanding Platform-Based Digital Currencies: Ben Fung and Hanna Halaburda, Currency DepartmentTATSAT CHOPRANo ratings yet

- Adoption of Bitcoin Currency and Its EffectsDocument8 pagesAdoption of Bitcoin Currency and Its EffectsJacob MaginaNo ratings yet

- Running Head: Bitcoins 1Document6 pagesRunning Head: Bitcoins 1Vidzone CyberNo ratings yet

- Essay On BitcoinDocument5 pagesEssay On BitcoinPéter Hegyi0% (2)

- DecryptedDocument8 pagesDecryptedmuxie SSUSSNo ratings yet

- Website AssignmentDocument9 pagesWebsite Assignmentjishika491No ratings yet

- Rael A 1757610Document5 pagesRael A 1757610Ezekiel ChoosenNo ratings yet

- The Digital War: How China's Tech Power Shapes the Future of AI, Blockchain and CyberspaceFrom EverandThe Digital War: How China's Tech Power Shapes the Future of AI, Blockchain and CyberspaceNo ratings yet

- Financial Regulations and Price Inconsistencies Across Bitcoin MarketsDocument45 pagesFinancial Regulations and Price Inconsistencies Across Bitcoin MarketsmacielwillNo ratings yet

- Top 4 Crypto Trends To ExpectDocument4 pagesTop 4 Crypto Trends To ExpectCrypto Currency Latest News0% (1)

- Cryptocurrencies and BlockchainDocument26 pagesCryptocurrencies and BlockchainAlex LindgrenNo ratings yet

- Page 077Document1 pagePage 077francis earlNo ratings yet

- Page 074Document1 pagePage 074francis earlNo ratings yet

- Page 081Document1 pagePage 081francis earlNo ratings yet

- Page 075Document1 pagePage 075francis earlNo ratings yet

- Page 071Document1 pagePage 071francis earlNo ratings yet

- Page 068Document1 pagePage 068francis earlNo ratings yet

- Page 076Document1 pagePage 076francis earlNo ratings yet

- Page 055Document1 pagePage 055francis earlNo ratings yet

- Page 042Document1 pagePage 042francis earlNo ratings yet

- Page 064Document1 pagePage 064francis earlNo ratings yet

- Page 059Document1 pagePage 059francis earlNo ratings yet

- Page 066Document1 pagePage 066francis earlNo ratings yet

- Page 065Document1 pagePage 065francis earlNo ratings yet

- Page 062Document1 pagePage 062francis earlNo ratings yet

- Page 058Document1 pagePage 058francis earlNo ratings yet

- Page 057Document1 pagePage 057francis earlNo ratings yet

- Page 053Document1 pagePage 053francis earlNo ratings yet

- Page 046Document1 pagePage 046francis earlNo ratings yet

- Page 051Document1 pagePage 051francis earlNo ratings yet

- Page 038Document1 pagePage 038francis earlNo ratings yet

- Page 043Document1 pagePage 043francis earlNo ratings yet

- Page 049Document1 pagePage 049francis earlNo ratings yet

- Page 040Document1 pagePage 040francis earlNo ratings yet

- Page 035Document1 pagePage 035francis earlNo ratings yet

- Page 036Document1 pagePage 036francis earlNo ratings yet

- Page 041Document1 pagePage 041francis earlNo ratings yet

- Page 039Document1 pagePage 039francis earlNo ratings yet

- Page 037Document1 pagePage 037francis earlNo ratings yet

- Page 032Document1 pagePage 032francis earlNo ratings yet

- Page 034Document1 pagePage 034francis earlNo ratings yet

- USFB Annual ReportDocument149 pagesUSFB Annual Reportvanitha vemulaNo ratings yet

- Print POBatchDocument7 pagesPrint POBatchDhomo RahadiNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesDocument6 pagesNUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesKyla Artuz Dela CruzNo ratings yet

- TPK Database May 2009Document1,544 pagesTPK Database May 2009api-17236257No ratings yet

- GST - Time of Supply of Goods (Summary)Document1 pageGST - Time of Supply of Goods (Summary)Saksham KathuriaNo ratings yet

- RTI Online: Online RTI Information SystemDocument1 pageRTI Online: Online RTI Information SystemPrishita VatsayanNo ratings yet

- Revised Philippine Government Internal Audit Manual 2020Document361 pagesRevised Philippine Government Internal Audit Manual 2020Rizza Lacao BorjaNo ratings yet

- Pharmaceutical MarketingDocument5 pagesPharmaceutical MarketingRahel StormNo ratings yet

- Tourism DistributionDocument15 pagesTourism DistributionMircelaine AlbaNo ratings yet

- Using IP VPN Encryption Solutions From Crypto AG Over BGANDocument14 pagesUsing IP VPN Encryption Solutions From Crypto AG Over BGANPurcarea AndreiNo ratings yet

- AAHamlen 3e - Solutions Manual - Ch05Document48 pagesAAHamlen 3e - Solutions Manual - Ch05JimboWine100% (4)

- BSPDocument2 pagesBSPapi-236234542No ratings yet

- Bseform - El10005385Document1 pageBseform - El10005385Nagaraju ZenmoneyNo ratings yet

- CPA Board Exam October 2009 ResultsDocument88 pagesCPA Board Exam October 2009 ResultsOrman O. Manansala0% (1)

- Renewal Invitation Letter 244075913Document2 pagesRenewal Invitation Letter 244075913Sam VeeversNo ratings yet

- Ledger Book Question BankDocument15 pagesLedger Book Question BankAKSHAY KUMAR GUPTANo ratings yet

- 3359-2 Zurich ValueLife Junior Brochure R2Document22 pages3359-2 Zurich ValueLife Junior Brochure R2Venodaren VelusamyNo ratings yet

- E-Business in Organization:: North South UniversityDocument12 pagesE-Business in Organization:: North South UniversityJubayer HasanNo ratings yet

- Galaxy Freight ForwardingDocument13 pagesGalaxy Freight ForwardingArsalan Feroz KhanNo ratings yet

- The Brief History of BankDocument2 pagesThe Brief History of BankEmy Rose GaringaNo ratings yet

- Content Chapter I: Direct Marketing. Definition. How It Works Chapter II: DM Features. Benefits and Tools of Direct Marketing Conclusion ReferencesDocument22 pagesContent Chapter I: Direct Marketing. Definition. How It Works Chapter II: DM Features. Benefits and Tools of Direct Marketing Conclusion ReferencesCray AlisterNo ratings yet

- Accounts ReceivableDocument7 pagesAccounts ReceivablePeter PiperNo ratings yet

- DAGUPLO c2 p16 p17Document7 pagesDAGUPLO c2 p16 p17Jane Leona Almosa Daguplo100% (1)

- International Accounting Standards Board (IASB)Document8 pagesInternational Accounting Standards Board (IASB)Arabi AsadNo ratings yet

- Blockchain Based Cloud Computing Architecture and Research ChallengesDocument16 pagesBlockchain Based Cloud Computing Architecture and Research Challengesunnati srivastavaNo ratings yet

- Panasonic KX-TD816 Programming TableDocument168 pagesPanasonic KX-TD816 Programming TableTrevor BernardNo ratings yet

- O2 Settings Access WAP Internet UMTS - AreamobileDocument3 pagesO2 Settings Access WAP Internet UMTS - AreamobilesudarskiNo ratings yet

- Q.2: What Historically Has Been Walmart's Key Source of Competitive Advantage in Discount Retailing?Document8 pagesQ.2: What Historically Has Been Walmart's Key Source of Competitive Advantage in Discount Retailing?Veda ShahNo ratings yet

- Index 1. Frequently Asked Question Page 2 2Document11 pagesIndex 1. Frequently Asked Question Page 2 2SnehasreeNo ratings yet

- E CashDocument46 pagesE CashJosephine Jebet RonohNo ratings yet