Professional Documents

Culture Documents

Challenges of International Real Estate Investment Amidst COVID - 19 Pandemic: Nigeria Perspective

Uploaded by

judexnams1on1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challenges of International Real Estate Investment Amidst COVID - 19 Pandemic: Nigeria Perspective

Uploaded by

judexnams1on1Copyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/352327463

Challenges of International Real Estate Investment amidst COVID -19 Pandemic:

Nigeria Perspective

Article · June 2021

CITATION READS

1 321

3 authors:

Udobi Alexander Nnamdi Emmanuela Uzoamaka Otty

Nnamdi Azikiwe University, Awka Nnamdi Azikiwe University, Awka

18 PUBLICATIONS 28 CITATIONS 8 PUBLICATIONS 1 CITATION

SEE PROFILE SEE PROFILE

Chiemezie Chisom Nwosu

Nnamdi Azikiwe University, Awka

15 PUBLICATIONS 2 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Evaluation of challenges of maintenance management of commercial buildings in Awka, Anambra state, Nigeria. View project

All content following this page was uploaded by Chiemezie Chisom Nwosu on 11 June 2021.

The user has requested enhancement of the downloaded file.

ISSN 2321 3361 © 2021 IJESC

Research Article Volume 11 Issue No.06

Challenges of International Real Estate Investment amidst COVID -19

Pandemic: Nigeria Perspective

Udobi Alexander Nnamdi1, Otty Emmanuela Uzoamaka2, Nwosu Chiemezie Chisom3

Department of Estate Management

Nnamdi Azikiwe University, Awka Anambre State, Nigeria

Abstract:

The study focused on examination of the challenges facing international real estate investment and impact of COVID 19 in Nigeria.

Relevant twelfth challenges surveyed from related literatures were subjected to study. Relative Importance Index (RII) was used to

determine the significance of each challenges based on the respondents’ rating. From the study land registration process, real estate

taxes payable, financial sector risk and legal risk were ranked as the most significant challenges with RII of 4.47, 4.38, 4.24and

4.05respectively. The least significant challenges are capital importation/repatriation and expropriation/nationalization with RII of

2.75and 2.56 respectively.The research also recommend the government to reduce the processes and cost of land registration as well

reduce the taxes paid for real estate ownership.

Keywords: Challenges, international real estate, investment, COVID, Nigeria.

1.0 INTRODUCTION return on real estate investment is certain as rent or prestige

(Olawande, 2011). Sale or lease of parcel of land by a speculator

Real estate is an immovable asset or property that is fixed or prospective seller to willing buyer entails good returns to the

permanently to one location. This includes land and anything seller and asset possession to the willing buyer. Another good

that is built on the land. It also includes anything that is growing aspect of investment on real estate is tenants selection. However,

on the land or that exists under the face of the land (Badmus, real estate investment is strictly related to the housing price. It

Yusuff&Alli, 2017).Real estaterefers to land, as well as any has been pointed out by many researchers that the housing price

physical property or improvements affixed to the land, including is affected by many factors, such as interest rate, land supply,

houses, buildings, landscaping, fencing, wells, air right above government policies and inflation rate (Hui, and Yu, 2010).

the land, mining right under the land etc. Vacant land and International real estate investment is necessitated by real estate

residential lots, plus the houses, outbuildings, decks, trees investors seeking to diversify risks inherent in such investments

sewers and fixtures within the boundaries of the property are all in their domestic markets. Risks here encompass both variability

referred to as real estate. Nowadays, with modern method of in expected returns from investment (Byrne and Cadman, 1985)

construction and technology, mobile houses may be referred to and expected uncertainties (unknown occurrences) inherent in

as part of a real estate.Finnih (2017) stated that from time such investments (Kalu,2001). Some of the risks are specific to

immemorial, real estate has shown to be an excellent source of the class of investment while others are in the macro economy of

profit through the increase in investment property value over the country or the area where the investment is undertaken.

time. People have been investing in real estate because of its Specific risks can be diversified while risk inherent in the macro

benefits of generally capable of appreciating in value with time, economy (the systematic risks) cannot be diversified. Investors

all things being equal. Real estate is important because it is a are compensated by the market for bearing systematic risks but

basic need for individual, family, corporate organisations and not unsystematic risks. In going international investors hope to

government, and demand for it will be directly correlated with diversify their domestic market risks and tap into the benefits of

increasing population, increasing production and increasing going international (Solnik, 1993). To this end investors must

quality of living determined by increasing per capital income. seek to enter countries with low systematic risks. Christner

Real estate investment is among the key investment that enables (2009) and Solnik (1993) and other eminent scholars advise that

the investor to recover his investment as at when due (Braimoh there exist certain factors the foreign investors must note in the

and Onishi, 2007). For any investment to flourish one has to destination market they intend to explore and adequate

make any aspect of the business feasibility and viability studies precautions taken in order to avoid pitfalls and failure. The

for proper dealings and carefulness from avoiding fraudulent country and continent chosen for investment matter so much as

business, real estate business has less harm if the owner or the expected returns can be affected either negatively or positively

buyer makes a proper investigation of the subject matter. (Christner, 2009).

Eichholtz, Gugler, and Kok, (2011) stated that an increase in International real estate investments are made in a foreign

international real estate capital flows could foster increasing country’s property market in order to reduce the investor’s

demand for stronger institutions across global real estate market portfolio risk. Such investment risk reduction is possible because

. A number of article have argued that real estate investment has real estate markets of different countries generally have low

realized tremendous positive abnormal risk adjustment returns, levels of correlation (Chua, 1999; Conover et al, 2002; and

IJESC, June 2021 28062 http:// ijesc.org/

Baum, 1999 among others). In addition, real estate investments experienced. He further stated that the primary problems

overseas may help investors increase returns. However, encountered with international investment include lack of local

investing in real estate markets overseas means venturing into knowledge, agency costs, regulatory restrictions on foreign

the unknown, where you meet unfamiliar political and economic ownership, higher transaction costs, complex taxation, small-

environments, unstable currencies, strange cultures and scale markets, political and economic risks, exchange rate risk,

languages, and so although the advantages of international and access to local services. The growth in the use of real estate

diversification might appear attractive, the risks of international funds for real estate investments has facilitated an increase in

portfolio investment must not be overlooked (Sirmans and international real estate investments. Real estate funds allow

Worzala (2000); and Kateley (2002). Nonetheless, capital investors who lack the resources or skills to invest directly to

markets are becoming global markets and commercial real estate enjoy the benefits of diversification into cross-border products

markets are no exception so despite the difficulties posed by without the need to know the characteristics and functioning

venturing overseas, no investor can overlook the potential details of foreign property markets. The growth in international

international real estate investment holds out. real estate investments, while widening the potential pool of

According to the World Health Organization (WHO, 2020), the properties available for purchase, does not come without

coronavirus is a large family of viruses which may cause illness challenges. In particular, real estate funds are exposed to foreign

in animals or humans. In humans, several coronaviruses are exchange risk. Currency exposure is particularly apparent in the

known to cause respiratory infections ranging from the common case of international real estate investments, given the relative

cold to more severe diseases such as Middle East Respiratory low volatility of property operating income. This low volatility

Syndrome (MERS) and Severe Acute Respiratory Syndrome of operating income often renders exchange rate movements as

(SARS). COVID-19 has become a global pandemic affecting the main source of short-term risks and returns (positive or

many countries which Nigeria is one of them as reported by the negative) from investing abroad, unless currency risk is hedged.

World Health Organization (WHO, 2020). The most common The globalization of economy activity through deregulation and

symptoms of COVID-19 are fever, dry cough, and tiredness. liberalization and advances in information and communication

Other symptoms that are less common and may affect some technologies present an appetizing environment for world real

patients include aches and pains, nasal congestion, headache, estate investors to go international. Advantages abound for

conjunctivitis, sore throat, diarrhea, loss of taste or smell or a international real estate investment and include risk reduction by

rash on skin or discoloration of fingers or toes. As a result of the eliminating non-systematic volatility, higher expected returns

constant rapid increase of coronavirus cases in Nigeria and the and large size of international markets. Again most countries of

application of social distancing to curb the spread of the virus, the world have limited properties for overwhelming domestic

real estate has been affected greatly compared to the major demand and yet there exist investors having huge funds but lack

financial asset classes owing to the peculiar characteristics of avenues to invest. Nigeria is one of such countries. Domestic

real estate. Real estate investments are largely traded in private, investors battle with country systematic risks which cut down on

non-centralized market, with inaccessible private data and often their returns on investment yet there exist prospects

poor quality data. However, the recent developments in global internationally to better their investment outcomes through

economy has necessitated that real estate investment decision international diversification. Real estate investment faces many

needs to be properly informed (Oyewole, 2019). In Nigeria, real challenges such as land acquisition and Registration, interest

estate investment was seen in the past as a means to obtain rate, Government policies, real estate pricing, lack of clear and

security and regular income, thus decisions were often made on proper real estate legislation, scarcity of land, Bureaucracy in

the basis of intuition and past experience (Ajayi&Fabiyi, 1984). registering title deeds (Kazimoto, 2016). However, the study

Appraisal of portfolio performance was limited to financial examine the challenges facing international real estate

holdings, while limited interest was shown on the level of investment in Nigeria.

performance achieved by real estate investments. Location and

sound management were recognized as the only important 2.0. LITERATURE REVIEW

factors influencing the return on real estate investment. Such

considerations as basis of investment decision sufficed for the 2.1 Challenges of international Real Estate Investment

period of the economic boom (Oyewole, 2019). However, the Even though Nigeria has the above beautiful economy prospect,

recent happenings in the global and national economy require she has been known to be in high risk market for investment

thorough investigation of all forces that influence real estate (Agu,2015). The challenges of international real estate

performance including the impact of COVID-19 on real estate investment today are:

investment.

Urbi (2016) stated that international real estate investing offers Land Registration Process

opportunities for enhanced diversification. Investors often begin International real estate investors need security to access

real estate investing domestically because local opportunities are mortgage fund. Such security must necessarily be registered

more familiar and easier to undertake than cross-border both at the co-operate affairs commission and the Land Registry

(international) investments. As investors gain experience to give it legal backing (Lovells, 2013). According to World

investing in a variety of domestic real estate projects, they often Bank Doing Business Report (2013), Nigeria is ranked 182 out

look to other countries for new opportunities. Institutional of 185 countries. She is among the worst in land registration.

investors pursuing direct access to real estate assets often begin The process can take up to 12 processes, last between 6months

investing abroad by becoming a limited partner in an to 2years and cost about 20.8% of the property value.

international project somewhat similar to the domestic Developers are usually frustrated and sometimes lose their

opportunities with which they are already familiar and source of funding or incur further costs in interest on bank loans

(Emiedafe, 2015).

IJESC, June 2021 28063 http:// ijesc.org/

Real Estate Taxes Payable estate investors to Nigeria. Omisore (2012) posits that Nigerian

The taxes payable include Value Added Tax (VAT) on the real estate sector lacks well-defined and reliable mortgage

services of Estate Agents (5% of the fees charged), Capital financing as it is seen not being affordable to support longer

Gains tax (10% on the value of the property), withholding terms loans and funding. The Federal Mortgage bank and its

tax(5% - 10%), stamp duties (assessed and paid by the payee on subsidiary are the only mortgage institutions in Nigeria funding

annual or ad valorem bases). Other taxes and levies include real estate investment and the cue to access the fund is unending.

development levy, income tax, building plan approved levy, Therefore investors must move capital for investment into the

property tax, renovation tax (in the occasion of renovation of country. The cost of such transfer may be huge considering the

buildings) and other miscellaneous charges and levies. Most of processes involved in the country.

these charges, in practice are arbitrarily charged. This informs

the present advocacy by The Estate Surveyors Registration Legal Risk and Bureaucratic Encumbrances

Board of Nigeria (ESVARBON) that the assessment and This is the major risk as postulated by (Alfred, 2014) plaguing

payment of Stamp duty and Estate Duty should be on Dutiable Nigerian real estate sector. The apex legislation controlling all

basis while Capital Gains Tax should be on Chargeable Gains land matters in Nigeria is the Land Use Decree, of 1978 now

(CG) (Mekadolf, 2015). As Christner (2009) and other authors Land Use Act (Cap 202) of 1990. Land development is under

reviewed above state, numerous, arbitrarily, and unfriendly taxes the auspices of the Urban and Regional Planning Department by

repress investment outcomes in returns. Decree of 1992. The bureaucracy of obtaining either the Right of

Occupancy over a purchased land or the Development approval

Bribery and Corruption are very cumbersome to domestic operators not to talk of foreign

This factor tops Lovells (2013) risk list for foreign real estate investors. Government can be erratic and changing in its

investment in Nigeria. This is because Nigeria is currently policies. Delays exist in passing relevant laws by National

ranked by the Transparency International as the 35th most Assembly. The courts handling land matters are no better. Cases

corrupt country globally. Buildings collapse because of non- are left unresolved for years on end (Lovells, 2013). Aggrieved

compliance to building regulations by contractors engaging in persons die and live cases unresolved. This discourages

sharp practices. The staffs of government Regulatory Agencies investors into the sector.

prefer taking bribes rather than ensuring that building

regulations are adhered to. Investors can overcome this by Political Instability/Violence

keeping close personal monitoring on building projects or Lovells (2013) and Agu et al. (2013) write that political

employ reliable project managers to do same. instability and violence have killed the interest of both domestic

and foreign investors in Nigeria. Bombing attacks, stampede,

Fraud fighting, bomb explosions, kidnappings, killings have

Fraud dominates real estate business in Nigeria. This was clearly discouraged investors. Boko Haram sects terrorized the north

demonstrated by Jones, Lang, Lasalle ranking in 2012, when east while Niger Delta militants hold swage in the South South,

Nigeria was ranked96/97 in transparency index. By the ranking, bombing and blowing off oil pipe lines. Buildings are destroyed

Nigeria was x-rayed to suffer from corruption, lack of and probability of rebuilding by investors is very slim for

operational real estate data and poor environment sustainable obvious reason – fear of repeated attacks. Hamilton et. al. (2009)

programs in massive property development (Emiedafe, 2015). posits that the risk assessment in the regions is very high.

Unqualified people are allocated land and the qualified

developers denied. Popular global real estate investors prefer Capital Importation/Repatriation and other Foreign

countries in North and South Africa where the investment Exchange rules

environment is friendlier and more transparent. Makarova Foreign investors operating jointly with or without Nigerian

(2013) suggest that partnership with local investors can solve the investors must register with the Nigerian Investment Promotion

riddle and eminent estate surveyors and valuers too. A lot of Commission (NIPC) and obtain the certificate. The certificate

those who desire to invest in real estate are afraid because of will be needed before funds can be repatriated by foreign

fraudulent practices that are prevalent in the industry. The investors in non-exempt companies. Foreign investors are

greatest fraud today is being perpetrated through sales of off- allowed free access to import into Nigeria with recognized

plan properties. Off-plan properties are properties sold before foreign currency to fund their operations, but subject to the

completion. Off-plan properties are usually lucrative because country’s money laundery law. Such importation must be

they are sold below market values. Gbonegun (2018) stated that through an authorized Agency (Bank) which must issue to the

the concept of buying off-plan properties in Nigeria has been operator Certificate of Capital Importation (CCI) to evidence the

fraught with sharp practices. Most of the sellers of off-plan inflow of such funds into Nigeria (Lovells,2013). The same rule

properties fail to deliver. applies to other imported resources like raw materials and

equipment. The CCI will further on assist in the purchase of

Financial Sector risk foreign exchange from official market for easy repatriation of

Nigeria mortgage industry is still under-developed. This is the investors proceeds.

evidenced by statistics from World Bank. Between 1960 and

2009, its transaction profile stands at less than 100,000 Devaluation of Naira (Exchange Rate)

(Emiedafe, 2015). The contribution of mortgage financing to The recent devaluation of Naira as compared to other world

Nigeria GDP is almost zero with real estate contributing 5% and currency in international market has made housing cost to go up

mortgage loans and advances contributing 0.5%. Alfred (2014) 25% to 35% and there is prospect for higher rise (Lovells, 2013).

posits that finance sector risk is a great worry to foreign real Some foreign developers peg their construction costs and value

IJESC, June 2021 28064 http:// ijesc.org/

of selling finished product in the US dollars while they pay their Opportunity cost of rival investments

clients in Naira. There will be no problem if the cost and value The opportunity cost of investing in shares, bond and motor

of the development in Naira translates into its anticipated vehicles. The temptation and or opportunity costs to invest in

equivalent in dollars. But this is not so as Naira continuous fall shares of quoted companies, government bonds and motor

constitutes a loss to developers (Ekpenyong, 2015).Emiedafe vehicles may lead one not buying real estate.

(2015) believes that higher construction cost is as a result of

over dependent of the real estate industry on foreign equipment 2.2Impact of COVID-19 on Real Estate Investment in

and raw materials. Naturally developers shift high construction Nigeria

costs on consumers. Real estate investment is actually a hedge The outbreak of COVID-19 has had a massive impact on

against inflation as high inflation is rewarded by high interest financial markets and the economy worldwide. The impact of

yield on capital invested as income will go up if demand is the COVID-19 pandemic on real estate can be deemed to be an

strong (Solnik, 1993; Shapiro, 1993; Hoesli, et. al.,2000). If indirect one; as the pandemic affect humans, their characteristics

demand is not strong resulting in low rentals or voids, then and activities, these in turn lay impact on the real estate sector.

losses will ensue. Even at high rental yields, the real value of The demand for living space for several years now, has

money (purchasing power) is low, meaning a loss to investors. exceeded the scarce supply of real estate in many cities and

regions. This trend is believed will not change significantly even

Expropriation and Nationalization in the present times, as the reasons for the excess demand will

Nigeria has bilateral investment treaties with several countries of continue to exist (Okafor and Keke, 2020).

the world including United Kingdom, Turkey, China, France, The pandemic has disrupted life and performance in most

Germany, Italy, Korea, Finland, Russia etcetera. Some of the sectors. Some have been lucky to have the capacity to withstand

treaties afford investors of the countries mutual mitigation the shocks. The telecommunications sector, for instance, has

against investment expropriation, repatriation of investment been the bright spot during the pandemic as business owners and

returns thereon and compensation for losses caused by wars, individuals rely on technology for meetings and milestone

riots etc. In Nigeria except such treaties are ratified by National celebrations. Other sectors, such as aviation, education, and

Assembly and made part of the Domestic laws, they cannot be trade, have crashed under the weight of the pandemic. Social

enforced (Lovells, 2013). The Nigerian Constitution safeguards distancing guidelines have affected their ability to conduct

every property owner’s interest in their property whether business and resulted in a significant loss of

Nigerians or foreigners. To this end foreign investors’ properties revenue.Unfortunately, the real estate sector is among the

are safe and are not subject to arbitrary confiscation. Prompt significant losers of the current crisis. The impact of the

compensations are paid in occasion of their acquisition for pandemic on the real estate sector is unique in that it is not felt

overriding public interest. The NIPC Act and similar bilateral immediately by key stakeholders. The sector is a lagging

investment treaties between Nigeria and other world countries indicator, which means that it can confirm long term trends but

safeguard against expropriation of foreign assets. not predict them. The fragmentation of the sector means that

different sub-sectors will feel the pinch of the virus differently

Absence of Secondary real estate market/Illiquidity/ease of than others. However, one common factor is that all sub-sectors

entry will be negatively affected.

The absence of this market and electronic listed platform make Okafor and Keke (2020) stated that marketing and prices of real

real estate market slow and many buildings remain vacant for estate have remained stable despite the emergence of the

long periods. Again it takes years to convert real estate coronavirus, however demand for some specific classes of

investment to cash. It is a common experience to see completed property, such as recreational may drop, while demand for some

properties remaining unlet for months if not years. Foreign others such as medical and agricultural are on the increase.

investors will be required to obtain other than NIPC certificate Nevertheless, investors as well as all individuals are likely to put

other operational licenses and business permits to carry on their scarce resources only to necessities due to the uncertainties

business in Nigeria. of the global economic situation and this can affect the real

estate sector activities indirectly in the long run. Marketing of

The NIPC is empowered to assist the intending investor to make real estate for sale or rental is going virtual in order to reduce

the obtaining of the licenses/permits easy. Some state laws make personal contact and observe the required social and physical

it difficult for foreign investors to acquire land to invest except distancing rules. The agricultural real estate sector is predicted

such investment has prior approval by the apex government. to remain stable as the demand for agricultural products both for

Investors are to note this closely. food and export will always be on the rise. This makes the

agricultural sector relatively inelastic, thereby giving it the

The Risk Involved in Real Estate potential of growing, particularly in the manufacturing of

Investing in real estate may be risky and complex especially for medical and herbal products which are believed to help fight

a first-timer. Buying land or houses from government agency against the virus. Overall, investing in real estate remains a safe

directly is less risky than buying from individuals and investment.

mushrooms companies which come out with different products

every day. In a country like Nigeria, where titled properties are 3.0 METHODOLOGY

less than 3% of the available properties (PTCLR, 2018), getting

a titled property may be a herculean task. Mark of any The data for this research work was obtained through the use of

transaction on land is security of title to land. A titled land may structured questionnaires from Real Estate Investor/Developer,

have its title revoked and Governor’s consent is not a warranty Estate Surveyors and Valuers, Builders, Quantity Surveyor and

to develop.

IJESC, June 2021 28065 http:// ijesc.org/

Engineers. 88 completed questionnaires where use for the Indifferent with 3 points, and Disagree with 2 points and

analysis. Relative Importance Index (RII) was used to analyse Strongly disagree with 1 point.

the respondents’ scores of the basic challenges. In this study, an The relative importance index (RII) is given by equation (1)

ordinal measurement scale 1 to 5 was used to determine the ∑ WF

Relative Importance Index =

effect level. With the use of Likert scale, respondent’s opinion 𝑁

Where W is the weighting given to each factor by the

on the challenges facing international real estate investment was

respondents, ranging from 1 to 5, F is the frequency of responses

obtained and they were asked to score challenges associated

and N is the total number of samples. The rating of all the

with international real estate investment, according to the degree

challenges for degree of significance was based on the value of

of important: Strongly agree with 5 points, Agree with 4 points,

their respective relative importance index (RII).

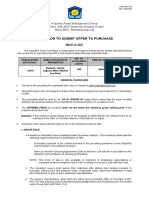

4.0.DATA PRESENTATION

Responses and Ranking on Challenges Associated with International Real Estate InvestmentScored on the Degree of

Importance

R II Ranking

Scales and number of respondents

S/N

Challenges

5 4 3 2 1

1. Land registration process 52 27 7 2 - 4. 47 1

2. Real estate taxes payable 50 25 9 4 - 4.38 2

Financial sector risk

3. 47 22 12 7 - 4.24 3

Legal risk and bureaucratic

4. encumbrances 44 20 10 12 2 4.05 4

5

Fraud 44 20 10 11 3 4.03 5

6 Political instability/violence

39 23 11 12 3 3.94 6

7 Devaluation of naira exchange

rate 39 23 11 11 4 3.93 7

8 Bribery and corruption

35 25 13 12 3 3.55 8

9 Absence of secondary real estate

market/illiquidity 25 26 15 17 5 3.56 9

10 Opportunity cost of rival

investment 13 15 26 26 8 2.99 10

Capital importation/repatriation

11 and other foreign exchange rules

9 11 27 31 10 2.75 11

12 Expropriation and

nationalization 5 8 30 33 12 2.56 12

Rank: (Strongly agree -5, Agree -4, Undecided-3, Disagree -2, strongly disagree -1)

IJESC, June 2021 28066 http:// ijesc.org/

From the result in table above, land registration process ranked [7]. Braimoh, A. K., &Onishi, T. (2007). Spatial determinants of

first, real estate taxes payable ranked second, financial sector urban land use change in Lagos, Nigeria. Journal of Land Use

risk was ranked third and Legal risk and bureaucratic Policy, 24(2), 502–515

encumbrances ranked fourth and they are most significant

challenges facing international real estate investment in Nigeria . [8]. Christner, R. (2009). A Risk Management Approach to

International Real Estate Investment. International Journal of

5.0. CONCLUSION AND RECOMMENDATIONS Economics and Business, 1(1), 43 - 59.

International Real estate investment is one of the best investment [9]. Christner, R. (2009). A Risk Management Approach to

products available in any economy. The rate of appreciation of International Real Estate Investment. International Journal of

real estate and the services it provides make investment decision Economics and Business, 1(1), 43 - 59.

in it a wise one. Location is the major factor in decision-making

before buying a property.Real estate investment is desirable by [10]. Chua, A. (1999) The Role of International Real Estate In

both the rich and the poor because it is a basic need and has Global Mixed-Asset Investment Portfolios. Journal of Real

lower comparative risk on investment. International real estate Estate Portfolio Management, 5 (2) 129-137.

investment is faced with many challenges which when not

handled properly would affect Nigeria economy. COVID-19 [11]. Eichholtz, P. M. A., Gugler, N., &Kok, N. (2011).

pandemic have an impact on real estate supply, demand, sale Transparency, Integration, and the Cost of International Real

value and rental value in Nigeria. From the discussion so far, it Estate Investments. The Journal of Real Estate Finance and

is correct to state that the real estate sector of the Nigerian Economics, 43( 2), 152–173.

economy has been greatly affected by the outbreak of COVID-

19 so much so that investors are very scared to invest in the [12].Emiedafe, W. (2015). 10 issues-affecting Nigeria real estate

sector. The following recommendations were made to mitigate industry. Retrieved June 10, 2016, from sapientvendors.com.ng:

the influence of the problem of international real estate http://www.sapientvendors.

investment during similar pandemic in the future. Nigeria

foreign real estate investment terrain should be safer for [13]. Finnih, A. (2017). Real estate needs proper regulation to

investors to achieve their diversification benefits.The paper develop sector. Vanguard Newspaper, August 26, 2017.

recommend that the Federal Government should work on the

macro economy indices to stem most of the risk factors to make [14].Hoesli, M., & MacGregor, B. D. (2000). Property

the investment arena conducive for international investors to Investment: Principle and Practice of Portfolio Management.

operate profitably. Furthermore foreign investors need to partner London: Essex: Longman.

with reliable domestic investors and estate surveyors and

Valuers who are more familiar with the economy terrain to [15].Hui, E., Yu, C., &Ip, W.-C. (2010). Jump point detection

safeguard against losses. The research also recommend the for real estate investment success. Physica A:Statistical

government to reduce the processes and cost of land registration Mechanics and its Applications, 389(5), 1055–1064. doi:

as well reduce the taxes paid for real estate ownership. 10.1016/j.physa.2009.11.022

6.0. REFERENCES [16].Kateley, R. (2002) Managing International Risk: Practical

Considerations for Direct Investors, PREA Quarterly, 14, 1, pp.

[1]. Agbola, T. (1994). The Prospect for Private Sector Involve 31-35.

ment in urban management function in Nigerian. Journal of

Review of Urban & Regional Development Studies, 6(2), 135– [17]. Kateley, R. (2002) Managing International Risk: Practical

149 Considerations for Direct Investors, PREA Quarterly, 14, 1, pp.

31-35.

[2]. Agu, O. C. (2015, April). Determinants of Private Invest

ment in Nigeria an Econometric Analysis. International Journal [18].Lovells, H. (2013). Foreign Investment in Nigeria -

of Economics, Commerce preliminary legal issueswww. lexology. com/ library/ detail.

aspx?g=. Retrieved June 10, 2016 and Management, 111(4).

[3].Ajayi, C. A., &Fabiyi, Y. L. (1984). A critique of property

investment feasibility and viability appraisal reporting in [19].Makarova, E. P. (2013). Basis of Management of the Real

Nigeria. Quarterly Journal of Administration, 161-169. Estate. Moscow. Russia: People Friendship University of Russia

[4]. Alfred, M. (2014). Opportunities & Risks For Foreign Real [20]. Okafor, J. I. &Keke, O. (2020). Influence of novel

Estate Investments in Nigeria. International Journal of coronavirus disease on Nigeria real estate sector and way

Economics, Commerce and Management, 2(7). forward. International Journal of Real Estate Studies.

[5].Badmus, A. I., Yusuff, A. M. &Alli, I. A. (2017). Principles [21]. Olawande, O. A. (2011). Harnessing real estate investment

of Law. Igboora, Oyo State: Sakol Prints Ventures. through proper tenant selection in Nigeria. Property Manage

ment, 29(4), 383–397.

[6]. Baum, A (1999) Changing Styles in International Real

Estate Investment, Australian Land Economists Review, 5, 2, [22]. Omisore, T. (2012, January 6). Real Estate Investment in

pp. 3-11. Nigeria is promising Lagos, Nigeria: Vanguard Newspaper.

IJESC, June 2021 28067 http:// ijesc.org/

[23]. Oyewole, M. O. (2019). A review of real estate investment

performance in Nigeria. Retrieved on 29 October. World Health

Organization

[24]. Sirmans, C. and Worzala, E. (2000) International Direct

Real Estate Investment: A Review of the Literature, Urban

Studies, 40(5), 1081-1114.

[25].Urbi, G. (2016). International real estate investment.

https//www.researchgate.net/publication

[26]. World Health Organization (WHO). (2020). Q&A on

coronavirus (COVID-19). Retrieved 19 July 2020 from

https://www.who.int/emergencies/diseases/ novelcoronavirus-

2019

IJESC, June 2021 28068 http:// ijesc.org/

View publication stats

You might also like

- ADB International Investment Agreement Tool Kit: A Comparative AnalysisFrom EverandADB International Investment Agreement Tool Kit: A Comparative AnalysisNo ratings yet

- Engineering Economy, 3rd Ed With SolutionDocument398 pagesEngineering Economy, 3rd Ed With SolutionJay Dalwadi100% (1)

- CrisisAfterCrisis SovereinDocument13 pagesCrisisAfterCrisis SovereindrkwngNo ratings yet

- CA Final SFM Divya Jadi BootiDocument630 pagesCA Final SFM Divya Jadi Bootisunny bhaiNo ratings yet

- Real Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelyDocument9 pagesReal Estate: Unobservable Theoretical Construct. Housing Stock Depreciates Making It QualitativelykrupaleeNo ratings yet

- Bank's Lending Functions and Types of LoansDocument26 pagesBank's Lending Functions and Types of LoansAshish Gupta100% (1)

- A Study On Investment Pattern of General PublicDocument9 pagesA Study On Investment Pattern of General PublicIJRASETPublicationsNo ratings yet

- Factors Affecting Cost of Construction in NigeriaDocument44 pagesFactors Affecting Cost of Construction in NigeriaGeomanjeri100% (1)

- A Project Report ON Analysis of Real Estate Investment' ATDocument48 pagesA Project Report ON Analysis of Real Estate Investment' ATSamuel DavisNo ratings yet

- Standing Instruction and Indemnity FormDocument7 pagesStanding Instruction and Indemnity FormDebbie NagelNo ratings yet

- Overview of Financial EnggDocument44 pagesOverview of Financial Engghandore_sachinNo ratings yet

- Fdi in Nigeria ThesisDocument62 pagesFdi in Nigeria ThesisYUSUF BAKO100% (1)

- Challenges and ProspectsDocument4 pagesChallenges and ProspectsArega GenetieNo ratings yet

- Is Consideration of Global Real Estate Investment Risks Worth?Document6 pagesIs Consideration of Global Real Estate Investment Risks Worth?Harjot KaurNo ratings yet

- Plenary IRERS 2010 UnderstandingDocument18 pagesPlenary IRERS 2010 Understandingracan19No ratings yet

- Siskos Dimitrios-SsrnDocument15 pagesSiskos Dimitrios-Ssrnapi-207179647No ratings yet

- Axioms 10 00140 v2Document25 pagesAxioms 10 00140 v2LamNo ratings yet

- 0601 Wuefh 97 RDocument30 pages0601 Wuefh 97 RPokemongo helpingspooferNo ratings yet

- BSM135 Topic One PDF Updated .CompressedDocument16 pagesBSM135 Topic One PDF Updated .Compressedalanmoore123No ratings yet

- Mitigating Risk Impact of Disputes On Real Estate Business and Investment in Lagos: The Alternative Dispute Resolution (ADR) ApproachDocument94 pagesMitigating Risk Impact of Disputes On Real Estate Business and Investment in Lagos: The Alternative Dispute Resolution (ADR) ApproachCHI EMELENo ratings yet

- 7.3 - Corona Transmission Islamic Vs ConventionalDocument14 pages7.3 - Corona Transmission Islamic Vs ConventionalHounaida JlassiNo ratings yet

- COVID-19 and Stock Market Reaction in Indonesia: Accounting InvestmentDocument14 pagesCOVID-19 and Stock Market Reaction in Indonesia: Accounting InvestmentRizky KatiliNo ratings yet

- Foreign Ownership, Return Volatility, Trading Volume, and Risk of Stocks in IndonesiaDocument24 pagesForeign Ownership, Return Volatility, Trading Volume, and Risk of Stocks in IndonesiaFery GamingNo ratings yet

- Sample ProjectDocument13 pagesSample ProjectDeepak SachdevNo ratings yet

- Presentation at JVEC's Meeting 29 May 2004 "Locational Determinants of Foreign Direct Investment: The Case of Vietnam"Document31 pagesPresentation at JVEC's Meeting 29 May 2004 "Locational Determinants of Foreign Direct Investment: The Case of Vietnam"Trần Thị Kim NhungNo ratings yet

- Analysis On Effect of COVID - 19 On Property Valuation in Real Estate MarketDocument9 pagesAnalysis On Effect of COVID - 19 On Property Valuation in Real Estate MarketIJRASETPublicationsNo ratings yet

- Fin Irjmets1665811796Document10 pagesFin Irjmets1665811796Amit BrarNo ratings yet

- HedgingDocument23 pagesHedgingjoycetsNo ratings yet

- Reconciling International Investment Law Vs Public Policy Ethiopia's Perspective (PDFDrive)Document21 pagesReconciling International Investment Law Vs Public Policy Ethiopia's Perspective (PDFDrive)yeshiwas abereNo ratings yet

- Determinants of Foreign Investors' Home Bias in The Vietnamese Stock MarketDocument13 pagesDeterminants of Foreign Investors' Home Bias in The Vietnamese Stock MarketTrần Ngọc Phương UyênNo ratings yet

- Global Commercial and Residential Property MarketDocument6 pagesGlobal Commercial and Residential Property MarketBani Miza NamzaliNo ratings yet

- Practiceschallengesandprospectsofrealesatedevtin AADocument17 pagesPracticeschallengesandprospectsofrealesatedevtin AAMekonnen TamiratNo ratings yet

- Revising BITs As A New Tendency PDFDocument21 pagesRevising BITs As A New Tendency PDFJustin HalimNo ratings yet

- Global Financial Markets: Factors Influencing The Global Financial MarketsDocument13 pagesGlobal Financial Markets: Factors Influencing The Global Financial MarketsKomal sharmaNo ratings yet

- Problem and Prospect of Residential Kanta ORIGINALDocument48 pagesProblem and Prospect of Residential Kanta ORIGINALAdegbenro MichealNo ratings yet

- Home Bias in Equity Portfolios: Theory and Evidence For Developed MarketsDocument10 pagesHome Bias in Equity Portfolios: Theory and Evidence For Developed MarketsAnna RodinaNo ratings yet

- The Effect of Covid 19 On The Nigerian Financial Market Performance - JsdaDocument12 pagesThe Effect of Covid 19 On The Nigerian Financial Market Performance - JsdaAbubakar MuhammadNo ratings yet

- Oooooooooo Oooooooooo o Oooooooooo OoooooooooDocument5 pagesOooooooooo Oooooooooo o Oooooooooo OoooooooooSolomonNo ratings yet

- Reactions of Indonesia Stock Market To Covid-19 PandemicDocument9 pagesReactions of Indonesia Stock Market To Covid-19 PandemicThe IjbmtNo ratings yet

- Chapter 2Document29 pagesChapter 2Satyam BobadeNo ratings yet

- Mansourfar Et AlDocument7 pagesMansourfar Et AlGurvinder Singh DhillonNo ratings yet

- Economy & Recession-Bhdruka 200309Document37 pagesEconomy & Recession-Bhdruka 200309Phaniraj LenkalapallyNo ratings yet

- My Course Work 2Document62 pagesMy Course Work 2Simplified LekelyNo ratings yet

- Project ReportDocument62 pagesProject Reportchippanavin1No ratings yet

- FDI and Economic Growth: The Role of Local Financial MarketsDocument52 pagesFDI and Economic Growth: The Role of Local Financial MarketsUmair MuzammilNo ratings yet

- The Impacts of Financial Challenges in Case of Real Estate Developers in EthiopiaDocument7 pagesThe Impacts of Financial Challenges in Case of Real Estate Developers in Ethiopiatesfalem kirosNo ratings yet

- World Dev (BITs)Document45 pagesWorld Dev (BITs)JurasimNo ratings yet

- Ataifiok ProjectDocument56 pagesAtaifiok ProjectDaniel NeddNo ratings yet

- Unclaimed Dividend: A Latent Alternative Source For Housing Finance in NigeriaDocument12 pagesUnclaimed Dividend: A Latent Alternative Source For Housing Finance in NigeriaCHI EMELENo ratings yet

- Chap 6 FDI Impacts - Host 2021Document39 pagesChap 6 FDI Impacts - Host 2021Nguyễn Hải QuỳnhNo ratings yet

- Issues, Challenges and Thier Solution in An Execution of Real Estate Project at Selected Site in Addis Ababa.Document91 pagesIssues, Challenges and Thier Solution in An Execution of Real Estate Project at Selected Site in Addis Ababa.Eyob Light Worku100% (1)

- Foreign Direct Investment in Developing Countries: Determinants and ImpactDocument26 pagesForeign Direct Investment in Developing Countries: Determinants and ImpactAriscynatha Putra INo ratings yet

- VIR - Talkshow - AP CheckedDocument4 pagesVIR - Talkshow - AP CheckedAlex PhamNo ratings yet

- Future of Real Estate in post-COVID-19 WorldDocument4 pagesFuture of Real Estate in post-COVID-19 WorldAlex PhamNo ratings yet

- Foreign Direct Investment Theories: An Overview of The Main FDI TheoriesDocument7 pagesForeign Direct Investment Theories: An Overview of The Main FDI TheoriessyedmuneebulhasanNo ratings yet

- Presentation at The 9 International Conference On Macroeconomic Analysis and International Finance May 2005 Rethymno, CreteDocument14 pagesPresentation at The 9 International Conference On Macroeconomic Analysis and International Finance May 2005 Rethymno, CreteHenrique SanchezNo ratings yet

- 1 s2.0 S0969593123000367 MainDocument15 pages1 s2.0 S0969593123000367 MaincacaNo ratings yet

- 98 FutureinvestmentarbitrDocument25 pages98 FutureinvestmentarbitrAlexa JoNo ratings yet

- Globalization and The Development of The Nigerian Capital MarketDocument6 pagesGlobalization and The Development of The Nigerian Capital MarketEditor IJTSRDNo ratings yet

- Jurnal Ekonomi 3Document19 pagesJurnal Ekonomi 3phoebe buffayNo ratings yet

- A Study On The Impact of COVID-19 On Investor Behaviour of Individuals in A Small Town in The State of Madhya Pradesh, IndiaDocument24 pagesA Study On The Impact of COVID-19 On Investor Behaviour of Individuals in A Small Town in The State of Madhya Pradesh, IndiaJUAN PABLO PLAZA RIOSNo ratings yet

- Idp000831 001Document27 pagesIdp000831 001sarvesh gunessNo ratings yet

- Why Do Foreign Firms Invest in South West England?: Damian N. Whittard and Don J. WebberDocument24 pagesWhy Do Foreign Firms Invest in South West England?: Damian N. Whittard and Don J. WebberVishal Sambuca Elber ParmarNo ratings yet

- Stock Market Linkages and Causal Relationships: Empirical Investigation of Em7 EconomiesDocument10 pagesStock Market Linkages and Causal Relationships: Empirical Investigation of Em7 EconomiesIJAR JOURNALNo ratings yet

- 1.foreign Direct Investment and Economic Growt Literature From 1980 To 2018Document10 pages1.foreign Direct Investment and Economic Growt Literature From 1980 To 2018Azan RasheedNo ratings yet

- A Study On The Impact of COVID - 19 On Investor Behaviour of IndivDocument23 pagesA Study On The Impact of COVID - 19 On Investor Behaviour of IndivParth TrivediNo ratings yet

- First Term Student ResultDocument36 pagesFirst Term Student Resultjudexnams1on1No ratings yet

- Second Term Subject SheetDocument36 pagesSecond Term Subject Sheetjudexnams1on1No ratings yet

- Assessment of Real Estate Risk in Nasarawa Property MarketDocument56 pagesAssessment of Real Estate Risk in Nasarawa Property Marketjudexnams1on1No ratings yet

- Facility ManagementDocument8 pagesFacility Managementjudexnams1on1No ratings yet

- QUS 316 RecentDocument5 pagesQUS 316 Recentjudexnams1on1No ratings yet

- Man and Society BieatriceDocument11 pagesMan and Society Bieatricejudexnams1on1No ratings yet

- Qus 309-Tendering and EstimatingDocument24 pagesQus 309-Tendering and Estimatingjudexnams1on1No ratings yet

- Construction MangamentDocument23 pagesConstruction Mangamentjudexnams1on1No ratings yet

- Theory Picture of Language BabeDocument5 pagesTheory Picture of Language Babejudexnams1on1No ratings yet

- Explain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageDocument5 pagesExplain What Type of Information Should Be Included in The Schedule For The Permanent File in Respect of The MortgageBeyonce SmithNo ratings yet

- Melendrez vs. DecenaDocument15 pagesMelendrez vs. DecenaAngelie FloresNo ratings yet

- Principles of Taxation - RedaeDocument16 pagesPrinciples of Taxation - Redaegizachewnani2011No ratings yet

- Kulkarni Sarang MilindDocument21 pagesKulkarni Sarang MilindSarang KulkarniNo ratings yet

- Midterm F08 With SolutionsDocument11 pagesMidterm F08 With SolutionsSupri awasthiNo ratings yet

- Managing Dairy Farm Finances: Larry F. Tranel ISU Extension Dairy Field SpecialistDocument17 pagesManaging Dairy Farm Finances: Larry F. Tranel ISU Extension Dairy Field SpecialistAbc AbcNo ratings yet

- Department of Education: Republic of The PhilippinesDocument8 pagesDepartment of Education: Republic of The PhilippinesJeweljoy PudaNo ratings yet

- Invitation To Submit Offer To PurchaseDocument25 pagesInvitation To Submit Offer To PurchaseClarita MelisNo ratings yet

- 5 Steps To Negotiating PaymentDocument39 pages5 Steps To Negotiating PaymentThanh Loan100% (1)

- Islamic Banking in BangladeshDocument26 pagesIslamic Banking in BangladeshAkram khanNo ratings yet

- Asset Backed FinancingDocument2 pagesAsset Backed FinancingAyesha HamidNo ratings yet

- Summary of Final Income TaxDocument7 pagesSummary of Final Income TaxeysiNo ratings yet

- Fac4863 105-2017, UnisaDocument85 pagesFac4863 105-2017, UnisasamNo ratings yet

- United States V Kirby LumberDocument31 pagesUnited States V Kirby LumberKTNo ratings yet

- Bye-Laws of Sanskruti Township Flat Owners Welfare AssociationDocument18 pagesBye-Laws of Sanskruti Township Flat Owners Welfare AssociationSaddi Mahender Reddy100% (1)

- Fsa 2006-09Document637 pagesFsa 2006-09zainabNo ratings yet

- Financial Market and Institution Test BankDocument9 pagesFinancial Market and Institution Test BankChi NguyễnNo ratings yet

- LIC - Amritbaal - Brochure - 4 Inch X 9 Inch - Eng - Single PGDocument20 pagesLIC - Amritbaal - Brochure - 4 Inch X 9 Inch - Eng - Single PGsrajdinesh94No ratings yet

- Simple, Compound Interest, Depreciation, Growth & Decay (H) : Name: Total MarksDocument8 pagesSimple, Compound Interest, Depreciation, Growth & Decay (H) : Name: Total Markslinuxuser userNo ratings yet

- Chapter 10 Interest Rate & Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument15 pagesChapter 10 Interest Rate & Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsAbdulrahman KhelefNo ratings yet

- The Uncommon InvestorDocument232 pagesThe Uncommon InvestorRodrigo MorenoNo ratings yet

- NHB Vishal GoyalDocument24 pagesNHB Vishal GoyalSky walkingNo ratings yet

- BRICKTOWN DEVT CORP Vs AMOR TIERRA DEVT CORP DIGESTDocument2 pagesBRICKTOWN DEVT CORP Vs AMOR TIERRA DEVT CORP DIGESTChasz CarandangNo ratings yet

- Bhartiyam Vidya Niketan: Duration: 3 Hours Maximum Marks: 80Document7 pagesBhartiyam Vidya Niketan: Duration: 3 Hours Maximum Marks: 80Shashank SharmaNo ratings yet