Professional Documents

Culture Documents

Insurance Assignment Bitan

Insurance Assignment Bitan

Uploaded by

Bitan SahaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Assignment Bitan

Insurance Assignment Bitan

Uploaded by

Bitan SahaCopyright:

Available Formats

Insurance

Assignment

PGDM- BIFS 2023-2025

Submitted to: Prof. Avinash Signaraju

Submitted by: Bitan Saha

F2023014

Given Rishi's situation, it's crucial to pinpoint the insurance policies that align with his needs. He

should concentrate on constructing a well-rounded insurance portfolio to protect against

various risks he may encounter. Below is a structured suggestion for fulfilling his insurance

needs:

1. Cyber Liability Insurance: Given Rishi's profession as an architect, it's probable that he

handles digital plans, client data, and may utilize project management tools. This

insurance coverage offers safeguard against financial repercussions in case of a data

breach or cyber assault targeting his systems.

2. Umbrella Insurance: This functions as supplementary liability coverage, activating once

the limits of existing policies are met. It would serve as an additional layer of protection

for Rishi, stepping in once the coverage limits of his other policies have been exhausted.

It offers him extra financial security against potentially expensive lawsuits or damages.

3. Business Interruption Insurance: This insurance could prove beneficial for Rishi in the

event of unforeseen circumstances, such as a fire, natural disaster, or a serious illness

preventing him from working, leading to a temporary closure of his architectural practice.

This type of insurance assists in mitigating the financial impact by covering lost income

during the period of closure.

4. Professional Indemnity Insurance: This insurance safeguards Rishi against potential

legal liabilities stemming from professional negligence. Given his profession as an

architect, Rishi could face legal action from clients if there are flaws in his building

designs. This insurance covers the associated legal expenses and any compensation that

Rishi might be required to pay to the client.

5. Life Insurance: As a businessowner, Rishi should contemplate acquiring life insurance

to ensure financial stability for his family in the event of his unforeseen demise. This

ensures coverage for any remaining debts, mortgages, or offers replacement income for

his dependents.

6. Two-Wheeler Insurance (Bike): Despite Rishi's intention to use his old bike infrequently,

it's advisable to obtain at least third-party two-wheeler insurance. This ensures financial

protection in the event he is responsible for causing damage to another individual or their

property in an accident.

7. Automobile Insurance (Car): Since Rishi owns a new car primarily for business travel,

it's legally required to have at least third-party car insurance. This policy safeguards

against any harm inflicted on a third party's vehicle or property in the event of an accident.

Rishi might also want to explore comprehensive car insurance, which extends coverage

to damage sustained by his own vehicle.

8. Health Insurance: Given lengthy commutes and the risks associated with frequent

travel, it's imperative to have health insurance in effect to ensure coverage for unforeseen

medical expenses due to accidents. In such scenarios, having robust health insurance

provides a crucial safety net, ensuring that Rishi and his family are protected against

unexpected medical costs.

You might also like

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- Information Technology Strategic Plan 2018 - 2022Document10 pagesInformation Technology Strategic Plan 2018 - 2022Nadeera PathiranaNo ratings yet

- Job Hazard Analysis (Jha) Worksheet: Installation/Facility Job Activity Location Description of Activity NoteDocument2 pagesJob Hazard Analysis (Jha) Worksheet: Installation/Facility Job Activity Location Description of Activity Noteganeshkanth100% (1)

- Commercial Insurance FinalDocument42 pagesCommercial Insurance FinalRiddhimaSawant0% (1)

- Health Needs Assessment StepsDocument40 pagesHealth Needs Assessment Stepsdennis8113100% (2)

- General InsuranceDocument65 pagesGeneral InsurancePaul MeshramNo ratings yet

- Gas Welding Risk AssessmentDocument8 pagesGas Welding Risk AssessmentvictorNo ratings yet

- Ayesha Srivastava ERMDocument6 pagesAyesha Srivastava ERMSAasha SinghNo ratings yet

- General Oda Project Proposal Format Cover PageDocument18 pagesGeneral Oda Project Proposal Format Cover PageBillVeelNo ratings yet

- An Introduction To CCARDocument10 pagesAn Introduction To CCARRanit Banerjee100% (1)

- Tata AiaDocument132 pagesTata AiaHimanshu Jadon100% (1)

- DRRR Q1 Module 1Document33 pagesDRRR Q1 Module 1Carl RodriguezNo ratings yet

- FACTORS INFLUENCING INDIVIDUALS' GAMBLING Behavior - A Case Study in MalaysiaDocument11 pagesFACTORS INFLUENCING INDIVIDUALS' GAMBLING Behavior - A Case Study in Malaysiar2pm100% (1)

- Project Report On Insurance IndustryDocument68 pagesProject Report On Insurance IndustryshabnamNo ratings yet

- Appendix G Site Management Safety Training Scheme (SMSTS)Document16 pagesAppendix G Site Management Safety Training Scheme (SMSTS)dodozeeNo ratings yet

- Tony RobbinsDocument3 pagesTony RobbinsGerardoGutierrezAndueza33% (9)

- Insurance CompaniesDocument11 pagesInsurance CompaniesPricia AbellaNo ratings yet

- Identify Hazards and Risks: By: Rosemel C. Rempillo TLE Teacher, Balogo HSDocument28 pagesIdentify Hazards and Risks: By: Rosemel C. Rempillo TLE Teacher, Balogo HSMhel Abbyzj100% (1)

- Nfpa 502 Critical Velocity Vs Fffs EffectsDocument5 pagesNfpa 502 Critical Velocity Vs Fffs Effectsamir shokrNo ratings yet

- Betriebsanleitung Engl PDFDocument812 pagesBetriebsanleitung Engl PDFotipi100% (3)

- COMPANY PprrooffileDocument12 pagesCOMPANY PprrooffileKai MK4No ratings yet

- NotesDocument6 pagesNotesGoodataka ZackamanNo ratings yet

- Banking and InsuranceDocument17 pagesBanking and InsuranceDeepak GhimireNo ratings yet

- A Complete Guide and Strategy Handbook For General InsuranceDocument33 pagesA Complete Guide and Strategy Handbook For General InsuranceDibbendu BhattacharyaNo ratings yet

- Advantages of InsuranceDocument3 pagesAdvantages of InsuranceGursharan Saggu0% (1)

- Micro Insurance ProjectDocument12 pagesMicro Insurance ProjectSushil PrajapatNo ratings yet

- Ibis Unit 03Document28 pagesIbis Unit 03bhagyashripande321No ratings yet

- Importance and Benefits of InsuranceDocument7 pagesImportance and Benefits of InsurancePooja TripathiNo ratings yet

- Assignment: Name-Vishlesh Hukmani ENROLLMENT NO.-03014901819 Course-Bba (B&I) Subject-Principles of Insurance 2 SemsterDocument4 pagesAssignment: Name-Vishlesh Hukmani ENROLLMENT NO.-03014901819 Course-Bba (B&I) Subject-Principles of Insurance 2 SemsterVishlesh 03014901819No ratings yet

- 20201BBL0016 Sec3 IPRIDocument6 pages20201BBL0016 Sec3 IPRIAditi AvvaruNo ratings yet

- Mi Final CCDocument52 pagesMi Final CCHomework PingNo ratings yet

- Financial InstitutionsDocument13 pagesFinancial Institutionsr3ewrhymesNo ratings yet

- What Is Insurance - Meaning, Types, Importance & BenefitsDocument7 pagesWhat Is Insurance - Meaning, Types, Importance & BenefitsAyush VermaNo ratings yet

- Project On Maxlife InsuranceDocument41 pagesProject On Maxlife Insurancejigna kelaNo ratings yet

- UNIT 1 InsuranceDocument9 pagesUNIT 1 InsuranceHarleenNo ratings yet

- 9th Chap Insurance & Business RiskDocument9 pages9th Chap Insurance & Business Riskbaigz0918No ratings yet

- DDDDDocument7 pagesDDDDShrajith A NatarajanNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentShantam GulatiNo ratings yet

- P7Document6 pagesP7pardeshikanchan07No ratings yet

- Summer Internship Project With Prudent Corporate Advisory Services LTD Comparison of Kotak Mahindra ULIP With Other Private Insurance PlayersDocument40 pagesSummer Internship Project With Prudent Corporate Advisory Services LTD Comparison of Kotak Mahindra ULIP With Other Private Insurance Playersk3k.k3kNo ratings yet

- Motor Insurance, Fidelity Insurance, Burglary Insurance, Employee Benefits Plans, Health Care Financing and Health Care InsuranceDocument14 pagesMotor Insurance, Fidelity Insurance, Burglary Insurance, Employee Benefits Plans, Health Care Financing and Health Care Insurancevijayadarshini vNo ratings yet

- Icici Complete Project Mba 3Document106 pagesIcici Complete Project Mba 3Javaid Ahmad MirNo ratings yet

- Principles of Insurance GENERAL INSURANCE (Non Life)Document4 pagesPrinciples of Insurance GENERAL INSURANCE (Non Life)Nipun DhingraNo ratings yet

- Insurance - Definition and Meaning 2Document4 pagesInsurance - Definition and Meaning 2ЕкатеринаNo ratings yet

- Remaining ProjectDocument81 pagesRemaining ProjectvickychapterNo ratings yet

- Chapter SixDocument12 pagesChapter Six108 AnirbanNo ratings yet

- Chap Iii - FinaldraftDocument12 pagesChap Iii - FinaldraftOjo Meow GovindhNo ratings yet

- Insurance TrainingDocument12 pagesInsurance TrainingAnish RIngeNo ratings yet

- Insurance Insurance-This Is An Undertaking or Contract Between An Individual or Business and An Insurance AnDocument23 pagesInsurance Insurance-This Is An Undertaking or Contract Between An Individual or Business and An Insurance AnangaNo ratings yet

- Chapter SixDocument12 pagesChapter SixMeklit TenaNo ratings yet

- Executive SummaryDocument25 pagesExecutive SummaryRitika MahenNo ratings yet

- Types of Insurance - Different Types of Insurance Policies in India PDFDocument14 pagesTypes of Insurance - Different Types of Insurance Policies in India PDFHS AspuipluNo ratings yet

- Customer Satisfaction Level of Lic ProductsDocument90 pagesCustomer Satisfaction Level of Lic ProductsPiyush Soni100% (2)

- Insurance CompaniesDocument5 pagesInsurance CompaniesangelicamadscNo ratings yet

- 18bco32c U1Document14 pages18bco32c U1Vipul TyagiNo ratings yet

- SYBBI FP ProDocument9 pagesSYBBI FP ProSudarshan TakNo ratings yet

- Swamy InsuranceDocument7 pagesSwamy InsuranceSannidhi MukeshNo ratings yet

- New India Assurance Company LTDDocument63 pagesNew India Assurance Company LTDkevalcool25050% (2)

- Property & Casualty Insurance BasicsDocument28 pagesProperty & Casualty Insurance Basics邵晨冬No ratings yet

- Insurance Notes - Docx 1625567004928Document27 pagesInsurance Notes - Docx 1625567004928herbert muhumuzaNo ratings yet

- Unit - 5 InsuranceDocument82 pagesUnit - 5 InsuranceSwapnil SonjeNo ratings yet

- Accidental InsuranceDocument33 pagesAccidental InsuranceHarinarayan PrajapatiNo ratings yet

- Apollo MunichDocument52 pagesApollo MunichSumit ManglaniNo ratings yet

- Insurance Is The Granted To An Individual, Institution or Indeed The TradersDocument109 pagesInsurance Is The Granted To An Individual, Institution or Indeed The TradersMahesh KempegowdaNo ratings yet

- Insurance & UTIDocument22 pagesInsurance & UTIReeta Singh100% (1)

- InsuranceDocument45 pagesInsuranceAlex HaymeNo ratings yet

- Accidental InsuranceDocument38 pagesAccidental InsuranceSohail ShaikhNo ratings yet

- Chapter - 1Document51 pagesChapter - 1Ankur SheelNo ratings yet

- Types of InsuranceDocument11 pagesTypes of InsuranceHimanshu Conscript100% (1)

- Icici Bank Project ReportDocument68 pagesIcici Bank Project ReportNeeraj PurohitNo ratings yet

- Insurance ManagementDocument25 pagesInsurance ManagementDeepak ParidaNo ratings yet

- Insurance ProvisionDocument8 pagesInsurance ProvisionJake GuataNo ratings yet

- Recruitment of Advisors in IciciDocument77 pagesRecruitment of Advisors in Icicipadamheena123No ratings yet

- Reinsurance Industry in IndiaDocument18 pagesReinsurance Industry in Indiapriyank2380804621100% (12)

- Notes Chapter WiseDocument55 pagesNotes Chapter WiseBitan SahaNo ratings yet

- Estimating The Cost of Debt: Prof. Abhinav SharmaDocument10 pagesEstimating The Cost of Debt: Prof. Abhinav SharmaBitan SahaNo ratings yet

- Foreign Exchange MarketDocument10 pagesForeign Exchange MarketBitan SahaNo ratings yet

- Babita RMDocument64 pagesBabita RMBitan SahaNo ratings yet

- Guess-EstimationsDocument9 pagesGuess-EstimationsBitan SahaNo ratings yet

- Case WizDocument4 pagesCase WizBitan SahaNo ratings yet

- Business Economics Unit 4Document36 pagesBusiness Economics Unit 4Bitan SahaNo ratings yet

- FMI Term1Document27 pagesFMI Term1Bitan SahaNo ratings yet

- Customer Value and Satisfaction Week 3Document27 pagesCustomer Value and Satisfaction Week 3Bitan SahaNo ratings yet

- DDM Firm Value CalculationDocument4 pagesDDM Firm Value CalculationBitan SahaNo ratings yet

- GuiuanDocument1 pageGuiuanPdrrmo Eastern SamarNo ratings yet

- Stages in Policy IssuanceDocument9 pagesStages in Policy IssuanceNeha AmitNo ratings yet

- 2nd Assignment Progress-HoangThanh (May 31)Document97 pages2nd Assignment Progress-HoangThanh (May 31)Nguyễn Hoàng ThànhNo ratings yet

- Chapter 9 Audit SamplingDocument17 pagesChapter 9 Audit SamplingCzarmae DumalaonNo ratings yet

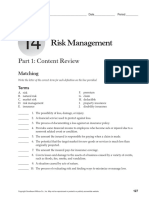

- Risk Management: Part 1: Content ReviewDocument8 pagesRisk Management: Part 1: Content ReviewKourtni GladneyNo ratings yet

- Long Quiz Auditing Assurance Principles Feb. 2021Document8 pagesLong Quiz Auditing Assurance Principles Feb. 2021Jamie Rose AragonesNo ratings yet

- Cbi Myanmar Garment Sector Value Chain AnalysisDocument43 pagesCbi Myanmar Garment Sector Value Chain AnalysisWint Wah HlaingNo ratings yet

- 6th Year Infectious Diseases Synopsis Mu-PlevenDocument6 pages6th Year Infectious Diseases Synopsis Mu-PlevenAngie frabreaNo ratings yet

- PSM ExamenDocument14 pagesPSM ExamenradiaNo ratings yet

- Audit Project Final DraftDocument26 pagesAudit Project Final Draftapi-301020804No ratings yet

- Nadkarni & Herrmann, 2010Document25 pagesNadkarni & Herrmann, 2010Harshad Vinay SavantNo ratings yet

- Goines, and Louis: Noise Pollution: A Modem PlagueDocument8 pagesGoines, and Louis: Noise Pollution: A Modem PlagueFeby RumwaropenNo ratings yet

- Major Assignment Auditing and AssuranceDocument9 pagesMajor Assignment Auditing and AssuranceMariaSangsterNo ratings yet

- Cdra Compilation SampleDocument19 pagesCdra Compilation SampleTere YalongNo ratings yet

- Senco Gold RHPDocument499 pagesSenco Gold RHPRahul MehtaNo ratings yet