Professional Documents

Culture Documents

Q123 KSA Benchmarking

Uploaded by

Shaaban HassanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q123 KSA Benchmarking

Uploaded by

Shaaban HassanCopyright:

Available Formats

Construction Costs Benchmarking

Kingdom of Saudi Arabia

Q1 2023

Market Highlights

Riyadh, the capital of Saudi Arabia, is witnessing

rapid development to become a contender Saudi market witnessed a fast economy According to industry sources, more Saudi Arabia approves airports Major growth in new destination

amongst the world’s major cities in all sectors growth by 8.7% in 2022 and 5.4% in than 5,200 construction projects are and major infrastructure projects developments, as evident in heritage

namely entertainment, leisure, hospitality, retail, Q4-2022. Real GDP of non-oil activities currently ongoing in Saudi Arabia at a cooperating with international and local hospitality resorts in different parts of

theme parks, residential, and infrastructure, during the year 2022 grew by 5.4% value of USD 819 billion. These projects investors under the PPP route. This step Saudi Arabia, such as lodges, camps,

compared to the previous year 2021 account for approximately 35% of the will boost the construction market and heritage, eco-tourism and farming

demonstrating that the Kingdom’s capital is on a as reported by General Authority for total value of active projects across the also enhance the connectivity of Saudi resorts.

growth trajectory. Statistics (GASTAT). Gulf Cooperation Council (GCC). Arabia to the entire world.

Low

About Compass

High Low High Low High

Building Construction Building Construction Fit-out Construction

SAR/m2 SAR/m2 SAR/m2 SAR/m2 SAR/m2 SAR/m2

Drawing on our extensive delivery experience,

knowledge and sophisticated project development

Residential Retail Cinema industry-wide tools, we facilitate the most

The building costs for respective asset types including The building costs for respective asset types including The fit-out works costs for respective asset types including proficient path towards project success,

building construction works, and fixed fit-out works. building shell & core construction works, front-of-house and warm shell, architectural & MEP fit-out works, specialist overcoming constraints and obstacles to deliver

back-of-house fit-out excluding the retail tenant area. AV/IT installations, projectors, screens, seats, carpet, and projects effectively and efficiently for our Clients.

Villa Standard 3,400 4,200 lighting.

District Mall 4,500 6,000 Specialising in start-to-finish project development solutions,

Villa Mid-market 3,500 5,400 Cinema Standard 7,500 8,500 our collective attention to detail, and our passion for getting

Regional Mall 5,500 7,000 everything right, helps define and solidify your goals, whilst

Villa Upper Mid-market 4,500 7,600

Cinema Boutique 8,500 9,500 establishing and managing realistic schedules and budgets.

Apartment Standard 4,500 5,500 We lead construction projects from concept right through to

Car Park Cinema VIP 9,500 11,000

completion with services including:

Apartment Mid-market 5,500 6,500

Food & Beverage Development Management

Apartment Premium 6,500 8,500 Basement / Underground 2,900 3,850

Program Management

On Grade 500 1,200 The fit-out works costs for respective asset types including

Project Management

Hospitality architectural, FF&E & MEP fit-out works, and shop-front.

Above Ground 1,800 3,200 Rate excludes variable cost items like lighting, kitchen Procurement Management

The building costs for respective asset types including equipment, AV/IT/security, and artwork. Commercial Management

building construction works, fixed fit-out works, kitchen and Low High

laundry equipment. Fit-out Construction Restaurant Standard 4,000 5,500 Construction Management

SAR/m2 SAR/m2

3 Star Hotel 6,500 9,500 Restaurant Mid-market 5,500 10,000 Benchmarking Notes

Offices

The m2 area is based on GIA measurement as defined by the RICS code

4 Star Hotel 8,500 11,500 Restaurant High-end 10,000 17,500 of measuring practise 6th edition.

The fit-out works costs for respective asset types including

architectural & MEP fit-out works, specialist AV/IT/Security SAR/m2 rates are current as of Q1 2023.

5 Star Hotel 11,500 15,800

installations, and fixed FF&E. Rates include contractor’s overhead & profit, and general requirements.

Rates assume a traditional build only procurement route, considering

Office Standard 3,000 4,000 Tier 1 main contractor.

The rates in this document are indicative and subject to each project’s

Office Mid-market 4,000 6,800 requirements and specifications.

To find out more, contact: Rates exclude: Contingency, inflation beyond Q1 2023, professional

Office High-end 6,800 9,000 fees, statutory fees, legal fees, sales & marketing fees, pre-opening

insights@compass-pc.com

costs, land costs, finance costs, client direct costs, loose FF&E (except

compass-pc.com for F&B fitout), OS&E and VAT.

You might also like

- KSA Benchmarking Q422Document1 pageKSA Benchmarking Q422Steve KingNo ratings yet

- Ksa Cost Benchmarking q1 2020Document1 pageKsa Cost Benchmarking q1 2020Ty BorjaNo ratings yet

- Construction: Kingdom of Saudi ArabiaDocument4 pagesConstruction: Kingdom of Saudi ArabiaElyas AhmedNo ratings yet

- 237 Brochure 2023 FINALDocument15 pages237 Brochure 2023 FINALJoe WaigwaNo ratings yet

- UAE Construction Costs Update May 2018Document4 pagesUAE Construction Costs Update May 2018eng_asayedNo ratings yet

- The Big 5 Construct Nigeria Sales Brochure International RatesDocument8 pagesThe Big 5 Construct Nigeria Sales Brochure International RatesNOBERT ODOHNo ratings yet

- Emaar Properties PJSCDocument44 pagesEmaar Properties PJSCahmedNo ratings yet

- 2021 02 Teaser GTC Bonds Issue FINALDocument10 pages2021 02 Teaser GTC Bonds Issue FINALddelaflorNo ratings yet

- KSA Construction Cost Benchmarking May 2016Document4 pagesKSA Construction Cost Benchmarking May 2016mszsohailNo ratings yet

- Investor Memo - Liberty House 2405 ENDocument15 pagesInvestor Memo - Liberty House 2405 ENKobina KyemNo ratings yet

- Digital Company Business Plan - SampleDocument31 pagesDigital Company Business Plan - SampleLinked Business Solutions50% (2)

- 2f Properties, January Catalog +971522277398Document14 pages2f Properties, January Catalog +971522277398zxtb46qkjpNo ratings yet

- CW PPT 24th JunDocument37 pagesCW PPT 24th Junsushil aroraNo ratings yet

- KSA Construction Cost 01 Sept 2020Document5 pagesKSA Construction Cost 01 Sept 2020Mohamed A.HanafyNo ratings yet

- KSA Construction Cost 01 Sept 2020Document5 pagesKSA Construction Cost 01 Sept 2020Hisbullah KLNo ratings yet

- Transforming: SkylinesDocument66 pagesTransforming: SkylinesAshu RathiNo ratings yet

- Saudi Construction Rates - 2021Document4 pagesSaudi Construction Rates - 2021BobNo ratings yet

- Corner Walk PPTDocument37 pagesCorner Walk PPTDEEPAK KUMARNo ratings yet

- Abu Dhabi and Dubai Construction Costs Update May 2019Document5 pagesAbu Dhabi and Dubai Construction Costs Update May 2019Daniyar KussainovNo ratings yet

- 2F Dubai 1M Less Project Catalog January 2024 (2) 2Document14 pages2F Dubai 1M Less Project Catalog January 2024 (2) 2zxtb46qkjpNo ratings yet

- Brochure 2020Document5 pagesBrochure 2020Harry AloysiusNo ratings yet

- REVISED - Euphoria - Flip Chart - 2023-04-18-1Document66 pagesREVISED - Euphoria - Flip Chart - 2023-04-18-1Humpty VlogsNo ratings yet

- Sunteck ShareDocument4 pagesSunteck ShareLalit AgrawalNo ratings yet

- KSA Construction Costs October 2019Document5 pagesKSA Construction Costs October 2019Elyas AhmedNo ratings yet

- India Pune Residential MB Q2 2023Document2 pagesIndia Pune Residential MB Q2 2023Pranav KarwaNo ratings yet

- Altusgroup Costguide2017 WebDocument15 pagesAltusgroup Costguide2017 Webmand42No ratings yet

- Ali Tower: Initial Feasibility AssessmentDocument12 pagesAli Tower: Initial Feasibility AssessmentAamir AzizNo ratings yet

- CLM + Types BrochureDocument52 pagesCLM + Types BrochureAsheer MoneerNo ratings yet

- Phuket Condominium Market Thailand Year End 2017 5630Document4 pagesPhuket Condominium Market Thailand Year End 2017 5630alexm.linkedNo ratings yet

- Financial One PagerDocument1 pageFinancial One Pagerlildude84678No ratings yet

- M3MDocument56 pagesM3MAshu RathiNo ratings yet

- Hotel Project ProposalDocument10 pagesHotel Project ProposalBetel Abe100% (2)

- UAE Cost Benchmarking Q4 2016Document4 pagesUAE Cost Benchmarking Q4 2016RajasekarNo ratings yet

- Vatika One On One 130315 PDFDocument16 pagesVatika One On One 130315 PDFVaibhav RaghuvanshiNo ratings yet

- Genesis Project by SquarefieldDocument23 pagesGenesis Project by Squarefieldobafemi.blueplanetNo ratings yet

- Comfort LivinDocument21 pagesComfort Livinharshitashukla2003No ratings yet

- Final Project - Business Plan - Copper BarDocument85 pagesFinal Project - Business Plan - Copper BarAmany AbozaidNo ratings yet

- Breytton Company Profile 2018Document19 pagesBreytton Company Profile 2018Ken ElofukeNo ratings yet

- Earnings Presentation q4 Fy23 For PrintingDocument49 pagesEarnings Presentation q4 Fy23 For PrintingJoshi EswarNo ratings yet

- KCT ProfileDocument96 pagesKCT ProfileJuan MajeedNo ratings yet

- Luxury: in The Lap of at The Footsteps of The AravallisDocument18 pagesLuxury: in The Lap of at The Footsteps of The AravallisVikas GaurNo ratings yet

- General Catalog Asia 01Document10 pagesGeneral Catalog Asia 01András SzántaiNo ratings yet

- Presentation For Partners ENGDocument20 pagesPresentation For Partners ENGinvestorsclinicleadsNo ratings yet

- National Institute of Construction Management & ResearchDocument17 pagesNational Institute of Construction Management & ResearchHarshit DhawanNo ratings yet

- Colliers International KSA-Construction Cost in The Kingdom of Saudi ArabiaDocument3 pagesColliers International KSA-Construction Cost in The Kingdom of Saudi ArabiaJamil Fakhri100% (1)

- MD SaquibDocument6 pagesMD SaquibMd SaquibNo ratings yet

- Présentation H2FDocument19 pagesPrésentation H2FmouadNo ratings yet

- Coliseum Presentation - 8.13.2020Document13 pagesColiseum Presentation - 8.13.2020Helen BennettNo ratings yet

- Results Presentaion SEP19Document13 pagesResults Presentaion SEP19ahmed.haseebNo ratings yet

- Ad CampaignDocument19 pagesAd CampaignAnkit SinghNo ratings yet

- PROJECT EXECUTIVE SUMMARY DEVELOPMENT LAND (52 ACRES) - Mar2015-FINALDocument11 pagesPROJECT EXECUTIVE SUMMARY DEVELOPMENT LAND (52 ACRES) - Mar2015-FINALNasbi Wan MohamadNo ratings yet

- TUTORIAL 2 - Development AppraisalDocument2 pagesTUTORIAL 2 - Development AppraisalMUHAMMAD DANIEL BIN MOHD SALIMNo ratings yet

- Ehab ElsayedDocument4 pagesEhab ElsayedEhab IbrahimNo ratings yet

- Audit of Specialized Industries - Telecommunications: 1 July 2021 - 6:00 PM - 7:00 PM Via MS TeamsDocument33 pagesAudit of Specialized Industries - Telecommunications: 1 July 2021 - 6:00 PM - 7:00 PM Via MS TeamsJoris Yap67% (6)

- 19 Years of Experience: Ciadco - LTD Quality Contracting . On Time, Within BudgetDocument4 pages19 Years of Experience: Ciadco - LTD Quality Contracting . On Time, Within Budgetnelkon7No ratings yet

- Port of Newcastle - Hydrogen PlansDocument6 pagesPort of Newcastle - Hydrogen PlansMatthew KellyNo ratings yet

- Innovative Financing To Support Massive Toll Road DevelopmentDocument10 pagesInnovative Financing To Support Massive Toll Road DevelopmentFREE FOR FREEDOMNo ratings yet

- Golf Estate Ebrochure UpdatedDocument31 pagesGolf Estate Ebrochure UpdatedAmit GolaNo ratings yet

- a Roadmap For BIM Modelers and Managers in Successful Migration nad Career BuildingFrom Everanda Roadmap For BIM Modelers and Managers in Successful Migration nad Career BuildingNo ratings yet

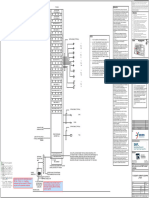

- Lighting Calcs Mark-Up AttachmentDocument2 pagesLighting Calcs Mark-Up AttachmentShaaban HassanNo ratings yet

- LEED PRACTISE EXMS - Indooe Environmental QualityDocument24 pagesLEED PRACTISE EXMS - Indooe Environmental QualityShaaban HassanNo ratings yet

- Wa0105Document4 pagesWa0105Shaaban HassanNo ratings yet

- 4maka08-Tnec-Fc-720-Te-Dwg-60402-A-It & Security Schematic Diagram Layout-AaaDocument1 page4maka08-Tnec-Fc-720-Te-Dwg-60402-A-It & Security Schematic Diagram Layout-AaaShaaban HassanNo ratings yet

- It Was Noticed That All Power Feeders Serving Life SafetyDocument1 pageIt Was Noticed That All Power Feeders Serving Life SafetyShaaban HassanNo ratings yet

- Parking Monitoring SystemDocument15 pagesParking Monitoring SystemShaaban HassanNo ratings yet

- Pool e Leed ExamDocument49 pagesPool e Leed ExamShaaban HassanNo ratings yet

- Power Load Calculation Revision-R00: November 2021Document52 pagesPower Load Calculation Revision-R00: November 2021Shaaban HassanNo ratings yet

- Pool GDocument48 pagesPool GShaaban HassanNo ratings yet

- CEAG Advantages Over AC AC System - CBSDocument2 pagesCEAG Advantages Over AC AC System - CBSShaaban HassanNo ratings yet

- Untitled TtyDocument1 pageUntitled TtyShaaban HassanNo ratings yet

- M AC OFF 306 Layout1Document1 pageM AC OFF 306 Layout1Shaaban HassanNo ratings yet

- Untitled TRDocument1 pageUntitled TRShaaban HassanNo ratings yet

- UntitledDocument1 pageUntitledShaaban HassanNo ratings yet

- UntitledDocument1 pageUntitledShaaban HassanNo ratings yet

- Fire and Life Safety 56Document25 pagesFire and Life Safety 56Shaaban HassanNo ratings yet

- UntitledDocument1 pageUntitledShaaban HassanNo ratings yet

- Baggage X RayDocument4 pagesBaggage X RayShaaban HassanNo ratings yet

- Wire - Chart DC Voltage Drop2Document9 pagesWire - Chart DC Voltage Drop2Shaaban HassanNo ratings yet

- CRESTRON Din Dali 2 Manuelutilisation enDocument44 pagesCRESTRON Din Dali 2 Manuelutilisation enShaaban HassanNo ratings yet

- Introduction To Voice AlarmDocument58 pagesIntroduction To Voice AlarmShaaban HassanNo ratings yet

- E700gd R01Document1 pageE700gd R01Shaaban HassanNo ratings yet

- Office Areas Maximum CWS - GPM ListDocument1 pageOffice Areas Maximum CWS - GPM ListShaaban HassanNo ratings yet

- Calculation of Lightning Flashovers and Backflash CompressDocument7 pagesCalculation of Lightning Flashovers and Backflash CompressShaaban HassanNo ratings yet

- مهم JH FLS Report - Madinah Gate - 14 May 2020Document44 pagesمهم JH FLS Report - Madinah Gate - 14 May 2020Shaaban HassanNo ratings yet

- List of Acceptable Manufacturers / Suppliers Lowcurrent System Equipment Manufacturer / SupplierDocument6 pagesList of Acceptable Manufacturers / Suppliers Lowcurrent System Equipment Manufacturer / SupplierShaaban HassanNo ratings yet

- Required ELECTRICAL Rooms in Buildings: Room Name Dim. Location Equipment Inside The Room Notes & Special RequirementsDocument5 pagesRequired ELECTRICAL Rooms in Buildings: Room Name Dim. Location Equipment Inside The Room Notes & Special RequirementsShaaban HassanNo ratings yet

- Study of Different Cleaning Methods For Solar Reflectors Used in CSP PlantsDocument10 pagesStudy of Different Cleaning Methods For Solar Reflectors Used in CSP PlantsShaaban HassanNo ratings yet

- (Bloom's Modern Critical Views) (2000)Document267 pages(Bloom's Modern Critical Views) (2000)andreea1613232100% (1)

- 14CFR, ICAO, EASA, PCAR, ATA Parts (Summary)Document11 pages14CFR, ICAO, EASA, PCAR, ATA Parts (Summary)therosefatherNo ratings yet

- BLR - Overall Attendance Report - 22mar24Document64 pagesBLR - Overall Attendance Report - 22mar24Purahar sathyaNo ratings yet

- Upcoming Book of Hotel LeelaDocument295 pagesUpcoming Book of Hotel LeelaAshok Kr MurmuNo ratings yet

- PMP PDFDocument334 pagesPMP PDFJohan Ito100% (4)

- HelpDocument5 pagesHelpMd Tushar Abdullah 024 ANo ratings yet

- History and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFDocument1,124 pagesHistory and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFOmkar sinhaNo ratings yet

- Final WorksheetDocument13 pagesFinal WorksheetAgung Prasetyo WibowoNo ratings yet

- Tecson VS Glaxo LaborDocument2 pagesTecson VS Glaxo LaborDanyNo ratings yet

- How Beauty Standards Came To BeDocument3 pagesHow Beauty Standards Came To Beapi-537797933No ratings yet

- A Brief Journey Through Arabic GrammarDocument28 pagesA Brief Journey Through Arabic GrammarMourad Diouri100% (5)

- Dividend Discount ModelDocument54 pagesDividend Discount ModelVaidyanathan Ravichandran100% (1)

- Literacy Technology of The IntellectDocument20 pagesLiteracy Technology of The IntellectFrances Tay100% (1)

- Metaphors of GlobalizationDocument3 pagesMetaphors of GlobalizationShara Christile ColanggoNo ratings yet

- CHAPTER 1 - 3 Q Flashcards - QuizletDocument17 pagesCHAPTER 1 - 3 Q Flashcards - Quizletrochacold100% (1)

- Introduction To Anglo-Saxon LiteratureDocument20 pagesIntroduction To Anglo-Saxon LiteratureMariel EstrellaNo ratings yet

- People v. Bandojo, JR., G.R. No. 234161, October 17, 2018Document21 pagesPeople v. Bandojo, JR., G.R. No. 234161, October 17, 2018Olga Pleños ManingoNo ratings yet

- Power of Attorney UpdatedDocument1 pagePower of Attorney UpdatedHitalo MariottoNo ratings yet

- Distribution Logistics Report 2H 2020Document21 pagesDistribution Logistics Report 2H 2020IleanaNo ratings yet

- Sharmeen Obaid ChinoyDocument5 pagesSharmeen Obaid ChinoyFarhan AliNo ratings yet

- CH 1 QuizDocument19 pagesCH 1 QuizLisa Marie SmeltzerNo ratings yet

- "Working Capital Management": Master of CommerceDocument4 pages"Working Capital Management": Master of Commercekunal bankheleNo ratings yet

- Student Guidelines The School PoliciesDocument5 pagesStudent Guidelines The School PoliciesMaritessNo ratings yet

- Report WritingDocument3 pagesReport WritingSeema SinghNo ratings yet

- HDFC Bank Summer Internship Project: Presented By:-Kandarp SinghDocument12 pagesHDFC Bank Summer Internship Project: Presented By:-Kandarp Singhkandarp_singh_1No ratings yet

- Sarala Bastian ProfileDocument2 pagesSarala Bastian ProfileVinoth KumarNo ratings yet

- NIST SP 800-53ar5-1Document5 pagesNIST SP 800-53ar5-1Guillermo Valdès100% (1)

- Depreciated Replacement CostDocument7 pagesDepreciated Replacement CostOdetteDormanNo ratings yet

- DocumentDocument2 pagesDocumentHP- JK7No ratings yet