Professional Documents

Culture Documents

BE Quiz

Uploaded by

Nimrod Cabrera0 ratings0% found this document useful (0 votes)

11 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesBE Quiz

Uploaded by

Nimrod CabreraCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

NAME:________________________________ 2. Daily rate is sometimes equal to hourly rate.

3. If the hourly rate of employee A is equal to the

TRUE OR FALSE daily rate of employee B, then employee A earns

1. All employees are required to work overtime. more than employee B on a daily basis.

2. Daily rate is sometimes equal to hourly rate. 4. If an employee worked for 6 hours yesterday and

3. If the hourly rate of employee A is equal to the work 10 hours today, then he will receive an

daily rate of employee B, then employee A earns equivalent to 2-day daily rate.

more than employee B on a daily basis. 5. If an employee works on his rest day, then he will

4. If an employee worked for 6 hours yesterday and automatically earn an overtime pay.

work 10 hours today, then he will receive an 6. Compensation for injuries or sickness is non

equivalent to 2-day daily rate. taxable.

5. If an employee works on his rest day, then he will 7. Prizes and awards exempted by law is not

automatically earn an overtime pay. taxable.

6. Compensation for injuries or sickness is non 8. Employees salaries and wages is non taxable.

taxable. 9. Transportation allowances is taxable.

7. Prizes and awards exempted by law is not 10. Mr. De la Cruz bonus amounting to P200,000.00

taxable. is taxable.

8. Employees salaries and wages is non taxable. 11. Gross earnings is sometimes greater than net

9. Transportation allowances is taxable. income.

10. Mr. De la Cruz bonus amounting to P200,000.00 12. The total deductions is always equal to the net

is taxable. earnings

11. Gross earnings is sometimes greater than net 13. Overtime pay is part of deductions.

income. 14. The sum of deductions and the net pay is equals

12. The total deductions is always equal to the net to the total earnings.

earnings 15. If the total deduction is 0, then gross earning is

13. Overtime pay is part of deductions. equal to net earnings.

14. The sum of deductions and the net pay is equals 16. Mrs. Perez 13th month pay amounting to

to the total earnings. P30,000.00 is non taxable.

15. If the total deduction is 0, then gross earning is 17. Mr. Tan’s retirement pay is non taxable.

equal to net earnings. 18. Mr. Lee’s profit in selling bond in a company

16. Mrs. Perez 13th month pay amounting to Mr. Tan’s retirement pay is taxable.

P30,000.00 is non taxable. 19. Angel’s birthday gift Mr. Tan’s retirement pay is

17. Mr. Tan’s retirement pay is non taxable. taxable.

18. Mr. Lee’s profit in selling bond in a company 20. Life insurance policy Mr. Tan’s retirement pay is

Mr. Tan’s retirement pay is taxable. non taxable.

19. Angel’s birthday gift Mr. Tan’s retirement pay is

taxable.

20. Life insurance policy Mr. Tan’s retirement pay is

non taxable.

NAME:________________________________

TRUE OR FALSE

1. All employees are required to work overtime.

You might also like

- BusinessMath Module5 13-16Document64 pagesBusinessMath Module5 13-16Precious SarcillaNo ratings yet

- Salary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesDocument9 pagesSalary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesAlmirah H. AliNo ratings yet

- Compensation and BenefitsDocument3 pagesCompensation and BenefitsBago Resilyn100% (1)

- Mathematics 3 Week 5: Unified Supplementary Learning Materials Abm-Business MathematicsDocument9 pagesMathematics 3 Week 5: Unified Supplementary Learning Materials Abm-Business MathematicsRex MagdaluyoNo ratings yet

- Income TaxDocument13 pagesIncome TaxHennesy Mae TenorioNo ratings yet

- Business Math Q2 Week 3Document9 pagesBusiness Math Q2 Week 3john100% (1)

- ModuleDocument6 pagesModuleGe Ne VieveNo ratings yet

- Bm (1)Document10 pagesBm (1)DaniiNo ratings yet

- Business Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloDocument15 pagesBusiness Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloKim Yessamin Madarcos100% (2)

- Business Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloDocument15 pagesBusiness Math11 12 q2 Clas4 Benefits Given To Wage Earners v2 Joseph AurelloKim Yessamin MadarcosNo ratings yet

- Faqs On 13TH Month Pay PDFDocument31 pagesFaqs On 13TH Month Pay PDFhaechan's fluffy bucket hatNo ratings yet

- Salary Wage IncomeDocument5 pagesSalary Wage IncomeEnrique RiñosNo ratings yet

- Twenty Something Project-2020Document21 pagesTwenty Something Project-2020Sun SlingerNo ratings yet

- Gross Net IncomeDocument14 pagesGross Net IncomeRisalyn MitraNo ratings yet

- Business Mathematics Benefits of Wage EarnersDocument6 pagesBusiness Mathematics Benefits of Wage EarnersZeus Malicdem100% (1)

- Payroll Accounting 2013 Bieg 23rd Edition Test BankDocument43 pagesPayroll Accounting 2013 Bieg 23rd Edition Test BankHelene Johnson100% (37)

- Business Math 2ND QuarterDocument33 pagesBusiness Math 2ND QuarterKuroeNo ratings yet

- ABM11 BussMath Q2 Wk3 Benefits-Of-Wage-EarnersDocument11 pagesABM11 BussMath Q2 Wk3 Benefits-Of-Wage-EarnersArchimedes Arvie GarciaNo ratings yet

- EH 0102 GuidetoPayroll SG V2Document19 pagesEH 0102 GuidetoPayroll SG V2chydhx59ydNo ratings yet

- Business Math Exam ReviewDocument5 pagesBusiness Math Exam ReviewPrecious Claire BorbanoNo ratings yet

- 15 Important Points From Salaries ChapterDocument2 pages15 Important Points From Salaries ChapterDEVILAL DAGARNo ratings yet

- Salaries and WagesDocument16 pagesSalaries and WagesKarlo SityarNo ratings yet

- Salary, Wage, Income: Business MathematicsDocument20 pagesSalary, Wage, Income: Business MathematicsNatasha Dela PeñaNo ratings yet

- Example For Gross Pay and Basic PayDocument2 pagesExample For Gross Pay and Basic PayAnju KhasyapNo ratings yet

- working_out_your_wages__1___2_Document10 pagesworking_out_your_wages__1___2_13593678No ratings yet

- TAX Ch05Document12 pagesTAX Ch05GabriellaNo ratings yet

- Labor Law Quiz SummaryDocument5 pagesLabor Law Quiz SummaryEmmaQueenInMybaby’sHeart HeartNo ratings yet

- Allowances and Minmum Wage ActDocument22 pagesAllowances and Minmum Wage ActjinujithNo ratings yet

- BusmathDocument2 pagesBusmathalyssaNo ratings yet

- Primer On W.O. RX 16-ConsolidatedDocument22 pagesPrimer On W.O. RX 16-ConsolidatedThoughts and More ThoughtsNo ratings yet

- BUSMATH Salaries and WageDocument50 pagesBUSMATH Salaries and Wagelasker bellezaNo ratings yet

- Employment Standards AssignmentDocument4 pagesEmployment Standards Assignmentapi-377742706No ratings yet

- Labor Law DoctrinesDocument30 pagesLabor Law DoctrinesOnat PNo ratings yet

- Questionnaire (Labor Law)Document4 pagesQuestionnaire (Labor Law)Camilla Kaye FloresNo ratings yet

- Tax Calculation for Salary IncomeDocument8 pagesTax Calculation for Salary IncomeAli Raza RahmaniNo ratings yet

- Application For Emergency Arrangement SZWDocument3 pagesApplication For Emergency Arrangement SZWRafael FernandezNo ratings yet

- Salaries and WagesDocument2 pagesSalaries and WagesMisha Dela Cruz CallaNo ratings yet

- Employment Standards AssignmentDocument3 pagesEmployment Standards Assignmentapi-379967485No ratings yet

- Wage Earner Benefits ExplainedDocument12 pagesWage Earner Benefits ExplainedRex MagdaluyoNo ratings yet

- Salaries and Wages: Salary Is The Compensation UsuallyDocument7 pagesSalaries and Wages: Salary Is The Compensation UsuallyJulius LitaNo ratings yet

- Business Math Report WEEK 1Document25 pagesBusiness Math Report WEEK 1HOney Mae Alecida OteroNo ratings yet

- True or FalseDocument2 pagesTrue or FalseJonalene CalaraNo ratings yet

- LST Q and ADocument4 pagesLST Q and AhughesboroNo ratings yet

- Final Exam in Business Mathematics GAS 1, 2, 3 & ABM 12: Department of EducationDocument3 pagesFinal Exam in Business Mathematics GAS 1, 2, 3 & ABM 12: Department of EducationRainy Wagas100% (1)

- Q2 - Business Math LAS3 FOR PRINTING - 230517 - 092725Document5 pagesQ2 - Business Math LAS3 FOR PRINTING - 230517 - 092725yenny lynNo ratings yet

- Salaries and WagesDocument3 pagesSalaries and WagesAndrea OrbisoNo ratings yet

- SalariesDocument4 pagesSalariesChristian VerdaderoNo ratings yet

- What Is The Reason For According Greater Protection To Employees? Explain. 2. What Is Bonus?Document22 pagesWhat Is The Reason For According Greater Protection To Employees? Explain. 2. What Is Bonus?ArahbellsNo ratings yet

- Principles of Microeconomics 6th Edition Frank Test BankDocument38 pagesPrinciples of Microeconomics 6th Edition Frank Test Bankjaydenwells3w8100% (19)

- Summary of Greg Crabtree's Simple Numbers, Straight Talk, Big Profits!From EverandSummary of Greg Crabtree's Simple Numbers, Straight Talk, Big Profits!No ratings yet

- Business Math Q2 W2.2Document17 pagesBusiness Math Q2 W2.2Sophia Sandrin MendozaNo ratings yet

- Employee CompensationDocument7 pagesEmployee CompensationDaniiNo ratings yet

- Labor Law QuestionsDocument8 pagesLabor Law QuestionsJM BermudoNo ratings yet

- Income from Salary GuideDocument15 pagesIncome from Salary GuideSakibul Haque NavinNo ratings yet

- Business Math 1Document40 pagesBusiness Math 1monch1998No ratings yet

- Principles of Economics 6th Edition Frank Test Bank 1Document89 pagesPrinciples of Economics 6th Edition Frank Test Bank 1penelope100% (50)

- Test Bank For Payroll Accounting 2013 23Rd Edition Bieg Toland 113396253X 9781133962533 Full Chapter PDFDocument36 pagesTest Bank For Payroll Accounting 2013 23Rd Edition Bieg Toland 113396253X 9781133962533 Full Chapter PDFangie.walker146100% (12)

- Salaries and Wages: Definitions, Calculations, BenefitsDocument47 pagesSalaries and Wages: Definitions, Calculations, BenefitsJenny Stypay100% (1)

- Money on the Side 75 Ways to Earn Extra Money Working Side JobsFrom EverandMoney on the Side 75 Ways to Earn Extra Money Working Side JobsRating: 5 out of 5 stars5/5 (1)

- LeadershipDocument2 pagesLeadershipNimrod CabreraNo ratings yet

- READING-PROGRESS-REPORT-CARDDocument4 pagesREADING-PROGRESS-REPORT-CARDLyne FernandezNo ratings yet

- Pre-Final Examination III With AnswerDocument3 pagesPre-Final Examination III With AnswerNimrod CabreraNo ratings yet

- DIFFERENTIATED-INSTRUCTION-MAM-CHEDocument64 pagesDIFFERENTIATED-INSTRUCTION-MAM-CHENimrod CabreraNo ratings yet

- Week 5Document2 pagesWeek 5Nimrod CabreraNo ratings yet

- UN Activity ProposalDocument7 pagesUN Activity ProposalNimrod CabreraNo ratings yet

- Week 4Document2 pagesWeek 4Nimrod CabreraNo ratings yet

- Equivalent Points for SelectionDocument3 pagesEquivalent Points for SelectionNimrod CabreraNo ratings yet

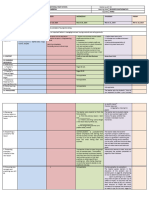

- BM DLL Week 7Document4 pagesBM DLL Week 7Nimrod CabreraNo ratings yet

- III QuizDocument2 pagesIII QuizNimrod CabreraNo ratings yet

- BM DLL Week 8Document4 pagesBM DLL Week 8Nimrod CabreraNo ratings yet

- 2 Module Branches of PhilosophyDocument19 pages2 Module Branches of PhilosophyNimrod CabreraNo ratings yet

- Week 6Document2 pagesWeek 6Nimrod CabreraNo ratings yet

- ACR LetterDocument1 pageACR LetterNimrod CabreraNo ratings yet

- Week 3Document3 pagesWeek 3Nimrod CabreraNo ratings yet

- UN Activity ProposalDocument7 pagesUN Activity ProposalNimrod CabreraNo ratings yet

- Week 7Document2 pagesWeek 7Nimrod CabreraNo ratings yet

- LecturesDocument7 pagesLecturesNimrod CabreraNo ratings yet

- Pe TosDocument2 pagesPe TosNimrod CabreraNo ratings yet

- Intent To Transfer - R.ASTRERODocument1 pageIntent To Transfer - R.ASTRERONimrod CabreraNo ratings yet

- DLP GenMath Part 1Document4 pagesDLP GenMath Part 1Nimrod CabreraNo ratings yet

- G12-SLM1-PR2-Q3-Module 1 - V2 (Final) 1Document16 pagesG12-SLM1-PR2-Q3-Module 1 - V2 (Final) 1MILAFLOR MAMUYACNo ratings yet

- Department of Education: Training Accomplishment ReportDocument14 pagesDepartment of Education: Training Accomplishment ReportNimrod CabreraNo ratings yet

- Activity Proposal 2024 National Womens Month Celebration SY 2022 2023Document9 pagesActivity Proposal 2024 National Womens Month Celebration SY 2022 2023Nimrod Cabrera100% (3)

- Family BusinessDocument9 pagesFamily BusinessNimrod CabreraNo ratings yet

- BM - DLL - Week 3Document3 pagesBM - DLL - Week 3Nimrod CabreraNo ratings yet

- Happy QuizDocument12 pagesHappy QuizNimrod CabreraNo ratings yet

- Organization Theories For Effective Business ManagementDocument21 pagesOrganization Theories For Effective Business ManagementNimrod Cabrera100% (2)

- DLP Stats Part 1Document2 pagesDLP Stats Part 1Nimrod CabreraNo ratings yet

- 020 CHRC Quarry Business Plan Draft V1.1 26 September 2019Document105 pages020 CHRC Quarry Business Plan Draft V1.1 26 September 2019hussen seidNo ratings yet

- Jasso 4950 Spring 2021exam OneDocument1 pageJasso 4950 Spring 2021exam OneОстап ЖолобчукNo ratings yet

- 6.0 Quality Assurance InsulationDocument15 pages6.0 Quality Assurance InsulationMukiara LuffyNo ratings yet

- CV SummaryDocument3 pagesCV SummaryNaseer AhmedNo ratings yet

- The Humane Solution: Trap-Ease Mouse TrapsDocument14 pagesThe Humane Solution: Trap-Ease Mouse TrapsSamiul21No ratings yet

- Providing Brand New Ambulance ServicesDocument83 pagesProviding Brand New Ambulance Servicesmadhav kumarNo ratings yet

- Treasury ManagementDocument108 pagesTreasury Managementchinmoymishra100% (1)

- NL-0000325 DocDocument14 pagesNL-0000325 DocAjeya SaxenaNo ratings yet

- Monitor Deloitte - CaseStudy - Footloose - 2019Document20 pagesMonitor Deloitte - CaseStudy - Footloose - 2019Ester SusantoNo ratings yet

- Section 5 Reflection EssayDocument2 pagesSection 5 Reflection Essayapi-302636671100% (1)

- CFO Corporate Controller in Buffalo NY Resume John MarhoferDocument2 pagesCFO Corporate Controller in Buffalo NY Resume John MarhoferJohnMarhoferNo ratings yet

- Paper 1 - JKKPDocument26 pagesPaper 1 - JKKPalexcus1539No ratings yet

- Emerging Trends in Banking SectorDocument35 pagesEmerging Trends in Banking SectorThyagarajan MuthiyanNo ratings yet

- Guidelines On A Major Accident Prevention PolicyDocument17 pagesGuidelines On A Major Accident Prevention PolicyRemeras TartagalNo ratings yet

- Zoom CarDocument4 pagesZoom Carmahanth gowdaNo ratings yet

- GE Whistleblower Report - Harry MarkopolosDocument175 pagesGE Whistleblower Report - Harry MarkopolosDaniel NguyenNo ratings yet

- Financial EngineeringDocument81 pagesFinancial Engineeringtannyjohny100% (2)

- Accounts Project Yamini JainDocument57 pagesAccounts Project Yamini Jainbabaraligour234No ratings yet

- Accenture CSR Focus on Livelihood, EnvironmentDocument11 pagesAccenture CSR Focus on Livelihood, EnvironmentHarshit Katyal0% (1)

- BUS 393 - Exam 2 - Chapter 4-9Document13 pagesBUS 393 - Exam 2 - Chapter 4-9Nerdy Notes Inc.No ratings yet

- BarcelonaDocument15 pagesBarcelonaSyed Quasain Ali NaqviNo ratings yet

- HermesInternational URD 2019 EN - 01Document468 pagesHermesInternational URD 2019 EN - 01José Manuel EstebanNo ratings yet

- Joint Cost Allocation Methods for Multiple ProductsDocument17 pagesJoint Cost Allocation Methods for Multiple ProductsATLASNo ratings yet

- Nykaa - Fundamental Technical AnalysisDocument6 pagesNykaa - Fundamental Technical Analysiskhyati kaulNo ratings yet

- Profile of Sidikalang Poda Agro and HistoryDocument6 pagesProfile of Sidikalang Poda Agro and HistorySempruldroidNo ratings yet

- GE Nine Cell MatrixDocument21 pagesGE Nine Cell MatrixMadhuri Bhojwani67% (3)

- Unit 11 - Essay VVVV QuestionsDocument7 pagesUnit 11 - Essay VVVV Questionsايهاب العنبوسيNo ratings yet

- Jurnal Internasional 3Document9 pagesJurnal Internasional 3Bella Nur anggrainiNo ratings yet

- Stock Trading Mastery - Explainer PDFDocument19 pagesStock Trading Mastery - Explainer PDFAG ShayariNo ratings yet

- Credit Risk Management CourseDocument9 pagesCredit Risk Management CoursePradeep GautamNo ratings yet