Professional Documents

Culture Documents

Discussion Problems

Uploaded by

Sid Tushaar SiddharthCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Discussion Problems

Uploaded by

Sid Tushaar SiddharthCopyright:

Available Formats

Discussion Problems:

Q4.BCCI's balance sheet indicates the financial health of Indian cricket and the fact that BCCI's assets

have grown significantly in recent years and the future of the game will be great. The future of Indian

cricket at the international level looks great as BCCI can afford in training players at all levels.

Numerical Problems :

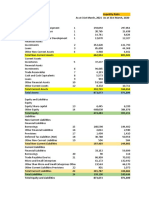

Q2.

Particulars Amount in Rs. Million

EQUITY and LIABILITIES

Shareholders’ Fund

Share Capital 298

Reserves and Surplus 8065

Sub Total 8363

Non-Current Liabilities

Long Term Provisions 81

Other Long Term Liabilities 8

Sub Total 89

Current Liabilities

Trade Payables 724

Short Term Provisions 0

Short Term Provisions 89

Other Current Liabilities 713

Sub Total 1526

Total 9978

Assets

Non-Current Assets

Fixed Assets

Long Term Loans & Advances 302

Intangible Assets 838

Tangible Assets 1581

Capital work in progress 41

Deferred Tax Assets(Net) 172

Non Current Investments 654

Sub Total 3588

Current Assets

Cash and Bank Balances 2901

Trade Receivables 1742

Short Term Loans & Advances 1021

Other Current Assets 726

Sub-Total 6390

Total 9978

Mini Cases:

4.

Q1 . a. Infosys: A fair improvement on total Assets and equity , has highest debt to equity ratio

b. Raymond and Blue Dart: Increased Liabilities, Depreciation and amortization. Meagre

increase in net worth.

d. Colgate: decrease in net worth but increase in liabilities and meagre increase in assets.

Q2. Infosys and Raymond: Significant Increase in Liabilities

Blue Dart: Increase in Long Term Loans and Advances under Non-Current Asset

Colgate: Increase in Depreciation.

Q3. Infosys as the Company possess significant Share equity and mainly Reserve and surplus

Amount which is beneficial in hard times.

Q4. Infosys due to its high current assets, availability of cash and its equivalents, highest debt to

equity ratio.

6. Roll No = 294

DOB= 25

Assets Liabilities and Owner Equity

Cash 1555500 Payables 1000 +2600+306800

Inventory 61360 Loan 25000

Prepaid Rent 29500 Provisions

Total Current Assets 1804260 Total Liabilities 335400

Capital 589000

Fixed Assets 2600 Profit 724560

Total Fixed Assets 2600 Total Owners’ Equity 1313560

Total Assets 1648960 Total Liabilities and Equity 1648960

You might also like

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- PAS 33 Test BankDocument4 pagesPAS 33 Test BankJake ScotNo ratings yet

- Test Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition GranofDocument15 pagesTest Bank For Government and Not For Profit Accounting Concepts and Practices 5th Edition Granofsamuel debebe100% (1)

- Consolidated Financial StatementDocument36 pagesConsolidated Financial StatementArt KingNo ratings yet

- Corporate Liquidation Quiz 5docxDocument5 pagesCorporate Liquidation Quiz 5docxAngelica Duarte33% (6)

- INTRODUCED PAGE - Merged ArpitDocument13 pagesINTRODUCED PAGE - Merged ArpitArpit Mayank ChaurasiaNo ratings yet

- Buku Financial Distress Tanpa ContohDocument6 pagesBuku Financial Distress Tanpa ContohPutri RenalitaNo ratings yet

- Ilovepdf Merged OrganizedDocument16 pagesIlovepdf Merged OrganizedArpit Mayank ChaurasiaNo ratings yet

- Balance Sheet Asset: Total Current AssetsDocument2 pagesBalance Sheet Asset: Total Current AssetsTrinh VũNo ratings yet

- Current Assets Liabilties QuestionsDocument4 pagesCurrent Assets Liabilties QuestionssusieNo ratings yet

- The Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDocument3 pagesThe Following Are The Financial Statements (Along With Common Sized Analysis) of XYZ LTDDeloresNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Requirement 1: BALANCE SHEETDocument3 pagesRequirement 1: BALANCE SHEETAnnabeth BrionNo ratings yet

- Poll 3 - SolutionDocument19 pagesPoll 3 - Solutionakshita bansalNo ratings yet

- University of Central Punjab: Project Appraisal & Credit ManagementDocument6 pagesUniversity of Central Punjab: Project Appraisal & Credit ManagementMisha ButtNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- Mergers and Acquisitions: Arzac, Chapter 9Document17 pagesMergers and Acquisitions: Arzac, Chapter 9crisnoel1No ratings yet

- Book 2Document3 pagesBook 2Tichaona NgomaNo ratings yet

- 8 Session 20 Pillar 02 Finance Management Part 1Document13 pages8 Session 20 Pillar 02 Finance Management Part 1Azfah AliNo ratings yet

- Case Safilo-Luxottica PART A 2018 V - 1Document5 pagesCase Safilo-Luxottica PART A 2018 V - 1Reyansh SharmaNo ratings yet

- Exercises For Chapter 23 EFA2Document13 pagesExercises For Chapter 23 EFA2tuananh leNo ratings yet

- Anagerial Ccounting: June 2019Document16 pagesAnagerial Ccounting: June 2019aniudhNo ratings yet

- Cost Accounting ProjectDocument4 pagesCost Accounting Projecttungeena waseemNo ratings yet

- Practice Set 2 Pfizer HM SolvedDocument17 pagesPractice Set 2 Pfizer HM SolvedNISHA BANSALNo ratings yet

- Financial Statement Analysis MidDocument11 pagesFinancial Statement Analysis MidArslan BhuttaNo ratings yet

- Studying The Financial Statements of A Bank: Balance Sheet of ICICI Bank LTD As On 31.03.2003. (Figures in Rs'000)Document10 pagesStudying The Financial Statements of A Bank: Balance Sheet of ICICI Bank LTD As On 31.03.2003. (Figures in Rs'000)Anand KumarNo ratings yet

- DSML Mar 07Document1 pageDSML Mar 07usman_dhilloNo ratings yet

- Shiksha: Non-Current AssetsDocument4 pagesShiksha: Non-Current AssetsdebojyotiNo ratings yet

- Aquamarine Chemical Limited: Empowering The CivilizationDocument15 pagesAquamarine Chemical Limited: Empowering The CivilizationyousufalkaiumNo ratings yet

- Workshop 3 - Cash Flow 1234 Company StudentsDocument2 pagesWorkshop 3 - Cash Flow 1234 Company StudentsMaria DominguezNo ratings yet

- SABV Topic 5 QuestionsDocument5 pagesSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- FM Ii Case 4 Group 5Document8 pagesFM Ii Case 4 Group 5AntonNo ratings yet

- Shree Ram Electricity LLP: 1) Non-Current AssetsDocument5 pagesShree Ram Electricity LLP: 1) Non-Current AssetsSaba MullaNo ratings yet

- Reliance Industries LTD.: Balance SheetDocument10 pagesReliance Industries LTD.: Balance SheetAayush PeriwalNo ratings yet

- CVS Health Corporation (NYS: CVS)Document10 pagesCVS Health Corporation (NYS: CVS)sahil karmaliNo ratings yet

- Excel - Situatii Financiare Consolidate-Consolidated Financial StatementsDocument3 pagesExcel - Situatii Financiare Consolidate-Consolidated Financial StatementsCristina Maria DeneşanNo ratings yet

- Chapter-2 (Web Chapters)Document27 pagesChapter-2 (Web Chapters)g23111No ratings yet

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesDocument7 pagesSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyNo ratings yet

- Trial Balance As On 31 March 2020 Particulars Debit Balance Credit BalanceDocument14 pagesTrial Balance As On 31 March 2020 Particulars Debit Balance Credit BalanceSantosh KumarNo ratings yet

- Balance Sheet Excel Template: Visit: EmailDocument7 pagesBalance Sheet Excel Template: Visit: EmailPrecious UmingaNo ratings yet

- What Is A Balance Sheet?Document6 pagesWhat Is A Balance Sheet?AraNo ratings yet

- Sessions 8 - 9 - BS - SentDocument11 pagesSessions 8 - 9 - BS - SentAjay DesaleNo ratings yet

- Industrial Analysis:: Major CompetitorsDocument6 pagesIndustrial Analysis:: Major CompetitorsuniversefairyNo ratings yet

- Accounting c3Document26 pagesAccounting c3Alya IzzatiNo ratings yet

- Cosco Example PDFDocument4 pagesCosco Example PDFBeatrice BallabioNo ratings yet

- Accounting Assignment QuestionDocument14 pagesAccounting Assignment QuestionsureshdassNo ratings yet

- Introduction To Business Finance Feasibility Plan of Skydiving in KarachiDocument18 pagesIntroduction To Business Finance Feasibility Plan of Skydiving in KarachiAsad HaiderNo ratings yet

- Accounting II FinalDocument6 pagesAccounting II FinalPak KhNo ratings yet

- Fatima Fertilizer Company Limited: Balance SheetDocument44 pagesFatima Fertilizer Company Limited: Balance SheetAroma KousarNo ratings yet

- AssignmentDocument7 pagesAssignmentDebadipta SanyalNo ratings yet

- Chapter 1 Financial AccountingDocument10 pagesChapter 1 Financial AccountingMarcelo Iuki HirookaNo ratings yet

- Camille ManufacturingDocument4 pagesCamille ManufacturingChristina StephensonNo ratings yet

- Accounting Insights Into Entrepreneurial FinanceDocument49 pagesAccounting Insights Into Entrepreneurial FinanceJa takNo ratings yet

- Financial Statement AnalysisDocument29 pagesFinancial Statement AnalysisasifNo ratings yet

- MABALAZADocument4 pagesMABALAZAMahasa R HajiiNo ratings yet

- Annual Income Statement (Values in 000's $) : Current AssetsDocument6 pagesAnnual Income Statement (Values in 000's $) : Current AssetsVikash ChauhanNo ratings yet

- Course Folder Fall 2022Document26 pagesCourse Folder Fall 2022Areeba QureshiNo ratings yet

- Advanced Financial Management - Finals-11Document2 pagesAdvanced Financial Management - Finals-11graalNo ratings yet

- Liquidity RatioDocument2 pagesLiquidity RatioRahul PrasadNo ratings yet

- Basic Q&A Balance SheetDocument6 pagesBasic Q&A Balance SheetKunal Khaparkar patilNo ratings yet

- Financial Statement Analysis Report ofDocument24 pagesFinancial Statement Analysis Report ofLawrence Joshua ManzoNo ratings yet

- Tutorial 5 Part 1 Ratio CalculationsDocument14 pagesTutorial 5 Part 1 Ratio CalculationsNISHA BANSALNo ratings yet

- Case Study - : The Chubb CorporationDocument6 pagesCase Study - : The Chubb Corporationtiko bakashviliNo ratings yet

- KhacksDocument1 pageKhacksSid Tushaar SiddharthNo ratings yet

- Chapter 16Document19 pagesChapter 16Sid Tushaar SiddharthNo ratings yet

- MSAFPL - Summer Trainee Ecomm and Retail Approach PaperDocument1 pageMSAFPL - Summer Trainee Ecomm and Retail Approach PaperSid Tushaar SiddharthNo ratings yet

- Internship Request FormDocument4 pagesInternship Request FormSid Tushaar SiddharthNo ratings yet

- Steel TMT TrendsDocument3 pagesSteel TMT TrendsSid Tushaar SiddharthNo ratings yet

- Rules & Guidelines - Boardroom Simulation FinalDocument2 pagesRules & Guidelines - Boardroom Simulation FinalSid Tushaar SiddharthNo ratings yet

- Session 14Document18 pagesSession 14Sid Tushaar SiddharthNo ratings yet

- Brs Finalround CasesDocument2 pagesBrs Finalround CasesSid Tushaar SiddharthNo ratings yet

- BRM Term Project Guildlines PGPDocument3 pagesBRM Term Project Guildlines PGPSid Tushaar SiddharthNo ratings yet

- Session 17Document16 pagesSession 17Sid Tushaar SiddharthNo ratings yet

- Market ResearchDocument3 pagesMarket ResearchSid Tushaar SiddharthNo ratings yet

- Continous Assignment 3Document1 pageContinous Assignment 3Sid Tushaar SiddharthNo ratings yet

- Student Championship - R1 Final ResultDocument4 pagesStudent Championship - R1 Final ResultSid Tushaar SiddharthNo ratings yet

- G 01 HistDocument25 pagesG 01 HistSid Tushaar SiddharthNo ratings yet

- Cost of Prodn PR8e GE Ch07Document23 pagesCost of Prodn PR8e GE Ch07Sid Tushaar SiddharthNo ratings yet

- P Data Extract From World Development IndicatorsDocument15 pagesP Data Extract From World Development IndicatorsSid Tushaar SiddharthNo ratings yet

- GDP ExtractDocument15 pagesGDP ExtractSid Tushaar SiddharthNo ratings yet

- Partnerships-1Document20 pagesPartnerships-1samuelNo ratings yet

- Exercise PTDTCK HVNHDocument10 pagesExercise PTDTCK HVNHBánh Bèo Kang100% (1)

- Assignment I - Ashapura Minechem LimitedDocument8 pagesAssignment I - Ashapura Minechem LimitedSibika GadiaNo ratings yet

- Analysis of Adani PortsDocument63 pagesAnalysis of Adani PortsHarsh JaswalNo ratings yet

- Master Budget.9Document3 pagesMaster Budget.9Hiraya ManawariNo ratings yet

- Change in Profit-Sharing RatioDocument3 pagesChange in Profit-Sharing RatioPainNo ratings yet

- Learning Guide Learning Guide: Nefas Silk Poly Technic CollegeDocument36 pagesLearning Guide Learning Guide: Nefas Silk Poly Technic CollegeNigussie BerhanuNo ratings yet

- Revised FAR SyllabusDocument4 pagesRevised FAR SyllabusFaith GuballaNo ratings yet

- MSCI111 - CVP ModelsDocument22 pagesMSCI111 - CVP ModelsViviene Seth Alvarez LigonNo ratings yet

- 002 Topic 2b (Set A) Q_98212a37f76c2aeb76f391122e9_202405051917_02377Document9 pages002 Topic 2b (Set A) Q_98212a37f76c2aeb76f391122e9_202405051917_02377vooyinyin6No ratings yet

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- FABM Q3 L1. SLeM 1 - IntroductionDocument16 pagesFABM Q3 L1. SLeM 1 - IntroductionSophia MagdaraogNo ratings yet

- Esperenza Bakeshop, IncDocument3 pagesEsperenza Bakeshop, IncKizziah ClaveriaNo ratings yet

- Mba 104 PDFDocument2 pagesMba 104 PDFSimanta KalitaNo ratings yet

- Theory of AccountsDocument11 pagesTheory of AccountsMarc Eric Redondo50% (2)

- C13 Gitman Leverage and CapitalDocument53 pagesC13 Gitman Leverage and CapitalPhước Nguyễn100% (1)

- Gbs 520:financial and Management Accounting: Bryson MumbaDocument46 pagesGbs 520:financial and Management Accounting: Bryson MumbaSANDFORD MALULUNo ratings yet

- Nisha Verma, BEM/809 Assignment - Project Procurement Management BEM 3.1 Topic: Material Management Session: Aug 21-Dec 21Document5 pagesNisha Verma, BEM/809 Assignment - Project Procurement Management BEM 3.1 Topic: Material Management Session: Aug 21-Dec 21Nisha VermaNo ratings yet

- Accounts From Incomplete Records Class 11 NotesDocument32 pagesAccounts From Incomplete Records Class 11 Notesrbking15081999No ratings yet

- 2C00445Document41 pages2C00445VijayNo ratings yet

- After-Tax Weighted Average Cost of Capital (WACC)Document6 pagesAfter-Tax Weighted Average Cost of Capital (WACC)Kenny HoNo ratings yet

- IAS 11 - Construction ContractsDocument2 pagesIAS 11 - Construction ContractsMarc Eric RedondoNo ratings yet

- Afm Module 3 - IDocument26 pagesAfm Module 3 - IABOOBAKKERNo ratings yet

- Organization Behaviour and Human Resource Dynamics-2 HRMM504 HrisDocument5 pagesOrganization Behaviour and Human Resource Dynamics-2 HRMM504 HrisSumit kumarNo ratings yet

- Final Performance Task in Business Finance (Case Study)Document6 pagesFinal Performance Task in Business Finance (Case Study)Annie RapanutNo ratings yet

- Sadbhav Engineering Result UpdatedDocument14 pagesSadbhav Engineering Result UpdatedAngel BrokingNo ratings yet