Professional Documents

Culture Documents

BCH - TallyPractical - Set 3

Uploaded by

Shafi Choudhary0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

BCH_TallyPractical_Set 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesBCH - TallyPractical - Set 3

Uploaded by

Shafi ChoudharyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Daulat Ram College

B. Com Semester I – Financial Accounting

Practical Examination 2022-23

Set 3

Date: 19th February 2023 MM: 20

The company details are as follows:

(a) Name – Exam20195

(b) Address – Your Address, Telephone No., Mobile No.

(c) Email Id – admin@drc.ac.in

(d) GSTIN- 07ABHNG1256G1ZY

(e) Currency Symbol: ₹

(f) All transactions of sale and purchase of goods, payments to creditors and receipts from

debtors are done through Dena Bank.

(g) Any other payment and receipt are done through Syndicate Bank or Cash.

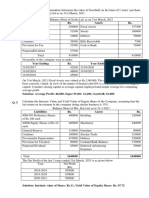

Balance Sheet as at 31-03-2021

Liabilities Amount Assets Amount

Capital 1575000 Land and Buildings 1350000

Reserves 165000 Plant and Machinery 375000

Profit and Loss Account 105000 Furniture 112500

Secured loan 300000 Investment 180000

Debentures 262500 Stock 554250

Loan from Promoters 150000 Debtors 500000

Provision for tax 180000 Bills Receivables 27000

Bills Payable 22500 Syndicate Bank 262500

Sundry Creditors 667750 Dena Bank 112500

Salaries outstanding 30000 Cash in Hand 40000

Rent outstanding 60000 Prepaid insurance 4000

3517750 3517750

The company deals in the following stocks:

Name of the Items Group Quantity Rate GST Rate Opening Stock

(₹) Value

Plastic Chairs 340 250 12% 85000

Wooden Chairs 450 300 12% 135000

Metal Chairs 125 225 12% 28125

Stone Tables 325 425 12% 138125

Wood Tables 200 240 12% 48000

Glass Tables 240 500 12% 120000

Total 554250

The list of company debtors is as follows:

Debtors Address GSTIN Balance Due

Karan Delhi 07HGTRY3542Z1TY 45000

Deepak Delhi 07FTRHS3652W1ZY 125000

Rohan Punjab 03THTRS2563Z1WT 225000

Geeta Maharashtra 27RTEYSF8763Z1TY 40000

Sadhna Delhi 07HTYST7643Z1RE 65000

Total 500000

The list of company creditors is as follows:

Creditors Address GSTIN Balance Payable

Sunita Delhi 07ABGDR2345C1ZY 350000

Rajesh Delhi 07ABGDR2378C1ZY 30000

Mohan Haryana 06JYHGD8734H1Z4 22750

Sita Delhi 07TRHYSV9034J1Z1 165000

Harish Delhi Unregistered 100000

Total 667750

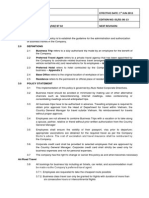

Record the following transactions that took place during financial year 2021-2022.

S.No. Transaction Item Quantity Amount

1. Purchase from Sunita Wood Tables 80 40000

2. Sale to Rohan Metal Chairs 100 280000

3. Sale to Sadhna Stone Tables 275 137500

4. Paid to Sunita Rs 35000 in full settlement for her transaction at no. 1 above.

5. Received from Rohan ₹ 275000 and Sadhna ₹ 135000 in full settlement for their

transactions at no. 2 and 3 above.

6. Paid to Sita in full settlement of her account 162500

7. Purchase from Mohan Plastic 100 80000

Chairs

8. Sale to Geeta (Trade discount 5% on list price) Glass Tables 200 tables. List

Price ₹ 1700/- each

9. Goods sold to Rohan were found defective and returned by him. 10

10. 10 Wooden chairs were gifted to the daughter by the owner.

11. Purchased Furniture on 1.5. 2021 and GST @ 18% 60000

12. Sold all the investment 5,00,00

0

13. Purchased Plant and Machinery from ABC Ltd for ₹ 5,00,000. To pay for this the

company borrowed from bank a loan of ₹ 1,50,000 and issued fully paid debentures of

₹ 3,50,000 to ABC Ltd.

14. Paid

1. Outstanding Rent 25000

2. Current Rent 45000

3. Current Salaries 22000

4. Telephone 1000

5. Tax of last year 80000

6. Insurance Premium Paid 8000

15. Outstanding

1. Total Provision for Tax 140000

2. Total Rent Outstanding 45000

3. Prepaid Insurance 4000

Charge Depreciation for the period 01-04-2021 to 31-03-2022 on Furniture @ 10%.

You are required to: -

1. Create a company as per details given above

2. Create appropriate groups and Ledger Accounts.

3. Enter the transactions as given selecting appropriate voucher type.

4. Export the following statements in pdf format (detailed and portrait mode)

(a) Day book

(b) Trial Balance as on 31st March 2022.

(c) Profit and Loss Account for the year ended on 31st March 2022.

(d) Balance Sheet as on 31st March 2022.

(e) Cash flow statement

(f) GST Report.

You might also like

- Tally PracticeQuestion 1Document3 pagesTally PracticeQuestion 1Khushi Kumari80% (5)

- Advantage and Disadvantages of Using PCN, HCN & TCNDocument11 pagesAdvantage and Disadvantages of Using PCN, HCN & TCNR Srinivas Karthik45% (20)

- Marketing Analytics AssignmentDocument4 pagesMarketing Analytics AssignmentPriyanshu RanjanNo ratings yet

- Testmax™ Atpg and Testmax Diagnosis DRC Rules: Version S-2021.06, June 2021Document435 pagesTestmax™ Atpg and Testmax Diagnosis DRC Rules: Version S-2021.06, June 2021Gopinathan Muthusamy100% (2)

- Step by Step Tally Question Practice SBSC PDFDocument69 pagesStep by Step Tally Question Practice SBSC PDFMufaddal Daginawala67% (3)

- Case 10 1 Quality Management - Allan Arvi PaulDocument3 pagesCase 10 1 Quality Management - Allan Arvi PaulAllan GunawanNo ratings yet

- GST Tally QDocument3 pagesGST Tally Qbabitasingh.ysNo ratings yet

- Tally With GSTDocument2 pagesTally With GSTkhushboogrover06100% (1)

- Question 7Document2 pagesQuestion 7abhishek georgeNo ratings yet

- Tally Practical (B) - 1Document3 pagesTally Practical (B) - 1Bhaavya GuptaNo ratings yet

- Tally With GSTDocument2 pagesTally With GSTRishikaNo ratings yet

- Tally Practice QuesDocument4 pagesTally Practice Quesayoshi33upscNo ratings yet

- Duration: 1 Hour Max. Marks: 20Document2 pagesDuration: 1 Hour Max. Marks: 20Khushi TanejaNo ratings yet

- Tally 1Document2 pagesTally 1Anushka TiwariNo ratings yet

- Co-Operative Accounting Assignment and Case AnalysisDocument3 pagesCo-Operative Accounting Assignment and Case AnalysisTitus Clement100% (2)

- Tally Practice QuestionsDocument68 pagesTally Practice Questionspranav tomar100% (1)

- Banking 9 & 10 QuestionsDocument2 pagesBanking 9 & 10 Questionssara.028279No ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- Step by Step Tally Question Practice SBSCDocument69 pagesStep by Step Tally Question Practice SBSCcejijit238No ratings yet

- Tally GSTDocument3 pagesTally GSTIsha PatelNo ratings yet

- TallyDocument8 pagesTallyHarsh GuptaNo ratings yet

- Sunrise Pvt. LTDDocument1 pageSunrise Pvt. LTDYashi GuptaNo ratings yet

- Accounting For Mgt.Document3 pagesAccounting For Mgt.RNo ratings yet

- BCom Tally1 23Document2 pagesBCom Tally1 23Priyanka MondalNo ratings yet

- CFS 2Document2 pagesCFS 2RositaNo ratings yet

- Excise Tril BalDocument3 pagesExcise Tril Balvihanjangid223No ratings yet

- Step by Step Tally Question Practice SBSCDocument69 pagesStep by Step Tally Question Practice SBSCRohit sharmaNo ratings yet

- Tally 1Document1 pageTally 1Yashi GuptaNo ratings yet

- Final Ac P2Document5 pagesFinal Ac P2SudeepNo ratings yet

- 13 Consolidated Financial StatementDocument9 pages13 Consolidated Financial StatementArnold DsouzaNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- QuesDocument3 pagesQuesSiya GuptaNo ratings yet

- Tally QuestionsDocument5 pagesTally QuestionsvarshiniNo ratings yet

- XI AccoutingDocument8 pagesXI AccoutingJaiswal BrotherNo ratings yet

- Tally With GST - 231003 - 111251Document4 pagesTally With GST - 231003 - 111251Gargi BhardwajNo ratings yet

- Set 1 & 3 PDFDocument6 pagesSet 1 & 3 PDFCorona VirusNo ratings yet

- Tally PaperDocument3 pagesTally Papergitu219No ratings yet

- Ques SET 1Document3 pagesQues SET 1NIKHIL NAUTIYALNo ratings yet

- Tally TestDocument2 pagesTally TestHK DuggalNo ratings yet

- Mid Term Examination November 2014 II Puc AccountancyDocument4 pagesMid Term Examination November 2014 II Puc AccountancyManju PNo ratings yet

- Financial Statement Exercise - Ravi TextilesDocument2 pagesFinancial Statement Exercise - Ravi TextilesPrasad GharatNo ratings yet

- Unit Five: Final Accounts: Question-1: From The Following Information, Prepare TheDocument11 pagesUnit Five: Final Accounts: Question-1: From The Following Information, Prepare TheBinod KhatriNo ratings yet

- Hot Qus Class 12thDocument13 pagesHot Qus Class 12thNaveen ShahNo ratings yet

- Single Entry (F. Y. B.com) Sem.1Document13 pagesSingle Entry (F. Y. B.com) Sem.1Jignesh Togadiya0% (2)

- B - Com - Tally I Sem Exam Set 3Document2 pagesB - Com - Tally I Sem Exam Set 3Vikas100% (1)

- Valuation of BusinessDocument2 pagesValuation of BusinessLAKHAN TRIVEDINo ratings yet

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- Session 12: Topic Cover Bill of Materials ProductionDocument45 pagesSession 12: Topic Cover Bill of Materials ProductionTanureema DebNo ratings yet

- Computation 1Document2 pagesComputation 1Gaurav SinsinbarNo ratings yet

- Advanced Financial Accounting: Question Paper 2014Document3 pagesAdvanced Financial Accounting: Question Paper 2014irfanNo ratings yet

- Practice ProblmDocument2 pagesPractice ProblmRatnesh SinghNo ratings yet

- Model Question PaperDocument3 pagesModel Question Paperi.am.dheeraj8463No ratings yet

- 12th BK Prelium 1Document4 pages12th BK Prelium 1Harpreet Singh SainiNo ratings yet

- 12 Accountancy Lyp 2012 Set1Document9 pages12 Accountancy Lyp 2012 Set1SeasonNo ratings yet

- EAB Case StudyDocument13 pagesEAB Case StudyVipin VipsNo ratings yet

- Excise Tril Bal 1-15Document15 pagesExcise Tril Bal 1-15vihanjangid223No ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- Img 20210330 0003 NewDocument4 pagesImg 20210330 0003 NewDheeraj GuptaNo ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- Company UpdateDocument39 pagesCompany UpdateShafi ChoudharyNo ratings yet

- Quick Note 2024-03-11 20-51-18Document4 pagesQuick Note 2024-03-11 20-51-18Shafi ChoudharyNo ratings yet

- University of Delhi: Semester Examination DECEMBER 2023 Statement of Marks / GradesDocument2 pagesUniversity of Delhi: Semester Examination DECEMBER 2023 Statement of Marks / GradesShafi ChoudharyNo ratings yet

- Syllabus Semester 1Document10 pagesSyllabus Semester 1Shafi ChoudharyNo ratings yet

- CSR Personalised NotesDocument12 pagesCSR Personalised NotesShafi ChoudharyNo ratings yet

- Personal Financial Planning Unit 1Document16 pagesPersonal Financial Planning Unit 1Shafi ChoudharyNo ratings yet

- Market Study Turkey Logistics IndustryDocument27 pagesMarket Study Turkey Logistics IndustryAnna SaeediNo ratings yet

- Establishing Overall Audit StrategyDocument8 pagesEstablishing Overall Audit StrategyMarnelli CatalanNo ratings yet

- Analyzing Oil and Gas Farmout AgreementsDocument111 pagesAnalyzing Oil and Gas Farmout AgreementstmtspainNo ratings yet

- Defaulter List For 2011-2012 Aug (2) CurrentDocument20 pagesDefaulter List For 2011-2012 Aug (2) CurrentpsapalikarNo ratings yet

- Finance 221 Problem Set 4 (Practice Problems) : SolutionsDocument9 pagesFinance 221 Problem Set 4 (Practice Problems) : SolutionsEverald SamuelsNo ratings yet

- Financial Accounting. (Sem-1) 2017-20Document39 pagesFinancial Accounting. (Sem-1) 2017-20Rahul DasNo ratings yet

- Policy - Business TravelDocument5 pagesPolicy - Business TravelBell LờNo ratings yet

- Consumers Buying Behaviour in Life InsuranceDocument36 pagesConsumers Buying Behaviour in Life InsuranceRajeshsatpute74% (19)

- Case Study ProposalDocument5 pagesCase Study ProposalTadele DandenaNo ratings yet

- Topic1-Concept of LendingDocument16 pagesTopic1-Concept of LendingPrEm GaBriel50% (2)

- Payment FactoryDocument22 pagesPayment FactoryIgnacio KristofNo ratings yet

- Human Resource Management Practices in The Ghanaian Banking SectorDocument111 pagesHuman Resource Management Practices in The Ghanaian Banking SectorUniwatt EnergyNo ratings yet

- OligopoliesDocument5 pagesOligopoliesChris ZhaoNo ratings yet

- Engineering Reference DocumentDocument50 pagesEngineering Reference DocumentjeddijNo ratings yet

- Types of BanksDocument3 pagesTypes of BanksrajendrakumarNo ratings yet

- SolidCAM Reseller-Conference Agenda 100Document2 pagesSolidCAM Reseller-Conference Agenda 100Tân VoiNo ratings yet

- Advance Accounting Installment Sales Manual MillanDocument14 pagesAdvance Accounting Installment Sales Manual MillanHades AcheronNo ratings yet

- Analyzing Balance Sheet of Nestle India LTDDocument2 pagesAnalyzing Balance Sheet of Nestle India LTDPrashant BarveNo ratings yet

- Purchase Order: Technical Education and Skills Development AuthorityDocument1 pagePurchase Order: Technical Education and Skills Development AuthorityAdz MadapinNo ratings yet

- CHAP 1.editedDocument5 pagesCHAP 1.editedChesca Mae PenalosaNo ratings yet

- Final Bid For Farm Machineries 03Document38 pagesFinal Bid For Farm Machineries 03Alodia RiveraNo ratings yet

- Module 6: 4M'S of Production and Business ModelDocument43 pagesModule 6: 4M'S of Production and Business ModelSou MeiNo ratings yet

- Cellular ManufacturingDocument42 pagesCellular ManufacturingSubash DhakalNo ratings yet

- Planning and Conducting Remote AuditsDocument5 pagesPlanning and Conducting Remote AuditsBaja Consulting Group BCGNo ratings yet

- 10 Prioritization FrameworksDocument2 pages10 Prioritization FrameworksVikas DeshmaneNo ratings yet