Professional Documents

Culture Documents

Vi - Inventories

Uploaded by

by ScribdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vi - Inventories

Uploaded by

by ScribdCopyright:

Available Formats

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Inventories

Definition

PAS 2 defines inventories as assets:

a. Produced and held for sale in the ordinary course of business (finished goods inventory)

b. In the process of production for such sale (work in process inventory)

c. In the form of materials or supplies to be consumed in production (raw materials inventory)

d. Purchased and held for resale in the ordinary course of business (merchandise inventory)

Recognition

Inventories are recognized when they meet the definition of inventory and they qualify for

recognition as assets, such as when legal title is obtained by the buyer from the seller.

Ownership over inventories

Legal title normally passes when possession over the goods is transferred. However, there may

be cases where the transfer of control (ownership) does not coincide with the transfer of physical

possession. Regardless of location, an entity shall report in its financial statements all inventories

over which it holds legal title to or has obtained control of the related economic benefits.

In this regard, proper consideration should be given to the following:

a. Goods in transit – pertain to goods already shipped by the seller but are not yet received by

the buyer. Goods in transit may form part of the inventories of either the buyer and the seller,

but not both, depending on the terms of the sale contract:

i. Under FOB Shipping Point, ownership over the goods is transferred upon shipment.

Therefore, the goods in transit form part of the buyer’s inventories. The buyer records

“Purchases” (and “Accounts Payable”) upon shipment.

ii. Under FOB Destination, ownership over the goods is transferred only when the buyer receives

the goods. Therefore, the goods in transit still form part of the seller’s inventories. The

buyer records the “Purchases” (and “Accounts Payable”) when the goods are received.

b. Consigned Goods – pertain to goods transferred by a consignor to a consignee who will act

as an agent of the consignor in trying to sell the goods. Consigned goods are included in the

consignor’s inventory and are excluded from that of consignee’s. When goods are delivered

to the consignee, the consignor retains ownership of the consigned goods.

Only a memo entry is normally used in recording the consignment. Freight and other

incidental costs of transferring consigned goods to the consignee form part of the cost of the

consigned goods. Repair costs for damages and other maintenance costs are charged as expenses.

c. Inventory financing agreements

i. Product financing agreement – a seller sells inventory to a buyer but assumes an

obligation to repurchase it at a later date. This arrangement does not result to the transfer

of control over the asset. Therefore the seller retains ownership over the inventory.

ii. Pledge of inventory – a borrower uses its inventory as collateral security for a loan. This

arrangement does not result to the transfer of control over the asset. Therefore the

borrower retains ownership over the inventory.

iii. Warehouse financing – a third party holds the inventory and acts as the creditor’s agent.

This arrangement does not result to the transfer of control over the asset.

iv. Loan of inventory – an entity borrows inventory from another entity to be replaced with

the same kind of inventory. This arrangement results to transfer of control over the asset.

The borrower includes the goods he has received in its inventory.

d. Sale with unusual right of return – the buyer does not recognize any inventory when: (a)

the buyer assesses that no economic benefits will be derived from the goods (i.e. they are

defective or unsalable) or; (b) the buyer intends to return the goods to the seller within the

time limit allowed under the sale agreement.

Accountancy Academic Organization Tutorials 2020 1

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

e. Sale on trial (or approval) – a seller allows a prospective customer to use a good for a given

period of time with an option to purchase the same after the specified period. Under this

arrangement, the legal title over the good does not pass to the prospective customer until he

approves it and purchases it. Therefore, the good remains in the seller’s inventory during the

trial period.

In some arrangements, the good is considered sold if it is not returned within a reasonable

period of time after the trial period has lapsed

f. Installment sale – an installment sale where the possession of the goods is transferred to the

buyer but the seller retains legal title solely to protect the collectability of the amount due is

considered as a regular sale. Therefore, the goods are excluded from the seller’s inventory

and included in the buyer’s inventory at the point of sale.

g. Bill and hold sale – a contract under which an entity bills a customer for a product but the

entity retains physical possession of the product until it is transferred to the customer at a

future date. The goods sold under a bill and hold sale is excluded from the seller’s inventory

and included in the buyer’s inventory at the point of sale when title passes to the buyer and

he accepts the billing.

h. Lay away sale – a type of sale in which goods are delivered only when the buyer makes the

final payment in a series of installments. The goods sold under a lay away sale are included

in the seller’s inventory until the goods are delivered to the buyer after the final installment is

paid. However, when significant payments have already been made, the goods may be

included in the buyer’s inventory provided delivery is probable.

Accounting for inventories

Inventories are accounted for either through:

a. Perpetual inventory system – under this system, the “Inventory” account is updated for

each purchase and sale of inventory. The balance of inventory on hand and cost of goods sold

at any given point of time can be determined by referring to the running totals without the

need of having a physical count of inventories.

Purchases, freight-in, purchase returns, discounts and allowances are recorded as debits

or credits to the “Inventory” account. “Cost of goods sold” is debited and “Inventory” is

credited each time a sale is made.

b. Periodic inventory system – under this system, the “Inventory” account is updated only when

a physical count is performed. Thus, the amounts of inventory and cost of goods sold are

determined only periodically. Prior to physical count, the balance of the inventory account

represents the beginning balance or the balance from the last physical count. Cost of goods

sold is determined only after the physical count as follows:

Purchases of inventory are debited to the Beginning inventory xx

“Purchases” account; shipping costs are debited Add: Net purchases xx

to the “Freight-in” account; purchase returns, Total goods available for sale xx

discounts and allowances are credited to the Less: Ending inventory (physical count) (xx)

Cost of goods sold xx

“Purchase returns, discounts and allowances”

account. No entry is made to recognize cost of goods sold when inventory is sold.

When an entity uses a perpetual inventory system and a difference exists between the perpetual

inventory balance and the physical inventory count, the difference is recorded in the account

“Inventory Shortage or Overage”. Inventory shortage is charged to cost of goods sold if it is

considered normal spoilage. If considered abnormal spoilage, the shortage is charged to loss.

Measurement of inventories

Inventories are measured at the lower of cost and net realizable value (NRV).

Accountancy Academic Organization Tutorials 2020 2

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Cost of inventories

The cost of inventories comprise all:

a. Costs of purchase – include:

i. Purchase price

ii. Import duties

iii. Transport and handling costs (freight-in)

iv. Other costs directly attributable to the acquisition of finished goods, materials and services

The cost of purchase does not include taxes paid which are subsequently recoverable (i.e.

VAT paid by VAT payers). Trade discounts, rebates and similar items are deducted in

determining the costs of purchase.

b. Costs of conversion - include costs incurred directly in converting raw materials into finished

goods. Conversion costs include direct labor and variable and fixed production overheads.

c. Other costs – include only those incurred in bringing the inventories to their present location

and condition. The following costs should be excluded from cost of inventories and

recognized as expenses in the period in which they are incurred:

i. Abnormal amounts of wasted materials, labor or other production costs

ii. Selling costs (i.e. advertising, promotion costs, delivery expense or freight out)

iii. Administrative overheads

iv. Storage costs, unless those costs are necesarry in the production process

Interest expense incurred on borrowings (borrowing costs) made to finance the acquisition or

production of an inventory that meets the definition of a qualifying asset forms part of the cost of

the inventory. All other interests are charged as expenses.

Cost formulas

1. Specific identification – this shall be used for items that are not ordinarily

interchangeable or for items that are individually unique. This cost formula best parallels

the actual costs of specifically identified items of inventory.

2. First-in, First-out (FIFO) cost formula – this cost formula assumes that the items of

inventory that were purchased or produced first are sold first and consequently, the items

remaining in inventory at the end of the period are those most recently purchased or

produced. Thus, the cost of goods sold represents costs from earlier purchases while cost

of ending inventory represents costs from the most recent purchases.

A unique characteristic of FIFO formula is that it yields the same amounts of cost of

goods sold and ending inventory when applied in either a perpetual or periodic system.

3. Weighted average cost formula – under this cost formula, the cost of each item is

determined from the weighted average of the cost of similar items purchased or produced

during the period. The average may be calculated under either periodic or perpetual system.

a. Weighted average cost – Periodic (Simple weighted average) – the weighted

average cost is determined at the end of the period by using the following formula:

Total goods available for sale∈ pesos

WAC=

Total goods available for sale∈units

b. Weighted average cost – Perpetual (Moving average) – a new or moving

weighted average cost is determined after every purchase or as each shipment is

received by dividing total goods available for sale as of that date by the total

quantity of goods available for sale as of that date. The moving average unit cost

is then multiplied by the quantity of goods sold after the latest purchase to

determine cost of goods sold or by the quantity of inventory on hand to determine

ending inventory.

Net realizable value (NRV)

Accountancy Academic Organization Tutorials 2020 3

Ateneo de Zamboanga University

ACCOUNTANCY ACADEMIC ORGANIZATION

A School of Management and Accountancy Student Government

Subsequent to initial recognition, inventories are measured at the lower of cost or net realizable

value. NRV is the estimated selling price in the ordinary course of business less the estimated

costs of completion and the estimated costs necesarry to make the sale.

Write-down to NRV

In cases where the recoverable amounts of inventories fall below the costs (NRV<Cost), the

inventories may need to be written down to their net realizable value.

If the cost of an inventory exceeds its NRV, the inventory is written down to NRV, the lower

amount. The excess of cost over NRV represents the amount of write-down. If the cost of an

inventory is lower than its NRV (NRV>Cost), no write-down is necesarry.

Write-downs of inventories to NRV are normally charged to cost of goods sold in the period of

write-down. However, write-downs due to abnormal losses are charged to loss.

Reversal of write-downs

A new assessment is made of NRV at each subsequent period. When there is clear evidence of an

increase in NRV which was previously written down below cost, the amount of write-down is

reverted in profit or loss in the period of such reversal so that the new carrying amount is the

lower of the cost and the revised NRV.

However, the amount of reversal to be recognized should not exceed the amount of the original

write-down previously recognized.

Inventory estimation

There may be instances where the value of inventories must be estimated such as when it is not

possible to take physical count. The cost of inventories may be estimated using either the:

a. Gross profit method – under this method, gross profit is assumed to be relatively constant

from period to period. Thus, gross profit is used to compute for the gross profit rate1 (GPR)

which will in turn used to determine the cost ratio2. The cost ratio will be used in estimating

the cost of inventory and cost of goods sold.

1

– Gross profit rate can be expressed as a percentage based on sales (computed by dividing gross

profit by the net sales3) or based on cost (computed by dividing gross profit by cost of goods

sold).

2

– Cost ratio from GPR based on sales = 100% Net sales – GPR based on sales

Cost ratio from GPR based on cost = 100% COGS ÷ % Net sales = 100% COGS ÷ (100% + GPR

based on cost)

3

– Only sales returns are deducted from gross sales in computing for net sales. Sales discounts

and allowances are not deducted.

b. Retail method – under this method, the cost ratio is computed directly without regard to the

gross profit rate while net mark-ups1 and net mark-downs2 are considered. Retail method is

applied using either the (a) average cost method or (b) FIFO cost method

1

– Net mark-up is equals to markups less markup cancellations. Markup refers to the increase above

the original retail price3. Markup cancellation refers to decrease in the selling price that does not

reduce the selling price below the original retail price.

2

– Net markdown is equals to markdowns less markdown cancellations. Markdown refers to the

decrease below the original retail price. Markup cancellation refers to increase in the selling

price that does not raise the selling price below the original retail price.

3

– Original retail price refers to the selling price at which the goods are first offered for sale.

Under Average cost method:

Cost ratio = TGAS at cost ÷ TGAS at sales or retail price

Under FIFO cost method:

Cost ratio = (TGAS at cost – Beg. inventory at cost) ÷ (TGAS at retail - Beg. inventory at retail)

Total goods available for sale at cost is equals to Beg. inventory + Net purchases. When

determining Total goods available for sale at sales price, net mark-ups are added while net

mark downs are deducted.

Accountancy Academic Organization Tutorials 2020 4

You might also like

- InventoriesDocument35 pagesInventoriesJay PinedaNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- InventoryDocument20 pagesInventoryE.D.J33% (3)

- Inventories P1Document8 pagesInventories P1Shane CalderonNo ratings yet

- Topic 9 - Inventories - Rev (Students)Document42 pagesTopic 9 - Inventories - Rev (Students)RomziNo ratings yet

- Discussion - InventoriesDocument3 pagesDiscussion - InventoriesVel JuneNo ratings yet

- Chapter 2 InventoriesDocument10 pagesChapter 2 Inventoriesvea domingoNo ratings yet

- INVENTORIESDocument4 pagesINVENTORIESHANZ JOSHUA P ESTERBANNo ratings yet

- Week 07 - 02 - Module 017 - Accounting For InventoriesDocument10 pagesWeek 07 - 02 - Module 017 - Accounting For Inventories지마리No ratings yet

- 07a Inventories Cost Flow ValuationDocument87 pages07a Inventories Cost Flow Valuationfordan Zodorovic65% (20)

- Chapter 7 Inventories InventoriesDocument24 pagesChapter 7 Inventories InventoriesharumanNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotesMinh ThưNo ratings yet

- Inventories - Items Included in Inventory - Inventory Cost FlowDocument38 pagesInventories - Items Included in Inventory - Inventory Cost FlowmarkNo ratings yet

- S07 - Inventory - 23 Dec. 2021Document17 pagesS07 - Inventory - 23 Dec. 2021Yassin DyabNo ratings yet

- JPIAN - S Digest - InventoriesDocument12 pagesJPIAN - S Digest - InventoriesMyrrh ErosNo ratings yet

- CoffeeDocument107 pagesCoffeeyes yesnoNo ratings yet

- Chapter 6 PAS 2 InventoriesDocument14 pagesChapter 6 PAS 2 InventoriesSimon RavanaNo ratings yet

- 11 Accounting For Merchandising Businesses Part 1Document15 pages11 Accounting For Merchandising Businesses Part 1Aple Balisi100% (1)

- QuestionsDocument2 pagesQuestionsEl AgricheNo ratings yet

- Inventories: Related Standard: PAS 2 Inventories ObjectiveDocument2 pagesInventories: Related Standard: PAS 2 Inventories Objectivegenevive santorNo ratings yet

- GROUP 2 - PAS 2 InventoriesDocument7 pagesGROUP 2 - PAS 2 InventoriesNhicoleChoiNo ratings yet

- Inventories Part 1 With AnswersDocument9 pagesInventories Part 1 With AnswersDyenNo ratings yet

- Iac10 C10 DalidaDocument3 pagesIac10 C10 DalidaEdith DalidaNo ratings yet

- Chapter 10 - Inventories (Gatdc)Document19 pagesChapter 10 - Inventories (Gatdc)Joan LeonorNo ratings yet

- Included Excluded Excluded IncludedDocument5 pagesIncluded Excluded Excluded IncludedAprilyn Batayo100% (1)

- Inventory: Financial Accounting Volume 1 6:30 - 7:30Document35 pagesInventory: Financial Accounting Volume 1 6:30 - 7:30Juliet Leron MediloNo ratings yet

- 161 12 PAS 2 InventoriesDocument2 pages161 12 PAS 2 InventoriesRegina Gregoria SalasNo ratings yet

- 5 InventoriesDocument3 pages5 InventoriesChinchin Ilagan DatayloNo ratings yet

- Inventories Supplementary MaterialsDocument3 pagesInventories Supplementary MaterialsdayanNo ratings yet

- 00 Quick Notes On Expenditure and Disbursements Cycle & Correction of Errors PDFDocument4 pages00 Quick Notes On Expenditure and Disbursements Cycle & Correction of Errors PDFBecky GonzagaNo ratings yet

- Inventories (Ias 2)Document16 pagesInventories (Ias 2)Corinne GohocNo ratings yet

- Learning LogsDocument3 pagesLearning LogsRhejel TubilagNo ratings yet

- CHAPTER 9 PART 1 - InventoriesDocument6 pagesCHAPTER 9 PART 1 - InventoriesWilliam StevenNo ratings yet

- Inventories (PAS No. 2)Document14 pagesInventories (PAS No. 2)Da Eun LeeNo ratings yet

- Ch-1-Merchandising InventoriesDocument15 pagesCh-1-Merchandising Inventorieskenenisagetachew856No ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotessibivjohnNo ratings yet

- Unit One: Accounting For Merchandising InventoriesDocument24 pagesUnit One: Accounting For Merchandising Inventoriesmelaku muka100% (1)

- Far RevDocument7 pagesFar RevPEACE- Kia Jane AponestoNo ratings yet

- FAR-4105: INVENTORIES - Part 1: - T R S ADocument6 pagesFAR-4105: INVENTORIES - Part 1: - T R S AJohn Paulo SamonteNo ratings yet

- Accounting For InventoriesDocument58 pagesAccounting For InventoriesMarriel Fate CullanoNo ratings yet

- Quiz ReviewerDocument64 pagesQuiz ReviewerMARIANo ratings yet

- Wuolah Free Apuntes Unit 5 Gulag FreeDocument12 pagesWuolah Free Apuntes Unit 5 Gulag FreeNOA PEREZ FERRERNo ratings yet

- Accounting ReviewerDocument5 pagesAccounting ReviewerMeynard BatasNo ratings yet

- Chapter 8 PDFDocument6 pagesChapter 8 PDFMAMTA KHARISMANo ratings yet

- IA 1 - Chapter 10 - ReviewerDocument4 pagesIA 1 - Chapter 10 - Reviewerkimingyuse1010No ratings yet

- Inventories - Part 1: College of Business and AccountancyDocument6 pagesInventories - Part 1: College of Business and AccountancyCaryll Joy BisnanNo ratings yet

- Module 3 - InventoryDocument12 pagesModule 3 - InventoryJehPoyNo ratings yet

- C10 InventoriesDocument53 pagesC10 InventoriesKenzel lawasNo ratings yet

- Semester - 1 Financial Accounting Chapter 2 - Consignment: (I) (Ii) (Iii)Document11 pagesSemester - 1 Financial Accounting Chapter 2 - Consignment: (I) (Ii) (Iii)Shrinidhi.k.joisNo ratings yet

- Inventories - Answer KEyDocument12 pagesInventories - Answer KEyMiru YuNo ratings yet

- Chapter 7: Inventories: Inventories of A Government EntityDocument4 pagesChapter 7: Inventories: Inventories of A Government EntityShantalNo ratings yet

- Chapter 3 Accounting For Merchandising OperationsDocument10 pagesChapter 3 Accounting For Merchandising OperationsSKY StationeryNo ratings yet

- FAR3 - InventoryDocument17 pagesFAR3 - InventoryBeing TuluvaNo ratings yet

- Introduction To Merchandising TransactionsDocument9 pagesIntroduction To Merchandising TransactionsCarrie DizonNo ratings yet

- Accounting For Merchandising BusinessDocument4 pagesAccounting For Merchandising BusinessVincent MadridNo ratings yet

- Chapter 5 - 6 - Inventory Accounting and ValuationDocument61 pagesChapter 5 - 6 - Inventory Accounting and ValuationNaeemullah baig100% (1)

- Chapter 7 InventoriesDocument4 pagesChapter 7 Inventoriesmaria isabellaNo ratings yet

- INTACC DQsDocument9 pagesINTACC DQsMa. Alessandra BautistaNo ratings yet

- Easy Round 1 Point Each Theory - 10 Seconds Problem - 15 SecondsDocument8 pagesEasy Round 1 Point Each Theory - 10 Seconds Problem - 15 Secondsby ScribdNo ratings yet

- Basic AccountingDocument36 pagesBasic Accountingby ScribdNo ratings yet

- RFBTDocument9 pagesRFBTby ScribdNo ratings yet

- MODULE 3 AutosavedDocument24 pagesMODULE 3 Autosavedby ScribdNo ratings yet

- Global Financial SystemDocument16 pagesGlobal Financial Systemby ScribdNo ratings yet

- Vii. The Accounting CycleDocument6 pagesVii. The Accounting Cycleby ScribdNo ratings yet

- Module 1Document45 pagesModule 1by ScribdNo ratings yet

- Statement of Cash Flows Final Term - 240325 - 221434Document20 pagesStatement of Cash Flows Final Term - 240325 - 221434by ScribdNo ratings yet

- I. Adjusting ProcessDocument7 pagesI. Adjusting Processby ScribdNo ratings yet

- Adjusting EntriesDocument49 pagesAdjusting Entriesby ScribdNo ratings yet

- I. Nature of Business and Accounting Module (Aao Tutorials 2018)Document6 pagesI. Nature of Business and Accounting Module (Aao Tutorials 2018)by ScribdNo ratings yet

- Bsac II - A ScheduleDocument1 pageBsac II - A Scheduleby ScribdNo ratings yet

- Loona Space Presentation TemplateDocument12 pagesLoona Space Presentation Templateby ScribdNo ratings yet

- Reo RFBTDocument14 pagesReo RFBTby ScribdNo ratings yet

- Chapter 4 Enterprise Risk Management and Related Topics (Test Bank)Document8 pagesChapter 4 Enterprise Risk Management and Related Topics (Test Bank)by ScribdNo ratings yet

- Acclaw 3 NotesDocument32 pagesAcclaw 3 Notesby ScribdNo ratings yet

- ADZU POWER BI - Assignment Per StudentDocument4 pagesADZU POWER BI - Assignment Per Studentby ScribdNo ratings yet

- Reo atDocument18 pagesReo atby ScribdNo ratings yet

- Updated Problem ConconDocument2 pagesUpdated Problem Conconby ScribdNo ratings yet

- G6 Morality As Human ReasonablenessDocument2 pagesG6 Morality As Human Reasonablenessby ScribdNo ratings yet

- G5 Practical Reason and Art of ContemplationDocument2 pagesG5 Practical Reason and Art of Contemplationby ScribdNo ratings yet

- CONWOR InstructionsDocument2 pagesCONWOR Instructionsby ScribdNo ratings yet

- Finacc3 LQ1Document4 pagesFinacc3 LQ1by ScribdNo ratings yet

- 1 Lecture Corporation p.2Document31 pages1 Lecture Corporation p.2by ScribdNo ratings yet

- HTTPS://WWW - Youtube.com/watch?v A1Xfy8fl Qg&embeds Euri HTTPS://WWW - Wakacoffee.com/&feature Emb Imp WoytDocument1 pageHTTPS://WWW - Youtube.com/watch?v A1Xfy8fl Qg&embeds Euri HTTPS://WWW - Wakacoffee.com/&feature Emb Imp Woytby ScribdNo ratings yet

- A Lecture7 10 21 22Document36 pagesA Lecture7 10 21 22by ScribdNo ratings yet

- A Lecture6 9 29 22Document46 pagesA Lecture6 9 29 22by ScribdNo ratings yet

- 1 Lecture Financial Statements Is and BSDocument60 pages1 Lecture Financial Statements Is and BSby Scribd100% (1)

- A Lecture8 Acc Cycle Step 6 10 11-11-22Document36 pagesA Lecture8 Acc Cycle Step 6 10 11-11-22by ScribdNo ratings yet

- Integrated Approach To BCM System Design: by Rama Lingeswara Satyanarayana Tammineedi, Mbci, CBCP, Cissp, Cisa, PMP, ItilDocument3 pagesIntegrated Approach To BCM System Design: by Rama Lingeswara Satyanarayana Tammineedi, Mbci, CBCP, Cissp, Cisa, PMP, ItilDostfijiNo ratings yet

- 11-Article Text-1499-1-10-20220406Document12 pages11-Article Text-1499-1-10-20220406lionaramadani febriosaNo ratings yet

- PNB Foreclosed Properties in Dagupan Auction Flyer For 2016-06-16 FinalDocument4 pagesPNB Foreclosed Properties in Dagupan Auction Flyer For 2016-06-16 FinalkennymontenegroNo ratings yet

- Case Document Inocencio IldefonsoDocument4 pagesCase Document Inocencio IldefonsoAngie DouglasNo ratings yet

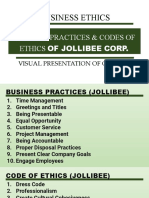

- Business Ethics: Business Practices & Codes of Ethics of Jollibee CorpDocument14 pagesBusiness Ethics: Business Practices & Codes of Ethics of Jollibee CorpspaghettiNo ratings yet

- Database Assignment 1 Mohammed Shalabi 201810028Document5 pagesDatabase Assignment 1 Mohammed Shalabi 201810028Mohammed ShalabiNo ratings yet

- Essentials To ICTDocument19 pagesEssentials To ICTTS100% (9)

- B2B Lead Generation (Event Mangement US) : SL Company Name Website AddressDocument3 pagesB2B Lead Generation (Event Mangement US) : SL Company Name Website AddressMd.Hasibul Hasan RokibNo ratings yet

- B.Sc. Dissertation Proposal: On Automatic Control System For Fuel StationDocument47 pagesB.Sc. Dissertation Proposal: On Automatic Control System For Fuel StationHtet lin AgNo ratings yet

- Gerf Vi 2024 Pre-Announcement Ger EgyDocument2 pagesGerf Vi 2024 Pre-Announcement Ger Egyyimam seeidNo ratings yet

- LMI Presenatation 1Document36 pagesLMI Presenatation 1HoLinhNo ratings yet

- Competing On The Edge: Strategy As Structured ChaosDocument18 pagesCompeting On The Edge: Strategy As Structured ChaosMariano ZorrillaNo ratings yet

- HR Tricks That WorkDocument2 pagesHR Tricks That WorkVIKRANT AHERNo ratings yet

- Schwab Family ValuesDocument18 pagesSchwab Family ValuesguingooNo ratings yet

- Unit 1: The Big Picture: Week 1: Introduction - Abap Restful Application Programming ModelDocument12 pagesUnit 1: The Big Picture: Week 1: Introduction - Abap Restful Application Programming ModelAmir MardaniNo ratings yet

- Income Tax Calculator Calculate Income Tax For FY 2022-23Document1 pageIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaNo ratings yet

- Discontinued Operation: Intermediate Accounting 3Document21 pagesDiscontinued Operation: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Co - Founder of Boat: Mr. Aman GuptaDocument5 pagesCo - Founder of Boat: Mr. Aman GuptaTrupti RawoolNo ratings yet

- II. Multiple Choice.: Archdiocese of TuguegaraoDocument3 pagesII. Multiple Choice.: Archdiocese of TuguegaraoRamojifly LinganNo ratings yet

- Macquarie Banking & Insurance CoverageDocument19 pagesMacquarie Banking & Insurance CoverageManipal SinghNo ratings yet

- Section 153Document8 pagesSection 153Himanshu KhiwalNo ratings yet

- Resuemne Quiz 1Document5 pagesResuemne Quiz 1Adriel M.No ratings yet

- Unified Opcrf For Schoolheads 2022-2023 - 012353Document44 pagesUnified Opcrf For Schoolheads 2022-2023 - 012353Skul TV ShowNo ratings yet

- 6 Objectives of AuditingDocument5 pages6 Objectives of AuditingJay GudhkaNo ratings yet

- PRIME Issuer Transactions V1.1Document44 pagesPRIME Issuer Transactions V1.1Sivakumar VeerapillaiNo ratings yet

- G.R. No. 148775 January 13, 2004 Shopper'S Paradise Realty & Development Corporation, Petitioner, EFREN P. ROQUE, RespondentDocument4 pagesG.R. No. 148775 January 13, 2004 Shopper'S Paradise Realty & Development Corporation, Petitioner, EFREN P. ROQUE, RespondentPrincess Aiza MaulanaNo ratings yet

- Iec 61131-8 PDFDocument4 pagesIec 61131-8 PDFAndres GomezNo ratings yet

- Katrina's ResumeDocument2 pagesKatrina's ResumeTestyNo ratings yet

- June 2023 SANTA MARTA MARINA AND BEACH FRONT PROPERTY THROUGH FASTBLOC BUILDING SYSTEMDocument14 pagesJune 2023 SANTA MARTA MARINA AND BEACH FRONT PROPERTY THROUGH FASTBLOC BUILDING SYSTEMLUZ MOSNo ratings yet

- Parental Leave Application Form - HR 108 (J)Document3 pagesParental Leave Application Form - HR 108 (J)LexNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)