Professional Documents

Culture Documents

FORM-GST-RFD-08: Notice For Rejection of Application For Refund

FORM-GST-RFD-08: Notice For Rejection of Application For Refund

Uploaded by

RiaZ MoHamMaDOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FORM-GST-RFD-08: Notice For Rejection of Application For Refund

FORM-GST-RFD-08: Notice For Rejection of Application For Refund

Uploaded by

RiaZ MoHamMaDCopyright:

Available Formats

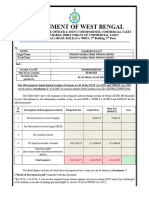

FORM-GST-RFD-08

[See rule 92(3)]

Notice for rejection of application for refund

SCN No.: ZL0911230257482 Date: 21/11/2023 5:45 PM

To

09AAHCV7304A1ZJ

VEERSA TECHNOLOGIES INDIA PRIVATE

29- sector 142,Noida,Gautam Buddha Nagar,Gautam Buddha

Nagar,09,201301

ACKNOWLEDGEMENT No…… ZL0910230258414

ARN : AA091023041926A Date : 10/10/2023 12:00 AM

This has reference to your above mentioned application for refund, filed under section 54 of the Act. On examination, it appears that

refund application is liable to be rejected on account of the following reasons:

Sr. No Description (select the reasons of inadmissibility of refund from the drop

Amount Inadmissible

down)

1 Wrong ITC Claim 111297

You are hereby called upon to show cause as to why your refund claim, to the extent of the amount specified above, should not be

rejected for reasons stated above.

You are hereby directed to furnish a reply to this notice within fifteen days from the date of service of this notice.

You are also directed to appear before the undersigned on 28/11/2023 5:43 PM

If you fail to furnish a reply within the stipulated date or fail to appear for personal hearing on the appointed date and time, the case will

be decided ex parte on the basis of available records and on merits.

Remark As per Rule 89 of CGST Rules 2017, excess refund claimed is Rs. 1,11,297/-.

Date : 21/11/2023 5:45 PM Signature (DSC)

Place : DIVISION VI NOIDA Name of Proper ABHISHEK BHUSHAN

Designation Assistant Commissioner

Office Address DIVISION VI NOIDA

You might also like

- LIC Superannuation Claim Form PDFDocument3 pagesLIC Superannuation Claim Form PDFManoj Mantri50% (2)

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- Form GST Rfd11Document63 pagesForm GST Rfd11forbooksNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- Return Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)Document30 pagesReturn Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)ch7utiyapa9No ratings yet

- RefundsDocument32 pagesRefundsanubalanNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- POLICY SERVICING REQUEST 2 - With StandardDocument3 pagesPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNo ratings yet

- Form GST RFD 01aDocument8 pagesForm GST RFD 01adizzi dagerNo ratings yet

- Oio DRC 07Document3 pagesOio DRC 07pandav165No ratings yet

- Sales Tax Appel Form 00219FORM-310 - EnglishDocument3 pagesSales Tax Appel Form 00219FORM-310 - EnglishsawshivNo ratings yet

- GPFFinal PayappDocument3 pagesGPFFinal Payappdhinesh subramaniamNo ratings yet

- SB 0066Document5 pagesSB 0066LJANo ratings yet

- Applicable For Casual or Non-Resident Taxable Person, Tax Deductor, Tax Collector, Un-Registered Person and Other Registered Taxable PersonDocument8 pagesApplicable For Casual or Non-Resident Taxable Person, Tax Deductor, Tax Collector, Un-Registered Person and Other Registered Taxable PersonVAIBHAV ARORANo ratings yet

- GPF PDFDocument24 pagesGPF PDFHimanshuKaushikNo ratings yet

- Return Formats (Sugam Return - FORM GST RET-3) (Quarterly) (Including Amendment)Document32 pagesReturn Formats (Sugam Return - FORM GST RET-3) (Quarterly) (Including Amendment)Puneet PrajapatiNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Form37 BST PDFDocument4 pagesForm37 BST PDFAshok BarotNo ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- Form 47 BackDocument1 pageForm 47 BackGollapalli JRatnakar BabuNo ratings yet

- Refund Under GST Regime Up To Date 12-03-2021 Detailed AnalysisDocument17 pagesRefund Under GST Regime Up To Date 12-03-2021 Detailed AnalysisChaithanya RajuNo ratings yet

- Demand & RecoveryDocument24 pagesDemand & Recoverygeegostral chhabraNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- New - Functionalities - Compilation - July 2022Document4 pagesNew - Functionalities - Compilation - July 2022AmanNo ratings yet

- 5254 - Tax Regime - 2024 - 240408 - 212256Document3 pages5254 - Tax Regime - 2024 - 240408 - 212256sunil78No ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Domiciliary Treatment Benefit Claim Discharge Form: Revenue StampDocument1 pageDomiciliary Treatment Benefit Claim Discharge Form: Revenue StampSubhadip MaityNo ratings yet

- E - Book On Recovery of Arrears Under GST Law - Dated - 01 - 10 - 2023Document85 pagesE - Book On Recovery of Arrears Under GST Law - Dated - 01 - 10 - 2023acgstdiv4No ratings yet

- Drc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Document1 pageDrc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Rahul KumarNo ratings yet

- Issues Related To Taxation of NPOsDocument17 pagesIssues Related To Taxation of NPOsCA Poonam GuptaNo ratings yet

- Refunds Under GST Q2 AssignmentDocument4 pagesRefunds Under GST Q2 Assignmentzm2pfgpcdtNo ratings yet

- Cir 188 20 2022 CGSTDocument4 pagesCir 188 20 2022 CGSTAtanu Kumar SenNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- Refund of GSTDocument2 pagesRefund of GST76-Gunika MahindraNo ratings yet

- CS Form No. 6, Revised 2020 (Application For Leave) (Fillable)Document2 pagesCS Form No. 6, Revised 2020 (Application For Leave) (Fillable)HelBoy AlabadoNo ratings yet

- Form No. 2 Notice of Demand: NotesDocument1 pageForm No. 2 Notice of Demand: NotesYashu GoelNo ratings yet

- E Newsletter September 2013Document13 pagesE Newsletter September 2013sd naikNo ratings yet

- GSTNTF55Document7 pagesGSTNTF55JGVNo ratings yet

- Rdao 05-01Document3 pagesRdao 05-01cmv mendoza100% (1)

- Complete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - inDocument3 pagesComplete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - insuraj shekhawatNo ratings yet

- Artifact 5 PF Withdrawal Form PDFDocument1 pageArtifact 5 PF Withdrawal Form PDFSuraj BaugNo ratings yet

- Chapter 13 Refund Under GSTDocument68 pagesChapter 13 Refund Under GSTDR. PREETI JINDALNo ratings yet

- Chit Fund FormsDocument45 pagesChit Fund Formssaisankar ladiNo ratings yet

- Saving Declaration 20-21Document3 pagesSaving Declaration 20-21pankajNo ratings yet

- Search Result: Case TitleDocument28 pagesSearch Result: Case Titleic corNo ratings yet

- BillingStatement - JO-ANN V. ESTEBANDocument2 pagesBillingStatement - JO-ANN V. ESTEBANJo-Ann Chan ValleNo ratings yet

- BST AppealDocument4 pagesBST AppealvnbanjanNo ratings yet

- E NEWSLETTER May 2013Document9 pagesE NEWSLETTER May 2013sd naikNo ratings yet

- Payout FormDocument5 pagesPayout FormMMayoor1984No ratings yet

- Going To File GST Refund Know The Important Changes in The Process First.Document2 pagesGoing To File GST Refund Know The Important Changes in The Process First.Richa SachdevaNo ratings yet

- Gujarat Gas - Temp. Disconnection & Reconnection FormDocument2 pagesGujarat Gas - Temp. Disconnection & Reconnection Formmohsinkachot77No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Apcotex-Concall Transcript-Q4-FY 21-22Document15 pagesApcotex-Concall Transcript-Q4-FY 21-22Vivek RamNo ratings yet

- Joint Venture Mutaawe PandeDocument6 pagesJoint Venture Mutaawe PandeBob KellyNo ratings yet

- Pse HistoryDocument36 pagesPse HistoryRyan Angelo MarasiganNo ratings yet

- Vehicle/Vessel Refund Request: Dol - Wa.Gov Customercare@Dol - Wa.GovDocument1 pageVehicle/Vessel Refund Request: Dol - Wa.Gov Customercare@Dol - Wa.GovRonald SandersNo ratings yet

- City of Manila and Office of The City Treasurer of ManilaDocument3 pagesCity of Manila and Office of The City Treasurer of ManilaRemy Casidsid MayoralgoNo ratings yet

- The Association Between Income and Life Expectancy in The United States 2001 To 2014Document17 pagesThe Association Between Income and Life Expectancy in The United States 2001 To 2014Noemi HidalgoNo ratings yet

- CTA 2D CV 08764 D 2018MAY23 ASS Documentary Stamp Tax On InstallmentDocument46 pagesCTA 2D CV 08764 D 2018MAY23 ASS Documentary Stamp Tax On InstallmentAvelino Garchitorena Alfelor Jr.No ratings yet

- Fesco Online BillDocument2 pagesFesco Online BillWaqar AkramNo ratings yet

- Tax DigestDocument7 pagesTax DigestLeo Angelo LuyonNo ratings yet

- Functions of Management AccountantDocument9 pagesFunctions of Management AccountantAnonymous S8zE7RZ50% (2)

- Town of Tusten - Public Comment and Response - Zoning LawDocument82 pagesTown of Tusten - Public Comment and Response - Zoning Lawtony_ritter6305No ratings yet

- Deloitte - Establishing The Investment CaseDocument14 pagesDeloitte - Establishing The Investment Casejhgkuugs100% (1)

- Gold StandardDocument78 pagesGold StandardTheodore GoldenNo ratings yet

- NISADocument4 pagesNISAWinnie AustinNo ratings yet

- 2022 Annual ReportDocument107 pages2022 Annual ReportSutami SuparminNo ratings yet

- Thomas J. Sargent, Jouko Vilmunen Macroeconomics at The Service of Public PolicyDocument240 pagesThomas J. Sargent, Jouko Vilmunen Macroeconomics at The Service of Public PolicyHamad KalafNo ratings yet

- Chapter 17 - Consolidated Financial Statements: Intragroup TransactionsDocument14 pagesChapter 17 - Consolidated Financial Statements: Intragroup TransactionsShek Kwun HeiNo ratings yet

- E Corporate Manager June 2022 - FINALDocument90 pagesE Corporate Manager June 2022 - FINALlegal shuruNo ratings yet

- Settlement Commission: Dr. P. Sree Sudha, LL.D Associate ProfessorDocument20 pagesSettlement Commission: Dr. P. Sree Sudha, LL.D Associate ProfessorBharath SimhaReddyNaiduNo ratings yet

- 2018 Sigma Rho Fraternity Bar Operations TAX LAW Bar QA 1999 2017 PDFDocument68 pages2018 Sigma Rho Fraternity Bar Operations TAX LAW Bar QA 1999 2017 PDFMa-an SorianoNo ratings yet

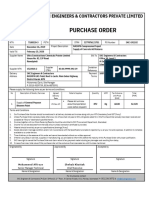

- Purchase Order: SKC Engineers & Contractors Private LimitedDocument1 pagePurchase Order: SKC Engineers & Contractors Private LimitedMohammed AffrozeNo ratings yet

- Fundamental Analysis On Stock MarketDocument6 pagesFundamental Analysis On Stock Marketapi-3755813No ratings yet

- AFL Overview: Enabling Business Transformation Through ITDocument29 pagesAFL Overview: Enabling Business Transformation Through ITshubhendra mishraaNo ratings yet

- NLUJ Law Review Volume 5 Issue 2Document150 pagesNLUJ Law Review Volume 5 Issue 2indrajit royNo ratings yet

- Dynamism: Worldwide Reach Millions of Delighted Customers Industry-Next Innovation Cutting-Edge TechnologyDocument236 pagesDynamism: Worldwide Reach Millions of Delighted Customers Industry-Next Innovation Cutting-Edge TechnologyAshesh DasNo ratings yet

- 4 - CIR v. Kudos Metal Corp.Document3 pages4 - CIR v. Kudos Metal Corp.JaysieMicabaloNo ratings yet

- Reliance PO 5103415813 Amended PODocument16 pagesReliance PO 5103415813 Amended POsiegamingytNo ratings yet

- Name of The Business-Rainbow Blooms LLC. Executive SummaryDocument17 pagesName of The Business-Rainbow Blooms LLC. Executive SummaryAhamed AliNo ratings yet

- Sole Proprietorship: Your Company's Form Will AffectDocument4 pagesSole Proprietorship: Your Company's Form Will AffectPauline ApiladoNo ratings yet

- Module 6Document14 pagesModule 6Tin ZamudioNo ratings yet