Professional Documents

Culture Documents

Cash Certificate

Cash Certificate

Uploaded by

srijainsravakcharitabletrustCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Certificate

Cash Certificate

Uploaded by

srijainsravakcharitabletrustCopyright:

Available Formats

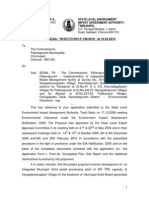

PHYSICAL VERIFICATION OF CASH

Bank & Branch: CANARA BANK , KHAMMAM (0775)

Year ended: March 31, 2022

Date of Physical Verification 06-April-2022; 06:05 PM

Opening / Closing Closing

Name of Person who carried out verification Yash Jain & CA Yashwardhan Joshi

Name of Cashier T. Kanta Rao

Name of Joint Custodian B. Vasantha and P. Vani Sree

Bait Money / Decoy Money changed at regular intervals No

Date of last change NA

Denomi Physical balance Rs. 23,54,952

Number Amount (Rs.)

-nation Bal. as per denomn. Book Rs. 23,54,952

2,000 28 56,000 Bal. as per Ledger Rs. 23,54,952

500 3,597 17,98,500

200 41 8,200

Balance on date of verification Rs. 23,54,952

100 272 27,200

Add: Withdrawals

50 70 3,500

20 6,354 1,27,080 From: 01/04/2022 Rs. 2,48,75,275

10 12,886 1,28,860 To :06/04/2022

Coins Less: Deposits

20 200 4,000 From:01/04/2022 Rs. 2,61,97,083

10 10,800 11,060 To :06/04/2022

5 32 160 Balance as on March 31st 2022 Rs. 10,33,144

2 36 72

Comments:

1. Soiled notes –Rs. 1,90,305 (One lakh Ninety Thousand Three Hundred and Five Only)

2. Bank is holding cash more than the retention limit specified on regular intervals

Audit Assistant/Auditor Cashier Branch In charge

Conducted by concurrent

I Surprise verification of cash

auditor

Physical cash balance Refer page 1

As per daily cash balance book (DCB) Refer page 1

As per GLB/ Cash report Refer page 1

Discrepancies – Shortage / (excess) Refer page 1

Observations

- Bank’s note slips on packets not found

- Sign of preparer and checker on note slips not available

Surprise physical verification of cash by Independent

II

Officer

- Not done (If yes, date of last verification) 03/12/2021; Thomas Tiru (DM)

- Other deviations / irregularities, if any None

III Cash holdings

- Cash Retention Limit (CRL) of the branch 50,00,000/-

- No of days on which cash balance exceeded CRL Many

- Avg cash balance held -

IV Joint custody

- DCB not signed by either of the custodians Signed; no irregularities found

- Amount not written in words / figures Complied

- Alterations not authorized Complieds

- Key register not maintained / entries not authorized Maintained

- Custodians not as per key register Complied

- Safe-in and safe-out register not maintained / entries

Maintained

not authenticated

- Cash discrepancies (excess / shortage) register not

Not maintained

maintained / entries not authenticated

- Discrepancies not reported to controllers NA

V Insurance of cash

- In safe: Not held / expired / underinsured At HO Level

- In cabin: Not held / expired / underinsured At HO Level

- In transit: Not held / expired / underinsured At HO Level

- In ATM: Not held / expired / underinsured At HO Level

Signature of Auditor Signature of Branch Manager

FOR AUDIT USE:

Whether effective joint-custody of cash evidenced – Yes / No

Significant discrepancies / inconsistencies observed, further audit procedures taken / to be

reported in Main Report / LFAR/ Tax Audit Report.

Audit Remarks: Cash held by the bank exceeds the retention limit prescribed at regular

intervals.

Bank is holding soiled notes of Rs. 1,90,305

Cash discrepancy register not maintained.

You might also like

- Hotel Management SystemDocument92 pagesHotel Management SystemFatima Altuhaifa90% (67)

- CCEDocument3 pagesCCESofia Nadine100% (1)

- Intermediate Accounting 1Document46 pagesIntermediate Accounting 1Jashi SiñelNo ratings yet

- Cash and Account Receivable: Tugas Pengantar Praktik Pengauditan Pertemuan VDocument18 pagesCash and Account Receivable: Tugas Pengantar Praktik Pengauditan Pertemuan VwillyNo ratings yet

- Concurrent Audit ReportDocument12 pagesConcurrent Audit ReportRUPESH KEDIANo ratings yet

- Final Report Tekkali q4Document20 pagesFinal Report Tekkali q4dccb tekkaliNo ratings yet

- Final Report On Ring Road Br.Document13 pagesFinal Report On Ring Road Br.Sohel RanaNo ratings yet

- MonthlyPCB ELB VLB Concurrent ChecklistDocument32 pagesMonthlyPCB ELB VLB Concurrent Checklist41 Shaivya ManaktalaNo ratings yet

- Trisa Grace T. Cawaling (Bsba 2-A)Document3 pagesTrisa Grace T. Cawaling (Bsba 2-A)Sofia NadineNo ratings yet

- Annexure I (Scope of Audit - Concurrent Auditor)Document29 pagesAnnexure I (Scope of Audit - Concurrent Auditor)Niraj JainNo ratings yet

- Final Report Dandiveedhi q4 2022-23Document20 pagesFinal Report Dandiveedhi q4 2022-23dccb tekkaliNo ratings yet

- Bab 23 Audit KasDocument47 pagesBab 23 Audit KasAyakaNo ratings yet

- Ia1 NotesDocument23 pagesIa1 NotesAssej C AustriaNo ratings yet

- Bank Reconciliation Statement: 150 AccountancyDocument31 pagesBank Reconciliation Statement: 150 AccountancyTarkeshwar Singh100% (1)

- Audit 2 Cash Receipt and Sales Receipt FlowchartDocument8 pagesAudit 2 Cash Receipt and Sales Receipt Flowchartandi TenriNo ratings yet

- Bank Reconcilaition Statement I Accounting Workbooks Zaheer SwatiDocument4 pagesBank Reconcilaition Statement I Accounting Workbooks Zaheer Swatiarslankhosa33No ratings yet

- Bank Rekonsiliasi PDFDocument31 pagesBank Rekonsiliasi PDFSekar Ayu Kartika SariNo ratings yet

- Audit of Cash and Cash EquivalentsDocument20 pagesAudit of Cash and Cash Equivalentsjona saloNo ratings yet

- Audit Report of Dolma Chowk Branch June 2017Document29 pagesAudit Report of Dolma Chowk Branch June 2017Sonalir RaghuvanshiNo ratings yet

- Audit of Cash and Cash EquivalentsDocument16 pagesAudit of Cash and Cash EquivalentsShaira Ellyxa Mae VergaraNo ratings yet

- Annex 5-REGISTER OF CASH RECEIPTS, DEPOSITS AND OTHER RELATED FINANCIALDocument3 pagesAnnex 5-REGISTER OF CASH RECEIPTS, DEPOSITS AND OTHER RELATED FINANCIALVermon JayNo ratings yet

- Bank Reconciliation StatementDocument27 pagesBank Reconciliation Statementkimuli FreddieNo ratings yet

- Bank and Cash 2023 MS SUNLEARNDocument34 pagesBank and Cash 2023 MS SUNLEARNJustyneNo ratings yet

- Cash and Cash Eqivalents Test (Version 2)Document21 pagesCash and Cash Eqivalents Test (Version 2)kedir mohamedNo ratings yet

- Matrix On Cash ExamsDocument3 pagesMatrix On Cash ExamsAllyssa GabaldonNo ratings yet

- Tonya SobanskiDocument85 pagesTonya Sobanskialicewilliams83nNo ratings yet

- 2017 BirDocument49 pages2017 BirjhaNo ratings yet

- DocxDocument11 pagesDocxYukiNo ratings yet

- DocxDocument11 pagesDocxYukiNo ratings yet

- Form2 Appl Premature Closure AccountDocument1 pageForm2 Appl Premature Closure AccountPraveen KumarNo ratings yet

- Branch Banking PresentationDocument11 pagesBranch Banking PresentationSuprotim DuttaNo ratings yet

- Audit of Cash and Cash EquivalentsDocument20 pagesAudit of Cash and Cash Equivalentsjona saloNo ratings yet

- Cash and Cash EquivalentsDocument33 pagesCash and Cash EquivalentsQuennie Kate RomeroNo ratings yet

- ATL-Reviewed BrgyAOM2022-01 KC Saravia CashDeficitDocument4 pagesATL-Reviewed BrgyAOM2022-01 KC Saravia CashDeficitkipar_16No ratings yet

- Financial StatementDocument197 pagesFinancial StatementShouvik NagNo ratings yet

- BBQ Lucknow Report April-13Document28 pagesBBQ Lucknow Report April-13sanand_1992No ratings yet

- LFAR 1 - LFAR FormatDocument18 pagesLFAR 1 - LFAR FormatLucky RohillaNo ratings yet

- Accounting Process FlowDocument22 pagesAccounting Process FlowCherry AldayNo ratings yet

- Chapter - 6Document12 pagesChapter - 6Mehamed NureNo ratings yet

- Slides - Bank ReconciliationsDocument21 pagesSlides - Bank ReconciliationsJaceNo ratings yet

- RaisiDocument5 pagesRaisisakshiNo ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentSalim MohamedNo ratings yet

- Bank Reconciliations Credit Memo PDF FormatDocument8 pagesBank Reconciliations Credit Memo PDF FormatGeorge MockNo ratings yet

- INTACC 1 GJFCPA Cash ARDocument12 pagesINTACC 1 GJFCPA Cash ARRhea AlianzaNo ratings yet

- Substantive of Audit of Cash Audit Objectives For Cash BalancesDocument6 pagesSubstantive of Audit of Cash Audit Objectives For Cash BalancesMa Tiffany Gura RobleNo ratings yet

- Report On Financial Reporting of Abans RSL To The ManagementDocument15 pagesReport On Financial Reporting of Abans RSL To The ManagementNatala De LemisNo ratings yet

- Cash and Securities DepartmentDocument38 pagesCash and Securities DepartmentHAMMADHRNo ratings yet

- Intermidiate Accounting 1Document3 pagesIntermidiate Accounting 1Melka BelmonteNo ratings yet

- September Montly Rep 2020Document22 pagesSeptember Montly Rep 2020meskerem hailuNo ratings yet

- Notes: MARCH 18, 2021Document4 pagesNotes: MARCH 18, 2021Joris YapNo ratings yet

- Acc 106 - Sas 4Document14 pagesAcc 106 - Sas 4bakdbdkNo ratings yet

- WootDocument1 pageWootNemir ViluanNo ratings yet

- Chapter 4 Financial AssetsDocument54 pagesChapter 4 Financial AssetsAddisalem MesfinNo ratings yet

- Format of IRDocument10 pagesFormat of IRKaran KapoorNo ratings yet

- BANK Audit Material 15th March 2013Document23 pagesBANK Audit Material 15th March 2013padmanabha14No ratings yet

- Cash Cash Equivalents: Practical Accounting 1 Theory of AccountsDocument4 pagesCash Cash Equivalents: Practical Accounting 1 Theory of AccountsMaria Fe ValenzuelaNo ratings yet

- LFAR Ready Reckoner 31.03.2020 by Kuldeep GuptaDocument13 pagesLFAR Ready Reckoner 31.03.2020 by Kuldeep GuptaJAY SHARMA100% (1)

- BRSDocument5 pagesBRSMAHENDERNo ratings yet

- Presentation of Cash FlowDocument22 pagesPresentation of Cash Flowwisal.abdullah.mNo ratings yet

- Michael IrbyDocument42 pagesMichael Irbyalicewilliams83nNo ratings yet

- 1384252949F.No. 198 ECDocument20 pages1384252949F.No. 198 ECPrintNo ratings yet

- UNIT-2 Production and Operation ManagementDocument15 pagesUNIT-2 Production and Operation ManagementVasu PatelNo ratings yet

- E Auction - Final RSH Agro Products LTDDocument50 pagesE Auction - Final RSH Agro Products LTDVinod RahejaNo ratings yet

- Internasional 6Document14 pagesInternasional 6M Rizki Rabbani 1802112922No ratings yet

- Co-Founder of Google (Larry Page)Document3 pagesCo-Founder of Google (Larry Page)Muhammad Anwar ul hassanNo ratings yet

- JpmorganDocument4 pagesJpmorganSabri MaggiNo ratings yet

- Principles of Risk Management and Insurance 13th Edition Rejda Test BankDocument23 pagesPrinciples of Risk Management and Insurance 13th Edition Rejda Test Bankoutlying.pedantry.85yc100% (26)

- KASUS 1 - TranslasiDocument3 pagesKASUS 1 - TranslasiainopeNo ratings yet

- Unit 1 - Session 1 - Introduction To Risk ManagementDocument10 pagesUnit 1 - Session 1 - Introduction To Risk ManagementAbhishek SinhaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePuneet VermaNo ratings yet

- Cambridge Igcse English Coursework Cover SheetDocument8 pagesCambridge Igcse English Coursework Cover Sheetafiwhhioa100% (2)

- E-Business Unit 3Document5 pagesE-Business Unit 3Danny SathishNo ratings yet

- Inequality Essay 2019Document2 pagesInequality Essay 2019api-604802402No ratings yet

- Update On ISIC Rev5Document14 pagesUpdate On ISIC Rev5Raflizal Fikrar OdriansyahNo ratings yet

- G. Radhakrishnan Sr. Construction Engineer (Civil, Building & Structure) Mobile: - Sultanate of Oman +968 97768759 India +91 9003954578Document7 pagesG. Radhakrishnan Sr. Construction Engineer (Civil, Building & Structure) Mobile: - Sultanate of Oman +968 97768759 India +91 9003954578Vasanthan MohanNo ratings yet

- Strata HighriseDocument1 pageStrata Highrisesaya amirazNo ratings yet

- f6MYS 2019 DecDocument11 pagesf6MYS 2019 DecChoo LeeNo ratings yet

- Company Profile Updated 3 May 2020 Smaller Size PDFDocument17 pagesCompany Profile Updated 3 May 2020 Smaller Size PDFSonOfJamesNo ratings yet

- Appointment LETTERDocument4 pagesAppointment LETTERAbul HussainNo ratings yet

- PPT-10 REITs - InvITs PresentaionDocument24 pagesPPT-10 REITs - InvITs PresentaionVikas MaheshwariNo ratings yet

- Audit and Assurance EngagementDocument36 pagesAudit and Assurance EngagementHillary MageroNo ratings yet

- Talk About Your Business SeminarDocument3 pagesTalk About Your Business SeminarBrian JennerNo ratings yet

- SUDAN Investment Prospectus 2021Document59 pagesSUDAN Investment Prospectus 2021Mustafa SaeedNo ratings yet

- IshikawaDocument16 pagesIshikawaAnthony CollierNo ratings yet

- GrivanceDocument3 pagesGrivancemariam hsainiNo ratings yet

- Certificate For Claming Children Educational AllowanceDocument4 pagesCertificate For Claming Children Educational AllowanceMakaradhwaj Sahani Subhawti SahaniNo ratings yet

- CH 1 Introduction To EnterpreneurshipDocument7 pagesCH 1 Introduction To EnterpreneurshipIshmaal KhanNo ratings yet

- Rich A YadavDocument64 pagesRich A YadavRicha YadavNo ratings yet

- International Macroeconomics: Slides For Chapter 1: Global ImbalancesDocument54 pagesInternational Macroeconomics: Slides For Chapter 1: Global ImbalancesM Kaderi KibriaNo ratings yet