Professional Documents

Culture Documents

Analisis CBA

Uploaded by

daniarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analisis CBA

Uploaded by

daniarCopyright:

Available Formats

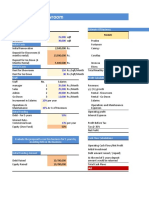

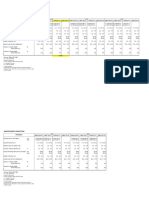

Simulation Scenario Benefit and Cost Analysis

Scenario 1 (Base Scenario ) Scenario 2 Scenario 3 Scenario 4 Scenario 5

Description Capital Expenditure Capital Expenditure Capital Expenditure Capital Expenditure Capital Expenditure

247.849.589.703,20 247.849.589.703,20 247.849.589.703,20 247.849.589.703,20 247.849.589.703,20

Additional Capital Budget - - 50.000.000.000 50.000.000.000 50.000.000.000

50.000.000.000 50.000.000.000

Operational Expenditure Operational Expenditure Operational Expenditure Operational Expenditure Operational Expenditure

Year 1 40.152.661.349 40.152.661.349 40.152.661.349 40.152.661.349 40.152.661.349

Year 2 (+5%) 42.160.294.416 42.160.294.416 42.160.294.416 42.160.294.416 42.160.294.416

Year 3 (+5%) 44.268.309.137 44.268.309.137 44.268.309.137 44.268.309.137 44.268.309.137

Benefits Benefit Tangible Benefit Tangible Benefit Tangible Benefit Tangible Benefit Tangible

70.811.825.906 236.078.992.466 236.078.992.466 70.811.825.906 236.078.992.466

Benefit Intangible Benefit Intangible Benefit Intangible Benefit Intangible Benefit Intangible

74.445.864.733 74.445.864.733 74.445.864.733 74.445.864.733 74.445.864.733

Discount rate (BI7DDR) 3,50% 3,50% 3,50% 3,50% 3,50%

Financing period 3 year 3 year 3 year 3 year 3 year

Feasibility Indicator (CBA)

BCR (BCR > 1) 1,16 2,49 2,19 0,92 1,96

Feasible Feasible Feasible Not Feasible Feasible

NPV (NPV ≥ 0) Rp 31.428.466.909 Rp 478.789.438.468 Rp 430.480.259.724 -Rp 65.189.890.579 382.171.080.980

Feasible Feasible Feasible Not Feasible Feasible

IRR (IRR > 3,5%) 8% 64% 53% -4,13% 43%

Feasible Feasible Feasible Not Feasible Feasible

Payback period 2 years 5 months 1 year 2 months 1 year 4 months 3 years 3 months 1 year 5 months

PP < Financing period PP < Financing period PP < Financing period PP > Financing period PP < Financing period

Base scenario

You might also like

- Case Study PeregrineDocument4 pagesCase Study PeregrineCamille Fajardo67% (3)

- Unit 6 Written Assignment BUS 5110Document5 pagesUnit 6 Written Assignment BUS 5110luiza100% (6)

- Accounting Problems With SolutionsDocument63 pagesAccounting Problems With Solutionssumit_sagar69% (13)

- Assignment 1 BFinanceDocument7 pagesAssignment 1 BFinanceAkshat100% (1)

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreDocument6 pagesAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- Exercise 1 (Skyline University College)Document6 pagesExercise 1 (Skyline University College)Salman SajidNo ratings yet

- Basic Model-01Document6 pagesBasic Model-01Sambit SarkarNo ratings yet

- 29116520Document6 pages29116520Rendy Setiadi MangunsongNo ratings yet

- Ch07 Beams10e TBDocument29 pagesCh07 Beams10e TBjeankoplerNo ratings yet

- Reserve Bank of India - NSDP Display 16 JunDocument1 pageReserve Bank of India - NSDP Display 16 JunSwatiNo ratings yet

- Refinance Risk Analysis Tool: Visit This Model's WebpageDocument4 pagesRefinance Risk Analysis Tool: Visit This Model's WebpageAyush PandeNo ratings yet

- Gladiolus CultivationDocument7 pagesGladiolus CultivationPraharsh ShahNo ratings yet

- DepreciationDocument2 pagesDepreciationumeshNo ratings yet

- Franchise - CarDocument14 pagesFranchise - Carshrish guptaNo ratings yet

- Inv Appraisal Activity AnsDocument2 pagesInv Appraisal Activity AnsTrần NghĩaNo ratings yet

- Inv Appraisal Activity AnsDocument2 pagesInv Appraisal Activity AnsTrần NghĩaNo ratings yet

- Bus 5110 Managerial Acccounting Written Assignment Unit 6Document6 pagesBus 5110 Managerial Acccounting Written Assignment Unit 6rumbidzai chemhereNo ratings yet

- ReversionaryBonus PDFDocument4 pagesReversionaryBonus PDFPiyush BhartiNo ratings yet

- EVA, VPL e CVA 2003Document4 pagesEVA, VPL e CVA 2003Pedro CoutinhoNo ratings yet

- Welcome To The Presentation: On Stress Testing of National Housing Finance LimitedDocument55 pagesWelcome To The Presentation: On Stress Testing of National Housing Finance LimitedOtoshi AhmedNo ratings yet

- Macro IndicatorsDocument2 pagesMacro IndicatorsRomelNo ratings yet

- RiskDocument5 pagesRiskMd. Samiul Islam ShozibNo ratings yet

- Refinance Analysis v1.01Document1 pageRefinance Analysis v1.01AlexNo ratings yet

- Fin ModelDocument4 pagesFin Modelrobin_rana2001No ratings yet

- IndiaFirst Life Guaranteed Pension Plan - 1407135Document3 pagesIndiaFirst Life Guaranteed Pension Plan - 1407135Krishna GoyalNo ratings yet

- Girum Tsega PerfectDocument13 pagesGirum Tsega PerfectMesi YE GINo ratings yet

- Key Corp 3Q07 PresentationDocument26 pagesKey Corp 3Q07 Presentationmdv31500No ratings yet

- Salary Terms and Conditions (REV On 20230911)Document13 pagesSalary Terms and Conditions (REV On 20230911)fRAFSACRFCZDNo ratings yet

- Capa CiteDocument29 pagesCapa CiteParas ChhedaNo ratings yet

- Hide & Seek MKT MiniDocument15 pagesHide & Seek MKT Minipiyush rawatNo ratings yet

- Capital Budgeting: Ravi Kanth MiriyalaDocument20 pagesCapital Budgeting: Ravi Kanth MiriyalaBonkyNo ratings yet

- Evaluate The Proposal To Run This Business For 5 Years by Investing 50% in The BusinessDocument5 pagesEvaluate The Proposal To Run This Business For 5 Years by Investing 50% in The BusinessRahul lodhaNo ratings yet

- Property Valuation Analysis: Building I Want 160Document21 pagesProperty Valuation Analysis: Building I Want 160yhcdyhdNo ratings yet

- Dri 2024014Document2 pagesDri 2024014detix97225No ratings yet

- Chicago SaharsaDocument6 pagesChicago SaharsaShail DokaniaNo ratings yet

- Budget 2018 - Final Approved by BODDocument118 pagesBudget 2018 - Final Approved by BODMuhammad SamiNo ratings yet

- The Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Document34 pagesThe Basics of Capital Budgeting: Evaluating Cash Flows: Should We Build This Plant?Garima BansalNo ratings yet

- Lampiran VDocument23 pagesLampiran VArif Rahman SetiawanNo ratings yet

- Data Collection Template For Af210 AssignmentDocument31 pagesData Collection Template For Af210 AssignmentSelvindra Naidu100% (1)

- 160 Tanuku Tanmai Prateek Q12Document6 pages160 Tanuku Tanmai Prateek Q12SATYA SHANKER KARINGULANo ratings yet

- Executive Summary: Philippines Construction CompanyDocument7 pagesExecutive Summary: Philippines Construction CompanyVon Ulysses CastilloNo ratings yet

- Trichkova-Kanaryan-First Balkan Valuation ConferenceDocument16 pagesTrichkova-Kanaryan-First Balkan Valuation ConferenceAniket SinghNo ratings yet

- (A) Payback Period: InvestmentDocument6 pages(A) Payback Period: InvestmentJuliet BhandariNo ratings yet

- Financial Planning FOR Mr. Yogesh ModyDocument17 pagesFinancial Planning FOR Mr. Yogesh Modyruchi1321No ratings yet

- Profit Rates November 2021Document4 pagesProfit Rates November 2021Abubakar112No ratings yet

- Financial Profiling ExampleDocument8 pagesFinancial Profiling ExampleWasim SNo ratings yet

- Single Statment Income StatementDocument13 pagesSingle Statment Income StatementDishanth GowdaNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- Condensed Consol 1QFY22Document7 pagesCondensed Consol 1QFY22Master EnglishNo ratings yet

- Surveilans Aktif Rs Penyakit Menular & KLB: Rumah Sakit Daerah Idaman Kota BanjarbaruDocument15 pagesSurveilans Aktif Rs Penyakit Menular & KLB: Rumah Sakit Daerah Idaman Kota BanjarbaruIRNA RSDINo ratings yet

- 02 Laboratory Exercise 1 TemplateDocument11 pages02 Laboratory Exercise 1 TemplateMarie OsorioNo ratings yet

- Mawjihan Tsakilla 023001701045 710:13.15 Selpita&LisnaDocument8 pagesMawjihan Tsakilla 023001701045 710:13.15 Selpita&Lisnaadis salsabilaNo ratings yet

- Building ModelDocument4 pagesBuilding Modelqxcars1No ratings yet

- Net Present Vale NPV TemplateDocument3 pagesNet Present Vale NPV TemplateVoTrieuAnhNo ratings yet

- Ditta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Document36 pagesDitta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Ummaya MalikNo ratings yet

- Marketing Management Creating Long-Term Loyalty RelationshipsDocument15 pagesMarketing Management Creating Long-Term Loyalty RelationshipsZera Mae FigueroaNo ratings yet

- Retirement PlannerDocument7 pagesRetirement PlannerPrakash RajagopalanNo ratings yet

- Mu BashirDocument6 pagesMu BashirShahzaib ShaikhNo ratings yet

- Consolidated Financial Statements - FY23Document59 pagesConsolidated Financial Statements - FY23Bhuvaneshwari .ANo ratings yet

- Union Budget - 2023-24 - Direct Tax Proposals (K&Co)Document54 pagesUnion Budget - 2023-24 - Direct Tax Proposals (K&Co)Charul ChhajerNo ratings yet

- Chapter 6 - Capital BudgetingDocument12 pagesChapter 6 - Capital BudgetingParth GargNo ratings yet

- Financial Planning FOR Mr. Yogesh ModyDocument17 pagesFinancial Planning FOR Mr. Yogesh ModyInder_Joshi_8243No ratings yet

- Financial Analysis of Rolls Royce Holdings PLCDocument26 pagesFinancial Analysis of Rolls Royce Holdings PLCPrtk Srstha100% (1)

- Palepu 3e ch7Document21 pagesPalepu 3e ch7Nadine SantosNo ratings yet

- Acst LK TW I 2021Document80 pagesAcst LK TW I 2021alif aditya suwandaruNo ratings yet

- Accounting Basics 1 QuizDocument6 pagesAccounting Basics 1 QuizRegine Pahigo HilladoNo ratings yet

- 603-Article Text-1225-1-10-20200203Document16 pages603-Article Text-1225-1-10-20200203ABAYNEGETAHUN getahunNo ratings yet

- OHADA Financial AnalysisDocument5 pagesOHADA Financial AnalysisCheikh Omar Touré100% (1)

- Interview Questions With Answers On All Topics (Rev1)Document41 pagesInterview Questions With Answers On All Topics (Rev1)Ajit ShettyNo ratings yet

- ValuationDocument3 pagesValuationRendry Da Silva SantosNo ratings yet

- Far Reviewer 1Document4 pagesFar Reviewer 1MARK JAYSON MANABATNo ratings yet

- CFAS - Theory Review QuestionsDocument12 pagesCFAS - Theory Review QuestionsRi ChardNo ratings yet

- Test BDocument5 pagesTest Bhjgdjf cvsfdNo ratings yet

- Introduction To Accounting Principles AccountingDocument7 pagesIntroduction To Accounting Principles AccountingAnand PrasadNo ratings yet

- Credit Card BillDocument2 pagesCredit Card Billmohasinkamal421No ratings yet

- Chapter 7 Acctg For Financial InstrumentsDocument32 pagesChapter 7 Acctg For Financial InstrumentsjammuuuNo ratings yet

- Home Depot Financial QuestionDocument3 pagesHome Depot Financial Questionmktg1990No ratings yet

- RAJESH Accounts STUDY MATERIAL-2Document111 pagesRAJESH Accounts STUDY MATERIAL-2rajesh indukuriNo ratings yet

- Other Long-Term Investments: NAME: Piolo Encela Date: 5-11-2020 Professor: Dr. Valcorza Section: BSA 1B ScoreDocument2 pagesOther Long-Term Investments: NAME: Piolo Encela Date: 5-11-2020 Professor: Dr. Valcorza Section: BSA 1B ScoreKrissa Mae LongosNo ratings yet

- Resa First PB PDFDocument94 pagesResa First PB PDFAnjolina BautistaNo ratings yet

- Chapter-Four Financial InstrumentsDocument15 pagesChapter-Four Financial InstrumentsAbdiNo ratings yet

- Persistent Systems: Equity Research - ModelDocument9 pagesPersistent Systems: Equity Research - ModelNaman MalhotraNo ratings yet

- Introduction To Investment AppraisalDocument43 pagesIntroduction To Investment AppraisalNURAIN HANIS BINTI ARIFFNo ratings yet

- Conso FS Subsequent To Date of AcquisitionDocument5 pagesConso FS Subsequent To Date of Acquisitionguliramsam5No ratings yet

- Chapter 7Document22 pagesChapter 7Rygiem Dela CruzNo ratings yet

- Equities Crossing Barriers 09jun10Document42 pagesEquities Crossing Barriers 09jun10Javier Holguera100% (1)

- ShareDocument20 pagesShareSaroj MeherNo ratings yet

- Intro To Re ExcelDocument16 pagesIntro To Re Excelnina9121No ratings yet

- Alternative Investments and EquityDocument613 pagesAlternative Investments and EquitySen RinaNo ratings yet