Professional Documents

Culture Documents

Basic Instinct IMFORMED RWF 1 2018

Uploaded by

engr kazamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Instinct IMFORMED RWF 1 2018

Uploaded by

engr kazamCopyright:

Available Formats

MARKETS & ECONOMY

Basic Instinct: Magnesia Supply to the Refractories Industry

M. O’Driscoll

If

Increasing price USD/tonne

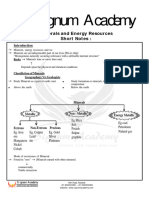

ever there was a time to Scale of magnesia grade processing Avg. China

2016 export

2017 China

FOB pricing

Increasing

acknowledge and try to under- temp.°C 2 800-3 000°C electrofused magnesia

USD 500

USD 400-

heat 96-98% MgO 1200

stand the significant influence treatment

1 500-2 300°C dead burned magnesia

of Chinese policies on refractory Decreasing

reactivity 90-97.5% MgO

USD 240

USD 250-

1000

mineral supply to western mar- Increasing 1 000-1 500°C hard burned caustic

calcined magnesia

kets that time is now. The upshot refractoriness

USD 200 USD200-500

Increasing 700-1 050°C light burned caustic

is that 2017 will be remembered energy cost

calcined magnesia

as the "Year of the Perfect", or,

perhaps, …"Imperfect Storm" – Fig. 1 Grade diversity of magnesia raw materials

depending on whether one is a

frankly, 2018 is expected to remain a tough Of the world’s magnesite resources, about

Western refractory mineral pro- time for consumers of refractory minerals. 90 % is of the sparry, macrocrystalline,

ducer/developer or a Western This article focuses on supply of refractory coarse-grained type hosted by carbonate

consumer of Chinese refractory grade magnesia. rocks, and 10 % of the cryptocrystalline,

minerals, respectively. fine grained type hosted by ultramafic or

2 Magnesia basics fresh sedimentary rocks.

Without refractories, there would be no Increasing heat treatment (calcination,

steel, non-ferrous metals, glass, and cement sintering, electrofusion) produces a range

1 Introduction production, just to name a few depend- of magnesia grades (with corresponding

The leading steel refractory producers – ent market sectors. But without industrial price increments), of which dead burned

such as RHI Magnesita, Vesuvius, Minteq, minerals, there would be no refractories (1500–2300 °C) and fused magnesias

HarbisonWalker – are suffering at the time – refractory minerals are the “DNA” of re- (2800–3000 °C) are suitable for refrac-

of writing (early December 2017), in that it fractories. tory use. Fused magnesia maybe produced

has been very difficult to secure refractory Dead burned magnesia (DBM; 85–99,8 % direct from magnesite or from caustic cal-

mineral supply and prices for H1 2018, let MgO) and fused magnesia (FM; 97–99,8 % cined magnesia.

alone rest of 2018 and 2019. MgO) are two of the primary workhorse World production of natural DBM is es-

The cumulative effects of swift and robust mineral derivatives used in many refractory timated at 7,7 Mt and synthetic DBM at

central government policies in cracking formulations. After refractory clays, magne- 0,8 Mt.

down on pollution (leading to plant clo- sia is the second most consumed refractory The majority of the 8500 Mt of world re-

sures), explosives provision (limited or no mineral by volume. serves of magnesite are hosted by Russia

mine blasting), and unlicensed businesses Magnesium oxide, or magnesia (MgO), is (27 %), China (20 %), North Korea (18 %),

(companies closing), not to mention domes- derived from two main sources: from natu- followed by Turkey, Australia, Brazil, Greece,

tic market demand factors, have combined rally occurring minerals, mostly magnesite Slovakia, India, and Austria, at 5 % or less.

to create a storm of severe shortages and (but also from other mineral such as serpen- Magnesia production is dominated by Chi-

soaring prices for key refractory minerals tinite, dolomite, huntite, bischofite) known na (69 %), followed by Turkey (10 %) and

exported from China. as “natural magnesia”, and from sea water Russia (5 %), and others at 3 % or less.

The impact has been keenly felt by consum- and magnesium-rich brines known as “syn-

ers of dead burned and fused magnesia, thetic” magnesia. Mike O’Driscoll,

plus other refractory raw materials such as IMFORMED Industrial Mineral Forums &

calcined bauxite, brown fused alumina, sili- 2.1 Resources and production Research Ltd

con carbide and graphite. According to data from the US Geological

This is not a cyclical phase; the fall-out is Survey, almost 12 Mt of MgO equivalent is mike@imformed.com

unlikely to be temporary for many opera- produced worldwide of which 89 % is de- www.imformed.com

tions; this time it’s serious. rived from natural sources and 11 % from

By the time this article is published, per- synthetic sources. Extract of keynote presented at UNITECR

haps the outlook will be slightly clearer, but 2017

refractories WORLDFORUM 10 (2018) [1] 1

MARKETS & ECONOMY

2.2 Trends and developments

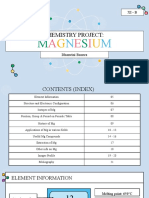

World magnesite reserves World magnesite production

The three main areas of trends and devel-

Total 8.5bn tonnes Total 27.7m tonnes

ROW

N. Korea India

opments, which are affecting the refractory

17% Brazil

Austria 2% Australia

2%

1%

Greece

1% magnesia industry are corporate ownership,

1% Spain ROW

India 2%

1%

2% capacity changes, and China.

1%

Slovakia

Slovakia

2%

The last 30 years have seen a gradual

1% Russia shrinking of the refractory magnesia sup-

Greece 27% Austria

3% 3% ply sector outside China and with it con-

Brazil Russia

3% 5% solidation of ownership of the world’s main

Australia China

4% China 69% magnesia sources, perhaps peaking in 2017

20% Turkey

Turkey N. Korea 10% with the “magnesia mega-merger” of RHI

5% 18%

and Magnesita, which concluded on 26 Oc-

tober 2017.

ROW

World natural magnesia production 2015 37%

Parallel to consolidated corporate owner-

China

China & ROW 63% Source: data from USGS ship has also been an increase in vertical

integration, mainly pursued by RHI, Mag-

Source: Richard Flook & Ian Wilson (2016) nesita, and Magnezit, each striving to at-

tain at least 80+% raw material supply

Fig. 2 Natural magnesia resources security. Refractory producers Minteq and

Refratechnik also have captive magnesia

While magnesia sources may occur in many largest steel producing countries – reflect- sources.

countries, there are actually only limited ing the steel industry as the primary driver In response to market demand, and the

commercially developed sources of refrac- for refractory demand. The top 11 magnesia evolving situation in China, there are a

tory grade magnesia which maybe termed importing countries accounted for 74 % of number of interesting developments with

primary sources: Australia, Brazil, China, crude steel output in 2016. regard to existing refractory magnesia pro-

Greece, Ireland, Mexico, Netherlands, Slova- In general, refractory magnesia production duction facilities and projects:

kia, Spain, Russia, Turkey. can be summarised by the following charac-

In 2016, China produced 3,4 Mt of DBM teristics: as having mostly natural, few syn- 2.2.1 Existing producers:

and 1,38 Mt of FM. Not surprisingly, China thetic producers; with mostly 1–2 producers IBAR/BR

still dominates exports at 42 % (1,8 Mt) in per country (except China and Turkey); many • recent expansion; from 2016 40 ktpa

2016. are part of large, integrated groups; some DBM for export with Cofermin

There are other, “secondary” sources of of these are captive producers; some serve Magnesium do Brasil/BR

refractory magnesia, but these are mainly mostly local/regional markets; outside China • expansion 2015/16; by 2020 150 ktpa

either captive producers or supply only lo- there are very few FM and high purity DBM incl. 40 ktpa DBM

cal markets, or have small scale production. producers; some have diversified away from Magnesitas Navarras/ES

When reviewing the key importing countries refractories into industrials/specialities; world • 2017: Upgrading kiln no. 2 Zubiri to in-

of magnesia, it is instructive to note that the supply is dominated by China; and refractory crease DBM cap. to 200 ktpa

top eight importing countries are also host magnesia demand is driven by steel markets. • Borobia mine (Magnesitas Sorianos

to the world’s no.1, 2, 4, 6 and 7 ranked 250 ktpa crude ore); permit delays since

2011; initial ore extraction 2015; on

stream July 2017

World magnesia exports 2016 World magnesia imports 2016

Total 4.5m tonnes Total 4.2m tonnes

Nedmag/NL

ROW

• Feb. 2016 EUR 122 million investment for

Germany

Greece 14%

2%

11% new salt extraction site; permitting 2018,

Russia

Japan

development wells by 2022

2%

Israel China

9% RHI/NO

3% 42%

N. Korea ROW • 2012: 85 ktpa FM plant

4% 37% USA

8% • 2014: technical issues, reduced utilisation

Spain

4% • Dec. 2017: restart with “increased out-

Slovakia Netherlands put”

5% 8%

Brazil

France

3% Taiwan

Magnezit/RU

5%

Australia Ukraine Austria

5% • 2017 Satka: started new 100 ktpa MHF

5% Turkey Netherlands 3%

6% 8% Poland China S. Korea

4%

5% • + 130 ktpa DBM (2 x new shaft kilns

3% 4%

80 ktpa + 50 ktpa)

Source: data from ITC; Dr Richard Flook

• Autumn 2017 construction of new

Fig. 3 Primary trade (exports/imports) 50 ktpa FM on stream 2019–20

2 refractories WORLDFORUM 10 (2018) [1]

MARKETS & ECONOMY

• 2020 Krasnoyarsk: new 50 ktpa FM fol- (‘000s tpa total per country)

lowed by Phase 2 50 ktpa FM indicates producer not

• 2020 cap.: 630 ktpa DBM (12 x SK integrated with

refractories production

500 ktpa + new 2 x SK 130 ktpa);

170 ktpa FM (70 ktpa + new 100 ktpa)

Russia

IRRPCO/IR Netherlands

Nedmag

Slovakia

SMZ

Magnezit

500 DBM nat.

• 2015: 9 ktpa FM plant started; 52 ktpa 170 DBM syn. 370 DBM nat.

FM 70

Ireland Austria

DBM; RHI (PPL) RHI

72 DBM syn. Japan

• 2017: new monolithics plant 290 DBM nat.

16 FM Ube

Spain 150 DBM syn.

Kumas/TR Magna Greece Turkey

Mexico 165 DBM nat. Grecian Mag.

Kumas China 200+?

• 2015: 4 x EAF 40 ktpa FM capacity Penoles

80 DBM syn.

90 DBM nat.

Turkmag

285 DBM nat.

3,520 DBM

1,330 FM

40 FM

• 260 k DBM-CCM-DBD capacity 10 FM

Turkmag/TR (Cihan Group) Brazil Australia

Magnesita Sibelco (QMAG)

• 100 ktpa 86 % + 94 % MgO DBM Askale, IBAR

Mag. Do Brasil

110 DBM

32 FM

eastern Anatolia 500 DBM nat.

34 FM

• 2011: start-up then mothballed

• 2014: RHI abandoned acquisition

• 2016: restarted in July Fig. 4 Primary refractory magnesia sources and capacities

• 2017-18: planning 2nd rotary kiln to ex-

pand cap. 2.2.3 Greenfield projects ate (HMC), hard burned magnesia (HBM)

Sibelco/AU AusMag (Korab Resources)/AU and magnesium hydroxide (MDH) recov-

• 2015-17 cutbacks in output and staff • Winchester magnesite deposit, NT; ered from waste bitterns discharged from

(30 %) 16,6 Mt @ 43,2 % MgO; 1,5 Mt raw salt works and potash mining in WA and

• Reduced MHF utilisation; no DBM (110 k magnesite offtake agreement Li-Mg salar brines in South America.

cap.) Thessally Resources/AU • 500 ML/year bitterns (4 % Mg) = 78 ktpa

• focus on FM (30 ktpa cap.) • Huandot, NT deposit, 9 Mt @ 44,3 % HMC

• Gas price rise: 2012-18 A$4.25/GJ to MgO for CCM 95 %, 90 % and 85 % MGX Minerals Inc./CA

A$12-15/GJ MgO • Driftwood Creek Magnesium Project,

Leigh Creek Magnesite Pty Ltd/AU Brisco, BC: M+I 8 Mt @ 43,31 % MgO;

2.2.2 Brownfield Projects • 453 Mt @ 41,4 % MgO; CCM, DBM pilot plant; PEA underway, CCM, DBM.

IMC (Ma’aden), Saudi Arabia EcoMag Australia, South America Karnalyte Resources/CA

• Ganmag Magnesite Solutions (N. Gangu- • PFS; 2017–2021 to produce >99,5 % • Wynyard Potash Project, SK; 7,9 Mt MgCl2

tia) MgO pure hydrated magnesium carbon- probable reserves

• July 2017: start-up of vertical shaft kiln,

direct sintering, 33 ktpa low SiO2, 92 % + Tab. 1 Corporate landscape

95 % MgO DBM; reporting much interest Company Ownership Integrated

from market Semi-captive

• Sept. 2017: 36 ktpa mixing plant for IBAR Nordeste IBAR - Brazilian Industries Articles Refratários Y

monolithics; GCC steel market >100 ktpa

Grecian Magnesite Private (Portolos Family) Y

Ternamag/GR

Kumas Kobin Madencilik İnşaat ve Ticaret A.Ş. (2012; namechange to Y

• 2012: started mining at Gerorema on Eu- Kumas Manyezit Sanayi A.S)

boea Is.

Magnesita GP Investiments (35,29 %); Rhône (8,26 %); Free Float (54,78 %); Y

• 2014: 1st shipment raw magnesite, then Treasury (1,68 %) Merger with RHI concluded end-Oct 2017

MHF CCM (60 ktpa cap.)

Magnesitas Navarras Groupe Roullier (60 %); Grecian Magnesite (40 %; in 2000) Y

• 2017: commencing Phase 2 construction

of 60 ktpa rotary kiln for DBM+CCM Magnesium do Brasil Hermano Franck (50 %); Groupe Roullier (50 %; in 2013) Y

• April 2018: start-up Magnezit Magnezit Group JSC Y

JORMAG, Jordan Nedmag Lhoist Group (50 %); NOM (50 %) N

• 2005: Al-Safi plant MHF + HT VSK on- Penoles (Magnelec - Industrias Peñoles SAB de CV (Grupo BAL) N

stream 50 ktpa syn. 98 % DBM, 10 ktpa Química del Rey)

CCM; APC halted operations RHI RHI (61 %); MSP (28,5 %); Chestnut (5,2 %); Silver (5,2 %) Y

• Feb 2017: sold to Manaseer Group for Merger with RHI concluded end-Oct 2017

USD 12,5 million SMZ SMZ a.s. Jelšava Y

• Q3 2018: plan to bring on stream, CCM Sibelco Australia SCR-Sibelco NV (acquired QMAG 2012) N

first, DBM decide later.

Ube Material Industries Ube Industries Group Y

refractories WORLDFORUM 10 (2018) [1] 3

MARKETS & ECONOMY

4 Outlook

Norway

In a nutshell, regarding China and the

Porsgrunn

Ireland

85,000 FM impact on mineral supply: this time it’s

90,000 CCM

USA Drogheda Seawater sourced

China

serious.

H1 2016 19,000

72,000 DBM

York, PA

200,000 DBD 85,000 CCM Turkey Dashiqiao, Liaoning Xi Jinpeng consolidated his position as

150,000 MDH 41,000 DBM

25m dolomite

Seawater sourced Eskisehir 22,500 FM China’s premier for a second term at the

260,000 DBM 5,000 CCM

Liaoning RHI Jinding 19th National Congress of the Communist

Belgium Magnesia Co. Ltd JV;

83.33% RHI Party of China (NCCPC) in October 2017

March les Dames

180,000 DBD

Austria China and his party will continue to drive home its

Brazil 31m dolomite Temporarily

Brumado, BA

Sinterco Dolomite JV;

70% Magnesita; 30% Breitenau Qingyang, Anhui closed 2015 reforms, including its robust clean-up of the

240,000 DBM (98.5% MgO) 190,000 DBM 65,000 DBD

150,000 DBM (95-96% MgO)

Lhoist

5,000 CCM 18m dolomite environment and business practices (a po-

Hochfilzen

60,000 CCM

Italy tential Environmental Tax has been mooted

343m magnesite 100,000 DBM

Radenthein

Global refractory

Uberaba, MG

72,000 gibbsitic clays

Marone

450,000 dolomite 48,000 CCM raw material for 2018).

15,000 spinel

22m clays

Santa Luz, BA

DBD

Breitenau sources of Continued tight supply and high prices for

Sept. 2017 sold to 20,000 MDH

30,000 chromite

1.2m chromite

Intocast AG MAGNIFIN JV; 50% refractory minerals (especially fused miner-

RHI; 50%

Additional reserves

37m Dolomite

CCM caustic calcined magnesia Martinswerke (HEM) als with power rationing and shutdowns

DBD dead burned dolomite

36m Graphite DBM dead burned magnesia enforced over winter) are expected into Q2

1m Kaolin FM fused magnesia (where known: nominal

1m Pyrophyllite MDH magnesium hydroxide

capacities, tpa; reserves, 2018, and likely H2 2018.

tonnes) Although prices may peak soon, physical

Fig. 5 Global refractory raw material sources of RHI MAGNESITA availability is the key issue. With some op-

erations remaining closed and others hav-

ing difficulty in securing environmental (and

• PFS for 100 ktpa MgCl2 brine and of explosives provision; and a crackdown on business) permits, we should expect to lose

104 ktpa basic magnesium carbonate illegally operating companies. some Chinese refractory magnesia produc-

• Gujarat State Fertilizers & Chemicals In summary, this brought about an almost tion capacity in 2018/19.

(21,5 %) 20 year potash offtake agreement instantaneous closure of 80–90 % of mag- There is also a move to reform the mag-

• “construction ready”, chasing financing nesia production capacity in Liaoning as nesite industry in China to a single, part

plants were closed for inspection. Some state-owned entity, China Magnesite Min-

3 China operations were able to restart later in the ing Co. Ltd, responsible for the majority of

The year 2017 will certainly live long in year, although many others need to invest in magnesite supply. Should this come to frui-

the memory of any trader or consumer of and install suitable antipollution equipment tion, then it is yet another transformation

Chinese refractory minerals, and refractory in order to restart, if at all. the market will need to adapt to.

magnesia was no exception. The enforced ban on dynamite provision A wider issue is the potential game changer

The year started with the abolition of the naturally curtailed any mine blasting ac- of refractory producers considering and

much maligned export quota system, initi- tivities and thus availability of primary raw evaluating the potential for adopting al-

ated in 1994, evolving and frustrating the material has been severely restricted, thus ternative refractory formulations to ease

global market annually to 2016’s export impacting feedstock for calcination plants. reliability on the magnesia input – perhaps

volume quota of 1,7 m tonnes magnesia, Like other minerals in China, much of the in- using more refractory dolomite, alumina-

with export licences quoted at RMB140– dustry capacity is made up of small and me- based alternatives, and increased refractory

330 (USD 20–48)/tonne; export tax 5 % dium sized companies, many of which have recycling.

CCM, 10 % for DBM and FM. sailed close to the wind regarding their The flip side of course is that it has given

A combination of pressure from the USA, book keeping and business practices. Many a new lease of life for the existing, emerg-

the EU and the WTO, and the Chinese wish- such companies may now fall foul of State ing, and potential new sources of refractory

ing to establish a new Foreign Trade Zone in Council Order 684 against "undocumented magnesia outside China. These will aim to

Liaoning resulted in the export quota sys- and unlicensed operating procedures" ef- reassure consumers of future consistent

tem being discarded from 1 January 2017. fective 1 October 2017. supply and quality and pick up the shortfall

This almost immediately resulted in an in- The upshot has been a sudden and severe in supply from China.

crease in magnesia export volumes and a shortage in refractory magnesia from China However, any investment/start-up needs to

lowering of prices at the start of 2017. accompanied by an unprecedented increase be now and there needs to be increased al-

However, this was short-lived as a triumvi- in export prices: DBM 95-96 % MgO FOB liances with the refractory manufacturers.

rate of central government decreed and im- China up from USD 300–400/t in January 2018 is already looking to be as exciting a

plemented measures were brought to bear 2017 to USD 900–1200/t in November year as 2017 for refractory magnesia.

from February to the end of the year with 2017; FM USD 400–600/t to USD 100–

clinical and unflinching force: environmen- 1200/t, according to Refractory Window.

tal inspections of mines and plants; control

4 refractories WORLDFORUM 10 (2018) [1]

You might also like

- Gill Battery Service ManualDocument67 pagesGill Battery Service ManualravNo ratings yet

- FeMo Publication Swinbourne 2018 Paper For MPEM - FINALDocument12 pagesFeMo Publication Swinbourne 2018 Paper For MPEM - FINALJuan Ignacio Gonzalez CabreraNo ratings yet

- MagnesiteDocument3 pagesMagnesiteBlackcat FreeManNo ratings yet

- Characterizing and Recovering The Platinum Group Minerals - A ReviewDocument19 pagesCharacterizing and Recovering The Platinum Group Minerals - A ReviewSlim Kat NkosiNo ratings yet

- Textbook of Polymer ScienceDocument596 pagesTextbook of Polymer Sciencenabil81% (26)

- Raw Materials For Manufacturing of Superior Quality Mgo-C BricksDocument8 pagesRaw Materials For Manufacturing of Superior Quality Mgo-C Bricksjom erfNo ratings yet

- Magnesite 2020Document17 pagesMagnesite 2020Bibek ChatterjeeNo ratings yet

- Characterisation of Different Commercial Reactive MagnesiaDocument13 pagesCharacterisation of Different Commercial Reactive MagnesiaSwaroop NarayananNo ratings yet

- MagnesiaDocument21 pagesMagnesia1866272No ratings yet

- Cenelec: HD 603 S1/A3Document742 pagesCenelec: HD 603 S1/A3Евгений ПузькоNo ratings yet

- Nickel Production From Low-Iron Laterite Ores - Process DescriptionsDocument12 pagesNickel Production From Low-Iron Laterite Ores - Process DescriptionsSun HaikuoNo ratings yet

- Minerals in Refractory Shapes - Which Way NowDocument4 pagesMinerals in Refractory Shapes - Which Way NowEmílio LobatoNo ratings yet

- C1797-16e1 Standard Specification For Ground Calcium Carbonate and Aggregate Mineral Fillers For Use in Hydraulic Cement ConcreteDocument5 pagesC1797-16e1 Standard Specification For Ground Calcium Carbonate and Aggregate Mineral Fillers For Use in Hydraulic Cement ConcreteFahad RedaNo ratings yet

- Classification Wirsing 2015Document49 pagesClassification Wirsing 2015Moud Sakly100% (1)

- Cement Plant VIPDocument51 pagesCement Plant VIPengr kazamNo ratings yet

- Presentation Cement TMDocument35 pagesPresentation Cement TMengr kazamNo ratings yet

- 4 Metallurgical and Refractory Minerals NotesDocument9 pages4 Metallurgical and Refractory Minerals NotesNamwangala Rashid Natindu100% (1)

- Classification Wirsing 2015 PDFDocument49 pagesClassification Wirsing 2015 PDFvũ minh tâmNo ratings yet

- Filtration Report.Document35 pagesFiltration Report.Kartik Balasubramaniam70% (10)

- Refratechnik Bricks Wear RreasonsDocument8 pagesRefratechnik Bricks Wear Rreasonsengr kazamNo ratings yet

- How To Choise Refractory For Metallurgy FurnacesDocument15 pagesHow To Choise Refractory For Metallurgy FurnacesGuilherme Dos Santos MoreiraNo ratings yet

- RWF News 12367Document8 pagesRWF News 12367engr kazamNo ratings yet

- The Science Technology and Applications of Magnesium - 1998 - F H FroesDocument5 pagesThe Science Technology and Applications of Magnesium - 1998 - F H FroesMingying QinNo ratings yet

- 4 - RHIM Spinosphere Technology (PTSI Webinar)Document34 pages4 - RHIM Spinosphere Technology (PTSI Webinar)neo 87No ratings yet

- Investigation Into Coal-Based Magnetizing Roasting of An Iron-Rich Rare Earth Ore and The Associated Mineralogical TransformationsDocument13 pagesInvestigation Into Coal-Based Magnetizing Roasting of An Iron-Rich Rare Earth Ore and The Associated Mineralogical TransformationsHoracio Piña SpeziaNo ratings yet

- Beard p690-698 02Document9 pagesBeard p690-698 02mauricio rojas alvarezNo ratings yet

- Magnesium OxidetDocument3 pagesMagnesium OxidetmarctcNo ratings yet

- Magnesite Deposit of Lesser Himalaya IndiaDocument6 pagesMagnesite Deposit of Lesser Himalaya IndiaBibek ChatterjeeNo ratings yet

- INTRAWDocument2 pagesINTRAWSergii KlochkovNo ratings yet

- Recent Growing Demand For Magnesium in The Automotive IndustryDocument5 pagesRecent Growing Demand For Magnesium in The Automotive IndustrySapandeepNo ratings yet

- Artigo 4 MGDocument4 pagesArtigo 4 MGAllan BarreiroNo ratings yet

- Preparation and Characterization of Basic Ceramics From Moroccan MagnesiteDocument9 pagesPreparation and Characterization of Basic Ceramics From Moroccan MagnesitefonsNo ratings yet

- An Investigation of The Factors Affecting The Recovery of Molybdenite in The Kennecott Utah Copper Bulk Flotation CircuitDocument9 pagesAn Investigation of The Factors Affecting The Recovery of Molybdenite in The Kennecott Utah Copper Bulk Flotation CircuitDaniel Ernesto Nauduan FloresNo ratings yet

- X Ray Transmission Based Ore Sorting atDocument10 pagesX Ray Transmission Based Ore Sorting atThomasHearneNo ratings yet

- Magnesia-Spinel Composite Refractories For Cement Rotary KilnsDocument8 pagesMagnesia-Spinel Composite Refractories For Cement Rotary Kilnsakbar davoodiNo ratings yet

- TasmaniaDocument20 pagesTasmaniaVavania MNo ratings yet

- For Rare-Earth Production.: A Better PlanDocument4 pagesFor Rare-Earth Production.: A Better PlankaiselkNo ratings yet

- Report Goldman Sachs PDFDocument31 pagesReport Goldman Sachs PDFJose Luis Puma VenturaNo ratings yet

- 2007, MN Review Part 1Document23 pages2007, MN Review Part 1Sumitro AgusNo ratings yet

- Canter Ford 1985Document49 pagesCanter Ford 1985DanielNo ratings yet

- A Review On Magnesium Aluminate (Mgal2O4) Spinel: Synthesis, Processing and ApplicationsDocument51 pagesA Review On Magnesium Aluminate (Mgal2O4) Spinel: Synthesis, Processing and ApplicationsSajan P ShamsudeenNo ratings yet

- Magnesium Aluminate Spinel Raw Materials-For High PerformanceDocument13 pagesMagnesium Aluminate Spinel Raw Materials-For High Performanceshiqiang liNo ratings yet

- Grade and Product Quality of Mineral Sands Using MicroCTDocument11 pagesGrade and Product Quality of Mineral Sands Using MicroCTabrahamsrs72No ratings yet

- Molybdenite Polytypism and Its Implications For Processing and Recovery: A Geometallurgical-Based Case Study From Bingham Canyon Mine, UtahDocument6 pagesMolybdenite Polytypism and Its Implications For Processing and Recovery: A Geometallurgical-Based Case Study From Bingham Canyon Mine, UtahUnurbayar EnkhbaatarNo ratings yet

- Processing of Ores of Titanium, Zirconium, Hafnium, Niobium, Tantalum, Molybdenum, Rhenium, and Tungsten: International Trends and The Indian SceneDocument32 pagesProcessing of Ores of Titanium, Zirconium, Hafnium, Niobium, Tantalum, Molybdenum, Rhenium, and Tungsten: International Trends and The Indian Scenemufti abdillahNo ratings yet

- Mineral Wool Producers PDFDocument7 pagesMineral Wool Producers PDFZoltán BoérNo ratings yet

- 2015-07 - ZR - A Closer Look at Magnesium 10p ===رامین فریدی - ترجمه کاملDocument10 pages2015-07 - ZR - A Closer Look at Magnesium 10p ===رامین فریدی - ترجمه کاملraminNo ratings yet

- Selection of Optimum Ferronickel GradeDocument9 pagesSelection of Optimum Ferronickel GraderezaardNo ratings yet

- 2 - Basic Bricks - Dec 2017 Incl RED2Document62 pages2 - Basic Bricks - Dec 2017 Incl RED2quỳnh lêNo ratings yet

- Geol Resources Lecture 15 (Greisen SN-W and Pegmatites)Document29 pagesGeol Resources Lecture 15 (Greisen SN-W and Pegmatites)ArchieBunneyNo ratings yet

- The FTIR Spectra of Raw Magnesite and Sintered MagnesiteDocument5 pagesThe FTIR Spectra of Raw Magnesite and Sintered MagnesiteEditor IJTSRDNo ratings yet

- NEW Mineral Resources FULLDocument61 pagesNEW Mineral Resources FULLHafsa JavedNo ratings yet

- Geology of Titanium-Mineral Deposit Force1991Document113 pagesGeology of Titanium-Mineral Deposit Force1991Nicouux MagnetiteNo ratings yet

- Ch-5 Minerals and Energy Resources NoteDocument6 pagesCh-5 Minerals and Energy Resources Notetanusree1603No ratings yet

- Economic Evaluation of Magnesite Deposits of Khuzdar, Balochistan, PakistanDocument6 pagesEconomic Evaluation of Magnesite Deposits of Khuzdar, Balochistan, Pakistanengr kazamNo ratings yet

- Magnesium-A ResearchDocument19 pagesMagnesium-A ResearchDhanvini BasavaNo ratings yet

- Recent Advances in Magnetization Roasting of Refractory Iron Ores: A Technological Review in The Past DecadeDocument13 pagesRecent Advances in Magnetization Roasting of Refractory Iron Ores: A Technological Review in The Past DecaderavibelavadiNo ratings yet

- Raphite: by Rustu S. KalyoncuDocument11 pagesRaphite: by Rustu S. KalyoncudimasNo ratings yet

- (Prelim) Mineral ResourcesDocument19 pages(Prelim) Mineral ResourcesMarkNo ratings yet

- Alloys MGDocument16 pagesAlloys MGJuan Diego Ospina FlorezNo ratings yet

- Microcrystalline GraphiteDocument4 pagesMicrocrystalline GraphiteFamiloni LayoNo ratings yet

- BR Dolomitic Vs Mgo BriquettesDocument4 pagesBR Dolomitic Vs Mgo BriquettesAbhinandan ChatterjeeNo ratings yet

- INTERVIEW China's Magnesium Price Direction in 2022 Hinges On CoalDocument4 pagesINTERVIEW China's Magnesium Price Direction in 2022 Hinges On CoalMahdyeNo ratings yet

- The Primary Production of Platinum Group Metals (PGMS)Document7 pagesThe Primary Production of Platinum Group Metals (PGMS)Erdi Sofyandra AdikriNo ratings yet

- Addressing Criticality in Rare Earth Elements Via Permanent Magnets Recycling. INGLESDocument12 pagesAddressing Criticality in Rare Earth Elements Via Permanent Magnets Recycling. INGLESJunior SolonNo ratings yet

- Toaz - Info Clinker Vs Kiln Feed Factor PRDocument3 pagesToaz - Info Clinker Vs Kiln Feed Factor PRengr kazamNo ratings yet

- Brochure AnkergunDocument2 pagesBrochure Ankergunengr kazamNo ratings yet

- Carsit Sol CastableDocument3 pagesCarsit Sol Castableengr kazamNo ratings yet

- RHIM New CatalogDocument42 pagesRHIM New Catalogengr kazamNo ratings yet

- NOx Reduction TechniquesDocument37 pagesNOx Reduction Techniquesengr kazamNo ratings yet

- Presentazione OTP After SalesDocument12 pagesPresentazione OTP After Salesengr kazamNo ratings yet

- Economic Evaluation of Magnesite Deposits of Khuzdar, Balochistan, PakistanDocument6 pagesEconomic Evaluation of Magnesite Deposits of Khuzdar, Balochistan, Pakistanengr kazamNo ratings yet

- Bvs 2034 DegbDocument8 pagesBvs 2034 Degbengr kazamNo ratings yet

- Modeling of Process Parameters and Analysis of Effect of Variables in The Dead Burning of Magnesite in Rotary KilnDocument8 pagesModeling of Process Parameters and Analysis of Effect of Variables in The Dead Burning of Magnesite in Rotary Kilnengr kazamNo ratings yet

- Production of DBMDocument2 pagesProduction of DBMengr kazamNo ratings yet

- ANKRAL Q1 Zement ISO ENDocument1 pageANKRAL Q1 Zement ISO ENengr kazamNo ratings yet

- RDF Refuse Derived Fuel An Alternate Energy Resource - July - 2015 - 7170430234 - 2908640Document3 pagesRDF Refuse Derived Fuel An Alternate Energy Resource - July - 2015 - 7170430234 - 2908640engr kazamNo ratings yet

- 7th. INTERNATIONAL CONGRESS OF THE CHEMISTRY OF CEMENT - Vol I Principal Report - Paris - 1980Document41 pages7th. INTERNATIONAL CONGRESS OF THE CHEMISTRY OF CEMENT - Vol I Principal Report - Paris - 1980engr kazamNo ratings yet

- 2019-06 RHI Magnesita Reference List CARSIT M10Z-6-DEDocument1 page2019-06 RHI Magnesita Reference List CARSIT M10Z-6-DEengr kazamNo ratings yet

- 1 RefreactoriesDocument18 pages1 Refreactoriesengr kazamNo ratings yet

- 2014-07 RHI Reference List CARSIT SOL M10-6Document2 pages2014-07 RHI Reference List CARSIT SOL M10-6engr kazamNo ratings yet

- Cement Kiln RefractoryDocument3 pagesCement Kiln Refractoryengr kazamNo ratings yet

- 05 - G. Hesslemann (Doosan Babcock)Document20 pages05 - G. Hesslemann (Doosan Babcock)engr kazamNo ratings yet

- 12 Wear Mechanism 2015Document52 pages12 Wear Mechanism 2015engr kazamNo ratings yet

- Mixing Ratio 1Document3 pagesMixing Ratio 1engr kazamNo ratings yet

- Cement Kiln Flame FormationDocument7 pagesCement Kiln Flame Formationengr kazamNo ratings yet

- Coal Carbon ISO-609-1975Document9 pagesCoal Carbon ISO-609-1975engr kazamNo ratings yet

- Project Engineer MR - Naeem Evaluation Matrix 01Document2 pagesProject Engineer MR - Naeem Evaluation Matrix 01engr kazamNo ratings yet

- Coal Ash ISO-1171-1997Document9 pagesCoal Ash ISO-1171-1997engr kazamNo ratings yet

- Welding Alloys Cement-BrochureDocument11 pagesWelding Alloys Cement-Brochureengr kazamNo ratings yet

- Basic Bricks PropertiesDocument4 pagesBasic Bricks Propertiesengr kazamNo ratings yet

- Mathematical Model and System Identification To Optimize Inputs Conditions For Plant Design of CyclohexaneDocument28 pagesMathematical Model and System Identification To Optimize Inputs Conditions For Plant Design of CyclohexaneBüşraNo ratings yet

- Marine Coating - Sealer - Sureseal PS 700Document1 pageMarine Coating - Sealer - Sureseal PS 700Sandro BNo ratings yet

- SAR Surface AeratorDocument8 pagesSAR Surface Aeratorqoreysoe19No ratings yet

- SOP For Handling Out of Specification (OOS)Document8 pagesSOP For Handling Out of Specification (OOS)Turiyo AnthonyNo ratings yet

- Chemistry of Rocket PropellantsDocument7 pagesChemistry of Rocket PropellantsH JNo ratings yet

- Keyfix E - TDS Epoxy Resin For DowelsDocument4 pagesKeyfix E - TDS Epoxy Resin For Dowelsjude tallyNo ratings yet

- CLASS X (2019-20) Science (Code 086) Sample Paper-4: Section ADocument6 pagesCLASS X (2019-20) Science (Code 086) Sample Paper-4: Section ARitik GolaNo ratings yet

- CitriSurf 3050 Product InformationDocument2 pagesCitriSurf 3050 Product InformationHerrera ErickNo ratings yet

- Electron Transport ChainDocument40 pagesElectron Transport ChainUtkarsh SharmaNo ratings yet

- Downloaded From: The Bookcorner Study BotDocument10 pagesDownloaded From: The Bookcorner Study BotSarthac JainNo ratings yet

- Structural Polyglass Spec Sheet PDFDocument2 pagesStructural Polyglass Spec Sheet PDFChathura DarshanaNo ratings yet

- Determination of Heavy Metals On The Non-Woven in Wet Wipes Using ICP-MSDocument9 pagesDetermination of Heavy Metals On The Non-Woven in Wet Wipes Using ICP-MSAhmad AlshahrourNo ratings yet

- Safety Data Sheet: Acetylene (Dissolved)Document2 pagesSafety Data Sheet: Acetylene (Dissolved)UMUTNo ratings yet

- Octyl AcetateDocument6 pagesOctyl AcetateKristine BautistaNo ratings yet

- Lecture 7a: Synthesis of CoumarinsDocument15 pagesLecture 7a: Synthesis of CoumarinsAndrew GirgisNo ratings yet

- 1 The Particle Model QP - Gcse Ocr Chemistry Gateway ScienceDocument5 pages1 The Particle Model QP - Gcse Ocr Chemistry Gateway ScienceChandrasekaran SubramaniamNo ratings yet

- PHD Thesis - Eugene Atiemo (Final)Document210 pagesPHD Thesis - Eugene Atiemo (Final)desalegn aberaNo ratings yet

- B3 Biological Molecules Book Report - Duc MinhDocument7 pagesB3 Biological Molecules Book Report - Duc MinhMinh Hoàng ĐứcNo ratings yet

- Max-Temp CTVB/CTVT: Theoretical Working Point Performance ChartDocument7 pagesMax-Temp CTVB/CTVT: Theoretical Working Point Performance ChartIgor SpirovNo ratings yet

- Araldite Price List - InTERNAL FinalDocument10 pagesAraldite Price List - InTERNAL FinalAashish PaulNo ratings yet

- Proseal Surfaseal: Beautiful SurfacesDocument4 pagesProseal Surfaseal: Beautiful SurfacesChoice OrganoNo ratings yet

- Filter Integrity Test Certificate Purpose: To Determine The Integrity of Installed Hepa FiltersDocument2 pagesFilter Integrity Test Certificate Purpose: To Determine The Integrity of Installed Hepa FiltersbalajichandrakantNo ratings yet

- Utilitatea Protein Coronei in TNBCDocument19 pagesUtilitatea Protein Coronei in TNBCRadu AndreiNo ratings yet

- Questions ElisaDocument4 pagesQuestions ElisaMariz MartinezNo ratings yet

- Water Supply Engineering PracticalDocument5 pagesWater Supply Engineering PracticalJust for FunNo ratings yet