Professional Documents

Culture Documents

Companies Accounting Class Execises - Williams LTD

Uploaded by

ndilimotuwilika001Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Companies Accounting Class Execises - Williams LTD

Uploaded by

ndilimotuwilika001Copyright:

Available Formats

Accounting for Companies_Financial Accounting 1A_15 April 2019

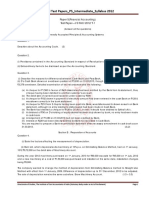

The following information was obtained from the accounting records of Williams Limited, a distribution

of vehicle motor parts:

WILLIAMS LIMITED

TRIAL BALANCE ON 31 DECEMBER 2011

DEBIT CREDIT

N$ N$

Stated capital: 2 000 000 ordinary shares without par value 2 325 000

12% Preference shares capital: 200 000 shares at N$ each 200 000

Retained earnings (1 January 2011) 1 320 000

General reserve (1 January 2011) 418 700

8% Mortgage loan from Investec 1 500 000

Trade creditors 10 000

Land and buildings (at cost) 2 800 000

Office equipment (at cost) 280 000

Delivery vehicles (at cost) 1 200 000

Accumulated depreciation on office equipment 122 500

Accumulated depreciation on delivery vehicles 480 000

Trade debtors 977 500

Allowance for credit losses (1 January 2011) 52 000

Inventory 920 000

Cash and cash equivalents 1 100 000

Inland Revenue: Normal tax (provisional tax payments) 201 000

Sales 5 700 000

Cost of sales 3 800 000

Distribution expenses 303 000

Administrative expenses 324 000

Other operating expenses 102 700

Interest on mortgage loan paid 120 000

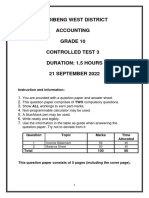

Additional information and adjustments:

1. The company’s authorised share capital consists of:

3 000 000 ordinary shares with no par value

500 000 12% preference shares at N$ 1 par value.

2. On 1 December 2011, the directors of the company decided and resolved to use their general

authorisation to affect the following:

To issue 300 000 12% preference shares to the public at par value.

To convert the 2 000 000 no par ordinary shares into par value shares of N$ 1 each.

These transactions have not yet being recorded.

3. Annual depreciation has not yet been provided for. The company’s accounting policy states

that depreciation is written off as follows:

Office equipment 25% diminishing balance method

Delivery vehicles 25% straight-line method

The company does not provide for depreciation on land and buildings. Office equipment

exclusively used for administrative purposes and delivery vehicles used in the distribution

of vehicle parts. The company did not purchase or dispose of any office or delivery vehicles

during the year.

4. The company purchased land and buildings (stand 34, Sandton) in 2009 for N$ 2 800 000 by

taking out a mortgage loan from Investec. The company’s accounting policy states that land

and buildings should be revalued. Mr Damon Hill, a sworn appraiser, revalued the land and

buildings for the first time on 31 December 2011 at a fair value of N$3 500 000. No entries

pertaining to the revaluation have been recorded.

5. Interest on the mortgage loan of N$120 000 was calculated correctly and has already been

paid.

6. The company’s credit controller, Mr Juan Montoya, performed an analysis of the company’s

debtors on 31 December 2011. The analysis indicated that N$102 000 of the outstanding

debtors are expected not to be recoverable. The allowance for credit losses should be adjusted

accordingly. Credit losses are considered part of the operating expenses.

7. The shareholders approved a final ordinary dividend of 50c per share 0n 31 December 2011.

8. It was decided on 31 December 2011 to transfer a further N$11 300 to the general reserve.

This transaction has not yet been recorded.

9. The normal income tax rate for companies is 32%.

Required: (comparative amounts are required where adequate information is available)

(a) Prepare the adjusting journal entries for the items in points 2,3,4,6,7 & 8 above.

(b) Prepare the following in accordance with the requirements of International Financial Reporting

Standards (IFRS) and the Companies Act 28 of 2004:

1. Statement of profit or loss and other comprehensive income for the year ended 31

December 2011 according to function of expenses.

2. Statement of financial position as at 31 December 2011

3. Statement of changes in equity for the year ended 31 December 2011.

You might also like

- How To Stop Employers From Withholding Income TaxesDocument14 pagesHow To Stop Employers From Withholding Income TaxesSaleem Alhakim90% (10)

- GZU Fin Reporting Masters Question BankDocument31 pagesGZU Fin Reporting Masters Question BankTawanda Tatenda Herbert100% (2)

- Impulse Wave PatternDocument13 pagesImpulse Wave Patternpuplu123No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- O Level Important Questions PDFDocument55 pagesO Level Important Questions PDFibrahoNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Long Quiz Overview Pas23 ReviewerDocument15 pagesLong Quiz Overview Pas23 ReviewerHassanhor Guro Bacolod100% (1)

- Financial Accounting and Reporting Problems Freebie PDFDocument46 pagesFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- PNB Vs Sta. MariaDocument3 pagesPNB Vs Sta. MariaJD DXNo ratings yet

- Supplementary AgreementDocument2 pagesSupplementary AgreementI CreateNo ratings yet

- Seminar 8 PART BDocument3 pagesSeminar 8 PART BGaba RieleNo ratings yet

- Icmap Past QuestionsDocument11 pagesIcmap Past QuestionsJahanzaib ButtNo ratings yet

- ExercisesDocument20 pagesExercisesRolivhuwaNo ratings yet

- CSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Document8 pagesCSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Melokuhle MhlongoNo ratings yet

- Accounting Final Mock 1 2023Document13 pagesAccounting Final Mock 1 2023diya pNo ratings yet

- F 13 Financial Accounting CpaDocument9 pagesF 13 Financial Accounting CpaMarcellin MarcaNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- April 2022 (Fa4)Document7 pagesApril 2022 (Fa4)Amelia RahmawatiNo ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- Postal Test Papers - P5 - Intermediate - Syllabus 2012Document27 pagesPostal Test Papers - P5 - Intermediate - Syllabus 2012Viswanathan SrkNo ratings yet

- Intermediate Group I Test Papers PDFDocument88 pagesIntermediate Group I Test Papers PDFkrishna PNo ratings yet

- Preparing Financial StatementsDocument6 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- 05 s101 FfaDocument5 pages05 s101 FfaMuhammad AsifNo ratings yet

- Financial Accounting A November 2013Document7 pagesFinancial Accounting A November 2013Munodawafa ChimhamhiwaNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Test 1 - 2022 08 17Document3 pagesTest 1 - 2022 08 17MiclczeeNo ratings yet

- AC405 Practice QuestionDocument5 pagesAC405 Practice QuestionCalvin Thompson kamukosiNo ratings yet

- Financial Accounting and Reporting: RequirementsDocument4 pagesFinancial Accounting and Reporting: RequirementsebshuvoNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Incomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Document5 pagesIncomplete Records: Calculation of Profit or Loss (Without Preparing Financial Statements)Tawanda Tatenda Herbert100% (1)

- Tugas CH 1, 2 Dan 4 Inter I Sepr 17Document2 pagesTugas CH 1, 2 Dan 4 Inter I Sepr 17dheyaNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- PPE Disclosure 2023Document2 pagesPPE Disclosure 2023Liwena DelinNo ratings yet

- EZ 1 Financial AccountingDocument4 pagesEZ 1 Financial AccountingMohona SenguptaNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- Quiz - Financial Statements With SolutionDocument6 pagesQuiz - Financial Statements With SolutionMary Yvonne AresNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- CE Principles of Accounts 2000 PaperDocument7 pagesCE Principles of Accounts 2000 Paperapi-3747191100% (1)

- Name: Dao Mai Linh Class: F13B ID NUMBER: F13-127Document30 pagesName: Dao Mai Linh Class: F13B ID NUMBER: F13-127Linhzin LinhzinNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- Extra Questions - A LevelDocument8 pagesExtra Questions - A LevelMUSTHARI KHANNo ratings yet

- 2021 Unit 8 Tutorial QuestionsDocument7 pages2021 Unit 8 Tutorial Questions日日日No ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Aud and atDocument21 pagesAud and atVtgNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Functional Currency Is Not The Currency of A Hyperinflationary EconomyDocument5 pagesFunctional Currency Is Not The Currency of A Hyperinflationary EconomyArn KylaNo ratings yet

- Financial Management: Page 1 of 7Document7 pagesFinancial Management: Page 1 of 7cima2k15No ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Physical and Financial Decrease of Fixed Assets AreDocument180 pagesPhysical and Financial Decrease of Fixed Assets AreMeliha Mednolucanin (KULT)No ratings yet

- Group Assignment On FSDocument4 pagesGroup Assignment On FSHuyền TrangNo ratings yet

- Fa May June - 2012Document4 pagesFa May June - 2012xodic49847No ratings yet

- Unit 1 2018 Paper 2Document9 pagesUnit 1 2018 Paper 2Pettal BartlettNo ratings yet

- Unit - 19 - Accounting and Financial Statement SlidesDocument41 pagesUnit - 19 - Accounting and Financial Statement SlidesPychNo ratings yet

- Over TradingDocument4 pagesOver TradingPiyush Gupta100% (1)

- FMO Module 2Document8 pagesFMO Module 2Sonia Dann KuruvillaNo ratings yet

- Chapter 13Document56 pagesChapter 13Dyllan Holmes0% (1)

- Chapter 3.5: Calculating The Lifetime Value of A CustomerDocument24 pagesChapter 3.5: Calculating The Lifetime Value of A CustomerT HawkNo ratings yet

- Seminar Outline 4Document16 pagesSeminar Outline 4cccqNo ratings yet

- Siemens Company PresentationDocument44 pagesSiemens Company PresentationUhule PeterNo ratings yet

- Finance: Finance Is A Field That Is Concerned With The Allocation (Investment)Document3 pagesFinance: Finance Is A Field That Is Concerned With The Allocation (Investment)nidayousafzaiNo ratings yet

- The Insider CodeDocument15 pagesThe Insider CodeJohn PatlolNo ratings yet

- 0126financial and Corporate ReportingDocument6 pages0126financial and Corporate ReportingSmag SmagNo ratings yet

- TOI Ahmadabad PDFDocument18 pagesTOI Ahmadabad PDFJugarNo ratings yet

- How To Start A Business Enterprise PDFDocument22 pagesHow To Start A Business Enterprise PDFDhana RedNo ratings yet

- Experiential MarketingDocument22 pagesExperiential Marketingjatin_met1No ratings yet

- Sensata Technologies Holland B.V: InvoiceDocument2 pagesSensata Technologies Holland B.V: InvoiceDayana IvanovaNo ratings yet

- Test Bank For Principles of Managerial Finance Arab World Edition Pack Lawrence J Gitman Chad J Zutter Wajeeh Elali Amer Al Roubaie 2Document35 pagesTest Bank For Principles of Managerial Finance Arab World Edition Pack Lawrence J Gitman Chad J Zutter Wajeeh Elali Amer Al Roubaie 2bibberbombycid.p13z100% (40)

- Financial Markets Institutions Tutorial Sheet 3Document2 pagesFinancial Markets Institutions Tutorial Sheet 3BriannaNo ratings yet

- Partnership DissolutionDocument2 pagesPartnership DissolutionAnnie AseradoNo ratings yet

- FGHGHDFHGFDocument10 pagesFGHGHDFHGFbriandss123No ratings yet

- Curriculum VitaeDocument3 pagesCurriculum VitaeOttoNo ratings yet

- Dilip Chawla Vs Ravinder Kumar & Anr. On 10 August, 2017Document6 pagesDilip Chawla Vs Ravinder Kumar & Anr. On 10 August, 2017Anuradha MohapatraNo ratings yet

- Fundamentals of Human Resource ManagementDocument25 pagesFundamentals of Human Resource ManagementKim Rommel PanaguitonNo ratings yet

- Macroeconomics Australian 4th Edition Blanchard Test BankDocument26 pagesMacroeconomics Australian 4th Edition Blanchard Test BankStephenChavezgkze100% (52)

- Afin210 FPD 8 2015 1 PDFDocument186 pagesAfin210 FPD 8 2015 1 PDFGizachew Zeleke100% (1)

- Cost Accounting Updated VersionDocument128 pagesCost Accounting Updated VersionTct TurgutNo ratings yet

- Chapter 6 BFMDocument59 pagesChapter 6 BFMrifat AlamNo ratings yet