Professional Documents

Culture Documents

Test 6 Solution

Uploaded by

Zoya RehmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test 6 Solution

Uploaded by

Zoya RehmanCopyright:

Available Formats

CMA VIPUL SHAH CHAPTER 6 GOOD IMPORTED BY POST,BAGGAGE,STORES

CHAPTER 6 GOOD IMPORTED BY POST, BAGGAGE, STORIES

Illustration 1

Write a brief note on the declaration made by the owner of baggage. (ICAI Material)

Solution

Section 77 and baggage declaration rule: Under this section, the owner of the baggage has to

make a declaration of its contents to the proper officer of customs, for the purpose of clearing

it. This is known as Baggage Declaration Form. Declaring packing list is sufficient declaration.

The declaration of the goods brought in is an absolutely necessity. If the goods are not declared

under section 77, the passenger cannot subsequently claim the benefit under section 80 and the

goods are liable for confiscation.

Illustration 2

Explain in brief the duty exemption to baggage under section 79(1) of the Customs Act, 1962.

(Exam Question May 2010, RTP May 2011)

Solution

Section 79(1) of the Customs Act, 1961 exempts the bona fide baggage of the passengers.

Following Baggage is passed free of duty:

1. Articles in the baggage of a passenger / crew for the minimum period prescribed by the

Baggage Rules, 2016. These Rules, as on date, do not prescribe any minimum period for use of

articles by the passengers / crew. However, totally unused articles may not be held as bona

fide baggage.

2. Articles for use by passenger or his family or bona fide gifts or souvenirs provided that the

value of each such article does not exceed the limits prescribed in the aforesaid Baggage rules.

Illustration 3

Mr. Anil and his wife (non – tourist Indian passengers) are returning from Dubai to India after

staying there for a period of two years. They wish to bring gold jewellery purchased from Dubai.

Please enumerate provisions of customs laws for jewellery allowance in their case. (ICAI Material)

Solution

As per rule 5 of the Baggage Rules, 2016, a passenger who has been residing abroad for more than

one year and returns to India shall be allowed duty free clearance of jewellery in bona fide baggage

as under:

Jewellery upto a weight of 20 grams with a value cap of Rs. 50,000 for a gentlemen passengers.

Jewellery upto a weight of 40 grams with a value cap of Rs.1,00,000 for a lady passenger.

www.vipulshah.org 7559173787 6.1

CMA VIPUL SHAH CHAPTER 6 GOOD IMPORTED BY POST,BAGGAGE,STORES

Thus, in the given case, Mr. Anil would be allowed duty free jewellery upto a weight of 20 grams

with a value cap of Rs. 50,000 and his wife would be allowed duty free jewellery upto a weight of

40 grams with a value of cap of Rs.1,00,000.

Further, in addition to the jewellery allowance, Mr. Anil and his wife would also be allowed duty

free clearance of jewellery worth Rs.1,00,000 (Rs. 50,000 per person) as part of free baggage

allowance.

Illustration 4

Mr. Nirvaan, an Indian resident, aged 40 years, returned to India on 10.2.2017 after visiting

England. He had been to England on 1.02.2017. On his way back to India he brought following goods

with him:

1. Personal effect like clothes etc. valued at Rs.2,00,000

2. 1 litre of wine worth Rs. 10,000

3. Sound system worth Rs. 50,000

4. A mobile worth Rs. 20,000

a. What is the customs duty payable?

b. Would your answer differ if Mr. Nirvaan the tourist foreign origin

c. Would your answer differ if Mr. Nirvaan is arriving by land route.

Solution

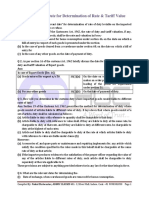

a. Computation of Duty

Duty free allowance (Rs.) Non duty free

allowance

Personal effect Nil

Others

1 litter of wine 10,000

Sound system 50,000

Mobile 20,000

Total 80,000

Less: Duty free limit (50,000)

Total 30,000

Duty @ 38.5% 11,550

b. If Mr. Nirvaan is the tourist of foreign origin, then duty free limit is 15,000. Therefore,

Duty payable = (80,000 – 15,000) x 38.5% = Rs. 25,025

c. If Mr. John is arriving by land route, then no duty free limit is available.

Duty payable = 80,000 x 38.5% = Rs. 30,800

Note:

If passenger is coming from country other than Nepal, Bhutan and Myanmar personal effect –

allowed duty free, other duty free limit is Rs. 50,000

www.vipulshah.org 7559173787 6.2

CMA VIPUL SHAH CHAPTER 6 GOOD IMPORTED BY POST,BAGGAGE,STORES

Illustration 5

Mr. Samuel, a US resident aged 35 years, has come to India on a tourist visa for a month – long

vacation. He carries with him, as part of baggage, the following:

Particulars Value in Rs.

Travel souvenirs 85,000

Other articles carried on in person 1,50,000

80 sticks of cigarettes of Rs.100 each 8,000

30 cartridges of fire arms valuing Rs.500 each 15,000

One litre wine 15,000

With reference to the Baggage Rules, 2016, determination whether Mr. Samuel will be required to

pay any customs duty (CA Final RTP May 2020)

Solution

As per rule 3 of Baggage Rules, 2016, tourist of foreign origin, excluding infant, is allowed duty

free clearance of

1. Travel souvenirs and

2. Articles upto the value of Rs. 15,000 (excluding, inter alia, cigarettes exceeding 100 sticks,

cartridges of fire arms exceeding 50 and alcoholic liquor or wines in excess of two litres), if

carried on in person.

Further, any articles the value of which exceeds the duty free allowance admissible to such

passenger or member under the Baggage Rules, 2016, is chargeable to customs duty @ 35%. The

effective rate of duty becomes 38.5% after including social welfare surcharge @ 10% on customs

duty.

Accordingly, the customs duty payable by Mr. Samuel will be calculated as under:

Computation of custom duty payable Rs.

Travel souvenir Nil

Articles carried on in person 1,50,000

Cigarettes (since the number of cigarettes does not exceed 100, the same will be 8,000

covered within the scope of rule 3 of Baggage Rules, 2016 and thus, be eligible for

general free allowance (GFA) or concessional rate of duty applicable to baggage)

Firm arms cartridge (Since the number of fire arms cartridge does not exceed 50, 15,000

the same will be covered within the scope of rule 3 of Baggage Rules, 2016 and thus,

be eligible for GFA or concession rate of duty applicable to baggage)

One litre of wine (since the quantity of wine does not exceed 2 litres, the same will 15,000

be covered within the scope of rule 3 of baggage rules, 2016 and thus, be eligible for

GFA or concessional rate of duty applicable to baggage)

Baggage within the scope of rule 3 of Baggage Rules, 2016 1,88,000

Less: GFA 15,000

Baggage on which duty is payable 1,73,000

Customs duty payable @ 38.5% 66,605

www.vipulshah.org 7559173787 6.3

CMA VIPUL SHAH CHAPTER 6 GOOD IMPORTED BY POST,BAGGAGE,STORES

Illustration 6

After visiting USA for a month, Mrs. And Mr. Iyer (Indian residents aged 35 and 40 years

respectively) brought to India a laptop computer valued at Rs. 70,000, used personal effects valued

Rs.1,40,000 and a personal computer for Rs. 58,000. Calculate the custom duty payable by Mrs. &

Mr. Iyer, if any (CA Final Nov. 19 Exam Old) (ICAI Material)

Solution

1. As per the Baggage Rules, 2016, an Indian resident arriving from an country other than Nepal,

Bhutan or Myanmar is allowed duty free clearance of:

a. Used personal effects and travel souvenirs without any value limit

b. Articles (other than certain specified articles) up to a value of Rs. 50,000 carried as a

accompanied baggage (General duty free baggage allowance).

c. Further, such general duty free baggage allowance of a passenger cannot be pooled with the

general duty free baggage allowance of any other passenger.

2. One laptop computer when imported into India by a passengers of the age of 18 years or above

(other than member of crew) is exempt from whole of the customs duty.

3. (a) Accordingly, there will be no customs duty on used personal effects (worth Rs.1,40,000) of

Mrs. And Mr. Iyer and laptop computer brought by them will be exempt from duty.

(b) Duty payable on personal computer after exhausting the duty free baggage allowance will be

Rs. 58,000 – Rs. 50,000 = Rs. 8,000

(c) Effective rate of duty for baggage = 38.5% (including SWS)

Therefore, total customs duty = Rs. 3,080

www.vipulshah.org 7559173787 6.4

You might also like

- Q. What Is The Rate of Customs Duty On Baggage?Document20 pagesQ. What Is The Rate of Customs Duty On Baggage?z_eguyNo ratings yet

- Baggage, Postage and Courier Under Custom ActDocument38 pagesBaggage, Postage and Courier Under Custom Actamin pattani100% (8)

- UNIT 6 Import ExportDocument14 pagesUNIT 6 Import Exportprayana smartwisetechNo ratings yet

- Sanju (Provision Regarding Baggage)Document15 pagesSanju (Provision Regarding Baggage)sanjucadbury_sNo ratings yet

- Baggage Rules at A Glance: Clearance of Incoming Passengers (Green and Red Channels)Document19 pagesBaggage Rules at A Glance: Clearance of Incoming Passengers (Green and Red Channels)zydusNo ratings yet

- Chief Commissioner of Customs Mumbai Zone - IIIDocument8 pagesChief Commissioner of Customs Mumbai Zone - IIISandeep RangapureNo ratings yet

- GUIDE FOR TRAVELLERS v5Document19 pagesGUIDE FOR TRAVELLERS v5varun sachdevaNo ratings yet

- Information of TravellersDocument31 pagesInformation of Travellersimadz853No ratings yet

- Baggage Rules at A Glance - CBECDocument16 pagesBaggage Rules at A Glance - CBECshish0iitrNo ratings yet

- Guide To Travellers PDFDocument22 pagesGuide To Travellers PDFGoljanNo ratings yet

- Baggage Rule 1998 Dec11Document6 pagesBaggage Rule 1998 Dec11apoorvbadamiNo ratings yet

- Amendment of Income Tax Rules, 1962 Applicable For NOV 2010 Changes in Limits For Valuation of Car (Refer Page 38)Document25 pagesAmendment of Income Tax Rules, 1962 Applicable For NOV 2010 Changes in Limits For Valuation of Car (Refer Page 38)Gurpreet SinghNo ratings yet

- UntitledDocument18 pagesUntitledbetty KemNo ratings yet

- General Provisions About BaggageDocument10 pagesGeneral Provisions About BaggageSunil VishwakarmaNo ratings yet

- Illustration 1 - Computation of Duty Drawback: Gajanan & Co. Has Imported A PlantDocument5 pagesIllustration 1 - Computation of Duty Drawback: Gajanan & Co. Has Imported A PlantTapan BarikNo ratings yet

- Some Definitions : Compiled by DR Renu AggarwalDocument9 pagesSome Definitions : Compiled by DR Renu AggarwalSandeep nayakaNo ratings yet

- Other Percentage TaxesDocument7 pagesOther Percentage TaxesFloyd delMundoNo ratings yet

- Excise DutyDocument39 pagesExcise DutyAmrit NeupaneNo ratings yet

- CustomsDocument18 pagesCustomsprustyassociates1989No ratings yet

- Air Customs Chennai International Airport Welcomes YouDocument26 pagesAir Customs Chennai International Airport Welcomes YousreeramaNo ratings yet

- Indian Customs Declaration FormDocument2 pagesIndian Customs Declaration Formanand GVNo ratings yet

- Percentage Tax: APRIL 17, 2021Document28 pagesPercentage Tax: APRIL 17, 2021Floyd delMundoNo ratings yet

- Input Tax CreditDocument8 pagesInput Tax Creditloey xafNo ratings yet

- 21833vol3cstms cp11Document6 pages21833vol3cstms cp11timirkantaNo ratings yet

- Customs Amendments 2017Document8 pagesCustoms Amendments 2017Mita SethiNo ratings yet

- 94-12 OPT - HandoutDocument14 pages94-12 OPT - HandoutMj BauaNo ratings yet

- BaggageDocument2 pagesBaggageamarprabhu567No ratings yet

- Assessment & Date For Determination of Rate & Tariff ValueDocument18 pagesAssessment & Date For Determination of Rate & Tariff ValueMegha0% (1)

- Origin of Customs DutyDocument45 pagesOrigin of Customs DutyJayagokul SaravananNo ratings yet

- IATA - India Customs, Currency & Airport Tax Regulations DetailsDocument3 pagesIATA - India Customs, Currency & Airport Tax Regulations DetailsThiruvengadam100% (1)

- Material 9 OPTDocument14 pagesMaterial 9 OPTnodnel salonNo ratings yet

- OPT - HandoutDocument16 pagesOPT - HandoutGrant Kenneth D. FloresNo ratings yet

- Rate of Duty and Tariff ValuationDocument1 pageRate of Duty and Tariff ValuationWelcome 1995No ratings yet

- CCCC CC CC CCCCCDocument53 pagesCCCC CC CC CCCCCndaharwalNo ratings yet

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- Nepal Baggage RulesDocument9 pagesNepal Baggage Rulesquestion markNo ratings yet

- Unit 5 ItDocument28 pagesUnit 5 ItAbhi NandanaNo ratings yet

- Enotes 10 Percentage TaxDocument12 pagesEnotes 10 Percentage TaxIrish Gracielle Dela CruzNo ratings yet

- Ipc ProjectDocument40 pagesIpc ProjectAkshay LalNo ratings yet

- CPAR TAX - Other Percentage Taxes PDFDocument13 pagesCPAR TAX - Other Percentage Taxes PDFJohn Carlo CruzNo ratings yet

- Mock Test Series 2 QuestionsDocument10 pagesMock Test Series 2 QuestionsSuzhana The WizardNo ratings yet

- Assignment of Travel Documentation: Airport CustomsDocument12 pagesAssignment of Travel Documentation: Airport CustomsKunal SinghNo ratings yet

- Income TAX CalculationDocument33 pagesIncome TAX CalculationTaharat Ahmed ChowdhuryNo ratings yet

- GST ModelDocument7 pagesGST ModelGOVIND JANGIDNo ratings yet

- Customs, Excise and GST Full MaterialDocument55 pagesCustoms, Excise and GST Full MaterialramNo ratings yet

- RA 7160 - Local Government Code of 1991: Taxation Shall Be UniformDocument6 pagesRA 7160 - Local Government Code of 1991: Taxation Shall Be UniformChad FerninNo ratings yet

- Other Percentage TaxesDocument8 pagesOther Percentage TaxesRoxanne PeñaNo ratings yet

- Chapter 3 Percentage Taxes - UpdatedDocument13 pagesChapter 3 Percentage Taxes - UpdatedDudz Matienzo100% (1)

- F.No 370142 2016-TI'L Government of Ministry of Finance of Board of Taxes (TPLDocument4 pagesF.No 370142 2016-TI'L Government of Ministry of Finance of Board of Taxes (TPLShariq AltafNo ratings yet

- Professional Tax Act KPKDocument6 pagesProfessional Tax Act KPKHumayunNo ratings yet

- Percentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDocument16 pagesPercentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDon CabasiNo ratings yet

- Percentage Tax CTBDocument16 pagesPercentage Tax CTBDon CabasiNo ratings yet

- Module 1. Customs Payments (Imports)Document14 pagesModule 1. Customs Payments (Imports)Настя КнутоваNo ratings yet

- Government of India M1Nistrty of Finance Department of RevenueDocument6 pagesGovernment of India M1Nistrty of Finance Department of Revenuepatelpratik1972No ratings yet

- Other Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATDocument14 pagesOther Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATJana Trina LibatiqueNo ratings yet

- Exercises Compiled PDFDocument134 pagesExercises Compiled PDFnena cabañes50% (2)

- Baggage RulesDocument37 pagesBaggage RulesHiteshi AggarwalNo ratings yet

- Profession Tax-Schedule 1Document3 pagesProfession Tax-Schedule 1SAYAN BHATTANo ratings yet

- Locational Adjustment 2. Cash Discount (CD) & Early Payment Discount (EPD)Document14 pagesLocational Adjustment 2. Cash Discount (CD) & Early Payment Discount (EPD)Mohit MohataNo ratings yet

- CBSE Class 6 Maths Sample Paper SA2 Set 2Document5 pagesCBSE Class 6 Maths Sample Paper SA2 Set 2ApproxNo ratings yet

- GST AssignmentDocument7 pagesGST AssignmentZoya RehmanNo ratings yet

- Principles of MarketingDocument4 pagesPrinciples of MarketingZoya RehmanNo ratings yet

- 20harcbapr000259Document1 page20harcbapr000259prakashpushp11No ratings yet

- 5th Sem FeesDocument1 page5th Sem FeesZoya RehmanNo ratings yet

- Reproduction in Flowering PlantDocument22 pagesReproduction in Flowering PlantZoya RehmanNo ratings yet

- Employee CostDocument3 pagesEmployee CostZoya RehmanNo ratings yet

- Job CostingDocument4 pagesJob CostingZoya RehmanNo ratings yet

- Assignment 4Document38 pagesAssignment 4Zoya RehmanNo ratings yet

- Timetablesem IvDocument1 pageTimetablesem IvZoya RehmanNo ratings yet

- AssignmentDocument15 pagesAssignmentZoya RehmanNo ratings yet

- Maths Class 10 AssignmentDocument2 pagesMaths Class 10 AssignmentZoya RehmanNo ratings yet

- CH 1cost ShhetDocument21 pagesCH 1cost ShhetZoya RehmanNo ratings yet

- Polymeric Nanoparticles - Recent Development in Synthesis and Application-2016Document19 pagesPolymeric Nanoparticles - Recent Development in Synthesis and Application-2016alex robayoNo ratings yet

- Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Document1 pageCambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013RedrioxNo ratings yet

- Extinct Endangered Species PDFDocument2 pagesExtinct Endangered Species PDFTheresaNo ratings yet

- Entrenamiento 3412HTDocument1,092 pagesEntrenamiento 3412HTWuagner Montoya100% (5)

- LAW OF ContractDocument1 pageLAW OF ContractKhurshid Manzoor Malik50% (2)

- Xavier High SchoolDocument1 pageXavier High SchoolHelen BennettNo ratings yet

- Atelierul Digital Pentru Programatori: Java (30 H)Document5 pagesAtelierul Digital Pentru Programatori: Java (30 H)Cristian DiblaruNo ratings yet

- A Professional Ethical Analysis - Mumleyr 022817 0344cst 1Document40 pagesA Professional Ethical Analysis - Mumleyr 022817 0344cst 1Syed Aquib AbbasNo ratings yet

- Narrative ReportDocument6 pagesNarrative ReportAlyssa Marie AsuncionNo ratings yet

- SET UP Computer ServerDocument3 pagesSET UP Computer ServerRicHArdNo ratings yet

- Charles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsDocument20 pagesCharles P. Jones, Investments: Analysis and Management, Eleventh Edition, John Wiley & SonsRizki AuliaNo ratings yet

- Hypnosis ScriptDocument3 pagesHypnosis ScriptLuca BaroniNo ratings yet

- Volvo D16 Engine Family: SpecificationsDocument3 pagesVolvo D16 Engine Family: SpecificationsJicheng PiaoNo ratings yet

- Oral Communication in ContextDocument31 pagesOral Communication in ContextPrecious Anne Prudenciano100% (1)

- Outline - Criminal Law - RamirezDocument28 pagesOutline - Criminal Law - RamirezgiannaNo ratings yet

- CGP Module 1 FinalDocument19 pagesCGP Module 1 Finaljohn lexter emberadorNo ratings yet

- Ignorance Is The Curse of God. Knowledge Is The Wing Wherewith We Fly To Heaven."Document3 pagesIgnorance Is The Curse of God. Knowledge Is The Wing Wherewith We Fly To Heaven."Flori025No ratings yet

- Magnetic Effect of Current 1Document11 pagesMagnetic Effect of Current 1Radhika GargNo ratings yet

- Electronic ClockDocument50 pagesElectronic Clockwill100% (1)

- PHD Thesis - Table of ContentsDocument13 pagesPHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- DHBVNDocument13 pagesDHBVNnitishNo ratings yet

- Labor Rules English Noi Quy Bang Tieng Anh PDFDocument27 pagesLabor Rules English Noi Quy Bang Tieng Anh PDFNga NguyenNo ratings yet

- 2017 - The Science and Technology of Flexible PackagingDocument1 page2017 - The Science and Technology of Flexible PackagingDaryl ChianNo ratings yet

- Government by Algorithm - Artificial Intelligence in Federal Administrative AgenciesDocument122 pagesGovernment by Algorithm - Artificial Intelligence in Federal Administrative AgenciesRone Eleandro dos SantosNo ratings yet

- Reflection On Sumilao CaseDocument3 pagesReflection On Sumilao CaseGyrsyl Jaisa GuerreroNo ratings yet

- Wonderland Audition PacketDocument5 pagesWonderland Audition PacketBritt Boyd100% (1)

- Alcatraz Analysis (With Explanations)Document16 pagesAlcatraz Analysis (With Explanations)Raul Dolo Quinones100% (1)

- TN Vision 2023 PDFDocument68 pagesTN Vision 2023 PDFRajanbabu100% (1)

- SQ1 Mogas95Document1 pageSQ1 Mogas95Basant Kumar SaxenaNo ratings yet

- Gamboa Vs Chan 2012 Case DigestDocument2 pagesGamboa Vs Chan 2012 Case DigestKrissa Jennesca Tullo100% (2)