Professional Documents

Culture Documents

Bos 62980

Uploaded by

Gagan Agrawal0 ratings0% found this document useful (0 votes)

1 views4 pagesOriginal Title

78690 Bos 62980

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views4 pagesBos 62980

Uploaded by

Gagan AgrawalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Study Guidelines – May 2024 Examination

Paper 3-Taxation

Section B: Goods and Services Tax

Applicability of the GST law

The provisions of the CGST Act, 2017 and the IGST Act, 2017 as amended by

the Finance Act, 2023 including significant notifications and circulars issued and

other legislative amendments made, which have become effective up to

31.10.2023, are applicable for May 2024 examination.

The amendments made by the Annual Union Finance Acts in the CGST Act,

2017 and IGST Act, 2017 are made effective from the date notified

subsequently. Thus, only those amendments made by the relevant Finance

Acts which have become effective till 31.10.2023 are applicable for May 2024

examination. Accordingly, all the amendments made by the Finance Act, 2023

are applicable for May 2024 examination.

Further, since the amendments made by the Central Goods and

Services Tax (Amendment) Act, 2023 and Integrated Goods and

Services Tax (Amendment) Act, 2023, (enacted as on 18.08.2023)

have become effective from 01.10.2023, the same are also applicable

for May 2024 examination.

The Study Guidelines given below specify the exclusions from the syllabus for

May 2024 examination.

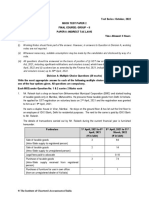

List of topic-wise exclusions from the syllabus

(1) (2) (3)

S. No. in Topics of the Exclusions

the syllabus (Provisions which are excluded from

syllabus the corresponding topic of the

syllabus)

2(iii) Charge of tax CGST Act, 2017

including reverse (i) Rate of tax prescribed for supply of

charge goods*

(ii) Rate of tax prescribed for supply of

services*

© The Institute of Chartered Accountants of India

(iii) Categories of supply of goods, tax on

which is payable on reverse charge

basis under section 9(3)

IGST Act, 2017

(i) Rate of tax prescribed for supply of

goods

(ii) Rate of tax prescribed for supply of

services

(iii) Categories of supply of goods, tax on

which is payable on reverse charge

basis under section 5(3)

2(iv) Exemption from CGST Act, 2017 & IGST Act, 2017

tax Exemptions for supply of goods

3(ii) Basic concepts of IGST Act, 2017 & IGST Rules, 2017

place of supply (i) Place of supply of goods imported

into, or exported from India

(ii) Place of supply of services where

location of supplier or location of

recipient is outside India

(iii) Special provision for payment of tax

by a supplier of online information

and database access or retrieval

[OIDAR] services

(iv) Refund of integrated tax paid on

supply of goods to tourist leaving

India

(v) Special provision for specified

actionable claims supplied by a

person located outside taxable

territory

3(iii) Basic concepts of CGST Act, 2017 & CGST Rules, 2017

time of supply Provisions relating to change in rate of tax

in respect of supply of goods or services

3(iv) Basic concepts of CGST Act, 2017 & CGST Rules, 2017

value of supply Chapter IV: Determination of Value of

Supply [Rules 27-35] of CGST Rules, 2017

© The Institute of Chartered Accountants of India

3(v) Basic concepts of

CGST Act, 2017 read with CGST

input tax credit

Rules, 2017

(i) Manner of determination of input tax

credit in respect of inputs or input

services and reversal thereof [Rule

42]

(ii) Manner of determination of input tax

credit in respect of capital goods and

reversal thereof in certain cases [Rule

43]

(iii) Input tax credit provisions in respect

of inputs and capital goods sent for

job work.

(iv) Input tax credit provisions relating to

distribution of credit by Input Service

Distributor [ISD]

(v) Manner of recovery of credit

distributed in excess

(vi) Manner of reversal of credit of

additional duty of customs in respect

of Gold dore bar

*Rates specified for computing the tax payable under composition

levy are included in the syllabus.

Note: The syllabus includes select provisions of the CGST Act, 2017 and IGST

Act, 2017 and not the entire CGST Act, 2017 and the IGST Act, 2017. The

provisions covered in any topic(s) of the syllabus which are related to or

correspond to the topics not covered in the syllabus shall also be excluded.

In the above table, in respect of the topics of the syllabus specified in column

(2) the related exclusion is given in column (3). Where an exclusion has been

so specified in any topic of the syllabus, the provisions corresponding to such

exclusions, covered in other topic(s) forming part of the syllabus, shall also be

excluded. For example, since provisions relating to ISD are excluded from the

topics “Input tax credit”, the provisions relating to (i) registration of ISD and

(ii) filing of returns by an ISD are also excluded from the topics “Registration”

and “Returns” respectively.

The entire content included in the Study Material and the Statutory Update for

May 2024 examination shall be relevant for the said examination. The

amendments in the GST law made after the issuance of the Study Material - to

the extent covered in the Statutory Update for May 2024 examination alone

© The Institute of Chartered Accountants of India

shall be relevant for the said examination. Statutory Update has been

webhosted at the following link:

https://resource.cdn.icai.org/77999bos62625.pdf

Though the Statutory Update for May 2024 examination shall provide the

precise scope and coverage of the amendments, for the sake of clarity, it may

be noted that the amendments made in the various provisions of the GST law

for providing relief to the taxpayers of Manipur shall not be applicable for May

2024 examination.

© The Institute of Chartered Accountants of India

You might also like

- Problem Solving Process Report Template and ToolsDocument2 pagesProblem Solving Process Report Template and ToolsKhaled Naseem Abu-SabhaNo ratings yet

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- Corporate VeilDocument8 pagesCorporate VeilKaran BindraNo ratings yet

- GST Scanner by DG SirDocument41 pagesGST Scanner by DG SirvishnuvermaNo ratings yet

- GST Scanner v1 PDFDocument566 pagesGST Scanner v1 PDFsrivani vemula100% (1)

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- Statement: Business Current AccountDocument1 pageStatement: Business Current AccountGrace HillNo ratings yet

- C4.Developing An Effective Business ModelDocument38 pagesC4.Developing An Effective Business Modelmnornajamudin100% (1)

- The Trade Price Method 1.2Document84 pagesThe Trade Price Method 1.2Nadzif Hasan100% (1)

- MetrobankDocument3 pagesMetrobankDuchess SaudiaNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Analytic Techniques Using Excel Power BIDocument7 pagesAnalytic Techniques Using Excel Power BIPankush0% (1)

- Study Guidelines For May 2023 Examination: Intermediate Course - Paper 4: Taxation - Section B: Indirect TaxesDocument2 pagesStudy Guidelines For May 2023 Examination: Intermediate Course - Paper 4: Taxation - Section B: Indirect TaxesHema LathaNo ratings yet

- Study Guidelines For November 2021 Examination: Intermediate New Course Paper 4: Taxation Section B: Indirect TaxesDocument2 pagesStudy Guidelines For November 2021 Examination: Intermediate New Course Paper 4: Taxation Section B: Indirect TaxesPrachi KarkhanisNo ratings yet

- CA InterDocument7 pagesCA InterKrrish KelwaniNo ratings yet

- Study Guidelines For May, 2019 ExaminationDocument2 pagesStudy Guidelines For May, 2019 ExaminationUrvi MishraNo ratings yet

- Bos 60629Document6 pagesBos 60629ROCKSPYNo ratings yet

- Ca FoundationDocument7 pagesCa FoundationSantosh ThakurNo ratings yet

- CA Inter Applicability Amendments For Nov22Document7 pagesCA Inter Applicability Amendments For Nov22311903736No ratings yet

- CA Final AmendmentsDocument2 pagesCA Final AmendmentsMalvika RaoNo ratings yet

- All India GST JurisdictionDocument2 pagesAll India GST JurisdictionNitish AggarwalNo ratings yet

- Harsh Shah - Input Tax Credit - 27!4!17-Ilovepdf-CompressedDocument63 pagesHarsh Shah - Input Tax Credit - 27!4!17-Ilovepdf-Compresseddinesh kasnNo ratings yet

- Applicability of Standards/Guidance Notes/Legislative Amendments Etc. For May, 2021 Examination Intermediate Level (New Course) Paper 1: AccountingDocument8 pagesApplicability of Standards/Guidance Notes/Legislative Amendments Etc. For May, 2021 Examination Intermediate Level (New Course) Paper 1: AccountingsoniNo ratings yet

- Study Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For May 2022 Examination: Final (New Course) Paper 8: Indirect Tax Lawsparam.ginniNo ratings yet

- Ca Final NotesDocument2 pagesCa Final NotesShantanuNo ratings yet

- Study Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax LawsDocument2 pagesStudy Guidelines For November 2022 Examination: Final Paper 8: Indirect Tax Lawsruhi MalviyaNo ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- Farooq Haque Classes: Exclusions From Syllabus of IDT of CA FinalDocument1 pageFarooq Haque Classes: Exclusions From Syllabus of IDT of CA FinalNikhilNo ratings yet

- Refund in GSTDocument6 pagesRefund in GSTNilesh SoniNo ratings yet

- Latest Updates in GST - NovDocument6 pagesLatest Updates in GST - NovVishwanath HollaNo ratings yet

- Ca Final Idt RtpsDocument31 pagesCa Final Idt Rtpschandrakantchainani606No ratings yet

- 63925bos51393finalnew p8Document23 pages63925bos51393finalnew p8Salman ghaswalaNo ratings yet

- Place of SupplyDocument66 pagesPlace of SupplydataprotaxNo ratings yet

- IGSTDocument18 pagesIGSTAvinash KumarNo ratings yet

- Bos 59410Document23 pagesBos 59410Bharath Krishna MVNo ratings yet

- GST AmendmentsDocument15 pagesGST AmendmentsSana KhanNo ratings yet

- Paper 11 New PDFDocument443 pagesPaper 11 New PDFAnand KumarNo ratings yet

- Latest Updates in GSTDocument6 pagesLatest Updates in GSTprathNo ratings yet

- Goods and Services Tax Council Standing Committee On Capacity Building and FacilitationDocument61 pagesGoods and Services Tax Council Standing Committee On Capacity Building and FacilitationJeyakar PrabakarNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- 58794bos47893finalnew p8 PDFDocument21 pages58794bos47893finalnew p8 PDFANIL JARWALNo ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- Notification No. 03 - 2022Document4 pagesNotification No. 03 - 2022Ankit Jeswani (IN)No ratings yet

- 73974bos59825 GSTDocument52 pages73974bos59825 GSTchashmishbabaNo ratings yet

- Direct Tax or Indirect TaxDocument8 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- Refunds: S. No. Particulars (')Document9 pagesRefunds: S. No. Particulars (')Rohit KasbeNo ratings yet

- GST PPT (Group 5)Document20 pagesGST PPT (Group 5)Hanna GeorgeNo ratings yet

- Supply Under GST, Time & Value of Supply SolutionDocument2 pagesSupply Under GST, Time & Value of Supply SolutionAman RayNo ratings yet

- Important Questions On Tax LiabilityDocument8 pagesImportant Questions On Tax Liabilitytarakmehta5211No ratings yet

- GST - Ch. 6, 8 - 13 - NS - Dec. 23Document2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23Madhav TailorNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- Idt QDocument10 pagesIdt QriyaNo ratings yet

- CA Final DT A MTP 1 May 23Document14 pagesCA Final DT A MTP 1 May 23Mayur JoshiNo ratings yet

- Input Tax Credit Rules: Rule# Rule Title Form # Time Limit Section Reference Text of The Provision AnalysisDocument23 pagesInput Tax Credit Rules: Rule# Rule Title Form # Time Limit Section Reference Text of The Provision AnalysisABHISHEKNo ratings yet

- CA Inter IPCC IDT Amendments May2020 ExamDocument25 pagesCA Inter IPCC IDT Amendments May2020 ExamMohammed IbrahimNo ratings yet

- Series 2 ADocument15 pagesSeries 2 ARaghav TibdewalNo ratings yet

- Supply Under GSTDocument14 pagesSupply Under GSTTreesa Mary RejiNo ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- Interstate and Intrastate Transactions Under GSTDocument11 pagesInterstate and Intrastate Transactions Under GSTD.Naga RajuNo ratings yet

- Circular 78-52-2018 Export ServicesDocument4 pagesCircular 78-52-2018 Export ServicesTRI City GujaratNo ratings yet

- Paper18 - Set1 Rev AnsDocument15 pagesPaper18 - Set1 Rev AnsSanya GoelNo ratings yet

- Changes Applicaple-2022Document11 pagesChanges Applicaple-2022sanjayNo ratings yet

- GST PRACTICE SETs - SET 7 (9th Edition)Document6 pagesGST PRACTICE SETs - SET 7 (9th Edition)Ismail RizwanNo ratings yet

- Infrastructure and Employment Creation in the Middle East and North AfricaFrom EverandInfrastructure and Employment Creation in the Middle East and North AfricaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Project Integration ManagementDocument2 pagesProject Integration ManagementKrityNo ratings yet

- PresentationDocument16 pagesPresentationAysha Rahmy100% (1)

- Handbook 2009Document282 pagesHandbook 20097gopeshm4610No ratings yet

- File1pages From CHAPTER 8 - FOOD AND BEVERAGE FUNCTION PLANNINGDocument4 pagesFile1pages From CHAPTER 8 - FOOD AND BEVERAGE FUNCTION PLANNINGTeddy KrisdiyantoNo ratings yet

- Phantom Trading - ? Support - FaqDocument11 pagesPhantom Trading - ? Support - FaqmikoNo ratings yet

- Lumber Liquidators Announces Memorandum of Understanding To Settle Class Actions Related To Chinese-Laminate FlooringDocument3 pagesLumber Liquidators Announces Memorandum of Understanding To Settle Class Actions Related To Chinese-Laminate FlooringWSETNo ratings yet

- Managementand Organisationalbehaviourlaurie JDocument7 pagesManagementand Organisationalbehaviourlaurie JPrabhamohanraj MohanrajNo ratings yet

- TimeSheet-Calculator TrumpExcelRevised-2021 v1Document7 pagesTimeSheet-Calculator TrumpExcelRevised-2021 v1Utkarsh TalmaleNo ratings yet

- India Vs China 2030Document11 pagesIndia Vs China 2030stifler joeNo ratings yet

- Valuation of Fixed AssetsDocument28 pagesValuation of Fixed Assetsmaster53015No ratings yet

- Quiz Installment Sales 2Document1 pageQuiz Installment Sales 2MARJORIE BAMBALANNo ratings yet

- Aksari Resort Ubud: Booking ConfirmationDocument3 pagesAksari Resort Ubud: Booking ConfirmationSyed NawazNo ratings yet

- ElcaMedia Guide To Branding and Advertising (Sustainability) - Marketing CommunicationDocument34 pagesElcaMedia Guide To Branding and Advertising (Sustainability) - Marketing Communicationelcamedia csr consultancyNo ratings yet

- TescoDocument39 pagesTescosneha100% (1)

- IB Eonomics Market Structure NotesDocument4 pagesIB Eonomics Market Structure NotessanjanaghoshNo ratings yet

- MIAA vs. Ding Velayo Sports Center, Inc.Document7 pagesMIAA vs. Ding Velayo Sports Center, Inc.Patrisha AlmasaNo ratings yet

- Mahindra GMC SIP 2012Document36 pagesMahindra GMC SIP 2012NageswariChikkamNo ratings yet

- Feasibility Report Purpose:: Analysis Evaluation Project Estimated Cost ProfitableDocument4 pagesFeasibility Report Purpose:: Analysis Evaluation Project Estimated Cost ProfitablenikitaNo ratings yet

- CS Executive Old Syllabus ABC AnalysisDocument15 pagesCS Executive Old Syllabus ABC Analysisjanardhan CA,CSNo ratings yet

- CH 14Document28 pagesCH 14Erica Uy100% (1)

- Mantis Dock Leveler BrochureDocument2 pagesMantis Dock Leveler Brochurerochim_putech_126885No ratings yet

- Petronas Media ResponseDocument5 pagesPetronas Media ResponseThe Vancouver SunNo ratings yet

- LSMWDocument3 pagesLSMWsrinivas100% (1)