Professional Documents

Culture Documents

Photon Benefits Summary - Jan 2024

Photon Benefits Summary - Jan 2024

Uploaded by

Saravanan MuniandiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Photon Benefits Summary - Jan 2024

Photon Benefits Summary - Jan 2024

Uploaded by

Saravanan MuniandiCopyright:

Available Formats

PHOTON BENEFITS SUMMARY

JANUARY 2024

PRIVATE & CONFIDENTIAL

CONTENTS

PHOTON BENEFIT SUMMARY ........................................................................................................................... 3

1. MEDICAL INSURANCE................................................................................................................................ 3

2. BCBS - DENTAL INSURANCE ..................................................................................................................... 6

3. VISION INSURANCE – EYE MED PLAN ....................................................................................................... 7

4. DEPENDENT INSURANCE AND PREMIUM DETAILS ................................................................................... 8

5. BASIC LIFE INSURANCE & ACCIDENTAL DEATH & DISMEMBERMENT (AD&D) ......................................... 8

6. VOLUNTARY/ SUPPLEMENTAL LIFE INSURANCE AND AD&D – EMPLOYEE PAID...................................... 9

7. 401K RETIREMENT PLAN ........................................................................................................................... 9

8. COMMUTER BENEFITS ............................................................................................................................ 10

9. LEAVE POLICY .......................................................................................................................................... 10

10. PAY PERIODS ........................................................................................................................................... 12

<Version 1.2> Prepared – January 1, 2024

PHOTON BENEFITS SUMMARY

Included below are the details pertaining to the Insurance and other benefits that PHOTON provides to

all its employees.

1. Medical Insurance

2. Dental Insurance

3. Vision Insurance

4. Dependent Insurance and premium details

5. Life Insurance and Accidental death and dismemberment Insurance

6. Voluntary life insurance

7. 401(K) Retirement Plan

8. Commuter Benefits

9. Leave Policy

10. Pay Periods

1. MEDICAL INSURANCE

Photon’s provides employees and their dependents access to medical, dental, and vision care benefits.

Photon pays 100% of the premium for employee and 50% of the premium for any dependents.

Coverage begins from the date of joining and will be active till the end of the month after the last

working day. The option of enrollment is open at the time of joining Photon or at the beginning of the

annual insurance cycle (August 1), at the time of any life event (e.g., birth, marriage, loss of coverage,

etc.), or for dependents traveling to the USA from other countries. Eligible employees may participate in

the health insurance plan and are subject to all terms and conditions of the agreement between Photon

and the insurance carrier.

BCBS TX is the Service Provider for the below

a. Medical & Dental coverage

b. Vision coverage

c. Life insurance and AD&D

Included below is a summary of the Medical, Dental & Vision policies and the premium for dependents'

insurance enrollment:

Photon currently offers 2 medical plans, and you can opt for either:

1.1 BCBS TX PPO $750 Ded

1.2 BCBS TX HDHP HSA $3000 (High deductible plan)

<Version 1.2> Prepared – January 1, 2024

1.1 BCBS TX PPO Network - Medical

BCBS TX PPO PLAN IN NETWORK CARE OUT-OF- NETWORK CARE

$750 - Individual $1500 - Individual

Deductible

$2250 - Family $4500 - Family

Coinsurance 20% After Deductible 40% After Deductible

Annual Out-Of-Pocket $5000 - Individual $10000 - Individual

Maximum $10000 - Family $20000 - Family

Office Visit $30 Copay Deductible Waived 40% After Deductible

Special Office Visit $30 Copay Deductible Waived 40% After Deductible

In-Hospital 20% After Deductible 40% After Deductible

Urgent Care $30 Copay Deductible Waived 40% After Deductible

Walk-In Clinic $30 Copay Deductible Waived 40% After Deductible

Preventive Care 0% Deductible Waived 40% After Deductible

20% After $150 Copay;

Emergency Care Deductible Waived; Copay Same as in-Network Care

Waived If Admitted

X-Rays, Complex Imaging 20% After Deductible 40% After Deductible

BCBS TX PPO Pharmacy Benefits

OUT-OF-NETWORK CARE

BCBS TX PPO PLAN IN NETWORK CARE

(MAIL ORDER: NOT APPLICABLE)

Retail: $5 Copay Retail: 40% of Submitted Cost;

Preferred Generics

Mail Order: $12.50 Copay After Rx Copay

Retail: $20 Copay Retail: 40% of Submitted Cost;

Non-Preferred Generics

Mail Order: $50 Copay After Rx Copay

Retail: $30 Copay Retail: 40% of Submitted Cost;

Preferred Brands

Mail Order: $75 Copay After Rx Copay

Retail: $50 Copay Retail: 40% of Submitted Cost;

Non-Preferred Brands

Mail Order: $125 Copay After Rx Copay

40% of Submitted Cost; After

Specialty Medicines 30% (CY. Ded. Waived)

30% Co-Insurance

CY- Calendar Year

<Version 1.2> Prepared – January 1, 2024

1.2 BCBS TX HDHP HSA (High Deductible Plan)

HDHP HSA PLAN IN NETWORK CARE OUT-OF- NETWORK CARE

$3000 - Individual $3000 - Individual

Deductible $6000 - Family $6000 - Family

Coinsurance 0% After Deductible 30% After Deductible

Annual Out-Of-Pocket $3,425 –Individual $7,000 –Individual

Maximum $6,850 –Family $14,000 –Family

Office Visit 0% After Deductible 30% After Deductible

Special Office Visit 0% After Deductible 30% After Deductible

In-Hospital 0% After Deductible 30% After Deductible

Urgent Care 0% After Deductible 30% After Deductible

Walk-In Clinic 0% After Deductible 30% After Deductible

Preventive Care 0% Deductible Waived 30% After Deductible

Emergency Care 0% After Deductible Same as in-NetworkCare

X-Rays, Complex Imaging 0% After Deductible 30% After Deductible

8/1/23: Calendar Year Deductible changes from $2,800 Individual/$5,600 Family to $3,000 / $6,000

BCBS TX HSA Pharmacy Benefits

OUT-OF-NETWORK CARE

BCBS TX PPO PLAN IN NETWORK CARE

(MAIL ORDER: NOT APPLICABLE)

Retail: $5 Copay after CY deductible Retail: 30% of Submitted Cost;

Preferred Generics Mail Order: $12.50 Copay After Rx Copay & deductible

Retail: $15 Copay after CY deductible Retail: 30% of Submitted Cost;

Non-Preferred Generics

Mail Order: $37.50 Copay After Rx Copay & deductible

Retail: $40 Copay after CY deductible Retail: 30% of Submitted Cost;

Preferred Brands

Mail Order: $100 Copay After Rx Copay & deductible

Retail: $60 Copay after CY deductible Retail: 30% of Submitted Cost;

Non-Preferred Brands

Mail Order: $150 Copay After Rx Copay & deductible

30% of Submitted Cost; After 30%

Specialty Medicines 30% (after CY. Ded. Waived)

Co-Insurance & deductible

CY- Calendar Year

<Version 1.2> Prepared – January 1, 2024

HSA is linked to the High Deductible plan.

A Health Saving Account (HSA) is a special type of account designed to help you save tax and pay for

certain qualified healthcare expenses.

HSA Process:

Employees enrolled in the HSA plan can open an HSA account with a participating bank and provide

information on the amount to be contributed towards the HSA account. The specified amount will be

deducted from every paycheck by the Company on a pre-tax basis and deposited directly to the

employee’s HSA account.

The HSA account provider will issue a debit card to employees, which can be used to pay for approved

medical expenditures. Please ensure to save your receipts for each year. The HSA account can be used for

trackingthe HSA deductible.

The IRS HSA limits for 2024 are $4,150 for individuals and $8,300 for participants with dependent

coverage.

2. BCBS - DENTAL INSURANCE

Your Dental Plan at a Glance PPO In-Network PPO - Out-Of-Network

$50 Individual $50 Individual

Annual Deductible

$150 Family $150 Family

$1000 Per Covered

Annual Benefit Maximum $1000 Per CoveredIndividual

Individual

Preventive Services 100% DeductibleWaived 100% DeductibleWaived

Basic Services 50% After Deductible 50% After Deductible

Major Services 50% After Deductible 50% After Deductible

Orthodontic Services* Not Covered Not Covered

Orthodontic Lifetime Maximum* N/A N/A

The prices charged by the provider vary if you are in-network or out-of-network, so the total out-of-

pocket will vary.

<Version 1.2> Prepared – January 1, 2024

3. VISION INSURANCE – EYE MED PLAN

OUT OF NETWORK

VISION CARE SERVICES IN NETWORK

(REIMBURSEMENT)

Exam Copay $20 Upto $40

Materials Copay $20 N/A

BENEFIT FREQUENCY – EXAMS EVERY 12

MONTHS / LENSES & FRAMES EVERY 24

MONTHS

LENSES

Single Vision $25 Copay Upto $30

Bifocal $25 Copay Upto $50

Trifocal $25 Copay Upto $70

Lenticular $25 Copay Upto $70

Progressive - Standard $90 Copay Upto $50

CONTACT LENSES

$0 Copay, $150

Elective Upto $105

Allowance*

$0 Copay, Covered In-

Medically Necessary Upto $210

Full

$0 Copay, $150

Frames Upto $105

Allowance*

*Discount offered on amounts above the allowance

<Version 1.2> Prepared – January 1, 2024

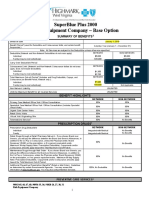

4. DEPENDENT INSURANCE AND PREMIUM DETAILS

The table below has the dependents' premium breakdown for the medical, dental, and Vision care

benefits. The cost of the premium for employees and dependents is mentioned below. The below

premium costs are for the plan year August 2023 to July 2024.

BCBS TX BCBS TX BCBSTX BCBSTX

COVERAGE TYPE MEDICAL MEDICAL DENTAL

HDHP -HSA PPO VISION

PPO

Employee Only (Paid by Photon) Free Free Free Free

Employee + Spouse/Domestic Partner $280.35 $251.33 $13.34 $1.83

Employee + Children only $210.48 $188.70 $10.41 $2.04

Employee + Family $455.61 $408.44 $23.75 $3.95

*The rates mentioned above are for a month. Premium contributions will be deducted from each

paycheck on a pre-tax basis unless otherwise requested by you in writing.

5. BASIC LIFE INSURANCE & ACCIDENTAL DEATH & DISMEMBERMENT (AD&D)

Photon offers Life Insurance and AD&D at no additional cost. The plan details are as follows:

LIFE & AD&D LINCOLN FINANCIAL LIFE

Life Insurance & AD&D Benefit $100,000 each

*Benefit reduces by 35% of the original amount at age 65 and an additional 15% at age 70;

coverage terminates at retirement.

Additional Information: (Limitations may apply to these services. Please see your plan document.)

Benefits are doubled in the event of an accidental death.

Accelerated Living/ (Terminal Illness) Benefit (75% of your benefit)

Beneficiary Resource Services - Access to grief counseling, financial and legal support

Online Will Preparation/Funeral Planning - Call 1 800 769 9187, or visit BeneficiaryResource.com

Travel Resource Services via Assist America - Access to emergency medical assistance when you’re

on a trip 100+ miles from your home.

Annual Health Check-ups under preventive care for both PPO and HSA(HDHP) options in medical

coverage.

Other covered services include Acupuncture and Chiropractic care under both PPO and HSA plans.

Travel assistance service available 24/7 at (800)872-1414. For employees and/or family members

traveling more than 100 miles from home. Download Mobile App: Assist America. Register using

Reference Number 01-AA-TRS-12201.

<Version 1.2> Prepared – January 1, 2024

6. VOLUNTARY/ SUPPLEMENTAL LIFE INSURANCE AND AD&D – EMPLOYEE PAID

You may purchase coverage in increments of $10,000 to a maximum benefit of $500,000 or 5X annual

earnings, whichever is less.

You must submit evidence of insurability for you and for your dependents that you wish to enroll in the

plan and Lincoln Financial must approve any amounts. Coverage reduces to 65% of original amount at age

65, and to 50% at age 70.

Optional accidental death and dismemberment insurance benefit: You may purchase Optional AD&D

benefits in addition to Optional Life Insurance

Optional life coverage for your family

You may also choose additional life coverage for your spouse and/or your child(ren):

You may purchase coverage for your spouse in increments of $5,000 up to $250,000

You may purchase coverage for your child(ren) in increments of $5,000 up to $10,000

Dependent coverage may not exceed 50% of the employee’s benefit amount. To cover your dependents,

you must be covered for voluntary term life. Spouse rates are based on the employee’s age.

7. 401(k) RETIREMENT PLAN

Photon offers a 401(k) Retirement Plan to its employees.

Employees must bear 100% of the contribution. There are no matching employer

contributionsas of now.

An employee will be able to register in the 401(k) portal after meeting the 60-day

employmenteligibility requirement.

The entry date into the plan is the first day of the month coinciding with or next following the

date requirements are met. The employee can register on the 401(k) portal any time after

theirentry date.

Example: An employee is hired on August 16, 2023. The employee must meet the 60-day

eligibility requirement to register in the 401(k) portal. This employee will meet eligibility

requirements as of October 14th. Employees must then wait for the next entry date into

theplan. That would be November 1.

The money in your 401(k) account is invested (you choose investment options) and your

accountgrows according to your investment options with tax-free interest earnings.

The yearly contribution limit is $23,000 for those under 50 and $30,500 for those 50 and older.

The employee can enroll in 401(k) Plan online or by Phone.

Enrollment:

To Enroll Online log into www.TA-Retirement.com

To Enroll by Phone: +1 (800)-401-8726

<Version 1.2> Prepared – January 1, 2024

8. COMMUTER BENEFITS

By enrolling in a commuter benefit plan, employees can pay for qualified workplace mass transit and

parking expenses with tax-free contributions, meaning that employees will not pay federal income taxes,

social security (FICA) taxes, or state income taxes (may vary by state) on these expenses. When you enroll

in the plan, you will indicate how much you want to contribute to your Mass Transit and/or Parking

Account.

Qualified workplace commuting expenses must be for mass transit and/or parking expenses incurred

between a residence and a place of employment. Qualified mass transit expenses include buses, trains,

subways, ferries, and vanpools. Qualified parking expenses include parking expenses incurred near your

workplace or a location from which you commute to work (e.g. park-and-ride).

When enrolling in a commuter benefit plan, employees need to make separate elections for their monthly

qualified expenses for mass transit and/or parking. The maximum tax-free amount you can contribute to

each account is limited by the IRS and is subject to change each year. For current tax-free maximums,

please refer to your plan documentation or visit www.BenefitResource.com

9. LEAVE POLICY

9.1 Paid Time Off (PTO)

15 days of PTO is offered to employees every year on a pro-rata basis.

1.25 PTO will be credited to the employee’s leave account at the beginning of each month.

1.25 PTO will be credited if an employee joins before the 15 th of a given month.

No PTO will be credited for that month if an employee joins after the 15 th of a given month.

No carryover of accrued, unused PTO to the following year will be permitted.

PTO will be forfeited and will not be paid out at the time of exit, unless applicable state law

mandatespayment for PTO.

9.2 Holidays

Photon offers the below-mentioned holidays for the year 2024:

New Year’s Day

Memorial Day

Independence Day

Labor Day

Thanksgiving Day

Christmas Day

9.3 Compensatory Leave (COFF)

Compensatory leave can be sanctioned at the discretion of your reporting manager, when either

an employee or a team has gone beyond the call of duty and has given a considerable amount of

personal time (minimum 8 hours on a non-working day) to meet company/project deadlines.

This is applicable only when the Organization makes a decision to ask an employee to work on a

non-working day due to business urgencies.

A combination of a total of 15 days of accrued, unused PTOs plus accrued, unused comp off as of

December 31st will be eligible for encashment.

<Version 1.2> Prepared – January 1, 2024

Compensatory leave shall be logged and approved before availing it.

No carry-over of accrued, unused Compensatory leave to the following year will be permitted.

9.4 Family and Medical Leave (FML)

Up to 12 weeks of unpaid family and medical leave as per Family and Medical leave

The employee must have been on the rolls of Photon Infotech Inc. for 12 months to be able to

avail Family and Medical leave.

The employee must have worked at least 1250 hours in the preceding 12 months before availing

theFamily and medical leave.

Employees must be working at a location where the company employs 50 or more employees

within75 miles.

<Version 1.2> Prepared – January 1, 2024

10. PAY PERIODS

Payroll will be run on a bi-weekly cycle, meaning once every two weeks, in accordance with the

Company’s regular payroll policies and subject to all withholdings and deductions as required or

permitted by law, currently paid on alternate Fridays. Please refer to the table below with the current

payroll schedule that details the pay periods and the pay dates.

S.no Pay period Start Date Pay period End date Pay date

1 17 December 2023 30 December 2023 05 January 2024

2 31 December 2023 13 January 2024 19 January 2024

3 14 January 2024 27 January 2024 02 February 2024

4 28 January 2024 10 February 2024 16 February 2024

5 11 February 2024 24 February 2024 01 March 2024

6 25 February 2024 09 March 2024 15 March 2024

7 10 March 2024 23 March 2024 29 March 2024

8 24 March 2024 06 April 2024 12 April 2024

9 07 April 2024 20 April 2024 26 April 2024

10 21 April 2024 04 May 2024 10 May 2024

11 05 May 2024 18 May 2024 24 May 2024

12 19 May 2024 01 June 2024 07 June 2024

13 02 June 2024 15 June 2024 21 June 2024

14 16 June 2024 29 June 2024 05 July 2024

15 30 June 2024 13 July 2024 19 July 2024

16 14 July 2024 27 July 2024 02 August 2024

17 28 July 2024 10 August 2024 16 August 2024

18 11 August 2024 24 August 2024 30 August 2024

19 25 August 2024 07 September 2024 13 September 2024

20 08 September 2024 21 September 2024 27 September 2024

21 22 September 2024 05 October 2024 11 October 2024

22 06 October 2024 19 October 2024 25 October 2024

23 20 October 2024 02 November 2024 08 November 2024

24 03 November 2024 16 November 2024 22 November 2024

25 17 November 2024 30 November 2024 06 December 2024

26 01 December 2024 14 December 2024 20 December 2024

<Version 1.2> Prepared – January 1, 2024

You might also like

- Free Payroll Book PDFDocument27 pagesFree Payroll Book PDFGspr BoJoyNo ratings yet

- Blue Shield of California Shield Savings Plans A36813 2011Document2 pagesBlue Shield of California Shield Savings Plans A36813 2011DennisNo ratings yet

- Recruiting in JapanDocument29 pagesRecruiting in JapanRam100% (1)

- Private and Confidential: Application For Employment FormDocument4 pagesPrivate and Confidential: Application For Employment FormAlezec WangNo ratings yet

- Employee Engagement & Retention - Keeping The Right People - HR Toolkit - HrcouncilDocument6 pagesEmployee Engagement & Retention - Keeping The Right People - HR Toolkit - HrcouncilPayel Sinha Chowdhury DasNo ratings yet

- EMPLOYEE Recruitment and SelectionDocument9 pagesEMPLOYEE Recruitment and Selectionjaydee_atc5814No ratings yet

- Money Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2From EverandMoney Saving Tips - A White Paper: Techniques I've Actually Used: Thinking About Money, #2No ratings yet

- 38 - Nisda vs. Sea ServeDocument2 pages38 - Nisda vs. Sea ServeMigel DemdamNo ratings yet

- Department of TamilDocument404 pagesDepartment of TamilSaravanan Muniandi100% (1)

- Photon Benefits 2022 (August)Document7 pagesPhoton Benefits 2022 (August)sojithesouljaNo ratings yet

- 2023 FMCNA Medical Plan Cost ComparisonDocument2 pages2023 FMCNA Medical Plan Cost ComparisonCristal PeoplesNo ratings yet

- 2021 BAAG - Technologies - TalentDocument2 pages2021 BAAG - Technologies - TalentDalt RaNo ratings yet

- Blueoptimum Plus Ppo Plan: Benefit SummaryDocument4 pagesBlueoptimum Plus Ppo Plan: Benefit Summarylooksmart111No ratings yet

- Aetna 2014Document1 pageAetna 2014Vignesh EswaranNo ratings yet

- 2 VEBA Plan ComparisonDocument2 pages2 VEBA Plan ComparisonMitchell BigleyNo ratings yet

- Complete Employee Benefits Guide TemplateDocument38 pagesComplete Employee Benefits Guide TemplateAriyanta DanyNo ratings yet

- 2023 Open Enrollment Benefit Presenation - 11142022Document30 pages2023 Open Enrollment Benefit Presenation - 11142022margreen5No ratings yet

- Jo Say 2020 QuotesDocument6 pagesJo Say 2020 QuotessebastianNo ratings yet

- 2021 THNM Individual Health PlansDocument1 page2021 THNM Individual Health PlansSara SnowNo ratings yet

- Pick A Health Plan - HealthCare - GovDocument9 pagesPick A Health Plan - HealthCare - GovBruce henschelNo ratings yet

- BCBS Enrollment GuideDocument6 pagesBCBS Enrollment GuideAnonymous Lri40PrlkNo ratings yet

- USS Pre-Medicare PPO With RX PlanDocument3 pagesUSS Pre-Medicare PPO With RX PlanAnonymous w0egAgMouGNo ratings yet

- 2017 Employee Benefit Highlights - Support StaffDocument8 pages2017 Employee Benefit Highlights - Support StaffJohn AcardoNo ratings yet

- 2022 Steven Charles BAG - CODocument4 pages2022 Steven Charles BAG - COAlejuanchis Kamacho GarciaNo ratings yet

- Us Apple Plus Ppo Feb2019 en 1Document3 pagesUs Apple Plus Ppo Feb2019 en 1Lucas Coleta AlmeidaNo ratings yet

- Book1 (Version 1)Document1 pageBook1 (Version 1)agulabNo ratings yet

- Aetna Open Choice Ppo: Plan DetailsDocument2 pagesAetna Open Choice Ppo: Plan DetailsSnake Diet RyanNo ratings yet

- Plan ComparisonDocument2 pagesPlan ComparisonSahil JindalNo ratings yet

- Blue Cross Select BronzeDocument6 pagesBlue Cross Select Bronzeapi-285960909No ratings yet

- Benefit Highlights: AARP Medicare Advantage Choice (PPO)Document3 pagesBenefit Highlights: AARP Medicare Advantage Choice (PPO)EstherNo ratings yet

- What You Pay in The PPO PlanDocument2 pagesWhat You Pay in The PPO Plannathan wongNo ratings yet

- FY 2022-2023 Instruction Partners Benefits OverviewDocument16 pagesFY 2022-2023 Instruction Partners Benefits OverviewSendhil RevuluriNo ratings yet

- Thomas PPO Thomas HMO Claire EPO Claire HMO: in Network. in NetworkDocument1 pageThomas PPO Thomas HMO Claire EPO Claire HMO: in Network. in Networkanas fassiNo ratings yet

- 2023 Talent BAAGDocument3 pages2023 Talent BAAGThi HanNo ratings yet

- Benefits Overview 2018Document5 pagesBenefits Overview 2018Joby JoNo ratings yet

- LTIM - USA Employees Benefits Overview - 2024Document20 pagesLTIM - USA Employees Benefits Overview - 2024Ramesh Kumar KNo ratings yet

- KP - Plan Summary Medical - PPODocument3 pagesKP - Plan Summary Medical - PPOshanegbaker51No ratings yet

- Medical Insurance: January 1, 2023 - December 31, 2023Document4 pagesMedical Insurance: January 1, 2023 - December 31, 2023Andrés BaqueroNo ratings yet

- Summary of 2022 Benefit Changes: MedicalDocument5 pagesSummary of 2022 Benefit Changes: MedicalChinnu SalimathNo ratings yet

- M2A1 US Census Data SearchDocument6 pagesM2A1 US Census Data SearchragcajunNo ratings yet

- Plan ComparisonDocument4 pagesPlan Comparisontth79hj4dvNo ratings yet

- UserDocument5 pagesUserAldieno PribadiNo ratings yet

- Anthem® Blue Cross Your Plan: Snap, Inc: Custom Classic PPO 500/20/20 Your Network: Prudent Buyer PPODocument9 pagesAnthem® Blue Cross Your Plan: Snap, Inc: Custom Classic PPO 500/20/20 Your Network: Prudent Buyer PPOSamson FungNo ratings yet

- TransPhos MedicalDocument3 pagesTransPhos Medicalres6250No ratings yet

- Isoa Hea OMPASS - 2016 - 2017 PDFDocument13 pagesIsoa Hea OMPASS - 2016 - 2017 PDFSharif M Mizanur RahmanNo ratings yet

- 2010 UnitedHealthcare Benefits SummaryDocument1 page2010 UnitedHealthcare Benefits Summaryapi-27017317No ratings yet

- Kaiser Permanente Compare Plans CA 2011 KPIFDocument1 pageKaiser Permanente Compare Plans CA 2011 KPIFDennis AlexanderNo ratings yet

- Medical Comparison Chart 2020Document3 pagesMedical Comparison Chart 2020hollingermikeNo ratings yet

- 2020 Ankura Benefits GuideDocument20 pages2020 Ankura Benefits GuidegpperkNo ratings yet

- Schedule of BenefitsDocument7 pagesSchedule of BenefitsMaddy CruzNo ratings yet

- 76962CT0010006-01 en USDocument98 pages76962CT0010006-01 en USKathy ApergisNo ratings yet

- Employee Benefits-Wellness Guide 2023-24Document30 pagesEmployee Benefits-Wellness Guide 2023-24shanzeh2609No ratings yet

- WWW - Healthcare.gov/sbc-Glossary: Important Questions Answers Why This MattersDocument10 pagesWWW - Healthcare.gov/sbc-Glossary: Important Questions Answers Why This MattersRohitKumarNo ratings yet

- Blue-Cross-Premier-Platinum-Extra-Dental-Vision CareerDocument8 pagesBlue-Cross-Premier-Platinum-Extra-Dental-Vision Careerapi-248930594No ratings yet

- Rish Equipment Base Plan Option Eff. 1.1.2019Document4 pagesRish Equipment Base Plan Option Eff. 1.1.2019michala anthonyNo ratings yet

- Blue Shield of California Shield Savings Plans IFP 1-2011Document2 pagesBlue Shield of California Shield Savings Plans IFP 1-2011Dennis AlexanderNo ratings yet

- 02 28 2019Document4 pages02 28 2019Deep khatkarNo ratings yet

- Kaiser Permanente: Good Health Is No SecretDocument6 pagesKaiser Permanente: Good Health Is No SecretThomas Dominic CazneauNo ratings yet

- Public Employees' Benefit Board: Plan Design Options: UpdatedDocument4 pagesPublic Employees' Benefit Board: Plan Design Options: UpdatedStatesman JournalNo ratings yet

- 2017 Anthem GHIP Benefits Booklet (Final)Document119 pages2017 Anthem GHIP Benefits Booklet (Final)Alexander NewberryNo ratings yet

- 2017 Anthem GHIP Benefits Booklet (Final)Document119 pages2017 Anthem GHIP Benefits Booklet (Final)Alexander NewberryNo ratings yet

- I A Bluechoice Ppo - Large Group (51+ Employees) Plan 4511Sx Benefit SummaryDocument3 pagesI A Bluechoice Ppo - Large Group (51+ Employees) Plan 4511Sx Benefit SummaryDave EmersonNo ratings yet

- Trinity Health 020 Traditional Ppo Plan 10202021Document10 pagesTrinity Health 020 Traditional Ppo Plan 10202021emily WNo ratings yet

- International Student Health Certificate Individual CoverageDocument40 pagesInternational Student Health Certificate Individual CoverageJialun ZhuNo ratings yet

- HSA Choice Plus Plan AIQM/02V: Important Questions Answers Why This MattersDocument8 pagesHSA Choice Plus Plan AIQM/02V: Important Questions Answers Why This MattersAnonymous PWVeGM5n9gNo ratings yet

- Kaiser Permanente: KP CA Silver 2000/45: This Is Only A SummaryDocument8 pagesKaiser Permanente: KP CA Silver 2000/45: This Is Only A SummaryKelly HoffmanNo ratings yet

- 2024 Salaried ICSDocument4 pages2024 Salaried ICSSaravanan MuniandiNo ratings yet

- 401k Separation From Service FormDocument9 pages401k Separation From Service FormSaravanan MuniandiNo ratings yet

- PG Scholar, Lecturer, HOD, Department of Maruthuvam,: Biography of Siddhars R.N.Hema, H.Nalini Sofia, S.MohanDocument7 pagesPG Scholar, Lecturer, HOD, Department of Maruthuvam,: Biography of Siddhars R.N.Hema, H.Nalini Sofia, S.MohanSaravanan MuniandiNo ratings yet

- Gratitude Journal Printable With PromptsDocument2 pagesGratitude Journal Printable With PromptsSaravanan MuniandiNo ratings yet

- TVA BOK 0018936 Encyclopaedia of Tamil LiteratureDocument694 pagesTVA BOK 0018936 Encyclopaedia of Tamil LiteratureSaravanan MuniandiNo ratings yet

- MicroDocument1 pageMicroSaravanan MuniandiNo ratings yet

- Coronavirus Economic Depression Survival PDFDocument42 pagesCoronavirus Economic Depression Survival PDFSaravanan MuniandiNo ratings yet

- QA Analyst - Automation TestingDocument1 pageQA Analyst - Automation TestingSaravanan MuniandiNo ratings yet

- SystemDocument1 pageSystemSaravanan MuniandiNo ratings yet

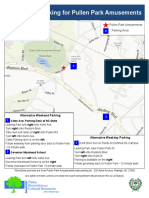

- Alternative Parking For Pullen Park AmusementsDocument1 pageAlternative Parking For Pullen Park AmusementsSaravanan MuniandiNo ratings yet

- Delivery Manager: The Main Responsibilities of The Post AreDocument4 pagesDelivery Manager: The Main Responsibilities of The Post AreSaravanan MuniandiNo ratings yet

- Factors Affecting StaffingDocument1 pageFactors Affecting Staffingbabbusinghmann007No ratings yet

- 1978 Mowday, Steers, L.W. PorterThe Measurement of Organizational CommitmentDocument58 pages1978 Mowday, Steers, L.W. PorterThe Measurement of Organizational CommitmentÁtila de AssisNo ratings yet

- Professional EthicsDocument11 pagesProfessional EthicsConnie LopicoNo ratings yet

- Baylor ComplaintDocument22 pagesBaylor ComplaintDeadspinNo ratings yet

- Osha NotesDocument4 pagesOsha NotesYee JingyeNo ratings yet

- Written HW4Document14 pagesWritten HW4aplesgjskNo ratings yet

- Psea - 19 Advance Payment For Maternity BenefitDocument1 pagePsea - 19 Advance Payment For Maternity BenefitForemost HRNo ratings yet

- Letter On Staff Welfare MeasuresDocument2 pagesLetter On Staff Welfare Measuresdsk4678No ratings yet

- Element 3 Case Study: Change in Organizational Culture at JaguarDocument3 pagesElement 3 Case Study: Change in Organizational Culture at JaguarRohaan a.k.a HoneyNo ratings yet

- The HR Scorecard AND The Balanced Scorecard: Presented By: MAYURI DAS (10BSP1061)Document21 pagesThe HR Scorecard AND The Balanced Scorecard: Presented By: MAYURI DAS (10BSP1061)Mayuri DasNo ratings yet

- ASM2 EV THẦY DŨNGDocument7 pagesASM2 EV THẦY DŨNGNguyễn Thành Nam 12C4 25.No ratings yet

- Domestic Contract 2024Document5 pagesDomestic Contract 2024vicky.sharon2No ratings yet

- Qa7-Assessment and Training Staff Registration FormDocument3 pagesQa7-Assessment and Training Staff Registration FormDang Minh HuongNo ratings yet

- Unitop PayrollDocument2 pagesUnitop Payrolldelacruzstevewyatt0208No ratings yet

- Federal Civil Servants ProclamationDocument35 pagesFederal Civil Servants ProclamationephremNo ratings yet

- Effect of Glob On WomenDocument36 pagesEffect of Glob On WomenRahul JeshnaniNo ratings yet

- Business Operations AND ImplementationDocument45 pagesBusiness Operations AND ImplementationDar LynnNo ratings yet

- Group 1 Chapters 1 3Document11 pagesGroup 1 Chapters 1 3Julius Miguel SarmientoNo ratings yet

- Mayor Annise Parker Inaugural Address January 3, 2012: I Love This City!Document4 pagesMayor Annise Parker Inaugural Address January 3, 2012: I Love This City!Houston ChronicleNo ratings yet

- Socio-Economic Status of Daily Wage Earners in Cuddalore TownDocument8 pagesSocio-Economic Status of Daily Wage Earners in Cuddalore TownarcherselevatorsNo ratings yet

- Clare BerminghamDocument93 pagesClare BerminghamBryan Ken TanNo ratings yet

- Labour Law Cheat SheetDocument34 pagesLabour Law Cheat SheetAnjana P NairNo ratings yet

- HR Guide Xto10x 4b781550b0Document35 pagesHR Guide Xto10x 4b781550b0Yatharth SahooNo ratings yet

- Family Particular FormDocument2 pagesFamily Particular FormYin ChuangNo ratings yet