Professional Documents

Culture Documents

West Visayas State University PITCHING YOU SOFTLY 1

West Visayas State University PITCHING YOU SOFTLY 1

Uploaded by

ERICAH VILLACARLOSCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

West Visayas State University PITCHING YOU SOFTLY 1

West Visayas State University PITCHING YOU SOFTLY 1

Uploaded by

ERICAH VILLACARLOSCopyright:

Available Formats

COMPANY BACKGROUND

Nickel Asia Corporation and its subsidiaries engage in the production and

exportation of industrial metals. Currently, the company runs the 3rd

largest nickel mining facility in the world and dominates the country's

local nickel production. The company also has increasing interests in the

renewable energy sector by holding assets in solar and geothermal

NICKEL ASIA

NICKEL ASIA CORP.

CORP. sources in different parts of the country.

DATA AS OF OCTOBER 19, 2022

BUSINESS SUMMARY RECOMMENDATION AND TARGET PRICE

Company Name: Nickel Asia Corporation

Nickel Processing and Exploration Stock Symbol: NIKL P10,000

Historical Data

Last Traded Price: P5.01 P7,500

60% 65% 100% Volume: 4,249,000

P5,000

Free Cash

Value: P21,349,235.00 Flow

*All values displayed

in Millions

P2,500

Rio Tuba Taganito Mining Hinatuan Mining 52 Week High: P9.77

Nickel Corporation Corporation Corporation P0

52 Week Low: P4.88

Ownership in the company P-2,500

The company is the biggest nickel producer in the Market Capitalization: P68.56B 2017 2018 2019 2020 2021

country. NIKL owns productive mining assets in Earnings per Share (EPS): P0.57 For five years, the company was able to sustain a

Palawan, Surigao del Norte, and Dinagat Islands. P/E Ratio: P7.7x positive cash flow maintaining an Average Free Cash

According to the company's 2021 report they produced flow of 5.5 Billion PHP which means that NIKL has a

Dividend per Share: P0.22 healthy financial health and efficient operations.

a total of 17.9 million wet metric tons of nickel to

Dividened Yield: 4.76%

various clients in China, Japan, and the Philippines. Discounted Cash Flow (DCF)

Renewable Energy Sector FINANCIAL ASSESSMENT Fair Value P7.34 per share

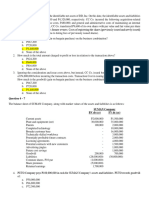

Income Statement Buy at Price P4.41 per share

86.3% 100% 100%

Revenues 2021 2020

Current Price P5.01 per share

Emerging Mindoro Geothermal Biliran Holdings Sale of ore and limestone P 26,099,020 P 20,456,629

Power Inc. Power Corporation Inc. Services and others P 797,163 P 1,026,794 Sell at Price P6.48 per share

Ownership in the company Sale of power P 507,932 P 288,158

The power sector of Nickel Asia is also securing its Total Revenue P 27,404,115 P 21,771,581 As per calculation, the fair value of Nickel Asia

status to make more profits for the company. Total Expenditure P 14,611,111 P 13,854,718 Corporation is valued at P7.34 per share. However, the

Emerging Power Inc. a subsidiary of Nickel Asia Margin market undervalues this stock by 31% in which its

supplies 73,596 MW of green energy in the Subic Bay Gross 67.24% 51.54%

current stock price is only P5.01.

Net 29.64%

Area thus producing P17.06 million of net income for Company P/E Ratio

Growth Rates

the company.

Revenue P 27,404,115 P 21,771,581 Industry Average 11.7x

Mindoro Geothermal Corp. and Biliran Holdings Inc.

Net Profit P 10,638,174 P 5,489,042

also dominate the power distribution and generation Century Peak Holdings 31.3x

EPS 0.57 0.30

in the Provinces of Mindoro Occidental, Oriental and Nickel Asia 7.7x

EPS Growth Rate (vs. 2020) 92.07% 51.95%

the whole island of Mindanao. *All values displayed in Thousands, PHP. Fiscal Year ends in December*

Global Ferronickel Holdings 6.3x

Nickel Asia Corporation has 3 different income streams,

BUSINESS STRENGTH according to their 2021 reports 95% of their income was Philex Mining 5.6x

collected from the sale of ores and limestone in their mining Currently trading at P5.01 it is currently 34.9%

The demand for electric cars is going bullish. In 2018, operations. A 2.9% of their earnings was taken from their undervalued based in its current P/E ratio of P7.7x.

global electric vehicles only accounts for 2.2% market service sector and the remaining 2.1% was produced by their

share in automobiles, however, by 2035 it is estimated holdings in power generation. Total P/E Ratio Total

that 45% of all vehicle sales would be electric. The company has also a healthy gross margin of 67.24% Market P68.56B P8.92B Earnings

Capitalization

P7.7x Per Share

Export ban in Indonesia and Western Embargo of presenting that the company has an edge in operational

Russian nickel would mean that the Philippines would efficiency against the whole mining industry which has an

likely become the largest nickel producer in the world. average margin of 40%. Price to Book

The company is well-positioned in this trend given The company also saw a 29.6% rise in net profit, this signifies Outstanding

Shareholders

that it controls 54% of the total market share of nickel that the company recovered faster amidst the impact of the P36.32B P2.66 P13.63B Shares

Equity

in the Philippines. COVID-19 pandemic. We are confident that this rise in profit

The nickel export ban in Indonesia would mean a would continue, given that the demand for nickel is going

The company has a lower price to book value which

lower supply in the overall market, this would push bullish.

means that this company has to offer a cheaper

nickel prices to go up which means a higher profit Balance Sheet valuation which means the investors are not overpaying

margin for the company. 2021 2020

for the shares that they buy.

The company also has a strong moat against its Current Assets P 24, 011, 065 P 22,011,970

competitor. Nickel Asia has an 83% lead in market

INVESTMENT SUMMARY

Total Assets P 51, 700, 882 P 48,913,290

capitalization, a much higher market share of 54.3%, Current Liabilities P 11, 924, 982 P 10,944,323

enjoys diversity with its holdings in Renewable Energy Total Liabilities P 15, 371, 682 P 14,316,501

and a higher production rate against Global Stockholder’s Equity P 36, 329, 200 P 34,596,789 Shareholder Returns

Ferronickel Holdings Inc. Stockholder’s Equity- Parent P 36, 939, 767 P 31,042,396 NIKL Industry Market

Book Value per Share P 2.42 P 2.28 7-day -0.2% -0.9% 3.5%

The company has also received citations and awards

30-day -11.2% -8.8% -4.6%

for being a safe, reliable, and responsible mining *All values displayed in Thousands, PHP. Fiscal Year ends in December*

company. In 2017, they received the First ASEAN The company saw a 5% increase in its total assets from 2020 to 90-day -7.4% -9.8% -3.3%

Mineral Awards and by 2020 they received the 2021, book value per share is also up by 6.12%. 1 -year

-3.8% -21.4% -13.8%

-10.2% -23.9% -15.8%

Presidential Mineral Industry Environment Award. The company has strong financials. Its accumulated assets are

63.2% 9.3% -14.6%

These recognitions by local and foreign institutions 70% higher than its total liabilities. We can assure that Nickel 3-year

28.5% 0.7% -19.8%

can help the company in maintaining their good Asia Corporation is free from the risk of debt. 89.1% -16.7% -11.9%

5-year

public relations and secure their position in ESG Cash Flow Statement 33.8% -24.2%

including dividend return

-20.6%

ratings. Operating Activities 2021 2020

For the past five years, Nickel Asia has outperformed

Net Cash Flow P 9,778, 000 P 8,960,000

both the mining sector and the overall market. This is a a

Global Ferronickel Net Operating Cash Flow Growth (vs.

Nickel Asia

Holdings Inc. 2020)

9.12% 43.94% great sign to invest in Nickel Asia; the company also

Market Capital P68.5B P11.12B Net Operating Cash Flow/ Sales (vs. 2020) 37.10% 42.80%

enjoyed high levels of returns from dividends alone.

Market Share 54.3% 4.75% Investing Activities

1.Macroeconomic Trends

Renewable Energy, Capital Expenditures P 2,046, 000 P 2,349,000

Industries Mining

Mining 2. Stable Finances

Capital Expenditures (Fixed Assets) P 1,774, 000 P 2,133,000

Dividend Yield 4.39% 7.14% 3. Excellent Valuations

Capital Expenditures (Other Assets) P 272, 000 P 216,000

17.9 million wet 4.88 million wet metric 4. Moat

Total Nickel Production Capital Expenditures Growth 12.90% -52.88%

metric tons tons 5. High Dividend Yield

Cash Flow from Financing

6. Low Potential Risks

Total Cash Dividends Paid P 7,854,000 P 5,732,000

INVESTMENT RISKS

Free Cash Flow P 8,003,000 P 6,827,000

The company is well-positioned in the need of the

Free Cash Flow Growth 17.22% 37.39%

world to decarbonize, as the demand for electric

*All values displayed in Thousands, PHP. Fiscal Year ends in December*

vehicles and renewable energy is on the rise investing

Zero COVID Policy of China The company’s free cash flow increased by 17.22%. This only

in Nickel Asia would allow investors to profit in this

Due to the government's strict lockdown regulations, shows that the company has enough cash flow to sustain its

trend.

the manufacturing sector in China is currently slowing operations and responsibilities.

The company has also an excellent profit margin,

down. This harsh policy is slowing down the demand Increasing amount of free cash flow is also a good sign for

enough assets to counter its debt and increasing cash

for nickel and may affect the earnings of the company. dividend investors, higher cash flows would likely mean higher

flow. We project that this trend would continue given

However, we are confident that once this policy would dividend yields for the shareholders.

that global demand for nickel is on the rise and the

be reversed demand for nickel would be back at high

company’s investments in renewable energy are

levels.

starting to become profitable.

HOLD The market undervalues this stock by 31% in which its

Volatility As the central bank increase its interest rates, we current stock price is only P 5.01. For long term

The volatility of the stock market and the price of

nickel on the global market both have an impact on

are expecting that the bond market would investors, this miscalculation of the market is a great

opportunity to buy a great company that has a healthy

NIKL. The performance of the company would reflect outperform the stock market. As a result we are

cash flow and quite good dividend yield. However, if

the general health of both the commodity and the giving a HOLD rating to Nickel Asia Corporation. We investors are looking for a shorter duration of holding

stock market as business cycles go through booms and are recommending that investors should wait for time, we advise to buy the company at P 4.41 and sell it

busts.

the stock price to fall at P4.41 per share to maximize at P 6.48 to earn a 47% profit from capital appreciation.

potential returns. For investors that already hold We assume that the potential risks that threaten the

Central Bank's Interest Rates

company are just temporary and does not give any

Investors may choose government bonds over stocks. equity in Nickel Asia, we highly recommend to hold

existential threat to the company, rather these threats

As the interest rates increases, it would hurt the whole your shares because the upside potential of the are just a part of market corrections and regular

stock market itself, lowering the perceived value of the company is highly possible. business cycles.

company.

You might also like

- Treasury Manipulation ComplaintDocument61 pagesTreasury Manipulation ComplaintZerohedgeNo ratings yet

- Cash and Marketable Securities ManagementDocument56 pagesCash and Marketable Securities Managementkhanglala100% (3)

- Kelly's Finance Cheat Sheet V6Document2 pagesKelly's Finance Cheat Sheet V6Kelly Koh100% (4)

- 2014 CFA Level 3 Mock Exam AfternoonDocument30 pages2014 CFA Level 3 Mock Exam AfternoonElsiiieNo ratings yet

- Value Investor Insight - 3.31.14 Kopernik PDFDocument11 pagesValue Investor Insight - 3.31.14 Kopernik PDFJohn Hadriano Mellon FundNo ratings yet

- Problem 22-1, Page 610 Classic Company: GivenDocument3 pagesProblem 22-1, Page 610 Classic Company: GivenDeanne LumakangNo ratings yet

- EMI Group PLC Case - RichaDocument9 pagesEMI Group PLC Case - RichaRahul UdainiaNo ratings yet

- Chap 025Document40 pagesChap 025malek99No ratings yet

- Reviewer - Joint CostDocument22 pagesReviewer - Joint Costhsjhs0% (1)

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Homework Assignment - Week 2 - AnswersDocument11 pagesHomework Assignment - Week 2 - AnswersVoThienTrucNo ratings yet

- Victoria Chemicals PLC (A) The Merseyside ProjectDocument12 pagesVictoria Chemicals PLC (A) The Merseyside ProjectAde AdeNo ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.No ratings yet

- Ezra Holdings (EZRA SP) : OW (V) : Shifting Gears - NDR TakeawaysDocument13 pagesEzra Holdings (EZRA SP) : OW (V) : Shifting Gears - NDR TakeawaysTheng RogerNo ratings yet

- Interview With Bill Nygren of Oakmark FundsDocument9 pagesInterview With Bill Nygren of Oakmark FundsExcessCapitalNo ratings yet

- AMFI Sample 500 Questions.Document35 pagesAMFI Sample 500 Questions.amankumar sahuNo ratings yet

- Business Combination and Consolidated FS Part 1Document6 pagesBusiness Combination and Consolidated FS Part 1markNo ratings yet

- Patersons+NIC+Initiation 20190409Document28 pagesPatersons+NIC+Initiation 20190409andyNo ratings yet

- Mike Beveridge - Doing Business Under The OceanDocument18 pagesMike Beveridge - Doing Business Under The OceanGiacomo CalligarisNo ratings yet

- Kencana Petroleum Berhad: Going Into IPF-20/04/2010Document5 pagesKencana Petroleum Berhad: Going Into IPF-20/04/2010Rhb InvestNo ratings yet

- TTR IDeals Brazil MA Handbook 2022Document63 pagesTTR IDeals Brazil MA Handbook 2022Vitor SáNo ratings yet

- India Tech Monthly Funding ReportDocument29 pagesIndia Tech Monthly Funding ReportShreyaNo ratings yet

- KEI INDUSTRIES LIMITED Corporate PresentationDocument32 pagesKEI INDUSTRIES LIMITED Corporate PresentationKEI IndustriesNo ratings yet

- BS Delhi English 12-09-2023Document22 pagesBS Delhi English 12-09-2023maddyyNo ratings yet

- Final Answers (Group 1)Document3 pagesFinal Answers (Group 1)Carl Roger AnimaNo ratings yet

- SK Energy NDR PT 20100407Document62 pagesSK Energy NDR PT 20100407Thierno Samassa LyNo ratings yet

- AGY Research ReportDocument14 pagesAGY Research ReportHoward QinNo ratings yet

- PCS Payroll April 11 17. 2024Document1 pagePCS Payroll April 11 17. 2024johnrexNo ratings yet

- FAR Week 7. Investment in Equity Securities and Investment in AssociateDocument3 pagesFAR Week 7. Investment in Equity Securities and Investment in AssociateMarianeNo ratings yet

- Partnership AcctgDocument3 pagesPartnership AcctgcessbrightNo ratings yet

- TTR Ideals Brazil Venture Capital Handbook 2022Document55 pagesTTR Ideals Brazil Venture Capital Handbook 2022Andreia OlliveiraNo ratings yet

- Kuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Document4 pagesKuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Rhb InvestNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- This Study Resource Was: Cebu Cpar CenterDocument9 pagesThis Study Resource Was: Cebu Cpar CenterGlizette SamaniegoNo ratings yet

- Cement Sector Detail Report - Sow The Seeds For Long TermDocument39 pagesCement Sector Detail Report - Sow The Seeds For Long TermMehroz KhanNo ratings yet

- Valoral Advisors Food Agriculture Investment Funds 2023 1Document1 pageValoral Advisors Food Agriculture Investment Funds 2023 1burmanikgpNo ratings yet

- Account Titles Debit Credit: Set BDocument1 pageAccount Titles Debit Credit: Set BAngel TabuenaNo ratings yet

- Havells India Limited April 2023Document35 pagesHavells India Limited April 2023shivangi.singhalNo ratings yet

- Quiz 1 Operating Segment and Interim Financial Reporting Oct 8 2022Document4 pagesQuiz 1 Operating Segment and Interim Financial Reporting Oct 8 2022laurence inocencioNo ratings yet

- The Next 500: Most ValuableDocument6 pagesThe Next 500: Most Valuablesreejit nairNo ratings yet

- Techno Funda 65.0 - Metals To Shine AgainDocument3 pagesTechno Funda 65.0 - Metals To Shine AgainTomás ColaçoNo ratings yet

- Presentasi AKRA Di Forum OSK SIngapura 6-7 Januari 2011Document41 pagesPresentasi AKRA Di Forum OSK SIngapura 6-7 Januari 2011efendidutaNo ratings yet

- Tax Mac2002Document8 pagesTax Mac2002Insan KerdilNo ratings yet

- Project Iron, PresentationDocument30 pagesProject Iron, PresentationAndre SylvestreNo ratings yet

- Project Report Format in Excel KnowyourgstDocument18 pagesProject Report Format in Excel KnowyourgstStena NadishaniNo ratings yet

- Puncak Niaga Berhad: Eyeing Hogenakkal Water Project in India - 21/10/2010Document2 pagesPuncak Niaga Berhad: Eyeing Hogenakkal Water Project in India - 21/10/2010Rhb InvestNo ratings yet

- Entrepreneurship Module 5: Week 6: Basic Books Need For Business RecordkeepingDocument4 pagesEntrepreneurship Module 5: Week 6: Basic Books Need For Business RecordkeepingAra GonzagaNo ratings yet

- Financial Assets Management KPI & Dashboard: Your Company NameDocument25 pagesFinancial Assets Management KPI & Dashboard: Your Company NameRUPAV TIWARINo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Booklet For Public Investors: Contact UsDocument12 pagesBooklet For Public Investors: Contact UsSan KimSorngNo ratings yet

- 3C 8349 Fo2891Document31 pages3C 8349 Fo2891sanjeev_1990100% (1)

- Parag Parikh Tax Saver FundDocument1 pageParag Parikh Tax Saver FundYogi173No ratings yet

- J.P. Morgan Industrials Conference Fireside Chat: Bob Patel - CEODocument15 pagesJ.P. Morgan Industrials Conference Fireside Chat: Bob Patel - CEOmanojkp33No ratings yet

- Power Monthly - October 19 Roundup 07-11-19Document8 pagesPower Monthly - October 19 Roundup 07-11-19Santosh HiredesaiNo ratings yet

- FNI Presentation 07.04.18 For Widescreen (ACIC - Rev) With Final TranscriptDocument56 pagesFNI Presentation 07.04.18 For Widescreen (ACIC - Rev) With Final TranscriptShella VamNo ratings yet

- Assessment 3Document4 pagesAssessment 3Sarah Nicole S. LagrimasNo ratings yet

- Ms DD 4810 Ics DWG 0302 - Rev2Document1 pageMs DD 4810 Ics DWG 0302 - Rev2lhecemponNo ratings yet

- Mindtree LTD: Strong Numbers, Rich ValuationsDocument8 pagesMindtree LTD: Strong Numbers, Rich ValuationsBhavyaNo ratings yet

- Steps in Consolidation Working Papers On The Date of AcquisitionDocument3 pagesSteps in Consolidation Working Papers On The Date of AcquisitionPinky DaisiesNo ratings yet

- No.C/l, G Block, Bandra - Kurla ComplexDocument25 pagesNo.C/l, G Block, Bandra - Kurla ComplexBhaskar DasguptaNo ratings yet

- DDDDDDocument18 pagesDDDDDSunny MoreNo ratings yet

- Apriavronijs: Date: November 9, 2020Document2 pagesApriavronijs: Date: November 9, 2020Martine Amos AntonioNo ratings yet

- Europe & Israel 4Q21 Deals Done ReviewDocument69 pagesEurope & Israel 4Q21 Deals Done ReviewCarolina GutierrezNo ratings yet

- Alfm Growth Fund: COL Key HighlightsDocument1 pageAlfm Growth Fund: COL Key Highlightsjovz castillonesNo ratings yet

- Fin 1 Tutorial 3 AnswersDocument3 pagesFin 1 Tutorial 3 AnswersLumumba KuyelaNo ratings yet

- ABUSCOM Lecture 15Document2 pagesABUSCOM Lecture 15Mark Lyndon YmataNo ratings yet

- Cost Acc CHP1 COCDocument8 pagesCost Acc CHP1 COCpurvi doshiNo ratings yet

- Partnership - Dissolution Upon Ownership Changes: Problem 2-1Document22 pagesPartnership - Dissolution Upon Ownership Changes: Problem 2-1marieieiemNo ratings yet

- Ms Block - Lnisom Unit Cause & Effect Chart: Algiers Refinery Rehabilitation and Adaptation ProjectDocument20 pagesMs Block - Lnisom Unit Cause & Effect Chart: Algiers Refinery Rehabilitation and Adaptation ProjectGahaNo ratings yet

- Philequity Fund: Value of P5,000 Invested Since 1998Document1 pagePhilequity Fund: Value of P5,000 Invested Since 1998jovz castillonesNo ratings yet

- Nepal's Investment Climate: Leveraging the Private Sector for Job Creation and GrowthFrom EverandNepal's Investment Climate: Leveraging the Private Sector for Job Creation and GrowthNo ratings yet

- Student Leaders MasterclassDocument2 pagesStudent Leaders MasterclassERICAH VILLACARLOSNo ratings yet

- Villacarlos - Preliminary TopicDocument1 pageVillacarlos - Preliminary TopicERICAH VILLACARLOSNo ratings yet

- Ab Polsci 2a, Villacarlos EricahDocument1 pageAb Polsci 2a, Villacarlos EricahERICAH VILLACARLOSNo ratings yet

- g3 - St. Augustine (Narrative)Document7 pagesg3 - St. Augustine (Narrative)ERICAH VILLACARLOSNo ratings yet

- REALISM Amigable Blanca Sumbi ABPOLSCI 2ADocument4 pagesREALISM Amigable Blanca Sumbi ABPOLSCI 2AERICAH VILLACARLOSNo ratings yet

- Villacarlos Shortpaper2Document4 pagesVillacarlos Shortpaper2ERICAH VILLACARLOSNo ratings yet

- Pre-Fitness VillacarlosDocument2 pagesPre-Fitness VillacarlosERICAH VILLACARLOSNo ratings yet

- Article 10 Local Government Code-BernasDocument19 pagesArticle 10 Local Government Code-BernasERICAH VILLACARLOSNo ratings yet

- Local Legislative Bodies and PowersDocument57 pagesLocal Legislative Bodies and PowersERICAH VILLACARLOSNo ratings yet

- CapitalBudgetingPractice Questions PDFDocument10 pagesCapitalBudgetingPractice Questions PDFKelvin ChenNo ratings yet

- Financial Statements Analysis - Ratio AnalysisDocument44 pagesFinancial Statements Analysis - Ratio AnalysisDipanjan SenguptaNo ratings yet

- NBP Nafa Funds PDFDocument23 pagesNBP Nafa Funds PDFHamid AliNo ratings yet

- A Financial Study of Cattle Integration in Oil Palm PlantationsDocument11 pagesA Financial Study of Cattle Integration in Oil Palm Plantationscospi03No ratings yet

- Introduction To The Investment EnvironmentDocument51 pagesIntroduction To The Investment EnvironmentSaish ChavanNo ratings yet

- Interest RatesDocument38 pagesInterest RatesLealyn CuestaNo ratings yet

- MCS 035 NotesDocument7 pagesMCS 035 NotesAshikNo ratings yet

- Jun 2003 - AnsDocument15 pagesJun 2003 - AnsHubbak KhanNo ratings yet

- The Best Strategies For Inflationary TimesDocument32 pagesThe Best Strategies For Inflationary TimesAlvaro Neto TarcilioNo ratings yet

- Investec Temple Bar Investment TrustDocument56 pagesInvestec Temple Bar Investment TrustJohnGi10No ratings yet

- Finmar Prelims Reviewer 2ND Yr BsaDocument7 pagesFinmar Prelims Reviewer 2ND Yr BsaCristine Joy JemillaNo ratings yet

- Practice Questions C1-C3Document6 pagesPractice Questions C1-C3Vân Nhi PhạmNo ratings yet

- Cfs AssignmentDocument27 pagesCfs Assignmentcharlie simoNo ratings yet

- Understanding Financial Ratios AnalysisDocument6 pagesUnderstanding Financial Ratios AnalysismanuNo ratings yet

- FIN222 Lecture 2: Recording 1: AnnouncementDocument12 pagesFIN222 Lecture 2: Recording 1: AnnouncementStephanie BuiNo ratings yet

- Valuation of SharesDocument44 pagesValuation of SharesShivu BaligeriNo ratings yet

- Intermediate Accounting CH 6 SolutionsDocument6 pagesIntermediate Accounting CH 6 SolutionsNatazia IbañezNo ratings yet

- Accounting For Corporations: ACT B861FDocument61 pagesAccounting For Corporations: ACT B861FCalvin MaNo ratings yet

- FIN 1050 - Final ExamDocument6 pagesFIN 1050 - Final ExamKathi100% (1)