Professional Documents

Culture Documents

Chapter-4-Project MGT Lecture Note

Uploaded by

Jiru AlemayehuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter-4-Project MGT Lecture Note

Uploaded by

Jiru AlemayehuCopyright:

Available Formats

Project Management Lecture Note

UNIT 4: PROJECT PREPARATION/FEASIBILITY STUDY

A feasibility study is an in depth investigation of the factors that affect the future success of a

project or the process of project preparation and analysis.

Feasibility study provides relevant information for the final investment decision (accept or reject)

based on a thorough and comprehensive analysis of the project technical, financial, economic,

social and institutional aspects.

Feasibility study covers the following areas of study:

1. Market and Demand Analysis

2. Raw Materials and Supplies Study

3. Location, site and Environmental Impact Assessment (EIA)

4. Production Program and Plant Capacity

5. Technology Selection

6. Organizational and Human Resource

7. Financial and Economic Analysis

4.1. Markets and Demand Analysis

In most circumstances, the first step in project analysis is to estimate the potential size of the

market for the product proposed to be manufactured (or service planned to be offered) and get an

idea about the market share that is likely to be captured. The task demands an in – depth study

and analysis of various factors such as:

o existing pattern of consumption and growth,

o consumption of the market,

o nature of competition,

o income levels of the society,

o availability of substitutes,

o system of distribution channels, etc.

The objectives of market and demand analysis in preparing a project are to:

◊ Identify potential consumers or buyers.

◊ Gathering secondary and/or primary data/ information

◊ Market survey

◊ Market classification/characterization of the market demand forecasting

◊ Uncertainties in demand forecasting

◊ Market planning

4.2. Raw Materials and Supplies Study

An important aspect of technical analysis is concerned with defining the materials and utilities

required; specifying their properties in is some detail, and setting up their supply program me.

There is technical relationship between input and output; the amount of input determines the

amount of output. The raw materials and supplies study consists of thorough analysis on:

◊ What type of input?

◊ Where to find the inputs?

◊ How much it costs?

Material inputs and utilities may be classified into four broad categories:

i. Raw materials(unprocessed and Semi-processed)

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 1

Project Management Lecture Note

ii. Processed industrial materials and components

iii. Auxiliary materials and factory supplies(such as electricity, fuel, water & recycled waste),

and

iv. Utilities.

4.3. Location, Site and Environment Impact Assessment (EIA)

4.3.1. Location and Site

The choice of location and site necessitates an assessment of demand, size, and input

requirement. Although most often the terms ‘location’ and ‘site‘ are used synonymously, they

should be distinguished. Location refers to a relatively broad area like a city, an industrial zone,

or a costal area; site refers to a specific piece of land where the project would be set up.

The locational requirements and conditions that are significant for the selection of both location

and site should be judged against the defined corporate strategies and the financial and economic

impacts.

a. Choice of Location

In a feasibility study, a good starting – point for the final selection of a suitable location is the

location of raw materials and factory supplies, or if the project is market oriented – the location

of the principal consumption centers in relation to the plant.

Generally, the choice of location is influenced by a variety of considerations such as:

◊ Project itself

◊ proximity to raw materials and markets,

◊ availability of infrastructure,

◊ labor situation,

◊ governmental policies, and

◊ other factors like climatic conditions, general living conditions, proximity to ancillary units,

ease in coping with pollution / controlling pollution.

Location wise projects can be categorized in three forms i.e.

i. Rooted Projects - Proximity to an Input

ii. Tied Projects - Proximity to the Market

iii. Foot Loose Projects - Projects that can be located anywhere.

b. Site Selection

After the completion of final locational selection, a specific project site and, if available, site

alternatives should be defined in the feasibility study. This will require an evaluation of the

characteristics of each site. The structure of site analysis is basically the same as for location

analysis and the key requirements, identified for the project, may give guidance also for site

selection. For sites available within the selected area, the following requirements and conditions

are to be assessed:

Ecological conditions on site (soil, site hazards, climate etc.)

Environmental impacts (restrictions, standards, guidelines)

Socio – economic conditions (restrictions, incentive, requirements)

Local infrastructure at site location (existing industrial infrastructure, economic and

social infrastructure, availability of critical project inputs such as labour and factory

supplies)

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 2

Project Management Lecture Note

Strategic aspects (corporate strategies regarding possible future extension, supply and

marketing policies)

Cost of land

Site preparations and development, requirements and costs

√ The cost of land tends to differ from one site to another in the same broad location. Sites

close to a city cost more whereas sites away from the city cost less.

4.3.2. Environment Impact Assessment (EIA)

Environmental impact assessment is part of the project planning process. Practically it is an

integral part of feasibility analysis. Environmental benefits or costs of a project are usually

externalities or side effects that affect the society wholly or partially. In a broader socio –

economic evaluation of the feasibility of a project, environmental effects on the quality of life are

considered along with other factors to determine if the overall effect of the project is positive, or

to determine what modifications may be necessary to achieve a positive evaluation.

In principle, environmental impacts should be assessed on the basis of legal regulations and

emission standards and guidelines established in the country where the project is located.

Whereas, in countries, where no or only vague regulations and standards are defined, it may be

advisable to anticipate a future serious environmental control measures, especially in the case of

long – term projects.

Generally, externalities or side effects may bound to create environmental conflicts that might

ultimately lead to compensation claims, substantial costs for purification and equipment, and

possibly to the extent of the closure of the plant.

The general objective of environmental impact assessment in project analysis is to ensure

whether the development projects are environmentally sound. This implies that the effects of the

project over its estimated life do not unacceptably degrade the environment, and that no residual

effects are anticipated that would contribute to long – term environmental deterioration. It is

well known that the immediate and long – term health and welfare of people are linked to their

natural, cultural and socio – economic environment. Because of this reason, and to promote the

objective of incorporating the ideas and aspirations of the affected population in the decision

process, right from the earliest stages and throughout the project development cycle, public

participation is desirable.

The specific objectives of environmental impact assessment are as follows:

√ To promote a comprehensive, interdisciplinary investigation of environmental consequences

of the project and its alternatives for the affected natural and cultural human habitat.

√ To develop an understanding of the scope and magnitude of incremental environmental

impacts (with and without the project) of the proposed project for each of the alternative

project designs.

√ To incorporate in the designs any existing regulatory requirements.

√ To identify measures for mitigation of adverse environmental impacts and for possible

enhancement of beneficial impacts.

√ To identify critical environmental problems requiring further investigation.

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 3

Project Management Lecture Note

√ To assess environmental impacts qualitatively and quantitatively, as required, for the

purpose of determining the overall environmental merit of each alternative.

4.4. Production Program and Plant Capacity

The production program and plant capacity study involves in:

1. Determination of production program

It implies how you intend to produce the selected products? There are often four factors to

determine production programs; namely:

◊ Market requirement and marketing concepts

◊ Input requirement

◊ Technology

◊ Timeframe

2. Determination of Plant Capacity

The term production capacity can be defined as the volume or number of units that can be

produced during a given period. Plant capacity may be seen from two perspectives:

a. Feasibility normal capacity (FNC) and

b. Nominal maximum capacity (NMC).

a. Feasibility normal capacity (FNC) refers to capacity achievable under normal working

conditions, taking into account not only the installed equipment and technical conditions of

the plant, such as normal stoppages, down time, holidays, maintenance, tool changes, desired

shift patterns and indivisibilities of major machines to be combined, but also the management

system applied. Hence, the feasible normal capacity is the number of units produced during

one year under the above conditions.

b. Nominal Maximum Capacity (NMC) is the technically feasible capacity, which frequently

corresponds to the installed capacity as guaranteed by the supplier of the plant. A higher

capacity – nominal maximum capacity – may be achieved, but this would entail overtime,

excessive consumption of factory supplies, utilities, spare parts and wear – and tear parts, as

well as disproportionate production cost increases.

4.5. Technology Selection

Selection of appropriate technology and know–how is a critical element in any feasibility study.

Such selection should be based on a detailed consideration and evaluation of technological

alternatives and the selection of the most suitable alternative in relation to the project to

investment strategy chosen and to socio – economic and ecological considerations. Appropriate

technology choice is directly related to the conditions of application in particular situations.

The choice of technology is influenced by a variety of considerations:

1. Plant Capacity: Often, there is a close relationship between plant capacity and production

technology. Perhaps, only a certain production technology may be viable so as to meet a

given capacity requirement.

2. Principal Inputs: The chosen technology, in some cases, may be influenced by the raw

materials available – for instance, the quality of limestone determines whether the wet or dry

process should be used for a cement plant.

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 4

Project Management Lecture Note

3. Investment Outlay and Production Cost: The effect of alternative technologies on

investment outlay and production cost over a period of time should be carefully assessed.

4. Use by Other Units: The technology adopted must be proven by successful use by other

units.

5. Product Mix: The chosen technology must be judged in terms of the total product – mix

generated by it, including saleable by – products.

6. Latest Developments: The technology adopted must be based on the latest developments in

order to ensure that the likelihood of technological obsolescence in the near future, at least, is

minimized.

7. Ease of Absorption: The ease with which a particular technology can be absorbed can

influence the choice of technology.

4.6. Organizational and Human Resource Study

A. Organizational study

Organizational study deals with the development and design of the organization needed to

manage and control the entire operations of an organization (establishment).

Steps in designing the organizational structure are:

1. State goals/ objectives of the organization

2. Identify the necessary functions to achieve the goal

3. Group the functions which are related and that could be performed by a responsible individual

4. Design the structure taking into account the level and span of control

5. Analyze and describe the key jobs (put the job description)

6. Work out qualification requirement and prepare recruiting and training program for staffing.

B. Human Resources (Manpower) Requirement:

In project where there is labor–intensive, the labor situation becomes important. The human

resources needed for the implementation and operational stages can be classified as skilled and

unskilled management, supervisory or workforce.

◊ Recruitment and Training of Human Resources – employment, economic development,

recruitment methods and policies, the means of retaining key personnel and the possible

fringe benefits to employees if any.

◊ Cost Estimates for Human Resources Requirement – salary and wages, fringe benefits,

overhead costs (these include factory supplies, maintenance costs, office supplies, utilities,

communication and rent expense, insurance and taxes etc) and recruitment/training costs.

4.7. Financial Analysis

Financial analysis is analytical work required to identify the critical variables which are useful

for likely to determine the success or failure of an investment. Its concern is to determine,

analyze and interpret all the financial consequences of an investment that might be relevant to

and significant for the investment and financing decisions.

Financial analysis is essentially undertaken for the following purposes:

1. It provides an adequate financing plan for the proposed investment

2. It determines the profitability of a project

3. It assists in planning the operation and control of the project by providing management

information to both internal and external users

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 5

Project Management Lecture Note

4. It advises on methods of improving the financial viability of a project entity.

To judge a project from the financial point of view, information about the following issue is

needed:

1. Initial Investment Cost

2. Production Cost

3. Marketing Cost

4. Projection of Cash Flow

5. Financial Evaluation

i. Payback Period (PBP)

ii. Accounting Rate of Return (ARR)

iii. Net Present Value (NPV)

iv. Internal Rate of Return (IRR)

v. Benefit Cost Ratio (BCR)

vi. Break – Even Analysis (BEA)

4.7.1. Initial Investment Cost/ Cost of a project

Initial Investment Cost represents the total cost of all items of outlay associated with a project are

called Project costs that are supported by long-term funds (financing). It covers capital expenditure

items such as land, buildings, equipment and furniture etc. It includes three groups of costs:

a. Initial fixed investment costs. This includes investment made for

o the acquisition of land,

o development of land for construction purpose,

o civil works (laying the foundation),

o equipment and machinery costs,

o installation of the machines or the plant, vehicle, furniture, building etc.

All these above costs are subject to depreciation except land which is depleted over time.

b. Pre-production capital expenditure. The pre-production capital expenditure includes:

- Research and development

- Pre-feasibility or feasibility study cost

- Training costs incurred before the commencement of the operation

- Recruitment of personnel costs

- Arrangement for marketing of the product such as early advertisement to inform the

public in advance before the actual distribution of the product to the market

- Arrangements for supplies etc.

c. Working capital. Working capital is simply a revolving fund. It is the difference between

current asset and current liability. This is known as a circulating fund because at the end of

the project's life it can be put as a benefit of the project. Defining the working capital

requirement appropriately is important because many projects fail while they are in operation

due to shortage of cash or working capital. The amount of the total working capital required

depends upon the operating costs for the project.

Table 1: Project Investment Costs ('000 Birr)

Item Project Year

1 2 3 4 5 N

Land preparation X X X X X

Building X X X X X

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 6

Project Management Lecture Note

Equipment X X X X X

Vehicles X X X X X

Working Capital X X X X X

Other costs X X X X X

Total XX XX XX XX XX XX

4.7.2. Production Cost/ Operating costs

Operating costs can be divided into two:

1. Fixed costs- fixed costs will include maintenance, administration and managerial charges,

etc. which will be relatively fixed with respect to the volume of production.

2. Variable costs - Variable working capital includes items such as materials, power, labor

inputs required for manufacture which will vary directly with the volume of production.

o The total operating costs will then be the sum of the fixed and variable costs and will

increase over the operating years until full utilization of the investment asset is reached.

Table 2. Project Operating Costs Schedule

Years

No Items 1 2 3 4 5 N

Capacity Utilization Rate (%) 50% 75% 80% 85% 90% 100%

1 Raw material

2 Labor

3 Utilities

4 Repair

5 Maintenance and Repair

6 Factory Overhead

Factory Costs (1-6) (a) XX XX XX XX XX

7 Administrative costs

8 Sales costs

9 Distribution cost

Operating Costs (7-9) (b) XX XX XX XX XX

10 Depreciation (c)

11 Interest expenses (d)

Total production

Cost (a + b + c + d) (Bold) XX XX XX XX XX

Note: n represents the number of periods covered in the project appraisal.

As it is shown in the above schedule, operating cost includes: cost of production/cost of sales,

administrative expenses, selling expenses, depreciation on fixed assets, and write off of

preliminary and preoperative expenses.

a. Cost of Production

The cost of production includes

- Material cost

- Wages including salaries for executives

- Utilities

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 7

Project Management Lecture Note

- Repairs and maintenance

- Factory over heads. These items include expenses for the factory as:

√ rent, for factory, if any

√ insurance premium for factory assets and factory workers

√ postage, telephone, fax, e-mail, etc, in the factory

√ traveling expenses

√ depreciation of plant and machinery and other factory equipment;

√ Proportionate management expenses, which may be charged to factory on the basis

of time spent by management on the project operation.

b. Administrative Expenses

This represents all indirect expenses incurred in the organization including estimates for

salaries of all indirect staff

traveling expenses

insurance other than for the factory assets

rent, rates, taxes, electricity etc and

depreciations of all fixed assets other than factory assets other than factory fixed assets

c. Selling Expenses

This represents estimated expenses in sales divisions as per projected organizations and includes

the items:

- salaries and personnel cost for sales staff and managers as planned

- publicity, advertisement, exhibitions, etc.

- subsidies, commissions, discounts to dealers, etc.

- administrative expenses of sales office including rent.

d. Depreciation

Depreciation expenses represent consumption of utility units contained in an asset. It relates to

the cost center where such assets are installed.

4.7.3. Marketing Cost

Marketing Cost arises from the marketing strategy, such as packaging, storage, salaries,

commissions, discounts, promotion and advertisement, transportation, insurance, Distribution,

supplies and market research.

4.7.4. Projection of Cash Flow

Cash insufficiency can negatively affect the activities of a project. Even, it can lead to an

extinction of the project. Therefore, the project planner has to develop some techniques of

forecasting cash receipts and payments. Such a technique is called cash flow statement.

The principal elements of cash flow statements are:

1. Total Receipts from sales and other sources (cash, debtors, etc.)

2. Payments (to stock supplies, wages & salaries, equipment, etc.)

3. Net inflow or outflow

4. Add: cash at the beginning (at the start of the month)

5. Equals cash at the end of the month (ending cash balance).

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 8

Project Management Lecture Note

An example of a typical cash flow statement is given below:

Cash Flow Statement for Financial Planning ('000)

Years

No Items 1 2 3 4 5 6 n

1 Cash in flows

2 Financial sources:

3 Loans

4 Equity

5 Bank over draft

6 Supplies

7 Credit

8 Total in flow (2 + 3 + 4 + 5 + 6) XX XX XX XX XX

9 Cash out flows:

10 Operating costs (fixed and variable)

11 Debt service (Interest plus loan

repayment)

12 Corporate tax

13 Total assets

14 Dividend

15 Working capital (physical and

financial)

16 Surplus or deficit (Net cash flow)

(7 – 14)

17 Cumulative cash balance

(151 + 152 + 153 etc)

4.7.5. Financial Evaluation

Measures of project worth are measures that tell you whether a project is worth undertaking form

a particular viewpoint. All such measures are concerned with the question "are the benefits

greater than the costs?" There are different ways of measuring project worth, which may fall

under the following methods.

4.7.5.1. Payback Period (PBP)

Payback period is one of the simplest methods to find out the period by which the investment on

the project may be recovered from the net cash inflows, i.e., gross cash inflow less the cash

outflows. In short it is defined as the period required recovering the original investment cost.

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 9

Project Management Lecture Note

A. Payback period (PBP)

The Payback period is the length of time required for an investment to pay itself out.

It is computed as;

PBP = I/E = __________Initial Investment_______________________

Projected Net Cash Flow per year from the Investment

When the projected net cash flows (E) are uniform

Examle: If ETB 4 million is invested with the aim of earning ETB500 000 per year (net cash

earnings), the payback period is:

P = ETB 4 000 000 = 8 years

ETB 500 000

Or

When the projected net cash flows are non-uniform.

Where

I = the initial investment.

E = the projected net cash flows per year from the investment.

PBP = Pay Back Period expressed in number of years.

4.7.5.2. Accounting Rate of Return (ARR)

It basically expresses the average net profits (Net Cash Flows) generated each year by an investment

as a percentage of investment over the investments expected life. It is as

Y

ARR =

I

Where, Y = the average annual net profit (after allowing depreciation) from the investment

I = the initial investment

The calculated SRR should be compared with the investor’s Required Rate of Return (RRR) to

judge the profitability of the investment. The investment will be accepted if ARR >= RRR,

otherwise it will be rejected. When the ARR of all the investment opportunities is greater than

the RRR of the investor, then the investment yielding the highest ARR should be selected.

Example: Average Annual Net Profit = 1,000,000

Initial investment = 3,500,000

RRR = 22%

4.7.5.3. Net Present Value (NPV)

NPV is a standard method for using the time value of money to appraise long-term projects. NPV

can be described as the “difference amount” between the sums of discounted cash inflows and cash

outflows. It compares the present value of money today to the present value of money in the future,

taking inflation and returns into account.

Steps to find out the NPV

1. Find the project costs

2. Find the future cash flows as estimated for the projected business, net of cash outflows

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 10

Project Management Lecture Note

3. Select an appropriate rate and a period to be considered for such evaluation to find the

present value of the future cash flows for the period by discounting by the selected rate

4. Find out the difference between the present value of cash inflows (net) and the investment

cost (present value of investments over the life of the project).This difference represents

NPV. Where:

This calculation can be represented algebraically as: CF = Cash inflows at different periods

CF t

∑ (1+r )t −C0 r = discounting rate

NPV =

C0 = cash outflow in the beginning

The decision rule here is to accept a project if the NPV is positive and reject it if it is negative. A

project that NPV approaching zero is a marginal project, the planner has to re-modify, otherwise it

will be very risk to take such projects.

If… It means… Then…

NPV>0 The investment would add value to the The project may be accepted

firm

NPV<0 The investment would subtract value from The project should be rejected

the firm

NPV=0 The investment would neither gain nor We should be indifferent in the decision whether

lose value to accept or reject the project. This project adds

for the firm no monetary value. Decision should be based on

other criteria (e.g, strategic positioning or other

factors not explicitly included in the calculation).

Table. Net Present Value

4.7.5.4. Internal Rate of Return (IRR)

4.7.5.5. Benefit Cost Ratio (BCR)

Cost Benefit Analysis (CBA) is used for determining the attractiveness of a proposed

investment in terms of the welfare of society as a whole.

By presenting social benefits and costs in a monetary format, CBA not only facilitates choices

between alternative investment options but also gives an idea of the project worth. The

technique is principally used with regard to public sector investments.

CBA differs from financial appraisal which views an investment solely from the perspective

of individual participants, focusing on private benefits and costs and using market prices. In

contrast, CBA adopts a much broader approach, considering both monetary and non-monetary

benefits and costs, and uses prices that more accurately reflect economic, environmental and

social values.

This is a measure of efficiency and used for comparison of different projects. It is given by the

formula:

BCA = Benefits

Cost of the project

4.7.5.6. Break – Even Analysis (BEA)

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 11

Project Management Lecture Note

===============================//====================================

UNIT 5: PROJECT IMPLEMENTATION, MONITORING AND EVLAUATION

5.1. Project Planning

Planning is the systematic arrangement of tasks to accomplish an objective. The plan lays out what

needs to be accomplished and how it is to be accomplished. The plan becomes a benchmark against

which actual progress can be compared; then, if deviations occur, corrective action can be taken.

project objective

The first step in the planning process is to define the project objective—the expected result or end

product. The objective must be clearly defined and agreed upon by the customer and the organization or

contractor that will perform the project. The objective must be clear, attainable, specific, and measurable.

Achievement of the project objective must be easily recognizable by both the customer and the

contractor. The objective is the target—the tangible end product that the project team must deliver.

For a project, the objective is usually defined in terms of scope, schedule, and cost—it requires

completing the work within budget by a certain time.

5.2. Project Organization

5.2.1. Line and Staff Organization

5.2.2. Divisional Organization

5.2.3. Matrix Organization

5.3. Project Directing

5.4. Project Control (Monitoring and Evaluation)

5.5. Human Aspects of Project Management

5.6. Pre – requisites for Successful Project Implementations

Compiled by Gemechis J. Dandi Boru College Shambu Campus Page 12

You might also like

- Inked 2011-02Document102 pagesInked 2011-02Herr Panzer40% (5)

- TOR Starter Set The ShireDocument56 pagesTOR Starter Set The ShireAugust Tsugua100% (1)

- NH Field Guide For Residential New Construction - 2011Document88 pagesNH Field Guide For Residential New Construction - 2011Nh Energy CodeNo ratings yet

- Career Change From Real Estate to Oil and Gas ProjectsFrom EverandCareer Change From Real Estate to Oil and Gas ProjectsRating: 5 out of 5 stars5/5 (1)

- Steel Connection MethodsDocument18 pagesSteel Connection MethodsVishnuVardhan100% (1)

- Chapter TwoDocument36 pagesChapter TwoJiru AlemayehuNo ratings yet

- Project Identification and FormulationDocument17 pagesProject Identification and FormulationDianne100% (1)

- Environmental Impact AssessmentDocument200 pagesEnvironmental Impact AssessmentDulanja OmeshNo ratings yet

- EIA Chapter TwoDocument27 pagesEIA Chapter TwoAlexis Jabesa67% (3)

- Single Phase Induction MotorsDocument11 pagesSingle Phase Induction MotorsSafnas KariapperNo ratings yet

- Dr. Ma. Teresa V. GonzalesDocument18 pagesDr. Ma. Teresa V. GonzalesAngel Rose SuanoNo ratings yet

- Civil Engineering ProjectsDocument24 pagesCivil Engineering ProjectsJoyce SejalboNo ratings yet

- The Project Life CycleDocument8 pagesThe Project Life Cyclegosaye desalegn100% (3)

- 3 Separator Design and Construction - UpdateDocument36 pages3 Separator Design and Construction - Updateمصطفى العباديNo ratings yet

- Business Planning and Project Management: Faculty Name: Ms. Supriya KamaleDocument18 pagesBusiness Planning and Project Management: Faculty Name: Ms. Supriya KamaleTaha Merchant100% (1)

- Commonwealth of Australia Constitution Act 1901 PDFDocument2 pagesCommonwealth of Australia Constitution Act 1901 PDFTiffany0% (1)

- Unit - 4 PPMDocument34 pagesUnit - 4 PPMdemeketeme2013No ratings yet

- 1550 - BSCS Ix 16 Rating and Billing - LZU1082288Document4 pages1550 - BSCS Ix 16 Rating and Billing - LZU1082288Francisco Menchu0% (1)

- SLE Lesson 1 - Things in The SurroundingsDocument4 pagesSLE Lesson 1 - Things in The SurroundingsKat Causaren Landrito86% (22)

- Steps in A Feasibility StudyDocument7 pagesSteps in A Feasibility Studybereket worede100% (1)

- A Detailed Lesson Plan in Mathematics (The Set of Integers)Document11 pagesA Detailed Lesson Plan in Mathematics (The Set of Integers)angeliNo ratings yet

- Unit 4Document25 pagesUnit 4okongaonakNo ratings yet

- Chapter FiveDocument6 pagesChapter FivehussenNo ratings yet

- Chapter 4: Technical Analysis of Project: 4.1. The Role of Feasibility StudiesDocument9 pagesChapter 4: Technical Analysis of Project: 4.1. The Role of Feasibility StudiesTemesgenNo ratings yet

- Project Management Unit - 2Document41 pagesProject Management Unit - 2Angelamary Maria SelvamNo ratings yet

- Project Identification and FormulationDocument17 pagesProject Identification and Formulationjoy dungonNo ratings yet

- Project AppraisalDocument5 pagesProject AppraisalSiva SankariNo ratings yet

- Chapter 4 ProjDocument15 pagesChapter 4 ProjEphrem ChernetNo ratings yet

- Preparation of Project Feasibility Report: PurposeDocument8 pagesPreparation of Project Feasibility Report: PurposeDheva ChellamNo ratings yet

- Chapter 3 Project AnalysisDocument20 pagesChapter 3 Project AnalysisadNo ratings yet

- CH 6 LocationDocument9 pagesCH 6 LocationMebratu SimaNo ratings yet

- Unit 3 - Project AppraisalDocument4 pagesUnit 3 - Project AppraisalSakthiNo ratings yet

- Pgdba - Fin - Sem III - Project FinanceDocument31 pagesPgdba - Fin - Sem III - Project Financeapi-3762419100% (6)

- Assignment 2018 135 016Document22 pagesAssignment 2018 135 016Jecinta EzeakorNo ratings yet

- Project AppraisalDocument39 pagesProject AppraisalDebasmita SahaNo ratings yet

- ST - Mary's University: Department of Marketing ManagementDocument4 pagesST - Mary's University: Department of Marketing ManagementIsrael Ad FernandoNo ratings yet

- Feasibility Study - WikipediaDocument7 pagesFeasibility Study - WikipediaPannad ChenNo ratings yet

- Project Design For AppraisalDocument73 pagesProject Design For AppraisalMitseyNo ratings yet

- Project Preparation: Unit FourDocument37 pagesProject Preparation: Unit FourTemesgen100% (1)

- Chapter 3 Project Contex AnalysisDocument32 pagesChapter 3 Project Contex AnalysisAklilu GirmaNo ratings yet

- PpeDocument11 pagesPpeSomendra SwarajNo ratings yet

- Villalobos, Ivana Joyce L. - Research No. 1 - Planning 1Document6 pagesVillalobos, Ivana Joyce L. - Research No. 1 - Planning 1Ivana Joyce VillalobosNo ratings yet

- Project Feasibility StudyDocument3 pagesProject Feasibility StudyInza NsaNo ratings yet

- Certified FS GuideDocument18 pagesCertified FS GuidewinwinNo ratings yet

- Deliverability Appraisal: Same Person As The Project Sponsor)Document7 pagesDeliverability Appraisal: Same Person As The Project Sponsor)Keeme100% (1)

- Chapter 2Document4 pagesChapter 2DakshNo ratings yet

- 3.2. Technical AnalysisDocument104 pages3.2. Technical AnalysisHabtamu AyeleNo ratings yet

- Valuation Note - Environmental IssuesDocument14 pagesValuation Note - Environmental IssuesEmmanuel OladeleNo ratings yet

- All About Project PreparationDocument23 pagesAll About Project PreparationIsuu JobsNo ratings yet

- Chapter IIDocument72 pagesChapter IINesri YayaNo ratings yet

- Chapter 4 and 5 - Feasibility StudyDocument36 pagesChapter 4 and 5 - Feasibility StudyHanaNo ratings yet

- Construction Project Management: Planning and DesigningDocument6 pagesConstruction Project Management: Planning and DesigningIna RoseNo ratings yet

- Esa Unit IiDocument39 pagesEsa Unit Iimanushreshkrishnan2No ratings yet

- 3.1 Project Feasibility StudyDocument27 pages3.1 Project Feasibility Studydawit tibebuNo ratings yet

- 1 CPM - NoteDocument21 pages1 CPM - NoteKashi Nath SharmaNo ratings yet

- UntitledDocument11 pagesUntitledHamza Dawid HamidNo ratings yet

- Lecture 1Document26 pagesLecture 1Yadeta RegasaNo ratings yet

- Impact Assessment Terms of ReferenceDocument12 pagesImpact Assessment Terms of ReferenceTezie AyugiNo ratings yet

- Ecu 401 L9 Project AppraisalDocument6 pagesEcu 401 L9 Project AppraisalJohn KimaniNo ratings yet

- Business CommunicationDocument19 pagesBusiness CommunicationbhavyaNo ratings yet

- Economic and Market AnalysisDocument5 pagesEconomic and Market AnalysisAlba PeaceNo ratings yet

- Capital Budgeting Process 1Document41 pagesCapital Budgeting Process 1Manjunatha Swamy VNo ratings yet

- Feasibility ReportDocument24 pagesFeasibility Reportips4788No ratings yet

- Terms of References (Tors) For Eias: Digital Assignment-IiiDocument6 pagesTerms of References (Tors) For Eias: Digital Assignment-IiiArun KumarNo ratings yet

- Chapter-3-Project MGT Lecture NoteDocument3 pagesChapter-3-Project MGT Lecture NoteJiru AlemayehuNo ratings yet

- Chapter Two: Project Life CycleDocument54 pagesChapter Two: Project Life CycleNeway Alem100% (3)

- Terms of Reference For An Environmental Impact Assessment: Annex 6Document14 pagesTerms of Reference For An Environmental Impact Assessment: Annex 6Ayon RoyNo ratings yet

- DPR Sample Detailed Project ReportDocument7 pagesDPR Sample Detailed Project ReportShubhangi Singh100% (1)

- Annex 6: Content and Format of Iee and Siee: Environment Assessment & ReviewDocument8 pagesAnnex 6: Content and Format of Iee and Siee: Environment Assessment & ReviewAlia KhanNo ratings yet

- Unit 3. Edited 2Document25 pagesUnit 3. Edited 2Mulugeta AdugnaNo ratings yet

- 02 FM Chapter-2-1Document42 pages02 FM Chapter-2-1Jiru AlemayehuNo ratings yet

- Chapter-2-Project MGT Lecture Note - (2024)Document12 pagesChapter-2-Project MGT Lecture Note - (2024)Jiru AlemayehuNo ratings yet

- Chapter-3-Project MGT Lecture NoteDocument3 pagesChapter-3-Project MGT Lecture NoteJiru AlemayehuNo ratings yet

- Project GuideDocument2 pagesProject GuideJiru AlemayehuNo ratings yet

- Chapter-1-Project MGT Lecture Note (2024)Document6 pagesChapter-1-Project MGT Lecture Note (2024)Jiru AlemayehuNo ratings yet

- MfI Chapter 1Document32 pagesMfI Chapter 1Jiru AlemayehuNo ratings yet

- Inn. MGT CH - 1-1Document9 pagesInn. MGT CH - 1-1Jiru AlemayehuNo ratings yet

- Chapter ThreeDocument46 pagesChapter ThreeJiru AlemayehuNo ratings yet

- Mis Rvu Chapter FiveDocument7 pagesMis Rvu Chapter FiveJiru AlemayehuNo ratings yet

- OM Chapter 1 Lecture Note 1Document9 pagesOM Chapter 1 Lecture Note 1Jiru AlemayehuNo ratings yet

- OM Chapter 2 Lecture Note Final 1Document9 pagesOM Chapter 2 Lecture Note Final 1Jiru AlemayehuNo ratings yet

- Seven Secrets of The SphinxDocument9 pagesSeven Secrets of The SphinxEmil WhiteNo ratings yet

- Binary and Hexadecimal Number SystemDocument4 pagesBinary and Hexadecimal Number Systemkaran007_m100% (3)

- Formal Essay ExamplesDocument2 pagesFormal Essay Examplesfz6etcq7No ratings yet

- Daftar ECATALOG 2023 Yarindo For TP - 1 FebDocument6 pagesDaftar ECATALOG 2023 Yarindo For TP - 1 Febbayu setiawanNo ratings yet

- Suction Strainer Boxes: Standard Specification ForDocument5 pagesSuction Strainer Boxes: Standard Specification ForKevin JosueNo ratings yet

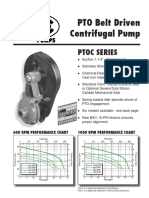

- Ptoc 03-13Document4 pagesPtoc 03-13Matias Contreras KöbrichNo ratings yet

- The RevCo BankruptcyDocument3 pagesThe RevCo BankruptcyPrashanth KumarNo ratings yet

- SpritzerDocument152 pagesSpritzerSYARMILA BINTI HASHIMNo ratings yet

- Social Audit - Definition - Objectives - Need - Disclosure of Information PDFDocument4 pagesSocial Audit - Definition - Objectives - Need - Disclosure of Information PDFSorabh KumarNo ratings yet

- Analisis Proses Pelaksanaan Anggaran Dana Bantuan Operasional Kesehatan (Bok) Pada Dinas Kesehatan Kabupaten BuolDocument11 pagesAnalisis Proses Pelaksanaan Anggaran Dana Bantuan Operasional Kesehatan (Bok) Pada Dinas Kesehatan Kabupaten BuolAyunDa RahayuNo ratings yet

- Fairtrade ExplanationDocument2 pagesFairtrade ExplanationnabilNo ratings yet

- DSP-Lab REC-553Document66 pagesDSP-Lab REC-553PraveenNo ratings yet

- Revuto Token SaleDocument1 pageRevuto Token Salekiranmai27No ratings yet

- AgriRise April-June 2023Document68 pagesAgriRise April-June 2023Kishore TataNo ratings yet

- KNPCC-13 Nit KNPCC 13Document10 pagesKNPCC-13 Nit KNPCC 13Shubh ShuklaNo ratings yet

- BH2 0316 en en-US PDFDocument955 pagesBH2 0316 en en-US PDFВячеславГрузевскийNo ratings yet

- SH 0027 2 PackageDocument8 pagesSH 0027 2 PackageChiara NaderNo ratings yet

- Bose JitDocument5 pagesBose JitsandeepNo ratings yet

- Analysis of The Seismic Coda of Local Earthquakes As Scattered WavesDocument9 pagesAnalysis of The Seismic Coda of Local Earthquakes As Scattered WavesAS LCNo ratings yet