Professional Documents

Culture Documents

Gold 10.4.2024

Gold 10.4.2024

Uploaded by

vu huu tuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gold 10.4.2024

Gold 10.4.2024

Uploaded by

vu huu tuCopyright:

Available Formats

Market Analysis

April 10, 2024

an

ph

lia

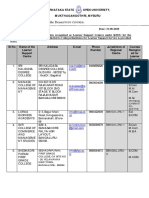

Potential Reversal Dates for Gold:

April 12-15

(Note: dates can be plus or minus 1-2 trading days, and can either be highs or lows)

ko

Since the last outlook from Sunday evening, Gold has continued to post higher highs into

early this week, with the metal running all the way up to a Tuesday peak of 2384.50 -

before consolidating the action into late-day. With that, the upward phase of our bigger

72-day cycle is still in control, now having made higher highs at the April 9th mark.

April 10, 2024 1

an

ph

lia

For the near-term picture, the upward phase of our 10-day cycle (chart, above) is well into

extended territory. In terms of price, our downside reversal point for this wave has moved

up slightly - now to the 2310.40 figure (June, 2024 contract) - and should continue to rise

in the next day or two, depending on the action.

ko

Stepping back slightly, from whatever peak that does form with our 10-day wave (who

knows from where), the probabilities will favor a drop back to the 10-day moving average

on its next downward phase. In terms of patterns, that decline seems favored to end up

as countertrend - holding above the prior 10-day low 2171.00.

Stepping back further, we know that it was the original reversal (back in late-February)

above the 2086 figure which triggered in the upward phase of our larger 72-day cycle.

April 10, 2024 2

an

ph

lia

With that, the probabilities favored Gold to be in the midst of a 10% (minimum) to 14%

(average) rally phase, which has obviously played itself out - and then some.

ko

In terms of time with the above, the average rallies with our 72-day cycle were noted as

having taken 39 trading days or more before peaking, which suggested higher highs into

this April 9th date - which has now been satisfied. With that, the next peak of significance

should come from this 72-day wave, though from what price level this peak will come

from is speculation.

Once this 72-day cycle tops, the ideal path is looking for a decent correction to play out

into what looks to be late-May, where the detrend that tracks this wave is next projecting

it to trough. In terms of price, a normal correction with this cycle will see the 72-day

April 10, 2024 3

an

ph

lia

moving average acting as the magnet, a move anticipated to end up as countertrend - due

to the position of the larger 310-day cycle (chart, above). Having said that, due to the

breakout to new all-time highs, there is at least the potential that the coming correction

ko

phase with the smaller 72-day wave will fall short of normal assumptions.

Notes for futures traders

I have a number of futures traders who are long Gold from the late-February reversal

(2086) to the upside, and have asked me for an exit/trailing stop point; however, I don't

trade futures - only the Gold ETF. With futures traders (and their accounts) everybody has

a different 'risk' level, and your timing has to be very precise. With the Gold ETF's, your

timing does not have to be as exact - and there are no commissions.

April 10, 2024 4

an

ph

lia

Having said the above, if you are holding long Gold futures, potential trailing stops could

be (1) the current 10-day downside reversal point of 2310.40, or (2) the 72-day downside

reversal figure of 2168.40. If you choose #2, then a correction with the 10-day wave - one

ko

which gives way to a higher high - would see our 72-day downside reversal number

starting to move higher, but for now it remains locked in place.

Otherwise - and what I am watching - is for a divergence in both our Gold Timing Index

(chart, above), as well as our 72-day detrend indicator. The first of these we are now

starting to see, with a minor divergence having developed with our Timing Index. Having

said that, no divergence has yet to form with the 72-day detrend. Should both of these

occur on the same day, then I would be looking for an exit on my open GLD long. We'll see

how Wednesday's CPI day plays out, then reassess in the next report.

April 10, 2024 5

an

ph

lia

ko

April 10, 2024 6

You might also like

- Wolfe Wave: Linda RaschkeDocument32 pagesWolfe Wave: Linda RaschkeDasharath Patel100% (3)

- 004 DaveDocument4 pages004 DaveBzasri RaoNo ratings yet

- The Stock Market Update: 2017 © David H. WeisDocument1 pageThe Stock Market Update: 2017 © David H. WeisDiLungBanNo ratings yet

- Market Profile StrategiesDocument3 pagesMarket Profile StrategiesMeghali BorleNo ratings yet

- P 830 Design DevelopmentDocument7 pagesP 830 Design DevelopmentTamara Johnson-Pariag100% (1)

- SUMMER INTERNSHIP REPORT - DoxDocument47 pagesSUMMER INTERNSHIP REPORT - DoxShubham Srivastava60% (5)

- Leadership Styles of Bill GatesDocument5 pagesLeadership Styles of Bill GatesNgocPhamNo ratings yet

- GWT - 11-17-14Document6 pagesGWT - 11-17-14hunghl9726No ratings yet

- Futures Daily Outlook - Trade With ProfileDocument3 pagesFutures Daily Outlook - Trade With ProfilemohamedNo ratings yet

- BofA - Bullish USD Snapback Ideas 20230219Document21 pagesBofA - Bullish USD Snapback Ideas 20230219Brandon Zevallos PonceNo ratings yet

- DailyFX Guide EN 2024 Q1 GoldDocument8 pagesDailyFX Guide EN 2024 Q1 GoldtoengsayaNo ratings yet

- Trend Determination 10topcryptobrokersDocument12 pagesTrend Determination 10topcryptobrokersomer khanNo ratings yet

- SPX Daily English 05 04 2024Document4 pagesSPX Daily English 05 04 2024vu huu tuNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- Volume Rate of ChangeDocument2 pagesVolume Rate of ChangeRitabrata BhattacharyyaNo ratings yet

- 03 October 2010 Long Term Trend Charts-Major Markets-S&P, Gold, DX, Oil, US T Bonds & EUR-USD S&PDocument6 pages03 October 2010 Long Term Trend Charts-Major Markets-S&P, Gold, DX, Oil, US T Bonds & EUR-USD S&PmleefxNo ratings yet

- Long Short Report Jan 2012Document7 pagesLong Short Report Jan 2012kotakgobiNo ratings yet

- Technically Speaking - April 21, 2016Document13 pagesTechnically Speaking - April 21, 2016dpbasicNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- Techcheck Daily: Emkay Global Financial Services LTDDocument9 pagesTechcheck Daily: Emkay Global Financial Services LTDDharmesh PatelNo ratings yet

- Game Plan: Scenario 1 - Highs Made First Unable To Break ResistanceDocument2 pagesGame Plan: Scenario 1 - Highs Made First Unable To Break ResistanceRICARDONo ratings yet

- Long Term Trend Charts-14 July 2014 S&PDocument6 pagesLong Term Trend Charts-14 July 2014 S&Pwes0806No ratings yet

- Market Outlook November 5, 2014 Publisher, Jim CurryDocument5 pagesMarket Outlook November 5, 2014 Publisher, Jim Curryhunghl9726No ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- Weekly Report - 28 MayDocument4 pagesWeekly Report - 28 MayDan HathurusingheNo ratings yet

- Weekly Trade Setups Ideas & Chart Analysis by Sipho Mnyakeni - October 12 To October 16, 2020Document3 pagesWeekly Trade Setups Ideas & Chart Analysis by Sipho Mnyakeni - October 12 To October 16, 2020eric5woon5kim5thakNo ratings yet

- Currency Report - Daily - 13 June 2023 - 13-06-2023 - 09Document4 pagesCurrency Report - Daily - 13 June 2023 - 13-06-2023 - 09Porus Saranjit SinghNo ratings yet

- Commodity Weekly Technicals: Technical OutlookDocument27 pagesCommodity Weekly Technicals: Technical OutlooktimurrsNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- V75 UPDATE, 24hr Insight - 24th Feb 2022Document8 pagesV75 UPDATE, 24hr Insight - 24th Feb 2022Gaming With Mr frostNo ratings yet

- Weekly Sector Watch-April 01,'24Document14 pagesWeekly Sector Watch-April 01,'24advik porwalNo ratings yet

- Monthly Technical Outlook: A Chart Book On Benchmark, Sectors, Global Market and Inter Market AnalysisDocument15 pagesMonthly Technical Outlook: A Chart Book On Benchmark, Sectors, Global Market and Inter Market AnalysisOkilaNo ratings yet

- Market Pulse - 08 December 2010Document4 pagesMarket Pulse - 08 December 2010prashant_karnNo ratings yet

- 2/24/15 Macro Trading SimulationDocument12 pages2/24/15 Macro Trading SimulationPaul KimNo ratings yet

- 3-19-24 Daily TaDocument8 pages3-19-24 Daily Taalpha2omega0007No ratings yet

- Trend-Reversal Trading Strategy Earned 175 Ticks Day Trading Crude Oil FuturesDocument4 pagesTrend-Reversal Trading Strategy Earned 175 Ticks Day Trading Crude Oil FuturesJoseph JamesNo ratings yet

- Weekly Forecast 06.25.2023.Document21 pagesWeekly Forecast 06.25.2023.Ahmed AbedNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- VIP Analytics GlobalDocument10 pagesVIP Analytics GlobalamdnorthrealtyNo ratings yet

- Currency Report - Daily - 14 July 2022 - 13-07-2022 - 22Document4 pagesCurrency Report - Daily - 14 July 2022 - 13-07-2022 - 22Porus Saranjit SinghNo ratings yet

- GOLD StandardDocument5 pagesGOLD StandardShe LagundinoNo ratings yet

- FuturesDocument58 pagesFuturesANMOL CHAUDHARYNo ratings yet

- Bullion Weekly Technicals: Technical OutlookDocument16 pagesBullion Weekly Technicals: Technical OutlookMarcin LipiecNo ratings yet

- Precious Metal Report Jan 11Document73 pagesPrecious Metal Report Jan 11Soren K. GroupNo ratings yet

- Gold and Silver Update: 09-08-12Document12 pagesGold and Silver Update: 09-08-12hunghl9726No ratings yet

- Technical Analysis Review: 2 Is NeutralDocument7 pagesTechnical Analysis Review: 2 Is NeutralajayvmehtaNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- Game Plan: Scenario 1 - Lows Made First, Expect Support at 2417 To Hold/or TheDocument2 pagesGame Plan: Scenario 1 - Lows Made First, Expect Support at 2417 To Hold/or TheRICARDONo ratings yet

- Cls 7 XNC 7 C 04 K 5 A 20 Ave 14 CoclDocument22 pagesCls 7 XNC 7 C 04 K 5 A 20 Ave 14 CoclanyeaknsNo ratings yet

- TR November 1 2022Document9 pagesTR November 1 2022Rajan PatelNo ratings yet

- Bullion Weekly Technicals: Technical OutlookDocument18 pagesBullion Weekly Technicals: Technical OutlookMarcin LipiecNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is Neturalajayvmehta0% (1)

- NFP Report 5 Aug 2022Document4 pagesNFP Report 5 Aug 2022Arie KristionoNo ratings yet

- Gold MatketviewsDocument8 pagesGold MatketviewsreadthemallNo ratings yet

- Buy These Two Stocks For Gains While Nifty Sits Near Crucial Overhead Resistance ofDocument2 pagesBuy These Two Stocks For Gains While Nifty Sits Near Crucial Overhead Resistance ofRPNNo ratings yet

- 1.0 Technical Analysis 1.1 Crude Palm Oil Futures (FCPO)Document6 pages1.0 Technical Analysis 1.1 Crude Palm Oil Futures (FCPO)nur izzatiNo ratings yet

- Commodity Weekly Technicals: Technical OutlookDocument27 pagesCommodity Weekly Technicals: Technical OutlooktimurrsNo ratings yet

- Technical Analysis Review: 2 Is NeturalDocument7 pagesTechnical Analysis Review: 2 Is NeturalajayvmehtaNo ratings yet

- WC ExercisesDocument5 pagesWC ExercisesRaniel PamatmatNo ratings yet

- 41 - Outreach Request - IAS 2 IAS 16 "Core Inventories"Document3 pages41 - Outreach Request - IAS 2 IAS 16 "Core Inventories"Socola ĐắngNo ratings yet

- Quiz - Job Order CostingDocument18 pagesQuiz - Job Order CostingDan RyanNo ratings yet

- Parchment AuditDocument21 pagesParchment AuditMalachi BarrettNo ratings yet

- PALS Mercantile Law-LibreDocument161 pagesPALS Mercantile Law-LibreDodong LamelaNo ratings yet

- HM Treasury Risk Management Assessment FrameworkDocument22 pagesHM Treasury Risk Management Assessment FrameworkAndy TrederNo ratings yet

- 2011-05-02 Quant REITSDocument40 pages2011-05-02 Quant REITSstepchoinyNo ratings yet

- Strategic Cost Management Balance ScorecardDocument51 pagesStrategic Cost Management Balance Scorecardterrence jacob diamaNo ratings yet

- Substitution EffectDocument13 pagesSubstitution EffectShivam SinghNo ratings yet

- HRM 2 PDFDocument3 pagesHRM 2 PDFmuhammad qasimNo ratings yet

- Acc QuesDocument2 pagesAcc QuesComedy Ka BaapNo ratings yet

- Study Centre Annexure A BDocument13 pagesStudy Centre Annexure A Bdhareppa dhangerNo ratings yet

- Advertising Age - 2010 To 2011 - A PDFDocument960 pagesAdvertising Age - 2010 To 2011 - A PDFjoebloggsscribd100% (1)

- Profit Impact of Marketing StrategyDocument6 pagesProfit Impact of Marketing StrategydoggyyyyyyNo ratings yet

- Uy V CADocument19 pagesUy V CAMoyna Ferina RafananNo ratings yet

- The Impact of Customer Service Managemen PDFDocument43 pagesThe Impact of Customer Service Managemen PDFDiaby Ndem100% (1)

- Maternity Benefit Act 1961Document21 pagesMaternity Benefit Act 1961shravaniNo ratings yet

- Sap 1Document16 pagesSap 1Rashid HussainNo ratings yet

- Work Study - Method Study and Work MeasurementDocument23 pagesWork Study - Method Study and Work Measurement9986212378No ratings yet

- Hickok Manufacturing Vs CADocument2 pagesHickok Manufacturing Vs CAAnonymous wDganZ67% (3)

- Entrepreneurship and Small, Medium and Micro Enterprises (Smmes) in PerspectiveDocument20 pagesEntrepreneurship and Small, Medium and Micro Enterprises (Smmes) in PerspectiveTholakele MsomiNo ratings yet

- Bio DataDocument7 pagesBio DataPrakash KcNo ratings yet

- 영국 INTO mmu-brochure-2013-14Document84 pages영국 INTO mmu-brochure-2013-14Joins 세계유학No ratings yet

- Vertical or Horizontal Marketing?Document8 pagesVertical or Horizontal Marketing?RoopalTrivediNo ratings yet

- The Determinants of Corporate Dividend PolicyDocument16 pagesThe Determinants of Corporate Dividend PolicyRutvikNo ratings yet

- Gillette Vs SchickDocument7 pagesGillette Vs SchickNIVENEETHANo ratings yet

- Economics WorkbookDocument207 pagesEconomics Workbookmrbubos88% (17)