Professional Documents

Culture Documents

Financial Affair: Unique Academy

Financial Affair: Unique Academy

Uploaded by

Venkatesan0 ratings0% found this document useful (0 votes)

12 views8 pagesOriginal Title

5_6073453673487270671

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views8 pagesFinancial Affair: Unique Academy

Financial Affair: Unique Academy

Uploaded by

VenkatesanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

1 | Unique Academy.

FINANCIAL AFFAIR

CURRENT DEVELOPMENT IN BANKING

Brief About Reserve Bank of India

➢ Established on April 1st 1935 Under RBI Act 1934

➢ Central office initially established in Calcutta but was moved to

Mumbai 1937

➢ Nationalization in 1949

➢ Fully owned by Government of India (GOI)

➢ 27 regional offices and 4 sub office

Main Function of RBI

1. Implementation of monitory policy to maintain price stability

2. Regulator and supervisor of the financial system to protect

depositor’s interest

3. Manager of foreign exchange under FEMA Act 1999

4. Issue of currency and coins not fit for circulation

5. Development rule to support national objectives

6. Regulator and supervisor of payment and settlement system

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

2 | Unique Academy.

Announcement in Union Budged 2020

➢ President by Smt. Nirmala Sitaraman

➢ Deposit insurance increase from 1 Lac to 5 Lac by Deposit

Insurance and Credit Guarantee Corporation (DICGC)

➢ Corporation bank will be strengthened by amending Banking

Regulation Act

➢ NBFCs to be eligible for debt recovery under securitization and

reconstruction of financial assets and enforcement of security

interest (SARFAESI) in reduced from 500 Croce to 100 Croce or

loan size from 1 Croce to 50 Lac

Financial Market

➢ Certain specified category of Government security to be open by

for nonresident investor also

➢ FPI Limited is increase to 15% from 9%

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

3 | Unique Academy.

Mega Bank Merge

➢ 10 big public sector bank merge into four (2019)

➢ Bank to be merged

Anchor Bank Amalgamating Bank PSB Rank by Size

Punjab National bank Oriental Bank of 2nd Largest

Commerce

United Bank of India

Canara Bank Syndicate bank 4th Largest

(15.20 Lac Crore Business and 10324 Branches)

Union Bank of India Andhra Bank 5th Largest

Corporation Bank

(14.59 Lac Crore Business with 9609 Branches)

Indian Bank Allahabad Bank 7th Largest

(8.80 Lac Crore Business)

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

4 | Unique Academy.

Banking of Unregulated Deposit Scheme Act, 2019

➢ The Act provides for a mechanism to bend unregulated deposit

Scheme and protect the interest of depositors

➢ It amend three law respectively

a. RBI Act 1934

b. SEBI Act 1992

c. Multi-state co-operation societies Act 2002

State Bank of India (SBI) Revised Service Charges w. e. f.

October 1st 2019

➢ Average monthly balances has reduced from 5000 to 3000

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

5 | Unique Academy.

➢ Amount fall to 50% (i.e. 1500) ; Rs. 10 charges plus GST

➢ Fall 75% : fine Rs.15 plus GST

➢ Semi urban area : Rs. 2000 fine 7.5 plus GST in fall of to 50%

and fine plus GST in fall of to 75% fall above 75 : Rs. 12 plus

GST

➢ Rural area : Rs. 1000

➢ Fall up to 50% : Rs. 5 plus GST

➢ Fall up to 75% : Rs. 7.50 plus GST

➢ Fall above 75% : Rs. 10 plus GST

National Electronic Fund Transfer (NEFT) and Real Time Gross

Settlement (RTGS) Through Digital Means Free

➢ NEFT up to Rs. 10000 : Rs. 2 plus GST

➢ Above Rs. 2 Lac : Rs. 20 plus GST

➢ RTGS between Rs. 2 Lac to Rs. 5 Lac : Rs 20 plus GST

➢ RTGS above Rs. 5 Lac : Rs. 40 plus GST

➢ Cash deposit in saving account three transaction in a month and

Rs. 50 plus GST after three transaction

➢ Maximum deposit non home branch is Rs. 2 Lac per day

➢ Account holder with an average monthly balance of Rs. 25000 can

perform free cash withdrawals twice a month

➢ Average monthly balance to Rs. 25000 to RS. 50000 can avail 10

free cash withdrawals

➢ Transaction average limit Rs. 50 plus GST

➢ For above Rs. 50000 to Rs. 1 Lac – charges Rs. 15 plus GST

➢ For above Rs. 1 Lac – Unlimited transaction

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

6 | Unique Academy.

RBI Restricts PMC Bank’s Operation

➢ RBI put Punjab and Maharashtra co-operative Bank under

direction for 6 month.

➢ Depositor allowed to withdraw a sum not exceeding Rs. 1000

ICICI Bank to Open 450 new branches

➢ New 450 branches in FY (Financial year)2020

➢ Cross 5000 branches across the country

➢ 5000th branch was set up at Thane in Maharashtra

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

7 | Unique Academy.

CURRENT DEVELOPMENT IN FINANCE/STOCK MARKET

➢ Disinvestment in LIC by way of IPO( Initial public offer )

➢ Investment by Foreign Government in priority sectors like

infrastructure before 31st March,2024 (lock- in 3 year) will get

100% Tax exemption to the interest, dividend and capital gains

➢ Abolition of dividend Distribution tax( DDT)and Concessional

Corporate Tax has been brought down to 22% ( lowest in the

world)

➢ Effective tax rate shall be 25.17% inclusive of surcharge

➢ Companies shall not require to pay maximum to alternate tax

➢ Investment under make in India initiative shall liable to pay

income tax @ 50% (effective rate 17.01%)

➢ Buy back announced before 5th July 2019 is exempted from tax

➢ Government expand the scope of CSR 2% now CRS fund can be

spend on incubators funded by central or state government, IIT’s

national laboratories and autonomous bodies .

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

8 | Unique Academy.

Important Notes

➢ India post payment bank has launched Aadhar enable payment

system service (AEPS)

➢ NIRVIK (Niryat Rim Vikash Yojna) launched by export credit

guarantee corporation to easy landing of loan to exporter

➢ Airtel Payment Bank has launched Bharosa Saving Account which

provide personal accident insurance up to Rs. 5 Lac event with

maximum balance of Rs. 500

➢ President of Asian Development Bank Takehiko Nakao has

announced registration from January 16th 2020

➢ Ishaat Hussain will head the community constituted by SEBI to

created social stock exchange

➢ Yezdi Hirji Mategam head the expert community recommended by

RBI to revise concurrent audit system

➢ Small exporter can avail the loan of Rs. 40 Crore (New Limited

Sanctioned by RBI

➢ Shyam Srinivasan was appointed as MD & CEO of Federal Bank

CS EET www.uniqueacademyforcommerce CS SHUBHAM ABAD

You might also like

- Unit 1 (The Capitalist Revolution)Document12 pagesUnit 1 (The Capitalist Revolution)jeannedreyer100% (1)

- JiboDocument33 pagesJibojyottsna67% (3)

- A Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Document54 pagesA Study On Credit Appraisal Process On Lotak Mahindra Bank (Draft)Rhea SrivastavaNo ratings yet

- Finance Dissertation TopicsDocument2 pagesFinance Dissertation Topicsmonabiswas100% (1)

- Weekly Regulatory Bodies Rbi News 22 30th June 2022Document9 pagesWeekly Regulatory Bodies Rbi News 22 30th June 2022Anil TalariNo ratings yet

- CSEET Current Affairs May 2022 Revision NotesDocument43 pagesCSEET Current Affairs May 2022 Revision NotesSAHAJPREET BHUSARINo ratings yet

- Banking Sector: Madhurima Mitra 11712303911Document43 pagesBanking Sector: Madhurima Mitra 11712303911mollymitraNo ratings yet

- IntroductionDocument5 pagesIntroductionAditi SinghNo ratings yet

- Articles From General Knowledge Today: Q+A 4: Banking Exams Based Upon Interview QuestionsDocument2 pagesArticles From General Knowledge Today: Q+A 4: Banking Exams Based Upon Interview Questionsniranjan_meharNo ratings yet

- April 2018 PDFDocument16 pagesApril 2018 PDFPallaviNo ratings yet

- Banking and Institutions Presentation Group#2Document78 pagesBanking and Institutions Presentation Group#2Debashish DharNo ratings yet

- Document (18) .OdtDocument28 pagesDocument (18) .Odtsoni GuptaNo ratings yet

- Sip CRMDocument33 pagesSip CRMADITYA KUMAR GAUTAMNo ratings yet

- Union Bank of IndiaDocument12 pagesUnion Bank of Indiaayyappan6031No ratings yet

- Commercial BanksDocument23 pagesCommercial Banksnisarg_No ratings yet

- NBPDocument57 pagesNBPbeehajiNo ratings yet

- An Overview of Banking in IndiaDocument41 pagesAn Overview of Banking in IndiaVinay SudaniNo ratings yet

- IBPS PO RRB Officer Scale Interview Questions Banking Awareness Part 01Document5 pagesIBPS PO RRB Officer Scale Interview Questions Banking Awareness Part 01Bhanu SekharNo ratings yet

- Our Classroom Program NowDocument34 pagesOur Classroom Program Nowdeepa duggalNo ratings yet

- MCB Bank:History: ProfitabilityDocument5 pagesMCB Bank:History: ProfitabilityShaheryar SialNo ratings yet

- Report On Banking SectorDocument8 pagesReport On Banking SectorSaurabh Paharia100% (1)

- SBI PO Mains Special BoltDocument44 pagesSBI PO Mains Special BoltTahir HussainNo ratings yet

- Badhti Ka Naam ZindagiiDocument14 pagesBadhti Ka Naam Zindagiiamruta_patade_vashiNo ratings yet

- Mergers in Indian Banking Sector-The Legal Framework, Role of RBI Vis-Avis Role of CCIDocument22 pagesMergers in Indian Banking Sector-The Legal Framework, Role of RBI Vis-Avis Role of CCISouvik Mukherjee100% (4)

- INDIAN OVERSEAS BANK - Group 17 - BOCA GR1Document29 pagesINDIAN OVERSEAS BANK - Group 17 - BOCA GR1simran guptaNo ratings yet

- ECONOMYDocument7 pagesECONOMYVishwam PrakashNo ratings yet

- Indian Banking SectorDocument18 pagesIndian Banking Sectorapurva JainNo ratings yet

- Catholic Syrian Bank LimitedDocument75 pagesCatholic Syrian Bank Limitedmraja18No ratings yet

- Performance AppraisalDocument49 pagesPerformance AppraisalJayant RanaNo ratings yet

- Internship Report On MCB BankDocument63 pagesInternship Report On MCB BankMaham ButtNo ratings yet

- History 2Document5 pagesHistory 2bickyboom96No ratings yet

- Nital Mundhe ProjectDocument8 pagesNital Mundhe Projectworkp2726No ratings yet

- Banking Sector of India PresentationDocument30 pagesBanking Sector of India Presentationvinni vone89% (53)

- Greater Bombay Bank CO OPERATIVESDocument62 pagesGreater Bombay Bank CO OPERATIVESsnehalgaikwadNo ratings yet

- Banking Sector: Analysis of LiquidityDocument17 pagesBanking Sector: Analysis of LiquidityUdit UpretiNo ratings yet

- 7th May 2024 Daily CADocument2 pages7th May 2024 Daily CAdumbthings1729No ratings yet

- 4.final Term Paper of FMDocument20 pages4.final Term Paper of FMvishal patyalNo ratings yet

- A Proposal Project O1Document7 pagesA Proposal Project O1mundhenitalNo ratings yet

- Final EbankingDocument24 pagesFinal EbankingheatbitNo ratings yet

- Group 3Document22 pagesGroup 3Rajesh RakeshNo ratings yet

- IBPS Clerk 5 Capsule 2015 by Affairscloud PDFDocument86 pagesIBPS Clerk 5 Capsule 2015 by Affairscloud PDFBala SubramanianNo ratings yet

- SIP ProjectDocument84 pagesSIP Projectraviims87No ratings yet

- Ifs PPT 101-110Document39 pagesIfs PPT 101-110Dhaval PadhiyarNo ratings yet

- GA Refresher January 2017Document60 pagesGA Refresher January 2017ajay kumarNo ratings yet

- FinalDocument11 pagesFinalsingla_skNo ratings yet

- Historical Perspective (History of Public Sector Banks)Document6 pagesHistorical Perspective (History of Public Sector Banks)Anoop AnilNo ratings yet

- 11 12 13 TH February Current Affairs Lyst8792Document16 pages11 12 13 TH February Current Affairs Lyst8792bipin kujur oraonNo ratings yet

- How Cash Reserve Ratio Affects Loan Rates?: Know Your CustomerDocument21 pagesHow Cash Reserve Ratio Affects Loan Rates?: Know Your CustomerDevendra Singh JodhaNo ratings yet

- Banks in India: NbfcsDocument49 pagesBanks in India: NbfcsVenkata Sai Reddy GarlapatiNo ratings yet

- The Federation of Universities: SBI LTDDocument26 pagesThe Federation of Universities: SBI LTDkohinoor_roy5447No ratings yet

- Chapter # 1: 1. What Is Bank?Document47 pagesChapter # 1: 1. What Is Bank?Shahid MehmoodNo ratings yet

- Banking GK Notes - IBPS Banking General Knowledge Notes For PO, Clerk and RRB ExamsDocument8 pagesBanking GK Notes - IBPS Banking General Knowledge Notes For PO, Clerk and RRB ExamsReneRadhikaNo ratings yet

- Bank of BarodaDocument12 pagesBank of BarodaRahul Panchigar0% (1)

- Weekly Current Affairs 1st To 7th August 2022 68Document13 pagesWeekly Current Affairs 1st To 7th August 2022 68IshitNo ratings yet

- PIB 2-14 MarchDocument122 pagesPIB 2-14 MarchgaganNo ratings yet

- A) Brief Relevance of The Topic and The Organization.: GrowthDocument38 pagesA) Brief Relevance of The Topic and The Organization.: GrowthShree CyberiaNo ratings yet

- Articles From General Knowledge Today: Q+A 4: Banking Exams Based Upon Interview QuestionsDocument2 pagesArticles From General Knowledge Today: Q+A 4: Banking Exams Based Upon Interview Questionsmathura4728No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Cseet Communique March 2022Document12 pagesCseet Communique March 2022VenkatesanNo ratings yet

- S English Cce QuestionDocument10 pagesS English Cce QuestionVenkatesanNo ratings yet

- NMS - Maths 1Document7 pagesNMS - Maths 1VenkatesanNo ratings yet

- E-Correspondence: BrowserDocument6 pagesE-Correspondence: BrowserVenkatesanNo ratings yet

- NMMS Application Notification 221116Document4 pagesNMMS Application Notification 221116VenkatesanNo ratings yet

- 11 Nmms Sat Exercise Questions MathsDocument6 pages11 Nmms Sat Exercise Questions MathsVenkatesanNo ratings yet

- English Worksheet Standard-I Marks-10Document18 pagesEnglish Worksheet Standard-I Marks-10VenkatesanNo ratings yet

- 9 Mat Exercise Questions 1 VerbalDocument29 pages9 Mat Exercise Questions 1 VerbalVenkatesanNo ratings yet

- Nmms Maths Siva 1Document7 pagesNmms Maths Siva 1VenkatesanNo ratings yet

- 8 Nmms Topic Wise Question PaperDocument9 pages8 Nmms Topic Wise Question PaperVenkatesanNo ratings yet

- Commerce BSTDocument296 pagesCommerce BSTVenkatesanNo ratings yet

- Nuramirah Juma'at, Nurul Husna BT Mohd Adan:, Nurul Fatin Hidayah Mohd Lazim, Norain Ahmad NordinDocument6 pagesNuramirah Juma'at, Nurul Husna BT Mohd Adan:, Nurul Fatin Hidayah Mohd Lazim, Norain Ahmad NordinVenkatesanNo ratings yet

- List Private Higher Recognised THE: AidedDocument11 pagesList Private Higher Recognised THE: AidedVenkatesanNo ratings yet

- Document 40Document4 pagesDocument 40VenkatesanNo ratings yet

- Katral Bio Enzyme: Telegram GroupDocument45 pagesKatral Bio Enzyme: Telegram GroupVenkatesanNo ratings yet

- Les ArticlesDocument6 pagesLes ArticlesVenkatesanNo ratings yet

- Uber Case StudyDocument2 pagesUber Case StudySagar GuptaNo ratings yet

- Bull Market VS Bear MarketDocument7 pagesBull Market VS Bear MarketDIVYANSH UMMATNo ratings yet

- Far 2 Quiz 03212024Document6 pagesFar 2 Quiz 03212024red118831No ratings yet

- FinmanDocument9 pagesFinmanCharles MateoNo ratings yet

- Macroeconomics 13th Edition Arnold Solutions ManualDocument35 pagesMacroeconomics 13th Edition Arnold Solutions Manualaraucariabesidesijd835100% (22)

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocument1 pageAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNo ratings yet

- Module 5 - Foreign Direct InvestmentDocument9 pagesModule 5 - Foreign Direct InvestmentMarjon DimafilisNo ratings yet

- Nestle India Limited: High Growth Phase To Continue Despite Industry HeadwindsDocument9 pagesNestle India Limited: High Growth Phase To Continue Despite Industry HeadwindsAmit KapoorNo ratings yet

- Share Based PaymentDocument21 pagesShare Based Paymentkean leigh felicanoNo ratings yet

- Description Quantity Unit Unit Cost Amount Item NoDocument31 pagesDescription Quantity Unit Unit Cost Amount Item NoMark Kevin C. PingolNo ratings yet

- A Thesis Proposal: Risk and Return Analysis Nic Asia Bank LimitedDocument7 pagesA Thesis Proposal: Risk and Return Analysis Nic Asia Bank LimitedSuman ShresthaNo ratings yet

- The Business Guardian 1708Document8 pagesThe Business Guardian 1708mohamedNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument8 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalancePrathapa Naveen KumarNo ratings yet

- Payslip For The Month of April 2022: Earnings DeductionsDocument2 pagesPayslip For The Month of April 2022: Earnings DeductionsPrateek KwatraNo ratings yet

- China Investment ReportDocument10 pagesChina Investment ReportJoel van der MerweNo ratings yet

- Mobile Crane Lifting PermitDocument2 pagesMobile Crane Lifting PermitMusadiq HussainNo ratings yet

- Final Year Report of BBS 4th YearDocument49 pagesFinal Year Report of BBS 4th Yearnepalfinance987No ratings yet

- Chapter 1 - Multinational Financial Management - OverviewDocument24 pagesChapter 1 - Multinational Financial Management - OverviewJean Pierre Naaman100% (2)

- List of Nodal Officers Nominated by States/UtsDocument4 pagesList of Nodal Officers Nominated by States/UtsLalita NaiduNo ratings yet

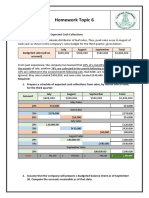

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDocument3 pagesHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamNo ratings yet

- Project MPCBDocument16 pagesProject MPCBJuliana WaniwanNo ratings yet

- Cement Edited RoadmapDocument57 pagesCement Edited RoadmapMULUGETA ANBESSIANo ratings yet

- 12.feb 2022Document8 pages12.feb 2022paan tiktokNo ratings yet

- Eval 5 Eco Ans KeyDocument3 pagesEval 5 Eco Ans KeyAlim ElmerNo ratings yet

- Oxford University Press Social Forces: This Content Downloaded From 128.189.137.167 On Sun, 28 Aug 2016 23:30:30 UTCDocument27 pagesOxford University Press Social Forces: This Content Downloaded From 128.189.137.167 On Sun, 28 Aug 2016 23:30:30 UTCQinran YangNo ratings yet

- BTC To USDT SWAP ProcedureDocument1 pageBTC To USDT SWAP ProcedureSuper TraderNo ratings yet

- Italian Design Compaso D OroDocument95 pagesItalian Design Compaso D OroRazvan Luscov100% (1)

- Case Study 3 Railroad - AnswersDocument7 pagesCase Study 3 Railroad - AnswersMahesh GunasenaNo ratings yet