Professional Documents

Culture Documents

Ita34 1051151254

Ita34 1051151254

Uploaded by

Alex De VriesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ita34 1051151254

Ita34 1051151254

Uploaded by

Alex De VriesCopyright:

Available Formats

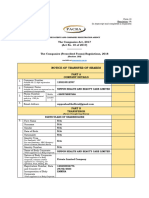

INCOME TAX ITA34

Notice of Assessment

Enquiries should be addressed to SARS:

Contact Centre

ALBERTON

AP DE VRIES 1528

2 Gubb Street Tel: 0800007277 Website: www.sars.gov.za

Penford

Details

Uitenhage

Reference number: 1051151254 Always quote this

6229 reference number

Document number: 2

when contacting

Date of assessment: 2023-07-01 SARS

Year of assessment: 2023

Type of assessment: Original Estimate Assessment

Period (days): 365

Payment Due date: 2023-08-01

Interest free period 2023-11-30

(Grace period) until:

PRN Number 1051151254T00000000

Balance of Account after this Assessment

Description Amount

Amount refundable to you by SARS -182.74

Compliance Information

Unprocessed payments 0.00 Provisional taxpayer N

Selected for audit or verification N

Please Note: Your assessment is not currently selected for Audit/Verification. Should this change SARS will notify you as such via an official

Verification or Audit notification.

Assessment Summary Information

Previous Assessment Current Assessment Account Adjustments

Income 0.00 90953.00

Taxable income / Assessed Loss 0.00 90953.00

Calculated Tax Liability:

Assessed tax after rebates (Tax calculated, Including Foreign Tax Credits discharged / 0.00 0.00

refunded & additional tax / penalties)

Tax credits and adjustments 0.00 -182.74

Assessment Result 0.00 -182.74

Net credit amount under this assessment -182.74

Less:

Add:

Net credit amount -182.74

NOTE: If Net debit amount or Net credit amount under this assessment differs from the amount payable/refundable in container "balance of

account after this assessment" stated above then refer to your detailed statement of account

Dear AP DE VRIES

Your assessment for the 2023 year of assessment has been concluded and the assessment summary as well as the current balance on

your account are reflected above. Please note that in the case of a debit balance on your account further interest may accrue.

Payments are to be made electronically or at any branch of the banks listed below. When you make a payment, please use the payment reference

number (PRN). The following payment channels are available to you:

- Via SARS eFiling (www.sars.gov.za)

- Via MobiApp

- Electronically using internet banking (EFT - electronic fund transfer)

- At a branch of one of the following banking institutions: ABSA, Capitec, FNB, Nedbank or Standard Bank.

- For more details on payments process details visit the SARS website (www.sars.gov.za)

A detailed statement of account (including all amounts payable or refundable under any previous assessment, refunds, payments, and interest),

may be requested from SARS through the following channels:

- Electronically via eFiling or the MobiApp (if you are registered as an eFiler)

- Call the SARS Contact Centre

- At your nearest SARS branch by appointment. To book an appointment visit the SARS website.

Reference Number 1051151254 ITA34_RO 2023.04.00 01/03

Please note that your refund cannot be paid as SARS is not in possession of valid banking details. A letter containing further instructions in this

regard will be issued. Any refund which may be due will be withheld pending finalisation of this matter.

The reference to additional tax/understatement penalty in this notice of assessment depends upon the circumstances.

(i) If additional tax was imposed before the commencement date of the Tax Administration Act (TAA) then an adjustment to that additional tax may

be made by an assessment issued in terms of the TAA after the commencement date of the TAA.

(ii) An assessment issued after the date of commencement of the TAA, in respect of any period that preceded the commencement date of the

TAA, may be subject to the imposition of an Understatement Penalty in terms of the TAA as an "understatement" is considered to be a continuing

act or omission in terms of the TAA

(iii) An assessment issued after the commencement date of the TAA, for a period that commences after the commencement date of the TAA, may

include the levy of an Understatement Penalty.

The amounts of income included and deductions allowed in calculating this assessment is reflected below. It is very important that you verify these

to ensure that:

1. The amounts are correct

2. All your taxable income and allowable deductions for the year are reflected

If you are of the view that this assessment is not correct, please file a tax return that is full and true on or before the gazetted date to request

SARS to issue a reduced or additional assessment. Your obligation to pay any amount due is not suspended regardless of whether you choose to

submit a return or not. If you are unable to submit a true and full return, you may request SARS to extend the period within which the return may

be submitted on or before the gazetted date.

Sincerely

ISSUED ON BEHALF OF THE COMMISSIONER FOR THE SOUTH AFRICAN REVENUE SERVICE

Reference Number 1051151254 ITA34_RO 2023.04.00 02/03

INCOME TAX ITA34

Notice of Assessment

Reference number: 1051151254

Document number: 2

Year of assessment: 2023

Income

Code Description and detail Computations & adjustments Amount assessed

Employment income [IRP5/IT3(a)] 90953.00

3601 Income - taxable 79747.00 79747.00

3601 Income - taxable 7265.00 7265.00

3605 Annual payment - taxable 3941.00 3941.00

3703 Re-imbursive travel allowance - non-taxable 18400.00 0.00

Non-taxable allowance -18400.00

Income 90953.00

Deductions allowed

Code Description and detail Computations & adjustments Amount assessed

Deductions Allowed 0.00

Taxable income

Code Description and detail Amount assessed

Taxable income – subject to normal tax 90953.00

Tax calculation

Code Description and detail Computations & adjustments Amount assessed

Normal tax 16371.54

Rebates -16371.54

Primary 16371.54

Employees’ tax -182.74

4102 PAYE - pay as you earn 182.74

Previous assessment result 0.00

Net amount refundable under this assessment -182.74

*This amount is separately reflected on your Statement of Account.

Grounds for the assessment

ASSESSMENT RAISED BASED ON INFORMATION AVAILABLE TO SARS

Notes

Amount assessed

1 Information declared that impacts this assessment:

Married in community of property N

Reference Number 1051151254 ITA34_RO 2023.04.00 03/03

You might also like

- Your Universal Credit Claim: We Need To Find Out More About Your Health ConditionDocument4 pagesYour Universal Credit Claim: We Need To Find Out More About Your Health ConditionNasir KarwanNo ratings yet

- Trip Management in Unidrive M700 Guide EN v1.0.0 PDFDocument178 pagesTrip Management in Unidrive M700 Guide EN v1.0.0 PDFferiferiNo ratings yet

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- Income Statement TaskDocument5 pagesIncome Statement Taskiceman2167No ratings yet

- 2022 Financial StatementsDocument19 pages2022 Financial StatementsThe King's UniversityNo ratings yet

- Profit or Loss From Business: I I I I I I I IDocument1 pageProfit or Loss From Business: I I I I I I I Idolapo BalogunNo ratings yet

- P6-Income Tax CalculationDocument15 pagesP6-Income Tax CalculationAnonymous rePT5rCr0% (1)

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNo ratings yet

- Brief Data Sheet: Hi3516E V200 Economical HD Ip Camera SocDocument7 pagesBrief Data Sheet: Hi3516E V200 Economical HD Ip Camera Socsijovow282No ratings yet

- Get NoticeDocument3 pagesGet NoticeJo anne Jo anneNo ratings yet

- Get NoticeDocument3 pagesGet NoticeLetsoai MalesaNo ratings yet

- Pillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Document4 pagesPillay Naidoo 56 Vaalboskat Street Hesteapark Ext 8 Pretoria Noord 0182Spoton AutomotiveNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact Centrebra9tee9tiniNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa 7455: Contact Centrebra9tee9tiniNo ratings yet

- Cash FlowDocument1 pageCash Flowpawan_019No ratings yet

- Coindirect CDD Form - Filled - NN 2Document7 pagesCoindirect CDD Form - Filled - NN 2ginaNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Bas (SBR) 2020Document4 pagesBas (SBR) 2020mahm82No ratings yet

- Notice of Assessment 2019 04 29 02 32 21 264865Document4 pagesNotice of Assessment 2019 04 29 02 32 21 264865Dennis EnnsNo ratings yet

- R43 2019 PDFDocument4 pagesR43 2019 PDFDavid Mark AldridgeNo ratings yet

- Financial Statement 2020 - Corporation of Hamilton 2Document27 pagesFinancial Statement 2020 - Corporation of Hamilton 2Anonymous UpWci5No ratings yet

- Tax Return 2022 2023 Amaicei ConstantinDocument18 pagesTax Return 2022 2023 Amaicei ConstantinamaiceicostelNo ratings yet

- Qualified Dividends and Capital Gains WorksheetDocument1 pageQualified Dividends and Capital Gains WorksheetBetty Ann LegerNo ratings yet

- Jose AbreuDocument39 pagesJose Abreueddy britoNo ratings yet

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn StarnesjpneebNo ratings yet

- Statement 115377 Oct-2022Document8 pagesStatement 115377 Oct-2022Mary MacLellanNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnAntonio InzulzaNo ratings yet

- Repayment Schedule 12-21-23Document1 pageRepayment Schedule 12-21-23Akash MajhiNo ratings yet

- Grey & White Minimal Resume PDFDocument1 pageGrey & White Minimal Resume PDFFakhri FaishalNo ratings yet

- Companies Form 18Document8 pagesCompanies Form 18Sianga SiangaNo ratings yet

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- Certificate of Document Filed: Office of The Secretary of State of The State of ColoradoDocument3 pagesCertificate of Document Filed: Office of The Secretary of State of The State of Coloradogsd100% (1)

- Important Dates and Fees - CPA AustraliaDocument4 pagesImportant Dates and Fees - CPA AustraliaTechbotix AppsNo ratings yet

- Tax Credit Claim Form 2018: For Donation Claims OnlyDocument2 pagesTax Credit Claim Form 2018: For Donation Claims OnlyasdfNo ratings yet

- 64-8 Form (Másolat)Document2 pages64-8 Form (Másolat)Molnar FerencneNo ratings yet

- Certificate of Loss of Earnings: For Self-Employed or Company DirectorsDocument2 pagesCertificate of Loss of Earnings: For Self-Employed or Company DirectorsSorina CorpaciNo ratings yet

- 2021 FullDocument14 pages2021 FullDamian MikaNo ratings yet

- US Internal Revenue Service: f1040nr - 2005Document5 pagesUS Internal Revenue Service: f1040nr - 2005IRSNo ratings yet

- Claim For Repayment of Tax Deducted From Savings and InvestmentsDocument4 pagesClaim For Repayment of Tax Deducted From Savings and InvestmentsxzmangeshNo ratings yet

- Tax Burden UKDocument13 pagesTax Burden UKArturas GumuliauskasNo ratings yet

- 2022 Uber 1099-KDocument2 pages2022 Uber 1099-Kelklote89No ratings yet

- February 2024 StatementDocument2 pagesFebruary 2024 StatementdrikiddoNo ratings yet

- Devaksha Rampersadh Ftnqngi2 ArchivedDocument2 pagesDevaksha Rampersadh Ftnqngi2 ArchiveddevaksharamharakhNo ratings yet

- Tax Alert Special Issue March 31, 2020 (Final)Document15 pagesTax Alert Special Issue March 31, 2020 (Final)Rheneir MoraNo ratings yet

- Bank of Missouri Privacy PolicyDocument2 pagesBank of Missouri Privacy PolicykirstieNo ratings yet

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- Private and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duDocument1 pagePrivate and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duElaine HicksNo ratings yet

- Clix Capital REPAYMENT - SCHEDULE - REPORT AC2020092465227Document1 pageClix Capital REPAYMENT - SCHEDULE - REPORT AC2020092465227Manohar Chaudhary100% (2)

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- When To Hire A Tax ProfessionalDocument7 pagesWhen To Hire A Tax ProfessionalMaimai Durano100% (1)

- Account # 0302080036: Lifegreen SavingsDocument2 pagesAccount # 0302080036: Lifegreen Savingsstorage mediaNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusCoen WalterNo ratings yet

- Form990 2021 1661373681961Document58 pagesForm990 2021 1661373681961Jeremy Joseph EhlingerNo ratings yet

- Profit & Loss, Balance Sheet and Cash Flow StatementDocument13 pagesProfit & Loss, Balance Sheet and Cash Flow Statementshivuch20No ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- Proof of IncomeDocument3 pagesProof of IncomeKenan DuranNo ratings yet

- Preview 28Document22 pagesPreview 28kakabadzebaiaNo ratings yet

- MC Machethe Proof of ResidenceDocument1 pageMC Machethe Proof of ResidencevelyassetsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- Toaster Oven Control SystemDocument12 pagesToaster Oven Control SystemfaridrahmanNo ratings yet

- Excelsior Audio Design & Services, LLC: Subwoofer Alignment With Full-Range SystemDocument10 pagesExcelsior Audio Design & Services, LLC: Subwoofer Alignment With Full-Range SystemAndres Felipe Gomez YepesNo ratings yet

- TK-C Transmitter PDFDocument4 pagesTK-C Transmitter PDFGopal HegdeNo ratings yet

- Office Chair Quotation Sheet 1Document8 pagesOffice Chair Quotation Sheet 1LarsenTwil100% (1)

- Strategic Human Resource Plan: Airasia BerhadDocument35 pagesStrategic Human Resource Plan: Airasia BerhadJae Kyung AsilahNo ratings yet

- 03-Admiralty Law Hall 1809Document121 pages03-Admiralty Law Hall 1809mlo356100% (4)

- Working Capital Management Project ReportDocument48 pagesWorking Capital Management Project ReportAman Kumar100% (1)

- Oracle Order Management Quiz 1Document24 pagesOracle Order Management Quiz 1Sajid KhawajaNo ratings yet

- Cement PackingDocument7 pagesCement PackingCao Ngoc AnhNo ratings yet

- Wireless Temperature and Humidity Monitoring Solution: The ClientDocument11 pagesWireless Temperature and Humidity Monitoring Solution: The ClientGonzalo ADS LogicNo ratings yet

- Schematic - Zigbee Stick 4.0 CH340CDocument1 pageSchematic - Zigbee Stick 4.0 CH340CSergey SuloevNo ratings yet

- Sample Size Determination: Monetary Unit Sampling WorksheetDocument1 pageSample Size Determination: Monetary Unit Sampling WorksheetAnonymous Ul3litqNo ratings yet

- Meguiar's A1214, Cleaner Wax-Paste: Motor ActiveDocument14 pagesMeguiar's A1214, Cleaner Wax-Paste: Motor Activejeanada phillipsNo ratings yet

- Heirs Vs MaramagDocument1 pageHeirs Vs MaramagMir SolaimanNo ratings yet

- Neuron Infographics by SlidesgoDocument35 pagesNeuron Infographics by SlidesgoKingProNo ratings yet

- Rev CTA 8835 8790 Chevron Holdings Inc vs. CIRDocument20 pagesRev CTA 8835 8790 Chevron Holdings Inc vs. CIRJerome Delos ReyesNo ratings yet

- Boarding Pass BA0117 LHR JFK 022Document1 pageBoarding Pass BA0117 LHR JFK 022garyNo ratings yet

- NGCP TDP With Process FlowDocument221 pagesNGCP TDP With Process FlowJoseph Tantoco100% (1)

- Pamantasan NG CabuyaoDocument15 pagesPamantasan NG CabuyaoJudithRavelloNo ratings yet

- Basic Processing of Library Materials - YapDocument18 pagesBasic Processing of Library Materials - YapJoseph Marmol Yap100% (3)

- Name: Samiena F. Abang Final SurveyDocument17 pagesName: Samiena F. Abang Final SurveyHelen Fairodz AmoraNo ratings yet

- Test Your Verilog Skills 1 PDFDocument44 pagesTest Your Verilog Skills 1 PDFram_786No ratings yet

- Murata IoT Business CasesDocument14 pagesMurata IoT Business CasesMohammad AminNo ratings yet

- Richa Gaur's Academy - CompressedDocument20 pagesRicha Gaur's Academy - CompressedcombatselfdefenseandfitnessNo ratings yet

- MR 315Document2 pagesMR 315David SMNo ratings yet

- Retold by Joanne Barkan Illustrated by Richard DownsDocument27 pagesRetold by Joanne Barkan Illustrated by Richard DownsRami IbrahimNo ratings yet

- Draft MOUDocument17 pagesDraft MOUariNo ratings yet

- Cooks Handbook For Egypt and The Sûdân-E.A.Wallis Budge-1906Document956 pagesCooks Handbook For Egypt and The Sûdân-E.A.Wallis Budge-1906zepolk100% (2)