Professional Documents

Culture Documents

Janet T Neff Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Janet T Neff Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

~ev.

U2011

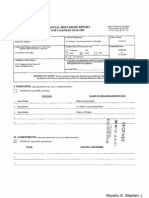

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or OrgmRIz~tlon US District Couxt Wcst~m Dis~ct of Michigan

Type (dleek appropriate Nomination, ] [] Initial Dat~ [] Annual ] Final

Report Required by the Elhtc~ In Government Act of 1978 (5 U.$.C. upp. I01-111)

1, Person Reporting O~t name, tint, middle initial) Neff, Jan-t T.

4. Title (Ar~le Illj edges indicate active or senior ~atus; magist~e judge~ indlc~t~ full- or part-time)

Date of Relmrt 05/9/2011

16. Reperting Period 01/01/2010 12/31/2010

US Dis~ct/udge, active stems

7. Chamben or Office Addr~s 1 I0 Michigan St NW Suit~ 402 Grand Rapids, Michigan 49503

B,On the basi~ of the information contained in this Report lid lay modlfl~tioas per~Riolng ~er~to, ~ h, in my opinion, Ja t~mplitmce with npplkable I~ and reguhtiol~ Reviewing Officer I~te

IMPORTANT NOTES: The Ins~ncaons accompanying th~form must ~efdtow~ Compim ~llpam,

checking the NONE box for each ga~ where ~ou have no reportable infonnadon. Sign on la.stpage.

I. POSITIONS. [~ NONE (No reportable positions.)

POSITION

NAME OF ORGANIZATION/ENTITY

r--=

==

[71

II. AGREEMENTS. t~,,,,~ ~,~-Io.~;

~ NONE (No reportable agreements.) DATE

I. 1989 2. 3.

PARTIES AND TERMS

Michigan Judges Retirement System - Pension upon Rrtirrment from Michigan Court of Appeals

Neff, Janet T.

FENANCIAL DISCLOSURE REPORT Page 2 of 8

Name of Persom Reporting Neff, Janet T.

Dste of Repor~ 05/9/20 ! L

IIl. NON-INVESTMENT IN COME. aoo,d.~ ~,,,~=..~ ,,.d ~=,,~ .~ ~ t z-u

A. Filers Non-Investment Income [~ NONE (No reportable non-investment income.) DATE

I. 2010 2. 3. 4.

,~OURCE AND TYPE

(yours, not spouses)

State of Michigan l~nsion $90,864.60

B, Spouses Non-Investment Income - 0yo- ~ere ~,,n~

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE

1.2010 2. 3. 4,

SOURCE AND TYPE

State of Michigan pension

IV. REIMBURSEMENTS - ~-w,-~- ~,Ioo~ ~,,.~-.~

(Tnclud~r~ ~o~e to ~e and d~n~ ~i[~n; see ~. 25-27 of fili~ i~o~.)

N0~ ~o reportable reim~rsements.)

SOURCE DATES LOCATION PURPOSE

ITEMS PAID OR PROV/DED

2. 3.

4.

5.

FINANCIAL DISCLOSURE REPORT Page 3 of8

Date of Reper~ 05/9/2011

V. GIFTS. a,~,,~

NO~ ~o reportable g~s.) SOURCE

I.

DESC~ION

V__ALUE

NONE (No reportable liabilities.) .07,EDITOR DESCRIPTION VALUECODE

1. 2. 3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 4 of 8 VII. INVESTMENTS and TRUSTS

NONE (No reportable income, assets, or transactions.)

A. Ikscfipdon of Assets (including t~mt asset~) Place "(X)" afar each asset exempt from prior disclosur, B. Income du~ng reporting period C. Oros~ value at end of reporting period D. Transactions during reporting period

Date of Repert 05/9/2011

O)

Amount Code 1 (A-H)

C2)

Type (e.g., div., rent, or inL)

(I)

(2)

(t)

Type (e.g., buy, sell, red~pdon)

(2)

(3) (4)

Gain Code I (A-H)

(5)

Identity of buyer/seller (if prlvate u-~tion)

Value Value Code 2 Method (J-P) Codv 3 (Q-W) K T

Date Value mm/dd/yy Code 2 (J-P)

1. 2. 3. 4. 5.

Grand Rapids Family Credit Union accotmt IRA - Charles Schwab - Arbitrage Fund CI R - Akxos Absolute Return Fund . American Funds New World - Betw3tn Income Fund - Hmsman Suate#c Total Return Fund - InUpid Small Cap - JP Morgan Stratigi Incm Oppty A " - JP Morgan Strategic lncm Oppty A - JP Morgan Stntegi~ Incm Oppty A - JP Morgan Strategic Incm Oppty A - JP Morgan Strategic Incm Oppty A

Interest

Int./Div.

T Sold Sold Sold Sold Sold Sold Sold 08/I0/10 K 05/21/10 12/31/10 08/13/10 04/29/10 12/31/10 K K K L K

6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17.

05/21/10 L

Buy 101/29/10

(addS)

Buy (addS)

Buy (addl)

Buy Buy Buy Buy

)2/26/10 J

03/31110 J

04/30110 03/30110 06/29110 03/31/10 J J

- Bewcy~ Income Fund - Betw~n Income Fund - Hussrnan Strategic Total Return Fund - Wint~rgretm Fund

J J

(a~~)

Buy 08/16/10 K

I. Income Grin Code~: (See Columns B I and D4) 2. VtI~ C~e~ (See Colwam CI am[ D3) 3. Value Mtthod Cod~$ (Set: Colunm C2)

A =$1,000 or lest F -$50,001 - $100,000 J =$|5,000 or I1~ N =1250.00t $500.0~0 P] =$25.000.001 - $$0.000.000 Q =Appraisal U -Book Value

B =$1,001. $2.500 O ~1100,001 - $ 1,000,000 K ~515.001 - $50.000 O -$500,001 - $1,000,000 R ,g~o~t (Real E.tmtt Ouly) V =(Xtx-r

C =$2,501 - $5,000 H I =$1.000,001 - SY,000.000 L -$50,001 - $ I00,000 PI ,,~1,000,001 - $5,000,000 P4 -Mote than 150.000.00(I S =At~c~ncnt W =E~timat~d

D =$5.001 - $! 5.000 H2 -Mote thin $5,000,000 M "$ I00,001 F2 -$5,000,001 - $25,000,000 T =,Cath Mmk~

E-SIS,001-

FINANCIAL DISCLOSURE REPORT Page 5 of 8

Name of Perso~ Reparfl~ Neff, Janet T.

Dire of R~rt 05/9/2011

VII. INVESTMENTS and TRUSTS - ~,~o.~, .~t,. ~,~ocao,~

NONE (No reportable income, assets, or transactions.) A. Description of Assets B. Income during O) (2) ~nt T~e (e.g., (A-~ or int.) C. Gros~ value at end CI) Va~e (J-P) (2) Vflue C~ 3 (Q-~ (D T~ (~g., ~p6on) D. Tran~:fiom during ~ing ~ (z) Da~ O) V~ (LP) (4) G~ (A-~ (~) Id~ of (if palate

Pl~e "~" afl~ ~h ~

18.

o Akr~ F~-us Fund Re~ail

Buy Buy

11/17/10 12/15110 07/01/10 i 12/13110

19. - IVA Worldwide Fund C1 A 20. 21, 22. 23. 24. 25. 26. 27. 28. 29. - FPA Crescent Fund Inst - FFA C~escem Fund Inst - Schwab Adv Cash Re.rye - S~hwab Adv Cash Reserve - Schwab Adv Cash Reserve - Schwab Adv Cash Reserve - Schwab Adv Cash Reserve - Schwab Adv Cash Reserve - Schwab Adv Cash Reserve - Schwab Adv Cash Reserve

(ada,l)

Buy

J J K J J L K L

(~ddl)

Sold Sold Sold

01104110 01/20/10 04/21110 05103/10 05/05/10 05/25/10 07109110 08/12!10 10/29/10 11/18/|0 12/27/10 12/29/10 12/31110

(pro)

Buy Sold Buy Sold Sold Sold Sold (pan) Buy Buy Buy

(part)

(pan) 30. - Sc~,a~ ^dr C~h ~eserve

31. 32. 33. 34. - Schwab Adv ~h Reserve - Americm Func~ New World - Intr~id Small Cap - Columbia Thermost~i Fund CI A

K J J J J K

(,~~)

B -|1,00! - ~2500 O -$ IO0.OOt - $1.000,000 O -$.~00,001 - $1.000,000 R -Co~t (Re~l Esme

C ~12.501 - $~,000 HI -$I.000.001 - $~i,000,DO0 L ~$$0,001 - $I00.000 P1 -$1,000,00| P4 -Mm~ ~,m w

E =115,001 $$0.000

FINANCIAL DISCLOSURE REPORT Page 6 0f8 VII. INVESTMENTS and TRUSTS

Name of Peasea Reporting Neff, Janet T.

Date of Repert 0519/2011

NONE (No reportable income, assets, or transactions.)

A. Ikscription of Assets

(including trust a.~et~)

B. Income during

reporting period

C. G~os$ value at end

of repotting period

D. Transactions during reporting period (l) Type (e.g., buy, sell, redemption) (2) (3) (4) Date Value rnm/dd/yy Code 2 (J-P)

Place "(X)" afle~ each asset exempt f~om prior disclosure

(1) Amount Code I (AoH)

(2) Type (e.g., div., rent, or int.)

(1) Value Code 2 (J-P)

(2) Value Method Code 3

Gain Code ! (A-H)

Identity of buyer/s~ller (if private

(Q-w)

35. 36. 37. 38. 39. 40. 41. 42. - Meridian Growth Fund - Ap#e.seed Fund Comerica Bank - US Saving, Bonds Chase Bank E A Interest Int!Div. J Buy Sold Redeemed 12/31/I0 12/3 I/I0 05/25/10 K K L

tnnsaction)

I. Income G,io Codes: (~.e Columvs BI trod D4) 2. Value Co~i (See Colu.,nn~ Cl and O3} 3. Valve Method Co~e~ (See Column C2)

A =$ t,000 m" lets F -$~0.001. $100.000 J -$15,000 o I~.s N ~730,001 - Sf~00,000 P] ,=~25,000.001 - $50,000,000 Q -Ap~li~ U =Book Value

B "$1.001 - E2,500 G =$ |00,00l - $1.000.000 K -$15,001 - $50,000 O ,~500,001 - $1,000,000 R =17.~t (Real Eatate Otfly) V -Other

C =$2,50| HI -$l.000.0OI - $5.000.000 L =$50,001. P[ -e*[,000.001 - $5,000,000 P4 =More I~lttt $ -A.eseatmem W -Exrlmated

E -$I 5.(X)! - $50,000

H2 -More time $5.000.000 1~2 -,$5,000,001 . ~.5.000.000 T =~lLsh Market

FINANCIAL DISCLOSURE REPORT Page 7 of 8

Name of Person Reporting Neff, Janet T.

Date of Report 0519/2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

~bonds cashed in 2010 were inadvertently omitted on prior financial disclosure reports. They were acquired by inheritanc~: ]~

FINANCIAL DISCLOSURE REPORT Page 8 of 8 IX. CERTIFICATION.

Name of Person Reporting Neff, Janet T,

Date of Report 0~19/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any Information not reported was withheld because it met applicable statutory provisions permitting non-disclosure.

I furfher cergfy that earned Income from oufatde employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions ors U.S.C. app. $0! et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

NOTE: ANY INDMDUAL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 On~ Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- Patrick J Duggan Financial Disclosure Report For 2009Document7 pagesPatrick J Duggan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard L Nygaard Financial Disclosure Report For 2009Document7 pagesRichard L Nygaard Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Howard A Matz Financial Disclosure Report For 2009Document13 pagesHoward A Matz Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephen J Murphy III Financial Disclosure Report For 2009Document8 pagesStephen J Murphy III Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William Eugene Davis Financial Disclosure Report For 2009Document8 pagesWilliam Eugene Davis Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Sandra Ikuta Financial Disclosure Report For 2009Document8 pagesSandra Ikuta Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Karen E Schreier Financial Disclosure Report For 2009Document13 pagesKaren E Schreier Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Ancer L Haggerty Financial Disclosure Report For 2009Document7 pagesAncer L Haggerty Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Lawrence J ONeill Financial Disclosure Report For 2010Document19 pagesLawrence J ONeill Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Jose A Fuste Financial Disclosure Report For 2009Document8 pagesJose A Fuste Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Lyle E Strom Financial Disclosure Report For 2010Document7 pagesLyle E Strom Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Sidney A Fitzwater Financial Disclosure Report For 2009Document9 pagesSidney A Fitzwater Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Patrick A Conmy Financial Disclosure Report For 2009Document7 pagesPatrick A Conmy Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- James B Zagel Financial Disclosure Report For 2009Document10 pagesJames B Zagel Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- David C Godbey Financial Disclosure Report For 2009Document7 pagesDavid C Godbey Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Monti L Belot Financial Disclosure Report For 2009Document8 pagesMonti L Belot Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Anthony Battaglia Financial Disclosure Report For Battaglia, AnthonyDocument7 pagesAnthony Battaglia Financial Disclosure Report For Battaglia, AnthonyJudicial Watch, Inc.No ratings yet

- Jackson L Kiser Financial Disclosure Report For 2009Document8 pagesJackson L Kiser Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joseph A Greenaway JR Financial Disclosure Report For 2009Document7 pagesJoseph A Greenaway JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joan B Gottschall Financial Disclosure Report For 2009Document11 pagesJoan B Gottschall Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Samuel Conti Financial Disclosure Report For 2009Document7 pagesSamuel Conti Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Joe L Heaton Financial Disclosure Report For 2010Document8 pagesJoe L Heaton Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- James H Hancock Financial Disclosure Report For 2009Document7 pagesJames H Hancock Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Lawrence H Silberman Financial Disclosure Report For 2009Document7 pagesLawrence H Silberman Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Larry J McKinney Financial Disclosure Report For 2009Document8 pagesLarry J McKinney Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert P Patterson JR Financial Disclosure Report For 2009Document8 pagesRobert P Patterson JR Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- James B Loken Financial Disclosure Report For 2009Document9 pagesJames B Loken Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John Antoon Financial Disclosure Report For 2009Document8 pagesJohn Antoon Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Theresa L Springmann Financial Disclosure Report For 2009Document6 pagesTheresa L Springmann Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Robert B Propst Financial Disclosure Report For 2009Document9 pagesRobert B Propst Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Leonard E Davis Financial Disclosure Report For 2009Document7 pagesLeonard E Davis Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Garnett T Eisele Financial Disclosure Report For 2009Document12 pagesGarnett T Eisele Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard H Kyle Financial Disclosure Report For 2009Document8 pagesRichard H Kyle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Gregory K Frizzell Financial Disclosure Report For 2009Document8 pagesGregory K Frizzell Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Spiegel S Financial Disclosure Report For 2009Document9 pagesSpiegel S Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William R Furgeson Financial Disclosure Report For 2009Document9 pagesWilliam R Furgeson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Kenneth M Karas Financial Disclosure Report For 2010Document7 pagesKenneth M Karas Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Henry T Wingate Financial Disclosure Report For 2009Document8 pagesHenry T Wingate Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Simeon T Lake Financial Disclosure Report For 2009Document9 pagesSimeon T Lake Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Daniel A Manion Financial Disclosure Report For 2009Document12 pagesDaniel A Manion Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Paul L Maloney Financial Disclosure Report For 2009Document12 pagesPaul L Maloney Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephan P Mickle Financial Disclosure Report For 2009Document7 pagesStephan P Mickle Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William H Pryor JR Financial Disclosure Report For 2010Document9 pagesWilliam H Pryor JR Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Patricia C Fawsett Financial Disclosure Report For 2009Document11 pagesPatricia C Fawsett Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Myron J Lorenz Financial Disclosure Report For 2009Document7 pagesMyron J Lorenz Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Tom S Lee Financial Disclosure Report For 2009Document8 pagesTom S Lee Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John Gleeson Financial Disclosure Report For 2009Document6 pagesJohn Gleeson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Kimberly A Moore Financial Disclosure Report For 2009Document11 pagesKimberly A Moore Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Frank H Seay Financial Disclosure Report For 2009Document8 pagesFrank H Seay Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Antonin Scalia Financial Disclosure Report For 2009Document12 pagesAntonin Scalia Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Stephen Anderson Financial Disclosure Report For 2009Document8 pagesStephen Anderson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William J Riley Financial Disclosure Report For 2010Document7 pagesWilliam J Riley Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Rebecca R Pallmeyer Financial Disclosure Report For 2009Document7 pagesRebecca R Pallmeyer Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- John T Curtin Financial Disclosure Report For 2009Document7 pagesJohn T Curtin Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Betty B Fletcher Financial Disclosure Report For 2010Document7 pagesBetty B Fletcher Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Russel H Holland Financial Disclosure Report For 2009Document10 pagesRussel H Holland Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard J Sullivan Financial Disclosure Report For 2009Document6 pagesRichard J Sullivan Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Richard Linn Financial Disclosure Report For 2009Document8 pagesRichard Linn Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- William F Nielson Financial Disclosure Report For 2009Document13 pagesWilliam F Nielson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Why Australia Prospered: The Shifting Sources of Economic GrowthFrom EverandWhy Australia Prospered: The Shifting Sources of Economic GrowthRating: 5 out of 5 stars5/5 (1)

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Schoolboard PowerpointDocument2 pagesSchoolboard PowerpointJudicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- Reg Vs Govinda On 18 JulyDocument4 pagesReg Vs Govinda On 18 JulyPritam SubbaNo ratings yet

- Case Digests of Perlas-BernabeDocument1 pageCase Digests of Perlas-BernabeMitzi S. Guzman-De DiosNo ratings yet

- Faq en PDFDocument4 pagesFaq en PDFRossellaFamularoNo ratings yet

- Contact Directory 2018: IndexDocument274 pagesContact Directory 2018: Indexbala subramanianNo ratings yet

- Amir Ali Jalia, A096 751 896 (BIA Jan. 6, 2011)Document7 pagesAmir Ali Jalia, A096 751 896 (BIA Jan. 6, 2011)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Contracts Notes 2Document106 pagesContracts Notes 2Mark Michael Strage100% (2)

- Department of Labor: GRAP FORM 1 Initial ApplicationDocument2 pagesDepartment of Labor: GRAP FORM 1 Initial ApplicationUSA_DepartmentOfLaborNo ratings yet

- The Mysore Code: Regulations Passed Subsequent to the RenditionDocument423 pagesThe Mysore Code: Regulations Passed Subsequent to the RenditionUmesh Hb100% (2)

- Kelvion Walker Vs Amy WilburnDocument63 pagesKelvion Walker Vs Amy WilburnHorrible CrimeNo ratings yet

- 2017-2-10 Letter To Region 2 Re PSD Permit Extension FINALDocument2 pages2017-2-10 Letter To Region 2 Re PSD Permit Extension FINALAngel GonzalezNo ratings yet

- Undertaking by Contractor On Compliances (During Runing Bills)Document1 pageUndertaking by Contractor On Compliances (During Runing Bills)nk229330No ratings yet

- 6.21 J.M. Tuason & Co. Inc. v. CADocument3 pages6.21 J.M. Tuason & Co. Inc. v. CALyssa TabbuNo ratings yet

- Module 3.1 Human Rights in InvestigationDocument42 pagesModule 3.1 Human Rights in InvestigationKy Rie100% (1)

- G.R. No. L-53487 - 1Document6 pagesG.R. No. L-53487 - 1MauNo ratings yet

- Drug Consignment Agreement SummaryDocument3 pagesDrug Consignment Agreement SummaryremaxiloiloNo ratings yet

- Equivalent Record FormDocument1 pageEquivalent Record Formbheybie0822No ratings yet

- Carlyle Thayer - 2008, Aug - One-Party Rule and The Challenge of Civil Society in Viet NamDocument27 pagesCarlyle Thayer - 2008, Aug - One-Party Rule and The Challenge of Civil Society in Viet NamintasmaNo ratings yet

- DMRC NotificationDocument4 pagesDMRC NotificationMalhotraSoniaNo ratings yet

- Maximum Security, Minimal AppreciationDocument34 pagesMaximum Security, Minimal AppreciationPG Edi100% (1)

- The Rentier State in The Middle EastDocument34 pagesThe Rentier State in The Middle EastbengersonNo ratings yet

- DEBATE GARB The Genuine Agrarian Reform BillDocument3 pagesDEBATE GARB The Genuine Agrarian Reform BillJacqueline NgNo ratings yet

- Suggested ReadingDocument23 pagesSuggested ReadingMuhammad KumailNo ratings yet

- Rakes vs. AGPDocument20 pagesRakes vs. AGPJesha GCNo ratings yet

- Case For Testamentary CapacityDocument2 pagesCase For Testamentary CapacityDeanne Mitzi SomolloNo ratings yet

- Mercado Vs Allied Banking Corporation, GR No. 171460, July 27, 2007Document18 pagesMercado Vs Allied Banking Corporation, GR No. 171460, July 27, 2007Ej CalaorNo ratings yet

- Babasaheb Bhimrao Ambedkar University: Importance of Right To Information For Good Governance in IndiaDocument15 pagesBabasaheb Bhimrao Ambedkar University: Importance of Right To Information For Good Governance in Indiashubham niderNo ratings yet

- Court rules on property disputeDocument5 pagesCourt rules on property disputeLaurie Carr LandichoNo ratings yet

- Documents-1 Click Transaction AgreementDocument2 pagesDocuments-1 Click Transaction AgreementjonatanNo ratings yet

- Enriquez vs. Sun Life AssuranceDocument2 pagesEnriquez vs. Sun Life AssuranceEuneun Bustamante100% (1)

- Sample Diploma Unit A Examination PaperDocument4 pagesSample Diploma Unit A Examination PaperKm MehboobNo ratings yet