Professional Documents

Culture Documents

AP Lecture 6-What Is Risk

Uploaded by

oxana_babyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AP Lecture 6-What Is Risk

Uploaded by

oxana_babyCopyright:

Available Formats

Lecture 6

What is Risk?

ASSET PRICING

Bristol Business School, UWE

Dr. Jesus G. Garza-Garcia

1. WHAT IS (FINANCIAL) RISK?

Some preliminary questions

Assume that you want to invest $100,000. What

do you want from this investment?

What dangers to your investment could you see?

1. WHAT IS (FINANCIAL) RISK?

Definition of risk:

Actual outcome (return) is different from the expected

outcome (return). This means a gain or a loss. So, the

definition of risk is symmetric.

However, people’s attitude towards risk is asymmetric.

People are more concerned about a possible loss than a

possible gain. People are risk averse.

The same amount added to wealth is valued less than the

same amount lost.

1. WHAT IS (FINANCIAL) RISK?

It follows: If people are risk averse, they will be less willing

to hold a risky asset than they will be to hold an asset with

little or no risk. Thus, agents only hold risky assets if they

receive a higher reward.

1. WHAT IS (FINANCIAL) RISK?

What is the reward? (Recall!)

Reward = return

Eg. A share: the current return is: (Recall: HPR!)

D1 ( P1 P0 )

return

P0

average return

sum of return

T

Again, risk is the deviation of the actual return from the

average return.

1. WHAT IS (FINANCIAL) RISK?

Exercise 1:

An investor has the choice between assets with

the following return-risk combinations: A(8,15);

B(6,12); C(11,15); D(16,21).

Which asset will the risk averse investor reject?

1. WHAT IS (FINANCIAL) RISK?

Daily returns of McDonald’s stock price 2 nd Jan 1990 to 31st Jan 1990

•Looking at the graph, is it risky to invest in

McDonald’s?

1. WHAT IS (FINANCIAL) RISK?

Daily data from 29th Dec 1989 until 31st Dec 1999

(2531 returns): Graph:

11.0% 8 September 1998

10.0% McDonald's--Daily Returns, 29 Dec 89 - 31 Dec 99

9.0%

8.0%

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

0 2 -J a n -9 0

0 9 -S e p -9 0

1 7 -M a y -9 1

2 2 -J a n -9 2

2 8 -S e p -9 2

0 5 -J u n -9 3

1 0 -F e b -9 4

1 8 -O c t-9 4

2 5 -J u n -9 5

0 1 -M a r-9 6

0 6 -N o v -9 6

1 4 - J u l- 9 7

2 1 -M a r-9 8

2 6 -N o v -9 8

0 3 -A u g -9 9

-1.0%

-2.0%

-3.0%

-4.0%

-5.0%

-6.0%

-7.0%

-8.0%

-9.0%

-10.0% 31 August 1998

-11.0%

What do you see?

1. WHAT IS (FINANCIAL) RISK?

You get a bit more when you look at a frequency distribution:

Highest daily return = 10.86%

Lowest daily return= -10.07%

What do you see now?

WHAT DOES AN INVESTOR WANT FROM THE INVESTMENT?

High average rate of return and low risk

How do we measure both?

For ease of calculation (and daily average return

is close to zero), we use annual data now.

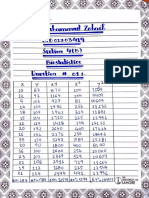

WHAT DOES AN INVESTOR WANT FROM THE INVESTMENT?

Date Return minus

McDonald's average,

return squared

31-Dec-90 -15.65% 11.908%

31-Dec-91 30.54% 1.365%

31-Dec-92 28.31% 0.893%

31-Dec-93 16.90% 0.038%

30-Dec-94 2.64% 2.633%

29-Dec-95 54.27% 12.536%

31-Dec-96 0.54% 3.357%

31-Dec-97 5.23% 1.857%

31-Dec-98 60.88% 17.659%

31-Dec-99 4.94% 1.938%

WHAT DOES AN INVESTOR WANT FROM THE INVESTMENT?

Calculate expected return:

1 T 1

E(r) rt 15.65 30.54 ... 4.94 18.86%

T t 1 10

On average, an investor in McDonald’s stocks receives

about 19% p.a.

Calculating the variance:

(Since risk is defined as the difference of actual returns

from expected returns, variance and standard deviations

seem to be good measures.)

WHAT DOES AN INVESTOR WANT FROM THE INVESTMENT?

The average variation around the expected return

of 18.86% is 24.56%.

Anything striking?

Average Standard Average Standard

AVERAGE RETURN

return VERSUS STANDARD DEVIATION

deviation return OF deviation

RETURNS 17.12%

Abbott 19.27% Marriott 7.15% 39.81%

Alcoa 19.03% 27.59% Microsoft 62.72% 37.99%

American

Airlines 9.26% 29.34% NASDAQ 23.00% 20.17%

ATT 6.76% 27.96% Nicor 9.15% 16.50%

Boeing 7.57% 25.57% Nordstrom 5.44% 38.21%

Cisco 67.31% 38.80% Northrop 14.76% 34.40%

Vanguard

Long-Term

Treasury

Coke 10.18% 24.29% Fund 2.43% 7.94%

Procter &

Dell 69.86% 55.48% Gamble 19.41% 20.91%

Standard &

Poor's 500

Duke 11.07% 15.43% Index 15.09% 13.18%

WHAT DOES AN INVESTOR WANT FROM THE INVESTMENT?

What do you see on the graph (relate to table)?

What does the straight line indicate to you?

VALUE AT RISK (VAR)

What is VaR?

VaR estimates the capital loss on a portfolio over a

given period (e.g.1 day) that will be exceeded with a

given percentage (e.g. 1%).

Capital loss can be in £ or, as we will define it here, it

can be a percentage of our portfolio.

VaR is calculated on the basis of the probability

distribution of returns.

VALUE AT RISK (VAR)

250

200

F

r

e 150 (1-p)=99%

q p=1%

u

e 100

n

c

y 50

0

-0.0546

-0.0506

-0.0466

-0.0426

-0.0386

-0.0346

-0.0306

-0.0266

-0.0226

-0.0186

-0.0146

-0.0106

-0.0066

-0.0026

0.0014

0.0054

0.0094

0.0134

0.0174

0.0214

0.0254

0.0294

0.0334

0.0374

0.0414

0.0454More

Return %

Figure 1: Histogram of daily returns of FTSE All

Shares between 3rd May 2004 and 2nd May 2008.

VALUE AT RISK (VAR)

Here: the daily VaR (99% confidence level) =

-2.61%. This means that if the portfolio value

were £100 million, the VaR would simply be:

VaR = £100 million x 2.61% = £2.61 million

The VaR value of £2.61 million tells us that there

is a 1% chance that next day we will lose £2.61

million or more.

2. USING EXCEL

NOTE: HPR (which we should calculate)

include dividends. When we look for data on

stock prices or stock indices, we need to be

careful to choose prices marked as ‘adj close’

(adjusted prices at the close of the day:

adjusted for dividends, splits etc).

Calculation of daily return (assuming adjusted

prices):

Arithmetic:

2. USING EXCEL

To calculate frequency distribution:

Use frequency function in EXCEL:

Construct classes (called BINS)

Use frequency command

2. USING EXCEL

A B C D E F

1 Date Price Return Frequency EXEL

Distribution Instruction

2 29-Jan-90 8.50 -10% =frequency(

c3:c102,

e3:e12)

3 30-Jan-90 8.59 1.05% -8%

4 31-Jan-90 8.50 -1.053% -6%

5 1-Feb-90 8.34 -1.900% -4%

6 2-Feb-90 8.19 -1.815% -2%

7 … … …. 0%

.. … … …. …

102

You might also like

- Star Wars Galaxy Map (Imperial Era)Document1 pageStar Wars Galaxy Map (Imperial Era)JackNo ratings yet

- Capital Asset Pricing ModelDocument34 pagesCapital Asset Pricing ModelasifanisNo ratings yet

- MAN106Document297 pagesMAN106Luz Analía Valdez Candia75% (4)

- Motion To Proceed Pro SeDocument3 pagesMotion To Proceed Pro SeThomas MatesNo ratings yet

- MANNx Syndicate 7Document8 pagesMANNx Syndicate 7heda kaleniaNo ratings yet

- An Architect Explains - The Tokyo International ForumDocument5 pagesAn Architect Explains - The Tokyo International ForumJorge DenisNo ratings yet

- Venture Building, A New Model For Entrepreneurship and Innovation - LinkedInDocument16 pagesVenture Building, A New Model For Entrepreneurship and Innovation - LinkedInkhaledhassangamal9516No ratings yet

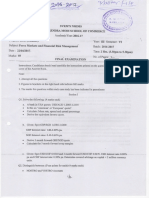

- FIN658 Degree Session 1 2012Document8 pagesFIN658 Degree Session 1 2012Amirah RahmanNo ratings yet

- Time Series AnalysisDocument24 pagesTime Series Analysisalptoker0% (1)

- Toy Car Lab - 2Document3 pagesToy Car Lab - 2api-260771184No ratings yet

- HIV/AIDS in Thailand (Sombat Thanprasertsuk, M.D., M.P.H.)Document46 pagesHIV/AIDS in Thailand (Sombat Thanprasertsuk, M.D., M.P.H.)National Press FoundationNo ratings yet

- Consumption, Saving & InvestmentDocument99 pagesConsumption, Saving & InvestmentGary BirginalNo ratings yet

- Very Negative Results in Dec 19: RiskyDocument17 pagesVery Negative Results in Dec 19: RiskyFinancial WisdomNo ratings yet

- GannDocument84 pagesGannsandypaiNo ratings yet

- AcceleratorDocument14 pagesAcceleratorJasjit BalNo ratings yet

- Math-9th ch-12 (2018-19)Document2 pagesMath-9th ch-12 (2018-19)Kabeer ahmedNo ratings yet

- 3AS U02 - E3 - Cour-Exe 05Document7 pages3AS U02 - E3 - Cour-Exe 05hlmNo ratings yet

- 367 STR4 003Document1 page367 STR4 003sibag49612No ratings yet

- Rapaport Diamond Report: Pears: Pears: Pears: Pears: PearsDocument2 pagesRapaport Diamond Report: Pears: Pears: Pears: Pears: PearsAna CaluNo ratings yet

- Scoring of Alignments: Einführung in Die BioinformatikDocument19 pagesScoring of Alignments: Einführung in Die BioinformatikjitendraNo ratings yet

- Structure and Materials AssignmentDocument30 pagesStructure and Materials AssignmentAkash PatelNo ratings yet

- J101 Vocabularywith Kanji F10Document1 pageJ101 Vocabularywith Kanji F10Dong LiNo ratings yet

- Lecture 5 InflationDocument34 pagesLecture 5 InflationShaoli MofazzalNo ratings yet

- Ecs g41t-m7 Rev. 1.0Document30 pagesEcs g41t-m7 Rev. 1.0Zidan YasrahNo ratings yet

- Rapaport Diamond Report: Pears: Pears: Pears: Pears: PearsDocument2 pagesRapaport Diamond Report: Pears: Pears: Pears: Pears: PearsPrachur SinghalNo ratings yet

- Bitwise Tricks and TechniquesDocument123 pagesBitwise Tricks and TechniquesKhuram AliNo ratings yet

- Baguio City Market Whole-ModelDocument1 pageBaguio City Market Whole-ModelArvin LacanlaleNo ratings yet

- Inv Quick GuideDocument60 pagesInv Quick GuideabellazarusNo ratings yet

- 4mccullocha: Downloaded FromDocument4 pages4mccullocha: Downloaded FromPablo LoboNo ratings yet

- Sealless Magnetic Drive Pumps - SundyneDocument5 pagesSealless Magnetic Drive Pumps - SundyneAlvin KimNo ratings yet

- Apc HW3 PDFDocument8 pagesApc HW3 PDFIan CasvitNo ratings yet

- Program Report - Economic Fluctuations and Growth, 2010Document32 pagesProgram Report - Economic Fluctuations and Growth, 2010Eliana BGNo ratings yet

- CIMENTACION Layout1 PDFDocument1 pageCIMENTACION Layout1 PDFBrian FernándezNo ratings yet

- Singkat Mikro PieDocument125 pagesSingkat Mikro PieRini HartatiNo ratings yet

- Singkat Mikro PieDocument125 pagesSingkat Mikro PieIsmail Andi Baso100% (1)

- Gantt Chart Template OrangescrumDocument6 pagesGantt Chart Template OrangescrumFarah DianaNo ratings yet

- Practice Problems Set-1 Ques-MergedDocument18 pagesPractice Problems Set-1 Ques-MergedManish PrajapatiNo ratings yet

- Chapter 4 - Value at RiskDocument50 pagesChapter 4 - Value at RiskVishwajit GoudNo ratings yet

- Ca Deltat Deltaca Cociente Caprom Lncociente LncapromedioDocument2 pagesCa Deltat Deltaca Cociente Caprom Lncociente LncapromedioLuisMirkoNo ratings yet

- Adobe Scan 26 Apr 2022 2Document3 pagesAdobe Scan 26 Apr 2022 2Moon ZeeNo ratings yet

- Commented (KC1)Document2 pagesCommented (KC1)Ryley HolmesNo ratings yet

- Stock Market Parts Feb 10Document2 pagesStock Market Parts Feb 10John Paul GroomNo ratings yet

- G41T-M7 15-R60-011002 (Diagramas - Com.br)Document30 pagesG41T-M7 15-R60-011002 (Diagramas - Com.br)José FrançaNo ratings yet

- Pie Kelompok 3Document15 pagesPie Kelompok 3Marsha HafizhaNo ratings yet

- Group Members: Project AdvisorsDocument21 pagesGroup Members: Project AdvisorsTahzeeb AttariNo ratings yet

- 1827 Stefanovic Karadzic Opisanije SrbijeDocument49 pages1827 Stefanovic Karadzic Opisanije SrbijeelfifdNo ratings yet

- ББDocument133 pagesББМөнххолбооЭнхбаатарNo ratings yet

- Martin Pring On Market Momentum Chart 6.5 Japanese Yen With Daily and Weekly Stochastics Reflecting Short-, Intermediate-, and Long-Term TrendsDocument1 pageMartin Pring On Market Momentum Chart 6.5 Japanese Yen With Daily and Weekly Stochastics Reflecting Short-, Intermediate-, and Long-Term TrendsTUAN NGUYỄNNo ratings yet

- CQF January 2023 M1L1 BlankDocument52 pagesCQF January 2023 M1L1 BlankAntonio Cifuentes GarcíaNo ratings yet

- EC 314: Public and Private Investment Q2: Time ValueDocument1 pageEC 314: Public and Private Investment Q2: Time ValueJamie WoodsNo ratings yet

- Part05 DevicesAvailableDocument13 pagesPart05 DevicesAvailableEd SilNo ratings yet

- Pear Shape DiamondsDocument2 pagesPear Shape DiamondsCheick BahNo ratings yet

- Measures of VariabilityDocument4 pagesMeasures of VariabilityCristy Lyn Kwan RiveraNo ratings yet

- C.finance Assignment 2Document14 pagesC.finance Assignment 2fiza akhterNo ratings yet

- Hearth DiagramDocument1 pageHearth DiagramTommaso PillonNo ratings yet

- Task 1Document1 pageTask 1hanNo ratings yet

- En CIMB Islamic DALI Asia Pacific Equity Growth Fund MYR FFSDocument2 pagesEn CIMB Islamic DALI Asia Pacific Equity Growth Fund MYR FFSmuy yaqNo ratings yet

- International Macroeconomics: Slides For Chapter 11: Exchange Rate Policy and UnemploymentDocument47 pagesInternational Macroeconomics: Slides For Chapter 11: Exchange Rate Policy and UnemploymentM Kaderi KibriaNo ratings yet

- Bisection R Falsi F (C)Document6 pagesBisection R Falsi F (C)Rivan YakhsaNo ratings yet

- Tugas 6 - Kestabilan PenguatDocument2 pagesTugas 6 - Kestabilan PenguatPrayogi PangersaNo ratings yet

- Forex Markets & Financial Risk Management187Document2 pagesForex Markets & Financial Risk Management187poorvaNo ratings yet

- EC 314: Public and Private Investment Q2: Time ValueDocument1 pageEC 314: Public and Private Investment Q2: Time ValueJamie WoodsNo ratings yet

- 1258Document1 page1258DFO AwantiporaNo ratings yet

- EthicsDocument4 pagesEthicsIra DionisioNo ratings yet

- Maths in Physics PDFDocument263 pagesMaths in Physics PDFNeetaiimsjipmer Ipe720/720No ratings yet

- Franklin 1988Document16 pagesFranklin 1988Verônica VieiraNo ratings yet

- Turn It inDocument32 pagesTurn It inFretz aaron BacongaNo ratings yet

- Group 2 - Gendered Family and Gendered Education (Notes) PDFDocument6 pagesGroup 2 - Gendered Family and Gendered Education (Notes) PDFMarlon C. ManaloNo ratings yet

- CPM Global 0181 PDFDocument20 pagesCPM Global 0181 PDFSMM ENTREPRISENo ratings yet

- How To Format A Political Science Research PaperDocument8 pagesHow To Format A Political Science Research Paperfvesdf9j100% (1)

- ColourDocument2 pagesColourIr Fik TNo ratings yet

- SH 5107 Dilution Ventilation 2021 - LumiNUS (Update Slide 75)Document103 pagesSH 5107 Dilution Ventilation 2021 - LumiNUS (Update Slide 75)Shuyuan LuNo ratings yet

- Conflict: Communication, Coaching, andDocument16 pagesConflict: Communication, Coaching, andNemam ImeNo ratings yet

- UK BIM Alliance, BSI & CDBB Launch UK BIM FrameworkDocument2 pagesUK BIM Alliance, BSI & CDBB Launch UK BIM FrameworkInuyashahanNo ratings yet

- 3RW50736AB14 Datasheet enDocument8 pages3RW50736AB14 Datasheet enRafael LucenaNo ratings yet

- Uk EssaysDocument7 pagesUk Essaysvotukezez1z2100% (2)

- Lec 02 Intelligent AgentsDocument40 pagesLec 02 Intelligent AgentsRizwan100% (1)

- Environmental Groups in AlbaniaDocument1 pageEnvironmental Groups in AlbaniaAnonymous 6qaFbHIrONo ratings yet

- San 310CTRDocument2 pagesSan 310CTRNguyễn Hồng NamNo ratings yet

- Operativa y ComsolDocument16 pagesOperativa y ComsolAnndre RamírezNo ratings yet

- Group Assignment 1 202020212Document2 pagesGroup Assignment 1 202020212satish chandranNo ratings yet

- How To Write Your Novel Study EssayDocument27 pagesHow To Write Your Novel Study EssayTimon WilsonNo ratings yet

- Midterm Leadership GGDocument5 pagesMidterm Leadership GGGiang GiangNo ratings yet

- Combined Homework 8 PDFDocument16 pagesCombined Homework 8 PDFAnsh SrivastavaNo ratings yet

- Motilal Nehru National Institute of Technology Allahabad - 211004 (India) Department of Training and Placement - Internship Notification Form (INF)Document2 pagesMotilal Nehru National Institute of Technology Allahabad - 211004 (India) Department of Training and Placement - Internship Notification Form (INF)Triranga BikromNo ratings yet

- Intercultural Business EssayDocument9 pagesIntercultural Business EssayĐỗ Hồng QuânNo ratings yet

- Part M Subpart F MOM 10102008 2Document20 pagesPart M Subpart F MOM 10102008 2viktorNo ratings yet

- 2nd Year English Cba WorkbookDocument18 pages2nd Year English Cba Workbookapi-582972598No ratings yet

- Stat 130 Module 1 B SlidesDocument16 pagesStat 130 Module 1 B SlidesambonulanNo ratings yet