Professional Documents

Culture Documents

New or Acquired Ventures: The Pathways

Uploaded by

roshan kc0 ratings0% found this document useful (0 votes)

6 views11 pagesOriginal Title

kuratko_02

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views11 pagesNew or Acquired Ventures: The Pathways

Uploaded by

roshan kcCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 11

Chapter 2

The Pathways

New or Acquired Ventures

© 2009 by Prentice Hall 2-1

New-new approach

◦ New products or services entering the market

New-old approach

◦ An individual “piggybacks” on someone else’s idea

© 2009 by Prentice Hall 2-2

Market analysis

◦ Market analysis can help a prospective business entrepreneur

determine whether a demand for a particular food or service

exists

The scientific method: four steps

1. Fact gathering

2. Organizing the facts

3. Analysis of the facts

4. Implementation of an action plan (covers three areas)

1. The entrepreneur as a person

2. The financial picture

3. Other key factors (marketing, insurance, building, etc.)

© 2009 by Prentice Hall 2-3

Personal questions

◦ Are you a self-starter?

◦ How do you feel about others?

◦ Can you lead people?

◦ Can you take responsibility?

◦ Are you an organizer?

◦ Are you a hard worker?

◦ Can you make decisions?

◦ Can people rely on your word?

◦ Can you stick with it?

◦ How good is your health?

© 2009 by Prentice Hall 2-4

Evaluation

◦ How much will it cost to stay in business for the

first year?

◦ How much revenue will the firm generate during

this time period?

Upside gain and downside loss

Risk versus reward analysis

Other key factors

◦ The location/building

◦ Merchandise and equipment

◦ Record keeping

◦ Insurance and legal concerns

◦ Marketing and personnel

© 2009 by Prentice Hall 2-5

Buying an Ongoing Venture

Advantages of buying an ongoing venture

1. Because the enterprise is already in operation, its

successful future operation is likely

2. The time and effort associated with starting a

new enterprise are eliminated

3. It sometimes is possible to buy an ongoing

business at a bargain price

© 2009 by Prentice Hall 2-6

Why is the business being sold?

What is the current physical condition of the

business?

What is the condition of the inventory?

What is the state of the company’s other assets?

Intangible assets? (goodwill, patents, franchise

rights, noncompete agreements)

How many of the employees will remain?

What type of competition does the business face?

What is the status of the firm’s financial picture?

◦ The company’s profitability

© 2009 by Prentice Hall 2-7

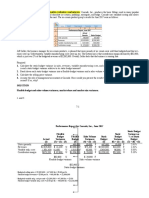

Assessing the price

1. Book value

2. Replacement value

3. Liquidation value

4. Past earnings

5. Cash flow

© 2009 by Prentice Hall 2-8

Determining the Value of a

Business: A 6-Step Process

1. Spending time in the trenches

2. Create a sound business plan

3. Secure working capital and backup resources

4. Invest in a strong brand / image

5. Keep accurate and complete records

6. Make a profit

© 2009 by Prentice Hall 2-9

Four critical elements should be recognized:

1. Information

2. Time

3. Pressure

4. Alternatives

© 2009 by Prentice Hall 2-10

1. Have a seller retain a minority interest in the

business

2. Never rely on oral statements

3. Have an accountant examine the books and

check the cash flow

4. Investigate, investigate, investigate

5. Interview the employees

6. Find out the real reason the company is for

sale

© 2009 by Prentice Hall 2-11

You might also like

- Kuratko 8 e CH 09Document24 pagesKuratko 8 e CH 09waqasNo ratings yet

- Kuratko 8e CH 09Document24 pagesKuratko 8e CH 09BoyNo ratings yet

- CH 9 EPSHIP 19032022 124913amDocument23 pagesCH 9 EPSHIP 19032022 124913amMustafa JawedNo ratings yet

- Kuratko 8e CH 09Document24 pagesKuratko 8e CH 09audi0% (1)

- ASSESSMENT OF ENTREPRENEURIAL OPPORTUNITIES GROUP 6 Saratao Achay LastimosoDocument31 pagesASSESSMENT OF ENTREPRENEURIAL OPPORTUNITIES GROUP 6 Saratao Achay LastimosoNyxz NightNo ratings yet

- Ch.8 New Ventr DevpDocument18 pagesCh.8 New Ventr DevpRitik MishraNo ratings yet

- 11-1 - Assessment of Entrepreneurial OpportunitiesDocument24 pages11-1 - Assessment of Entrepreneurial Opportunitiesmaverik Ad100% (1)

- 11-1 - Assessment of Entrepreneurial OpportunitiesDocument24 pages11-1 - Assessment of Entrepreneurial OpportunitiesMuhammad Obaid ElahiNo ratings yet

- Group 6Document11 pagesGroup 6Marites Peñaranda LebigaNo ratings yet

- Entrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual Full Chapter PDFDocument34 pagesEntrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual Full Chapter PDFnancyfranklinrmnbpioadt100% (13)

- Entrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions ManualDocument13 pagesEntrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manualscarletba4cc100% (25)

- ENVC Chapter 4 PDFDocument34 pagesENVC Chapter 4 PDFPotta SusmithaNo ratings yet

- Process of Entrepreneur: Identifying Entrepreneurial OpportunityDocument23 pagesProcess of Entrepreneur: Identifying Entrepreneurial OpportunitymkNo ratings yet

- Don'T Look For Jobs,: Create Them !!! Be An Entrepreneur!Document29 pagesDon'T Look For Jobs,: Create Them !!! Be An Entrepreneur!Heginio BaldanoNo ratings yet

- Entrepreneurship: Sessional ReportDocument9 pagesEntrepreneurship: Sessional Reportcrazy manNo ratings yet

- Enterprise, Business Growth and SizeDocument36 pagesEnterprise, Business Growth and SizeNeha ParekhNo ratings yet

- 1.1 Nature of Business ActivityDocument43 pages1.1 Nature of Business ActivityLaila GhanemNo ratings yet

- Entrepreneurship RevisionDocument3 pagesEntrepreneurship Revisionabshirshuriye7No ratings yet

- BSENT 3-3 BPP Group3-Mariano-Jan Francis-Assignment #1Document2 pagesBSENT 3-3 BPP Group3-Mariano-Jan Francis-Assignment #1jan francis marianoNo ratings yet

- Entrepreneurship Theory Process and Practice 10th Edition Kuratko Solutions ManualDocument15 pagesEntrepreneurship Theory Process and Practice 10th Edition Kuratko Solutions Manualedrichelenssuauq100% (29)

- Entrepreneurship Theory Process and Practice 10th Edition Kuratko Solutions Manual Full Chapter PDFDocument36 pagesEntrepreneurship Theory Process and Practice 10th Edition Kuratko Solutions Manual Full Chapter PDFnancyfranklinrmnbpioadt100% (16)

- Either Ethics or Profit Is Necessary For A Business To Survive One or The Other Is More ImportantDocument4 pagesEither Ethics or Profit Is Necessary For A Business To Survive One or The Other Is More ImportantTomaNo ratings yet

- CHP 12 Developing An Effective Business PlanDocument21 pagesCHP 12 Developing An Effective Business PlanSaranyieh RamasamyNo ratings yet

- Reasons Why An Individual May Want To Establish A BusinessDocument7 pagesReasons Why An Individual May Want To Establish A BusinessMickale SmithNo ratings yet

- Preparation of Business PlanDocument51 pagesPreparation of Business PlanRana MishraNo ratings yet

- Technopreneurship in Small Medium EnterprisegrouptwoDocument50 pagesTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraNo ratings yet

- ReadingMaterial Day 9Document42 pagesReadingMaterial Day 9Hijaz SalahudeenNo ratings yet

- Chapter 6Document35 pagesChapter 6zkNo ratings yet

- Haseeba - IE - Unit 1 - Idea - Generation and OpportunitiesDocument29 pagesHaseeba - IE - Unit 1 - Idea - Generation and OpportunitiesDavid RajuNo ratings yet

- Acquiring An Established BusinessDocument11 pagesAcquiring An Established BusinessManasa M AcharNo ratings yet

- Assessment of Entrepreneurial Opportunities 1Document37 pagesAssessment of Entrepreneurial Opportunities 1Jack LincalloNo ratings yet

- Assessment of Entrepreneurial OpportunitiesDocument41 pagesAssessment of Entrepreneurial OpportunitiesRea Mae ElevazoNo ratings yet

- AIS Romney 2006 Slides 02 Business ProcessDocument119 pagesAIS Romney 2006 Slides 02 Business Processsharingnotes123100% (1)

- Business Plan FinalDocument30 pagesBusiness Plan FinalAashna RamtriNo ratings yet

- Entrepreneurship Theory Process and Practice 10th Edition Kuratko Solutions Manual 1Document36 pagesEntrepreneurship Theory Process and Practice 10th Edition Kuratko Solutions Manual 1jorgethomasqwmfaijysk100% (25)

- 1-Do You Want Go Into Business SpeechDocument34 pages1-Do You Want Go Into Business SpeechvillafuertekriszelNo ratings yet

- Entrepreneurship Theory Process and Practice 10Th Edition Kuratko Solutions Manual Full Chapter PDFDocument35 pagesEntrepreneurship Theory Process and Practice 10Th Edition Kuratko Solutions Manual Full Chapter PDFkim.walls764100% (12)

- Hapter 2Document112 pagesHapter 2firoNo ratings yet

- Chapter 3Document35 pagesChapter 3ademe tamiruNo ratings yet

- Mod9 Business-Implementation v2Document10 pagesMod9 Business-Implementation v2MARY JOY RUSTIANo ratings yet

- For Entrep ADocument51 pagesFor Entrep AJose Jeirl Esula ArellanoNo ratings yet

- C2 FoodrichDocument7 pagesC2 FoodrichJonuelin InfanteNo ratings yet

- ENTREPRENEURSHIP 12 Q2 M9 Business ImplementationDocument12 pagesENTREPRENEURSHIP 12 Q2 M9 Business ImplementationMyleen CastillejoNo ratings yet

- Grooming Your Business For Sale: Plan For The Future But Be Prepared For The UnexpectedDocument8 pagesGrooming Your Business For Sale: Plan For The Future But Be Prepared For The Unexpectedcsylvestre_adixNo ratings yet

- Entrepreneu Rship: Understand The Concept of EntrepreneurshipDocument19 pagesEntrepreneu Rship: Understand The Concept of EntrepreneurshipShendy AcostaNo ratings yet

- Entrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual DownloadDocument13 pagesEntrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual DownloadBenjamin Rogers100% (27)

- Lecture 1. Intro To EntrepreneurshipDocument31 pagesLecture 1. Intro To EntrepreneurshipGerard Benedict Stephen JosephNo ratings yet

- Entrepreneurship: Quarter 2 - Module 9 Business ImplementationDocument10 pagesEntrepreneurship: Quarter 2 - Module 9 Business ImplementationGian Carlo Devera71% (7)

- Entrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual 1Document36 pagesEntrepreneurship Theory Process and Practice 9th Edition Kuratko Solutions Manual 1jorgethomasqwmfaijysk100% (21)

- Entrepreneurship Theory Process and Practice 9Th Edition Kuratko Solutions Manual Full Chapter PDFDocument36 pagesEntrepreneurship Theory Process and Practice 9Th Edition Kuratko Solutions Manual Full Chapter PDFkim.walls764100% (12)

- Applied Eco - Industry and Environmental Analysis Business Opportunity IdentificationDocument5 pagesApplied Eco - Industry and Environmental Analysis Business Opportunity IdentificationGarnet RigorNo ratings yet

- Kuratko 8e CH 12Document21 pagesKuratko 8e CH 12BoyNo ratings yet

- Enterprise Development NotesDocument6 pagesEnterprise Development NotesJames MwitaNo ratings yet

- SDocument12 pagesSjoe blowNo ratings yet

- GST NoteDocument84 pagesGST Notemusa99729No ratings yet

- Entrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandDocument36 pagesEntrepreneurship: Successfully Launching New Ventures, 2/e: Bruce R. Barringer R. Duane IrelandMuhammad SabihNo ratings yet

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Module 9: Business ImplementationDocument27 pagesModule 9: Business ImplementationPrincess Enrian Quintana Polinar100% (1)

- AssessmentDocument1 pageAssessmentroshan kcNo ratings yet

- Introduction To E-Business: BBA VIII SemesterDocument20 pagesIntroduction To E-Business: BBA VIII Semesterroshan kcNo ratings yet

- II - Technologies in E BusinessDocument43 pagesII - Technologies in E Businessroshan kcNo ratings yet

- Online Distribution: Bba 8 SemesterDocument37 pagesOnline Distribution: Bba 8 Semesterroshan kcNo ratings yet

- VII.E Payment SystemDocument49 pagesVII.E Payment Systemroshan kcNo ratings yet

- Business PlanDocument26 pagesBusiness Planroshan kcNo ratings yet

- Corporate Responsibility and Corporate Identity: Learning OutcomesDocument28 pagesCorporate Responsibility and Corporate Identity: Learning OutcomesPadma AcharyaNo ratings yet

- MCC604 C4Document47 pagesMCC604 C4Padma AcharyaNo ratings yet

- MCC604 C4Document47 pagesMCC604 C4Padma AcharyaNo ratings yet

- MCC604 C5Document38 pagesMCC604 C5Padma AcharyaNo ratings yet

- Corporate Responsibility and Corporate Identity: Learning OutcomesDocument28 pagesCorporate Responsibility and Corporate Identity: Learning OutcomesPadma AcharyaNo ratings yet

- MCC604 C5Document38 pagesMCC604 C5Padma AcharyaNo ratings yet

- What Is Ethics Corporate Communication and Marketing: Learning OutcomesDocument22 pagesWhat Is Ethics Corporate Communication and Marketing: Learning OutcomesPadma AcharyaNo ratings yet

- What Is Ethics Corporate Communication and Marketing: Learning OutcomesDocument22 pagesWhat Is Ethics Corporate Communication and Marketing: Learning OutcomesPadma AcharyaNo ratings yet

- MCC604 C2Document24 pagesMCC604 C2Padma AcharyaNo ratings yet

- Course Description: Nature of Course: Theoretical + PracticalDocument5 pagesCourse Description: Nature of Course: Theoretical + Practicalroshan kcNo ratings yet

- AF Roles and AssessmentDocument2 pagesAF Roles and Assessmentroshan kcNo ratings yet

- Google Drive Basics PDFDocument60 pagesGoogle Drive Basics PDFroshan kcNo ratings yet

- Marking Criteria: Step 1: Open The Assignment in Microsoft WordDocument5 pagesMarking Criteria: Step 1: Open The Assignment in Microsoft Wordroshan kcNo ratings yet

- Af Roles: Facilitat e Guide Evaluat eDocument2 pagesAf Roles: Facilitat e Guide Evaluat eroshan kcNo ratings yet

- Marking Criteria: Step 1: Open The Assignment in Microsoft WordDocument5 pagesMarking Criteria: Step 1: Open The Assignment in Microsoft Wordroshan kcNo ratings yet

- The Ten Commandments For Computer EthicsDocument9 pagesThe Ten Commandments For Computer Ethicsroshan kcNo ratings yet

- Bict DBMSDocument6 pagesBict DBMSroshan kcNo ratings yet

- CCP313 Object Oriented Programming - FT v2Document4 pagesCCP313 Object Oriented Programming - FT v2roshan kc100% (1)

- BICT Human Computer Interaction HCIDocument6 pagesBICT Human Computer Interaction HCIroshan kcNo ratings yet

- UCS105 Information Literacy & Research SkillDocument3 pagesUCS105 Information Literacy & Research Skillroshan kcNo ratings yet

- The Hybrid: FranchisingDocument15 pagesThe Hybrid: Franchisingroshan kcNo ratings yet

- Successful Business Plans: The RoadmapDocument13 pagesSuccessful Business Plans: The Roadmaproshan kcNo ratings yet

- Legal Forms of Ventures: The StructureDocument18 pagesLegal Forms of Ventures: The Structureroshan kcNo ratings yet

- New or Acquired Ventures: The PathwaysDocument11 pagesNew or Acquired Ventures: The Pathwaysroshan kcNo ratings yet

- Bussiness Case Nabati MTDocument12 pagesBussiness Case Nabati MTFi Fiyunda50% (2)

- Mambulao Lumber V PNB (22 SCRA 359)Document4 pagesMambulao Lumber V PNB (22 SCRA 359)Jose RolandNo ratings yet

- Freelance Marketer Sales DeckDocument14 pagesFreelance Marketer Sales DeckyanalkassiNo ratings yet

- Property, Plant and Equipment Problem SolvingDocument4 pagesProperty, Plant and Equipment Problem SolvingYDELVAN LLANONo ratings yet

- Solution To Continuing Case ProblemDocument5 pagesSolution To Continuing Case Problemmniher100% (2)

- Annual Report Messer Group GMBH 2020Document140 pagesAnnual Report Messer Group GMBH 2020Curt CNo ratings yet

- Spatial Access To Pedestrians and Retail Sales in Seoul, KoreaDocument11 pagesSpatial Access To Pedestrians and Retail Sales in Seoul, KoreaParth PasheklNo ratings yet

- Cambridge IELTS 5 Listening Test 1Document4 pagesCambridge IELTS 5 Listening Test 1ggggNo ratings yet

- GensetDocument5 pagesGensetdhkn9t8btgNo ratings yet

- Singapore IncDocument2 pagesSingapore IncBastiaan van de Loo100% (1)

- Presentation On Government BudgetingDocument2 pagesPresentation On Government BudgetingSherry Gonzales ÜNo ratings yet

- Valucon M1-M2 Ppt-ReviewerDocument137 pagesValucon M1-M2 Ppt-ReviewerEarl De LeonNo ratings yet

- ानम् "That which is not different from knowledge which arises spontaneously."Document1 pageानम् "That which is not different from knowledge which arises spontaneously."Ashutosh KumarNo ratings yet

- C 4 C 00 D 37Document12 pagesC 4 C 00 D 37alyaa rabbaniNo ratings yet

- 320 Accountancy Eng Lesson9Document20 pages320 Accountancy Eng Lesson9Lesley ShiriNo ratings yet

- Are Cloud (Virtual) Kitchens Profitable - Aadil Kazmi - MediumDocument9 pagesAre Cloud (Virtual) Kitchens Profitable - Aadil Kazmi - Mediumfatank0450% (2)

- SWP SimulatorDocument2 pagesSWP SimulatorDr. Mukilan RamadossNo ratings yet

- Bain Packaging CaseDocument8 pagesBain Packaging CaseThanh Phu TranNo ratings yet

- Tax Types QuestionsDocument5 pagesTax Types QuestionsJoseph Tinio CruzNo ratings yet

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- Module Learning BL 4Document54 pagesModule Learning BL 4Joyce Ann CortezNo ratings yet

- Module 2 Legal Aspects in Tourism & HospitalityDocument22 pagesModule 2 Legal Aspects in Tourism & HospitalityKenneth GallegoNo ratings yet

- Rfox DC Apc CJHX 58 NDocument14 pagesRfox DC Apc CJHX 58 NAnuj AnujNo ratings yet

- Impact of Black-MoneyDocument26 pagesImpact of Black-MoneyDevikaSharma100% (2)

- Tài liệu không có tiêu đềDocument5 pagesTài liệu không có tiêu đềThy Han LeNo ratings yet

- FIN221 Chapter 3Document45 pagesFIN221 Chapter 3jojojoNo ratings yet

- Cost AccountingDocument26 pagesCost AccountingdivinamariageorgeNo ratings yet

- Mitchells Balance Sheet: Question 1)Document3 pagesMitchells Balance Sheet: Question 1)Hamna RizwanNo ratings yet

- Chapter 1 IntroductionDocument8 pagesChapter 1 IntroductionSachin MohalNo ratings yet

- Retail Foods Manila PhilippinesDocument10 pagesRetail Foods Manila PhilippinesemsNo ratings yet