Professional Documents

Culture Documents

Deemed Ordinary Resident Finance Act, 2020

Uploaded by

Vicky D0 ratings0% found this document useful (0 votes)

7 views5 pagesOriginal Title

10

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views5 pagesDeemed Ordinary Resident Finance Act, 2020

Uploaded by

Vicky DCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

Deemed Ordinary Resident

Finance Act, 2020

Individuals

Basic conditions: [sec. 6(1)]

(a) He is in India in the previous year for a period of 182

days or more, or

P.Y. 2019-2020 - 182 Days

(b) he has been in India for at least 365 days during the four

years preceding the previous year and is in India for at least

60 days during the previous year.

2015-2016, 2016-2017, 2017-2018,2018-2019 = 365 days

P.Y. 2019-2020 = 60 days

Exceptions to the rules of 60 days’ stay in India

(i) An individual who is a citizen of India and leaves

India in any previous year for the purpose of

employment or as a member of the crew of an

Indian ship must have stayed in India for at least

182 days during the previous year instead of 60

days;

(ii) If any citizen of India or a foreign national of Indian

origin, who is living outside India, comes on a visit

to India in the previous year, he must have stayed in

India for at least 182 days during the previous year

instead of 60 days.

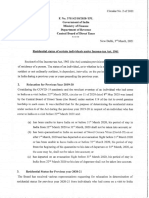

• Residential Status – determined by the number of days of his stay

in India

• The exception provided in Explanation 1(b) to section 6(1), for Indian

citizens and persons of India origin visiting India in that year has

been decreased to 120 days, only in cases where the total income of

such visiting individuals during the financial year from sources, other

than foreign sources, exceeds INR 15 lakhs.

• The term ‘income from foreign sources’ has been defined to

mean income which accrues or arises outside India (except income

derived from a business controlled in or a profession set up in India).

• Residential Status – Provision of ‘Deemed Resident’ applicable if

total income exceeds INR 15 lakhs

• To avoid misapprehension, the CBDT issued a Press Release dated 2

February 2020, clarifying that in case of an Indian citizen who

becomes deemed resident of India, income earned outside India by

him shall not be taxed in India unless it is derived from an Indian

business or profession.

• The scope of clause (1A) has been now limited through the Finance

Act, 2020, and shall only be applicable to such Indian citizens who

meet the threshold*. Accordingly, all Indian citizens who fail to meet

the threshold, but are not subject to tax in any other jurisdiction, will

not be considered as Indian tax resident

• (*Threshold: an individual, being a citizen of India, having total

income, other than the income from foreign sources, exceeding

fifteen lakh rupees during the previous year)

You might also like

- Residential Status of Individuals Under Income Tax Act, 1961 - Taxguru - inDocument4 pagesResidential Status of Individuals Under Income Tax Act, 1961 - Taxguru - inSimran SinghNo ratings yet

- Lesson 2 Residential Status & Scope of Total IncomeDocument27 pagesLesson 2 Residential Status & Scope of Total Income1A 10 ASWIN RNo ratings yet

- Residential Status and Tax LiabilityDocument2 pagesResidential Status and Tax LiabilityPrachi AlungNo ratings yet

- IT-02 Residential StatusDocument26 pagesIT-02 Residential StatusAkshat GoyalNo ratings yet

- Tax Lecture-5A Residential Status-Amendment by Finance Act 2020Document7 pagesTax Lecture-5A Residential Status-Amendment by Finance Act 2020Vineet RajNo ratings yet

- Basis of Charge in Income TaxDocument43 pagesBasis of Charge in Income TaxArpit GoyalNo ratings yet

- Kishan Kumar Income Tax Amendments May2021Document6 pagesKishan Kumar Income Tax Amendments May2021ileshrathod0No ratings yet

- Residential Status Cma IndaDocument10 pagesResidential Status Cma IndaKiran ChristyNo ratings yet

- Weeks 4,5,6 - PDFDocument191 pagesWeeks 4,5,6 - PDFMehul Kumar MukulNo ratings yet

- 2 Residential StatusDocument30 pages2 Residential StatusVEDANT SAININo ratings yet

- Income Tax Amendment - 2021 by CA Rajat MoghaDocument46 pagesIncome Tax Amendment - 2021 by CA Rajat MoghaOm Sai Enterprises100% (1)

- Residential Status and Scope of Total IncomeDocument19 pagesResidential Status and Scope of Total IncomeSamyak JainNo ratings yet

- 2021 128 Taxmann Com 128 Article Recent Amendments Impacting Residential StatusDocument5 pages2021 128 Taxmann Com 128 Article Recent Amendments Impacting Residential StatusGunay ChandawatNo ratings yet

- Residence in IndiaDocument7 pagesResidence in IndiaSuryaNo ratings yet

- Chapter-2 Residential StatusDocument5 pagesChapter-2 Residential StatusBrinda RNo ratings yet

- Residential Status and Tax IncidenceDocument4 pagesResidential Status and Tax IncidenceAshok Kumar MehetaNo ratings yet

- Residential status determination for individualsDocument14 pagesResidential status determination for individualsdhananjay7No ratings yet

- 3 - Basis of Charge, Scope of Total IncomeDocument165 pages3 - Basis of Charge, Scope of Total IncomeSaurin ThakkarNo ratings yet

- Residential Status and Scope of Total Income - AY 2023 - 24Document12 pagesResidential Status and Scope of Total Income - AY 2023 - 24Rajan SundararajanNo ratings yet

- Residential StatusDocument13 pagesResidential StatusABC 123No ratings yet

- Residential Status and its Impact on Tax LiabilityDocument25 pagesResidential Status and its Impact on Tax LiabilityPJ 123No ratings yet

- Residential StatusDocument33 pagesResidential StatusNovel Bipin Kr SawNo ratings yet

- Residential Status: - Impact On Tax Liability 060820Document37 pagesResidential Status: - Impact On Tax Liability 060820Abhay GroverNo ratings yet

- My Space: Indian Citizenship at A CrossroadDocument2 pagesMy Space: Indian Citizenship at A CrossroadprakashlegaladvisersNo ratings yet

- Model Answers Law of TaxationDocument46 pagesModel Answers Law of Taxationlavkush1234No ratings yet

- RESIDENCE AND TAX LIABILITY of PersonDocument6 pagesRESIDENCE AND TAX LIABILITY of PersonRuksana ChikodeNo ratings yet

- 1328866787Chp 2 - Residence and Scope of Total IncomeDocument5 pages1328866787Chp 2 - Residence and Scope of Total IncomeMohiNo ratings yet

- 31162sm DTL Finalnew-May-Nov14 Cp2Document25 pages31162sm DTL Finalnew-May-Nov14 Cp2gvcNo ratings yet

- Taxation Residential Status and Appeal ProvisionsDocument47 pagesTaxation Residential Status and Appeal ProvisionsSamata BohraNo ratings yet

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Document44 pagesModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Tejasvini KhemajiNo ratings yet

- Amndmnt I-M'21Document25 pagesAmndmnt I-M'21kri satNo ratings yet

- Determination of Residential Status of Individual Under Income Tax ActDocument5 pagesDetermination of Residential Status of Individual Under Income Tax ActnehaNo ratings yet

- Non Resident Indians Under FEMADocument4 pagesNon Resident Indians Under FEMAgaurav069No ratings yet

- The Income Tax Act SEC 6Document9 pagesThe Income Tax Act SEC 6MohsinNo ratings yet

- Week 4 - Residence Based TaxationDocument31 pagesWeek 4 - Residence Based Taxationkabir kapoorNo ratings yet

- Residential StatusDocument9 pagesResidential Statussadhana20bbaNo ratings yet

- Whoisannri?: Person Resident Outside India Means A Person Who Is Not Resident in IndiaDocument3 pagesWhoisannri?: Person Resident Outside India Means A Person Who Is Not Resident in Indiakrissh_87No ratings yet

- B71fedca 95fa 4b5b B32e A2fa493fbdeaDocument22 pagesB71fedca 95fa 4b5b B32e A2fa493fbdeaRaj DasNo ratings yet

- Residence Status and Tax LiabilityDocument14 pagesResidence Status and Tax LiabilityDrafts StorageNo ratings yet

- Unit 1, Part 2Document10 pagesUnit 1, Part 2Sandip Kumar BhartiNo ratings yet

- Residential Status Section 6: Exceeds 60 DaysDocument3 pagesResidential Status Section 6: Exceeds 60 DaysVachanamrutha R.VNo ratings yet

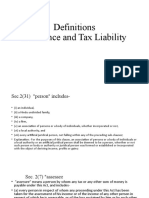

- Definitions Residence and Tax LiabilityDocument23 pagesDefinitions Residence and Tax LiabilityVicky DNo ratings yet

- Law of Taxation Law of Taxation Class Notes CompressDocument48 pagesLaw of Taxation Law of Taxation Class Notes CompressThrishul MaheshNo ratings yet

- Chapter - Non Resident TaxationDocument162 pagesChapter - Non Resident TaxationsayanghoshNo ratings yet

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax IncidenceAshok Kumar Meheta0% (1)

- Residential Status: A Project On Residential Status in India and The Effects of Tax On It. Made By: Somrita PalDocument17 pagesResidential Status: A Project On Residential Status in India and The Effects of Tax On It. Made By: Somrita Palsousam2387No ratings yet

- Residential Status DC 2023-24Document11 pagesResidential Status DC 2023-24avinashhpv7785No ratings yet

- Taxation Final ProjectDocument12 pagesTaxation Final ProjectShreya KalyaniNo ratings yet

- India Double Tax CovidDocument9 pagesIndia Double Tax CovidRockyRambo1No ratings yet

- Residence & Scope of Total IncomeDocument17 pagesResidence & Scope of Total IncomeSatyam Kumar AryaNo ratings yet

- Chapter 11 - Residence and Scope of Total Income - NotesDocument14 pagesChapter 11 - Residence and Scope of Total Income - NotesAkshay PooniaNo ratings yet

- Sec. 6Document15 pagesSec. 6Akanksha BohraNo ratings yet

- Corporate Tax Planning: Unit IDocument35 pagesCorporate Tax Planning: Unit ILavanya KasettyNo ratings yet

- Section 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersonDocument8 pagesSection 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersondipxxxNo ratings yet

- NRI TaxationDocument14 pagesNRI TaxationSanjay SinghNo ratings yet

- TaxitionDocument7 pagesTaxitionNithin MNo ratings yet

- TAX Planning AssigmentDocument11 pagesTAX Planning AssigmentKaba TidianeNo ratings yet

- Income Tax II UnitDocument3 pagesIncome Tax II UnitSheena ShahnawazNo ratings yet

- Incoem Tax Final PDFDocument138 pagesIncoem Tax Final PDFRam IyerNo ratings yet

- Mediationand Client Counseling Competition 2021Document10 pagesMediationand Client Counseling Competition 2021Vicky DNo ratings yet

- AFRICA OMBUDSMAN AND ZIMBAWE OMBUDSMANDocument19 pagesAFRICA OMBUDSMAN AND ZIMBAWE OMBUDSMANVicky DNo ratings yet

- Unit-Iv: Subsidiary Rules OF InterpretationDocument49 pagesUnit-Iv: Subsidiary Rules OF InterpretationSubh AshishNo ratings yet

- External Aids - IVDocument18 pagesExternal Aids - IVVicky DNo ratings yet

- Internal Aids Slide IIDocument83 pagesInternal Aids Slide IIVicky DNo ratings yet

- HARMONIOUS CONSTRUCTION (2) - Slide-5Document61 pagesHARMONIOUS CONSTRUCTION (2) - Slide-5Vicky DNo ratings yet

- Conduct of Arbitral ProceedingsDocument3 pagesConduct of Arbitral ProceedingsVicky DNo ratings yet

- Internal Aids - IIIDocument36 pagesInternal Aids - IIIVicky DNo ratings yet

- Mischief Rule (2) - Slide-3Document80 pagesMischief Rule (2) - Slide-3Vicky DNo ratings yet

- Overriding Effect of Non-Obstante Clauses in StatutesDocument71 pagesOverriding Effect of Non-Obstante Clauses in StatutesSubh AshishNo ratings yet

- Electoral System in India and US - Docx - Vipul DohleDocument26 pagesElectoral System in India and US - Docx - Vipul DohleVicky DNo ratings yet

- Remedies Under CISGDocument6 pagesRemedies Under CISGAshi S100% (1)

- Wishall International V UOIDocument4 pagesWishall International V UOIAshi SNo ratings yet

- Mediation and Client Counselling Competition 2021 FlyerDocument1 pageMediation and Client Counselling Competition 2021 FlyerVicky DNo ratings yet

- Itl 1204Document4 pagesItl 1204Vicky DNo ratings yet

- The Mimansa Principles of Interpretation: Essence, Utilization & ApplicationDocument32 pagesThe Mimansa Principles of Interpretation: Essence, Utilization & ApplicationVicky DNo ratings yet

- Conjunctive or Disjunctive Words-IVDocument79 pagesConjunctive or Disjunctive Words-IVVicky DNo ratings yet

- External Aids - IiiDocument84 pagesExternal Aids - IiiPrasun TiwariNo ratings yet

- India's Electoral System ExplainedDocument24 pagesIndia's Electoral System ExplainedVicky DNo ratings yet

- Mandatory & Directory Provisions - IIIDocument87 pagesMandatory & Directory Provisions - IIIVicky DNo ratings yet

- CPC - II End Term 2018 Model Answer KeyDocument3 pagesCPC - II End Term 2018 Model Answer KeyVicky DNo ratings yet

- External Aids To ConstructionDocument70 pagesExternal Aids To ConstructionPrasun TiwariNo ratings yet

- Itl 15 04Document4 pagesItl 15 04Vicky DNo ratings yet

- Parts of A Statute - Slide-IDocument52 pagesParts of A Statute - Slide-ISubh AshishNo ratings yet

- Later Social, Political and Economic Developments and Scientific InventionsDocument29 pagesLater Social, Political and Economic Developments and Scientific InventionsPrasun TiwariNo ratings yet

- GOLDEN RULE INTERPRETATIONDocument42 pagesGOLDEN RULE INTERPRETATIONVicky DNo ratings yet

- Answer Key ItlDocument6 pagesAnswer Key ItlVicky DNo ratings yet

- Youth Hub October EventDocument4 pagesYouth Hub October EventVicky DNo ratings yet

- BENEFICIAL CONSTRUCTION (2) - Slide-6Document41 pagesBENEFICIAL CONSTRUCTION (2) - Slide-6Vicky DNo ratings yet

- Tentative Plan For Semester Based Curriculum at Nliu: TH THDocument4 pagesTentative Plan For Semester Based Curriculum at Nliu: TH THShivam PatelNo ratings yet

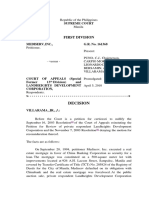

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency ActDocument15 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency ActmowzjeyneNo ratings yet

- Court Drops Sheriff From Rolls Due To AbsencesDocument70 pagesCourt Drops Sheriff From Rolls Due To AbsencesDaryll Gayle AsuncionNo ratings yet

- Arley Ward v. United States, 381 F.2d 14, 10th Cir. (1967)Document3 pagesArley Ward v. United States, 381 F.2d 14, 10th Cir. (1967)Scribd Government DocsNo ratings yet

- Termination of Employment Letter TemplateDocument4 pagesTermination of Employment Letter Templateprecious okpokoNo ratings yet

- Intellectual Property: HandbookDocument26 pagesIntellectual Property: HandbookMarjun CaguayNo ratings yet

- Court's Power to Appoint Commissioner in Execution ProceedingsDocument2 pagesCourt's Power to Appoint Commissioner in Execution ProceedingsArpit GoyalNo ratings yet

- Verification and Certification of Non Forum ShoppingDocument10 pagesVerification and Certification of Non Forum ShoppingKit BagaipoNo ratings yet

- Intensified Focus Police O (Perations On Lawless Criminals Elements and THreat Groups MemberDocument4 pagesIntensified Focus Police O (Perations On Lawless Criminals Elements and THreat Groups MemberNorman TarubalNo ratings yet

- 6) GR No.162890 - ZamoraDocument2 pages6) GR No.162890 - ZamoraLeopoldo, Jr. BlancoNo ratings yet

- Leg Med - Preganancy, Abortion, Paternity and Filiation (Nov - May 2021)Document8 pagesLeg Med - Preganancy, Abortion, Paternity and Filiation (Nov - May 2021)Shia LevyNo ratings yet

- Appeal Sitapur 4 FullDocument9 pagesAppeal Sitapur 4 FullAlokNo ratings yet

- Lim-Lua vs Lua support caseDocument2 pagesLim-Lua vs Lua support caseBenedict AlvarezNo ratings yet

- Estoppel Notice for DebtDocument3 pagesEstoppel Notice for DebtChris Ceezy Fontenot100% (3)

- Art. 177 - Gigantoni vs. People of The Phil.Document1 pageArt. 177 - Gigantoni vs. People of The Phil.Ethan KurbyNo ratings yet

- Course Module on Human Rights EducationDocument17 pagesCourse Module on Human Rights EducationGerald Pedrera Hinayon100% (1)

- Participant waiver for Bangalore Devil's Circuit 2019Document3 pagesParticipant waiver for Bangalore Devil's Circuit 2019Ankit SharmaNo ratings yet

- Fortune Express, Inc. vs. CA 305 SCRA 14Document2 pagesFortune Express, Inc. vs. CA 305 SCRA 14Hortense VarelaNo ratings yet

- Personal Development (Gr11) 4th QuarterDocument3 pagesPersonal Development (Gr11) 4th QuarterSandy SarajosNo ratings yet

- AG Sam Olens Sanctions OrderDocument9 pagesAG Sam Olens Sanctions OrderInformationIsPowerNo ratings yet

- Time at Large Malaysian Construction and Contract LawDocument5 pagesTime at Large Malaysian Construction and Contract LawrahimNo ratings yet

- FAN without PAN violates due processDocument3 pagesFAN without PAN violates due processCkey ArNo ratings yet

- Hartman Court DocumentsDocument9 pagesHartman Court DocumentsWSETNo ratings yet

- Lobby Group OutlineDocument1 pageLobby Group OutlineChris SchwarzNo ratings yet

- Raleigh GLBT Report March 18, 2011Document37 pagesRaleigh GLBT Report March 18, 2011Adam DJ BrettNo ratings yet

- (4th) EthicsDocument13 pages(4th) EthicsJosieka OnoderaNo ratings yet

- NLRB v. San Rafael Hospital, 1st Cir. (1994)Document25 pagesNLRB v. San Rafael Hospital, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- RA 9442: Magna Carta For PWDs 070430Document7 pagesRA 9442: Magna Carta For PWDs 070430Autism Society PhilippinesNo ratings yet

- High Court Order Restricts Physiotherapists From Using "DrDocument18 pagesHigh Court Order Restricts Physiotherapists From Using "DrnrusinghNo ratings yet

- On Harry Roque, The Truth Bender For HireDocument3 pagesOn Harry Roque, The Truth Bender For HireVERA FilesNo ratings yet

- 162 APCD vs. Phil. Coconut AuthorityDocument1 page162 APCD vs. Phil. Coconut AuthorityJulius Geoffrey TangonanNo ratings yet