Professional Documents

Culture Documents

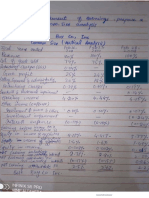

Kiran Zulfiqar Operation Management

Uploaded by

Atia Khalid0 ratings0% found this document useful (0 votes)

15 views4 pagesorganizational management

Original Title

kiran zulfiqar operation management

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentorganizational management

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views4 pagesKiran Zulfiqar Operation Management

Uploaded by

Atia Khalidorganizational management

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 4

SERVICES AND PRODUCTS

Account Opening Procedure

An account is opened by completing AOF.

As per SBP requirements banks must obtain a copy of CNIC before starting

any new customer relationship. And continuation of any previous

relationship.

AOF is also used when selling any asset or liability product. It is the first

step towards developing future sub –relationships with the customer

Account Opening Procedure

Customer Visits the Bank to open the account

The Bank officer explains the requirements with respect to account type

customer wants to open/avail. Min balance requirement should also be

mentioned. Documentation pertaining to account opening should also be

explained

AOF and SS Card ( Specimen Signature) card should be given to customer.

The customer will fill in AOF and SS card and submit them along with other

relevant documents as per bank requirement to the Bank Officer.

The AOF and other documents are to be signed in presence of designated

officer.

Account Opening

Procedure

The customer should provide any of the following identification

documents, along with photo copy , for verification to the designated

officer:

i. CNIC

ii. Passport

iii. Pakistan Origin Card

iv. NICOP

v. Alien Registration Card( ARC) issued by NARA

Account Opening

Procedure

Ensure the account operating instructions are clearly defined and specified .

The relevant officer should informally interview the customer to confirm the

authenticity of information provided.

The dealing officer should admit the customers signature after affixing “ SIGNATURE

ADMITTED” stamp.

Ensure documents are complete, in case of any deferral, seek approval from competent

authority.

The dealing officer/ supervising officer can approve AOF provided everything is in order.

The missing/incomplete documents must be completed by designated officer as soon as

possible.

You might also like

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Unclaimed Money - Step by Step Guide how you claim your moneyFrom EverandUnclaimed Money - Step by Step Guide how you claim your moneyNo ratings yet

- Account Opening GuidelinesDocument11 pagesAccount Opening GuidelinesGraphic MasterNo ratings yet

- R MD 2017085Document66 pagesR MD 2017085Dharmavir Singh GautamNo ratings yet

- Kyc and Aml Guidelines-2020Document52 pagesKyc and Aml Guidelines-2020Nishesh KumarNo ratings yet

- RequirementsDocument7 pagesRequirementspeteryoo12345No ratings yet

- Chap-4 Departmentalization of NBPDocument25 pagesChap-4 Departmentalization of NBP✬ SHANZA MALIK ✬No ratings yet

- Account Opening Procedure For Individual AccountDocument5 pagesAccount Opening Procedure For Individual AccountNazsh AnwarNo ratings yet

- Terms & Conditions: Savings Account Opened Through Video Based Account Opening ProcessDocument6 pagesTerms & Conditions: Savings Account Opened Through Video Based Account Opening ProcessShubham RokadNo ratings yet

- Remittances: Pay Order / Cashier's Cheque / Banker's ChequeDocument12 pagesRemittances: Pay Order / Cashier's Cheque / Banker's ChequeHussnain NaneNo ratings yet

- Training Program:-: ClearingDocument7 pagesTraining Program:-: ClearingBahawal KhanNo ratings yet

- Account Opening Department: Types of AccountsDocument24 pagesAccount Opening Department: Types of AccountsHammad AhmadNo ratings yet

- Chapter-IV: Analysis On Intern Department Activities and Problem SolvedDocument8 pagesChapter-IV: Analysis On Intern Department Activities and Problem SolvedSubekshya ShakyaNo ratings yet

- One-Stop Account Opening Process Retail Ver 3Document7 pagesOne-Stop Account Opening Process Retail Ver 3ዝምታ ተሻለNo ratings yet

- ST STDocument2 pagesST STJennell ArellanoNo ratings yet

- What Is KYC?Document4 pagesWhat Is KYC?Sumesh NairNo ratings yet

- Check List For OperationDocument12 pagesCheck List For OperationSudarshan AdhikariNo ratings yet

- Hello Accounts GuidelinesDocument1 pageHello Accounts GuidelinesMeraj TalukderNo ratings yet

- Best Practice Code FinalDocument111 pagesBest Practice Code FinalUmer SafdarNo ratings yet

- Know Your Custimer PolicyDocument15 pagesKnow Your Custimer PolicyPrathmesh GharatNo ratings yet

- KYC HANDOUT 21 January 2021Document7 pagesKYC HANDOUT 21 January 2021RupamNo ratings yet

- Account Opening Process in PSXDocument19 pagesAccount Opening Process in PSXshani 007No ratings yet

- Fastag Compliance Document PDFDocument7 pagesFastag Compliance Document PDFDev Printing SolutionNo ratings yet

- KYC Operational GuidelinesDocument40 pagesKYC Operational GuidelinesLakshmi Priya GodabaNo ratings yet

- Chapter 2: Activities UndertakenDocument3 pagesChapter 2: Activities UndertakencourseworkNo ratings yet

- Data Analysis: Saving AccountsDocument3 pagesData Analysis: Saving AccountsmariyaNo ratings yet

- Customer Due Diligence - Opening of Accounts: Digital TrainingDocument4 pagesCustomer Due Diligence - Opening of Accounts: Digital TrainingAjay Singh PhogatNo ratings yet

- Aml CFT Quiz Ans (1) 20211116212832Document205 pagesAml CFT Quiz Ans (1) 20211116212832Uday GopalNo ratings yet

- KYC Officers Master KeyDocument100 pagesKYC Officers Master KeyTarang100% (1)

- Requirement For Digital Account Opening, RDADocument2 pagesRequirement For Digital Account Opening, RDAhassanpc574No ratings yet

- NBP Internship ReportDocument29 pagesNBP Internship ReportKashif SheikhNo ratings yet

- Unit 3 TybbaDocument11 pagesUnit 3 TybbaChaitanya FulariNo ratings yet

- Unit 3. Procedure For Opening & Operating of Deposit AccountDocument11 pagesUnit 3. Procedure For Opening & Operating of Deposit AccountBhagyesh ThakurNo ratings yet

- Opening & Operation of Bank AccountDocument21 pagesOpening & Operation of Bank AccountNazmul H. PalashNo ratings yet

- Internship Report On: Presented To: The Manager Soneri Bank Chungi Amer Sidhu BranchDocument4 pagesInternship Report On: Presented To: The Manager Soneri Bank Chungi Amer Sidhu BranchUsman DudezNo ratings yet

- RKSV Commodity FormA PDFDocument13 pagesRKSV Commodity FormA PDFAkhilesh KumarNo ratings yet

- Lesson 6 Fabm 2Document39 pagesLesson 6 Fabm 2James Adrian Dianon0% (1)

- 1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Document14 pages1) - What Kind of Account You Offer and What Are The Details You Ask For Opening It?Pawan Jaju100% (1)

- Saving Account OpeningDocument18 pagesSaving Account OpeningmoregauravNo ratings yet

- Ann 2Document2 pagesAnn 2Kedriner LabanNo ratings yet

- Bank Audit Check List & Procedure (Concurrent Audit) : IndexDocument12 pagesBank Audit Check List & Procedure (Concurrent Audit) : IndexCA Jay ThakurNo ratings yet

- Cash Credit: OverviewsDocument1 pageCash Credit: OverviewsViswa KeerthiNo ratings yet

- BC CSP KYC Submission PDFDocument10 pagesBC CSP KYC Submission PDFSatya PrakashNo ratings yet

- ClientDocument3 pagesClientJennell ArellanoNo ratings yet

- UPDATED 12.10.23 REF 467/2023 Ravi Kumar Notes: Kyc/Aml/CftDocument47 pagesUPDATED 12.10.23 REF 467/2023 Ravi Kumar Notes: Kyc/Aml/CftharisrajpothiNo ratings yet

- Agent Banking ManualDocument12 pagesAgent Banking ManualShafiqulHasanNo ratings yet

- Chapter 10Document6 pagesChapter 10ag gNo ratings yet

- Assignment III Security Trading and Applied Finance - Kamran Rauf - F20MBA304Document6 pagesAssignment III Security Trading and Applied Finance - Kamran Rauf - F20MBA304Kamran RaufNo ratings yet

- ASASSDocument3 pagesASASSAnonymous fcqc0EsXHNo ratings yet

- Flowchart STAR Scheme Process Flows Bank of India FinalDocument4 pagesFlowchart STAR Scheme Process Flows Bank of India Finaldeepakpatni11No ratings yet

- Internship Report NiB BankDocument10 pagesInternship Report NiB BankAbdul WaheedNo ratings yet

- Module 10 (Abhishek)Document12 pagesModule 10 (Abhishek)abhishek gautamNo ratings yet

- Circular No Sebi Ho MRDDocument70 pagesCircular No Sebi Ho MRDgurubalaji15No ratings yet

- M2 Account OpeningDocument58 pagesM2 Account OpeningGouri K MakatiNo ratings yet

- Due Diligence of BorrowerDocument15 pagesDue Diligence of BorrowerRajesh shethNo ratings yet

- Current Account RulesDocument10 pagesCurrent Account RulesJags EesanNo ratings yet

- 100004752Document3 pages100004752Supriya Singh (Supriya)No ratings yet

- Direct Client & Broker AgreementDocument55 pagesDirect Client & Broker Agreementdoanthanh88No ratings yet

- Account OpeningDocument3 pagesAccount OpeningJhabindra PokharelNo ratings yet

- Impact of Covid-19 On Banking SectorDocument2 pagesImpact of Covid-19 On Banking SectorAtia KhalidNo ratings yet

- Documentation For Account OpeningDocument6 pagesDocumentation For Account OpeningAtia KhalidNo ratings yet

- Documentation For Account OpeningDocument6 pagesDocumentation For Account OpeningAtia KhalidNo ratings yet

- Business Risk and Its TypesDocument47 pagesBusiness Risk and Its TypesAtia KhalidNo ratings yet

- Cash Monitoring: Date Denomination Sorted - Reissuable Pieces - Soiled Defective Unsorted (Pieces0 CoinsDocument5 pagesCash Monitoring: Date Denomination Sorted - Reissuable Pieces - Soiled Defective Unsorted (Pieces0 CoinsAtia KhalidNo ratings yet

- Presentation 3Document5 pagesPresentation 3Atia KhalidNo ratings yet

- CamScanner 11-04-2020 10.18.20Document12 pagesCamScanner 11-04-2020 10.18.20Atia KhalidNo ratings yet

- Impact of Covid-19 On Banking SectorDocument2 pagesImpact of Covid-19 On Banking SectorAtia KhalidNo ratings yet

- CamScanner 10-22-2020 14.41.28Document6 pagesCamScanner 10-22-2020 14.41.28Atia KhalidNo ratings yet

- Research RabiaDocument11 pagesResearch RabiaAtia KhalidNo ratings yet

- Trade FinanceDocument8 pagesTrade FinanceAtia KhalidNo ratings yet

- Corona Virus Is Fueling The Movement Towards The Digital BankingDocument1 pageCorona Virus Is Fueling The Movement Towards The Digital BankingAtia KhalidNo ratings yet

- AFSDocument4 pagesAFSAtia KhalidNo ratings yet

- Impact of Covid 19 On Operatons of BanksDocument3 pagesImpact of Covid 19 On Operatons of BanksAtia KhalidNo ratings yet

- Impact of Covid 19 On Operatons of BanksDocument3 pagesImpact of Covid 19 On Operatons of BanksAtia KhalidNo ratings yet

- Js BankDocument17 pagesJs BankAtia KhalidNo ratings yet

- Impact of Covid 19 On Operatons of Banks-1Document3 pagesImpact of Covid 19 On Operatons of Banks-1Atia KhalidNo ratings yet

- Assignment of TREASURY Management: Sir Khalid SultanDocument5 pagesAssignment of TREASURY Management: Sir Khalid SultanAtia KhalidNo ratings yet

- Careers-WPS OfficeDocument4 pagesCareers-WPS OfficeAtia KhalidNo ratings yet

- Comparison of Pepsi and Coca-ColaDocument19 pagesComparison of Pepsi and Coca-ColaAtia KhalidNo ratings yet

- Atia Khalid BBFE-17-32 (SM)Document6 pagesAtia Khalid BBFE-17-32 (SM)Atia KhalidNo ratings yet

- ABL Asset Management LimitedDocument10 pagesABL Asset Management LimitedAtia KhalidNo ratings yet

- FM 3Document12 pagesFM 3Muhammad IbrahimNo ratings yet

- Roll No:: Lahore Institute of Science and TechnologyDocument7 pagesRoll No:: Lahore Institute of Science and TechnologyAtia KhalidNo ratings yet

- TRANSCRIBING NUMBERS ReportDocument8 pagesTRANSCRIBING NUMBERS ReportAtia KhalidNo ratings yet

- Generally Accepted Accounting PrinciplesDocument1 pageGenerally Accepted Accounting PrinciplesAtia KhalidNo ratings yet

- Why Is Strategic Planning Important To An OrganizationDocument3 pagesWhy Is Strategic Planning Important To An OrganizationAtia Khalid100% (1)

- Treasury Bills and Decision Making of A Treasury of A Commercial BanksDocument9 pagesTreasury Bills and Decision Making of A Treasury of A Commercial BanksAtia KhalidNo ratings yet

- Article ReviewDocument2 pagesArticle ReviewAtia KhalidNo ratings yet