Professional Documents

Culture Documents

Technology Acquisition

Uploaded by

ADITYA SATAPATHY0 ratings0% found this document useful (0 votes)

38 views14 pagesOriginal Title

TECHNOLOGY ACQUISITION

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views14 pagesTechnology Acquisition

Uploaded by

ADITYA SATAPATHYCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

TECHNOLOGY ACQUISITION

Nowadays, technology has become a strategic element in every organization

since its management is the key to creating and consolidating competitive

advantages in a market or a sector. Bringing in new technologies can provide

the company with the opportunity both to develop new products and to enter

new markets.

The technology acquisition process is an essential source of ideas for

creativity and the gradual incorporation of technological innovation

opportunities in an organization.

Specialist technical expertise and capabilities are often difficult to obtain and

a firm may not have the ability.

As a result, it involves bringing in new technologies from external sources rather than

using the firm’s own internal research and development activities. Technology can be

acquired in a number of ways like internal research and development, joint ventures,

organizational change, project management, licensing, corporate mergers and

acquisitions, technology transfer, technology insertion, subcontracting, alliances, joint

R&D and industry-university collaboration.

By its nature, technology acquisition is a technology transfer, with transaction costs

associated with the various stages of the acquisition process. Understanding the various

options available and deciding which might be best in particular circumstances can be

challenging. This is further complicated by the number of possible routes technology

acquisitions can take.

Technology Acquisitions In its most simple form,

technology acquisition requires:

Identification of attractive technologies or partners with technological capabilities;

Assessment of these opportunities, selection of the most promising ones and

consideration of the terms of the acquisition;

Negotiation of the terms of acquisition between acquirers and sellers;

Transfer of the technology to the acquirer, if these negotiations have been

successful.

The assessment and negotiation stages form a cycle as it is expected that the terms

discussed during negotiations will need to be re-assessed before acceptance. The

focus of this section is the second stage of this process, involving the assessment of

the technologies and the organizations that own them and the evaluation of all the

acquisition opportunities.

Acquisition Context

• Before making any decisions in relation to a proposed technology

acquisition it is essential to consider the context in which it is taking place

and to identify the key issues involved. A structured approach will help to

reduce the complexity of all the possible scenarios and ensure that those

involved remain objective and focused on the most important questions.

1. Why do we want to acquire the technology?

2. Who are we going to acquire the technology from?

3. How mature is the technology and how might this affect our acquisition

options?

Why do we want to acquire the technology?

An organization’s motive for wanting to acquire a technology will

affect the kind of technology they are looking for, the partners from

whom they decide to acquire it and the process they follow to make

the acquisition. Previous research indicates four kind of motivations:

M1: Developing new technological capabilities

M2: Increasing strategic options

M3: Gaining efficiency improvements

M4: Responding to the competitive environment.

M1: Developing new technological

capabilities

One of the fundamental motivations for the acquisition of external

technologies is the need to develop new technological capabilities and to fill

gaps in the R&D knowledge base. The objective of these acquisitions is

sometimes to fill holes in an existing product line, while in other cases it is

to create and establish a brand new product. This need may arise because

specialist technical expertise and capabilities are often difficult to obtain and

firms may not have the ability to develop these valuable knowledge-based

resources internally. This may be the case, for instance, when the

technological knowledge of a firm is close to exhaustion and most of the

possible technological combinations have already been tried.

M2: Increasing strategic options

• Acquisitions can enable a firm to improve its strategic flexibility. Increasing its internal

technological capabilities, can give the company more strategic options, allowing it to select the

best available technology.

• For example:

Acquisitions can encourage innovation, countering inertia and rigidity and increasing R&D

productivity. Relying on incremental improvements to existing technologies may limit a firm’s

potential. Experimenting with novel and emerging technologies can provide opportunities for

more radical innovation.

Acquisitions can open new markets, allowing the knowledge of new customers, channels,

inputs, processes and markets to be exploited.

Acquisitions may help to deal with uncertainty and risk. Companies operating in hightech

industries are often dependent on uncertain future outcomes or developments.

• In such cases, managers are more likely to avoid risky internal investments in R&D with long-

term payback periods, investing instead in external technologies as a way of keeping their

options open until the risks and uncertainty diminish.

M3: Gaining efficiency improvements

The need to innovate more rapidly is another motivation for

technology acquisition as it can reduce the time to market. The

internal development of new capabilities may take too long or be

too costly. Technology acquisition can create these more quickly

so that the firm can be more responsive to market demands. There

are often cost advantages to acquiring technologies externally.

Firms substitute fixed investment costs with variable acquisition

costs and such costs can be recovered via profits from new

businesses that follow a partnership-based strategy.

M4: Responding to the competitive

environments

Firms are more likely to consider technology acquisitions as

environments become more hostile, when there is rapid technological

change and fast-moving competition in their market area. Acquiring

technologies helps the firm to feel less vulnerable and more

competitive. In such an environment it is likely there will be a greater

use of partnerships, collaborations and outsourcing as a substitute for

in-house activities.

Acquisition options

• It help you identify and evaluate the different options for regulating and managing

the acquisition.

• We have divided these into seven areas:

Future technology development

Contracts and relationships

Ownership of intellectual property (IP)

Technology exploitation

Rights to use a technology

Exchange ‘currency’

IP protection

Future technology development

• Future technology development In most technology transactions, the technology is

still immature and needs to be enhanced and developed to fit the needs of the firm.

Knowledge has to pass between one party and the other at some point during this

development.

• There are three main approaches to this: the technology can be developed

internally by the acquiring company;

it can be done externally by the technology provider;

or it can be carried out collaboratively between the two.

The choice of development path will depend on a number of things including the type

of technology involved, the resources available, the degree of control the acquiring

firm needs to maintain over the technology and the strategy driving the

acquisition.

• Internal development When the technology to be acquired needs to fit very precisely with

the company’s products, a high degree of control over the development may be required

and hence internal development may be preferred. This approach is particularly desirable

where there are concerns over confidentiality.

• External development An alternative development path could be to give very detailed

specifications to the external party so they can carry out the required enhancements to the

technology. This is the preferred approach by firms who consider the cost of internal

development is too high and prefer to obtain as mature a technology as possible.

• Co-development Other firms may prefer to co-develop a technology with an external

partner or partners. This approach is likely to be preferred if they consider the partner

suitable for strategic long term collaborations. In such cases, the knowledge will pass from

one partner to another gradually, over a period of time. It could then be more formally

transferred at the end of the relationship. This type of development requires the

investment of a great deal of time and resources to manage the relationship effectively.

Contracts and relationships

Another dimension of acquisition to consider concerns the relationship between the

parties involved. The form the relationship takes will vary according to the nature of

the technology transfer. This may range from a simple contract for R&D services at

one end of the scale, to a joint venture or even take-over by one company of another.

The formal relationship between the parties will be governed by some kind of

contract designed to protect the parties during the transactions and act as a

guarantee that the relationship will be profitable for both sides. Perhaps equally

important is their informal relationship, which is based on the social norms and level

of trust that exist between them. Both these aspects of a relationship appear to be

necessary to ensure the success of acquisitions.31 We discuss each of these in turn

below

Ownership of intellectual property

• An important point of debate for any technology acquisition is the ownership

and control of the intellectual property (IP) relating to the knowledge

generated or transferred. Ownership can take one of three different forms:

The IP can belong to one party only

The IP can be shared between the parties who collaborated to develop it. This

might mean they co-own it equally or ownership could be divided up on a

‘field of use’ basis. Some parties might acquire rights to use, rather than actual

ownership of the IP

The IP can be owned by everyone and is donated to the public. In this case

nobody has the legal right to exclude others from using the IP.

You might also like

- Land Titles and Deeds ReviewerDocument62 pagesLand Titles and Deeds ReviewerDonna Dumaliang93% (15)

- LRP - Intro. To Agri. Commodity & Enterprise Dev. - AGEC02Document76 pagesLRP - Intro. To Agri. Commodity & Enterprise Dev. - AGEC02Gesabel Impabido100% (2)

- Technology Acquisition: Part-1Document24 pagesTechnology Acquisition: Part-1UsmanHaiderNo ratings yet

- Chapter 11Document14 pagesChapter 112020208100No ratings yet

- Technology TransferDocument22 pagesTechnology TransferRohith C Balachandran100% (1)

- Technology Transfer AcquisitionDocument36 pagesTechnology Transfer AcquisitionMeenakshi SinghNo ratings yet

- Accessing External Tech SourcesDocument25 pagesAccessing External Tech SourcesSidharth SahuNo ratings yet

- Technology Transfer in IndiaDocument9 pagesTechnology Transfer in IndiaMehak Bhargava100% (1)

- Technology Acquisition ProcessDocument21 pagesTechnology Acquisition ProcessTaibaNoor FatimaNo ratings yet

- 406 Unit 5Document23 pages406 Unit 5febaNo ratings yet

- What Is Technology Transfer ?Document17 pagesWhat Is Technology Transfer ?Shaifali GargNo ratings yet

- OM0009 - Technology ManagementDocument15 pagesOM0009 - Technology Managementaniljoshi26No ratings yet

- On Technology AcquisitionDocument37 pagesOn Technology Acquisitionravibabukancharla67% (6)

- TECHNOLOGY TRANSFER METHODS-by Denis 2013 PDFDocument5 pagesTECHNOLOGY TRANSFER METHODS-by Denis 2013 PDFHana AfifahNo ratings yet

- Technology Transfer: What ? How ?: Hopefully You Should Be Able To Answer These Questions at The End of This SeminarDocument38 pagesTechnology Transfer: What ? How ?: Hopefully You Should Be Able To Answer These Questions at The End of This Seminarm.asuncionNo ratings yet

- MCQsfor ClassDocument10 pagesMCQsfor Classrubab fatima0% (1)

- Principles of Management & EconomicsDocument9 pagesPrinciples of Management & EconomicsAwais AjmalNo ratings yet

- Exploitation TM Chapter 2Document7 pagesExploitation TM Chapter 2kainat khalidNo ratings yet

- It Acquisition ManagementDocument6 pagesIt Acquisition ManagementVhinny MolinaNo ratings yet

- Präsentation Collaborate With Your Competitors and WinDocument13 pagesPräsentation Collaborate With Your Competitors and WinEkaterina DimitrovaNo ratings yet

- MI Learn AlliancesDocument27 pagesMI Learn AlliancesWaseem Ahmed SoomroNo ratings yet

- Marketing of High Technology Products and Innovations 3rd Edition Mohr Solutions ManualDocument25 pagesMarketing of High Technology Products and Innovations 3rd Edition Mohr Solutions Manualbiglyerrorfullen2p100% (21)

- Project ManagementDocument28 pagesProject ManagementSAVINo ratings yet

- BA7302-Strategic Management Unit 5 Strategic Issues in Managing Technology and InnovationDocument15 pagesBA7302-Strategic Management Unit 5 Strategic Issues in Managing Technology and InnovationRevathiGNo ratings yet

- GROUP 5 CASE STUDYDocument7 pagesGROUP 5 CASE STUDYparneciohazelannNo ratings yet

- Elective 1: Business InnovationDocument31 pagesElective 1: Business Innovationrania nafieNo ratings yet

- Technology Transfer Principle & EstrstegyDocument10 pagesTechnology Transfer Principle & EstrstegyJorge Rodriguez MNo ratings yet

- SCM Module 2 NotesDocument7 pagesSCM Module 2 NotesRaveen MJNo ratings yet

- IT Solution Chapter 3 6Document8 pagesIT Solution Chapter 3 6Badhon IslamNo ratings yet

- Technology StrategyDocument12 pagesTechnology StrategyguniporgaNo ratings yet

- Technology Transfer MethodsDocument7 pagesTechnology Transfer MethodsM Jameel MydeenNo ratings yet

- Technology Market Opportunity Necessary Organisational SkillsDocument7 pagesTechnology Market Opportunity Necessary Organisational SkillsThitivuth_mickieNo ratings yet

- Technology Life Cycle: Upasna Sharma 45 Sakshi Uppal 44 Kritika Dua 59 Samahita Ghosh 57Document22 pagesTechnology Life Cycle: Upasna Sharma 45 Sakshi Uppal 44 Kritika Dua 59 Samahita Ghosh 57Vasundhara PahujaNo ratings yet

- Chapter 7 - Innovation and TechnologyDocument5 pagesChapter 7 - Innovation and TechnologyMuse ManiaNo ratings yet

- Technology Development - TransferDocument33 pagesTechnology Development - TransferRohit BhandariNo ratings yet

- Technology DevelopmentDocument18 pagesTechnology DevelopmentprabigyanNo ratings yet

- Transfer of TechnologyDocument7 pagesTransfer of TechnologyNeha SachdevaNo ratings yet

- MI 0040 Final AssignmentDocument9 pagesMI 0040 Final Assignmentbhandari0148No ratings yet

- Importance of Technology TransferDocument6 pagesImportance of Technology Transfereongoren80% (10)

- Technology Unit 4Document20 pagesTechnology Unit 4feba100% (1)

- Om 0009Document10 pagesOm 0009prisha4No ratings yet

- CH 6, 11 Insourcing OutsourcingDocument14 pagesCH 6, 11 Insourcing OutsourcingBa Ma ÔNo ratings yet

- CH 6, 11 Insourcing Outsourcing-SvDocument16 pagesCH 6, 11 Insourcing Outsourcing-SvNhi NguyễnNo ratings yet

- Technology Intelligence BenefitsDocument2 pagesTechnology Intelligence BenefitsguniporgaNo ratings yet

- Acquisition of Information Technology: July 2000Document13 pagesAcquisition of Information Technology: July 2000api-26916217No ratings yet

- STRATEGIC MANAGEMENT UNIT 5Document8 pagesSTRATEGIC MANAGEMENT UNIT 5Borish LiffinNo ratings yet

- Q1. What Is Meant by Small To Medium-Sized Enterprises? Explain BrieflyDocument14 pagesQ1. What Is Meant by Small To Medium-Sized Enterprises? Explain Brieflyhussien amareNo ratings yet

- ITIS407 Timing of Product Introductions and Market ChangesDocument20 pagesITIS407 Timing of Product Introductions and Market ChangesTala Tala1999No ratings yet

- Technology Acquisition Ad AbsorptionDocument33 pagesTechnology Acquisition Ad AbsorptionShikha SharmaNo ratings yet

- Characteristics of High Technology ProductsDocument39 pagesCharacteristics of High Technology ProductsNihal PatelNo ratings yet

- Deal Maker or BreakerDocument4 pagesDeal Maker or BreakerPrashantKNo ratings yet

- Itm BrahmaDocument2 pagesItm BrahmaBrahmaji Rao PNo ratings yet

- Technology Assessment FrameworkDocument8 pagesTechnology Assessment Frameworkkrishnalotia8044No ratings yet

- Technology Absorption and AcquisitionfinalDocument33 pagesTechnology Absorption and AcquisitionfinalChandra Abhishek GuptaNo ratings yet

- Strategic Competitiveness and Competitive AdvantageDocument23 pagesStrategic Competitiveness and Competitive AdvantageTalimur RahmanNo ratings yet

- Art 2 Technology Strategy in Networks Ford and Thomas 1997Document17 pagesArt 2 Technology Strategy in Networks Ford and Thomas 1997Hasiar BiukNo ratings yet

- Met466 Module 3 NotesDocument12 pagesMet466 Module 3 NotesFarhan Vakkeparambil ShajahanNo ratings yet

- Technology Acquisition and AbsorptionDocument35 pagesTechnology Acquisition and AbsorptionkunalNo ratings yet

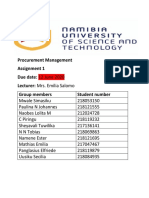

- MTC Procurement Management AssignmentDocument16 pagesMTC Procurement Management AssignmentBoris PichlerbuaNo ratings yet

- Technology Absorption and Diffusion ExplainedDocument27 pagesTechnology Absorption and Diffusion ExplainedAakriti28100% (1)

- MS 94Document9 pagesMS 94Rajni KumariNo ratings yet

- Attributes To Evaluating BrandsDocument11 pagesAttributes To Evaluating BrandsADITYA SATAPATHYNo ratings yet

- What is social cost-benefit analysisDocument28 pagesWhat is social cost-benefit analysisADITYA SATAPATHYNo ratings yet

- Financing of ProjectDocument13 pagesFinancing of ProjectADITYA SATAPATHYNo ratings yet

- How Independent Variables Impact Dependent VariablesDocument9 pagesHow Independent Variables Impact Dependent VariablesADITYA SATAPATHYNo ratings yet

- What is social cost-benefit analysisDocument28 pagesWhat is social cost-benefit analysisADITYA SATAPATHYNo ratings yet

- Easement Arts 613Document15 pagesEasement Arts 613PRINCESSLYNSEVILLANo ratings yet

- Participatory Land Use Planning in TanzaniaDocument49 pagesParticipatory Land Use Planning in TanzaniaMohamoud AbdulahiNo ratings yet

- Intellectual Property Management and Protection in ASEAN: Focus On Piracy and Counterfeiting in Physical MarketsDocument267 pagesIntellectual Property Management and Protection in ASEAN: Focus On Piracy and Counterfeiting in Physical MarketsAdam R. TanielianNo ratings yet

- Introduction To Entrepreneurship Chapter 3 Business OwnershipDocument31 pagesIntroduction To Entrepreneurship Chapter 3 Business OwnershipEida HidayahNo ratings yet

- MUNICIPALITY OF TACLOBAN v. DIRECTOR OF LANDS G.R. No. L-5543 December 9, 1910 PDFDocument14 pagesMUNICIPALITY OF TACLOBAN v. DIRECTOR OF LANDS G.R. No. L-5543 December 9, 1910 PDFZack SeiferNo ratings yet

- CREDIT TRANSACTIONS AND LOAN CONTRACTSDocument10 pagesCREDIT TRANSACTIONS AND LOAN CONTRACTSJay Kent RoilesNo ratings yet

- Law On IP ReviewerDocument67 pagesLaw On IP ReviewerRalph Romeo BasconesNo ratings yet

- Stockholder Appraisal RightsDocument19 pagesStockholder Appraisal RightsSharn Linzi Buan MontañoNo ratings yet

- Jimenez VS Ca 107132Document28 pagesJimenez VS Ca 107132Joyciie ContrerasNo ratings yet

- Condominiums: Saskatchewan Practice Checklists CondominiumsDocument16 pagesCondominiums: Saskatchewan Practice Checklists CondominiumsJackbox9999No ratings yet

- Submission of Altered Memorandum of Association (Company Update)Document66 pagesSubmission of Altered Memorandum of Association (Company Update)Shyam SunderNo ratings yet

- Teng v. Securities and Exchange Commission, G.R. No. 184332, February 17, 2016 Reyes, JDocument3 pagesTeng v. Securities and Exchange Commission, G.R. No. 184332, February 17, 2016 Reyes, JSabritoNo ratings yet

- Property ReviewerDocument7 pagesProperty ReviewerMikaela TriaNo ratings yet

- Sales Reviewer Judge AdvientoDocument54 pagesSales Reviewer Judge Advientoandreaivydy1993No ratings yet

- Lifting The Corporate VeilDocument22 pagesLifting The Corporate Veilpushkal sethiNo ratings yet

- Ferry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireDocument21 pagesFerry Van Asperen and Bram Van Besouw de Sotos Thesis and The Roman EmpireFerdinandAlxNo ratings yet

- Acquisition of Friar Lands Through FraudDocument2 pagesAcquisition of Friar Lands Through FraudBarrrMaidenNo ratings yet

- A.10. Calibo Vs CADocument2 pagesA.10. Calibo Vs CAeizNo ratings yet

- II. Ownership - Go Vs LooyukoDocument2 pagesII. Ownership - Go Vs LooyukoMaria Louissa Pantua AysonNo ratings yet

- GaerlanDocument2 pagesGaerlanRegina CoeliNo ratings yet

- Retail Session 5,6 Retail StrategyDocument65 pagesRetail Session 5,6 Retail StrategyArun KumarNo ratings yet

- Petitioner Vs Vs Respondents: First DivisionDocument9 pagesPetitioner Vs Vs Respondents: First Divisionmangopie00000No ratings yet

- Partnership and CorporationsDocument53 pagesPartnership and Corporationsbajhoy64No ratings yet

- Creating A Business PlanDocument36 pagesCreating A Business PlanXzibit ShabbirNo ratings yet

- Josephine A. Counihan v. Allstate Insurance Company, 25 F.3d 109, 2d Cir. (1994)Document8 pagesJosephine A. Counihan v. Allstate Insurance Company, 25 F.3d 109, 2d Cir. (1994)Scribd Government DocsNo ratings yet

- Investor Protection in AustraliaDocument33 pagesInvestor Protection in AustraliaAabhas KshetarpalNo ratings yet

- Tendernotice - 1 - 2022-01-20T121714.079Document30 pagesTendernotice - 1 - 2022-01-20T121714.079Monish MNo ratings yet

- Essential Steps to Opening a Restaurant in PakistanDocument14 pagesEssential Steps to Opening a Restaurant in PakistanMuhammad Derwaish Awan50% (2)