Professional Documents

Culture Documents

Scope Behaviours and Attitude Key Enablers Skills / Capabilities

Uploaded by

Rakesh BhurjOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scope Behaviours and Attitude Key Enablers Skills / Capabilities

Uploaded by

Rakesh BhurjCopyright:

Available Formats

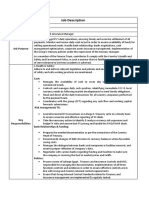

ROLE TITLE – FINANCE MANAGER MIDDLE EAST & SOUTH ASIA GRADE – BAND 3

R O L E P U R P O S E – Oversight and control of finance activities in the MESA region, including full local fiscal compliance. support tax and financial compliance matters for BA JOB REF –

including overall Financial support to the Regional & Head office teams. Manage Direct and Indirect Tax compliances, receipts & payments, other regulatory matters including but not limited (reward to complete)

to VAT, Withholding Taxes, Corporation Taxes and other Direct & indirect Taxes, Duties and Levies including managing ongoing litigations, central bank compliances and other statutory matters

for all markets in the area within scope.

DI R EC TO R AT E – OV E RSEA S FI N A NC E REGION – Middle East & South

Asia

J O B FA M I LY – FINANCE

Scope – to lead a team of 3+ colleagues and remotely work with the Behaviours and attitude Skills / capabilities Key enablers

colleagues in the service centre (GBS) . • I’m a role model for all BA brand

Countries: India, Pakistan, Bangladesh, Maldives, Sri Lanka, UAE, behaviours and ways of working – • Strong financial accounting understanding • I must be empowered to make

Saudi, Kuwait, Bahrain, Oman & Qatar I walk the talk • Ability to distil complex technical information into clear simple recommendations

• I exude a can-do attitude (best of messages • I need to be fully trained to ensure I

BA) • Ability to multi-task and prioritise, with focus on delivery am able to deliver and perform at the

Accountabilities • I’m flexible and agile, always ready • Influence others to optimise outcomes highest level

• Ensure all tax and regulatory returns, as applicable, are filed correctly and to adapt when things don’t go to • Performance management • I must have support from My

on time in all countries including managing third parties who file the plan • Excellent team working skills including working across manager who should keep me

returns on BA’s behalf • I’m an ambassador for BA and my functional boundaries informed and updated

• Robust balance sheet reconciliation team • Ability to work at consistently high standards

• Support finance BPO regarding tax applicability to supplier invoices and In depth understanding of BA policies and procedures

any other areas required, as applicable •

• Provide all locally required support for financial, taxation, treasury, legal, • IT literate, with a good understanding of the BA Finance

etc. matters in line with both corporate policies and country local law. Systems and using Excel, PowerPoint, Word

• Support the resolution of ongoing tax disputes and associated litigations, My core traits • Cultural awareness Key performance indicators

where applicable, • Excellent planning, organisational and time management skills

• Hold discussions with Tax officers, respond to summons, notices and

• Takes responsibility for making things • Strong commitment to a high level of confidentiality

letters from the tax office including issuance of clarificatory letters to Tax happen. • Comprehensive knowledge of ICFR, GDPR and PCI standards • 100% Balance sheet status A

authorities as and when required • Ability to work under pressure and to tight deadlines

Support Regional Finance Manager (RFM) with corporate tax compliance • Excellent interpersonal and • 100% compliance on local statutory

• communication skills, both written and and regulatory compliances

including issuance of exemption certificates verbal

• Keep abreast of new development in tax and financial compliance and • Tax and other relevant overseas

• Excellent written and spoken English payments made correctly and on

ensure BA remains compliant Displays confidence and resilience,

Support RFM, IAG Tax and other central departments on tax planning • time

• demonstrating energy to achieve

matters results in a positive manner Qualifications / experience • Recoveries (tax etc.)

• Support RFM, IAG with finance related synergies and support other group

• Proactive, innovative, enthusiastic, • Timely cash remittances

members where necessary positive and self-confident • Managing the performance of team

• Maintain relationships with local legal and tax advisors & accountants • Education to degree level or equivalent standard (Post

Graduate degree is an advantage - desirable) members to ensure a high

including support with specific activities, as applicable performing team

• Actively support RFM on projects for continuous process improvement • Working knowledge of local compliances in countries within

• Assistance in internal and external audits, investigations and disputes scope

• Represent, promote and protect the best interests of the company with • Tax experience in the airline industry (desirable)

external organisations, local authorities, local courts and unions. • Experience in dealing with tax litigations & Tax authorities

• Support RFM & the business in the set-up of new stations and liquidation • Experience in dealing with Vendor payments & PTP functions

of closed stations • Previous financial accounting experience in a large company

• Undertake any business-related activity in line with business needs Experience of dealing with confidential information with

•

discretion and integrity

• Has worked with sensitive information and has maintained a

flawless record in terms of confidentiality

You might also like

- Finance Operations: A Practical Approach - Which Ensures Success – Where Passion Gets Translated into Measurable PerformanceFrom EverandFinance Operations: A Practical Approach - Which Ensures Success – Where Passion Gets Translated into Measurable PerformanceNo ratings yet

- BCG Full Case PDFDocument11 pagesBCG Full Case PDFdwi andi rohmatika100% (1)

- Certified Professional Executive SecretaryFrom EverandCertified Professional Executive SecretaryRating: 5 out of 5 stars5/5 (3)

- Jonathan Mukisa 2020 PDFDocument2 pagesJonathan Mukisa 2020 PDFJonathan MukisaNo ratings yet

- Store Manager Resume SampleDocument2 pagesStore Manager Resume Sampleresume7.com100% (4)

- JD - Senior Finance Officer - SARODocument2 pagesJD - Senior Finance Officer - SAROrkumar lohia17100% (1)

- AVP - Admin and Finance Support Officer JD - Part Time - FinalDocument2 pagesAVP - Admin and Finance Support Officer JD - Part Time - Finalgayle aldoNo ratings yet

- Output 5 (Group 1)Document24 pagesOutput 5 (Group 1)Shane VeiraNo ratings yet

- Mariz Delos Santos - Fincon - 31-BFM-01Document7 pagesMariz Delos Santos - Fincon - 31-BFM-01Tine Delos SantosNo ratings yet

- Mariz Delos Santos - Fincon - 31-BFM-01Document7 pagesMariz Delos Santos - Fincon - 31-BFM-01Tine Delos SantosNo ratings yet

- Accounts PayableDocument1 pageAccounts Payablenana enguahNo ratings yet

- Position Description Finance Manager 1651619521Document3 pagesPosition Description Finance Manager 1651619521Tall Salif ThalesNo ratings yet

- Ali Asgar Resume PDFDocument2 pagesAli Asgar Resume PDFayesha siddiquiNo ratings yet

- Eleanora Snyder - AccountantDocument2 pagesEleanora Snyder - Accountantandersonmack047No ratings yet

- My CV LinkedINDocument6 pagesMy CV LinkedINHAbbunoNo ratings yet

- Experience HighlightsDocument3 pagesExperience HighlightsIbrahim A AzzamNo ratings yet

- سيرة ذاتيةAyshaButtDocument3 pagesسيرة ذاتيةAyshaButtIbrahim A AzzamNo ratings yet

- ProfileDocument5 pagesProfileHAbbunoNo ratings yet

- Ramshad G Accountant CVDocument2 pagesRamshad G Accountant CVramshadNo ratings yet

- Md. Forhad Hossain NDocument2 pagesMd. Forhad Hossain Nmfh.manikNo ratings yet

- JD - Tax Coding AsssociateDocument2 pagesJD - Tax Coding Asssociateravik00739No ratings yet

- Naukri ARPITA (11y 0m)Document4 pagesNaukri ARPITA (11y 0m)Sandeep FulhamNo ratings yet

- Junior Finance Business Partner Finance Job DescriptionDocument2 pagesJunior Finance Business Partner Finance Job DescriptionWong AngelinaNo ratings yet

- ULx R HR TA JD Analyst UpdatedDocument2 pagesULx R HR TA JD Analyst UpdatedSachin ChadhaNo ratings yet

- Curiculum VitaeDocument5 pagesCuriculum VitaeEzanin Binti Mohd IqbalNo ratings yet

- Senior Vice President Group Financial Accounting and OperationsDocument1 pageSenior Vice President Group Financial Accounting and OperationsJatin ReshamiyaNo ratings yet

- Vacancy AdvertisementDocument4 pagesVacancy AdvertisementNurl AinaNo ratings yet

- Job AdvertisementDocument3 pagesJob AdvertisementMARDILA SURYANDARI TRIASTITiNo ratings yet

- Bijender Chauhan 1 - ResumeDocument5 pagesBijender Chauhan 1 - ResumeroopsinghNo ratings yet

- WWF Tanzania SepDocument6 pagesWWF Tanzania SepVictorNo ratings yet

- Vasudev RavikumarDocument2 pagesVasudev RavikumarVasudev RNo ratings yet

- Scheduling Officer Role Description (2)Document5 pagesScheduling Officer Role Description (2)Aliyu AbdulqadirNo ratings yet

- My Work at Karma Capital - V - 1.1Document2 pagesMy Work at Karma Capital - V - 1.1Abhishek SaxenaNo ratings yet

- Nana Yaw Ofosu Cv. AtfuxDocument1 pageNana Yaw Ofosu Cv. AtfuxNana Yaw OfosuNo ratings yet

- Ahmed Bharuchi Resume 4 2022 FinalDocument1 pageAhmed Bharuchi Resume 4 2022 FinalMuzammil Ali SyedNo ratings yet

- Announcement For Operation Supervisor Metta MyaeDocument2 pagesAnnouncement For Operation Supervisor Metta MyaeEveryDay ILoveyouNo ratings yet

- Harun Muayad: EducationDocument2 pagesHarun Muayad: EducationHaroon Muayyad Muhammad AlhaditheyNo ratings yet

- Success C.VDocument3 pagesSuccess C.Vsuccessemonday01No ratings yet

- Kamilla Sadykova ResumeDocument4 pagesKamilla Sadykova Resumez5b5zz9wynNo ratings yet

- JD Head of Admin & FMDocument2 pagesJD Head of Admin & FMsofia_brownNo ratings yet

- General Manager JD 2019Document3 pagesGeneral Manager JD 2019Shelley RangihikaNo ratings yet

- 16.9 Trần Nguyễn Ngọc Trang- Gdcn HCMDocument9 pages16.9 Trần Nguyễn Ngọc Trang- Gdcn HCMTrương Hữu QuangNo ratings yet

- Job Description Fixed Asset - Tangible and Intangible AccountingDocument2 pagesJob Description Fixed Asset - Tangible and Intangible Accounting3208Akanksha JagdaleNo ratings yet

- Ahmed Nadeem PalekaarDocument1 pageAhmed Nadeem PalekaarShashank GuptaNo ratings yet

- Job Profile Role and Responsibilties Expected From CandidatesDocument5 pagesJob Profile Role and Responsibilties Expected From CandidatesRudraksha PatelNo ratings yet

- Yeny Lunardi - FinanceDocument2 pagesYeny Lunardi - FinanceTunggal AdilNo ratings yet

- Will Lewis ResumeDocument3 pagesWill Lewis ResumeKatrina ReyesNo ratings yet

- Ca Mohit Ramani: TH STDocument2 pagesCa Mohit Ramani: TH STMD's Excellence Office TraineeNo ratings yet

- Charted Accountant GuidelinesDocument2 pagesCharted Accountant GuidelinesDhawal GargNo ratings yet

- Naqibullah IrfaniDocument3 pagesNaqibullah IrfaniNaqibullah IrfaniNo ratings yet

- Manish Sahu CV 1Document2 pagesManish Sahu CV 1babbal_007No ratings yet

- Vacancies October 2023Document6 pagesVacancies October 2023info.nemesis21No ratings yet

- Ms. Ei Ei NyeinDocument2 pagesMs. Ei Ei NyeinlmNo ratings yet

- Logistics CV KwameDocument5 pagesLogistics CV KwamekamranilahiiNo ratings yet

- Finance Manager JD & Person SpecificationDocument5 pagesFinance Manager JD & Person SpecificationKeval GandhiNo ratings yet

- Munir Ahmad Amin CV - CletterDocument3 pagesMunir Ahmad Amin CV - CletterulearnasaidshahtestNo ratings yet

- HCM Program Head JDDocument3 pagesHCM Program Head JDsajNo ratings yet

- Job Description: Job Title Location Reporting ToDocument3 pagesJob Description: Job Title Location Reporting ToSameh MohamedNo ratings yet

- Vacancies: Kenya Reinsurance Corporation LimitedDocument2 pagesVacancies: Kenya Reinsurance Corporation LimitedmautidavisNo ratings yet

- Commercial Finance Operations Controller - JDDocument2 pagesCommercial Finance Operations Controller - JDDevy89No ratings yet

- 9 Direct Reports of A Financial ControllerDocument12 pages9 Direct Reports of A Financial ControllerFrancisco Sosa MaresNo ratings yet

- Document TemplateDocument1 pageDocument TemplateRakesh BhurjNo ratings yet

- Authorization FormDocument1 pageAuthorization FormRakesh BhurjNo ratings yet

- New FormDocument1 pageNew FormRakesh BhurjNo ratings yet

- AbhishekDocument2 pagesAbhishekRakesh BhurjNo ratings yet

- Resume IT TEMPLATEDocument4 pagesResume IT TEMPLATERakesh BhurjNo ratings yet

- Resume Template For ITDocument3 pagesResume Template For ITRakesh BhurjNo ratings yet

- Resume For ITDocument2 pagesResume For ITRakesh BhurjNo ratings yet

- IT Resume ModelDocument2 pagesIT Resume ModelRakesh BhurjNo ratings yet

- Application For Issuance of Certificate-1Document3 pagesApplication For Issuance of Certificate-1Rakesh BhurjNo ratings yet

- Implied AuthorityDocument4 pagesImplied AuthorityDevendra Babu100% (1)

- Research62 2015Document2 pagesResearch62 2015Ke LopezNo ratings yet

- IMT CDL Brochure July 2022Document44 pagesIMT CDL Brochure July 2022Manu P. TripathiNo ratings yet

- Group Assignment: FPT University Course: ECO111Document15 pagesGroup Assignment: FPT University Course: ECO111Trúc Ngân NguyễnNo ratings yet

- Industry AnalysisDocument22 pagesIndustry Analysispranita mundraNo ratings yet

- Srisaila Devasthanam: Phone: 8333901351, 8333901352, 8333901353, 8333901354, 8333901355, 8333901356 Fax: 08524-287126Document1 pageSrisaila Devasthanam: Phone: 8333901351, 8333901352, 8333901353, 8333901354, 8333901355, 8333901356 Fax: 08524-287126Ajay Chowdary Ajay ChowdaryNo ratings yet

- Matrices Restaurant (Ife)Document46 pagesMatrices Restaurant (Ife)Roselyn AcbangNo ratings yet

- Dali Foods Group: Short Shelf Life Bread Brand Meibeichen LaunchedDocument8 pagesDali Foods Group: Short Shelf Life Bread Brand Meibeichen LaunchedAshokNo ratings yet

- From Data To Action How Marketers Can Leverage AIDocument17 pagesFrom Data To Action How Marketers Can Leverage AIFRANCO PAREDES SCIRICANo ratings yet

- Cfa Level 1 Ethics-Code - Standard Class 6Document21 pagesCfa Level 1 Ethics-Code - Standard Class 6pamilNo ratings yet

- Letter To U.S. CongressDocument8 pagesLetter To U.S. CongressWWMTNo ratings yet

- Facturaev3 2 2bDocument81 pagesFacturaev3 2 2bJulian Martin De MingoNo ratings yet

- Geopak: Coordinate Measuring Machine Software For Users From Entry-Level To ExpertDocument6 pagesGeopak: Coordinate Measuring Machine Software For Users From Entry-Level To Expertcmm5477No ratings yet

- Module 1 - Bidding Process (Sample Problems)Document2 pagesModule 1 - Bidding Process (Sample Problems)Anna Daniella LunaNo ratings yet

- Photoshop Javascript Ref 2020Document233 pagesPhotoshop Javascript Ref 2020deathvimNo ratings yet

- Project Report of Itc LTD PDF FreeDocument75 pagesProject Report of Itc LTD PDF FreeSaad SiddiquiNo ratings yet

- AMAZONDocument22 pagesAMAZONASHWINI PATILNo ratings yet

- Kaizen Assignment 2Document4 pagesKaizen Assignment 2Walia Raunaq Rajiv PGP 2022-24 BatchNo ratings yet

- AbdulSamad - 12 - 16594 - 3 - CH 06 Merchandise InventoryDocument13 pagesAbdulSamad - 12 - 16594 - 3 - CH 06 Merchandise InventoryHassaan QaziNo ratings yet

- 23 W Group 8 Final Project CapstoneDocument14 pages23 W Group 8 Final Project CapstoneQwertNo ratings yet

- High Temperature Grease and Lubricants Market Size, Share and Forecast Upto 2021Document6 pagesHigh Temperature Grease and Lubricants Market Size, Share and Forecast Upto 2021Hari PurwadiNo ratings yet

- Human Resource ProcuretmentDocument14 pagesHuman Resource Procuretmentjeje jeNo ratings yet

- Applied Economics LESSON 3.1 Principles, Tools, and Techniques in Creating BusinessDocument3 pagesApplied Economics LESSON 3.1 Principles, Tools, and Techniques in Creating BusinessAislinnNo ratings yet

- ITIS407 IS Innovation and New Technologies: Fall 2021Document21 pagesITIS407 IS Innovation and New Technologies: Fall 2021Tala Tala1999No ratings yet

- Cloud Identity Patterns and Strategies Design Enterprise Cloud Identity Models With OAuth 2.0 and Azure Active DirectoryDocument258 pagesCloud Identity Patterns and Strategies Design Enterprise Cloud Identity Models With OAuth 2.0 and Azure Active DirectoryAlexey Fernández SuárezNo ratings yet

- Layout and Flow: © Nigel Slack, Stuart Chambers & Robert Johnston, 2004Document16 pagesLayout and Flow: © Nigel Slack, Stuart Chambers & Robert Johnston, 2004numan choudharyNo ratings yet

- AEG114-huynh Tien DatDocument8 pagesAEG114-huynh Tien DatPhung Tien Dat (FGW HCM)No ratings yet

- Abdul Rahim Suleiman & Anor V Faridah MD Lazim & Ors (2016) 6 AMR 481Document37 pagesAbdul Rahim Suleiman & Anor V Faridah MD Lazim & Ors (2016) 6 AMR 481Maisarah MustaffaNo ratings yet

- Name: Unsa Soomro Roll no:20S-MSHRM-BS-01 Assigned By: Sir. DR Shah Mohammad KamranDocument12 pagesName: Unsa Soomro Roll no:20S-MSHRM-BS-01 Assigned By: Sir. DR Shah Mohammad Kamranunsa soomro100% (1)