Professional Documents

Culture Documents

CH 15

Uploaded by

chengezen04140 ratings0% found this document useful (0 votes)

5 views12 pagesThe document discusses irrecoverable debts, allowances, and the accounting entries for them. It defines irrecoverable debts as amounts owed by credit customers that are unable or unwilling to be paid. An allowance is an estimate set aside for future losses on accounts receivable. The document differentiates between specific allowances for identified doubtful accounts and general allowances estimated as a percentage of total receivables. It provides examples of journal entries to record irrecoverable debts and changes to the allowance account.

Original Description:

Original Title

Ch15

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses irrecoverable debts, allowances, and the accounting entries for them. It defines irrecoverable debts as amounts owed by credit customers that are unable or unwilling to be paid. An allowance is an estimate set aside for future losses on accounts receivable. The document differentiates between specific allowances for identified doubtful accounts and general allowances estimated as a percentage of total receivables. It provides examples of journal entries to record irrecoverable debts and changes to the allowance account.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views12 pagesCH 15

Uploaded by

chengezen0414The document discusses irrecoverable debts, allowances, and the accounting entries for them. It defines irrecoverable debts as amounts owed by credit customers that are unable or unwilling to be paid. An allowance is an estimate set aside for future losses on accounts receivable. The document differentiates between specific allowances for identified doubtful accounts and general allowances estimated as a percentage of total receivables. It provides examples of journal entries to record irrecoverable debts and changes to the allowance account.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Chapter X

Chapter 15

Irrecoverable debts Chapter Title for Irrecoverable debts

and Allowance

An

Introduction to

Financial

Accounting

9th edition

Andrew Thomas & Anne Marie

Ward

© McGraw-Hill Education 2019

Objectives

By the end of the lecture (and with private study) students

should be able to:

• Explain the nature of irrecoverable debts (bad debts), allowances, and

allowances for irrecoverable debts;

• Distinguish between specific and general allowances for irrecoverable

debts; and

• Show the entries for irrecoverable debts and allowances for

irrecoverable debts in the journal, ledger, statement of profit or loss

and statement of financial position.

© McGraw-Hill Education 2019

Irrecoverable debts

Irrecoverable debts arise when a trade receivable

(credit customer) is unable (or unwilling) to pay the

amount owed in respect of goods sold on credit.

Irrecoverable debts are sometimes called ‘bad debts’.

Treating a receivable as irrecoverable is a matter of

judgement. A debt may be irrecoverable because:

• the credit customer cannot be traced;

• it is not worth taking the case to Court; or

• the customer has been declared bankrupt (and the

‘final dividend’ in bankruptcy received).

© McGraw-Hill Education 2019

The ledger entries for irrecoverable

debts

When it is decided that a customer balance is

irrecoverable:

Debit Irrecoverable debts a/c

Credit Trade receivables account

At the end of the accounting period:

Debit Statement of profit or loss a/c

Credit Irrecoverable debts a/c

© McGraw-Hill Education 2019

The nature of an allowance

A allowance is the setting aside of income to

meet a known or highly probable future liability

or loss, the amount and/or timing of which

cannot be ascertained exactly, and is thus an

estimate.

It is an application of the prudence concept

(providing for losses) and the matching concept

(it recognises the loss against the revenue that

generates it).

© McGraw-Hill Education 2019

Types of allowances for irrecoverable debts

An allowance for irrecoverable debts can consist of

either or both of the following:

• A specific allowance in respect of particular trade

receivable (credit customer) that has been identified

as unlikely to pay their debts;

• A general allowance representing an estimate,

usually computed as a percentage, of the trade

receivables at the end of the accounting year who

are unlikely to pay their debts.

A general allowance for irrecoverable debts involves the

use of an estimation technique.

© McGraw-Hill Education 2019

The ledger entries for an allowance for

irrecoverable debts

To create or increase the allowance:

Debit Movement in irrecoverable debts a/c (P/L)

Credit Allowance for Irrecoverable debts a/c

(SOFP)

Decrease in the allowance:

Debit Allowance for Irrecoverable debts a/c

(SOFP)

Credit Movement in irrecoverable debts a/c (P/L)

The balance on the allowance for irrecoverable debts

account is deducted from trade receivables in the

statement of financial position.

© McGraw-Hill Education 2019

Worked Example 15.1

(calculating the allowance)

A. Jones has an accounting year ending on 30 November. At 30

November 20X8 his ledger contained the following accounts:

£

Trade receivables 20,000

Provision for irrecoverable debts 1,000

The trade receivables at 30 November 20X9 were £18,900. This

includes an amount of £300 owed by F. Simons that was thought to be

irrecoverable. It also includes amounts of £240 owed by C. Steven,

£150 owed by M. Evans and £210 owed by A. Mitchell, all of which are

regarded as doubtful receivables.

You have been instructed to make a provision for irrecoverable debts

at 30 November 20X9. This should include a specific provision for

debts regarded as irrecoverable and a general provision of 5 per cent

of trade receivables.

© McGraw-Hill Education 2019

Worked Example 15.1

(calculating the allowance)

Provision for irrecoverable debt at 30

November 20X9 £

Specific provision – C. Steven 240

M. Evans 150

A. Mitchell 210

600

General allowance –

900

5% × (£18,900 − £300 − £600)

1,500

© McGraw-Hill Education 2019

Example 15.1 Double entry

Irrecoverable receivable:

Dr Irrecoverable debts a/c 300

Cr Trade receivables account 300

Movement in the allowance account:

Dr Movement a/c (P/L) 500

Cr Allow for Irrecoverable

debts a/c (SOFP) 500

This moves the balance on the allowance from £1,000 to

£1,500

© McGraw-Hill Education 2019

Summary – some key points

• Irrecoverable debts are amounts due from credit

customers which are deemed to be irrecoverable.

• Irrecoverable debts written off reduce trade receivables

and create an expense in the statement of profit or loss.

• Allowances for irrecoverable debts are amounts that

are set aside to cover expected losses, wherein there it

is reasonable to suspect that a trade receivable will not

be received.

• The allowance for irrecoverable debts reduces the

overall balance reported for trade receivables (but does

not write the balances off yet).

• Movements in the allowance for irrecoverable debts

affect the statement of profit or loss – increases,

increase expenses – decreases, reduce expenses in a

period.

© McGraw-Hill Education 2019

Student - study action

• Read chapter 15.

• Then - try to explain the key terms and concepts

(check your answer with the chapter and the online

glossary).

• Try the review questions (check your answers with

the chapter)

• Try the exercise questions with an asterisk (solutions

are available in the appendix)

• Try the exercise questions required by your tutor

(solutions to be provided by the tutor at their

discretion)

• Try the learning activities on the student online

learning centre (www.mcgraw-hill.co.uk/textbooks/thomas)

© McGraw-Hill Education 2019

You might also like

- Sample Audited Financial Statements For Sole Proprietorship PDFDocument16 pagesSample Audited Financial Statements For Sole Proprietorship PDFKristen100% (3)

- Exercises On Journalizing (Debit and Credit)Document2 pagesExercises On Journalizing (Debit and Credit)kim100% (4)

- Chapter 2 Problems and SolutionDocument19 pagesChapter 2 Problems and SolutionSaidurRahaman100% (1)

- Unit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodDocument6 pagesUnit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodRealGenius (Carl)No ratings yet

- Your Bofa Core Checking: Account SummaryDocument4 pagesYour Bofa Core Checking: Account SummaryDaniel Febres100% (1)

- 01 Accruals and Prepayments TestDocument13 pages01 Accruals and Prepayments TestThomas Kong Ying Li100% (1)

- CH 13Document28 pagesCH 13chengezen0414No ratings yet

- Fabm 1 Lesson 8Document21 pagesFabm 1 Lesson 8Dionel RizoNo ratings yet

- Lecture Note - Bad DebtsDocument4 pagesLecture Note - Bad DebtsRia AthirahNo ratings yet

- Hsslive-class-11-accountancy-Chapter 10 - Financial Statement - 1.3Document5 pagesHsslive-class-11-accountancy-Chapter 10 - Financial Statement - 1.3joysjosephnitcNo ratings yet

- HK MA: The Hong Kong Management Association Hong Kong Polytechnic Joint Diploma in Management StudiesDocument12 pagesHK MA: The Hong Kong Management Association Hong Kong Polytechnic Joint Diploma in Management StudiesSinoNo ratings yet

- Chapter 21Document10 pagesChapter 21soniadhingra1805No ratings yet

- RECEIVABLESDocument4 pagesRECEIVABLESCyril DE LA VEGANo ratings yet

- Akuntansi Bab11Document4 pagesAkuntansi Bab11AKT21Yola Jovita SilabanNo ratings yet

- Task 13 - 16Document5 pagesTask 13 - 16Ton VossenNo ratings yet

- Acb3 02Document42 pagesAcb3 02rameNo ratings yet

- Asset Recognition and Operating Assets: Fourth EditionDocument55 pagesAsset Recognition and Operating Assets: Fourth EditionAyush JainNo ratings yet

- Principles of Financial AccountingDocument14 pagesPrinciples of Financial AccountingSakshiNo ratings yet

- Topic9 Account ReceivableDocument52 pagesTopic9 Account ReceivableAbd AL Rahman Shah Bin Azlan ShahNo ratings yet

- Chapter 8 Feb.5Document51 pagesChapter 8 Feb.5AaaNo ratings yet

- Study Session 11 - ReceivablesDocument8 pagesStudy Session 11 - ReceivablesRuwani RathnayakeNo ratings yet

- A10 Bad Debts and Allowance 2Document16 pagesA10 Bad Debts and Allowance 2diggywilldoitNo ratings yet

- Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions ManualDocument51 pagesCornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manualsethedwardsenibcazmkt100% (12)

- CH 18Document13 pagesCH 18chengezen0414No ratings yet

- CHAPTER 6 Intermediate Acctng 1Document54 pagesCHAPTER 6 Intermediate Acctng 1Tessang OnongenNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument36 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.100% (1)

- Bad Debts and Doubtful Debts PDFDocument4 pagesBad Debts and Doubtful Debts PDFSanjiv KubalNo ratings yet

- CH 1 - End of Chapter Exercises SolutionsDocument37 pagesCH 1 - End of Chapter Exercises SolutionssaraNo ratings yet

- Introa5 7Document41 pagesIntroa5 7Ameya RanadiveNo ratings yet

- Week03 PPT 2022 Before ClassDocument79 pagesWeek03 PPT 2022 Before Class罗上宗No ratings yet

- Accruals and Prepayments 5: This Chapter Covers..Document18 pagesAccruals and Prepayments 5: This Chapter Covers..Amiir AlfaNo ratings yet

- Chapter 4Document16 pagesChapter 4April Noreen Riego PizarraNo ratings yet

- Current Liabilities, Provisions, and ContingenciesDocument56 pagesCurrent Liabilities, Provisions, and ContingenciesJofandio Alamsyah100% (1)

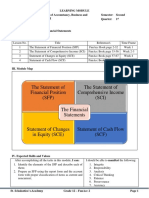

- Financial Statements - II: 360 AccountancyDocument65 pagesFinancial Statements - II: 360 AccountancyshantX100% (1)

- AccountingDocument36 pagesAccountingJoud AlNo ratings yet

- Contigency and WarrantiesDocument26 pagesContigency and WarrantiesCollins GitauNo ratings yet

- Irrecoverable Debts and AllowancesDocument3 pagesIrrecoverable Debts and AllowancesMuhammad Zubair YounasNo ratings yet

- Allowance For Doubtful Accounts PolicyDocument11 pagesAllowance For Doubtful Accounts PolicyMuri EmJayNo ratings yet

- Acctg11e SM CH11Document52 pagesAcctg11e SM CH11titirNo ratings yet

- Mse Module 5 Ae15 Ia1Document13 pagesMse Module 5 Ae15 Ia1Trisha Anne VenturaNo ratings yet

- Company Final Account-Balance SheetDocument10 pagesCompany Final Account-Balance SheetAyushNo ratings yet

- StudyGuideChap08 PDFDocument27 pagesStudyGuideChap08 PDFNarjes DehkordiNo ratings yet

- Session 5 - LT Liabilities - For Lecture SolutionsDocument78 pagesSession 5 - LT Liabilities - For Lecture Solutionsss9723No ratings yet

- CH 03Document44 pagesCH 03min xuan limNo ratings yet

- Rules of Debits and CreditsDocument6 pagesRules of Debits and CreditsJubelle Tacusalme Punzalan100% (1)

- Accounting For Non-Accounting Students - Summary Chapter 4Document4 pagesAccounting For Non-Accounting Students - Summary Chapter 4Megan Joye100% (1)

- Chapter 09 PPT - Holthausen & Zmijewski 2019Document103 pagesChapter 09 PPT - Holthausen & Zmijewski 2019royNo ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument26 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont CollegeRahim MazharNo ratings yet

- Class 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIDocument70 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIPathan KausarNo ratings yet

- Current Liabilities, Provisions and Contingencies LO2 Accounting For ProvisionsDocument40 pagesCurrent Liabilities, Provisions and Contingencies LO2 Accounting For Provisionsammad uddinNo ratings yet

- Ap 06 REO Receivables - PDF 074431Document19 pagesAp 06 REO Receivables - PDF 074431Christian100% (1)

- Adjusting Accounts For Financial Statements: Wild and Shaw Fundamental Accounting Principles 24th EditionDocument61 pagesAdjusting Accounts For Financial Statements: Wild and Shaw Fundamental Accounting Principles 24th EditionAudrey BienNo ratings yet

- Acc2 Q1W2Document3 pagesAcc2 Q1W2Asahi HamadaNo ratings yet

- Accounting For: Provisions, Prepayments and AccrualsDocument26 pagesAccounting For: Provisions, Prepayments and AccrualsChristopher RonaldNo ratings yet

- Group 2 - FS EVALUATIONDocument20 pagesGroup 2 - FS EVALUATIONmarriette joy abadNo ratings yet

- Quiz Week 8 Akm 2Document6 pagesQuiz Week 8 Akm 2Tiara Eva TresnaNo ratings yet

- CH 12 Irrecoverable Debts and AllowanceDocument6 pagesCH 12 Irrecoverable Debts and AllowanceBuntheaNo ratings yet

- RecivablesDocument12 pagesRecivablesGizaw BelayNo ratings yet

- WildFAP24e Ch03 PPT FinalDocument57 pagesWildFAP24e Ch03 PPT FinalDương Thái NgọcNo ratings yet

- Pre ClassDocument4 pagesPre Classnavjot2k2No ratings yet

- E - Financial Accounting 09Document47 pagesE - Financial Accounting 09Haarish Kumar JhummunNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Class 5 - JournalDocument17 pagesClass 5 - Journal04shubhgoelNo ratings yet

- CPA Review On FARDocument5 pagesCPA Review On FARYlor NoniuqNo ratings yet

- Lesson 1 The Statement of Financial PositionDocument11 pagesLesson 1 The Statement of Financial PositionFranchesca Calma100% (1)

- Hunny Tutorial: Class-XII Macro Economics Assignment-1 Ch-Balance of Payment Multiple Choice QuestionsDocument6 pagesHunny Tutorial: Class-XII Macro Economics Assignment-1 Ch-Balance of Payment Multiple Choice QuestionsArmaan SethiNo ratings yet

- Midterm 2nd 3rd Meeting RevisedDocument6 pagesMidterm 2nd 3rd Meeting RevisedChristopher CristobalNo ratings yet

- Lesson Plan - POADocument52 pagesLesson Plan - POAWendellene WilsonNo ratings yet

- ACC 102 - Accounts ReceivableDocument3 pagesACC 102 - Accounts Receivablewerter werterNo ratings yet

- Integration Point of MM-FI-SD in SAP ERP: Dibyendu PatraDocument41 pagesIntegration Point of MM-FI-SD in SAP ERP: Dibyendu PatraVijay KaushikNo ratings yet

- Inventory Write-Off Definition PDFDocument7 pagesInventory Write-Off Definition PDFPadmakrishnanNo ratings yet

- Name: Score:: Property of STIDocument2 pagesName: Score:: Property of STIFrancis TarnateNo ratings yet

- Multiple Choice Questions: B. C. D. EDocument18 pagesMultiple Choice Questions: B. C. D. ETsania AmbarNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument4 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The Questionfennie ilinah molinaNo ratings yet

- Accounting Terms - CrosswordDocument4 pagesAccounting Terms - CrosswordKl HumiwatNo ratings yet

- SAP FICO Certification Questions and Answers # 6: Register Now LoginDocument3 pagesSAP FICO Certification Questions and Answers # 6: Register Now LoginChechenZeruNo ratings yet

- Accounting System (Compatibility Mode) PDFDocument10 pagesAccounting System (Compatibility Mode) PDFAftab AlamNo ratings yet

- Week 4 - Before WebinarDocument16 pagesWeek 4 - Before WebinardkNo ratings yet

- Chapter 15 Practice QuizDocument7 pagesChapter 15 Practice QuizLara Lewis AchillesNo ratings yet

- Inter Company - Cross Company in SAP - SAP SIMPLE DocsDocument10 pagesInter Company - Cross Company in SAP - SAP SIMPLE DocsAnanthakumar ANo ratings yet

- History and Development of AccountingDocument5 pagesHistory and Development of AccountingLeonilaEnriquezNo ratings yet

- Suspense AccDocument4 pagesSuspense AccAhmad Hafid HanifahNo ratings yet

- Pre-8 7Document5 pagesPre-8 7Ronald YNo ratings yet

- Triple Duty BondDocument4 pagesTriple Duty BondYuneshmadhan SNo ratings yet

- Accounting EntriesDocument16 pagesAccounting EntriesphonraphatNo ratings yet

- Accounting TerminologyDocument215 pagesAccounting TerminologyJyoshna Reddy50% (2)

- Far First Set ADocument8 pagesFar First Set APaula Villarubia100% (1)

- Borrowing CostsDocument19 pagesBorrowing CostsIrfan100% (20)