Professional Documents

Culture Documents

Carbon Update 11 June 2013

Uploaded by

David BolesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carbon Update 11 June 2013

Uploaded by

David BolesCopyright:

Available Formats

DBLM Solutions

David Boles 01 4433584 (Direct) dblmdavid (SKYPE) david@dblmsolutions.com

DBLM Solutions Carbon Update

Carbon Overview

David Boles 01 4433584 (Direct) dblmdavid (SKYPE) david@dblmsolutions.com

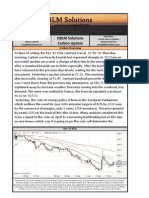

At time of writing the Dec '13 EUA Contract was at 4.02. Carbon dropped below 4.00 briefly yesterday as auction demand failed to push prices higher as witnessed in the recent past, prompting traders to take profits. The energy complex has also shedded some value with Brent shedding $1.30 since June 7. This may be shortlived as Gas demand is set to increase while supply is forecast to remain flat. The Obama administration looks to be gearing up for some positive action on climate change. A inter agency task force was set up to evaluate the cost of carbon on the public. The new estimates are up 66% on previous estimates calculated in 2010. These figures will have serious effects on Government decisions about projects such as the proposed Keystone pipeline. The administrations new calculations places a price of $43 on each tonne of CO 2 emitted, i.e the cost incurred by the damage to society that a tonne of the GHG causes. The increase in cost is attributed to more advanced models developed by peer reviewed papers. The estimates are extremely cvomplex and many scientists agree that estimates will only grow as more information becomes available. The new research should influence a range of policy changes and see the US cooperate to a larger degree with global efforts.

Dec 13 EUA

Past performance may not be a reliable guide to future performance. Mention of specific commodities should not be taken as a recommendation to buy or sell these commodities. Commodity Trading is risky and DBLM Solutions assume no liability for the use of any information contained herein. Past financial results are not necessarily indicative of future performance. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to accuracy. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples. Neither this information, nor any opinion expressed, constitutes a solicitation to buy or sell futures or options or futures contracts, or OTC products. Reproduction without authorization is forbidden. All rights reserved. DBLM Solutions.

You might also like

- Conversations about Energy: How the Experts See America's Energy ChoicesFrom EverandConversations about Energy: How the Experts See America's Energy ChoicesRating: 5 out of 5 stars5/5 (1)

- Carbon Update 22 July 2013 PDFDocument1 pageCarbon Update 22 July 2013 PDFDavid BolesNo ratings yet

- Carbon Update 02 July 2013Document1 pageCarbon Update 02 July 2013David BolesNo ratings yet

- Carbon Update 31 May 2013 PDFDocument1 pageCarbon Update 31 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 25 June 2013Document1 pageCarbon Update 25 June 2013David BolesNo ratings yet

- Carbon Update 15 July 2013Document1 pageCarbon Update 15 July 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 30 July 2013-1Document1 pageCarbon Update 30 July 2013-1David BolesNo ratings yet

- Carbon Update 15 April 2013 PDFDocument1 pageCarbon Update 15 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 10 May 2013 PDFDocument1 pageCarbon Update 10 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 23 April 2013 PDFDocument1 pageCarbon Update 23 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 22 April 2013 PDFDocument1 pageCarbon Update 22 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 16 April 2013Document1 pageCarbon Update 16 April 2013David BolesNo ratings yet

- Carbon Update 27 Aug 2013Document1 pageCarbon Update 27 Aug 2013David BolesNo ratings yet

- Carbon Update 21 Aug 2013Document1 pageCarbon Update 21 Aug 2013David BolesNo ratings yet

- Carbon Update 29 April 2013 PDFDocument1 pageCarbon Update 29 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 29 May 2013 PDFDocument1 pageCarbon Update 29 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 13 April 2013 PDFDocument1 pageCarbon Update 13 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 12 June 2013Document1 pageCarbon Update 12 June 2013David BolesNo ratings yet

- Carbon Update 30 Aug 2013Document1 pageCarbon Update 30 Aug 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon Updatequeeny40No ratings yet

- Carbon Update 20 May 2013 PDFDocument1 pageCarbon Update 20 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 28 Aug 2013Document1 pageCarbon Update 28 Aug 2013David BolesNo ratings yet

- Carbon Update 26 March 2013 PDFDocument1 pageCarbon Update 26 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 14 June 2013Document1 pageCarbon Update 14 June 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 08 July 2013Document1 pageCarbon Update 08 July 2013David BolesNo ratings yet

- Carbon Update 03 May 2013 PDFDocument1 pageCarbon Update 03 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 24 July 2013Document1 pageCarbon Update 24 July 2013David BolesNo ratings yet

- Carbon Update 26 April 2013 PDFDocument1 pageCarbon Update 26 April 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 19 April 2013Document1 pageCarbon Update 19 April 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 09 July 2013Document1 pageCarbon Update 09 July 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 15 March 2013 PDFDocument1 pageCarbon Update 15 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 05 April 2013 PDFDocument1 pageCarbon Update 05 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 08 May 2013 PDFDocument1 pageCarbon Update 08 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 21 June 2013Document1 pageCarbon Update 21 June 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 16 July 2013Document1 pageCarbon Update 16 July 2013David BolesNo ratings yet

- Economist Insights 2013 08 052Document2 pagesEconomist Insights 2013 08 052buyanalystlondonNo ratings yet

- Carbon Update 02 April 2013 PDFDocument1 pageCarbon Update 02 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 02 Aug 2013 PDFDocument1 pageCarbon Update 02 Aug 2013 PDFDavid BolesNo ratings yet

- Carbon Update 26 Aug 2013Document1 pageCarbon Update 26 Aug 2013David BolesNo ratings yet

- Carbon Update 15 May 2013 PDFDocument1 pageCarbon Update 15 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 05 July 2013Document1 pageCarbon Update 05 July 2013David BolesNo ratings yet

- SSRN Id1735555Document60 pagesSSRN Id1735555BhuwanNo ratings yet

- Paulson's GiftDocument67 pagesPaulson's Giftdsarkar2000No ratings yet

- Carbon Update 26 June 2013 PDFDocument1 pageCarbon Update 26 June 2013 PDFDavid BolesNo ratings yet

- Carbon Update 05 June 2013Document1 pageCarbon Update 05 June 2013David BolesNo ratings yet

- Carbon Update 19 Aug 2013Document1 pageCarbon Update 19 Aug 2013David BolesNo ratings yet

- Carbon Update 21 May 2013 PDFDocument1 pageCarbon Update 21 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 20 Aug 2013Document1 pageCarbon Update 20 Aug 2013David BolesNo ratings yet

- U.S. Coins Benefits and Considerations For Replacing The $1 Note With A $1 CoinDocument13 pagesU.S. Coins Benefits and Considerations For Replacing The $1 Note With A $1 CoinFedScoopNo ratings yet

- DBLM Solutions Carbon Newsletter 19 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 19 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 07 Jan 2016Document1 pageDBLM Solutions Carbon Newsletter 07 Jan 2016David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 19 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 19 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 06 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 06 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet