Professional Documents

Culture Documents

Carbon Update 15 July 2013

Uploaded by

David BolesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carbon Update 15 July 2013

Uploaded by

David BolesCopyright:

Available Formats

DBLM Solutions

David Boles 01 4433584 (Direct) dblmdavid (SKYPE) david@dblmsolutions.com

DBLM Solutions Carbon Update

Carbon Overview

David Boles 01 4433584 (Direct) dblmdavid (SKYPE) david@dblmsolutions.com

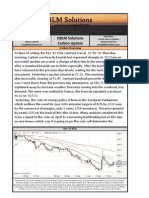

At time of writing the Dec '13 EUA Contract was at 4.05. The last week has seen carbon prices fall by 6%, returning to levels pre the European Parliament backloading vote. The price has become very flat, waiting for the next price signal. This mornings auction on EEX of 3,461,500 EUA's went off without a hitch. Demand at the auction was above average with a cover ratio of 3.03. (cover ratio = no. of bids/actual volume). Significant news from Australia indicates that Kevin Rudd is preparing to move towards a carbon cap and trade sooner than anticipated. The Australian carbon floating price is to be brought forward by a year .to 2014. Australia's carbon price started in July 2012 as a carbon tax and was levied at A $23. This month it rose to A$24.15 and was scheduled to rise to A$25.14 in July 2014. The tax on emissions covered approximately 300 power producers and heavy industry across the continent. This may bode well for the proposed link between the EUETS and the Australian cap and trade, schedulled for 2015, affording more time to get all the ducks in a row. At this stage, the above changes are speculative as a change in legislation is required, but thge path has been taken.

Dec 13 EUA

Past performance may not be a reliable guide to future performance. Mention of specific commodities should not be taken as a recommendation to buy or sell these commodities. Commodity Trading is risky and DBLM Solutions assume no liability for the use of any information contained herein. Past financial results are not necessarily indicative of future performance. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to accuracy. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples. Neither this information, nor any opinion expressed, constitutes a solicitation to buy or sell futures or options or futures contracts, or OTC products. Reproduction without authorization is forbidden. All rights reserved. DBLM Solutions.

You might also like

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 22 July 2013 PDFDocument1 pageCarbon Update 22 July 2013 PDFDavid BolesNo ratings yet

- Carbon Update 10 May 2013 PDFDocument1 pageCarbon Update 10 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 31 May 2013 PDFDocument1 pageCarbon Update 31 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 25 June 2013Document1 pageCarbon Update 25 June 2013David BolesNo ratings yet

- Carbon Update 02 July 2013Document1 pageCarbon Update 02 July 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 30 July 2013-1Document1 pageCarbon Update 30 July 2013-1David BolesNo ratings yet

- Carbon Update 11 June 2013Document1 pageCarbon Update 11 June 2013David BolesNo ratings yet

- Carbon Update 05 April 2013 PDFDocument1 pageCarbon Update 05 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 21 Aug 2013Document1 pageCarbon Update 21 Aug 2013David BolesNo ratings yet

- Carbon Update 08 July 2013Document1 pageCarbon Update 08 July 2013David BolesNo ratings yet

- Carbon Update 29 April 2013 PDFDocument1 pageCarbon Update 29 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 26 March 2013 PDFDocument1 pageCarbon Update 26 March 2013 PDFDavid BolesNo ratings yet

- Carbon Update 15 May 2013 PDFDocument1 pageCarbon Update 15 May 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 02 Aug 2013 PDFDocument1 pageCarbon Update 02 Aug 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 12 June 2013Document1 pageCarbon Update 12 June 2013David BolesNo ratings yet

- Carbon Update 27 Aug 2013Document1 pageCarbon Update 27 Aug 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon Updatequeeny40No ratings yet

- Carbon Update 16 April 2013Document1 pageCarbon Update 16 April 2013David BolesNo ratings yet

- Carbon Update 30 Aug 2013Document1 pageCarbon Update 30 Aug 2013David BolesNo ratings yet

- Carbon Update 28 Aug 2013Document1 pageCarbon Update 28 Aug 2013David BolesNo ratings yet

- Carbon Update 24 July 2013Document1 pageCarbon Update 24 July 2013David BolesNo ratings yet

- Carbon Update 26 Aug 2013Document1 pageCarbon Update 26 Aug 2013David BolesNo ratings yet

- Carbon Update 26 April 2013 PDFDocument1 pageCarbon Update 26 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 03 May 2013 PDFDocument1 pageCarbon Update 03 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 05 June 2013Document1 pageCarbon Update 05 June 2013David BolesNo ratings yet

- Carbon Update 28 May 2013 PDFDocument1 pageCarbon Update 28 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 15 March 2013 PDFDocument1 pageCarbon Update 15 March 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 10 July 2013Document1 pageCarbon Update 10 July 2013David BolesNo ratings yet

- Carbon Update 19 Aug 2013Document1 pageCarbon Update 19 Aug 2013David BolesNo ratings yet

- Carbon Update 23 April 2013 PDFDocument1 pageCarbon Update 23 April 2013 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 08 May 2013 PDFDocument1 pageCarbon Update 08 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 22 April 2013 PDFDocument1 pageCarbon Update 22 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 03 Aug 2013Document1 pageCarbon Update 03 Aug 2013queeny40No ratings yet

- Carbon Update 12 July 2013Document1 pageCarbon Update 12 July 2013David BolesNo ratings yet

- Carbon Update 21 May 2013 PDFDocument1 pageCarbon Update 21 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 20 May 2013 PDFDocument1 pageCarbon Update 20 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 29 May 2013 PDFDocument1 pageCarbon Update 29 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 15 April 2013 PDFDocument1 pageCarbon Update 15 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 17 June 2013Document1 pageCarbon Update 17 June 2013David BolesNo ratings yet

- Carbon Update 09 July 2013Document1 pageCarbon Update 09 July 2013David BolesNo ratings yet

- Carbon Update 03 July 2013Document1 pageCarbon Update 03 July 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 02 April 2013 PDFDocument1 pageCarbon Update 02 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 21 June 2013Document1 pageCarbon Update 21 June 2013David BolesNo ratings yet

- Carbon Update 16 July 2013Document1 pageCarbon Update 16 July 2013David BolesNo ratings yet

- Carbon Update 19 April 2013Document1 pageCarbon Update 19 April 2013David BolesNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- Carbon Update 14 April 2013 PDFDocument1 pageCarbon Update 14 April 2013 PDFDavid BolesNo ratings yet

- Carbon Update 07 May 2013 PDFDocument1 pageCarbon Update 07 May 2013 PDFDavid BolesNo ratings yet

- Carbon Update 14 April 2013 PDFDocument1 pageCarbon Update 14 April 2013 PDFDavid BolesNo ratings yet

- Weekly Trends January 10 2013Document4 pagesWeekly Trends January 10 2013John ClarkeNo ratings yet

- DBLM Solutions Carbon Newsletter 07 Jan 2016Document1 pageDBLM Solutions Carbon Newsletter 07 Jan 2016David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 19 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 19 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 19 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 19 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 06 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 06 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet