Professional Documents

Culture Documents

1 1 1 1 I 1 I 1 1 I 1 1 1 I I I I 1

1 1 1 1 I 1 I 1 1 I 1 1 1 I I I I 1

Uploaded by

sivavalaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 1 1 1 I 1 I 1 1 I 1 1 1 I I I I 1

1 1 1 1 I 1 I 1 1 I 1 1 1 I I I I 1

Uploaded by

sivavalaiCopyright:

Available Formats

Project GoalsIChoosing the Right Project

25

could obtainh n d s from a bank plus the rate of inflation. Others calculate it from its strategic plan needs.

0

NetPresentValue (NPV). Whereas IRR measuresrateofreturn,i.e., interest rate,NPV is a calculation of the size of the return in total dollars as measuredattodayseconomics.Thiscalculationinvolvesanumberof operationsandrequiresknowledgeaboutlengthoftheproject,when investment is to take place, when returns will start, the assumed inflation rate, and the reinvestment rate (how much return can be assumed for cash inflows). Companies have different assumptions when calculating the NPV, however, they all are useful in the same ways. If there is positive NPV, the project will make more money than placing it in a bank and, therefore,isprobablyeconomicallyjustified.Thelargerthe NPV, the higher the justification. This is a useful way to prioritize different projects where funds are not available to execute all good projects. NPV also gives us a better feel about risk. Projects that have high NPVs can usually support taking more risk. Projects with low NPVs may still be attractive, but should not have significant risk associated with them. Payback. This is a measure of how quickly the investment will be paid back. This is a time measurement. Some companies have hurdle times that dictate that a project must be paid back in a certain number of months before it will be approved. This is often done to overcome the hockey stickcurveswherereturnsare so faroutthatmeetingthem is very questionable.

Table 4.1 Example results

Option Cost,

~~

1 I 1

I

Cap Proj.Time, $M Mos.

1

I

1 1 I

I

Incremental IRR % profit, $Mlyr

4.7

1

I

I,,, 1 1 I

I

$M P c k ; , a ;;

A. Distillation

10.5

5.4

B. Solvent

Extraction C. Supercritical Extraction

7.0

1 I

16 16

24

13.728

3.3

4.1

I I

38 30

10.7 11.6

1 1

I

3

2

Table 4.1 indicates that all alternatives are profitable. Option B has the lowest capital and the lowest payback. However, it also has the lowest NPV. Option C has the highest capital and the highest NPV. From the analysis, is not it extremely clear yet which is the best option.

You might also like

- Business Finance Module 9Document13 pagesBusiness Finance Module 9Kanton FernandezNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Cap Budeting FinanaceDocument11 pagesCap Budeting FinanaceShah ZazaiNo ratings yet

- Net Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaDocument9 pagesNet Present Value and The Internal Rate of Return - CFA Level 1 - InvestopediaPrannoyChakrabortyNo ratings yet

- NPV, Irr, ArrDocument9 pagesNPV, Irr, ArrAhsan MubeenNo ratings yet

- Capital Budgeting Analysis: CA. Sonali Jagath PrasadDocument63 pagesCapital Budgeting Analysis: CA. Sonali Jagath PrasadSonali JagathNo ratings yet

- Accounting ExplainedDocument69 pagesAccounting ExplainedGeetaNo ratings yet

- IRR NPV and PBP PDFDocument13 pagesIRR NPV and PBP PDFyared haftuNo ratings yet

- Capital BudgetingDocument37 pagesCapital BudgetingJErome DeGuzman100% (3)

- IRR, NPV and PBPDocument13 pagesIRR, NPV and PBPRajesh Shrestha100% (5)

- Ross Chapter 9 NotesDocument11 pagesRoss Chapter 9 NotesYuk Sim100% (1)

- Capital Budgeting: Steps: Differ by Scale, Horizon, Complexity of The ProjectDocument7 pagesCapital Budgeting: Steps: Differ by Scale, Horizon, Complexity of The ProjectSumit KumarNo ratings yet

- The Use of Modern Capital Budgeting TechniquesDocument4 pagesThe Use of Modern Capital Budgeting TechniquesPrachi SharmaNo ratings yet

- Cap. Budgetinf ChapterDocument7 pagesCap. Budgetinf Chapterbhagat103No ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument10 pagesAnswers To Concepts Review and Critical Thinking QuestionsAhsan MubeenNo ratings yet

- Chapter 9 Capital BudgetinDocument184 pagesChapter 9 Capital BudgetinKatherine Cabading InocandoNo ratings yet

- Capital Bugeting TechniquesDocument14 pagesCapital Bugeting TechniquesShujja Ur Rehman TafazzulNo ratings yet

- MBA711 - Answers To All Chapter 7 ProblemsDocument21 pagesMBA711 - Answers To All Chapter 7 Problemsshweta shuklaNo ratings yet

- BUS - 539 Capital - Budgeting - Wk.5Document10 pagesBUS - 539 Capital - Budgeting - Wk.5TimNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingTowfiquzzaman ShummoNo ratings yet

- Chapter Five FMDocument4 pagesChapter Five FMHope GoNo ratings yet

- Economics Unit 2.1 NotesDocument9 pagesEconomics Unit 2.1 Notes3004 Divya Dharshini. MNo ratings yet

- Capital BudgetingDocument11 pagesCapital BudgetingShane PajaberaNo ratings yet

- Net Present Value: Problems in Using IRR in Risk AnalysesDocument11 pagesNet Present Value: Problems in Using IRR in Risk AnalysesAndrew LeeNo ratings yet

- CORP FIN Final TheoryDocument5 pagesCORP FIN Final Theoryjesin.estiana09No ratings yet

- Investment Evaluation MethodDocument13 pagesInvestment Evaluation MethodBAo TrAmNo ratings yet

- 04 Project Selection 2023Document7 pages04 Project Selection 2023Mahbub Zaman SiyamNo ratings yet

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Format of Project ReportDocument3 pagesFormat of Project ReportalanNo ratings yet

- Profitability Analysis L-3Document32 pagesProfitability Analysis L-3trko5354No ratings yet

- Capital Budgeting MethodsDocument13 pagesCapital Budgeting MethodsAmit SinghNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingchabeNo ratings yet

- Capital Budgeting: Long-Term Investment Decisions - The Key To Long Run Profitability and Success!Document21 pagesCapital Budgeting: Long-Term Investment Decisions - The Key To Long Run Profitability and Success!Mari BossNo ratings yet

- Module 2Document9 pagesModule 2vinitaggarwal08072002No ratings yet

- Document (1) (3) .EditedDocument7 pagesDocument (1) (3) .EditedMoses WabunaNo ratings yet

- Net Present ValueDocument6 pagesNet Present ValueHyun KimNo ratings yet

- Net Present Value - NPV: Capital BudgetingDocument4 pagesNet Present Value - NPV: Capital BudgetingCris Marquez100% (1)

- Capital BudgetinDocument5 pagesCapital Budgetinwantedavin26No ratings yet

- Net Present ValueDocument12 pagesNet Present ValueRamya SubramanianNo ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Chapter 6: Introduction To Capital BudgetingDocument3 pagesChapter 6: Introduction To Capital BudgetingDeneree Joi EscotoNo ratings yet

- Corporate Finance Sem3Document7 pagesCorporate Finance Sem3saurabhnanda14No ratings yet

- Villa, Jesson Bsa2a Finman Information SheetDocument4 pagesVilla, Jesson Bsa2a Finman Information SheetJESSON VILLANo ratings yet

- Acctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1Document8 pagesAcctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1masan01No ratings yet

- Chapt 05Document12 pagesChapt 05Richa KothariNo ratings yet

- Significance of Capital Budgeting: Discounted Cash Flow MethodDocument8 pagesSignificance of Capital Budgeting: Discounted Cash Flow MethodSarwat AfreenNo ratings yet

- Capital_Budgeting_PPTDocument12 pagesCapital_Budgeting_PPTshyamNo ratings yet

- A. The Importance of Capital BudgetingDocument98 pagesA. The Importance of Capital BudgetingShoniqua JohnsonNo ratings yet

- Capital Budgeting Presentation Part 1Document38 pagesCapital Budgeting Presentation Part 1eiaNo ratings yet

- Project. Capital BudgetingDocument8 pagesProject. Capital BudgetingGm InwatiNo ratings yet

- Module 6 - Capital Budgeting TechniquesDocument6 pagesModule 6 - Capital Budgeting Techniquesjay-ar dimaculanganNo ratings yet

- Practical Financial Management 8th Edition Lasher Solutions ManualDocument27 pagesPractical Financial Management 8th Edition Lasher Solutions Manualfumingmystich6ezb100% (22)

- Capital BudgetingDocument2 pagesCapital BudgetingMuhammad Akmal HossainNo ratings yet

- Capital Budgeting and Risk Analysis: Submit Ted byDocument6 pagesCapital Budgeting and Risk Analysis: Submit Ted bysouravbaidNo ratings yet

- Valuation of Non-Conventional Cash Flows PaperDocument10 pagesValuation of Non-Conventional Cash Flows PaperRonaldoDamascenoNo ratings yet

- Unit 2 Capital Budgeting Technique ProblemsDocument39 pagesUnit 2 Capital Budgeting Technique ProblemsAshok Kumar100% (1)

- IRR and PaybackDocument6 pagesIRR and PaybackXain AliNo ratings yet

- Chương 5: So Sánh Tiêu ChíDocument4 pagesChương 5: So Sánh Tiêu ChíNguyễn Thị Minh ThưNo ratings yet

- Investment Appraisal TechniquesDocument6 pagesInvestment Appraisal TechniquesERICK MLINGWANo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingRuchika AgarwalNo ratings yet

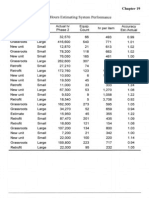

- Hours: Table 19.25 Engineering Estimating System PerformanceDocument1 pageHours: Table 19.25 Engineering Estimating System PerformancesivavalaiNo ratings yet

- Communications 241: 17.2 Documentation ChecklistDocument1 pageCommunications 241: 17.2 Documentation ChecklistsivavalaiNo ratings yet

- Semi-Detailed Estimating System: M LabDocument1 pageSemi-Detailed Estimating System: M LabsivavalaiNo ratings yet

- Project Control: Plant LayoutDocument1 pageProject Control: Plant LayoutsivavalaiNo ratings yet

- Cost Estimate Summary Case: Estimating 119Document1 pageCost Estimate Summary Case: Estimating 119sivavalaiNo ratings yet

- Phases The Startup: of An For ofDocument1 pagePhases The Startup: of An For ofsivavalaiNo ratings yet

- 3 - Shakedown Areas.: Construction ManagementDocument1 page3 - Shakedown Areas.: Construction ManagementsivavalaiNo ratings yet

- This Page Intentionally Left BlankDocument1 pageThis Page Intentionally Left BlanksivavalaiNo ratings yet

- 14.3 Construction Management ActivitiesDocument1 page14.3 Construction Management ActivitiessivavalaiNo ratings yet

- 15.5 Control During Construction: 80% of Bulk Materials Normally SuppliedDocument1 page15.5 Control During Construction: 80% of Bulk Materials Normally SuppliedsivavalaiNo ratings yet

- Project Control Problem Correction: During ConstructionDocument1 pageProject Control Problem Correction: During ConstructionsivavalaiNo ratings yet

- Speclfic To Project: 2 - Depth and BreadthDocument1 pageSpeclfic To Project: 2 - Depth and BreadthsivavalaiNo ratings yet

- All Equipment Should Be Accessible by Either Crane or Lift TruckDocument1 pageAll Equipment Should Be Accessible by Either Crane or Lift TrucksivavalaiNo ratings yet

- Agreement: ContractingDocument1 pageAgreement: ContractingsivavalaiNo ratings yet

- 2 - Drawings.: 3 - SpecificationsDocument1 page2 - Drawings.: 3 - SpecificationssivavalaiNo ratings yet

- Estimating Methods: Engineering EstimatesDocument1 pageEstimating Methods: Engineering EstimatessivavalaiNo ratings yet

- Process Design Phaseolphasel: Phase 1 SpecificationsDocument1 pageProcess Design Phaseolphasel: Phase 1 SpecificationssivavalaiNo ratings yet