Professional Documents

Culture Documents

Answer Spreadsheet5 2006

Uploaded by

ratikdayal0 ratings0% found this document useful (0 votes)

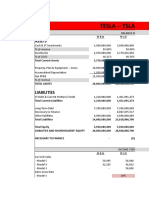

9 views1 pageThis document shows projected financial information for a business over 5 years, including:

- Sales increase each year from 5,000 units in Year 1 to 8,745 units in Year 5.

- Revenue grows from $225,000 in Year 1 to $393,526 in Year 5.

- Profits before tax range from $38,000 in Year 1 to $131,626 in Year 5.

- Cash flow is negative $60,000 in Year 1 but becomes positive each subsequent year, ranging from $9,080 in Year 2 to $173,752 in Year 5.

- The net present value of the 5 years of cash flows is calculated to be $77,345.22 using

Original Description:

JKJksd

Original Title

Answer.spreadsheet5.2006

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document shows projected financial information for a business over 5 years, including:

- Sales increase each year from 5,000 units in Year 1 to 8,745 units in Year 5.

- Revenue grows from $225,000 in Year 1 to $393,526 in Year 5.

- Profits before tax range from $38,000 in Year 1 to $131,626 in Year 5.

- Cash flow is negative $60,000 in Year 1 but becomes positive each subsequent year, ranging from $9,080 in Year 2 to $173,752 in Year 5.

- The net present value of the 5 years of cash flows is calculated to be $77,345.22 using

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageAnswer Spreadsheet5 2006

Uploaded by

ratikdayalThis document shows projected financial information for a business over 5 years, including:

- Sales increase each year from 5,000 units in Year 1 to 8,745 units in Year 5.

- Revenue grows from $225,000 in Year 1 to $393,526 in Year 5.

- Profits before tax range from $38,000 in Year 1 to $131,626 in Year 5.

- Cash flow is negative $60,000 in Year 1 but becomes positive each subsequent year, ranging from $9,080 in Year 2 to $173,752 in Year 5.

- The net present value of the 5 years of cash flows is calculated to be $77,345.22 using

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Yr 0

Yr 1

Yr 2

Yr 3

Yr 4

Yr 5

5,000

45

20

225,000

100,000

75,000

12,000

38,000

12,920

25,080

5,750

45

20

258,750

115,000

75,000

12,000

56,750

19,295

37,455

6,613

45

20

297,563

132,250

75,000

12,000

78,313

26,626

51,686

7,604

45

20

342,197

152,088

75,000

12,000

103,109

35,057

68,052

8,745

45

20

393,526

174,901

75,000

12,000

131,626

44,753

86,873

(28,000)

(13,500)

(15,525)

(17,854)

74,879

25,080

12,000

37,080

37,455

12,000

49,455

51,686

12,000

63,686

68,052

12,000

80,052

86,873

12,000

98,873

Changes in WC

Initial Capex

(60,000)

(28,000)

(13,500)

(15,525)

(17,854)

74,879

CF

(60,000)

9,080

35,955

48,161

62,198

173,752

Sales (Units)

Price

Variable Cost

Revenue

Total Variable Cost

Fixed Cost

Depreciation

Profit bfr Tax

Tax @ 34%

Net Income

Changes in WC

Equipment

Cash Flow

Net Income

+ Dep

OCF

NPV @ Disc. Rate 25%

(60,000)

$77,345.22

Note: In this solution WC is received back at year 5

You might also like

- InventoryDocument5 pagesInventoryAhmed El TayebiNo ratings yet

- Proyeccion de La Demanda de Agua Potable: AÑO Poblacion SERVIDA (Hab) Viviendas Servidas (Unidades)Document26 pagesProyeccion de La Demanda de Agua Potable: AÑO Poblacion SERVIDA (Hab) Viviendas Servidas (Unidades)juan_saavedra_10No ratings yet

- Cost BenefitDocument5 pagesCost Benefitjhoy contrerasNo ratings yet

- Retaining Wall3Document1 pageRetaining Wall3jparsbNo ratings yet

- S CurveDocument25 pagesS CurveHarold EscalonaNo ratings yet

- Impact On Net Tax Liability 1656083948Document2 pagesImpact On Net Tax Liability 1656083948Matthew AyonNo ratings yet

- No. Item Material Qty THK (MM) W (MM) L (MM) Unit Weight (Kg/EA)Document8 pagesNo. Item Material Qty THK (MM) W (MM) L (MM) Unit Weight (Kg/EA)Saša StankovićNo ratings yet

- Price List TLW (Jan-Mar 2016)Document3 pagesPrice List TLW (Jan-Mar 2016)pohoNo ratings yet

- Tabela1 Salarial Com Valores Liquidos AgostoDocument4 pagesTabela1 Salarial Com Valores Liquidos AgostoosvaldoNo ratings yet

- Departamento Ppto CIF #Per. Hs Máq. Hs H.: Mantenimiento Gerencia de Fábrica Servicios Generales Control de CalidadDocument8 pagesDepartamento Ppto CIF #Per. Hs Máq. Hs H.: Mantenimiento Gerencia de Fábrica Servicios Generales Control de CalidadFreddy JejenNo ratings yet

- Aliran Seragam: Percobaan KeDocument6 pagesAliran Seragam: Percobaan KePutri ChanNo ratings yet

- PL Reguler JBR - FixDocument202 pagesPL Reguler JBR - FixDaniiNo ratings yet

- Formulas DepreciacionDocument9 pagesFormulas DepreciacionLissa FloresNo ratings yet

- Tugas 2 IndraDocument13 pagesTugas 2 IndraAwad Mahardika IshaqNo ratings yet

- Tumble Dry Project Financial ReportDocument3 pagesTumble Dry Project Financial ReportAkash SanganiNo ratings yet

- SamigroupDocument9 pagesSamigroupsamidan tubeNo ratings yet

- Ready Tax Chart 2022-23Document8 pagesReady Tax Chart 2022-23jav3d762No ratings yet

- Coil Replacement 2019 PDFDocument23 pagesCoil Replacement 2019 PDFFatwa Hidayat 'otha'No ratings yet

- Coil Replacement 2018Document21 pagesCoil Replacement 2018koernia inderaNo ratings yet

- 2024Document9 pages2024cvq2877No ratings yet

- Mild Steel ChannelsDocument3 pagesMild Steel ChannelsKrishanu SahaNo ratings yet

- Mild Steel ChannelsDocument3 pagesMild Steel Channelsrk36266_732077041No ratings yet

- Mild Steel Channels PDFDocument3 pagesMild Steel Channels PDFmathewsujith31No ratings yet

- Available Lots (As of May, 2021) : NO. BLK LOT Area Price/Sqm Total Price 1 3 922Document42 pagesAvailable Lots (As of May, 2021) : NO. BLK LOT Area Price/Sqm Total Price 1 3 922Liv MañezNo ratings yet

- Mangal Keshav Securities LimitedDocument10 pagesMangal Keshav Securities Limitedsubh2501No ratings yet

- Astm A53a53mDocument4 pagesAstm A53a53mVCS1978100% (1)

- Book 1Document10 pagesBook 1hiwa sakaNo ratings yet

- Initial Outlays Year 0 Year 1 Year 2Document6 pagesInitial Outlays Year 0 Year 1 Year 2Monikams SNo ratings yet

- Sl. Section Cutting Volume No. From Difference Area Average Sq. Mtrs Sq. Mtrs Cubic MetersDocument2 pagesSl. Section Cutting Volume No. From Difference Area Average Sq. Mtrs Sq. Mtrs Cubic Metersrvkumar3619690No ratings yet

- Annum AllyaDocument2 pagesAnnum AllyaAllyhae QonitahNo ratings yet

- CP Curve 2Document1 pageCP Curve 2Jorge_Hernandez_HNo ratings yet

- Pricelist Meikarta Tower 2Document4 pagesPricelist Meikarta Tower 2Rian HutabaratNo ratings yet

- Hungry PediaDocument19 pagesHungry PediaPrashannaNo ratings yet

- Japanese Profiles (JIS 2018) - ChannelDocument2 pagesJapanese Profiles (JIS 2018) - ChannelRONIE ZENAROSANo ratings yet

- Project PDA Conch Republic: Ebit 13,000,000 9,300,000Document4 pagesProject PDA Conch Republic: Ebit 13,000,000 9,300,000Harsya FitrioNo ratings yet

- Proyecto de Urbanizacion Edificios Multifamiliares: Galpones, Tinglados, Depositos, ParqueosDocument17 pagesProyecto de Urbanizacion Edificios Multifamiliares: Galpones, Tinglados, Depositos, ParqueosGonza PfNo ratings yet

- Radiacion de Las Estacion ADocument10 pagesRadiacion de Las Estacion AChris DavidNo ratings yet

- Submitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoDocument8 pagesSubmitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoFaaiz YousafNo ratings yet

- Brosur Pricelist Sevilla Residence 28feb2019Document3 pagesBrosur Pricelist Sevilla Residence 28feb2019Ryan RedNo ratings yet

- Salary - TDS - 2020-21 (From July-2020)Document32 pagesSalary - TDS - 2020-21 (From July-2020)abu naymNo ratings yet

- 2022-26 2022 Total Unit Sales Total Revenue (Crore) Net Revenue (Crore) Total Expenses (Crore) Net Income (Crore) Crore in BDTDocument40 pages2022-26 2022 Total Unit Sales Total Revenue (Crore) Net Revenue (Crore) Total Expenses (Crore) Net Income (Crore) Crore in BDTAbdul MalakNo ratings yet

- Tesla ForecastDocument6 pagesTesla ForecastDanikaLiNo ratings yet

- Descripcion Red Primaria Total S/. Obras Civiles 86,372.47 Red SecundariaDocument1 pageDescripcion Red Primaria Total S/. Obras Civiles 86,372.47 Red SecundariaPedro BartolomeNo ratings yet

- Accomplishment ReportDocument1 pageAccomplishment ReportRalph Emmerson BalaneNo ratings yet

- Raw TablesDocument23 pagesRaw Tablessan21cortezNo ratings yet

- Bang TDDocument119 pagesBang TDLâm Quách TháiNo ratings yet

- Crane Data Table DGC GEARDocument19 pagesCrane Data Table DGC GEARIng. EstructuralNo ratings yet

- 8.extras GF 13Document1 page8.extras GF 13Gafita FlavianNo ratings yet

- Linearized Models For Ca 0,5Document5 pagesLinearized Models For Ca 0,5Novy CendianNo ratings yet

- Simple Vs Compound InterestDocument6 pagesSimple Vs Compound InterestKaushik SamantaNo ratings yet

- ToolDocument18 pagesToolLê Mỹ HạNo ratings yet

- Black Gold Pump y Supply, IncDocument2 pagesBlack Gold Pump y Supply, Inchebert perezNo ratings yet

- Exercise 1 DataDocument5 pagesExercise 1 DataAnh PhongNo ratings yet

- Footing Cutting List: Mark Length Width Thickness Spacing Bar Diameter Top&Botom Clear CoverDocument3 pagesFooting Cutting List: Mark Length Width Thickness Spacing Bar Diameter Top&Botom Clear CoverJohn Rhey Almojallas BenedictoNo ratings yet

- Footing Cutting List: Mark Length Width Thickness Spacing Bar Diameter Top&Botom Clear CoverDocument3 pagesFooting Cutting List: Mark Length Width Thickness Spacing Bar Diameter Top&Botom Clear CoverJohn Rhey Almojallas BenedictoNo ratings yet

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323No ratings yet

- Di Price ListDocument15 pagesDi Price ListMukesh ParasharNo ratings yet

- TDLM 2022834 Qhum 1Document11 pagesTDLM 2022834 Qhum 1lolaNo ratings yet

- Welding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement ConsumablesDocument8 pagesWelding Consumable Calculation (WCC) : Doc. No Project Client Project Details Technical Requirement Consumableskeymal9195No ratings yet

- Istorija Erp SistemaDocument16 pagesIstorija Erp SistemaMajaPetNo ratings yet

- Spreadsheets in The Cloud - Not Ready YetDocument14 pagesSpreadsheets in The Cloud - Not Ready YetratikdayalNo ratings yet

- 18959sm Finalnew Isca Cp7Document42 pages18959sm Finalnew Isca Cp7santu15038847420No ratings yet

- Indian Oil Corporation Limited Re - Engineering ProjectDocument22 pagesIndian Oil Corporation Limited Re - Engineering ProjectratikdayalNo ratings yet

- ERP Implementation For Manufacturing Enterprises (India)Document7 pagesERP Implementation For Manufacturing Enterprises (India)ratikdayalNo ratings yet

- Why Spreadsheets Rule in ERP DomainsDocument11 pagesWhy Spreadsheets Rule in ERP DomainsratikdayalNo ratings yet

- 10k Report GenpactDocument172 pages10k Report GenpactratikdayalNo ratings yet

- Yoga Ans NaturopathyDocument10 pagesYoga Ans NaturopathyMichele PóNo ratings yet

- Genpact FirstsDocument4 pagesGenpact FirstsPatrick AdamsNo ratings yet

- Genpact Manipal HospitalDocument3 pagesGenpact Manipal HospitalratikdayalNo ratings yet

- A Primer On The Secondary MarketDocument11 pagesA Primer On The Secondary MarketratikdayalNo ratings yet

- MARKETING International Student RecruitmentDocument104 pagesMARKETING International Student RecruitmentTerry Lollback100% (1)

- College Planning Guide - Michigan UniversityDocument2 pagesCollege Planning Guide - Michigan UniversityratikdayalNo ratings yet

- Selling To The World's PoorDocument9 pagesSelling To The World's PoorPatrick AdamsNo ratings yet

- Europe-Quality of Life in 2005Document39 pagesEurope-Quality of Life in 2005Patrick AdamsNo ratings yet

- GlobalEnglish - EdgeAcademy - Factsheet PDFDocument2 pagesGlobalEnglish - EdgeAcademy - Factsheet PDFratikdayalNo ratings yet

- Delhi NCRDocument533 pagesDelhi NCRratikdayal0% (2)

- Diploma in Urdu PDFDocument39 pagesDiploma in Urdu PDFratikdayalNo ratings yet

- Delhi NCRDocument533 pagesDelhi NCRratikdayal0% (2)

- Study Center ListDocument8 pagesStudy Center ListratikdayalNo ratings yet

- Mobile No OfbranchheadsDocument742 pagesMobile No Ofbranchheadsratikdayal0% (1)

- Medical Tourism Trends - Dec'10 PDFDocument14 pagesMedical Tourism Trends - Dec'10 PDFratikdayalNo ratings yet

- Data Monitor - Retail Lending in The US - Dec 2008Document30 pagesData Monitor - Retail Lending in The US - Dec 2008ratikdayalNo ratings yet

- Andhra CollegesDocument88 pagesAndhra CollegesratikdayalNo ratings yet

- North America A Company and Industry Analysis - MergentDocument36 pagesNorth America A Company and Industry Analysis - MergentPatrick AdamsNo ratings yet

- Fact SheetDocument2 pagesFact SheetratikdayalNo ratings yet

- Chapter 10: Return and Risk: The Capital-Asset-Pricing Model (CAPM)Document36 pagesChapter 10: Return and Risk: The Capital-Asset-Pricing Model (CAPM)Hoang NguyenNo ratings yet

- Ch10 ShortDocument3 pagesCh10 ShortratikdayalNo ratings yet

- BANKING - Hoover's Industry Snapshots, 2009Document2 pagesBANKING - Hoover's Industry Snapshots, 2009ratikdayalNo ratings yet

- Chapter 9: Capital Market Theory: An OverviewDocument2 pagesChapter 9: Capital Market Theory: An OverviewratikdayalNo ratings yet

- A Literature Review On Indonesia'S Deradicalization Program For Terrorist PrisonersDocument18 pagesA Literature Review On Indonesia'S Deradicalization Program For Terrorist PrisonersShaheen AzadNo ratings yet

- Rorschach Audio: Ghost Voices and Perceptual Creativity by Joe BanksDocument8 pagesRorschach Audio: Ghost Voices and Perceptual Creativity by Joe BanksyoutreauNo ratings yet

- Sobre Nicolás Gómez DávilaDocument4 pagesSobre Nicolás Gómez DávilaDiego GarridoNo ratings yet

- 2008 Issue 3 - The Most Expensive Test Is A Retest - Original - 28246Document6 pages2008 Issue 3 - The Most Expensive Test Is A Retest - Original - 28246Putri DozanNo ratings yet

- Sample Professional - Engineer - Summary - StatementDocument5 pagesSample Professional - Engineer - Summary - StatementmrahmedNo ratings yet

- Essential Question and Enduring Understanding TutorialDocument28 pagesEssential Question and Enduring Understanding TutorialAureliano BuendiaNo ratings yet

- Astm A489Document7 pagesAstm A489vtsusr fvNo ratings yet

- Unit 4: For A Better Community Skills: Reading Why Do People Volunteer?Document5 pagesUnit 4: For A Better Community Skills: Reading Why Do People Volunteer?Hồng Duyên QuáchNo ratings yet

- Principles of Accounting - Course SyllabusDocument7 pagesPrinciples of Accounting - Course SyllabusChristian Emil ReyesNo ratings yet

- Flymaster NAV Manual EN v2 PDFDocument52 pagesFlymaster NAV Manual EN v2 PDFRoberto PlevanoNo ratings yet

- Art History Research ProjectDocument3 pagesArt History Research Projectapi-245037226No ratings yet

- Literature ReviewDocument9 pagesLiterature ReviewreksmanotiyaNo ratings yet

- Session 4 LeadingSelf - FLA Expect The BestDocument16 pagesSession 4 LeadingSelf - FLA Expect The BesthendrikaNo ratings yet

- Beta-Blocker Use in Pregnancy and Risk of SpecificDocument13 pagesBeta-Blocker Use in Pregnancy and Risk of SpecificpyprattNo ratings yet

- Literature Review On Investment DecisionsDocument5 pagesLiterature Review On Investment Decisionsc5t0jsyn100% (1)

- Virtues, Vices and Values - The Master List - 2016Document24 pagesVirtues, Vices and Values - The Master List - 2016Lion Goodman100% (1)

- Cause and Effect Sutra English and ChineseDocument84 pagesCause and Effect Sutra English and ChineseVendyChenNo ratings yet

- Principle of TotalityDocument23 pagesPrinciple of TotalityMarggie Salao50% (6)

- Design and Development of Alternative Delivery SystemDocument3 pagesDesign and Development of Alternative Delivery Systemfredie unggayNo ratings yet

- Regular Verbs - FRENCHDocument8 pagesRegular Verbs - FRENCHdennis mavisNo ratings yet

- Soalan Tugasan Penilaian PrestasiDocument9 pagesSoalan Tugasan Penilaian PrestasiIna RawaNo ratings yet

- David Miano - Why Ancient History Matters v02Document16 pagesDavid Miano - Why Ancient History Matters v02Esteban LVNo ratings yet

- مذكرات كافر مغربي PDF - PDFDocument1 pageمذكرات كافر مغربي PDF - PDFYassin MejNo ratings yet

- Process Maker DocumentationDocument11 pagesProcess Maker DocumentationManoj PrabhakarNo ratings yet

- ORTHOSIS - and ProthesisDocument112 pagesORTHOSIS - and Prothesismanjukumard2007100% (1)

- Aristotelian Tragedy: From PoeticsDocument16 pagesAristotelian Tragedy: From PoeticsMohanaNo ratings yet

- Remote Healing Measured by The Bio Field MeterDocument5 pagesRemote Healing Measured by The Bio Field Meterz.geza4732No ratings yet

- Adult Autism Assessment RAADS R ScoringDocument7 pagesAdult Autism Assessment RAADS R ScoringCintia AndradeNo ratings yet

- GaurGopalDas ReportDocument3 pagesGaurGopalDas Reportdr.menganeNo ratings yet

- Ch01 AtmosDocument26 pagesCh01 AtmosPa Loma B. SantosNo ratings yet