Professional Documents

Culture Documents

Bed Linen Stitching Unit

Uploaded by

ali nisar zaidiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bed Linen Stitching Unit

Uploaded by

ali nisar zaidiCopyright:

Available Formats

Pre-Feasibility Study

BED LINEN STITCHING UNIT

Small and Medium Enterprise Development Authority

Government of Pakistan

www.smeda.org.pk

HEAD OFFICE

Waheed Trade Complex, 1s t Floor , 36-Commercial Zone, Phase III, Sector XX, Khayaban-e-Iqbal, DHA Lahore

Tel: (042) 111-111-456, Fax: (042) 5896619, 5899756

helpdesk@smeda.org.pk

REGIONAL OFFICE

PUNJAB

Waheed Trade Complex,

1 st Floor, 36-Commercial Zone,

Phase III, Sector XX,

Khayaban-e-Iqbal, DHA Lahore.

Tel: (042) 111-111-456

Fax: (042) 5896619, 5899756

helpdesk@smeda.org.pk

REGIONAL OFFICE

SINDH

REGIONAL OFFICE

NWFP

REGIONAL OFFICE

BALOCHISTAN

5 TH Floor, Bahria

Complex II, M.T. Khan Road,

Karachi.

Tel: (021) 111-111-456

Fax: (021) 5610572

Helpdesk -khi@smeda.org.pk

Ground Floor

State Life Building

The Mall, Peshawar.

Tel: (091) 9213046-47

Fax: (091) 286908

helpdesk-pew@smeda.org.pk

Bungalow No. 15-A

Chaman Housing Scheme

Airport Road, Quetta.

Tel: (081) 831623, 831702

Fax: (081) 831922

helpdesk-qta@smeda.org.pk

August, 2002

Pre-Feasibility Study

Bed Linen Stitching Unit

DISCLAIMER

The purpose and scope of this information memorandum is to introduce the subject matter

and provide a general idea and information on the said area. All the material included in

this document is based on data/information gathered from various sources and is based on

certain assumptions. Although, due care and diligence has been taken to compile this

document, the contained information may vary due to any change in any of the concerned

factors, and the actual results may differ substantially from the presented information.

SMEDA does not assume any liability for any financial or other loss resulting from this

memorandum in consequence of undertaking this activity. Therefore, the content of this

memorandum should not be relied upon for making any decision, investment or otherwise.

The prospective user of this memorandum is encouraged to carry out his/her own due

diligence and gather any information he/she considers necessary for making an informed

decision.

The content of the information memorandum does not bind SMEDA in any legal or other

form.

DOCUMENT CONTROL

Document No.

PREF-52

Revision

Prepared by

SMEDA-Punjab

Approved by

GM Punjab

Issue Date

August 10, 2002

Issued by

Library Officer

1

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

1 INTRODUCTION

1.1

Pro je ct B rie f

The objective of this document is to provide information regarding investment opportunity

in Bed Linen sector. Bed Linen is an important value added sub-sector of Textile sector.

The products include bed sheets, pillow covers, quilts, etc. This project provides

information about stitching unit of Bed Linen.

1.2

Oppo rt unity Rat io nale

Bed Linen is among the largest sector in terms of production and exports amongst all the

made ups in Pakistan. Pakistan is a major exporter of Bed Linen in the world and the basic

reason for the development of this industry in Pakistan is the existence of a huge

infrastructure of weaving in formal & informal sectors. The informal sector is also known

as Power Loom sector. Most of the products in Bed Linen are made from low-density

fabrics of wider widths. This fabric can be easily manufactured on Power & Auto Looms,

which forms the major chunk of weaving industry of Pakistan. The competitive edge in

cotton has also played an important role in development of Power Loom industry, as the

staple length of cotton produced in Pakistan is suitable for medium count yarn, which is

used to produce low-density fabrics. The cost of a low-density fabric is low compared to a

fabric meant for garments. Processing of the fabric meant for Bed Linen is done through

printing and dyeing, and Pakistan has an exceptional infrastructure of such printing and

dyeing in Faisalabad, Karachi and Lahore.

All these factors have led to a competitive advantage for Pakistan over other countries in

the Bed Linen industry, resulting in extra-ordinary growth during the past few years. The

projected growth rates in the said sector are also very high and promise good growth

opportunities to new entrants in the industry.

1.3

Pro pos e d Ca pacity

The proposed capacity of the project is based on 8-hour single shift and will produce 1,000

Bed Linen sets per day with 20 stitching machines.

1.4

Total Pro je ct Cos t

Total cost of the proposed project is about Rs. 3.5 Million.

2 CURRENT INDUSTRY STRUCTURE

A major chunk of the Pakistani Bed Linen industry is in the informal sector. According to

industry sources, there are 150 units producing Bed Linen in the organized sector and the

rest of the units are in the unorganized sector. There is no data available on these units. The

Bed Linen industry may be large or small depending upon the number of operations

carried out by a unit itself. It involves weaving/knitting, processing and stitching. A Bed

Linen manufacturer may be buying fabric from outside and converting it into final product

after processing it in- house. Or the processing is subcontracted and manufacturers are just

cutting, stitching and packing in their own premises. Vertically integrated units are smaller

2

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

in number and they operate in relatively upper market segments since it is easy to control

the quality in a vertically integrated operation.

Another reason for non-availability of data about Bed Linen industry is the nature of data

reporting. The classification of the industry is based on the operations rather than the

products. Moreover, manufacturers also keep on changing products. Major clusters of Bed

Linen are in Karachi, Faisalabad, Lahore, Multan and Hyderabad.

3 PRODUCTION PROCESS FLOW

The major raw material used in the Bed Linen is printed woven fabric, which is

manufactured on Power/Auto Looms or Shuttle- less Looms. Majority of the Bed Linen

manufacturers procures yarn and converts it into woven grey fabric by paying conversion

charges to the looms units.

Figure 3-1

Process flow Diagram

Procurment of

Grey Fabric

Inspection of

Printed

Fabric

Printing of

Fabric

Cutting

Packaging

Threading &

Final

Inspection

Stitching

The grey fabric is provided to printing & processing unit and printing charges are paid to

get printing according to the given designs and colors. The other possible option used in

the market is to directly buy printed fabric from the market and convert it into Bed Linen.

Once the bed sheet is stitched, final inspection is done. All the sheets are checked for any

defective stitching or loose threads and then they are packed in polyethylene bags along

with insert, which is the printed material with brand name etc and card called stiffener.

4 RAW MATERIAL

4.1

?

?

?

Lis t of Ra w M ate ria l

Printed Woven Fabric

Stitching Thread & Other Accessories

Packaging Material

Stitching thread and packaging material are easily available in the local market. Packaging

material consists of stiffener, which is of cardboard material, an insert, which is a printed

material with companys name and design and polyetnene bag, which is the plastic cover.

3

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

5 PRODUCTION

5.1

Pro duct ion Ca pac ity

The proposed project with 20 machines will produce 1,000 sets of Bed Linen per day on

the basis of 8- hour single shift. In the first year, the capacity utilization of the project will

be 75%, with annual growth rate of 5 %. The maximum capacity utilization of the project

is 95%. The details regarding the capacity of the project are given below:

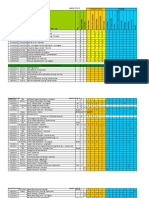

Table 5-1: -Capacity Details

Description

Maximum Production per Day

Production Capacity Per Year

Capacity Utilization first Year (75%)

5.2

1,000 Sets

300,000 Sets

225,000 Sets

Pro duct M ix

The proposed stitching unit has been defined to manufacture bed sets. The general product

mix and sizes are defined as follows:

Table 5-2

Product mix

Description

No

Items

Measurement

1

1

1

Flat

Fitted

Pillow

168x244 cm

178x230 + 20 cm

51x76 + 15 cm

1

1

2

Flat

Fitted

Pillows

206x244 cm

178x230 + 20 cm

51x76 + 15 cm

1

1

2

Flat

Fitted

Pillows

229x257 cm

196x241 + 20 cm

51x76 + 15 cm

1

1

2

Flat

Fitted

Pillows

274x257cm

244x244 + 20cm

51x76 + 15 cm

Twin Set

Full Set

Queen Set

King Set

4

PREF-52/August, 2002/1

Pre-Feasibility Study

5.3

Bed Linen Stitching Unit

Pro duct ion M ix

The proposed project will produce the products on the basis of following proportion:

Table 5-3

Production Mix Production Details

Description

Twin Set

Full Set

Queen

King

Production Percentage

12.5%

50%

25%

12.5%

6 MARKETING

Textile made-ups are one of the most valuable and important commodities being traded

internationally. In 1999, the international textile made-ups trade value was above US$ 11

billion, which can be divided into six major categories i.e. towels & cleaning cloths, bed

wear & bed linen, blankets, curtains and furnishings, canvas products and table linen.

Major exporters of textile made-ups include China, Pakistan, Turkey and Portugal

exporting nearly 47% of the total international market of textile made- ups. The textile

made-ups industry has been on a slow growth, for the last five years 1 with an average

annual growth rate of 3%, and 1999 was the worst year for textile made- ups products (3%

decline in international exports) which is the only year with negative growth in last five

years.

Pakistan being the second largest exporter of textile made-ups, has increased its share in

the internationa l market from 6.6% to 10.1% in previous five years by earning a foreign

exchange of US$ 1.18 billion in 1999 and an average growth of 15% per annum.

According to Federal Bureau of Statistics data, Pakistan exports for the year 2000-01 were

about US$ 1.3 billion.

6.1

Glo bal Tra de of Be d Li ne n

Bed Linen is an important value-added sub-sector of textile sector. Bed Linen products

include bed sheets, pillow covers, quilts, etc. In made ups, Bed Linens sub-sector is the

second largest in terms of production and exports, and shares 28% of total textile made- ups

market. Its share has increased from 26.3% as a sub category and has grown by 4% per

annum if total exports are analyzed. 2

Table 6-1

World Trade of Bed Linen

World

Growth % age

1995

2,753

1996

2,822

3%

1997

3,028

7%

(Value in $ Million)

1998

1999

3,154

3,260

4%

3%

Here data for the years 1995-99 has been used for international comparison, which is the latest available

data.

2

World trade of Bed Linen is reported under different SITC codes. For the purpose of analysis, all these

codes have been summed together to get the overall picture of the worlds trade of bed wear & linen.

5

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

The total exports of Bed Linen in 1999 were $ 3,260 million. Within different products of

Bed Linen, non-knit Bed Linen of cotton was the largest product in terms of international

exports. In 1999, total exports of this product were $2.09 billion, which constituted 64% of

the total exports of Bed Linen. Knit Bed Linen is the smallest category with only 10%

share. The rest of the 26% was accounted by Bed Linen of textile materials other than

cotton. The export market size of this product was $844 million.

Table 6-2

World Exports Category-wise

Commodity

SITC Code 3

(Aggregate)

Bed linen, cotton

Bed linen, other textiles

Bed linen, knit, crochet

65842

65843

65841

6.2

1995

1996

2,753

1,842

607

305

2,822

1,807

715

301

1997

3,028

1,902

835

291

(Value in $ Million)

%

1998 1999 Share

3,154

1,992

858

303

3,260

2,097

844

319

100%

64.32%

25.89%

9.78%

M ajo r Ex po rte rs of Be d Li ne n

China is the main exporter of bed Linen as a whole and exported 21.34% of the Bed Linen

market in 1999. Pakistan which had the second largest share i.e. 20.89% in 1999 had a

phenomenal growth of 16% per annum in last five years and then was Portugal, capturing

11.67% of Bed Linen market.

Table 6-3

Major Exporters of Bed Linen

1995

China

Pakistan

Portugal

Turkey

USA

France

Mexico

Other

6.3

658

376

321

117

103

108

85

986

(Value in $ Million)

1996

1997

1998

1999

% Share in 99

597

708

603

696 21.34%

469

487

567

681 20.89%

325

355

384

380 11.67%

131

174

210

214 6.55%

106

122

144

111 3.39%

103

108

122

127 3.89%

115

121

133

77 2.38%

975

953

990

974 29.88%

M ajo r I mpo rte rs of Be d Li ne n

USA. has been the biggest importer of Bed Linen for the last five years and shared 22.5 %

of total imports with a value of US$ 688 million in 1999. Germany was second with

approximately 14.46 % of world imports.

Standard International Trade Classification.

6

PREF-52/August, 2002/1

Pre-Feasibility Study

Table 6-4

Bed Linen Stitching Unit

Major Importers of Bed Linen

1995

1996

1997

1998

375

373

470

614

482

500

459

462

156

177

215

244

206

184

194

229

264

241

238

204

113

113

104

106

160

168

168

107

USA

Germany

Untd. Kingdom

France

Japan

Netherlands

Honk Kong

6.4

(Value in $ Million)

1999 % Share in 99

688 22.49%

442 14.46%

273 8.94%

241 7.87%

221 7.24%

106 3.46%

85 2.80%

Pakis ta ns Ex po rts i n Be d Line n

In 1999, Bed Linen accounted for $681 million in foreign exchange earnings, which was

approximately 57.4% of total textile made-ups exports of Pakistan. The share has increased

from 54.4% which shows that Pakistan exports of textile made-ups as a whole has

increased at a much lower rate than this sub category. In Pakistan, the Bed Linen market

has increased by an annual average of 16% in last five years with a high growth in 1996

and 1999, i.e. by 25% and 20% respectively. Looking at the international perspective,

Pakistans share of the Bed Linen market has increased from 13.65% in 1995 to 21% in

1999.

Table 6-5

Pakistan Exports of Bed Linen

(Value in $ Million)

1995

375.90

Years

Value

Growth % (Value)

1996

469.03

25%

1997

486.78

4%

1998

567.37

17%

1999

681.01

20%

2000

709

4%

2001

752

6%

For international comparisons, the data used is for the year 1999. However, data is also

available for Pakistan for the year 2000-2001, which shows that there has been an increase

in exports from $681.01 million to nearly $752.53 million by more than 11% in the last

two years.

6.5

Pakis ta ns Tra di ng Pa rt ne rs

Some of the leading importers from Pakistan include USA., which imported 24.9% of

Pakistans Bed Linen, UK, which imported nearly 12.1% and Germany, which shared

11.39% of the Pakistan exports of Bed Linen in 1999.

Table 6-6

Pakistan Trading Partners

Country

USA

United Kingdom

Germany

France

Netherlands

1998

% Share

133.4

23.50%

65.3

11.51%

72.3

12.74%

52.1

9.19%

61.7

10.88%

7

PREF-52/August, 2002/1

(Value in $ Million)

1999

% Share

169.6

24.90%

82.4

12.10%

77.6

11.39%

65.6

9.63%

53.4

7.85%

Pre-Feasibility Study

Bed Linen Stitching Unit

Looking at the break-up of Pakistani Bed Linen exports, it has been found that about two

third of the total value exported is accounted by just one category which is non-knit Bed

Linen of cotton i.e. 70% of the total Bed Linen exports. This is in line with the world

trend since this category is the largest category in the global exports with 64% share. A

table showing Pakistani exports to 7-digit SITC codes is given below:

Table 6-7

Pakistan Ex ports Details for Bed Linen

Description

Knit Bed Linen

Bed Sheets

Pillow Covers

Bed Linen nes.

Non-Knit Bed Linen of Cotton

Bed Sheet Mill made

Bed Sheet Hand loom

Bed Cover Mill made

Bed Cover Hand loom

Fitted Sheet Mill made

Fitted Sheet Hand loom

Pillow Cover Mill made

Pillow Cover Hand loom

Khes Hand loom

Quilts

Ghilaf with Embroidery

Bed Linen nes.

Non-Knit Bed Linen of Other Textiles

Bed Sheet Mill made

Bed Sheet Hand loom

Bed Cover Mill made

Bed Cover Hand loom

Fitted Sheet Mill Made

Fitted Sheet Hand loom

Pillow Cover Mill made

Pillow Cover Hand loom

Khes Hand loom

Quilt Cover

Bed Linen nes

SITC Code

65841

6584101

6584102

6584109

1999-2000

2000-2001

2.87

0.29

0.40

3.32

1.41

0.34

6584201

6584202

6584203

6584204

6584205

6584206

6584207

6584208

6584211

6584212

658213

6584219

306.1

1.13

3.23

0.51

50.72

0.02

23.41

0.36

0.26

117.55

0.11

0.53

319.05

1.11

4.03

0.19

61.1

0.01

27.62

0.32

0.28

107.42

6584301

6584302

6584303

6584304

6584305

6584306

6584307

6584308

6584311

6584312

6584319

121.12

0.16

0.25

0.22

11.90

133.96

0.23

0.54

0.08

13.93

0.46

18.14

0.05

Total

13.72

0.19

0.05

53.46

0.31

709.59

8

PREF-52/August, 2002/1

(Value in $ Million)

0.92

56.77

1.26

752.53

Pre-Feasibility Study

Bed Linen Stitching Unit

7 MACHINERY REQUIREMENT

Table 7-1

Machinery Details 4

Description

Cutting Machine

Lock Stitch (Single Needle)

Safety Stitching Over Lock (5 Thread)

Other Equipment

Electric Wiring (per machine)

Machine Base Tool

Machines

Required

1

18

2

Cost/Machine

(Rs)

85,000

32,500

85,000

18

18

1,000

1,500

Total Cost

(Rs)

85,000

585,000

170,000

18,000

27,000

Total (Rs)

885,000

All the required stitching machinery is easily available in the market. The stitching

machinery is available in quite a diversified range of suppliers & origins, i.e. Japanese,

Italian, Chinese, Korean and Taiwanese origin. There is a substantial difference between

their prices. European and Japanese machinery is 2 to 3 times more expensive as compared

to Chinese or Far Eastern machinery. Second hand machinery of different origins is also

available in the local market.

Table 7-2

Other Equipment Details

Description

Furniture & Fixture

Office Equipment

Telephone Set

Fax

Computer

Printer

Air conditioner

Carpeting

Total Cost

Number

Rate (Rs)

90,000

Cost (Rs)

90,000

2

1

1

1

1

300 Sq ft

1,500

7,000

35,000

7,000

45,000

20

3,000

7,000

35,000

7,000

45,000

6,000

193,000

8 HUMAN RESOURCE REQUIREMENT

The stitching operators will be paid on piece rate basis. The rates given in the below table:

Table 8-1: -Stitching Charges

Description

Stitching Operators

Rate

Rs. 8.00 Per Set

The machines used in the proposed project is Juki brand, which are assembled in China

9

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

Table 8-2: -Human Resource Requirement

Description

Required

Salary/Month

(Rs)

1

1

1

2

30,000

12,000

7,000

3,000

360,000

144,000

84,000

72,000

660,000

1

1

1

1

2

3

3

2

1

10,000

10,000

8,000

5,000

4,000

2,500

2,500

2,500

1,500

120,000

120,000

96,000

60,000

96,000

90,000

90,000

60,000

18,000

750,000

Administrative Staff

CEO/Owner

Marketing Manager

Accounts

Security Guards

Total

Direct Labor

Production In charge

Stitching Supervisor

Cutting Master

Finishing Supervisor

Rowing Inspector

Clippers

Packaging Staff

Final Table Inspector

Technician/Electrician (part time)

Total Direct Labor

Salary/Yearly

(Rs)

9 LAND & BUILDING

9.1

Total La nd Re qui re me nt

The detail regarding the area required for a Bed Linen unit of 20 stitching machines is

given below:

Table 9-1

Covered Area Requirement

Description

Production Area

Cutting Area

Inspection Room

Raw Material Store

Finished Goods Store

Management Building

Free Space

Total

9.2

Required Area (sq. ft)

1,600

400

700

400

400

300

700

4,500

Re ntal De tails

It is recommended that this project should be started in a rented building, as this will

reduce the initial capital cost of the project. An appropriate premises is generally available

in many commercial/industrial areas of the main clusters of Bed Linen. One year rent will

be paid in advance.

10

PREF-52/August, 2002/1

Pre-Feasibility Study

Table 9-2

Bed Linen Stitching Unit

Rent Cost

Rent Cost

Building rent cost (@ Rs. 15,000 per 4,500 sq. ft)

9.3

Monthly Rent

(Rs)

15,000

Annual Rent

(Rs)

180,000

Sui table Locat io ns

The clusters of Bed Linen stitching industry exist predominantly in Karachi, Faisalabad,

Lahore and Multan. Most of the Bed Linen manufacturers are based in these major cities,

so it is recommended that such unit should be started in these areas. The basic criteria for

the selection of location within these clusters should be the accessibility of skilled

manpower and easy accessibility of raw material. Also, basic utilities like electricity, water

and public transport are a must for the establishment of such sort of unit.

9.4

?

?

?

Uti li tie s Re qui re me nts

Electricity

Telephone

Water

11

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

10 PROJECT ECONOMICS

Table 10-1

Project Cost/Capital Requirements

Project Costs

Plant & Machinery

Furniture & Fixtures

Office Equipment

Pre-Operating Costs 5

Total Fixed Cost

885,000

90,000

103,000

137,000

1,215,000

Raw Material Inventory

Advance Building rent

Pre paid Insurance

Working Capital

2,170,680

180,000

32,340

2,383,019

Total Investment in Project

3,598,019

Table 10-2

Financing Plan

Equity

Debt

Long Term Loan

Short Term (Running Finance)

Total Debt

50 %

50 %

1,799,009

1,799,009

1,799,009

1,799,009

Major portion of investment is required for working capital, due to which the debt

recommended for the project is in form of short term because majority of investment will

be in raw material etc.

Table 10-3

Project Returns

Internal Rate of Return

Net Present Value (NPV) (Rs)

Payback Period (Years)

69.07%

12,049,513

5.33

These expenses are incurred before the unit is operational, e.g. salaries of key personal for 1 month,

stationery, company formation expenses, legal and registration charge, etc.

12

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

11 KEY SUCCESS FACTORS

The commercial viability of this Bed Linen stitching unit depends on the regular export

orders, which means a very effective marketing of the product in the international market.

One of the important factors in success of this business is procurement of raw material,

especially the grey woven fabric which is manufactured in a huge quantity. Due to which,

there is a huge fluctuation in the price of grey fabric. With better information regarding

quality manufactures and lower prices, a high profit margin can be attained.

Another aspect, which is mostly over- looked in this sector, is R&D. If the company has an

effective R&D department, it can come up with new designs, color schemes or innovative

packaging. This will increase the sales and also help in building high quality image of the

product, hence moving the product to upper tiers & quality conscious market segment,

resulting in higher profit margins.

Following are some of the points that have to be ensured to make this business successful:

?

?

?

?

?

Assurance of high consistent quality

Surety of products delivery on time

Competitive Rates

Cost efficiency through better managerial techniques

Better services to customers, i.e. claim settlement, etc.

12 THREATS FOR THE BUSINESS

Due to the low capital requirement of the business there has been an increase in the number

of commercial Bed Linen stitching units, which has resulted in an increase in competition

Internationally.

The elimination of quotas in 2004 will make it harder to compete. This might decrease the

profit margins in international market. Competition will be based on product quality and

competitive prices.

13

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

13 FINANCIAL ANALYSIS

13.1 Pro je cte d I nco me State me nt

Project Income Statement

SMEDA

In Rs

Year-1

Year-2

Year-3

Year-4

Year-5

Year-6

Year-7

Year-8

Year-9

Year-10

Sales

95,184,281

104,575,797

86,976,920

94,856,006

103,129,558

106,223,444

109,410,148

112,692,452

116,073,226

119,555,423

COST OF GOODS SOLD

Raw Material

Quota Cost

Payroll (Production Staff)

Machine Maintenance

Direct Electricity

Stationery

Clearing Cost

Sea Freight

Total

63,086,880

24,986,250

750,000

112,500

164,448

237,961

562,500

3,375,000

93,275,538

68,602,525

26,652,000

968,000

121,200

180,893

261,439

600,000

3,600,000

100,986,057

74,309,354

1,244,485

128,775

198,982

217,442

637,500

3,825,000

80,561,538

80,212,788

1,594,405

136,350

218,880

237,140

675,000

4,050,000

87,124,563

86,318,390

2,036,409

143,925

240,768

257,824

712,500

4,275,000

93,984,817

88,000,272

2,464,055

143,925

264,845

265,559

712,500

4,275,000

96,126,156

89,715,347

2,981,507

143,925

291,329

273,525

712,500

4,275,000

98,393,134

91,464,274

3,607,623

143,925

320,462

281,731

712,500

4,275,000

100,805,516

93,247,726

4,365,224

143,925

352,509

290,183

712,500

4,275,000

103,387,067

95,066,388

5,281,921

143,925

387,760

298,889

712,500

4,275,000

106,166,382

Gross Profit

1,908,743

3,589,740

6,415,382

7,731,443

9,144,741

10,097,288

11,017,014

11,886,936

12,686,159

13,389,040

OPERATING EXPENSE

Payroll (Admin)

Payroll (Marketing and Sale)

Fixed electricity

Insurance Expense

Administrative & Factory Overheads

Amortization (Pre-operational Expenses)

Depreciation

Total

516,000

144,000

298,966

32,340

485,440

13,700

107,800

1,598,246

567,600

158,400

328,862

29,106

543,794

13,700

107,800

1,749,263

624,360

174,240

361,749

25,872

461,152

13,700

107,800

1,768,872

686,796

191,664

397,923

22,638

512,795

13,700

107,800

1,933,317

755,476

210,830

437,716

19,404

568,467

13,700

107,800

2,113,393

831,023

231,913

481,487

16,170

597,019

13,700

107,800

2,279,113

914,125

255,105

529,636

12,936

627,009

13,700

107,800

2,460,311

1,005,538

280,615

582,600

9,702

658,510

13,700

107,800

2,658,465

1,106,092

308,677

640,860

6,468

691,599

13,700

107,800

2,875,195

1,216,701

339,544

704,946

3,234

726,355

13,700

107,800

3,112,280

Operating Profit

310,497

1,840,477

4,646,510

5,798,126

7,031,349

7,818,176

8,556,703

9,228,471

9,810,964

10,276,760

NON-OPERATING EXPENSE

Financial Charges on Running Finance

Building Rental

Total

287,842

179,998

467,840

686,965

197,998

884,963

703,883

217,798

921,681

40,512

239,578

280,090

0

263,536

263,536

0

289,889

289,889

0

318,878

318,878

0

350,766

350,766

0

385,843

385,843

0

424,427

424,427

(157,343)

713,882

(871,225)

0

(871,225)

955,514

784,318

171,195

(871,225)

(700,029)

3,724,828

652,327

3,072,501

(700,029)

2,372,472

5,518,036

711,420

4,806,616

2,372,472

7,179,088

6,767,813

773,472

5,994,341

7,179,088

13,173,429

7,528,286

796,676

6,731,611

13,173,429

19,905,040

8,237,825

820,576

7,417,248

19,905,040

27,322,288

8,877,705

845,193

8,032,512

27,322,288

35,354,800

9,425,122

870,549

8,554,572

35,354,800

43,909,372

9,852,334

896,666

8,955,668

43,909,372

52,865,040

PROFIT BEFORE TAX

Tax

PROFIT AFTER TAX

Retained Earnings beginning of year

Retained Earnings end of year

14

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

13.2 Pro je cte d Bala nce She e t

Project Balance Sheet

SMEDA

In Rs

Const Year

Year-1

Year-2

Year-3

Year-4

Year-5

Year-6

Year-7

Year-8

Year-9

Year-10

Current Assets

Cash

Equipment Spare Parts Inventory

Up-Front Insurance payment

Stocks and Inventory

Receivable

Pre-paid building rent

Total

32,340

2,170,680

179,998

2,383,019

50,000

2,344

29,106

2,361,700

4,759,214

197,998

7,400,362

50,000

2,525

25,872

2,559,493

5,228,790

217,798

8,084,478

50,000

2,683

22,638

2,764,252

4,348,846

239,578

7,427,997

4,403,929

2,841

19,404

2,976,178

4,742,800

263,536

12,408,688

10,331,556

2,998

16,170

3,035,702

5,156,478

289,889

18,832,793

17,030,633

2,998

12,936

3,096,416

5,311,172

318,878

25,773,033

24,408,314

2,998

9,702

3,158,344

5,470,507

350,766

33,400,632

32,393,806

2,998

6,468

3,221,511

5,634,623

385,843

41,645,248

40,893,453

2,998

3,234

3,285,941

5,803,661

424,427

50,413,715

52,969,880

2,998

5,977,771

466,869

59,417,519

Gross Fixed Assets

Less: Accumulated depreciation

Net Fixed Assets

1,078,000

1,078,000

1,078,000

107,800

970,200

1,078,000

215,600

862,400

1,078,000

323,400

754,600

1,078,000

431,200

646,800

1,078,000

539,000

539,000

1,078,000

646,800

431,200

1,078,000

754,600

323,400

1,078,000

862,400

215,600

1,078,000

970,200

107,800

1,078,000

1,078,000

-

137,000

137,000

123,300

123,300

109,600

109,600

95,900

95,900

82,200

82,200

68,500

68,500

54,800

54,800

41,100

41,100

27,400

27,400

13,700

13,700

Total Assets

3,598,019

8,493,862

9,056,478

8,278,497

13,137,688

19,440,293

26,259,033

33,765,132

41,888,248

50,535,215

59,417,519

Current Liabilities

Running Finance

Accounts payable

Total

1,799,009

1,799,009

4,293,532

3,272,546

7,566,078

4,399,270

3,558,227

7,957,498

253,201

3,853,814

4,107,015

4,159,590

4,159,590

4,467,855

4,467,855

4,554,984

4,554,984

4,643,834

4,643,834

4,734,439

4,734,439

4,826,833

4,826,833

4,753,469

4,753,469

Equity

Paid-up Capital

Retained Earnings

Total

1,799,009

1,799,009

1,799,009

(871,225)

927,785

1,799,009

(700,029)

1,098,980

1,799,009

2,372,472

4,171,482

1,799,009

7,179,088

8,978,097

1,799,009

13,173,429

14,972,438

1,799,009

19,905,040

21,704,049

1,799,009

27,322,288

29,121,298

1,799,009

35,354,800

37,153,809

1,799,009

43,909,372

45,708,382

1,799,009

52,865,040

54,664,049

Total Liabilities And Equity

3,598,019

8,493,862

9,056,478

8,278,497

13,137,688

19,440,293

26,259,033

33,765,132

41,888,248

50,535,215

59,417,519

Intangible Assets

Pre-operational Expenses

Total

Long-term liabilities

Total

15

PREF-52/August, 2002/1

Pre-Feasibility Study

Bed Linen Stitching Unit

13.3 Pro je cte d Cas h flo w State me nt

Project Cash Flow Statement

SMEDA

In Rs

Const Year

Operating activities

Net profit

Amortization (Pre-operational Expenses)

Depreciation

Accounts receivable

Equipment Spare Parts Inventory

Up-Front Insurance payment

Stocks-RM

Accounts payable

Cash provided by operations

Financing activities

Add: building rent expense

Building rent payment

Running Finance Repayment

Issuance of share

Cash provided by/ (used for) financing activities

Total

Investing activities

Capital expenditure

Cash (used for)/ provided by investing activities

Net Cash

Cash balance brought forward

Cash Balance

Running Finance

Cash carried forward

Year-1

Year-2

Year-3

Year-5

Year-6

Year-7

Year-8

Year-9

Year-10

(871,225)

13,700

107,800

(4,759,214)

(2,344)

3,234

(191,020)

3,272,546

(2,426,522)

171,195

13,700

107,800

(469,576)

(181)

3,234

(197,792)

285,681

(85,939)

3,072,501

13,700

107,800

879,944

(158)

3,234

(204,759)

295,587

4,167,849

4,806,616

13,700

107,800

(393,954)

(158)

3,234

(211,926)

305,776

4,631,087

5,994,341

13,700

107,800

(413,678)

(158)

3,234

(59,524)

308,264

5,953,980

6,731,611

13,700

107,800

(154,694)

3,234

(60,714)

87,130

6,728,066

7,417,248

13,700

107,800

(159,335)

3,234

(61,928)

88,850

7,409,569

8,032,512

13,700

107,800

(164,115)

3,234

(63,167)

90,605

8,020,568

8,554,572

13,700

107,800

(169,039)

3,234

(64,430)

92,394

8,538,232

8,955,668

13,700

107,800

(174,110)

3,234

3,285,941

(73,364)

12,118,869

179,998

(197,998)

(1,799,009)

197,998

(217,798)

(4,293,532)

217,798

(239,578)

(4,399,270)

239,578

(263,536)

(253,201)

263,536

(289,889)

-

289,889

(318,878)

-

318,878

(350,766)

-

350,766

(385,843)

-

385,843

(424,427)

-

424,427

(466,869)

-

(1,817,009)

(4,313,331)

(4,421,050)

(277,159)

(26,354)

(28,989)

(31,888)

(35,077)

(38,584)

(42,443)

(584,009)

(4,243,532)

(4,399,270)

(253,201)

4,353,929

7,985,492

8,499,647

12,076,427

(1,215,000)

(1,215,000)

(1,799,009)

(1,799,009)

1,799,009

-

(4,243,532)

(4,243,532)

4,293,532

50,000

(4,399,270)

50,000

(4,349,270)

4,399,270

50,000

(253,201)

50,000

(203,201)

253,201

50,000

4,353,929

5,927,627

6,699,077

7,377,681

7,985,492

50,000

4,403,929 10,331,556 17,030,633 24,408,314

4,403,929 10,331,556 17,030,633 24,408,314 32,393,806

4,403,929 10,331,556 17,030,633 24,408,314 32,393,806

8,499,647

32,393,806

40,893,453

40,893,453

12,076,427

40,893,453

52,969,880

52,969,880

(32,340)

(2,170,680)

(2,203,020)

(179,998)

1,799,009

1,619,011

16

PREF-52/August, 2002/1

Year-4

5,927,627

6,699,077

7,377,681

Pre-Feasibility Study

Bed Linen Stitching Unit

13.4 Ratio Analys is

Ratio Analysis

SMEDA

Year 1

Profitability ratios

Gross profit margin on sales

Operating Profit on Sales

Net profit margin on sales

ROA

ROE

Liquidity ratios

Current ratio

Quick ratio (Acid Test)

Year 2

2.0%

0.33%

-0.92%

-10.26%

-63.90%

3.4%

1.76%

0.16%

1.89%

16.89%

Year 3

Year 4

7.4%

5.34%

3.53%

37.11%

116.59%

Year 5

8.2%

6.11%

5.07%

36.59%

73.11%

Year 6

8.9%

6.82%

5.81%

30.83%

50.06%

Year 7

9.5%

7.36%

6.34%

25.64%

36.71%

0.99

0.68

1.03

0.71

1.83

1.16

3.00

2.29

4.23

3.55

5.67

4.99

Asset management ratios

Inventory turnover ratio

Days sales outstanding

Fixed assets turnover ratio

Total assets turnover ratio

40

8

98

11

41

14

121

12

31

17

115

11

32

14

147

7

34

14

191

5

34

15

246

4

Debt management ratios

Debt ratio

Times interest earned

Debt service coverage ratio

51%

1.08

0.15

49%

2.68

0.37

3%

6.60

0.91

143.12

19.74

17

PREF-52/August, 2002/1

Year 8

10.1%

7.82%

6.78%

21.97%

29.19%

Year 9

Year 10

10.5%

8.19%

7.13%

19.18%

24.24%

10.9%

8.45%

7.37%

16.93%

20.65%

11.2%

8.60%

7.49%

15.07%

17.84%

7.20

6.52

8.80

8.12

10.45

9.77

12.50

12.50

35

15

338

3

35

15

523

3

35

15

1,077

2

15

2

Pre-Feasibility Study

Bed Linen Stitching Unit

14 KEY ASSUMPTIONS

Table 14-1

Operating Related Assumptions

Hours operational per day

Days operational per month

Days operational per year

Table 14-2

Production Related Assumptions

Annual production capacity

Capacity utilization (1st Year)

Capacity growth rate (yearly)

Maximum Capacity utilization

First Year production utilization

Table 14-3

7.27

3%

$1= Rs 60/-

Raw Material Related Assumptions

Grey fabric 35 x 35/76 x 56 112(Rs)

Weighted average consumption Fabric per set

Printing cost per Meter (Rs)

Stitching & cutting cost per set (Rs)

Packaging cost (Rs)

Cutting Wastage

Printing Wastage

Quota charges per set (2 year) 6 (Rs)

Raw material price growth rate

6

15

15

15

1

Revenue Related Assumptions

Weighted average sale price ($)

Sale price growth rate

Dollar conversation rate

Table 14-6

10%

10%

5%

5%

Cash Flow Related Assumptions

Accounts Receivable cycle (in days)

Accounts Payable cycle (in days)

Raw material inventory (in days)

Equipment spare part inventory (in months)

Table 14-5

300,000 Sets

75%

5%

95%

225,000 Sets

Economic Related Assumptions

Electricity growth rate

Wages growth rate

Office equipment growth

Machine maintenance growth rate

Table 14-4

8

25

300

Quota charges will not be applicable after Dec. 2004.

18

PREF-52/August, 2002/1

34.75/meter

5.55 meter

10

8.5

15

3%

3%

111.05

2%

Pre-Feasibility Study

Table 14-7

Bed Linen Stitching Unit

Expense Related Assumptions

Administrative overhead (% of sales)

Office Expenses (stationery, entertainment, etc.)

Sea freight cost of export per set ($)

Forwarding/ Clearing cost per set (Rs)

Insurance rate (Annual)

Rent growth rate

Pre-paid building rent (months)

Growth rate in spare part inventory

Tax treatment

Table 14-8

Depreciation Related Assumptions

Machinery & Equipment depreciation rate

Furniture & Fixtures

Table 14-9

1%

2%

0.25

2.50

3%

5%

12

10%

0.75% of Sales Revenue

10%

10%

Financial Related Assumptions

Project life (Years)

Equity

Debt

Interest rate on short term debt

Discount rate for calculation of NPV

10

50%

50%

14%

20%

19

PREF-52/August, 2002/1

You might also like

- Bed Linen StitchingDocument20 pagesBed Linen Stitchingpradip_kumarNo ratings yet

- Fabric Weaving Unit Auto LoomsDocument21 pagesFabric Weaving Unit Auto LoomsAjay KarwaNo ratings yet

- Plant Design &economicsDocument55 pagesPlant Design &economicsGalata Bane100% (1)

- Yarn Count/Yarn Size/ Yarn NumberDocument15 pagesYarn Count/Yarn Size/ Yarn NumberManjul MungaliNo ratings yet

- Sewing MachinesDocument61 pagesSewing Machinesaqsa imranNo ratings yet

- Project of Textile DepartmentDocument13 pagesProject of Textile DepartmentsachinNo ratings yet

- Spring Air MatressDocument20 pagesSpring Air MatressAnuj GoelNo ratings yet

- Guideline Functional Safety EN 2022 135242Document138 pagesGuideline Functional Safety EN 2022 135242Margin Sorin100% (1)

- Technical Guide On Internal Audit of Textile Industry - Draft Form CA. HarshaDocument82 pagesTechnical Guide On Internal Audit of Textile Industry - Draft Form CA. HarshaManasa Ravi100% (2)

- Factors Affecting Sickness of Textile IndustriesDocument24 pagesFactors Affecting Sickness of Textile IndustriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Textile-Health and SafetyDocument26 pagesTextile-Health and SafetyRaj KumarNo ratings yet

- M01 Understand GarmentnproductinDocument51 pagesM01 Understand GarmentnproductinJocy ShiferaNo ratings yet

- Textile ProcessDocument149 pagesTextile ProcesskrismanishNo ratings yet

- Knitting Assignment-Types of TextilesDocument32 pagesKnitting Assignment-Types of TextilesOwaiste0% (1)

- Testing10 Quality ConclusionDocument18 pagesTesting10 Quality ConclusionalirrehmanNo ratings yet

- Zeden Automation SystemsDocument10 pagesZeden Automation SystemsYashvanth ShettyNo ratings yet

- Carding For Nonwoven Fabrics: (Lap Form To Web Formation)Document23 pagesCarding For Nonwoven Fabrics: (Lap Form To Web Formation)Shashi sssNo ratings yet

- Internship Project at NaharDocument89 pagesInternship Project at NaharShreya Bahl100% (2)

- Cotton QualityDocument13 pagesCotton QualityWaqas AkramNo ratings yet

- BASE Textiles LimitedDocument76 pagesBASE Textiles LimitedPushpa BaruaNo ratings yet

- Fabric Manufacturing Process PDFDocument2 pagesFabric Manufacturing Process PDFMaciel75% (4)

- Akshara Spinning MillsDocument42 pagesAkshara Spinning MillsbalaNo ratings yet

- Higg FEM How To Higg Guide 2017 ENGLISHDocument213 pagesHigg FEM How To Higg Guide 2017 ENGLISHNguyen Hoang100% (1)

- Raymond Visit ReportDocument12 pagesRaymond Visit ReportMandy Terrell100% (1)

- CTM EditedDocument32 pagesCTM Editednavdeep143No ratings yet

- Textile Handbook-1Document36 pagesTextile Handbook-1Celeste Rodríguez100% (1)

- KNT 305Document113 pagesKNT 305Farhad Rana100% (2)

- CVDocument3 pagesCVMansoor Khanali100% (1)

- Arvind Textiles Internship ReportDocument107 pagesArvind Textiles Internship ReportDipan SahooNo ratings yet

- ProcessingDocument49 pagesProcessingFatih Aydin100% (1)

- Steps To Be Taken For Quality Improvement of Textile ProcessingDocument4 pagesSteps To Be Taken For Quality Improvement of Textile ProcessingRezaul Karim TutulNo ratings yet

- The Impact of Energy Crisis On Textile SectorDocument4 pagesThe Impact of Energy Crisis On Textile SectorAymen SaeedNo ratings yet

- Tuvsud Practical GuideDocument44 pagesTuvsud Practical GuidejoaopaulodasilvaNo ratings yet

- HSE PLAN UZBEKISTAN PAVILION Rev16072020Document38 pagesHSE PLAN UZBEKISTAN PAVILION Rev16072020Amir khanNo ratings yet

- Textile ScienceDocument22 pagesTextile ScienceAbhinav VermaNo ratings yet

- Report On Spinning & Weaving FactoryDocument149 pagesReport On Spinning & Weaving FactoryMehzabeen ShahidyNo ratings yet

- Apparel Quality Management: Assignment-2Document46 pagesApparel Quality Management: Assignment-2Shivani JayanthNo ratings yet

- Speed Frame Operator 2.0Document73 pagesSpeed Frame Operator 2.0Danish NawazNo ratings yet

- Important Setting Point of A Carding MachineDocument5 pagesImportant Setting Point of A Carding MachineNaimul Hasan100% (1)

- Report On KnitwearDocument5 pagesReport On KnitwearHSNo ratings yet

- TTQCDocument7 pagesTTQCFiroz Rashid100% (1)

- The Kohinoor Textile Mills Limited (KTML) : Long ReportDocument30 pagesThe Kohinoor Textile Mills Limited (KTML) : Long ReportSaad ShafiqNo ratings yet

- Stenter Machine Operator ManualDocument42 pagesStenter Machine Operator ManualGopuk KNo ratings yet

- Topic: "A Study On Productivity Efficiency of Textile Industry of India"Document5 pagesTopic: "A Study On Productivity Efficiency of Textile Industry of India"Divya SinghNo ratings yet

- Publications: Fibre & YarnDocument14 pagesPublications: Fibre & YarnvigneshbalajirsNo ratings yet

- Checklist Based On Dye House (Points) PDFDocument112 pagesChecklist Based On Dye House (Points) PDFNarender Mehra SethNo ratings yet

- BBW Nicer Work ReportDocument32 pagesBBW Nicer Work Reportrahib203No ratings yet

- Industrial Report On Opex and Sinha Textile Group: Nasif ChowdhoaryDocument95 pagesIndustrial Report On Opex and Sinha Textile Group: Nasif Chowdhoaryদীপ্তি হুমাইরাNo ratings yet

- Kohinoor Mills Limited: Internship Report Hira TariqDocument33 pagesKohinoor Mills Limited: Internship Report Hira TariqZeeshan MunawarNo ratings yet

- Summer Training ProjectDocument50 pagesSummer Training ProjectNeha SinglaNo ratings yet

- Industrialattachmentofnazbangladeshltd 140515042508 Phpapp02Document198 pagesIndustrialattachmentofnazbangladeshltd 140515042508 Phpapp02Ripon SayanNo ratings yet

- Apparel Automation SolutionsDocument2 pagesApparel Automation Solutionssajjad_naghdi241No ratings yet

- Morarjee 1Document49 pagesMorarjee 1Anand SinghNo ratings yet

- Aarvee Denim (Final Report)Document52 pagesAarvee Denim (Final Report)DarshitSejpara100% (2)

- Kohinoor Textile MILLS, LTDDocument16 pagesKohinoor Textile MILLS, LTDBilal NaseerNo ratings yet

- SMEDA Fabric Weaving Unit (Auto Looms)Document18 pagesSMEDA Fabric Weaving Unit (Auto Looms)Shoaib Kamran100% (1)

- Embroidery Unit CommercialDocument18 pagesEmbroidery Unit CommercialtakembluesNo ratings yet

- Cotton Towels Manufacturing UnitDocument20 pagesCotton Towels Manufacturing UnitNaveenbabu SoundararajanNo ratings yet

- SMEDA Lingerie Stitching UnitDocument19 pagesSMEDA Lingerie Stitching UnitArshad Iqbal Bhatti100% (1)

- Production Process of BagsDocument22 pagesProduction Process of BagsHimanshu Bhatia100% (4)

- Oracle Fusion Chart of Accounts CreationDocument41 pagesOracle Fusion Chart of Accounts CreationshankarNo ratings yet

- Social Cost Benefit AnalysisDocument13 pagesSocial Cost Benefit AnalysisMohammad Nayamat Ali Rubel100% (1)

- Internal Control Policy Manual SCHOOLSDocument23 pagesInternal Control Policy Manual SCHOOLSmaryann lumactaoNo ratings yet

- Kase Fund Letter To Investors-Q1 14Document4 pagesKase Fund Letter To Investors-Q1 14CanadianValue100% (1)

- Understanding Service FailureDocument20 pagesUnderstanding Service FailureAnonymous H0SJWZE8No ratings yet

- Swink Chapter 1Document4 pagesSwink Chapter 1Milo MinderbenderNo ratings yet

- Wbut Mba 1 Business Economics 2012Document7 pagesWbut Mba 1 Business Economics 2012Hiral PatelNo ratings yet

- BLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.Document1 pageBLANKING VAM TOP ® 2.875in. 7.8lb-ft API Drift 2.229in.BaurzhanNo ratings yet

- Latihan Asas PerniagaanDocument36 pagesLatihan Asas PerniagaanKhairi A.RahmanNo ratings yet

- 2.shivananda Flyover - Tender Doc - Tec PDFDocument78 pages2.shivananda Flyover - Tender Doc - Tec PDFBirat PanthiNo ratings yet

- Sap SD BillingDocument236 pagesSap SD Billinggl_sudhir765386% (7)

- Aditya Birla Money Mart LTD.: Wealth Management DivisionDocument25 pagesAditya Birla Money Mart LTD.: Wealth Management DivisionAbhijeet PatilNo ratings yet

- 04 - Invesco European Bond FundDocument2 pages04 - Invesco European Bond FundRoberto PerezNo ratings yet

- Pakistan Ordnance FactoriesDocument1 pagePakistan Ordnance FactoriesBDO3 3J SolutionsNo ratings yet

- Engineering Economics FormularsDocument9 pagesEngineering Economics FormularsFe Ca Jr.No ratings yet

- Business PlanDocument5 pagesBusiness PlanSEGA CYBERNo ratings yet

- Ranchi Women's CollegeDocument5 pagesRanchi Women's Collegevarsha kumariNo ratings yet

- Final DabbawalaDocument68 pagesFinal DabbawalaVaishali MishraNo ratings yet

- Internship Ahsan AkhterDocument42 pagesInternship Ahsan Akhterinzamamalam515No ratings yet

- Strategic Management ReportDocument33 pagesStrategic Management ReportLuxme PokhrelNo ratings yet

- BriefDocument3 pagesBriefVăn LộcNo ratings yet

- Project List (Updated 11 30 12) BADocument140 pagesProject List (Updated 11 30 12) BALiey BustamanteNo ratings yet

- Mobil Annual Report 2016 FinalDocument204 pagesMobil Annual Report 2016 FinalDebashish NiloyNo ratings yet

- File SPI TambahanDocument76 pagesFile SPI Tambahansyarifah SPNo ratings yet

- SCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDocument23 pagesSCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDenny SheatsNo ratings yet

- 2006 Cpbi PrimerDocument5 pages2006 Cpbi PrimerkatherineNo ratings yet

- Company Profile Deeco PaperDocument12 pagesCompany Profile Deeco PaperMikee DeeNo ratings yet

- 320C10Document59 pages320C10Kara Mhisyella Assad100% (2)

- Classic Pen ABCDocument5 pagesClassic Pen ABCdebojyoti88No ratings yet

- Btled He Final ExamDocument8 pagesBtled He Final ExamVignette San AgustinNo ratings yet