Professional Documents

Culture Documents

Military Land Vehicle Electronics (Vetronics) Market 2014-2024 - Communications, Computing, Sensors & Remote Weapon Stations (RWS) - Yahoo Finance Canada

Uploaded by

lavishpants5838Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Military Land Vehicle Electronics (Vetronics) Market 2014-2024 - Communications, Computing, Sensors & Remote Weapon Stations (RWS) - Yahoo Finance Canada

Uploaded by

lavishpants5838Copyright:

Available Formats

Military Land Vehicle Electronics (Vetronics) Market 20142024 - Communications, Computing, Sensors & Remote Weapon Stations (RWS)

- Yahoo Finance Canada

Military Land Vehicle Electronics (Vetronics) Market 2014-2024 - Communications, Computing, Sensors & Remote Weapon Stations (RWS) - Yahoo Finance Canada

LONDON, March 13, 2014 /PRNewswire/ -- Reportbuyer.com just published a new market research report: Military Land Vehicle Electronics (Vetronics) Market 2014-2024 - Communications, Computing, Sensors & Remote Weapon Stations (RWS) Report Details The world military land vehicle electronics market will experience a turbulent start to the forecast period in this report. Having grown from relatively small beginnings prior to the US invasion of Afghanistan in 2001, the experience of long troop deployment abroad has seen the military land vehicle electronics market rise greatly in prominence and value, largely thanks to concerted efforts at investment by the USA. Driven both by the desire to increase the levels of information exchange possible between mounted ground troops and air assets and by efforts to increase solders' protection from asymmetric threats such as IED and RPG attack, the amount of electronics carried by military land vehicles has increased dramatically. Visiongain expects the world land vehicle electronics market to be worth $3.3bn in 2014. Visiongain's report the Military Land Vehicle Electronics (Vetronics) Market 2014-2024: Communications, Computing, Sensors & Remote Weapon Stations (RWS) offers one of the most detailed and authoritative quantitative and qualitative analyses on the military land vehicle electronics market to date. This comprehensive report forecasts 15 leading national markets and 5 technology submarkets and includes profiles of 15 leading companies in the military land vehicle electronics market, which detail company market share, market revenue and contracts signed within the market. Why you should buy the Military Land Vehicle Electronics (Vetronics) Market 2014-2024: Communications, Computing, Sensors & Remote Weapon Stations (RWS) Visiongain's comprehensive analysis contains highly quantitative content delivering solid conclusions benefiting your analysis and illustrates new opportunities and potential revenue streams helping you to remain competitive. This definitive report will benefit your decision making and help to direct your future business strategy. Avoid falling behind your competitors, missing critical business opportunities or losing market influence. In our new report you will discover forecasts from 2014-2024 at the global, submarket, and national level. The report also assesses technologies, competitive forces and political developments. Discover the future prospects for the military land vehicle electronics market.

Why choose Visiongain business intelligence? Visiongain's increasingly diverse sector coverage strengthens our research portfolio. The growing cross-sector convergence of key verticals and the interplay of game changing technologies across hitherto unrelated industries are creating new synergies, resulting in new business opportunities for you to leverage. Visiongain's team of London based in-house analysts offer a wealth of knowledge and experience to inform your strategic business decisions. Let visiongain guide you. We guarantee that you will receive key information which will benefit you in the following way o View world military land vehicle electronics market forecasts and analysis from 2014-2024 to keep your knowledge ahead of your competition and ensure you exploit key business opportunities - The report provides detailed sales projections of the military land vehicle electronics market, the competitors, and critical analysis of the commercial drivers and restraints allowing you to more effectively compete in the market. In addition to market forecasts from 2014-2024, our new study shows current market data and market shares of leading national markets and companies. o Why struggle to find key market data? Why miss crucial information? Our comprehensive report provides instant market insight - Our 168 page report provides unrivalled detail, with 179 tables, charts, and graphs and 249 market contracts and programmes detailed. Let our analysts present you with a thorough assessment of the current and future military land vehicle electronics systems market prospects. - This analysis will achieve quicker, easier understanding. Also you will gain from our analyst's industry expertise allowing you to demonstrate your authority on the military land vehicle electronics sector o Visiongain is one of the few business intelligence companies that provides full transcripts of primary research company interviews. Be part of this knowledge. Learn what industry thought leaders are thinking. Leaders hold critical information - By reading the exclusive expert interviews contained in the report you will keep up to speed with what is really happening in the market. Don't fall behind. You will gain a thorough knowledge on the military land vehicle electronics market, finding strategic advantages for your work and will learn how your organisation can benefit. - Read the full transcripts of exclusive expert opinion interviews from leading industry specialists informing your understanding and allowing you to assess prospects for investments and sales - Parvus Corporation - Tech Source o Discover sales predictions for the key end use submarkets from 2014-2023 - What are the secrets of the military land vehicle electronics industry's progress? How will these markets expand? Which submarkets will generate the most revenue? Use our forecasts and expert insight to grow your business and give you more industry influence. Find where you can gain and how your organisation can succeed. Avoid falling behind. - Stay informed about the potential for each of these military land vehicle electronics systems submarkets with individual forecasts and analysis from 2014-2024. - Command, Control & Communications Systems - Sensor Systems - Remote Weapon Stations - Computer, Power & Control Systems - Vehicle Protection Systems o Understand the prospects for the leading national military land vehicle electronics markets - where will the highest revenues and opportunities occur?

- Learn about the market potential for military land vehicle electronics companies in the developed and developing countries, from 2014 onwards. You will see where and how opportunities exist with revealing individual market forecasts and analysis from 2014-2024 for 15 leading national markets. - US forecast 2014-2024 - China forecast 2014-2024 - India forecast 2014-2024 - Russia forecast 2014-2024 - Saudi Arabia forecast 2014-2024 - Brazil forecast 2014-2024 - UK forecast 2014-2024 - Norway forecast 2014-2024 - South Korea forecast 2014-2024 - Canada forecast 2014-2024 - France forecast 2014-2024 - Germany forecast 2014-2024 - Turkey forecast 2014-2024 - Australia forecast 2014-2024 - Israel forecast 2014-2024 - Discover also a forecast for the Rest of the World (RoW) market: - Rest of the World forecast 2014-2024 o Find out about the market dynamics & opportunities in 15 leading countries - Understand industry activity with detailed data revealing where companies are earning their revenues and with what products and with which technology. - You will be able to examine 15 detailed tables revealing 249 significant regional contracts, projects & programmes as well as an additional table detailing significant contracts in the Rest of the World market. o Explore the factors affecting product developers, and everyone within the value chain. Learn about the forces influencing market dynamics. - Explore the strengths, weaknesses, opportunities and threats (SWOT) affecting market growth and commercial opportunities in the military land vehicle electronics market. Discover what the present and future outlook for business will be. Learn about the following business critical issues - Research and development (R&D) strategy - Technological issues and constraints. - Shifting demand and operational dynamics - Competition from new product types - Increasing industry consolidation. - Advances in product quality - Analysis of barriers to entry - Fiscal policy - Defence budgets - Procurement priorities o Identify who the leading companies are in the military land vehicle electronics market - we reveal their market share - Our report reveals the technologies and companies which hold the greatest potential. See where the expected gains will be. Prospects for advances in the military land vehicle electronics market are strong, and from 2014 it holds many opportunities for revenue growth. View visiongain's assessment of the prospects for established competitors, rising companies, and new market entrants. Our work explains that potential, helping you stay ahead. Gain a thorough understanding of the competitive landscape with profiles of 15 leading military land vehicle electronics companies examining their market share, positioning, capabilities, product portfolios, R&D activity, services, focus, strategies, M&A activity, and future outlook.

- BAE Systems - Bharat Electronics Limited (BEL) - Curtiss-Wright Corporation - Elbit Systems - Finmeccanica S.p.A. - General Dynamics Corporation - Harris Corporation - ITT Exelis - Kongsberg Gruppen ASA - Lockheed Martin Corporation - Rheinmetall AG - SRC Inc - Thales Group - ViaSat Inc - Volvo Group Discover Information found nowhere else in this independent assessment of the military electro optical and infrared systems market The Military Land Vehicle Electronics (Vetronics) Market 2014-2024: Communications, Computing, Sensors & Remote Weapon Stations (RWS) report provides impartial sector analysis. With the independent business intelligence found only in our work, you will discover key strategic advantages and prospects for profit. In particular: our informed forecasts, independent and objective analysis, exclusive interviews and revealing company profiles will provide you with that necessary edge, allowing you to gain ground over your competitors. With this report you are less likely to fall behind in knowledge or miss crucial business opportunities. You will save time and receive recognition for your market insight. See how you this report could benefit and enhance your research, analysis, company presentations and ultimately your individual business decisions and your company's prospects. What makes this report unique? Visiongain consulted widely with leading industry experts and full transcripts from these exclusive interviews with Parvus Corporation and with Tech Source are included in the report. Visiongain's research methodology involves an exclusive blend of primary and secondary sources providing informed analysis. This methodology allows insight into the key drivers and restraints behind market dynamics and competitive developments. The report therefore presents an ideal balance of qualitative analysis combined with extensive quantitative data including global, submarket and regional markets forecasts from 2014-2024. How the Military Land Vehicle Electronics (Vetronics) Market 2014-2024: Communications, Computing, Sensors & Remote Weapon Stations (RWS) report can benefit you Visiongain's report is for anyone requiring analysis of the military land vehicle electronics market. You will discover market forecasts, technological trends, predictions and expert opinion providing you with independent analysis derived from our extensive primary and secondary research. Only by purchasing this report will you receive this critical business intelligence revealing where revenue growth is likely and where the lucrative potential market prospects are. Don't miss this key opportunity to gain a competitive advantage.

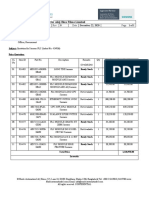

If you buy our report today your knowledge will stay one step ahead of your competitors. Discover how our report could benefit your research, analyses and strategic decisions, saving you time. To gain an understanding of how to tap into the potential of this market and stay one step ahead of the competition you must order now our report the Military Land Vehicle Electronics (Vetronics) Market 2014-2024: Communications, Computing, Sensors & Remote Weapon Stations (RWS) . Avoid missing out - order our report now. Visiongain is a trading partner with the US Federal Government CCR Ref number: KD4R6 Table of Contents 1. Executive Summary 1.1 World Military Land Vehicle Electronics Market Overview 1.2 Benefits of This Report 1.3 Who is This Report For? 1.4 Methodology 1.5 World Military Land Vehicle Electronics Market Forecast 2014-2024 1.6 World Military Land Vehicle Electronics Submarket Forecasts 2014-2024 1.7 Leading 15 National Military Land Vehicle Electronics Market Forecasts 2014-2024 2. Introduction to the World Military Land Vehicle Electronics Market Military Land Vehicle Electronics (Vetronics) Market 2014-2024 2.1 World Military Land Vehicle Electronics Market Background 2.2 World Military Land Vehicle Electronics Market Structure 2.3 World Military Land Vehicle Electronics Market Definition 2.4 World Military Land Vehicle Electronics Market Submarket Definitions 2.4.1 Command, Control & Communications (C3) Submarket Definition 2.4.2 Sensors Submarket Definition 2.4.3 Remote Weapons Stations (RWS) Submarket Definition 2.4.4 Computers, Power & Control Systems Submarket Definition 2.4.5 Vehicle Protection Systems Submarket Definition 3. World Military Land Vehicle Electronics Market 2014-2024 3.1 World Military Land Vehicle Electronics Market Forecast 2014-2024 3.2 World Military Land Vehicle Electronics Market Analysis 2014-2024 3.3 World Military Land Vehicle Electronics Market Drivers & Restraints 3.4 Sources of Growth & Contraction in the World Military Land Vehicle Electronics Market 4. World Military Land Vehicle Electronics Submarket Forecasts 2014-2024 4.1 Military Land Vehicle Electronics Submarket Forecast Comparison 2014-2024 4.2 Military Land Vehicle Command, Control and Communications Submarket Forecast 2014-2024 4.2.1 C3 Systems at the Core of Vetronics Spending 4.2.2 The Importance of Battlefield Networking 4.3 Military Land Vehicle Sensor Systems Submarket Forecast 2014-2024 4.3.1 EO/IR Sensors in the Vehicle Electronics Market 4.3.2 Reduced Cost Driving Demand for Vehicle Sensors 4.3.3 Night Vision Systems Becoming Essential In Vetronics 4.4 Military Land Vehicle Remote Weapon Station (RWS) Submarket Forecast 2014-2024 4.4.1 The Importance of Remote Weapon Stations 4.4.2 Force Protection a Major Driver of RWS Procurement

4.4.3 The Effect of Standalone RWS Retrofits on the Market 4.5 Military Land Vehicle Computer, Power & Control Systems Submarket Forecast 2014-2024 4.5.1 Changes Coming to Vehicle Electronics Architecture 4.5.2 Lower Tier Involvement Crucial in Ruggedised Computing 4.5.3 How COTS Purchasing will Affect Vehicle Electronics 4.6 Military Land Vehicle Protection Systems Submarket Forecast 2014-2024 4.6.1 Electronic Warfare in the Battle Against IEDs 4.6.2 High Technology Solutions to Low Technology Threats 4.6.3 The Potential of Hard-Kill Countermeasures for Ground Vehicles 5. Leading 15 National Military Land Vehicle Electronics Markets Forecast 2014-2024 5.1 Leading 15 National Military Land Vehicle Electronics Markets Share Forecast 2014-2024 5.2 Barriers to Entry Analysis of the Military Land Vehicle Electronics Market 5.3 USA Military Land Vehicle Electronics Market Forecast 2014-2024 5.3.1 USA Military Land Vehicle Electronics Market Drivers & Restraints 5.3.2 USA Military Land Vehicle Electronics Market Major Programmes 5.3.3 Analysis of Forecast US Vehicle Electronics Spending 5.3.4 Effects of US Withdrawal on the Vetronics Market 5.3.5 Significant US Future Vetronics Spending Programmes 5.3.5.1 Abrams M1A2 System Enhancement Package & Engineering Change Proposal 5.3.5.2 Bradley ODS SA, Engineering Change Proposal 2 & FIST Fire Support System 5.3.5.3 Paladin Integrated Management (PIM) 5.3.5.4 Warfighter Information Network-Tactical (WIN-T) Increment 2 5.3.5.5 Joint Battle Command - Platform (JBC-P) 5.3.5.6 Mid-tier Networking Vehicular Radio (MNVR) 5.3.5.7 Joint Light Tactical Vehicle (JLTV) 5.3.5.8 Ground Combat Vehicle (GCV) 5.4 Chinese Military Land Vehicle Electronics Market Forecast 2014-2024 5.4.1 Chinese Military Land Vehicle Electronics Market Drivers & Restraints 5.4.2 Chinese Military Land Vehicle Electronics Market Major Relevant Programmes 5.4.3 China to see Rising Market Share 5.4.4 Slowing Growth Rates in the Chinese Vetronics Market 5.4.5 Chinese Vetronics Investment Estimates 5.5 Indian Military Land Vehicle Electronics Market Forecast 2014-2024 5.5.1 Indian Military Land Vehicle Electronics Market Drivers & Restraints 5.5.2 Indian Military Land Vehicle Electronics Market Major Contracts & Programmes 5.5.3 Growth in Indian Vetronics Market 2nd Fastest in the World 5.5.4 India's Military Modernisation Goals 5.5.5 Significant Indian Vehicle Electronics Programmes 5.6 Russian Military Land Vehicle Electronics Market Forecast 2014-2024 5.6.1 Drivers & Restraints of the Russian Military Land Vehicle Electronics Market 5.6.2 Russian Military Land Vehicle Electronics Market Major Relevant Programmes 5.6.3 Russia's Ability to Finance Modernisation May Diminish 5.7 Saudi Arabian Military Land Vehicle Electronics Market Forecast 2014-2024 5.7.1 Saudi Arabian Military Land Vehicle Electronics Market Drivers & Restraints 5.7.2 Saudi Arabian Military Land Vehicle Electronics Market Major Contracts & Programmes 5.7.3 M1A2 Upgrades to Drive Saudi Market 5.8 Brazilian Military Land Vehicle Electronics Market Forecast 2014-2024 5.8.1 Brazilian Military Land Vehicle Electronics Market Drivers & Restraints 5.8.2 Brazilian Military Land Vehicle Electronics Market Major Contracts & Programmes 5.8.3 A Downward Trend in Brazilian Vehicle Electronics Spending

5.9 UK Military Land Vehicle Electronics Market Forecast 2014-2024 5.9.1 UK Military Land Vehicle Electronics Market Drivers & Restraints 5.9.2 UK Military Land Vehicle Electronics Market Major Contracts & Programmes 5.9.3 Warrior Capability Sustainment Programme to Drive UK Spending 5.10 Norwegian Military Land Vehicle Electronics Market Forecast 2014-2024 5.10.1 Norwegian Military Land Vehicle Electronics Drivers & Restraints 5.10.2 Norwegian Military Land Vehicle Electronics Market Major Contracts & Programmes 5.10.3 CV90 Upgrades Provide Boost to Norwegian Vetronics Market 5.11 South Korean Military Land Vehicle Electronics Market Forecast 2014-2024 5.11.1 South Korean Military Land Vehicle Electronics Drivers & Restraints 5.11.2 South Korean Military Land Vehicle Electronics Market Major Contracts & Programmes 5.11.3 High South Korean Vetronics Spending likely Unsustainable 5.12 Canadian Military Land Vehicle Electronics Market Forecast 2014-2024 5.12.1 Canadian Military Land Vehicle Electronics Market Drivers & Restraints 5.12.2 Canadian Military Land Vehicle Electronics Market Major Contracts & Programmes 5.12.3 Effects of Platform Procurement on Canadian Vetronics Market 5.13 French Military Land Vehicle Electronics Market Forecast 2014-2024 5.13.1 French Military Land Vehicle Electronics Drivers & Restraints 5.13.2 French Military Land Vehicle Electronics Market Major Contracts & Programmes 5.13.3 Fluctuating Growth Rates in French Vetronics Spending 5.13.4 The Effect of Poor French Macroeconomic Performance 5.14 German Military Land Vehicle Electronics Market Forecast 2014-2024 5.14.1 German Military Land Vehicle Electronics Market Drivers & Restraints 5.14.2 German Military Land Vehicle Electronics Market Major Contracts & Programmes 5.14.3 Slow Growth in German Vetronics Market 5.15 Turkish Military Land Vehicle Electronics Market Forecast 2014-2024 5.15.1Turkish Military Land Vehicle Electronics Market Drivers & Restraints 5.15.2 Turkish Military Land Vehicle Electronics Market Major Relevant Programmes 5.15.3 Domestic Industrial Development to Aid Turkish Market 5.16 Australian Military Land Vehicle Electronics Market Forecast 2014-2024 5.16.1 Australian Military Land Vehicle Electronics Market Drivers & Restraints 5.16.2 Australian Military Land Vehicle Electronics Market Major Contracts & Programmes 5.16.3 Australian Government Committed to Spending Increases 5.17 Israeli Military Land Vehicle Electronics Market Forecast 2014-2024 5.17.1 Israeli Military Land Vehicle Electronics Market Drivers & Restraints 5.17.2 Israeli Military Land Vehicle Electronics Market Major Contracts & Programmes 5.17.3 Insecurity Driving Vetronics Innovation in Israel 5.18 Rest of the World Military Land Vehicle Electronics Market Forecast 2014-2024 5.18.1 Rest of the World Military Land Vehicle Electronics Market Drivers & Restraints 5.18.2 Rest of the World Military Land Vehicle Electronics Market Major Contracts & Programmes 5.18.3 Rest of the World Markets Seeking Modern Capability 5.18.4 The Increasing Diversity of the Vehicle Electronics Market 5.18.5 Companies Likely to Market Mature Technologies in RotW 6. SWOT Analysis of the Military Land Vehicle Electronics Market 2014-2024 6.1 Strengths 6.1.1 Benefits of Platform Connectivity 6.1.2 Vetronic Systems are Relatively Economical 6.1.3 Multitude of Sources of Demand 6.1.4 Strong Utility In Force Protection 6.2 Weaknesses

6.2.1 Small Size of Vetronics Market 6.2.2 Low Value of Some Systems 6.2.3 Sophisticated Vetronics not 100% Necessary 6.2.4 Low Likelihood of Land Conflict 6.3 Opportunities 6.3.1 Multitude of Legacy Platforms to Upgrade 6.3.2 Wide Array of Electronic Systems 6.3.3 Introduction of More COTS Systems 6.3.4 New Markets in the Rest of the World 6.4 Threats 6.4.1 Falling Defence Budgets 6.4.2 Greater Likelihood of Maritime Operations 6.4.3 Continued Restrictions in Emerging Markets 6.4.4 Slowing Growth in Emerging Markets 7. Expert Opinion 7.1 Parvus Corporation 7.1.1 What Is Parvus's Background in Military Land Vehicle Electronics? 7.1.2 What Products does Parvus Supply in the Vetronics Market? 7.1.3 Which Parvus Products have been Most Successful? 7.1.4 How Important is the Vetronics Market to Parvus? 7.1.5 Is All of Parvus's Business in the Defence Industry? 7.1.6 Which Regions Contribute Most to Parvus's Revenue? 7.1.7 How has Parvus Achieved its Successes in the Market? 7.1.8 What Programmes is Parvus Currently Working on? 7.1.9 Who Does Parvus Compete with in the Vetronics Market? 7.1.10 What has changed in Parvus's Approach to the Market? 7.1.11 What Market Trends has Parvus Identified? 7.1.12 Have Economic Problems Affected Parvus's Business? 7.1.13 What are Parvus's Expectations of Market Growth ?

7.1.14 What Technologies Will Contribute Most to Growth? 7.1.15 What Challenges Will Parvus Have to Overcome? 7.1.16 How will Changing Technology Affect the Market? 7.2 Tech Source 7.2.1 What Solutions Does Tech Source Provide?

7.2.2 What is Tech Source's Specialism? 7.2.3 What Products does Curtiss-Wright Offer in the Cockpit Display Market? 7.2.4 Which Regions does Tech Source do Most Business with? 7.2.5 What Programmes has Tech Source been Involved with? 7.2.6 What Companies Does Tech Source Compete with? 7.2.7 Has Tech Source's Approach to the Market Changed? 7.2.8 What Trends Has Tech Source Identified in Vehicle Electronics? 7.2.9 Have Macroeconomic Problems Affected Tech Source? 7.2.10 Does Tech Source Expect the Vehicle Electronics Market to Grow? 7.2.11 What Challenges Does the Vetronics Market Face? 8. Leading 15 Companies in the Military Land Vehicle Electronics Market 8.1 Leading Military Land Vehicle Electronics Companies Ranking 8.2 BAE Systems Overview 8.2.1 BAE Systems Benefits from Bradley Upgrades 8.2.2 BAE Systems Historic Revenue 8.2.3 BAE Systems Main Regional Focus 8.2.4 BAE Systems Major Military Land Vehicle Electronics Contracts 8.2.5 BAE Systems Organisational Structure 8.3 Bharat Electronics Limited (BEL) Overview 8.3.1 Indian Investment Drives BEL Growth 8.3.2 Bharat Electronics Limited (BEL) Historic Revenue 8.3.3 Bharat Electronics Limited (BEL) Main Regional Focus 8.3.4 Bharat Electronics Limited (BEL) Major Military Land Vehicle Electronics Contracts 8.3.5 Bharat Electronics Limited (BEL) Organisational Structure 8.4 Curtiss-Wright Corporation Overview 8.4.1 Curtiss-Wright Corporation - Market Leading Embedded Computing 8.4.2 Curtiss-Wright Corporation Historic Revenue 8.4.3 Curtiss-Wright Corporation Main Regional Focus 8.4.4 Curtiss-Wright Corporation Major Military Land Vehicle Electronics Contracts 8.4.5 Curtiss-Wright Corporation Organisational Structure 8.5 Elbit Systems Overview 8.5.1 RWS Systems at the Heart of Elbit Systems' Vetronics Offerings 8.5.2 Elbit Systems Historic Revenue 8.5.3 Elbit Systems Main Regional Focus 8.5.4 Elbit Systems Major Military Land Vehicle Electronics Contracts 8.5.5 Elbit Systems Organisational Structure 8.6 Finmeccanica S.p.A. Overview 8.6.1 Finmeccanica S.p.A. - A Diverse Vetronics Product Range 8.6.2 Finmeccanica S.p.A. Historic Revenue 8.6.3 Finmeccanica S.p.A. Main Regional Focus 8.6.4 Finmeccanica S.p.A. Major Military Land Vehicle Electronics Contracts 8.6.5 Finmeccanica S.p.A. Organisational Structure 8.7 General Dynamics Corporation Overview 8.7.1 OEM Status boosts General Dynamics's Vetronic Revenue 8.7.2 General Dynamics Corporation Historic Revenue 8.7.3 General Dynamics Corporation Main Regional Focus 8.7.4 General Dynamics Corporation Major Military Land Vehicle Electronics Contracts 8.7.5 General Dynamics Corporation Organisational Structure 8.8 Harris Corporation Overview 8.8.1 Harris Corporation's Vehicle Communications Successes

8.8.2 Harris Corporation Historic Revenue 8.8.3 Harris Corporation Main Regional Focus 8.8.4 Harris Corporation Major Military Land Vehicle Electronics Contracts 8.8.5 Harris Corporation Organisational Structure 8.9 ITT Exelis (Exelis Inc) Overview 8.9.1 RCIED Jammers the Basis for Exelis's Vetronics Presence 8.9.2 ITT Exelis (Exelis Inc) Historic Revenue 8.9.3 ITT Exelis (Exelis Inc) Main Regional Focus 8.9.4 ITT Exelis (Exelis Inc) Major Military Land Vehicle Electronics Contracts 8.9.5 ITT Exelis (Exelis Inc) Organisational Structure 8.10 Kongsberg Gruppen ASA Overview 8.10.1 Kongsberg Gruppen ASA - a RWS leader 8.10.2 Kongsberg Gruppen ASA Historic Revenue 8.10.3 Kongsberg Gruppen ASA Main Regional Focus 8.10.4 Kongsberg Gruppen ASA Major Military Land Vehicle Electronics Contracts 8.10.5 Kongsberg Gruppen ASA Organisational Structure 8.11 Lockheed Martin Corporation Overview 8.11.1 Lockheed Martin Corporation - the Largest Company in the Vehicle Electronics Market 8.11.2 Lockheed Martin Corporation Historic Revenue 8.11.3 Lockheed Martin Corporation Main Regional Focus 8.11.4 Lockheed Martin Corporation Major Land Vehicle Electronics Contracts 8.11.5 Lockheed Martin Corporation Organisational Structure 8.12 Rheinmetall AG Overview 8.12.1 Rheinmetall AG Competitive in Vetronics Upgrades 8.12.2 Rheinmetall AG Historic Revenue 8.12.3 Rheinmetall AG Main Regional Focus 8.12.4 Rheinmetall AG Major Military Land Vehicle Electronics Contracts 8.12.5 Rheinmetall AG Organisational Structure 8.13 SRC Inc Overview 8.13.1 Vehicle CREW Propels SRC into Top 15 Vetronics Companies 8.13.2 SRC Inc Historic Revenue 8.13.3 SRC Inc Main Regional Focus 8.13.4 SRC Inc Major Military Land Vehicle Electronics Contracts 8.13.5 SRC Inc Organisational Structure 8.14 Thales Group Overview 8.14.1 C4ISR Products Maintain Thales Group's Vetronics Position 8.14.2 Thales Group Historic Revenue 8.14.3 Thales Group Main Regional Focus 8.14.4 Thales Group Major Military Land Vehicle Electronics Contracts 8.14.5 Thales Group Organisational Structure 8.15 ViaSat Inc Overview 8.15.1 Vehicle Satcoms Bring Vetronics Wins for ViaSat 8.15.2 ViaSat Inc Historic Revenue 8.15.3 ViaSat Inc Main Regional Focus 8.15.4 ViaSat Inc Major Military Land Vehicle Electronics Contracts 8.15.5 ViaSat Inc Organisational Structure 8.16 Volvo Group Overview 8.16.1 Renault Trucks Defense Secures French Contracts for Volvo 8.16.2 Volvo Group Historic Revenue 8.16.3 Volvo Group Main Regional Focus 8.16.4 Volvo Group Major Military Land Vehicle Electronics Contracts

8.16.5 Volvo Group Organisational Structure 8.17 Other Leading Companies in the World Military Land Vehicle Electronics Market 9. Conclusions 9.1 World Military Land Vehicle Electronics Market Outlook 9.2 World Military Land Vehicle Electronics Market Forecast 2014-2024 9.3 World Military Land Vehicle Electronics Submarket Forecasts 2014-2024 9.4 Leading 15 National Military Land Vehicle Electronics Market Forecasts 2014-2024 10. Glossary List of Tables Table 1.1 World Military Land Vehicle Electronics Forecast Summary 2014, 2019, 2024 ($m, CAGR %) Table 1.2 World Military Land Vehicle Electronics Forecast Summary 2014, 2019, 2024 ($m, CAGR %) Table 1.3 Leading 15 National Military Land Vehicle Electronics Market Forecast Summary 2014, 2019, 2024 ($m, CAGR %) Table 3.1 World Military Land Vehicle Electronics Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 3.2 World Military Land Vehicle Electronics Drivers & Restraints Table 4.1 World Military Land Vehicle Electronics Submarket Forecasts 2014-2024 ($m, AGR %) Table 4.2 Military Land Vehicle Command, Control & Communications Systems Submarket Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 4.3 Military Land Vehicle Sensor Systems Submarket Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 4.4 Military Land Vehicle Remote Weapon Stations Submarket Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 4.5 Military Land Vehicle Computer, Power & Control Systems Submarket Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 4.6 Military Land Vehicle Vehicle Protection Systems Submarket Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.2 USA Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.3 USA Military Land Vehicle Electronics Market Drivers & Restraints Table 5.4 USA Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.5 Chinese Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.6 Chinese Military Land Vehicle Electronics Market Drivers & Restraints Table 5.7 Chinese Military Land Vehicle Programmes Relevant to the Military Land Vehicle Electronics Market (Platform, Company, Date, Description) Table 5.8 Indian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.9 Indian Military Land Vehicle Electronics Market Drivers & Restraints Table 5.10 Indian Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.11 Russian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.12 Russian Military Land Vehicle Electronics Market Drivers & Restraints

Table 5.13 Russian Military Land Vehicle Programmes Relevant to the Military Land Vehicle Electronics Market (Platform, Company, Date, Description) Table 5.14 Saudi Arabian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.15 Saudi Arabian Military Land Vehicle Electronics Market Drivers & Restraints Table 5.16 Saudi Arabian Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.17 Brazilian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.18 Brazilian Military Land Vehicle Electronics Market Drivers & Restraints Table 5.19 Brazilian Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.20 UK Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.21 UK Military Land Vehicle Electronics Market Drivers & Restraints Table 5.22 UK Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.23 Norwegian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.24 Norwegian Military Land Vehicle Electronics Market Drivers & Restraints Table 5.25 Norwegian Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.26 South Korean Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.27 South Korean Military Land Vehicle Electronics Market Drivers & Restraints Table 5.28 South Korean Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Go and visit vet claire wilson's online resources on Camouflage http://www.revgear.com/category/mens-guns-knives -http://www.pinterest.com/virgsearch/defensive-weapons-guns-knives/ Table 5.29 Canadian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.30 Canadian Military Land Vehicle Electronics Market Drivers & Restraints Table 5.31 Canadian Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.32 French Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.33 French Military Land Vehicle Electronics Market Drivers & Restraints Table 5.34 French Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.35 German Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.36 German Military Land Vehicle Electronics Market Drivers & Restraints Table 5.37 German Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.38 Turkish Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.39 Turkish Military Land Vehicle Electronics Market Drivers & Restraints Table 5.40 Turkish Military Land Vehicle Programmes Relevant to the Military Land Vehicle Electronics Market (Platform, Company, Date, Description)

Table 5.41 Australian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.42 Australian Military Land Vehicle Electronics Market Drivers & Restraints Table 5.43 Australian Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.44 Israeli Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.45 Israeli Military Land Vehicle Electronics Market Drivers & Restraints Table 5.46 Israeli Military Land Vehicle Electronics Market Major Contracts (Date, Company, Value, Details) Table 5.47 RotW Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR %, CAGR%, Cumulative) Table 5.48 RotW Military Land Vehicle Electronics Market Drivers & Restraints Table 5.49 RotW Military Land Vehicle Electronics Market Major Contracts (Date, Country, Company, Value, Details) Table 6.1 SWOT Analysis of the World Military Land Vehicle Electronics Market 2014-2024 Table 8.1 Leading 15 Companies in the Military Land Vehicle Electronics Market 2013 (Market Ranking, Total Revenue, Revenue in Sector, Market Share % ) Table 8.2 BAE Systems Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.3 BAE Systems Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.4 Bharat Electronics Limited (BEL) Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Website) Table 8.5 Bharat Electronics Limited (BEL) Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.6 Curtiss-Wright Corporation Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.7 Curtiss-Wright Corporation Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.8 Elbit Systems Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.9 Elbit Systems Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.10 Finmeccanica S.p.A. Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.11 Finmeccanica S.p.A. Major Military Land Vehicle Electronics Market Contracts 20102013 (Date, Country, Value, Details) Table 8.12 General Dynamics Corporation Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics

Market, HQ, Ticker, Contact, Website) Table 8.13 General Dynamics Corporation Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.14 Harris Corporation Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %, HQ, Ticker, Contact, Website) Table 8.15 Harris Corporation Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.16 ITT Exelis Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %, HQ, Ticker, Contact, Website) Table 8.17 ITT Exelis Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.18 Kongsberg Gruppen ASA Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.19 Kongsberg Gruppen ASA Major Military Land Vehicle Electronics Market Contracts 20102013 (Date, Country, Value, Details) Table 8.20 Lockheed Martin Corporation Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.21 Lockheed Martin Corporation Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.22 Rheinmetall AG Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.23 Rheinmetall AG Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.24 SRC Inc Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Website) Table 8.25 SRC Inc Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.26 Thales Group Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %, HQ, Ticker, Website)

Table 8.27 Thales Group Major Military Land Vehicle Electronics Market Contracts 20102013 (Date, Country, Value, Details) Table 8.28 ViaSat Inc Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %, HQ, Ticker, Website) Table 8.29 ViaSat Inc Major Military Land Vehicle Electronics Market Contracts 20102013 (Date, Country, Value, Details) Table 8.30 Volvo Group Overview 2012 (Total Revenue, Revenue from Military Land Vehicle Electronics Market, % Revenue From Military Land Vehicle Electronics Market, Global Military Land Vehicle Electronics Market Share %,Subsidiaries in Military Land Vehicle Electronics Market, HQ, Ticker, Contact, Website) Table 8.31 Volvo Group Major Military Land Vehicle Electronics Market Contracts 2010-2013 (Date, Country, Value, Details) Table 8.32 Other Companies in the Military Land Vehicle Electronics Market 2014 (Company Name) Table 9.1 World Military Land Vehicle Electronics Forecast Summary 2014, 2019, 2024 ($m, CAGR %) Table 9.2 World Military Land Vehicle Electronics Submarket Forecast Summary 2014, 2019, 2024 ($m, CAGR %) Table 9.3 Leading 15 National Military Land Vehicle Electronics Market Forecast Summary 2014, 2019, 2024 ($m, CAGR %) List of Figures Figure 2.1 World Military Land Vehicle Electronics Market Structure Overview Figure 3.1 World Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR%) Figure 4.1 World Military Land Vehicle Electronics Submarkets Share Forecast 2014-2024 ($m) Figure 4.2 World Military Land Vehicle Electronics Submarkets Share Forecast 2014 (%) Figure 4.3 World Military Land Vehicle Electronics Submarkets Share Forecast 2019 (%) Figure 4.4 World Military Land Vehicle Electronics Submarkets Share Forecast 2024 (%) Figure 4.5 Military Land Vehicle Command, Control and Communications Systems Submarket Forecast 2014-2024 ($m, AGR%) Figure 4.6 Military Land Vehicle Command, Control and Communications Systems Submarket Share Forecast 2014, 2019 & 2024 (% Share) Figure 4.7 Military Land Vehicle Sensor Systems Submarket Forecast 2014-2024 ($m, AGR%) Figure 4.8 Military Land Vehicle Sensor Systems Submarket Share Forecast 2014, 2019 & 2024 (% Share) Figure 4.9 Military Land Vehicle Remote Weapon Stations Submarket Forecast 2014-2024 ($m, AGR%) Figure 4.10 Military Land Vehicle Remote Weapon Stations Submarket Share Forecast 2014, 2019 &

2024 (% Share) Figure 4.11 Military Land Vehicle Computer, Power & Control Systems Submarket Forecast 20142024 ($m, AGR%) Figure 4.12 Military Land Vehicle Computer, Power & Control Systems Submarket Share Forecast 2014, 2019 & 2024 (% Share) Figure 4.13 Military Land Vehicle Protection Systems Submarket Forecast 2014-2024 ($m, AGR%) Figure 4.14 Military Land Vehicle Protection Systems Submarket Share Forecast 2013, 2018 & 2023 (% Share) Figure 5.1 Leading 15 National Military Land Vehicle Electronics Markets Forecast 2014-2024 ($m) Figure 5.2 Leading 15 National Military Land Vehicle Electronics Markets Share Forecast 2014 (%) Figure 5.3 Leading 15 National Military Land Vehicle Electronics Markets Share Forecast 2019 (%) Figure 5.4 Leading 15 National Military Land Vehicle Electronics Markets Share Forecast 2024 (%) Figure 5.5 Military Land Vehicle Electronics Barriers to Entry vs. 2014 National Market Size vs. CAGR% 2014-2024 ($m, AGR%) Figure 5.6 USA Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR%) Figure 5.7 USA Military Land Vehicle Electronics Market Share Forecast 2014, 2019 & 2024 (% Share) Figure 5.8 Chinese Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR%) Figure 5.9 Chinese Military Land Vehicle Electronics Market Share Forecast 2014, 2019 & 2024 (% Share) Figure 5.10 Indian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR%) Figure 5.11 Indian Military Land Vehicle Electronics Market Share Forecast 2014, 2019 & 2024 (% Share) Figure 5.12 Russian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR%) Figure 5.13 Russian Military Land Vehicle Electronics Market Share Forecast 2014, 2019 & 2024 (% Share) Figure 5.14 Saudi Arabian Military Land Vehicle Electronics Market Forecast 2014-2024 ($m, AGR%) Figure 5.15 Saudi Arabian Military Land Vehicle Electronics Market Share Forecast 2014, 2019 & 2024 (% Share) Figure 5.16 Brazilian Military L Read the full report: Military Land Vehicle Electronics (Vetronics) Market 2014-2024 - Communications, Computing, Sensors & Remote Weapon Stations (RWS) http://www.reportbuyer.com/industry_manufacturing/defence/weaponry/military_land_vehicle_electr onics_vetronics_market_2014_2024_communications_computing_sensors_remote_weapon_stations_r ws.html#utm_source=prnewswire&utm_medium=pr&utm_campaign=Aerospace_and_Defense For more information: Sarah Smith Research Advisor at Reportbuyer.com Email: query@reportbuyer.com Tel: +44 208 816 85 48 Website: www.reportbuyer.com

Take a look at novelist mason martnez's web-sites on guns http://www.xfire.com/blog/incompetentstom77 -- http://workablepsychol89.soup.io

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Blake Mouton Managerial GridDocument3 pagesBlake Mouton Managerial GridRashwanth Tc100% (1)

- Eccentric FootingDocument3 pagesEccentric FootingVarunn VelNo ratings yet

- Mahindra&mahindraDocument95 pagesMahindra&mahindraAshik R GowdaNo ratings yet

- .CLP Delta - DVP-ES2 - EX2 - SS2 - SA2 - SX2 - SE&TP-Program - O - EN - 20130222 EDITADODocument782 pages.CLP Delta - DVP-ES2 - EX2 - SS2 - SA2 - SX2 - SE&TP-Program - O - EN - 20130222 EDITADOMarcelo JesusNo ratings yet

- Thesis TipsDocument57 pagesThesis TipsJohn Roldan BuhayNo ratings yet

- LC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Document2 pagesLC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Mahadi Hassan ShemulNo ratings yet

- End-Of-Chapter Answers Chapter 7 PDFDocument12 pagesEnd-Of-Chapter Answers Chapter 7 PDFSiphoNo ratings yet

- Project Name: Repair of Afam Vi Boiler (HRSG) Evaporator TubesDocument12 pagesProject Name: Repair of Afam Vi Boiler (HRSG) Evaporator TubesLeann WeaverNo ratings yet

- BSS Troubleshooting Manual PDFDocument220 pagesBSS Troubleshooting Manual PDFleonardomarinNo ratings yet

- Topic: Grammatical Issues: What Are Parts of Speech?Document122 pagesTopic: Grammatical Issues: What Are Parts of Speech?AK AKASHNo ratings yet

- Unit 1 PrinciplesDocument17 pagesUnit 1 PrinciplesRohit YadavNo ratings yet

- Intelligent Status Monitoring System For Port Machinery: RMGC/RTGCDocument2 pagesIntelligent Status Monitoring System For Port Machinery: RMGC/RTGCfatsahNo ratings yet

- CIPD L5 EML LOL Wk3 v1.1Document19 pagesCIPD L5 EML LOL Wk3 v1.1JulianNo ratings yet

- Audi A4-7Document532 pagesAudi A4-7Anonymous QRVqOsa5No ratings yet

- Class 12 Physics Derivations Shobhit NirwanDocument6 pagesClass 12 Physics Derivations Shobhit Nirwanaastha.sawlaniNo ratings yet

- Nominal GroupDocument3 pagesNominal GroupSrourNo ratings yet

- SM EFATEX Rev D2 3 1 2018 PDFDocument20 pagesSM EFATEX Rev D2 3 1 2018 PDFGuilhermePlacidoNo ratings yet

- Designed For Severe ServiceDocument28 pagesDesigned For Severe ServiceAnthonyNo ratings yet

- Test On Real NumberaDocument1 pageTest On Real Numberaer.manalirathiNo ratings yet

- SSC Gr8 Biotech Q4 Module 1 WK 1 - v.01-CC-released-09May2021Document22 pagesSSC Gr8 Biotech Q4 Module 1 WK 1 - v.01-CC-released-09May2021Ivy JeanneNo ratings yet

- Ficha Tecnica Bomba Inyeccion MiniFlex EDocument1 pageFicha Tecnica Bomba Inyeccion MiniFlex Ejohn frader arrubla50% (2)

- 06 SAP PM Level 1 Role Matrix Template SampleDocument5 pages06 SAP PM Level 1 Role Matrix Template SampleRiteshSinhmar100% (1)

- Maximum and Minimum PDFDocument3 pagesMaximum and Minimum PDFChai Usajai UsajaiNo ratings yet

- Amity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorDocument23 pagesAmity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorMayank TayalNo ratings yet

- Ficha Técnica Panel Solar 590W LuxenDocument2 pagesFicha Técnica Panel Solar 590W LuxenyolmarcfNo ratings yet

- CE EVALUATION EXAM No. 4 - MGT, Fluid Properties, Hydrostatic Force (Answer Key)Document6 pagesCE EVALUATION EXAM No. 4 - MGT, Fluid Properties, Hydrostatic Force (Answer Key)Angelice Alliah De la CruzNo ratings yet

- Functions of Theory in ResearchDocument2 pagesFunctions of Theory in ResearchJomariMolejonNo ratings yet

- FT2020Document7 pagesFT2020Sam SparksNo ratings yet

- Dec 2-7 Week 4 Physics DLLDocument3 pagesDec 2-7 Week 4 Physics DLLRicardo Acosta Subad100% (1)

- Consecration of TalismansDocument5 pagesConsecration of Talismansdancinggoat23100% (1)