Professional Documents

Culture Documents

Safeguards in An Accounting Environment

Uploaded by

Aj de CastroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Safeguards in An Accounting Environment

Uploaded by

Aj de CastroCopyright:

Available Formats

SECTION 220 CONFLICT OF INTEREST THREAT: a threat to objectivity may be created when a professional accountant in public practice competes

es directly with a client or has a joint venture or similar arrangement with a major competitor of a client. A threat to objectivity or confidentiality may also be created when a professional accountant in public practice performs services for clients whose interests are in conflict or the clients are in dispute with each other in relation to the matter or transaction in question.

(if refused) must not continue to act for one of the parties in the matter giving rise to the conflict of interest.

SECTION 230 SECOND OPINIONS THREAT: threat to professional competence and due care in circumstances where the second opinion is not based on the same set of facts that were made available to the existing accountant, or is based on inadequate evidence. SAFEGUARDS: seeking client permission to contact the existing accountant, describing the limitations surrounding any opinion in communications with the client and providing the existing accountant with a copy of the opinion. SECTION 240 FEES AND OTHER TYPES OF REMUNERATION * may quote whatever fee deemed to be appropriate. THREAT: a self-interest threat to professional competence and due care is created if the fee quoted is so low that it may be difficult to perform the engagement in accordance with applicable technical and professional standards for that price. SAFEGUARDS: Making the client aware of the terms of the engagement and, in particular, the basis on which fees are charged and which services are covered by the quoted fee. Assigning appropriate time and qualified staff to the task. SHOULD TAKE INTO ACCOUNT WHEN CHARGING FEES: the skill and knowledge required for the type of work involved; the level of training and experience of the persons necessarily engaged on the work; the time necessarily occupied by each person engaged on the work; and the degree of responsibility and urgency that the work entails.

SAFEGUARDS: (a) Notifying the client of the firms business interest or activities that may represent a conflict of interest, and obtaining their consent to act in such circumstances; or (b) Notifying all known relevant parties that the professional accountant in public practice is acting for two or more parties in respect of a matter where their respective interests are in conflict, and obtaining their consent to so act; or (c) Notifying the client that the professional accountant in public practice does not act exclusively for any one client in the provision of proposed services (for example, in a particular market sector or with respect to a specific service) and obtaining their consent to so act. ADDITIONAL SAFEGUARDS: (a) The use of separate engagement teams; and (b) Procedures to prevent access to information (e.g., strict physical separation of such teams, confidential and secure data filing); and (c) Clear guidelines for members of the engagement team on issues of security and confidentiality; and (d) The use of confidentiality agreements signed by employees and partners of the firm; and (e) Regular review of the application of safeguards by a senior individual not involved with relevant client engagements. WHEN THREAT CANNOT BE ELIMINATED: should conclude that it is not appropriate to accept a specific engagement or that resignation from one or more conflicting engagements is required.

CONTINGENT FEES THREAT: self-interest threat to objectivity. The significance of such threats will depend to these factors: The nature of the engagement. The range of possible fee amounts. The basis for determining the fee. Whether the outcome or result of the transaction is to be reviewed by an independent third party.

WHEN IN DOUBT: Consult with relevant professional body SECTION 260 GIFTS AND HOSPITALITY THREAT: self-interest threats to objectivity may be created if a gift from a client is accepted; intimidation threats to objectivity may result from the possibility of such offers being made public. *significance will depend on the nature, value and intent behind the offer. WHEN THREAT CANNOT BE ELIMINATED: Should not accept offer SECTION 270 CUSTODY OF CLIENT ASSETS THREAT: there is a self-interest threat to professional behavior and may be a self-interest threat to objectivity arising from holding client assets. SAFEGUARDS: Keep such assets separately from personal or firm assets; and Use such assets only for the purpose for which they are intended; and At all times, be ready to account for those assets, and any income, dividends or gain generated, to any persons entitled to such accounting; and Comply with all holding of and accounting for such assets. * should make appropriate inquiries about the source of such assets and should consider their legal and regulatory obligations. They may also consider seeking legal advice. SECTION 280 OBJECTIVITY ALL SERVICES THREAT: a familiarity threat to objectivity may be created from a family or close personal or business relationship. SAFEGUARDS: Withdrawing from the engagement team. Supervisory procedures. Terminating the financial or business relationship giving rise to the threat. Discussing the issue with higher levels of management within the firm. Discussing the issue with those charged with governance of the client.

SAFEGUARDS: An advance written agreement with the client as to the basis of remuneration. Disclosure to intended users of the work performed by the professional accountant in public practice and the basis of remuneration. Quality control policies and procedures. Review by an objective third party of the work performed by the professional accountant in public practice. REFERRAL FEE THREAT: Self-interest threat to objectivity professional competence and due care.

and

SAFEGUARDS: Disclosing to the client any arrangements to pay a referral fee to another professional accountant for the work referred. Disclosing to the client any arrangements to receive a referral fee for referring the client to another professional accountant in public practice. Obtaining advance agreement from the client for commission arrangements in connection with the sale by a third party of goods or services to the client. SECTION 250 MARKETING PROFESSIONAL SERVICES THREAT: a self-interest threat to compliance with the principle of professional behavior is created if services, achievements or products are marketed in a way that is inconsistent with that principle. SHOULD NOT: Make exaggerated claims for services offered, qualifications possessed or experience gained; or Make disparaging references to unsubstantiated comparisons to the work of another.

You might also like

- AuditDocument10 pagesAuditGeralyn MiralNo ratings yet

- Commonly Known Threats To Compliance With The Fundamental Principles. Again As in Part 1, Our Subject MatterDocument14 pagesCommonly Known Threats To Compliance With The Fundamental Principles. Again As in Part 1, Our Subject MatterPhrexilyn PajarilloNo ratings yet

- 220 Conflicts of InterestDocument5 pages220 Conflicts of InterestArman ArifNo ratings yet

- Audit Chapter 14Document4 pagesAudit Chapter 14Areej AzharNo ratings yet

- Chapter 7Document28 pagesChapter 7Phrexilyn PajarilloNo ratings yet

- Pervezvikiyo - 3498 - 17836 - 2 - Ethics, Threats & Safeguards (Nov 1, 2021)Document11 pagesPervezvikiyo - 3498 - 17836 - 2 - Ethics, Threats & Safeguards (Nov 1, 2021)Sadia AbidNo ratings yet

- Ethics and AcceptanceDocument41 pagesEthics and AcceptanceTaimur ShahidNo ratings yet

- Code of Ethics Summary - P 1 & 2Document9 pagesCode of Ethics Summary - P 1 & 2RafayAliNo ratings yet

- Ethical Issues in Accounting: Course Code: ACT 4102Document23 pagesEthical Issues in Accounting: Course Code: ACT 4102Tanvir AhmedNo ratings yet

- PRISCADocument7 pagesPRISCABELENGA GEOFREYNo ratings yet

- Section 320 MIADocument9 pagesSection 320 MIANaem EmahNo ratings yet

- Textbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 7, Exit Transactions: The Process of Selling an Urgent Care CenterNo ratings yet

- Chapter 3Document56 pagesChapter 3Michael AnthonyNo ratings yet

- Code of Ethics For Professional AccountantsDocument2 pagesCode of Ethics For Professional AccountantsNico AralesNo ratings yet

- Code of Ethics 2010 Fatal Flaw ReviewDocument6 pagesCode of Ethics 2010 Fatal Flaw ReviewGabriela Lourdes SandovalNo ratings yet

- Examples of Conflicts of InterestDocument5 pagesExamples of Conflicts of InterestRaymond LeeNo ratings yet

- De - Guzman - Module 12Document8 pagesDe - Guzman - Module 12Ma Ruby II SantosNo ratings yet

- Professional Accountants in Public PracticeDocument40 pagesProfessional Accountants in Public PracticeUmmul Khair HasanNo ratings yet

- 210 Professional AppointmentDocument9 pages210 Professional AppointmentHendry TupaiNo ratings yet

- Qualifications and Conflicts of InterestDocument4 pagesQualifications and Conflicts of InteresthumaidjafriNo ratings yet

- Code of EthicsDocument37 pagesCode of EthicsDawn Rei Dangkiw100% (1)

- Auditing Ethics: Lecture # 2 Fundamental PrinciplesDocument3 pagesAuditing Ethics: Lecture # 2 Fundamental PrinciplessiddiqueicmaNo ratings yet

- Part B-Professional Accountant in Public PracticeDocument58 pagesPart B-Professional Accountant in Public PracticeAlliahDataNo ratings yet

- Aaa 5Document3 pagesAaa 5Hamza ZahidNo ratings yet

- Accounting Ethics: Lect. Victor-Octavian Müller, PH.DDocument9 pagesAccounting Ethics: Lect. Victor-Octavian Müller, PH.DavalentinNo ratings yet

- The Code of Professional EthicsDocument33 pagesThe Code of Professional EthicsLaezelie PalajeNo ratings yet

- Code of Ethics QuestionsDocument11 pagesCode of Ethics QuestionsAiAiNo ratings yet

- Section 140 - Confidentiality: Confidential Information Acquired As A Result of Professional and Business RelationshipsDocument16 pagesSection 140 - Confidentiality: Confidential Information Acquired As A Result of Professional and Business RelationshipsKathlyn Ann MasilNo ratings yet

- Fraud Good Practice Guide From BIBADocument11 pagesFraud Good Practice Guide From BIBAPooja ChavanNo ratings yet

- Code of Ethics Reviewer - CompressDocument44 pagesCode of Ethics Reviewer - CompressGlance Piscasio CruzNo ratings yet

- Audit Lecture #6 - Ethical ThreatsDocument9 pagesAudit Lecture #6 - Ethical ThreatsAkira CambridgeNo ratings yet

- Philippine Framework For Assurance EngagementsDocument9 pagesPhilippine Framework For Assurance EngagementsKlo MonNo ratings yet

- Ethical Threats To IndependenceDocument4 pagesEthical Threats To IndependenceANASNo ratings yet

- PSGLE 121 Contract ClausesDocument44 pagesPSGLE 121 Contract Clausestest testNo ratings yet

- De-Tariffing Programme in Non-Life Insurance: by PC James Ed, IrdaDocument30 pagesDe-Tariffing Programme in Non-Life Insurance: by PC James Ed, IrdaSudhir JyothulaNo ratings yet

- CODE OF ETHICS - Professional Accountants PDFDocument31 pagesCODE OF ETHICS - Professional Accountants PDFAJ BlazaNo ratings yet

- Code of Ethics For Professional Accountants-2Document25 pagesCode of Ethics For Professional Accountants-2davidwijaya1986100% (1)

- AA MA-2022 Suggested AnswersDocument8 pagesAA MA-2022 Suggested AnswersMehedi Hasan TouhidNo ratings yet

- Poi Unit-D (2) Customer ServiceDocument16 pagesPoi Unit-D (2) Customer ServiceEHOUMAN JEAN JACQUES EBAHNo ratings yet

- Assurance Engagements Acceptance of AppointmentDocument17 pagesAssurance Engagements Acceptance of AppointmentSayraj Siddiki AnikNo ratings yet

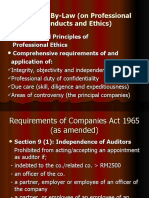

- 4.1 MIA By-Law (On Professional Conducts and Ethics)Document84 pages4.1 MIA By-Law (On Professional Conducts and Ethics)Yaya-Nadia AhmadNo ratings yet

- M003 - Level 2 - Client CareDocument3 pagesM003 - Level 2 - Client Carenishantdon007100% (1)

- Client Due Diligence Factsheet 0621Document4 pagesClient Due Diligence Factsheet 0621Robinson JeybarajNo ratings yet

- Chapter ThreeDocument36 pagesChapter ThreeVida SalehiNo ratings yet

- Topic 3 - Professional Code of Ethics and BehaviourDocument13 pagesTopic 3 - Professional Code of Ethics and BehaviourSandile Henry DlaminiNo ratings yet

- Lecturer 2 (Ii) - Professional EthicsDocument41 pagesLecturer 2 (Ii) - Professional EthicskhooNo ratings yet

- Final Audit AssignmentDocument11 pagesFinal Audit Assignmenttaohid khanNo ratings yet

- Lagcao Claire Ann 01 JournalDocument4 pagesLagcao Claire Ann 01 JournalLagcao Claire Ann M.No ratings yet

- AuditDocument2 pagesAuditFida MaisarohNo ratings yet

- Job DescriptionDocument2 pagesJob DescriptionWinnie NgNo ratings yet

- Chapter 5 (Rick Hayes) "Client Acceptance"Document19 pagesChapter 5 (Rick Hayes) "Client Acceptance"Joan AnindaNo ratings yet

- New AAA NotesDocument12 pagesNew AAA NotesSheda AshrafNo ratings yet

- AUD 1 Attestation Engagements 2021Document34 pagesAUD 1 Attestation Engagements 2021Y not me??No ratings yet

- Threats To IndependenceDocument5 pagesThreats To IndependencemadaaamNo ratings yet

- Professional Ethics in AuditingDocument4 pagesProfessional Ethics in AuditingWaseem Basha SkNo ratings yet

- DocxDocument17 pagesDocxJev CastroverdeNo ratings yet

- AT 03 Code of EthicsDocument5 pagesAT 03 Code of EthicsPrincess Mary Joy LadagaNo ratings yet

- Claims Management4Document13 pagesClaims Management4RajanRanjanNo ratings yet

- 02 Standards and Audit OpinionDocument18 pages02 Standards and Audit OpinionBts Army ForeverNo ratings yet

- Code of EthicsDocument5 pagesCode of EthicsZeus GamoNo ratings yet

- Baliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillDocument7 pagesBaliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillAj de CastroNo ratings yet

- NFJPIAR3 - 1415 - IRR No 14 - Christmas Photo - Contest Rules and Mechanics PDFDocument7 pagesNFJPIAR3 - 1415 - IRR No 14 - Christmas Photo - Contest Rules and Mechanics PDFAj de CastroNo ratings yet

- MAS - First Pre-Board 2014-15 With SolutionsDocument6 pagesMAS - First Pre-Board 2014-15 With SolutionsAj de CastroNo ratings yet

- Auditing Problems, Theory of Accounts & Practical Accounting 1 Auditing Problems Theory of Accounts Practical Accounting 1 Audit of CashDocument5 pagesAuditing Problems, Theory of Accounts & Practical Accounting 1 Auditing Problems Theory of Accounts Practical Accounting 1 Audit of CashAj de CastroNo ratings yet

- Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument34 pagesChapter I - Definitions SEC. 22. Definitions - When Used in This TitleAj de CastroNo ratings yet

- Std. Cost & Var 2014Document10 pagesStd. Cost & Var 2014Aj de CastroNo ratings yet

- Direct and Absorption Costing 2014Document15 pagesDirect and Absorption Costing 2014Aj de CastroNo ratings yet

- Day 0: Wednesday (February 19) Activity In-ChargeDocument4 pagesDay 0: Wednesday (February 19) Activity In-ChargeAj de CastroNo ratings yet

- Seize A Partner .And Never Be .: RightDocument1 pageSeize A Partner .And Never Be .: RightAj de CastroNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- Nfjpiar3 1314 IRR On ElectionDocument10 pagesNfjpiar3 1314 IRR On ElectionAj de CastroNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and Errors AND OTHER INCOME Cash Flows and Sme'SDocument1 pageAccounting Policies, Changes in Accounting Estimates and Errors AND OTHER INCOME Cash Flows and Sme'SAj de CastroNo ratings yet

- Persons Who Give Contribution To SociologyDocument4 pagesPersons Who Give Contribution To SociologyAj de Castro100% (1)

- Ccabeg Case Studies Accountants Public PracticeDocument20 pagesCcabeg Case Studies Accountants Public PracticeAj de CastroNo ratings yet

- Fertilization Chart For US 88 Hybrid RiceDocument1 pageFertilization Chart For US 88 Hybrid RiceAj de CastroNo ratings yet

- Environmental Accounting Reaction PaperDocument3 pagesEnvironmental Accounting Reaction PaperAj de CastroNo ratings yet

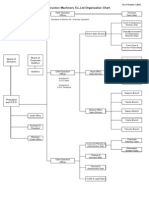

- Itochu Construction Machinery Co.,Ltd Organization Chart: Board of Directors Board of Corporate AuditorsDocument1 pageItochu Construction Machinery Co.,Ltd Organization Chart: Board of Directors Board of Corporate AuditorsAj de CastroNo ratings yet

- Business Ethics and Social ResponsibilityDocument17 pagesBusiness Ethics and Social ResponsibilityAj de CastroNo ratings yet

- Will CCT Help or Hurt The PoorDocument3 pagesWill CCT Help or Hurt The PoorAj de CastroNo ratings yet

- Multicolore PDFDocument1 pageMulticolore PDFAj de CastroNo ratings yet

- KATIPUNAN FinalDocument40 pagesKATIPUNAN FinalAj de Castro89% (19)

- Environmental Accounting Reaction PaperDocument3 pagesEnvironmental Accounting Reaction PaperAj de CastroNo ratings yet

- Chapter 2Document25 pagesChapter 2Aj de CastroNo ratings yet

- Angelica Joy S. de Castro: ObjectiveDocument2 pagesAngelica Joy S. de Castro: ObjectiveAj de CastroNo ratings yet

- Social Watch Philippines Position Paper On The Pantawid Pamilyang Pilipino Program (4Ps)Document1 pageSocial Watch Philippines Position Paper On The Pantawid Pamilyang Pilipino Program (4Ps)Aj de CastroNo ratings yet

- Auditing Theory Nov 26Document6 pagesAuditing Theory Nov 26Aj de CastroNo ratings yet

- Presidents of The PhilippinesDocument42 pagesPresidents of The PhilippinesAj de Castro86% (7)

- Finacle 10x - Menu OptionsDocument8 pagesFinacle 10x - Menu OptionsMohit100% (2)

- Lakemont Shores POA Original Bylaws 1976Document16 pagesLakemont Shores POA Original Bylaws 1976PAAWS2No ratings yet

- Fedex TermsDocument13 pagesFedex Termsquattro90rs4No ratings yet

- Feb 1-3613311284991 - BM2233I010340187Document7 pagesFeb 1-3613311284991 - BM2233I010340187Jihoon BongNo ratings yet

- Bank Statements OF ROLFEDocument7 pagesBank Statements OF ROLFEClifton WilsonNo ratings yet

- Diploma in Accountancy Student Registration Form: For Official Use OnlyDocument5 pagesDiploma in Accountancy Student Registration Form: For Official Use OnlyJeremiahNo ratings yet

- Original: Lease-Purchase AgreementDocument9 pagesOriginal: Lease-Purchase AgreementNikki JenkinsNo ratings yet

- April 2015 Project PlaceDocument50 pagesApril 2015 Project PlaceKatherine McNennyNo ratings yet

- 2022 IndictmentDocument8 pages2022 IndictmentUSA TODAY NetworkNo ratings yet

- Recognised Teaching Centre or Fees Charged by Your Local Examination Centre Goods or Services Tax (GST) or Sales TaxDocument3 pagesRecognised Teaching Centre or Fees Charged by Your Local Examination Centre Goods or Services Tax (GST) or Sales TaxvicgetNo ratings yet

- 2019 Annual SummaryDocument2 pages2019 Annual SummaryMELAKU HalikaNo ratings yet

- Globe at Home E-Bill - 907335244-2021-07-08Document6 pagesGlobe at Home E-Bill - 907335244-2021-07-08Speakup CampNo ratings yet

- AME User ManualDocument71 pagesAME User ManualAnand Kumar UpadhyayNo ratings yet

- E-Tendering Tender Notice No. 02/2019-2020 Main Portal: Http://mahatenders - Gov.inDocument2 pagesE-Tendering Tender Notice No. 02/2019-2020 Main Portal: Http://mahatenders - Gov.inSD TECHNo ratings yet

- LEED Certification FeesDocument14 pagesLEED Certification FeesScott Freeman0% (1)

- DHL Express Rate and Transit SG enDocument25 pagesDHL Express Rate and Transit SG enVenkatesan Kanagarajan0% (1)

- SCO-06 FeeSched Rev22Document1 pageSCO-06 FeeSched Rev22Micky PlumbNo ratings yet

- Manual On The New Government Accounting System For Local Government UnitsDocument13 pagesManual On The New Government Accounting System For Local Government UnitsrahmaNo ratings yet

- G.R. No. 131622. November 27, 1998 Medel, Medel and Franco vs. Court of Appeals, Spouses Gonzales - 299 SCRA 481Document8 pagesG.R. No. 131622. November 27, 1998 Medel, Medel and Franco vs. Court of Appeals, Spouses Gonzales - 299 SCRA 481Vanny Joyce BaluyutNo ratings yet

- AuctionPricelist2 10 20 PDFDocument31 pagesAuctionPricelist2 10 20 PDFJhon Antonio AbadNo ratings yet

- Restrictive Covenants - AfsaDocument10 pagesRestrictive Covenants - AfsaFrank A. Cusumano, Jr.No ratings yet

- QT 23100837-PT East Indo Fair Trading Rev3Document5 pagesQT 23100837-PT East Indo Fair Trading Rev3I Nengah Purna WirawanNo ratings yet

- Business Proposal PolRem Company PhilippinesDocument54 pagesBusiness Proposal PolRem Company PhilippinesAlfredo Jr FortuNo ratings yet

- Book A Flight Southwest Airlines YupDocument1 pageBook A Flight Southwest Airlines YupDerek CostanzoNo ratings yet

- User 3700Document72 pagesUser 3700Leonardo Mesquita AraujoNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online BillMuhammad AteeqNo ratings yet

- Sports Authority of Thailand Act, B.E. 2558 (2015)Document39 pagesSports Authority of Thailand Act, B.E. 2558 (2015)Chelsea MonasterioNo ratings yet

- Payment Receipt: Applicant DetailsDocument1 pagePayment Receipt: Applicant Detailsakhil SrinadhuNo ratings yet

- K Electric Jan.20Document2 pagesK Electric Jan.20Smart BunnyNo ratings yet

- PL WelcomeLetter UnlockedDocument2 pagesPL WelcomeLetter UnlockedLoan LoanNo ratings yet