Professional Documents

Culture Documents

Trial Copy Manyata Embassy Business Park (Inhem6) Sezonline Request Id:171501886135 / Page: 1 / 2

Uploaded by

Anonymous NQ2cBROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trial Copy Manyata Embassy Business Park (Inhem6) Sezonline Request Id:171501886135 / Page: 1 / 2

Uploaded by

Anonymous NQ2cBRCopyright:

Available Formats

BOE Print

https://sezonline-ndml.co.in/BOERevamp/BOEPrintForm.aspx?PrintQuantity=-1&RequestId=1715018...

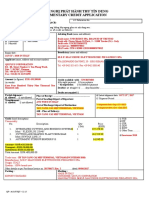

BILL OF ENTRY FOR HOME CONSUMPTION

TRIAL COPY

Manyata Embassy Business Park(INHEM6)

S = Sea

A = Air

L = Land

Port Code

Import Dept. S.No & Date

Custom House Agent Code

Importer's Code & BIN

AADCA0427BCH008

0313021228 - AACCL4310P

INBLR4

A

Vessel's Name/ Agent's Name

Rotation No. & Date

Line No.

Port of shipment

802152 - 03/08/2015

Vienna Danubepier Hov

PACKAGES

No. &

Description

QUANTITY

SR.

No.

Marks &

Numbers

1 PKG

12516190403

/15073256

HSS

Unit

Code

NA

DESCRIPTION

Customs

Tariff

Heading

Weight/

Volume

Number

etc.

R.I.T.C. Number

(Give detail of each class separately)

Exim Scheme Code, Where applicable

2

NOS

B3-REL 16 RELAY MODULE - BFB3-REL16-H - 20-1000004

-01-02

(85389000) - Others

Exemption

Notification

No. & Year

4

NOS

BFBEAM-WH-SPBC-H - BRACKET - FG020125 (85389000)

- Others

NA

14

NOS

BFGEHMOD2IP66-H - IP66 BOX FOR LOOP MODULES FG02

0235-A

(85389000) - Others

Gross Weight

Total Number Of Packages (in words)

14.3 KGS

One PACKAGES

S. No

Freight

Currency

EUR

INR - 3295.53

85389000

85389000

85389000

NA

26871.21

(Rs. Twenty Six

Thousand Eight

Hundred and

Seventy One and

Twenty One ps.

Only)

NA

2673.05

(Rs. Two Thousand

Six Hundred and

Seventy Three and

Five ps. Only)

NA

8338.05

(Rs. Eight Thousand

Three Hundred and

Thirty Eight and Five

ps. Only)

Amount

Basic

C. E. T.

Item

Auxiliary

Auxiliary

Exemption

Notification

No & Year

10

11

12

7.50%

2015.34

0.00

7.50%

200.48

0.00

7.50%

625.35

0.00

85389000

85389000

85389000

NA

NA

NA

Landing

Charges

(Rs.)

Exch.

Rate

Loading/ Local

Agency

Commission @

INR - 189.39

EUR

INR

73.4500

1.00

INR - 6285.50

26605.16

266.05

73.4500

1.00

INR - 625.26

2646.59

26.47

INR - 1950.37

8255.49

82.55

Insurance

EUR

22.80

INR - 327.83

INR - 18.84

EUR

71.12

INR - 1022.59

INR - 58.77

EUR

INR

73.4500

1.00

Total

EUR

323.12

0.00/ 0.00

267.00

NA

28886.55

NA

2873.53

NA

8963.40

Total Amount Of Duty In Words Rs.

Misc.

Charges

8861.13

Debit P.D. A/c No.

Total Value

(In Rupees)

37507.24

MAWB-12516190403/31/07/2015, HAWB-15073256/31/07/2015

Value for the purpose of Section 3

of Customs Tariff Act 1975

Col. 9+C0. 11

Amount

Where the

Where the

MRP per

Of Abate- provisions of

provision of

Unit, if

mene, If Sub-section(2) of sub-section(2) of

any

any

Section 4 A of the section 4A of the

Central Excise

Central Excise

Act. 1944 does Act, 1944 apply

not apply

12A

12B

13

13A

Assessable Value

(In Rupees)

375.07

NA

NA

NA

ADDITIONAL DUTY

TOTAL DUTY

Rate

Basic

Amount

Basic

Auxiliary

Auxiliary

Col. : (11)

+

Col. : (15)

Rs.

14

15

16

12.50%

12.50%

12.50%

3610.82

5626.16

Edu Cess 2%

112.52

SHE Cess 1%

56.26

SAD 19/2006 4%

1306.65

359.19

559.67

Edu Cess 2%

11.19

SHE Cess 1%

5.60

SAD 019/2006 4%

129.98

1120.43

1745.77

Edu Cess 2%

34.92

SHE Cess 1%

17.46

SAD 019/2006 4%

405.45

Duty Forgone

Ten Thousand and Eleven point Sixty Three Only

Import Clerk

I.T.C. License or C.C.P. No. & Date/ Part & S.No./ O.G.L. No./ Exemption No. & Value debited to License/ C.C.P. (in case of Letter of

Authority, Name of Person to whom issued, No. & Date)

1 of 5

Rate

Basic

EUR

INR

4645.95

Austria(AT)

Currency

Code

Value

229.20

Country of Origin & code

Nature

Assessable Value

Of

Under Section 14

Duty

Customs Act. 1962

Code

Importer's Name & Address Whether Government or Private

L&T Technology Services Limited

SEZ Unit II, Hazel-Block L3, Ground, 1st, 2nd and, 3rd Floors, Manyata Embassy Business Park,,

Nagawara Hobli, Outer Ring Road,, Bangalore - 560045, Karnataka, India PRIVATE

Country of Consignment (if different) and Code

Bill of Lading No. & Date

CUSTOMS DUTY

NA

Invoice Value(FC),(FOB)

SEZOnline Request Id:171501886135 / Page: 1 / 2

Prior Entry Stamp

10011.63

(Declaration to be signed by the Custom House Agent)

1. I/ We declare that the contents of this Bill of Entry for goods imported against Bill of

Landing No. M AWB-12516190403, HAWB-15073256 dated 31/07/2015, 31/07/2015

26871.21 are in accordance with the Invoice No. 15/666567 dated 08/07/2015and other documents

presented herewith.

2. I/ We declare that I/ We have not received any other documents or information showing

2673.05 a different, price, value, quantity or description of the said goods and that if any time

hereafter. I/ We receive any documents from the importer showing a different state of

facts I/ We will immediately make the same known to the Commissioner of Customs.

8338.05

N.B. :- Where a declaration is this made by the Custom House agents a declaration in the

prescribed form shall be furnished by the importers of the goods covered by this Bill of

37882.31 Entry.

Stamp for collection/ FREE No. & Date

This Bill of Entry Form is digitally signed.

24-Aug-15 2:38 PM

BOE Print

https://sezonline-ndml.co.in/BOERevamp/BOEPrintForm.aspx?PrintQuantity=-1&RequestId=1715018...

DECLARATION

(To be signed by an Importer.)

Request Id: 171501886135

Import Dept. Sr. No. & Date.: With

1. I/ We declare that the contents of invoice(s) No.(s) 15/666567

Custom*

dated 08/07/2015 of M /s. SCHRACK SECONET AG

and of other documents relating to the goods covered by the said invoice(s) and presented herewith

House Agent

are true and correct in every respect.

OR

Without

Custom*

House Agent

1. I/ We declare that the contents of this Bill of Entry for goods imported against Bill of Lading No.

M AWB-12516190403, HAWB-15073256 dated 31/07/2015, 31/07/2015

are in accordance with the invoice(s) No.(s) 15/666567 dated 08/07/2015

and other documents presented herewith. I/ We also declare that the contents of the above mentioned

invoice(s) and documents are true and correct in every respect.

2. I/ We declare that I/ we have not received and do no know of any other documents, or information showing a

different price, value (including) local payments, whether as commission or otherwise quantity or description

of the said goods and that if at any time hereafter, I/ we discover any information showing a different state of

facts, I/ we will immediately make the same known to the Commissioner of Customs.

3. I/ We declare that goods covered by the Bill of Entry have been imported on out-right purchase/ consignment

account.

4. I/ We am/ are not connected with the suppliers, manufacturers, as:

(a) Agent/ Distributor/ Indenter/ Branch/ Subsidiary/ Concessionaire, and

(b) Collaborator entitled to the use of the trade mark, patent or design.

(c) Otherwise than as ordinary importers or buyers.

5. I/ We declare that the method of invoicing has not changed since the date on which my/ our books of accounts

and/ or agreement with the suppliers were examined previously by the Custom House(s).

(This declaration is digitally signed.)

* Strike out whichever is inapplicable.

(FOR CUSTOM HOUSE USE)

Documents presented with Bill of Entry:

Date of receipt in:

Check here additional documents required

1.

Invoice............................................................................

2. Packing

List....................................................................

3. Bank

Draft.......................................................................

4. Insurance Memo/

Policy...................................................

5. Bill of Lading or

Delivery

Order..................................................................

6. Import License/ Custom

Clearance

Permit.............................................................

7. Certificate of

Origin..........................................................

8.

......................................................................................

9.

......................................................................................

10.

.....................................................................................

Appraising group

Central Exchange Unit

Daily List

Revenue Posting

Trade return I.A.D.

C.R.A.D. M.C.D. Key

Register

M.C.D. Manifest

Posting

[C.B.E & C. Notification No. 396-Cus., dated 1st August, 1976]

2 of 5

24-Aug-15 2:38 PM

BOE Print

https://sezonline-ndml.co.in/BOERevamp/BOEPrintForm.aspx?PrintQuantity=-1&RequestId=1715018...

BILL OF ENTRY FOR HOME CONSUMPTION

TRIAL COPY

Manyata Embassy Business Park(INHEM6)

S = Sea

A = Air

L = Land

Port Code

Import Dept. S.No & Date

Custom House Agent Code

Importer's Code & BIN

AADCA0427BCH008

0313021228 - AACCL4310P

INBLR4

A

Vessel's Name/ Agent's Name

Rotation No. & Date

Line No.

Port of shipment

802152 - 03/08/2015

Vienna Danubepier Hov

PACKAGES

No. &

Description

QUANTITY

SR.

No.

Marks &

Numbers

1 PKG

SEZOnline Request Id:171501886135 / Page: 2 / 2

Prior Entry Stamp

12516190403

/15073256

HSS

Unit

Code

NA

NA

DESCRIPTION

Customs

Tariff

Heading

Weight/

Volume

Number

etc.

R.I.T.C. Number

(Give detail of each class separately)

Exim Scheme Code, Where applicable

Exemption

Notification

No. & Year

14

NOS

50

NOS

BFBX-FOL-RR-H - BX-FOL-RR LOOP FLASHLIGHT 20-210

0009-01-06

(85437099) - Others

85389000

85437099

Gross Weight

Total Number Of Packages (in words)

14.3 KGS

One PACKAGES

Invoice Value(FC),(FOB)

S. No

Currency

EUR

323.12

EUR

613.20

EUR

1900.00

Total

EUR

2836.32

NA

71891.05

(Rs. Seventy One

Thousand Eight

Hundred and Ninety

One and Five ps.

Only)

NA

222754.38

(Rs. Two Lakh

Twenty Two

Thousand Seven

Hundred and Fifty

Four and Thirty Eight

ps. Only)

Loading/ Local

Agency

Commission @

Misc.

Charges

8861.13

Insurance

267.00

0.00/ 0.00

INR - 506.69

EUR

INR

73.4500

1.00

INR - 1569.99

EUR

INR

73.4500

1.00

0.00/ 0.00

40781.72

2343.68

Amount

Basic

C. E. T.

Item

Auxiliary

Auxiliary

Exemption

Notification

No & Year

10

11

12

7.50%

7.50%

5391.83

0.00

16706.58

0.00

85389000

85437099

MAWB-12516190403/31/07/2015, HAWB-15073256/31/07/2015

NA

NA

NA

77282.88

NA

239460.96

Total Value

(In Rupees)

Landing

Charges

(Rs.)

375.07

INR - 16816.19

71179.25

711.79

INR - 52104.96

220548.89

2205.49

329235.38

3292.35

77782.28

NA

TOTAL DUTY

Rate

Basic

Amount

Basic

Auxiliary

Auxiliary

Col. : (11)

+

Col. : (15)

Rs.

14

15

16

12.50%

12.50%

9660.36

15052.20

Edu Cess 2%

301.04

SHE Cess 1%

150.52

SAD 019/2006 4%

3495.79

29932.62

46639.20

Edu Cess 2%

932.78

SHE Cess 1%

466.39

SAD 019/2006 4%

10831.71

87881

(Declaration to be signed by the Custom House Agent)

Assessable Value

(In Rupees)

37507.24

NA

ADDITIONAL DUTY

Duty Forgone

Eighty Seven Thousand Eight Hundred and Eighty One Only

Exch.

Rate

Freight

INR - 27318.94

Value for the purpose of Section 3

of Customs Tariff Act 1975

Col. 9+C0. 11

Amount

Where the

Where the

MRP per

Of Abate- provisions of

provision of

Unit, if

mene, If Sub-section(2) of sub-section(2) of

any

any

Section 4 A of the section 4A of the

Central Excise

Central Excise

Act. 1944 does Act, 1944 apply

not apply

12A

12B

13

13A

Total Amount Of Duty In Words Rs.

4645.95

INR - 8816.83

Rate

Basic

Import Clerk

Currency

Code

Value

B.F.

Austria(AT)

CUSTOMS DUTY

BFBX-REL4-H - BX-REL4 RELAY MODULE 20-2100004-01

-03

(85389000) - Others

L&T Technology Services Limited

SEZ Unit II, Hazel-Block L3, Ground, 1st, 2nd and, 3rd Floors, Manyata Embassy Business Park,,

Nagawara Hobli, Outer Ring Road,, Bangalore - 560045, Karnataka, India PRIVATE

Country of Consignment (if different) and Code

Bill of Lading No. & Date

Country of Origin & code

Nature

Assessable Value

Of

Under Section 14

Duty

Customs Act. 1962

Code

Importer's Name & Address Whether Government or Private

1. I/ We declare that the contents of this Bill of Entry for goods imported against Bill of

37882.31 Landing No. M AWB-12516190403, HAWB-15073256 dated 31/07/2015, 31/07/2015

are in accordance with the Invoice No. 15/666567 dated 08/07/2015and other documents

71891.05 presented herewith.

2. I/ We declare that I/ We have not received any other documents or information showing

222754.38 a different, price, value, quantity or description of the said goods and that if any time

hereafter. I/ We receive any documents from the importer showing a different state of

facts I/ We will immediately make the same known to the Commissioner of Customs.

N.B. :- Where a declaration is this made by the Custom House agents a declaration in the

332528 prescribed form shall be furnished by the importers of the goods covered by this Bill of

Entry.

I.T.C. License or C.C.P. No. & Date/ Part & S.No./ O.G.L. No./ Exemption No. & Value debited to License/ C.C.P. (in case of Letter of

Authority, Name of Person to whom issued, No. & Date)

3 of 5

Debit P.D. A/c No.

Stamp for collection/ FREE No. & Date

This Bill of Entry Form is digitally signed.

24-Aug-15 2:38 PM

BOE Print

https://sezonline-ndml.co.in/BOERevamp/BOEPrintForm.aspx?PrintQuantity=-1&RequestId=1715018...

DECLARATION

(To be signed by an Importer.)

Request Id: 171501886135

Import Dept. Sr. No. & Date.: With

1. I/ We declare that the contents of invoice(s) No.(s) 15/666567

Custom*

dated 08/07/2015 of M /s. SCHRACK SECONET AG

and of other documents relating to the goods covered by the said invoice(s) and presented herewith

House Agent

are true and correct in every respect.

OR

Without

Custom*

House Agent

1. I/ We declare that the contents of this Bill of Entry for goods imported against Bill of Lading No.

M AWB-12516190403, HAWB-15073256 dated 31/07/2015, 31/07/2015

are in accordance with the invoice(s) No.(s) 15/666567 dated 08/07/2015

and other documents presented herewith. I/ We also declare that the contents of the above mentioned

invoice(s) and documents are true and correct in every respect.

2. I/ We declare that I/ we have not received and do no know of any other documents, or information showing a

different price, value (including) local payments, whether as commission or otherwise quantity or description

of the said goods and that if at any time hereafter, I/ we discover any information showing a different state of

facts, I/ we will immediately make the same known to the Commissioner of Customs.

3. I/ We declare that goods covered by the Bill of Entry have been imported on out-right purchase/ consignment

account.

4. I/ We am/ are not connected with the suppliers, manufacturers, as:

(a) Agent/ Distributor/ Indenter/ Branch/ Subsidiary/ Concessionaire, and

(b) Collaborator entitled to the use of the trade mark, patent or design.

(c) Otherwise than as ordinary importers or buyers.

5. I/ We declare that the method of invoicing has not changed since the date on which my/ our books of accounts

and/ or agreement with the suppliers were examined previously by the Custom House(s).

(This declaration is digitally signed.)

* Strike out whichever is inapplicable.

(FOR CUSTOM HOUSE USE)

Documents presented with Bill of Entry:

Date of receipt in:

Check here additional documents required

1.

Invoice............................................................................

2. Packing

List....................................................................

3. Bank

Draft.......................................................................

4. Insurance Memo/

Policy...................................................

5. Bill of Lading or

Delivery

Order..................................................................

6. Import License/ Custom

Clearance

Permit.............................................................

7. Certificate of

Origin..........................................................

8.

......................................................................................

9.

......................................................................................

10.

.....................................................................................

Appraising group

Central Exchange Unit

Daily List

Revenue Posting

Trade return I.A.D.

C.R.A.D. M.C.D. Key

Register

M.C.D. Manifest

Posting

[C.B.E & C. Notification No. 396-Cus., dated 1st August, 1976]

4 of 5

24-Aug-15 2:38 PM

BOE Print

5 of 5

https://sezonline-ndml.co.in/BOERevamp/BOEPrintForm.aspx?PrintQuantity=-1&RequestId=1715018...

24-Aug-15 2:38 PM

You might also like

- Free Trade Sample DocDocument26 pagesFree Trade Sample Docnatrajang100% (1)

- Export DocumentsDocument28 pagesExport DocumentsAmit PatelNo ratings yet

- ANF 5B LIC - NoDocument5 pagesANF 5B LIC - Nosuman_gourh100% (2)

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- Application Form For Export of SCOMET ItemsDocument4 pagesApplication Form For Export of SCOMET Itemsakashaggarwal88No ratings yet

- ANF 5A EPCG ApplicationDocument6 pagesANF 5A EPCG ApplicationBaljeet SinghNo ratings yet

- Export Declaration Form With SDFDocument12 pagesExport Declaration Form With SDFsandeepgupta29No ratings yet

- (Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Document7 pages(Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Thao MacNo ratings yet

- Annexure-19 MONTH MARCH-.2010: Details of Removals For Export in The Current MonthDocument4 pagesAnnexure-19 MONTH MARCH-.2010: Details of Removals For Export in The Current MonthRaj PatelNo ratings yet

- Co Thailand - ModificadoDocument2 pagesCo Thailand - ModificadoSebastian Aguilar EscalanteNo ratings yet

- IDFjun05 v2Document3 pagesIDFjun05 v2Akshay_S_Jain_7526No ratings yet

- CLAIM DUTY DRAWBACK APPENDIX 35Document6 pagesCLAIM DUTY DRAWBACK APPENDIX 35daljitkaurNo ratings yet

- Tender MagyarDocument5 pagesTender MagyarPeter HegedusNo ratings yet

- Excise Duty Exemption For SolarDocument5 pagesExcise Duty Exemption For SolarMA AhmedNo ratings yet

- Section LL of Tender DocumentDocument10 pagesSection LL of Tender DocumentMark KNo ratings yet

- Indian Oil Corporation Limited: Vendor Code:........................Document6 pagesIndian Oil Corporation Limited: Vendor Code:........................dheeraj1993No ratings yet

- Public Notice No 2Document98 pagesPublic Notice No 2Rajat MehtaNo ratings yet

- Bond Number: Pwl-01/2013-Mfg Bond/Exp Tax Registration Number:-0711483-4Document4 pagesBond Number: Pwl-01/2013-Mfg Bond/Exp Tax Registration Number:-0711483-4zubair_ahmed_importsNo ratings yet

- Pur - F07Document4 pagesPur - F07ZizoGamedNo ratings yet

- Shippers Letter of InstructionsDocument1 pageShippers Letter of InstructionsDipesh JainNo ratings yet

- Administartion Format Close ChecklistDocument15 pagesAdministartion Format Close ChecklistYogesh MisraNo ratings yet

- Acceptance Sheet (Printing) - Divine Fabrics Limited - 11.03.14Document2 pagesAcceptance Sheet (Printing) - Divine Fabrics Limited - 11.03.14S.M.A RobinNo ratings yet

- Workbook - 3rd SemDocument94 pagesWorkbook - 3rd SemKandu SahibNo ratings yet

- Export Import DocsDocument47 pagesExport Import DocsAreej Aftab SiddiquiNo ratings yet

- E - Sugam Notification For KarnatakaDocument8 pagesE - Sugam Notification For KarnatakaHitesh BansalNo ratings yet

- Form ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFDocument3 pagesForm ANF 2M For Ornamental Fish Import License - Firstbusiness - in PDFFirstBusiness.inNo ratings yet

- Appendix 11aDocument9 pagesAppendix 11adaljitkaurNo ratings yet

- BD0010990 Co Code: LC NO: 154013010272Document2 pagesBD0010990 Co Code: LC NO: 154013010272D M Shafiqul IslamNo ratings yet

- Annexures, Appendices and Deviation Statement To Be Filled Up & Uploaded by The BiddersDocument9 pagesAnnexures, Appendices and Deviation Statement To Be Filled Up & Uploaded by The BiddersDivyansh Singh ChauhanNo ratings yet

- ASSESSEE PROFILE FORMAT BlankDocument6 pagesASSESSEE PROFILE FORMAT BlankThanga Pandian SNo ratings yet

- TenderDocument19 pagesTendernambi.kumaresanNo ratings yet

- ApplicationDocument5 pagesApplicationEulNo ratings yet

- Certificate of Origin: Form and User GuideDocument10 pagesCertificate of Origin: Form and User Guideovi naNo ratings yet

- Export Import DocumentsDocument47 pagesExport Import DocumentssadafshariqueNo ratings yet

- Sample in QDocument8 pagesSample in QMOHD SUHAILNo ratings yet

- Osgan Consultants PVT - LTD.: E-24 (Basement), Lajpat Nagar - III, New Delhi - 110024Document9 pagesOsgan Consultants PVT - LTD.: E-24 (Basement), Lajpat Nagar - III, New Delhi - 110024avijit kundu senco onlineNo ratings yet

- Cbec Mig ExportdeclarationDocument45 pagesCbec Mig ExportdeclarationSameer KhanNo ratings yet

- 4500722329-Lekhwair FlowlinesDocument3 pages4500722329-Lekhwair FlowlinesMohsin WaseemNo ratings yet

- Form-16 PCBDocument1 pageForm-16 PCBKarthik chandraNo ratings yet

- INDSKPQP02L.01 02 Cost Analysis and Preferential Certificate Application Form - V5Document8 pagesINDSKPQP02L.01 02 Cost Analysis and Preferential Certificate Application Form - V5HoJienHau0% (1)

- Certificate of Origin-Form DDocument2 pagesCertificate of Origin-Form DAdelia Paramitha75% (4)

- Riot Drill EquipmentDocument26 pagesRiot Drill Equipmentluv manotNo ratings yet

- Apply EPCG Capital Goods Import LicenceDocument5 pagesApply EPCG Capital Goods Import LicencedaljitkaurNo ratings yet

- Tender DetailDocument24 pagesTender Detailmausamcuty1987No ratings yet

- 4509022956Document4 pages4509022956pratiwioktoritaymailNo ratings yet

- DS Ductofab - Asf PDFDocument11 pagesDS Ductofab - Asf PDFzone_rakeshNo ratings yet

- LC 216520020034Document4 pagesLC 216520020034gohoji4169No ratings yet

- Anf 3 CDocument3 pagesAnf 3 CNagu S PillaiNo ratings yet

- Application Form - N RailwayDocument10 pagesApplication Form - N RailwaySandeep K TiwariNo ratings yet

- Solid: BIR AssessmentDocument3 pagesSolid: BIR AssessmentBusinessWorldNo ratings yet

- Commercial ContractDocument5 pagesCommercial ContractHùng Lê VănNo ratings yet

- Export DocumentsDocument22 pagesExport DocumentsHarano PothikNo ratings yet

- Anf 5BDocument3 pagesAnf 5BAkash KediaNo ratings yet

- Appendix - Application Form For Allotment of Importer-Exporter Code (Iec) Number and Modification in Particulars of An Existing Iec No. HolderDocument6 pagesAppendix - Application Form For Allotment of Importer-Exporter Code (Iec) Number and Modification in Particulars of An Existing Iec No. Holderaswin_bantuNo ratings yet

- Goods Declaration: Shipping InformationDocument5 pagesGoods Declaration: Shipping InformationasadkhanpakNo ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- Air Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandAir Brakes (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- MBA 6315 - The Moral MachineDocument2 pagesMBA 6315 - The Moral MachineDat NguyenNo ratings yet

- Japanese Occupation Court Ruling ValidityDocument2 pagesJapanese Occupation Court Ruling ValidityGlen VillanuevaNo ratings yet

- Training Design TaekwondoDocument5 pagesTraining Design Taekwondoalexander100% (3)

- 2017 Normal EnglishDocument854 pages2017 Normal EnglishÂnuda M ĞalappaththiNo ratings yet

- Order Setting Trial - State V Matthew J. Wessels - Fecr012392Document22 pagesOrder Setting Trial - State V Matthew J. Wessels - Fecr012392thesacnewsNo ratings yet

- Recipe For ResilienceDocument54 pagesRecipe For ResilienceSam McNallyNo ratings yet

- Aquatic Animal Protection Act 2017 1960Document8 pagesAquatic Animal Protection Act 2017 1960Subham DahalNo ratings yet

- Assignment 6Document2 pagesAssignment 6Rishabh MelwankiNo ratings yet

- Fmi Case StudyDocument14 pagesFmi Case StudyTan Boon Jin100% (2)

- DLP Reading Comprehension 15th SeptemberDocument3 pagesDLP Reading Comprehension 15th SeptemberHanaa ElmostaeenNo ratings yet

- U2000 & PRS Operation Introduce V1.0Document25 pagesU2000 & PRS Operation Introduce V1.0Nam PhamNo ratings yet

- Hand Soap CDCDocument2 pagesHand Soap CDCswesty100% (1)

- Remedies in TortDocument4 pagesRemedies in TortAhmad Irtaza Adil100% (2)

- SSG Accomplishment ReportDocument7 pagesSSG Accomplishment ReportTeacheer Dan91% (22)

- IO Question Bank: The PromptDocument3 pagesIO Question Bank: The PromptAvijeetNo ratings yet

- Investigation of An Animal Mutilation Injuries in Cache County, UtahDocument33 pagesInvestigation of An Animal Mutilation Injuries in Cache County, UtahLionel Elyansun100% (1)

- Corporate Finance I - Lecture 7bDocument20 pagesCorporate Finance I - Lecture 7bSandra BempongNo ratings yet

- Rfc3435 Dial Plan Digit MapsDocument211 pagesRfc3435 Dial Plan Digit MapsSrinivas VenumuddalaNo ratings yet

- Final Placement Report 2021 shows 70% placementsDocument14 pagesFinal Placement Report 2021 shows 70% placementsRohitNo ratings yet

- DLP Pe - 1 & 2Document1 pageDLP Pe - 1 & 2Dn AngelNo ratings yet

- Chapter 1:: Grammatical Description of English, Basic TermsDocument6 pagesChapter 1:: Grammatical Description of English, Basic Termsleksandra1No ratings yet

- Qurratul Aynayn Translation AnalysisDocument15 pagesQurratul Aynayn Translation AnalysisAbdullah YusufNo ratings yet

- Registered Architects 2019 Grade 1Document3 pagesRegistered Architects 2019 Grade 1santosh bharathy100% (1)

- P3am 7642 enDocument205 pagesP3am 7642 enAmine SEMRANINo ratings yet

- An Investigation Into The Effectiveness of The Reward System in The Government Sector in The Sultanate of Oman and The Potential For Introducing A Total Reward StrategyDocument283 pagesAn Investigation Into The Effectiveness of The Reward System in The Government Sector in The Sultanate of Oman and The Potential For Introducing A Total Reward StrategyNguyen LongNo ratings yet

- 500 Chess Exercises Special Mate in 1 MoveDocument185 pages500 Chess Exercises Special Mate in 1 MoveRégis WarisseNo ratings yet

- Rat King rules the sewersDocument1 pageRat King rules the sewerstartartartar80No ratings yet

- Tendernotice 2Document133 pagesTendernotice 2Pratik GuptaNo ratings yet

- Activity 9 - Invitations Valentina Muñoz AriasDocument2 pagesActivity 9 - Invitations Valentina Muñoz AriasValentina Muñoz0% (1)

- Nick & Sammy - Baby You Love Me (Bass Tab)Document6 pagesNick & Sammy - Baby You Love Me (Bass Tab)Martin MalenfantNo ratings yet