Professional Documents

Culture Documents

Replicating Portfolio

Uploaded by

Chanakya Cherukumalli0 ratings0% found this document useful (0 votes)

9 views2 pagesportfolio

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentportfolio

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesReplicating Portfolio

Uploaded by

Chanakya Cherukumalliportfolio

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

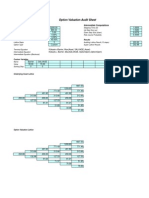

Replicating Portfolio Approach

Current Stock Price (Rs)

Option Type

Exercise Price (Rs)

Time to expiration (yrs)

Risk-free rate (%)

Volatility per year (%)

No of steps

up-factor (u)

down-factor (d)

Replicating Portfolio

Stock price

Option payof

Number of stocks

Stock value

Borrowing/Lending

Net portfolio price/payof

100

EC

110

1

6.0%

20.0%

1

1.2214

0.8187

t=0

100.00

0.3015

30.15

-23.25

6.9026

Expiration

122.14

81.87

12.14

0.00

36.82

-24.68

12.14

24.68

-24.68

0.00

Valuation using risk neutral probabilities

Up probability

Down probability

Option value

0.6037

0.3963

6.9026

Valuation using risk averse (real world) probabilities

Expected return of stock

10%

Up probability

0.7113

Down probability

0.2887

Weight of stock in replicating portfolio

4.3678

Weight of bond in replicating portfolio

-3.3678

Expected return of option

22.40%

Expected value of option payof

8.6360

Option value

6.9026

You might also like

- 01 OptionsValuationsDocument22 pages01 OptionsValuationsmahmut1970No ratings yet

- Option Valuation Audit Sheet: Assumptions Intermediate ComputationsDocument1 pageOption Valuation Audit Sheet: Assumptions Intermediate ComputationslifeeeNo ratings yet

- Lec 2Document6 pagesLec 2QwertyNo ratings yet

- Entropy Methods for Financial DerivativesDocument42 pagesEntropy Methods for Financial DerivativesArthur DuxNo ratings yet

- RatioDocument2 pagesRatiomakawana rameshNo ratings yet

- Anising and VisualisingDocument46 pagesAnising and VisualisingWajid AliNo ratings yet

- Anising and VisualisingDocument46 pagesAnising and VisualisingWajid AliNo ratings yet

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDocument25 pagesChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanNo ratings yet

- Probability Distribution-RefDocument24 pagesProbability Distribution-RefRajatNo ratings yet

- Other Important Labels On The Top: Acceptable Quality Level (AQL)Document2 pagesOther Important Labels On The Top: Acceptable Quality Level (AQL)Sabir AliNo ratings yet

- General: Preferred Value $3,636,363,636Document4 pagesGeneral: Preferred Value $3,636,363,636Raunaq KulkarniNo ratings yet

- Altman Credit Scoring Model UpdateDocument90 pagesAltman Credit Scoring Model UpdateJuan AntonioNo ratings yet

- A Quick Introduction To Machine Learning (Scaling) : Lecturer: John GuttagDocument10 pagesA Quick Introduction To Machine Learning (Scaling) : Lecturer: John GuttagMoamenNo ratings yet

- Tutorial 11 Binomial Option PricingDocument3 pagesTutorial 11 Binomial Option PricingHenry Ng Yong KangNo ratings yet

- Chart - Cost of Equity and Capital StructureDocument12 pagesChart - Cost of Equity and Capital Structureminhthuc203No ratings yet

- Decision Science Answer 1Document6 pagesDecision Science Answer 1shiv panjnaniNo ratings yet

- BS Option Pricing Basics PDFDocument38 pagesBS Option Pricing Basics PDFPankaj Dayani100% (1)

- Umts Performance Report2Document18 pagesUmts Performance Report2Benjamin MedinaNo ratings yet

- Black-Scholes Options Pricing Calculator: Effect of ChangesDocument7 pagesBlack-Scholes Options Pricing Calculator: Effect of ChangesVinay KaraguppiNo ratings yet

- Option Pricing ModelsDocument57 pagesOption Pricing ModelsJayesh ShetkarNo ratings yet

- Chapter 3 Prob SolutionsDocument33 pagesChapter 3 Prob SolutionsMehak Ayoub100% (1)

- Assingnment: Ch#4 (Options Market and Contracts)Document10 pagesAssingnment: Ch#4 (Options Market and Contracts)Mahnoor ShahbazNo ratings yet

- Book1 LatihanDocument14 pagesBook1 LatihanghinaputriauliaNo ratings yet

- Valuation of Bonds and Shares: Problem 1Document29 pagesValuation of Bonds and Shares: Problem 1Sourav Kumar DasNo ratings yet

- DECISION THEORY PRESENTATION BREAKDOWNDocument32 pagesDECISION THEORY PRESENTATION BREAKDOWNAmul Shrestha100% (1)

- Option Valuation Audit Sheet Assumptions & ComputationsDocument1 pageOption Valuation Audit Sheet Assumptions & ComputationslifeeeNo ratings yet

- Decision Science WordDocument10 pagesDecision Science Wordaman ranaNo ratings yet

- Marcospelaez PracproblemsDocument23 pagesMarcospelaez Pracproblemsapi-270738615No ratings yet

- Changingcell Setcell Outputvalue Stattype 10166.6666666667 1,941,421 0 3Document6 pagesChangingcell Setcell Outputvalue Stattype 10166.6666666667 1,941,421 0 3Dibyajyoti BeheraNo ratings yet

- Input Data Corporate Bond Treasury Bond Risk Free AssetDocument4 pagesInput Data Corporate Bond Treasury Bond Risk Free AssetAditya MaheshwariNo ratings yet

- SAAD Cost Benefit Analysis (Notes)Document24 pagesSAAD Cost Benefit Analysis (Notes)greatest_hoaxNo ratings yet

- Black Scholes Discrete DividendsDocument4 pagesBlack Scholes Discrete DividendsSyahrizkaNo ratings yet

- Cost of Equity and Beta: Debt RatiosDocument11 pagesCost of Equity and Beta: Debt Ratiosminhthuc203No ratings yet

- Chap 006Document32 pagesChap 006Dipesh JainNo ratings yet

- PNL and Risk Analysis For Credit DerivativesDocument36 pagesPNL and Risk Analysis For Credit DerivativesTheodor MunteanuNo ratings yet

- FINANCIAL DERIVATIVESDocument30 pagesFINANCIAL DERIVATIVESBevNo ratings yet

- Risk and ReturnDocument80 pagesRisk and ReturnMaira DogarNo ratings yet

- The Binomial Model For Pricing OptionsDocument4 pagesThe Binomial Model For Pricing OptionsFlorencia Tiffany WijayaNo ratings yet

- Study of cash flow analysisDocument2 pagesStudy of cash flow analysisjuanfernandouribegNo ratings yet

- BS Model Explains Option Pricing Using Lognormal DistributionDocument12 pagesBS Model Explains Option Pricing Using Lognormal DistributionNeetu SinghwalNo ratings yet

- Valuing An Expansion Option This Program Calculates The Value of An Expansion Option in An Investment AnalysisDocument2 pagesValuing An Expansion Option This Program Calculates The Value of An Expansion Option in An Investment AnalysisAlok P SinghNo ratings yet

- Global Security Investment Risk AnalysisDocument18 pagesGlobal Security Investment Risk AnalysisabdullahkuwariNo ratings yet

- 04 Risk Analysis (Session 8, 9, 10) - RevisionDocument20 pages04 Risk Analysis (Session 8, 9, 10) - RevisioncreamellzNo ratings yet

- Risk and Return AnswersDocument11 pagesRisk and Return AnswersmasterchocoNo ratings yet

- DCF and WACC - Sun by OracleDocument11 pagesDCF and WACC - Sun by OracleAmol Mahajan50% (2)

- Financial Derivative (90 M Session)Document33 pagesFinancial Derivative (90 M Session)nicero555No ratings yet

- Share Khan Option CalculatorDocument2 pagesShare Khan Option CalculatorquickutNo ratings yet

- Sara's Options AnalysisDocument14 pagesSara's Options AnalysisGaurav ThakurNo ratings yet

- Cost of Equity and Beta: Debt RatiosDocument11 pagesCost of Equity and Beta: Debt Ratiosminhthuc203No ratings yet

- Naked OptionsDocument5 pagesNaked OptionsstockNo ratings yet

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskFrom EverandFinancial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskNo ratings yet

- Calculating WACC using book value and market value proportionsDocument11 pagesCalculating WACC using book value and market value proportionsanshul dyundiNo ratings yet

- Binomial and Black Scholes - 111153Document18 pagesBinomial and Black Scholes - 111153merijan31773No ratings yet

- Ins 200, Slide Chapter 3Document30 pagesIns 200, Slide Chapter 3Syafiqah IlyanaNo ratings yet

- Option Calc v1.0Document2 pagesOption Calc v1.0mr_gauravNo ratings yet

- Risk and Return: by Vaishnav KumarDocument67 pagesRisk and Return: by Vaishnav KumarVaishnav KumarNo ratings yet

- Systems Approach to Management of Disasters: Methods and ApplicationsFrom EverandSystems Approach to Management of Disasters: Methods and ApplicationsNo ratings yet

- Fraud Analytics Using Descriptive, Predictive, and Social Network Techniques: A Guide to Data Science for Fraud DetectionFrom EverandFraud Analytics Using Descriptive, Predictive, and Social Network Techniques: A Guide to Data Science for Fraud DetectionNo ratings yet

- Chapter3 (1) MeenakshiDocument24 pagesChapter3 (1) MeenakshiChanakya CherukumalliNo ratings yet

- Chapter 1 MeenakshiDocument39 pagesChapter 1 MeenakshiChanakya CherukumalliNo ratings yet

- Lab 10Document6 pagesLab 10Chanakya CherukumalliNo ratings yet

- ECON F212 FOFA - Course Handout - 2015-16-2Document2 pagesECON F212 FOFA - Course Handout - 2015-16-2Chanakya CherukumalliNo ratings yet

- Chapter 1Document19 pagesChapter 1Chanakya CherukumalliNo ratings yet

- Notice For DSP Quiz DistributionDocument1 pageNotice For DSP Quiz DistributionChanakya CherukumalliNo ratings yet

- DSP Lab Generates Sine Waves Using TMS320C6713Document3 pagesDSP Lab Generates Sine Waves Using TMS320C6713Chanakya CherukumalliNo ratings yet

- Experiment: 1: To Generate A Sine Wave Using C6713 SimulatorDocument1 pageExperiment: 1: To Generate A Sine Wave Using C6713 SimulatorChanakya CherukumalliNo ratings yet

- Steps For Creating Sine Wave Using DSK6713Document2 pagesSteps For Creating Sine Wave Using DSK6713Chanakya CherukumalliNo ratings yet

- Lab 2Document12 pagesLab 2Chanakya CherukumalliNo ratings yet

- Digital Signal Processing: Date: 21/08/2014Document6 pagesDigital Signal Processing: Date: 21/08/2014Chanakya CherukumalliNo ratings yet

- DSP Exp-3Document5 pagesDSP Exp-3Chanakya CherukumalliNo ratings yet