Professional Documents

Culture Documents

Philippines: This Is Our Time!: August 2016 Volume 8, No. 4

Uploaded by

JylesronnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philippines: This Is Our Time!: August 2016 Volume 8, No. 4

Uploaded by

JylesronnCopyright:

Available Formats

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB

B MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

Guidance for Stock Market Investing Exclusively for TrulyRichClub Members

Note: To understand the Stocks Update, first read Bos Ebook, My Maid Invests in the Stock Market.

Click here www.TrulyRichClub.com to download now.

Volume 8, No. 4 August 2016

Philippines: This Is Our Time!

Im writing this piece in Singapore.

Im taking a 3-day self-retreat in a quite spot

just to write, walk in the woods, and welcome Gods

wellbeing. Ahhh

Im here because last night, we gave our

TrulyRichClub Stock Market Seminar to mostly Filipinos

working here in Singapore.

While here, I checked the stock market in Singapore,

and realize how blessed we are. Believe me, its nothing

compared to what were experiencing in the Philippines.

Heres what I realized: Theres really nothing out

there like the Philippine Stock Market. I also invest (a

bit) in the US Stock Market. And yes, my investments are

doing okay, but its nothing compared to my wonderful

earnings in the Philippines.

Reason: This is our time. This is our season.

In the next few years, youll see the Philippines economy grow by leaps and bounds.

Arent you happy youre living at this time?

Happy investing!

May your dreams come true,

Bo Sanchez

P.S. Some of our newer members are asking how they can avail of our FREE Life Insurance. Its very easy: Just pay

the TrulyRichClubs annual membership fees (which makes you save 20 percent!) and youll get free P100,000 Life

Insurance for as long as youre a member of the TrulyRichClub. To get your free Life Insurance, click the link below:

Yes Bo, I Want to Enjoy the Free Life Insurance

Stocks Update Page 1 of 9

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

Benefitting Sectors

By Mike Vias

In one of our recent issues of the Stocks Update, I shared with you a list of possible sectors that COL Research

and TRC believe will benefit from the policies of this new government administration. For this issue, I would like to

give you an update on this list.

Initially, we said that the mining sector will be a beneficiary to his policies. However, we were wrong. While

President Duterte is not against mining, it looks like he is seriously against irresponsible mining. With his appointment

of anti-mining advocate Gina Lopez as the Secretary of the Department of Environment and Natural Resources (DENR),

all operating mines are now required to be ISO-certified. Ms. Lopez also said that companies that will not comply

will be penalized by the suspension of their environmental compliance certificate and the non-issuance of the ore

transport permits. Good thing our SAM stocks are not directly involved in mining and thus will not be affected.

In addition to the list of sectors that will benefit from the Duterte administration, we would like to include

the tourism sector. Apparently, five out of the 14 Public-Private-Partnership (PPP) projects that will be bided are

airport projects. Also, in the Presidents 10-point economic agenda, he stated that he would like to promote rural

development through rural tourism.

Moreover, the property sector may also be benefitted further by the news that the present administration will

be reviewing the existing policies and rules of the Real Estate Investment Trusts or REITs. The current policies and

rules have discouraged REIT listing even if the REIT law have been passed in 2009.

Heres an updated list (from COL Research) of sectors that may be beneficiaries of the current administration.

Sector Reasons

Infrastructure Acceleration of infrastructure spending; More foreign direct investments (FDIs)

Five out of the next 17 PPPs are airports; Govt emphasis of rural development for inclusive

Tourism

growth

Consumer Favorable demographics; Tax cuts; Improvement of social protection programs

Properties Favorable demographics; Better infrastructure; Growing BPO sector; Review of REIT law

Banks Ample liquidity, Acceleration of infrastructure spending; More FDIs

This is good news for our SAM stocks that are under these sectors.

Company Update: CEB

Cebu Pacific has remained resilient in the 1st quarter of 2016 in spite of stiffer competition, with revenues showing

a 13.4 percent improvement to P16.1 billion. Revenues increased due to more passenger bookings, registering a seat

load factor of 86.7 percent. This is more than the load factor registered in the 2nd and 4th quarters of 2015 which are

seasonally stronger quarters. Furthermore, ancillary revenues per passenger increased by 9.8 percent as a result of

more international and long haul flights.

Moving forward, COL Research and TRC believe that CEB will be able to attract more passengers caused by their

relatively cheaper airline tickets. April operating statistics show that there is a continuous improvement in passenger

bookings, with a seat load factor of 90.1 percent. This is the highest in the past five years.

TRC and COLs revenue forecast for CEB for 2017 and 2018 increased due to a change in CEBs fleet program.

This led to increased capacity, which eventually will lead to higher passenger volume forecast. Also, from a fleet of 59

planes by the end of 2016, the company has hiked its expected fleet to 69 planes.

We will continue with our Company Updates, in our next issues.

Happy investing!

Stocks Update Volume 8, No. 4 August 2016 Page 2 of 9

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

P.S. If you or a friend would like to learn more on the basics of investing in the stock market, I conduct free seminars

twice a month at the COL Financial Training Center. Here, I teach the basics of long-term investing in the Stock Market.

You may sign-up for these seminars at www.colfinancial.com.

I also give powerful talks on various engaging and practical topics every Sunday at Feast ATC in Cinema 2 of

Alabang Town Center. The Mass starts at 9AM and The Feast kicks-off at 10M. Come by. Its for free!

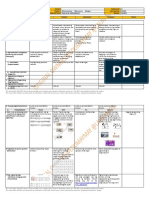

Heres our SAM STOCKS and Mutual Fund Table (as of August 19, 2016 closing).

STOCK CURRENT PRICE BUY BELOW PRICE TARGET PRICE ACTION TO TAKE

AC 896.00 810.43 932.00 Stop Buying

ALI 41.15 37.68 47.10 Stop Buying

BDO 112.30 111.30 128.00 Stop buying

CEB 122.30 129.60 162.00 Continue buying

CHP 12.60 12.18 14.00 Stop buying

DNL 11.22 10.86 12.50 Stop Buying

FGEN 25.20 30.69 35.30 Continue Buying

MBT 89.75 98.26 113.00 Continue buying

MEG 4.88 5.38 6.19 Continue buying

UBP 73.25 73.33 88.00 Continue buying

*Stop buying for now as advised by Bro. Bo

DATE PRICE PRICE ESTIMATED BUY BELOW EXPECTED

STOCK TARGET PRICE

BOUGHT BOUGHT TODAY RETURN PRICE GROWTH

AC Jul-13 603.50 896.00 48.47% 654.80 753.00 24.77%

Aug-13 598.50 896.00 49.71% 602.40 753.00 25.81%

Sep-13 580.00 896.00 54.48% 602.40 753.00 29.83%

Oct-13 601.50 896.00 48.96% 602.40 753.00 25.19%

Nov-13 569.50 896.00 57.33% 602.40 753.00 32.22%

Dec-13 555.00 896.00 61.44% 602.40 753.00 35.68%

Jan-14 525.00 896.00 70.67% 599.13 689.00 31.24%

Feb-14 538.50 896.00 66.39% 599.13 689.00 27.95%

Mar-14 574.00 896.00 56.10% 599.13 689.00 20.03%

Apr-14 590.00 896.00 51.86% 599.13 689.00 16.78%

Aug-14 704.00 896.00 27.27% 709.00 816.00 15.91%

Oct-14 688.00 896.00 30.23% 709.00 816.00 18.60%

Nov-14 690.00 896.00 29.86% 709.00 816.00 18.26%

Dec-14 689.00 896.00 30.04% 709.00 816.00 18.43%

Feb-15 730.00 896.00 22.74% 743.48 855.00 17.12%

Mar-15 732.00 896.00 22.40% 743.48 855.00 16.80%

Apr-15 800.00 896.00 12.00% 762.61 877.00 9.63%

Jun-15 772.50 896.00 15.99% 762.61 877.00 13.53%

Sep-15 755.00 896.00 18.68% 734.78 845.00 11.92%

Dec-15 725.00 896.00 23.59% 734.78 845.00 16.55%

Stocks Update Volume 8, No. 4 August 2016 Page 3 of 9

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

DATE PRICE PRICE ESTIMATED BUY BELOW EXPECTED

STOCK TARGET PRICE

BOUGHT BOUGHT TODAY RETURN PRICE GROWTH

AC Jan-16 660.00 896.00 35.76% 695.65 800.00 21.21%

Feb-16 685.00 896.00 30.80% 798.26 918.00 34.01%

ESTIMATE GAIN/LOSS 37.10%

ALI Jan-16 31.40 41.15 31.05% 33.34 41.67 32.71%

Feb-16 31.00 41.15 32.74% 33.34 41.67 34.42%

ESTIMATE GAIN/LOSS 31.05%

BDO Sep-15 101.90 112.30 10.21% 102.60 118.00 15.80%

Nov-15 101.40 112.30 10.75% 102.60 118.00 16.37%

Dec-15 100.20 112.30 12.08% 102.60 118.00 17.76%

ESTIMATE GAIN/LOSS 11.01%

CEB Nov-14 76.70 122.30 59.45% 78.26 90.00 17.34%

Dec-14 85.00 122.30 43.88% 130.43 150.00 76.47%

Jan-15 94.70 122.30 29.14% 124.80 156.00 64.73%

Feb-15 92.30 122.30 32.50% 124.80 156.00 69.01%

Mar-15 88.50 122.30 38.19% 124.80 156.00 76.27%

Apr-15 84.40 122.30 44.91% 124.80 156.00 84.83%

May-15 84.30 122.30 45.08% 124.80 156.00 85.05%

Jun-15 83.65 122.30 46.20% 124.80 156.00 86.49%

Jul-15 90.40 122.30 35.29% 124.80 156.00 72.57%

Aug-15 97.00 122.30 26.08% 124.80 156.00 60.82%

Sep-15 87.00 122.30 40.57% 124.80 156.00 79.31%

Oct-15 85.75 122.30 42.62% 129.60 162.00 88.92%

ESTIMATE GAIN/LOSS 40.33%

CHP Jul-16 11.90 12.60 5.88% 12.17 14.00 17.65%

Aug-16 12.04 12.60 4.65% 12.17 14.00 16.28%

ESTIMATE GAIN/LOSS 5.27%

DNL Jul-16 9.80 11.22 14.49% 10.87 12.50 27.55%

ESTIMATE GAIN/LOSS 14.49%

Legend: n Continue Buying n Stop Buying

Stocks Update Volume 8, No. 4 August 2016 Page 4 of 9

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

DATE PRICE PRICE ESTIMATED BUY BELOW EXPECTED

STOCK TARGET PRICE

BOUGHT BOUGHT TODAY RETURN PRICE GROWTH

FGEN Feb-15 29.00 25.20 -13.10% 32.43 37.30 28.62%

Mar-15 30.50 25.20 -17.38% 32.43 37.30 22.30%

Apr-15 29.40 25.20 -14.29% 31.30 36.00 22.45%

May-15 27.55 25.20 -8.53% 31.30 36.00 30.67%

Jun-15 25.30 25.20 -0.40% 28.80 36.00 42.29%

Jul-15 26.00 25.20 -3.08% 28.80 36.00 38.46%

Aug-15 26.75 25.20 -5.79% 28.56 35.70 33.46%

Sep-15 23.80 25.20 5.88% 28.56 35.70 50.00%

Oct-15 24.00 25.20 5.00% 27.28 34.10 42.08%

Nov-15 25.20 25.20 0.00% 27.28 34.10 35.32%

Dec-15 22.00 25.20 14.55% 27.28 34.10 55.00%

Jan-15 22.15 25.20 13.77% 28.43 32.70 47.63%

Feb-16 18.40 25.20 36.96% 28.43 32.70 77.72%

Mar-16 20.90 25.20 20.57% 28.43 32.70 56.46%

Apr-16 21.75 25.20 15.86% 29.30 33.70 54.94%

May-16 19.52 25.20 29.10% 29.30 33.70 72.64%

Jun-16 22.50 25.20 12.00% 29.30 33.70 49.78%

Jul-16 24.85 25.20 1.41% 29.30 33.70 35.61%

Aug-16 25.10 25.20 0.40% 29.30 33.70 34.26%

ESTIMATE GAIN/LOSS 4.89%

MBT Jun-11 50.06 89.75 79.27% 78.88 93.60 86.96%

Jul-11 55.69 89.75 61.17% 78.88 93.60 68.09%

Aug-11 52.85 89.75 69.82% 78.88 93.60 77.11%

Sep-11 50.40 89.75 78.08% 78.88 93.60 85.71%

Oct-11 48.34 89.75 85.68% 78.88 93.60 93.65%

Nov-11 50.33 89.75 78.32% 78.88 93.60 85.97%

Dec-11 47.60 89.75 88.55% 78.88 93.60 96.64%

Jan-12 49.42 89.75 81.61% 83.07 108.00 118.54%

Feb-12 55.23 89.75 62.50% 83.07 108.00 95.55%

Mar-12 61.60 89.75 45.70% 93.91 108.00 75.32%

Apr-12 60.20 89.75 49.09% 93.91 108.00 79.40%

May-12 62.13 89.75 44.47% 93.91 108.00 73.84%

Jun-12 60.55 89.75 48.22% 93.91 108.00 78.36%

Sep-12 65.38 89.75 37.27% 93.91 108.00 65.19%

Oct-12 65.10 89.75 37.86% 104.35 120.00 84.33%

Nov-12 67.24 89.75 33.49% 104.35 120.00 78.48%

Jan-13 72.38 89.75 24.00% 113.04 130.00 79.61%

Feb-13 78.75 89.75 13.97% 129.57 149.00 89.21%

Mar-13 81.90 89.75 9.58% 129.57 149.00 81.93%

Apr-13 82.81 89.75 8.38% 129.57 149.00 79.93%

Legend: n Continue Buying n Stop Buying

Stocks Update Volume 8, No. 4 August 2016 Page 5 of 9

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

DATE PRICE PRICE ESTIMATED BUY BELOW EXPECTED

STOCK TARGET PRICE

BOUGHT BOUGHT TODAY RETURN PRICE GROWTH

MBT Jun-13 84.70 89.75 5.96% 129.57 149.00 75.91%

Jul-13 78.89 89.75 13.77% 129.57 149.00 88.87%

Aug-13 77.00 89.75 16.56% 119.20 149.00 93.51%

Sep-13 84.65 89.75 6.02% 91.68 114.60 35.38%

Oct-13 86.95 89.75 3.22% 91.68 114.60 31.80%

Nov-13 80.55 89.75 11.42% 91.68 114.60 42.27%

Dec-13 73.20 89.75 22.61% 91.68 114.60 56.56%

Jan-14 73.75 89.75 21.69% 86.96 100.00 35.59%

Feb-14 79.55 89.75 12.82% 86.96 100.00 25.71%

Mar-14 81.40 89.75 10.26% 86.96 100.00 22.85%

Apr-14 79.70 89.75 12.61% 86.00 100.00 25.47%

May-14 83.50 89.75 7.49% 86.00 100.00 19.76%

Jun-14 85.15 89.75 5.40% 86.00 100.00 17.44%

Aug-14 85.75 89.75 4.66% 96.50 111.00 29.45%

Sep-14 88.00 89.75 1.99% 96.50 111.00 26.14%

Oct-14 83.65 89.75 7.29% 96.50 111.00 32.70%

Nov-14 82.50 89.75 8.79% 96.50 111.00 34.55%

Dec-14 82.95 89.75 8.20% 92.17 106.00 27.79%

Jan-15 88.00 89.75 1.99% 92.17 106.00 20.45%

Feb-15 94.75 89.75 -5.28% 97.39 112.00 18.21%

Jun-15 87.55 89.75 2.51% 86.09 99.00 13.08%

Jan-15 71.00 89.75 26.41% 80.00 92.00 29.58%

Feb-15 72.80 89.75 23.28% 80.00 92.00 26.37%

Jul-16 96.90 89.75 -7.38% 98.26 113.00 16.62%

Aug-16 93.80 89.75 -4.32% 98.26 113.00 20.47%

ESTIMATE GAIN/LOSS 27.89%

Legend: n Continue Buying n Stop Buying

Mike Vias is an Investment Trainer of COL Financial Group, Inc. He is a Certified Securities Representative and

Certified Investment Solicitor.

Stocks Update Volume 8, No. 4 August 2016 Page 6 of 9

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

DATE PRICE PRICE ESTIMATED BUY BELOW EXPECTED

STOCK TARGET PRICE

BOUGHT BOUGHT TODAY RETURN PRICE GROWTH

MEG May-13 4.23 4.88 15.37% 4.16 4.78 13.00%

Jun-13 3.67 4.88 32.97% 4.16 4.78 30.25%

Jul-13 3.15 4.88 54.92% 4.16 4.78 51.75%

Aug-13 3.40 4.88 43.53% 4.23 4.87 43.24%

Sep-13 3.21 4.88 52.02% 4.23 4.87 51.71%

Oct-13 3.64 4.88 34.07% 4.23 4.87 33.79%

Nov-13 3.58 4.88 36.31% 4.23 4.87 36.03%

Dec-13 3.23 4.88 51.08% 4.23 4.87 50.77%

Jan-14 3.36 4.88 45.24% 3.95 4.54 35.12%

Feb-14 3.78 4.88 29.10% 4.77 5.48 44.97%

Apr-14 4.43 4.88 10.16% 4.77 5.48 23.70%

May-14 4.65 4.88 4.95% 4.77 5.48 17.85%

Jun-14 4.51 4.88 8.20% 4.77 5.48 21.51%

Jul-14 4.47 4.88 9.17% 4.77 5.48 22.60%

Aug-14 4.26 4.88 14.55% 4.98 5.73 34.51%

Sep-14 4.30 4.88 13.49% 4.98 5.73 33.26%

Feb-15 5.09 4.88 -4.13% 5.10 5.86 15.13%

Jun-15 4.71 4.88 3.61% 5.10 5.86 24.42%

Sep-15 4.29 4.88 13.75% 5.10 5.86 36.60%

Oct-15 4.47 4.88 9.17% 5.07 5.83 30.43%

Dec-15 4.20 4.88 16.19% 5.07 5.83 38.81%

Jan-16 3.58 4.88 36.31% 4.85 5.58 55.87%

Feb-16 3.44 4.88 41.86% 4.85 5.58 62.21%

Mar-16 4.14 4.88 17.87% 4.85 5.58 34.78%

Apr-16 3.96 4.88 23.23% 4.85 5.58 40.91%

May-16 3.64 4.88 34.07% 4.85 5.58 53.30%

Jun-16 4.50 4.88 8.44% 4.85 5.58 24.00%

Jul-16 4.65 4.88 4.95% 5.38 6.19 33.12%

ESTIMATE GAIN/LOSS 14.05%

UBP May-16 59.00 73.33 24.29% 64.17 77.00 30.51%

Jul-16 67.50 73.33 8.64% 73.33 88.00 30.37%

ESTIMATE GAIN/LOSS 16.46%

NAVPS WHEN

CURRENT NAVPS ESTIMATED

FUND CODE FUND BOUGHT ACTION TO TAKE

(08/19/16) RETURN

(01/12/16)

XPEEQ Philequity Fund 31.0639 37.9398 22.13% Continue buying

XPEIF Philequity Index Fund 4.2155 5.2339 24.16%

Continue buying

First Metro Save and

XFMEQ 4.7707 5.5241 15.79%

Learn Equity Fund Continue buying

Sunlife Prosperity Equity

XSLEQ 3.4805 4.2885 23.22%

Fund Continue buying

Stocks Update Volume 8, No. 4 August 2016 Page 7 of 9

2015 Top Winners of TrulyRichClubs Stocks

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS THIS IS FOR THE EXCLUSIVE USE OF TRULYRICH CLUB MEMBERS

Note: The percentage returns cannot be compared between the two tables below. The All Time Winners table does

not take into consideration a cost-averaging method. The percentage return is only from a buy-and-hold strategy. The

2015 Table however integrates a cost-averaging method throughout the months it was under the Buy-Below.

ESTIMATED

STOCK TIME PRICE ESTIMATED

STOCKS TIME

SYMBOL RECOMMENDED RANGE RETURN

HELD

May 2014 to September

Aboitiz Power AP 16 Months P36.40 to P43.40 21.32%

2015

Lafarge Republic June 2013 to February

LRI 20 Months P11.50 to P10.20 5.88%

Inc. 2015

September 2014 to May

Meralco MER 8 Months P258.00 to P281 5.73%

2015

Top Past Winners of TrulyRichClubs Stocks

ESTIMATED

STOCK TIME PRICE ESTIMATED

STOCKS TIME

SYMBOL RECOMMENDED RANGE RETURN

HELD

June 2011 to February

Ayala Land ALI 2012 9 Months P15.09 to P21.65 35%

(3rd week)

Bank of The February 2012 to

BPI 10 Months P68.45 to P91.00 34.29%

Philippine Islands November 2012 (4th week)

October 2012 to P440.00 to

Ayala Corporation AC 2 Months 17.65%

December 2012 (2nd week) P520.00

February 2012 to

SM Prime Holdings SMPH 10 Months P12.48 to P17.00 27.75%

December 2012 (1st week)

P268.00 to

Meralco MER January 2013 to April 2013 3 Months 28.05%

P377.00

First Phlippine

FPH June 2011 to June 2013 25 Months P63.18 to P95.20 32.92%

Holdings

February 12 to October

JG Summit Holdings JGS 18 Months P25.75 to P43.50 39.96%

2013

February 2013 to April

D&L Industries DNL 14 Months P6.45 to P10.00 44%

2014

Banco De Oro BDO April 2013 to August 2014 16 Months P89.60 to P93.00 24%

May 2014 to September

Aboitiz Power AP 16 Months P36.40 to P43.40 21.32%

2015

(Disclaimer: Past performance doesnt guarantee that youll have the exact same results in the future. After all, your

earnings all depend on the markets performance.)

Stocks Update Volume 8, No. 4 August 2016 Page 9 of 9

You might also like

- Ed Seykota The Trading TribeDocument159 pagesEd Seykota The Trading TribeJeniffer Rayen43% (7)

- Bonanza A36 ChecklistDocument10 pagesBonanza A36 Checklistalbucur100% (4)

- Arthur Kleinman The Illness Narratives Suffering Healing and The Human ConditionDocument46 pagesArthur Kleinman The Illness Narratives Suffering Healing and The Human Conditionperdidalma62% (13)

- Stanley - Your Voice (1957) PDFDocument396 pagesStanley - Your Voice (1957) PDFŠašavi Sam MajmunNo ratings yet

- You Can Make Your Life Beautiful by Bro. Bo SanchezDocument133 pagesYou Can Make Your Life Beautiful by Bro. Bo SanchezCharis Mae DimaculanganNo ratings yet

- What Are Illegal Water Service Connections?Document2 pagesWhat Are Illegal Water Service Connections?Yusop B. Masdal100% (1)

- Alt Symbol CodesDocument16 pagesAlt Symbol CodesMohammadNo ratings yet

- Wf-1 Detail Wf-2 DetailDocument1 pageWf-1 Detail Wf-2 Detailrick100% (1)

- I D I Introduction To Integrated Water Meter ManagementDocument187 pagesI D I Introduction To Integrated Water Meter ManagementNeng KittNo ratings yet

- Module 1 and 2 - Intro & Meter Basics 2014Document48 pagesModule 1 and 2 - Intro & Meter Basics 2014Yusop B. MasdalNo ratings yet

- Quotation GyuDocument33 pagesQuotation Gyuchandumys89No ratings yet

- MeterDocument81 pagesMeterYutt WattNo ratings yet

- Column DesignDocument1 pageColumn Designmanoj_mousamNo ratings yet

- WSP Philippines WSS Turning Finance Into Service For The Future PDFDocument90 pagesWSP Philippines WSS Turning Finance Into Service For The Future PDFKarl GutierrezNo ratings yet

- Proposed 1 Storey Car Display and Repair Shop-PlumbingDocument1 pageProposed 1 Storey Car Display and Repair Shop-Plumbingmichael jan de celisNo ratings yet

- Swimming Pool MandyDocument80 pagesSwimming Pool MandyRENZZ IRVIN DELA TORRENo ratings yet

- Earthquake Resistant Design ConceptsDocument55 pagesEarthquake Resistant Design ConceptsKatherine Shayne Yee100% (1)

- Basic Principles of Earthquake Resistant StructuresDocument9 pagesBasic Principles of Earthquake Resistant StructuresKatherine Shayne YeeNo ratings yet

- Windows ALT Codes PDF Reference ChartDocument3 pagesWindows ALT Codes PDF Reference ChartChristian LlorcaNo ratings yet

- Septage Management Leader's GuidebookDocument116 pagesSeptage Management Leader's Guidebookecossich123100% (1)

- The Chef's KnifeDocument6 pagesThe Chef's Knifejaennii parkNo ratings yet

- Fortuner Quotation With SpecsDocument4 pagesFortuner Quotation With SpecsJc QuismundoNo ratings yet

- General Construction Notes: Drawing IndexDocument1 pageGeneral Construction Notes: Drawing IndexEdzon Lacay0% (1)

- Structural Calculation TemplateDocument26 pagesStructural Calculation TemplateJohn Christopher JusayanNo ratings yet

- Minimum Trap Diameter and Dfu Value / Size of Water Supply and Wsfu ValueDocument1 pageMinimum Trap Diameter and Dfu Value / Size of Water Supply and Wsfu Valueren salazarNo ratings yet

- Chapter 8 - Earthquake Design SamplesDocument3 pagesChapter 8 - Earthquake Design SamplesKatherine Shayne YeeNo ratings yet

- Recommended Rules for Sizing Water Supply SystemsDocument16 pagesRecommended Rules for Sizing Water Supply SystemsRadoNoun100% (1)

- Y2 - Module 1 - Preparing Plumbing Materials and ToolsDocument35 pagesY2 - Module 1 - Preparing Plumbing Materials and ToolsMichael ReyesNo ratings yet

- Dfu WsfuDocument1 pageDfu Wsfuren salazarNo ratings yet

- PUP Rizal campus plumbing analysisDocument14 pagesPUP Rizal campus plumbing analysisRhowelle TibayNo ratings yet

- Design Calculation Sheet: A-Water DemandDocument1 pageDesign Calculation Sheet: A-Water DemandMethaq AliNo ratings yet

- Water Distribution EPANEtDocument13 pagesWater Distribution EPANEtAli Hassan LatkiNo ratings yet

- Lets Get To Know ForexDocument5 pagesLets Get To Know ForexFlordelito B. Contreras Jr.No ratings yet

- Keep Doing Your Monthly Thing: (And If You Have Big Cash, Divide by Twelve)Document4 pagesKeep Doing Your Monthly Thing: (And If You Have Big Cash, Divide by Twelve)mike dNo ratings yet

- Marurungin Te Iango: Te Ibuobuoki Man Te BaibaraDocument16 pagesMarurungin Te Iango: Te Ibuobuoki Man Te BaibaraCristina PumarejoNo ratings yet

- How to calculate your retirement fund needs for comfortable livingDocument4 pagesHow to calculate your retirement fund needs for comfortable livingedUNo ratings yet

- A.I Video CreatorDocument1 pageA.I Video CreatorTahina ANDRIAMANGANo ratings yet

- TAS BG Integrated Amps 2010 PDFDocument98 pagesTAS BG Integrated Amps 2010 PDFjuaenelviraNo ratings yet

- Rhythmic Breathing - Relaxation TechDocument1 pageRhythmic Breathing - Relaxation TechSumiran TandonNo ratings yet

- The Power of Dividends To Make You Rich: October 2019 Volume 11, No. 20Document5 pagesThe Power of Dividends To Make You Rich: October 2019 Volume 11, No. 20Shan PelinoNo ratings yet

- Veo en Ti La LuzDocument4 pagesVeo en Ti La LuzRocío Soledad Baeza CastilloNo ratings yet

- Le Jatsuts Baaloob Ken UTS Aa DiosoDocument16 pagesLe Jatsuts Baaloob Ken UTS Aa DiosoOscar ChanNo ratings yet

- Making Sense of SufferingDocument16 pagesMaking Sense of SufferingLuis E. AriasNo ratings yet

- Ambopakyanam - 1Document57 pagesAmbopakyanam - 1sanathandharmaNo ratings yet

- Stocks Su 20210825Document11 pagesStocks Su 20210825Jake Aseo BertulfoNo ratings yet

- Ekadasi Vratha Mahima PDFDocument69 pagesEkadasi Vratha Mahima PDFPrasad PantuluNo ratings yet

- Ekadasi Vratha MahimaDocument69 pagesEkadasi Vratha MahimaashokvedNo ratings yet

- History05713 زراعة وصناعة وتسويق الورد في محافظة الطائف دراسة تطبيقية في الجغرافيا الزراعية ناريمان بنت محمود ابراهيم ابو عجوة جامعة ام القرى بالسعوديةDocument241 pagesHistory05713 زراعة وصناعة وتسويق الورد في محافظة الطائف دراسة تطبيقية في الجغرافيا الزراعية ناريمان بنت محمود ابراهيم ابو عجوة جامعة ام القرى بالسعوديةMIKENo ratings yet

- Katalog Nov 2020Document3 pagesKatalog Nov 2020Didik ApriantoNo ratings yet

- I Love You Lord Psalm 18 SongDocument1 pageI Love You Lord Psalm 18 SongDaniela De MattiaNo ratings yet

- How To Alter (Changes) in Group in Tally PrimeDocument3 pagesHow To Alter (Changes) in Group in Tally PrimeAmit GuptaNo ratings yet

- Three Lessons We Can Learn From Globe: Lesson 1: Ride The Wave of ChangeDocument10 pagesThree Lessons We Can Learn From Globe: Lesson 1: Ride The Wave of ChangeJake Aseo BertulfoNo ratings yet

- Compare Enthral Elite & Enthral 1.0 Road BikesDocument2 pagesCompare Enthral Elite & Enthral 1.0 Road Bikesdanish ihsanNo ratings yet

- The Concise Buddhist Monastic Code 1 PDFDocument343 pagesThe Concise Buddhist Monastic Code 1 PDFအသွ်င္ ေကသရNo ratings yet

- Proof ProducerDocument2 pagesProof ProducerlightfingaNo ratings yet

- WP MG 202305Document16 pagesWP MG 202305Roberalimanana Rivo LalainaNo ratings yet

- Tai Chi Retreat Course BookDocument168 pagesTai Chi Retreat Course BookMaurício Gallego67% (3)

- Pizza PartyDocument11 pagesPizza Partyapi-338927224No ratings yet

- May 5 Presentation: Comparing Public and Private Employee Compensaton and Retrement Benefits in CaliforniaDocument9 pagesMay 5 Presentation: Comparing Public and Private Employee Compensaton and Retrement Benefits in Californiasmf 4LAKidsNo ratings yet

- Walking With JesusDocument1 pageWalking With JesusboatcomNo ratings yet

- İstanbul - OboeDocument4 pagesİstanbul - OboeAlex DanielsNo ratings yet

- Buenos Aires: PDF EbookDocument259 pagesBuenos Aires: PDF EbookivananrodriguezNo ratings yet

- Hymns Mashup: BaritoneDocument2 pagesHymns Mashup: BaritoneRoger Velazquez0% (1)

- Victory in Jesus: Prestonwood Platinum Singers SongbookDocument3 pagesVictory in Jesus: Prestonwood Platinum Singers SongbookAndresNo ratings yet

- Su 20160315 PDFDocument9 pagesSu 20160315 PDFJylesronnNo ratings yet

- Su 20160523Document8 pagesSu 20160523JylesronnNo ratings yet

- Consistent Beats Dramatic: December 2015 Volume 6, No. 24Document8 pagesConsistent Beats Dramatic: December 2015 Volume 6, No. 24JylesronnNo ratings yet

- Su 20160201Document9 pagesSu 20160201JylesronnNo ratings yet

- Su 20160119Document12 pagesSu 20160119JylesronnNo ratings yet

- Su 20151004Document9 pagesSu 20151004JylesronnNo ratings yet

- Su 20160503Document8 pagesSu 20160503JylesronnNo ratings yet

- Why Our Stocks Went Down: September 2015 Volume 6, No. 17Document9 pagesWhy Our Stocks Went Down: September 2015 Volume 6, No. 17JylesronnNo ratings yet

- Stock Market Investing Is Not Complicated: November 2015 Volume 6, No. 22Document9 pagesStock Market Investing Is Not Complicated: November 2015 Volume 6, No. 22JylesronnNo ratings yet

- China Hong-Kong Cost Handbook 2014 WebsiteDocument158 pagesChina Hong-Kong Cost Handbook 2014 WebsiteLe'Novo FernandezNo ratings yet

- Su 20150824Document10 pagesSu 20150824JylesronnNo ratings yet

- Wonderful Companies: September 2015 Volume 6, No. 18Document9 pagesWonderful Companies: September 2015 Volume 6, No. 18RoyAndrew GarciaNo ratings yet

- The Newsletter of the TrulyRichClub.com - Sow in Time of FamineDocument6 pagesThe Newsletter of the TrulyRichClub.com - Sow in Time of FamineJylesronnNo ratings yet

- A: A Lot of Available Cash: Q: What Can Harm Your Business?Document5 pagesA: A Lot of Available Cash: Q: What Can Harm Your Business?JylesronnNo ratings yet

- Su 20150824Document10 pagesSu 20150824JylesronnNo ratings yet

- Avoid Free LunchDocument2 pagesAvoid Free LunchchamlavNo ratings yet

- SAM Quick StartDocument3 pagesSAM Quick StartEliezar Lim IñigoNo ratings yet

- Switch EEI and FLI To ALI: Stock Alert: Switch, Plus..Document5 pagesSwitch EEI and FLI To ALI: Stock Alert: Switch, Plus..JylesronnNo ratings yet

- The Stock Market Jumpstarter V2.0Document51 pagesThe Stock Market Jumpstarter V2.0Dennis LandichoNo ratings yet

- Stock Alert: Sell SMPH, Buy SECB-March 10, 2016Document1 pageStock Alert: Sell SMPH, Buy SECB-March 10, 2016JylesronnNo ratings yet

- Healing HabitsDocument7 pagesHealing HabitsJake Ernest R. SerojeNo ratings yet

- How to Fill Out COL Account Opening FormsDocument7 pagesHow to Fill Out COL Account Opening FormsRaymunda Rauto-avilaNo ratings yet

- HealingHabits03-Eat 5 Fruits For BreakfastDocument5 pagesHealingHabits03-Eat 5 Fruits For BreakfastJylesronnNo ratings yet

- A GUIDE TO TRULY RICH CLUB by BO SANCHEZDocument5 pagesA GUIDE TO TRULY RICH CLUB by BO SANCHEZRaymunda Rauto-avilaNo ratings yet

- Formula 1480 Rub Off Mask PDFDocument1 pageFormula 1480 Rub Off Mask PDFAbdul WasayNo ratings yet

- Bab 06 PindahPanasDocument41 pagesBab 06 PindahPanasPurna Satria NugrahaNo ratings yet

- CHEMDocument20 pagesCHEMValli RamalingamNo ratings yet

- Surgical Technologist Resume SampleDocument2 pagesSurgical Technologist Resume Sampleresume7.com100% (3)

- Subway 2009Document12 pagesSubway 2009sparklers_mNo ratings yet

- GP2A25J0000F Series: Detecting Distance: 1 To 9mm OPIC Output, Refl Ective Photointerrupter With ConnectorDocument10 pagesGP2A25J0000F Series: Detecting Distance: 1 To 9mm OPIC Output, Refl Ective Photointerrupter With Connectoralias_johndeere2301No ratings yet

- ZavzpretDocument21 pagesZavzpretNeethu Anna StephenNo ratings yet

- MEH B1 Video Book Answer KeyDocument6 pagesMEH B1 Video Book Answer KeyTru CallingNo ratings yet

- DLL - MAPEH 4 - Q4 - W8 - New@edumaymay@lauramos@angieDocument8 pagesDLL - MAPEH 4 - Q4 - W8 - New@edumaymay@lauramos@angieDonna Lyn Domdom PadriqueNo ratings yet

- Wörterbuch Der Humanbiologie - Dictionary of Human Biology - Deutsch - Englisch - Englisch - Deutsch. English - German - German - English (PDFDrive)Document1,002 pagesWörterbuch Der Humanbiologie - Dictionary of Human Biology - Deutsch - Englisch - Englisch - Deutsch. English - German - German - English (PDFDrive)MilaNo ratings yet

- Animal Names in English and Telugu - 20170912 - 182216545Document17 pagesAnimal Names in English and Telugu - 20170912 - 182216545karimulla goraNo ratings yet

- Planet X Restaurant Menu v2Document5 pagesPlanet X Restaurant Menu v2Chinthaka WilliamsNo ratings yet

- What Is A PronounDocument9 pagesWhat Is A PronounFanera JefferyNo ratings yet

- 0972 June 2021 QP 41 Cie Igcse Physics - Pdfquestion7Document2 pages0972 June 2021 QP 41 Cie Igcse Physics - Pdfquestion7Kareem YouakimNo ratings yet

- Flame Amplifier HoneywellDocument8 pagesFlame Amplifier Honeywellgavo vargoNo ratings yet

- 2requirements Permit PDFDocument1 page2requirements Permit PDFHazel CorralNo ratings yet

- Fertilization to Implantation StagesDocument18 pagesFertilization to Implantation StagesNurulAqilahZulkifliNo ratings yet

- Neonatal Ventilation, Step by StepDocument99 pagesNeonatal Ventilation, Step by StepMarely Ovando Castillo93% (14)

- 4-Ingredient Vegan Easy Brownies - Minimalist Baker RecipesDocument2 pages4-Ingredient Vegan Easy Brownies - Minimalist Baker RecipespeteNo ratings yet

- 2009 IECC Residential Code Requirements Apr 14 Draft InspectorsDocument4 pages2009 IECC Residential Code Requirements Apr 14 Draft Inspectorsbcap-oceanNo ratings yet

- DBXLH 8585B VTMDocument4 pagesDBXLH 8585B VTMmau_mmx5738No ratings yet

- ECSS Q ST 70 02C (15november2008)Document45 pagesECSS Q ST 70 02C (15november2008)jsadachiNo ratings yet

- Riel Comun Fstguide2Document2 pagesRiel Comun Fstguide2Rosita TejedaNo ratings yet

- Ventilation System Comparison - Constant Air Volume (CAV) and Variable Air Volume (VAV)Document15 pagesVentilation System Comparison - Constant Air Volume (CAV) and Variable Air Volume (VAV)ankurNo ratings yet

- Vitality Book (1606456525)Document57 pagesVitality Book (1606456525)Ritu ShewaniNo ratings yet

- Labrel 104-195Document1,014 pagesLabrel 104-195Maria Seleena HipolitoNo ratings yet

- Designing Resistance Training Programmes To Enhance Muscular Fitness A Review of The Acute Programme VariablesDocument12 pagesDesigning Resistance Training Programmes To Enhance Muscular Fitness A Review of The Acute Programme VariablesSheilani MartinsNo ratings yet