Professional Documents

Culture Documents

SH PARTNERS CO - Financial Assumption

Uploaded by

Dare Quimada0 ratings0% found this document useful (0 votes)

17 views1 pagewala lang to

Original Title

SH PARTNERS CO.financial Assumption

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentwala lang to

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views1 pageSH PARTNERS CO - Financial Assumption

Uploaded by

Dare Quimadawala lang to

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

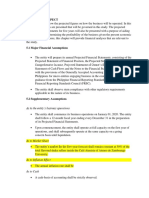

Financial Assumption

1. The company is a General Partnership.

2. Partners Contribution is P7, 000,000.00. Maao-50%, Umali-25%, Pujante-25%

3. Companys Income is divided equally.

4. No partners withdrawal of cash, accumulated cash is for business expansion.

5. All revenue is in a form of cash.

6. The company established Petty cash fund to cover its small expenses,

7. Cash in excess of the needed operating expenses are to be invested in the short term investment.

8. Cost of purchases is affected by the inflation rate of 2.6% per annum, and market growth of 5.23%

per annum.

9. Projected Revenue and Purchases are assumed to be Gross of VAT.

10. Salary of every employee increase by P10.00 per six months.

11. Acquisition of Plant, Equipment and Land Is assumed to be net of VAT.

12. All Supplies purchased are for one year and no yearend supplies.

13. Payment of salaries expense is three days after the cut off period.

14. Payment of withholding taxes on compensation is every 10th day of the following month, except for

the last month of the year which is to be paid in the 20th day of the following month.

15. Payment of SSS, HDMF, and PHIC is in subsequent month, depends on the members ID number.

16. Utilities are assumed to be paid a day after the month it is incurred.

17. Interest income received is assumed to be net of 20% final tax.

18. Fair Value of Land is assumed to be unchanged.

You might also like

- Financial Feasibility: Financial Assumptions of Dry Laundry ExpressDocument3 pagesFinancial Feasibility: Financial Assumptions of Dry Laundry ExpressLosing Sleep100% (1)

- Chapter 6 To Chapter 8Document4 pagesChapter 6 To Chapter 8Jarren BasilanNo ratings yet

- Initial Capi WPS OfficeDocument1 pageInitial Capi WPS OfficeMichael JimNo ratings yet

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- Income Taxation Finals Quiz 2Document7 pagesIncome Taxation Finals Quiz 2Jericho DupayaNo ratings yet

- IdentificationDocument1 pageIdentificationFrancez Anne Guanzon0% (1)

- Financial AssumptionsDocument4 pagesFinancial AssumptionsMarianne Dell Oberes100% (1)

- Quizes Income TaxationDocument20 pagesQuizes Income TaxationAllyssa GeronillaNo ratings yet

- Other Income Tax AccountingDocument19 pagesOther Income Tax AccountingHabtamu Hailemariam AsfawNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- Inac Finals AssessmentsDocument6 pagesInac Finals AssessmentsRovee PagaduanNo ratings yet

- Final MF0003 2nd AssigDocument6 pagesFinal MF0003 2nd Assignigistwold5192No ratings yet

- Taxation ReviewerDocument15 pagesTaxation ReviewerKaren YpilNo ratings yet

- FAR Quizzes and Practical ExerciseDocument23 pagesFAR Quizzes and Practical ExerciseCarla EspirituNo ratings yet

- 4.1 Assumptions: TH THDocument4 pages4.1 Assumptions: TH THLoise Anne MadridNo ratings yet

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanNo ratings yet

- Financial Aspect This Chapter Will Show The Projected Figures On How The Business Will Be Operated. in ThisDocument5 pagesFinancial Aspect This Chapter Will Show The Projected Figures On How The Business Will Be Operated. in Thisj castilloNo ratings yet

- Topic-6 MASDocument8 pagesTopic-6 MASMelvin CabilesNo ratings yet

- Notes Rental BusinessDocument3 pagesNotes Rental Businessdaniel bwireNo ratings yet

- Inac CompiDocument6 pagesInac CompiRovee PagaduanNo ratings yet

- Assignment 1 CF Section BDocument2 pagesAssignment 1 CF Section BPoornima SharmaNo ratings yet

- Bsa2 - TaxDocument40 pagesBsa2 - TaxLyca Nichol IbanNo ratings yet

- Improperly Accumulated Earnings TaxDocument4 pagesImproperly Accumulated Earnings TaxSophia OñateNo ratings yet

- Reviewer 4Document2 pagesReviewer 4Zamantha TiangcoNo ratings yet

- BF Case Study Sweet Beginnings Co 1Document3 pagesBF Case Study Sweet Beginnings Co 1Bryan Caadyang100% (1)

- Chap. 9 12Document58 pagesChap. 9 122vpsrsmg7jNo ratings yet

- ACTIVITYDocument1 pageACTIVITYjian21gamerNo ratings yet

- Advance Taxation Chp. 5Document6 pagesAdvance Taxation Chp. 5Rohan ThakkarNo ratings yet

- Solved ProblemsDocument44 pagesSolved ProblemsGlyzel Dizon0% (1)

- SH Partners Co-AppendicesDocument8 pagesSH Partners Co-AppendicesDare QuimadaNo ratings yet

- False 1. Marginal Income Earners Are Exempt From Both Business Tax and Income Tax. False 2. An Employed Professional Is Engaged in BusinessDocument3 pagesFalse 1. Marginal Income Earners Are Exempt From Both Business Tax and Income Tax. False 2. An Employed Professional Is Engaged in BusinessLazy LeathNo ratings yet

- Theories of AccountingDocument4 pagesTheories of AccountingShanine BaylonNo ratings yet

- Classwork CashBudgeted BusFinDocument2 pagesClasswork CashBudgeted BusFinSOFIA YASMIN VENTURANo ratings yet

- Chapter 2 ANNUITIESDocument21 pagesChapter 2 ANNUITIESCarl Omar GobangcoNo ratings yet

- Case Study 1: Make A Financial Report Part 1: Make A Balance SheetDocument3 pagesCase Study 1: Make A Financial Report Part 1: Make A Balance SheetThảo LêNo ratings yet

- Business Tax Laws in The PhilippinesDocument12 pagesBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaNo ratings yet

- 6,6 Taxation of Income of PersonsDocument29 pages6,6 Taxation of Income of Personsjoseph mbuguaNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Exam Reviewer FINMGTDocument8 pagesExam Reviewer FINMGTMary Elisha PinedaNo ratings yet

- Assignment - Mac - Fin 501 PGDBRM - Axis BankDocument2 pagesAssignment - Mac - Fin 501 PGDBRM - Axis BankShadab HasanNo ratings yet

- Banggawan 13 15b TFDocument10 pagesBanggawan 13 15b TFEarth PirapatNo ratings yet

- Business Sec5 KTDocument2 pagesBusiness Sec5 KTv2ch679jw7No ratings yet

- Income Tax Banggawan2019 Ch9Document13 pagesIncome Tax Banggawan2019 Ch9Noreen Ledda83% (6)

- View in Online Reader: Text Size +-RecommendDocument7 pagesView in Online Reader: Text Size +-RecommendRhea Mae AmitNo ratings yet

- Taxation of Income in NepalDocument24 pagesTaxation of Income in NepalSophiya PrabinNo ratings yet

- Business Tax Laws (Phils)Document15 pagesBusiness Tax Laws (Phils)Jean TanNo ratings yet

- Residential Status of An IndividualDocument11 pagesResidential Status of An IndividualRevathy PrasannanNo ratings yet

- Corporate Tax Planning V2Document6 pagesCorporate Tax Planning V2solvedcareNo ratings yet

- Rizza-Acsat Income TaxationDocument6 pagesRizza-Acsat Income TaxationRizza CasipongNo ratings yet

- Income Tax ExamDocument4 pagesIncome Tax ExamErwin Labayog Medina0% (1)

- UntitledDocument21 pagesUntitledAVelino PagandiyanNo ratings yet

- SPIT Abella SamplexDocument5 pagesSPIT Abella SamplexJasperAllenBarrientosNo ratings yet

- TaxDocument9 pagesTaxjay-r GutierrezNo ratings yet

- Acctng QuizDocument1 pageAcctng QuizSAIDA B. DUMAGAYNo ratings yet

- EXERCISESDocument25 pagesEXERCISESGandaNo ratings yet

- Inclusions in Gross Income: BAM 127: Income Taxation For BA Module #14Document18 pagesInclusions in Gross Income: BAM 127: Income Taxation For BA Module #14Mylene Santiago100% (1)

- Problem Set IIDocument8 pagesProblem Set IIVynz JoshuaNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- June 20 Review Day 2Document2 pagesJune 20 Review Day 2Dare QuimadaNo ratings yet

- June 19 Review Day 1Document2 pagesJune 19 Review Day 1Dare QuimadaNo ratings yet

- June 13 - Nature and Chemical ReactionDocument4 pagesJune 13 - Nature and Chemical ReactionDare QuimadaNo ratings yet

- Request Letter CanteenDocument1 pageRequest Letter CanteenDare QuimadaNo ratings yet

- Radio WaveDocument23 pagesRadio WaveDare QuimadaNo ratings yet

- Cot 2 Chemical ReactionsDocument5 pagesCot 2 Chemical ReactionsDare QuimadaNo ratings yet

- Aug 30 - DiagnosticDocument2 pagesAug 30 - DiagnosticDare QuimadaNo ratings yet

- Potential and Kinetic EnergyDocument24 pagesPotential and Kinetic EnergyDare QuimadaNo ratings yet

- April 26Document4 pagesApril 26Dare QuimadaNo ratings yet

- Photosynthesis & RespirationDocument30 pagesPhotosynthesis & RespirationDare QuimadaNo ratings yet

- Done Na PrettyDocument2 pagesDone Na PrettyDare QuimadaNo ratings yet

- Adam's QuestDocument18 pagesAdam's QuestDare QuimadaNo ratings yet

- School Profile Sir DarylDocument4 pagesSchool Profile Sir DarylDare QuimadaNo ratings yet

- Renato'S Integrated FarmDocument4 pagesRenato'S Integrated FarmDare QuimadaNo ratings yet

- Analyze and Discuss How Metal Reacts With Other ElementsDocument1 pageAnalyze and Discuss How Metal Reacts With Other ElementsDare QuimadaNo ratings yet

- 9 - GOLD DVaccineDocument10 pages9 - GOLD DVaccineDare QuimadaNo ratings yet

- School Grade Level Teacher Learning Area Date: Quarter TimeDocument2 pagesSchool Grade Level Teacher Learning Area Date: Quarter TimeDare QuimadaNo ratings yet

- 3rd Test ResultDocument8 pages3rd Test ResultDare QuimadaNo ratings yet

- Appendix-Konti Na LangDocument7 pagesAppendix-Konti Na LangDare QuimadaNo ratings yet

- Act For LMSDocument4 pagesAct For LMSDare QuimadaNo ratings yet

- asterism-finalAPPLICATION MARIDELDocument4 pagesasterism-finalAPPLICATION MARIDELDare QuimadaNo ratings yet

- SH Partners Co-AppendicesDocument8 pagesSH Partners Co-AppendicesDare QuimadaNo ratings yet

- Christ The King College of Science and Technology: Practicum Daily Time Record For The Month of DECEMBERDocument2 pagesChrist The King College of Science and Technology: Practicum Daily Time Record For The Month of DECEMBERDare QuimadaNo ratings yet

- SH CO. NOTES-konti Na LangDocument15 pagesSH CO. NOTES-konti Na LangDare QuimadaNo ratings yet

- Prospective Client SheetDocument8 pagesProspective Client SheetDare QuimadaNo ratings yet

- LP - Projcetile Solving (Daryl)Document3 pagesLP - Projcetile Solving (Daryl)Dare QuimadaNo ratings yet

- The Nervous SystemDocument26 pagesThe Nervous SystemDare QuimadaNo ratings yet