Professional Documents

Culture Documents

ch03 PDF

ch03 PDF

Uploaded by

Rahul agarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ch03 PDF

ch03 PDF

Uploaded by

Rahul agarwalCopyright:

Available Formats

The General Journal

3 and the General Ledger

DEMONSTRATION PROBLEM

G. Bell, a fitness enthusiast, buys an existing exercise center, Body Firm. The following

chart of accounts now applies:

Assets Revenue

111 Cash 411 Income from Services

124 Land

126 Building Expenses

128 Equipment 511 Wages Expense

512 Utilities Expense

Liabilities 513 Advertising Expense

221 Accounts Payable 514 Repair Expense

223 Mortgage Payable 519 Miscellaneous Expense

Owner's Equity

311 G. Bell, Capital

312 G. Bell, Drawing

Apr. 16 Bell deposited $100,000 in a bank account for the purpose of buying Body Firm.

17 Bought the assets of Body Firm for a total price of $188,000. The assets include

equipment, $28,000; building, $96,000; and land, $64,000. Made a down payment

of $89,000 and signed a mortgage note for the remainder.

17 Bought additional equipment from Fitness Supply Co. on account for $3,550, pay-

ing $710 down, with balance due in thirty days.

29 Celebrated the grand opening of Body Firm. Advertising expenses were paid in

cash for the following:

Advertising in newspaper $314

Announcements mailed to local residents 85

Postage 125

Balloons, ribbons, flowers 126

Food and refreshments 58

30 Received fees for daily use of the facilities, $1,152.

30 Paid wages for the period April 17 through April 30, $833.

30 Received and paid electric bill, $129.

30 Received and paid repair bill, $96.

30 Bell withdrew $600 for personal use.

Copyright © Houghton Mifflin Company. All rights reserved. 1

Instructions

1. Record the transactions in the general journal.

2. Post the transactions to the general ledger.

3. Prepare a trial balance as of April 30.

Copyright © Houghton Mifflin Company. All rights reserved. 2

SOLUTION

GENERAL JOURNAL PAGE 1

POST.

DATE DESCRIPTION REF. DEBIT CREDIT

1 20 — 1

2 Apr. 16 Cash 111 100,000.00 2

3 G. Bell, Capital 311 100,000.00 3

4 Invested cash in the business. 4

5 5

6 17 Equipment 128 28,000.00 6

7 Building 126 96,000.00 7

8 Land 124 64,000.00 8

9 Cash 111 89,000.00 9

10 Mortgage Payable 223 99,000.00 10

11 Bought Body Firm. 11

12 12

13 17 Equipment 128 3,550.00 13

14 Cash 111 710.00 14

15 Accounts Payable 221 2,840.00 15

16 Bought equipment on account from 16

17 Fitness Supply Co., with balance 17

18 due in 30 days. 18

19 19

20 29 Advertising Expense 513 708.00 20

21 Cash 111 708.00 21

22 Grand opening expenses. 22

23 23

24 30 Cash 111 1,152.00 24

25 Income from Services 411 1,152.00 25

26 Received fees. 26

27 27

28 30 Wages Expense 511 833.00 28

29 Cash 111 833.00 29

30 Paid wages for period 30

31 April 17 through April 30. 31

32 32

33 30 Utilities Expense 512 129.00 33

34 Cash 111 129.00 34

35 Paid electric bill. 35

36 36

37 30 Repair Expense 514 96.00 37

38 Cash 111 96.00 38

39 Paid repair bill. 39

40 40

41 30 G. Bell, Drawing 312 600.00 41

42 Cash 111 600.00 42

43 Withdrawal for personal use. 43

44 44

Copyright © Houghton Mifflin Company. All rights reserved. 3

GENERAL LEDGER

ACCOUNT Cash ACCOUNT NO. 111

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 16 1 100,000.00 100,000.00

17 1 89,000.00 11,000.00

17 1 710.00 10,290.00

29 1 708.00 9,582.00

30 1 1,152.00 10,734.00

30 1 833.00 9,901.00

30 1 129.00 9,772.00

30 1 96.00 9,676.00

30 1 600.00 9,076.00

ACCOUNT Land ACCOUNT NO. 124

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 17 1 64,000.00 64,000.00

ACCOUNT Building ACCOUNT NO. 126

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 17 1 96,000.00 96,000.00

ACCOUNT Equipment ACCOUNT NO. 128

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 17 1 28,000.00 28,000.00

17 1 3,550.00 31,550.00

Copyright © Houghton Mifflin Company. All rights reserved. 4

ACCOUNT Accounts Payable ACCOUNT NO. 221

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 17 1 2,840.00 2,840.00

ACCOUNT Mortgage Payable ACCOUNT NO. 223

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 17 1 99,000.00 99,000.00

ACCOUNT G. Bell, Capital ACCOUNT NO. 311

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 16 1 100,000.00 100,000.00

ACCOUNT G. Bell, Drawing ACCOUNT NO. 312

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 30 1 600.00 600.00

ACCOUNT Income from Services ACCOUNT NO. 411

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 30 1 1,152.00 1,152.00

Copyright © Houghton Mifflin Company. All rights reserved. 5

ACCOUNT Wages Expense ACCOUNT NO. 511

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 30 1 833.00 833.00

ACCOUNT Utilities Expense ACCOUNT NO. 512

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 30 1 129.00 129.00

ACCOUNT Adveritising Expense ACCOUNT NO. 513

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 29 1 708.00 708.00

ACCOUNT Repair Expense ACCOUNT NO. 514

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

20 —

Apr. 30 1 96.00 96.00

ACCOUNT Miscellaneous Expense ACCOUNT NO. 519

POST. BALANCE

DATE ITEM REF. DEBIT CREDIT DEBIT CREDIT

Copyright © Houghton Mifflin Company. All rights reserved. 6

Body Firm

Trial Balance

April 30, 20 —

ACCOUNT NAM E DEBIT CREDIT

Cash 9,076.00

Land 64,000.00

Building 96,000.00

Equipment 31,550.00

Accounts Payable 2,840.00

Mortgage Payable 99,000.00

G. Bell, Capital 100,000.00

G. Bell, Drawing 600.00

Income from Services 1,152.00

Wages Expense 833.00

Utilities Expense 129.00

Advertising Ex pense 708.00

Repair Expense 96.00

202,992.00 202,992.00

Copyright © Houghton Mifflin Company. All rights reserved. 7

You might also like

- 2-1 Maynard Company (A)Document1 page2-1 Maynard Company (A)Tarry Berry75% (4)

- RykaDocument39 pagesRykaNalbantis Spyros33% (3)

- Accounting QuizDocument1 pageAccounting QuizRepunzel Raaj0% (1)

- Chapter 9 Basic Reconcillation StatementDocument11 pagesChapter 9 Basic Reconcillation StatementRon louise Pereyra100% (1)

- South Asialink Finance Corporation (Credit Union)Document1 pageSouth Asialink Finance Corporation (Credit Union)Charish Kaye Radana100% (1)

- SMU - 3rd Sem MBA - Synopsis and ProjectGuidelinesDocument37 pagesSMU - 3rd Sem MBA - Synopsis and ProjectGuidelinesnitinsood0% (1)

- Project Report For New Business - FormatDocument4 pagesProject Report For New Business - FormatRajiv Ranjan0% (1)

- Quiz No. 7: A. MULTIPLE CHOICE: Write The Correct Letter Choice BeforeDocument6 pagesQuiz No. 7: A. MULTIPLE CHOICE: Write The Correct Letter Choice BeforeJOHN MITCHELL GALLARDONo ratings yet

- Business Math Quarter 3 Week 2Document8 pagesBusiness Math Quarter 3 Week 2Gladys Angela ValdemoroNo ratings yet

- Term Paper TQMDocument10 pagesTerm Paper TQMKathy SarmientoNo ratings yet

- Activity 7 Motivation-GomezDocument12 pagesActivity 7 Motivation-GomezANGELICA FRANSCINE GOMEZ100% (1)

- 01 Quiz 1Document2 pages01 Quiz 1Laisan SantosNo ratings yet

- Orca Share Media1569244186322Document8 pagesOrca Share Media1569244186322Zyn Marie OccenoNo ratings yet

- General Ledger - Adrianne, Mendoza-BSBA-1 BLK BDocument6 pagesGeneral Ledger - Adrianne, Mendoza-BSBA-1 BLK BJaks ExplorerNo ratings yet

- Resuento - Ulob ActivitiesDocument16 pagesResuento - Ulob Activitiesemem resuentoNo ratings yet

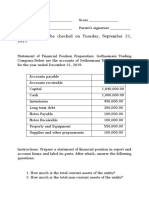

- Answer This To Be Checked On Tuesday, September 21, 2021Document2 pagesAnswer This To Be Checked On Tuesday, September 21, 2021Teresa Mae OrquiaNo ratings yet

- Holy Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Document3 pagesHoly Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Haries Vi Traboc Micolob100% (1)

- 03 Quiz 1 AubDocument3 pages03 Quiz 1 Aubken dahunanNo ratings yet

- Enclosure 1. Teacher-Made Learner's Home Task (Week 9) : The Nature of A Service BusinessDocument7 pagesEnclosure 1. Teacher-Made Learner's Home Task (Week 9) : The Nature of A Service BusinessKim FloresNo ratings yet

- Accounting Module 2 AssignmentDocument2 pagesAccounting Module 2 AssignmentGenner RazNo ratings yet

- FOA Final OutputDocument18 pagesFOA Final OutputGwyneth MogolNo ratings yet

- AccountingDocument5 pagesAccountingAbe Loran PelandianaNo ratings yet

- Assessment Task 2-Bank Reconciliation QuestionsDocument14 pagesAssessment Task 2-Bank Reconciliation QuestionsDaisy Ann Cariaga SaccuanNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Cindy Lota - Activity No. 3 - Statement of Financial PositionDocument6 pagesCindy Lota - Activity No. 3 - Statement of Financial PositionCindy LotaNo ratings yet

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Exercises in MerchandisingDocument10 pagesExercises in MerchandisingJhon Robert BelandoNo ratings yet

- ACCBP100 - ULOcdefg Lets Check ActivityDocument2 pagesACCBP100 - ULOcdefg Lets Check ActivityWennonah Vallerie LabeNo ratings yet

- Example of Oam Analysis ReportDocument15 pagesExample of Oam Analysis ReportRevo VillarminoNo ratings yet

- REVIEWER ACCOUNTING TUTORIAL Chapter 1-4Document20 pagesREVIEWER ACCOUNTING TUTORIAL Chapter 1-4bae joohyunNo ratings yet

- GEN005 - Quiz 2 ANSWER KEYDocument4 pagesGEN005 - Quiz 2 ANSWER KEYELLE WOODS0% (1)

- 2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyDocument1 page2-2B Basic Journal Entries, T-Accounts, Trial Balance - New CompanyRyoma EchizenNo ratings yet

- Journal-Entry AssignmentsDocument2 pagesJournal-Entry AssignmentsRieven BaracinasNo ratings yet

- Assignment Qs 1 - Journalization and PostingDocument2 pagesAssignment Qs 1 - Journalization and PostingShehzad Qureshi100% (1)

- Set IDocument2 pagesSet IAdoree RamosNo ratings yet

- 2 Major Types of AccountsDocument18 pages2 Major Types of AccountsLUKE ADAM CAYETANONo ratings yet

- Week 6 To 7Document22 pagesWeek 6 To 7JeanneNo ratings yet

- Promissory NotesDocument7 pagesPromissory NotesJasper MenesesNo ratings yet

- Lesson 7.4Document7 pagesLesson 7.4crisjay ramosNo ratings yet

- Answer Problem 1Document9 pagesAnswer Problem 1MARY JUSTINE PAQUIBOTNo ratings yet

- ACCCOB1 - (Module 1)Document36 pagesACCCOB1 - (Module 1)Andrei AngNo ratings yet

- Lesson 1 Prepared By: Asst. Prof. Sherylyn T. Trinidad: The Management ScienceDocument17 pagesLesson 1 Prepared By: Asst. Prof. Sherylyn T. Trinidad: The Management ScienceErine ContranoNo ratings yet

- Unadjusted Trial Balance Adjustments Account Titles Debit Credit DebitDocument6 pagesUnadjusted Trial Balance Adjustments Account Titles Debit Credit DebitAllen CarlNo ratings yet

- Basic Accounting Equation ExercisesDocument7 pagesBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- Accounting Concepts and PrinciplesDocument4 pagesAccounting Concepts and Principlesdane alvarezNo ratings yet

- Accounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloDocument41 pagesAccounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloRoxe XNo ratings yet

- Group Activity 1Document10 pagesGroup Activity 1Winshei Cagulada0% (1)

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Output Fabm1 Ladera Rhealyn Patan Ao Bsa I PDFDocument9 pagesOutput Fabm1 Ladera Rhealyn Patan Ao Bsa I PDFHaries Vi Traboc Micolob100% (1)

- Certified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasDocument63 pagesCertified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasAllen CarlNo ratings yet

- Well" - A New Way of Saying - "Do Well by Doing Good."Document3 pagesWell" - A New Way of Saying - "Do Well by Doing Good."Rinna Lynn FraniNo ratings yet

- Group Activity 2.2 in Strategic ManagementDocument4 pagesGroup Activity 2.2 in Strategic ManagementLizcel CastillaNo ratings yet

- Bhulero Merchandise Periodic 11 25Document10 pagesBhulero Merchandise Periodic 11 25Mary Jane PalermoNo ratings yet

- Financial Accounting Concept Assignment 2023Document15 pagesFinancial Accounting Concept Assignment 2023harmanchahalNo ratings yet

- Laarni Pascua TransactionDocument1 pageLaarni Pascua TransactionRhealyn GadainganNo ratings yet

- Quiz SolutionDocument3 pagesQuiz SolutionKim Patrick VictoriaNo ratings yet

- Acctg Journalizing TransactionsDocument30 pagesAcctg Journalizing TransactionsDaisy Marie A. RoselNo ratings yet

- Account Titles and Its ElementsDocument3 pagesAccount Titles and Its ElementsJeb PampliegaNo ratings yet

- FAR Assignment 1Document3 pagesFAR Assignment 1The Psycho100% (1)

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- Las-Business-Finance-Q1 Week 1Document16 pagesLas-Business-Finance-Q1 Week 1Kinn Jay100% (1)

- Chapter 22 - The Cost of Production Extra Multiple Choice Questions For ReviewDocument1,634 pagesChapter 22 - The Cost of Production Extra Multiple Choice Questions For ReviewRadhaNo ratings yet

- SAMPLE Assignment Madoff Ponzi Scheme 2010Document2 pagesSAMPLE Assignment Madoff Ponzi Scheme 2010scholarsassistNo ratings yet

- NEW Defined Pension OrderDocument4 pagesNEW Defined Pension OrdersjvkNo ratings yet

- Chapter 5 FinmanDocument4 pagesChapter 5 FinmanGen LibertadNo ratings yet

- VREIT Annual Report 31 Dec 2022 PSEDocument150 pagesVREIT Annual Report 31 Dec 2022 PSEjvNo ratings yet

- Auditing 2019 AnswersDocument10 pagesAuditing 2019 AnswersTakuriNo ratings yet

- Adobe Scan 03-May-2021Document22 pagesAdobe Scan 03-May-2021Mohit RanaNo ratings yet

- DM22118 - Dinakaran SDocument11 pagesDM22118 - Dinakaran SDinakaranNo ratings yet

- Underwriters and Brokers (Submitted)Document17 pagesUnderwriters and Brokers (Submitted)dollu mehtaNo ratings yet

- Sample UNDERTAKING POA BRDocument13 pagesSample UNDERTAKING POA BRHarishNo ratings yet

- Car IndustryDocument20 pagesCar IndustryNISRINE ALAMINo ratings yet

- Buying A Company in Canada: Business Purchase Finance Problems Are Solved Like ThisDocument5 pagesBuying A Company in Canada: Business Purchase Finance Problems Are Solved Like ThisStan ProkopNo ratings yet

- Module B Dec 2017answerDocument10 pagesModule B Dec 2017answerConnieChoiNo ratings yet

- Aviva Hy2019 Analyst PackDocument112 pagesAviva Hy2019 Analyst PackGioan DuyNo ratings yet

- Tax SparingDocument8 pagesTax SparingtaranNo ratings yet

- Patti B Saris Financial Disclosure Report For 2010Document64 pagesPatti B Saris Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- FIN101 SyllabusDocument4 pagesFIN101 SyllabusRyan FarellNo ratings yet

- Research Design: Primary DataDocument35 pagesResearch Design: Primary DataTusharJoshiNo ratings yet

- Chapter 09Document24 pagesChapter 09Mohamed MadyNo ratings yet

- MGAC SA - Sheet1Document1 pageMGAC SA - Sheet1Isaiah John Domenic M. CantaneroNo ratings yet

- Cash Flow For (Business Name) in (Financial Year) : Cash Flow July August September October November DecemberDocument5 pagesCash Flow For (Business Name) in (Financial Year) : Cash Flow July August September October November DecemberNishit SapatNo ratings yet

- 3 Masterplan & Cons - Final PDFDocument0 pages3 Masterplan & Cons - Final PDFmaungohsiNo ratings yet

- Zambia Weekly - Week 47, Volume 1, 26 November 2010Document8 pagesZambia Weekly - Week 47, Volume 1, 26 November 2010Chola MukangaNo ratings yet

- Achukatla Baba FakruddinDocument6 pagesAchukatla Baba Fakruddinferoz acNo ratings yet

- PitchBook 2016 Annual VC Valuations ReportDocument23 pagesPitchBook 2016 Annual VC Valuations ReportMonkeyboyNo ratings yet

- Small Scale and Village IndustryDocument17 pagesSmall Scale and Village IndustryNishant Gupta100% (1)